Xiaomi’s EV Ambitions Gain Speed: Profitability in Sight After New SU7 SUV Launch

Xiaomi, a name long synonymous with smartphones and consumer electronics, has officially taken a pivotal step into one of the most competitive frontiers of modern technology: electric vehicles (EVs). The recent unveiling and commercial debut of its SU7 electric sedan marks not just a product launch, but the crystallization of years of strategic planning, significant investment, and a broader ambition to reshape the company’s identity for the future. With Xiaomi founder and CEO Lei Jun projecting profitability for the company’s EV arm following the successful launch of this flagship model, a new chapter in the firm’s storied evolution is unfolding.

The automotive industry is undergoing a transformation that rivals the original industrial revolution. Legacy automakers and new entrants alike are racing to electrify their fleets amid rising climate concerns, government mandates, and shifting consumer preferences. While global players such as Tesla, BYD, and NIO have captured headlines and market share, the door remains open for tech-savvy, innovation-driven companies to disrupt the space. Xiaomi’s entrance, therefore, is both timely and calculated, leveraging its strengths in hardware manufacturing, software development, and ecosystem integration.

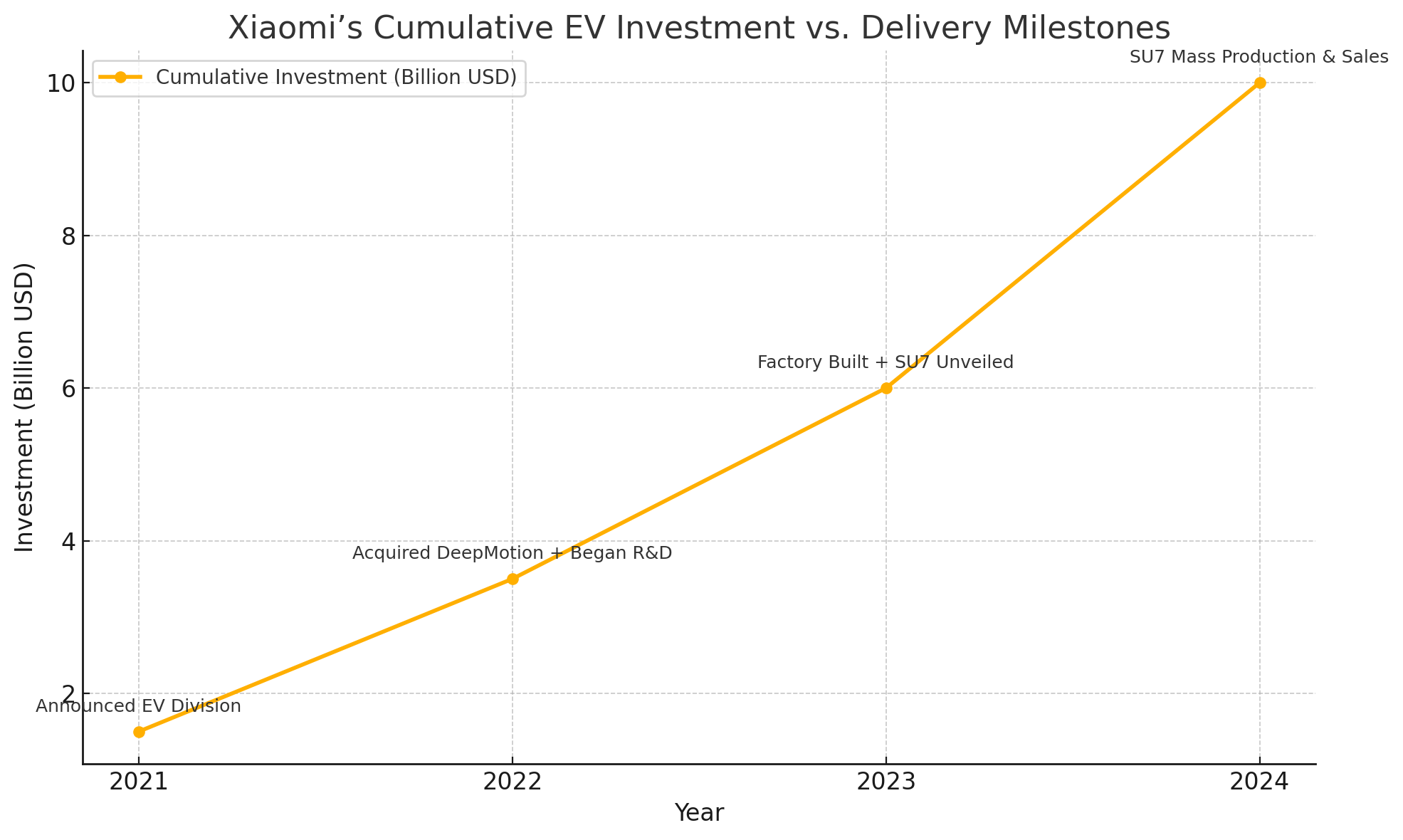

Xiaomi's decision to enter the EV market was not impulsive. The company announced its automotive ambitions in 2021, pledging a $10 billion investment over the following decade. This move was initially met with skepticism by industry analysts who questioned the feasibility of a smartphone manufacturer succeeding in such a capital-intensive, regulatory-heavy, and operationally complex domain. Yet, three years later, Xiaomi's first EV—the SU7—is rolling off production lines and onto city roads, signaling that the company’s ambitions are rooted in concrete execution.

At the heart of Xiaomi’s strategy is a belief in the convergence of smart technology and mobility. The SU7 is not just a vehicle; it is a digitally integrated product that extends Xiaomi’s connected ecosystem to the automobile space. From the MIUI-based in-car operating system to proprietary autonomous driving technologies and real-time cloud connectivity, Xiaomi’s entry into the EV market is more than a new business vertical—it is an extension of its brand philosophy that puts user experience and technological cohesion first.

The SU7 itself has been positioned to compete directly with industry stalwarts like the Tesla Model 3 and BYD Seal. Boasting sleek design, robust battery performance, semi-autonomous driving features, and seamless smartphone-to-car integration, the vehicle embodies Xiaomi’s consumer-centric design ethos. Early indications from preorders and public reception suggest that the market is not only receptive but enthusiastic. Reports indicate that tens of thousands of SU7 units were reserved within the first 24 hours of availability, underscoring both demand and the potential to capture market share in a crowded but dynamic industry.

Yet perhaps the most headline-grabbing assertion has come from Lei Jun himself. In a recent public statement, the Xiaomi founder projected that the company’s EV arm is on track to become profitable—an impressive claim given the industry’s notoriously thin margins and protracted gestation periods for new automotive ventures. This forecast of near-term profitability distinguishes Xiaomi from many of its contemporaries, particularly startups that often rely on years of loss-leading growth before even approaching a positive balance sheet.

For stakeholders—whether investors, industry observers, or consumers—this development signals a dramatic evolution in Xiaomi’s business model. Once firmly rooted in affordable electronics, the company is now transitioning toward a diversified industrial strategy that encompasses mobility, energy, and smart infrastructure. If successful, this pivot could position Xiaomi as not just a Chinese tech giant, but a global innovator capable of influencing how people live, communicate, and now—commute.

Moreover, the implications of Xiaomi’s foray into EVs extend beyond business headlines. It also raises important questions about the evolving nature of competition in the auto industry, the increasing overlap between consumer technology and industrial engineering, and the geopolitical considerations of Chinese firms expanding into globally sensitive sectors like transportation. These themes will be explored in detail throughout this blog.

In the following sections, we will examine the strategic logic and capital investments that enabled Xiaomi’s entry into the EV market, break down the technological and market performance of the SU7 sedan, explore financial projections and profitability pathways, and assess what this bold move means for the broader EV industry and for Xiaomi’s future as a diversified technology conglomerate.

As Xiaomi steers into this new era, the stakes are high, the challenges formidable, but the vision is unmistakably bold. The SU7 may just be the first in a fleet of vehicles that redefine not only Xiaomi’s trajectory but the future of mobility itself.

Strategic Vision and Investment Trajectory

Xiaomi's foray into the electric vehicle (EV) market is not merely a tactical business expansion; it is a strategic recalibration aimed at reshaping the company's long-term identity and positioning in the global technology ecosystem. This transformation is driven by a vision that sees the convergence of smart devices, artificial intelligence (AI), and mobility as the defining narrative of the next decade. Underpinning this vision is an ambitious investment plan, aggressive talent acquisition, and a relentless focus on technological integration. Together, these components form the foundation of Xiaomi’s EV strategy, which culminates in the launch of its first vehicle, the SU7, and the anticipated transition of its EV arm into profitability.

When Xiaomi formally announced its intention to enter the EV market in March 2021, it pledged an initial investment of $10 billion over a ten-year horizon. This announcement was notable not just for the magnitude of the capital commitment but for the timing and the manner in which it was communicated. Lei Jun, the company’s founder and CEO, personally spearheaded the announcement, underscoring its strategic importance. The move was not seen as a side venture but as a core pillar of Xiaomi’s evolution from a consumer electronics company into a comprehensive smart technology conglomerate.

The rationale behind this move is multi-faceted. At a macro level, the EV sector presents one of the most compelling growth opportunities in the global economy. With governments around the world pushing for carbon neutrality and sustainable transportation, the demand for electric vehicles has surged. China, Xiaomi's home market, has become the largest EV market in the world, with strong government support, widespread charging infrastructure development, and increasing consumer awareness. The alignment of national policy with corporate innovation created a fertile environment for Xiaomi’s entry.

At a company level, Xiaomi’s decision to diversify into EVs addresses a critical challenge: the plateauing growth in the smartphone market. The saturation of global smartphone adoption and intense price competition have eroded margins, prompting Xiaomi to seek new frontiers for revenue and innovation. The EV sector offers an avenue not only for growth but for strategic synergies. Modern electric vehicles are increasingly viewed as ‘smartphones on wheels,’ equipped with advanced operating systems, AI-assisted features, and cloud connectivity—all areas in which Xiaomi already possesses significant expertise.

Central to Xiaomi’s EV strategy is the principle of vertical integration. The company has pursued an in-house development model across key components such as batteries, motor systems, autonomous driving technologies, and software stacks. By doing so, Xiaomi aims to reduce dependency on third-party suppliers, lower production costs, and improve overall system integration. This approach mirrors its successful strategy in smartphones, where controlling both hardware and software has enabled the company to deliver a seamless user experience.

Xiaomi Auto, the company’s automotive division, established a dedicated R&D center that has attracted over 3,000 engineers, including industry veterans from automakers like Tesla, BYD, and Geely. The company has also invested heavily in autonomous driving capabilities through its subsidiary Xiaomi Pilot Technology. In 2022, Xiaomi acquired DeepMotion, an autonomous driving startup, to accelerate development in this field. The result is a robust ADAS (Advanced Driver Assistance Systems) suite integrated into the SU7, demonstrating Xiaomi’s commitment to technological depth rather than superficial participation.

In parallel, Xiaomi constructed a state-of-the-art manufacturing facility in Yizhuang, Beijing, with an annual production capacity of up to 300,000 vehicles. The factory is fully automated, employing industrial robots and AI-driven quality control mechanisms. This digital-first manufacturing approach aligns with Xiaomi’s broader ethos of efficiency, scalability, and innovation-driven cost management. Importantly, this facility also enables Xiaomi to exert greater control over supply chains—a critical advantage in an industry often plagued by logistical and component bottlenecks.

The company’s choice to debut with a high-performance sedan, rather than a more mainstream model, reflects a calculated branding strategy. The SU7 is designed not just to compete but to stand out in a market crowded with alternatives. Xiaomi’s brand equity, particularly among young and tech-savvy consumers, provides a powerful tailwind. By offering a vehicle that integrates seamlessly with the Xiaomi ecosystem—including smartphones, smart home devices, and wearables—the company enhances customer lock-in and ecosystem stickiness, thereby expanding its total addressable market (TAM).

The SU7 also serves as a proof of concept for Xiaomi’s longer-term roadmap, which includes multiple vehicle models across various price points. Lei Jun has hinted at plans for an SUV and a compact urban car, aiming to address broader segments of the Chinese and global markets. Each of these vehicles is expected to benefit from the foundational R&D and manufacturing infrastructure already in place, thereby achieving better economies of scale and margin optimization over time.

A major milestone in Xiaomi’s investment trajectory was the announcement of profitability expectations for its EV unit following the launch of the SU7. Lei Jun’s assertion that the business will turn profitable soon is both audacious and telling. It indicates confidence not only in the product-market fit of the SU7 but in the broader financial architecture Xiaomi has built around its automotive endeavor. This is particularly notable given the fact that most EV startups, including some with much higher market capitalizations, have struggled for years to attain profitability.

To contextualize the company’s financial progression, the following chart illustrates the correlation between Xiaomi’s cumulative EV investment and its key delivery and development milestones over the past three years:

Moreover, Xiaomi’s strategic partnerships further reinforce its trajectory. Collaborations with battery suppliers like CATL, semiconductor firms, and cloud providers ensure both resilience and innovation. The company’s global supply chain management experience from its smartphone business also allows it to scale operations with comparative agility, reducing lead times and mitigating cost overruns.

Another noteworthy component is the government’s supportive role. The Beijing municipal government has provided substantial backing in terms of land allocation, regulatory facilitation, and infrastructure development. This partnership exemplifies the public-private synergy required to build a sustainable and globally competitive EV ecosystem.

In summary, Xiaomi’s strategic vision and investment trajectory in the EV market are anchored in a long-term, vertically integrated approach that combines capital commitment, technological innovation, and ecosystem leverage. From establishing proprietary capabilities to building state-of-the-art facilities and securing strategic partnerships, the company has laid a robust foundation for future growth. With profitability now projected on the horizon, Xiaomi appears poised to emerge as a formidable player in the evolving landscape of smart mobility.

Performance of the SU7 and Market Response

The commercial debut of Xiaomi’s SU7 electric sedan represents a critical juncture not only for the company’s automotive ambitions but also for the broader Chinese electric vehicle (EV) market. As the first EV model from a brand better known for its smartphones and smart home devices, the SU7 has attracted considerable attention from consumers, investors, and industry observers alike. Its technical specifications, performance metrics, feature set, and initial market reception collectively serve as an indicator of how Xiaomi’s pivot into the automotive sector is being received and what its future in this domain may look like.

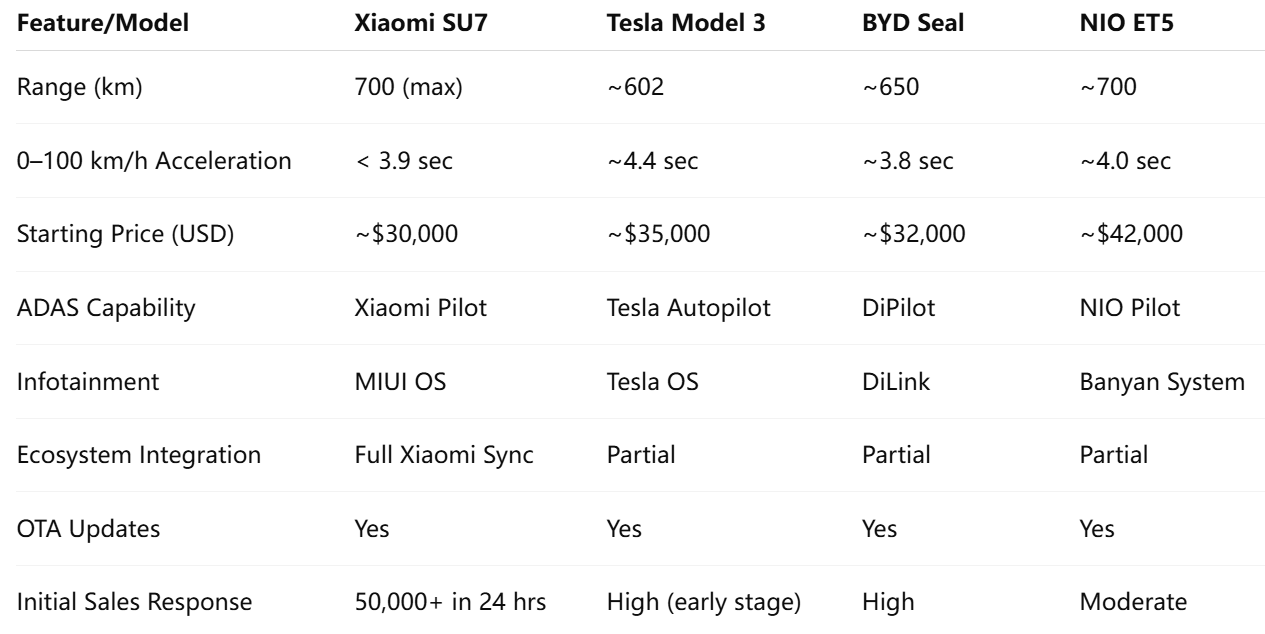

The SU7 is a four-door electric sedan that aims to directly compete with industry-leading models such as the Tesla Model 3, BYD Seal, and NIO ET5. It is positioned in the mid-to-premium EV segment and boasts a sophisticated blend of design, functionality, and smart features—all of which are deeply aligned with Xiaomi’s legacy of user-focused product development. The vehicle is offered in multiple configurations, including standard and performance variants, with price points strategically set to challenge competitors without eroding Xiaomi’s brand value or compromising profit margins.

From a performance standpoint, the SU7 impresses with a range of approximately 700 kilometers on a single charge for its top-end model, utilizing CATL-supplied lithium-ion batteries. Acceleration figures are equally competitive, with the performance version achieving 0–100 km/h in under 3.9 seconds. The vehicle is powered by Xiaomi’s in-house HyperEngine platform, developed to ensure seamless integration between powertrain components and digital systems. The powertrain efficiency and battery management systems are optimized through advanced AI algorithms—leveraging Xiaomi’s broader strength in embedded software and smart hardware.

The car's interior reflects Xiaomi’s minimalist yet high-tech design language, featuring a 16.1-inch central control screen, a heads-up display, and a MIUI-based vehicle operating system. This enables users to synchronize their Xiaomi smartphones, tablets, and wearables effortlessly with the car's digital interface. Features such as voice control, over-the-air (OTA) updates, in-vehicle apps, and a 360-degree camera system further enhance user convenience and safety. Moreover, Xiaomi has emphasized data security and privacy, particularly given the increasingly strict regulatory scrutiny on connected vehicles in China and abroad.

One of the standout components of the SU7 is its advanced driver assistance system (ADAS), branded as Xiaomi Pilot. Developed in part through the acquisition of autonomous driving startup DeepMotion, Xiaomi Pilot includes features such as adaptive cruise control, automatic lane changing, parking assist, and highway autopilot. These capabilities are enabled by a combination of cameras, LiDAR, radar, and high-definition maps—placing the SU7 at the forefront of semi-autonomous vehicle technology within its price segment.

In terms of market response, the SU7 has exceeded expectations. Upon opening reservations, Xiaomi reported over 50,000 units booked within the first 24 hours. This surge in demand not only reflects effective marketing and brand loyalty but also validates the company’s product-market fit in the EV segment. The initial batch of vehicles sold out quickly, prompting Xiaomi to ramp up production capacity at its Yizhuang manufacturing facility to meet backlogged demand. Online forums and review platforms in China show a generally positive sentiment, with early adopters praising the vehicle’s design, driving performance, and integration with the Xiaomi ecosystem.

Industry analysts have also responded favorably. Many have pointed out that Xiaomi's strategy of leveraging existing brand equity, combined with robust technological and manufacturing frameworks, provides a competitive edge. The company’s ability to deliver a high-performance, digitally integrated EV at a competitive price point has positioned it as a legitimate challenger in the crowded Chinese EV market—especially at a time when international brands like Tesla are encountering mounting pressure from local competitors.

To contextualize the SU7’s positioning and performance, the following table provides a comparative overview of the SU7 against key competitors in its category:

The table highlights several key takeaways. Firstly, the SU7 offers competitive range and performance, effectively matching or surpassing rivals in core technical specifications. Secondly, Xiaomi’s deep integration across its product ecosystem is a unique selling proposition (USP) that most competitors cannot replicate. Thirdly, its aggressive pricing strategy places it in a strong position to attract cost-conscious consumers who desire high-end features without premium pricing.

From a strategic perspective, the early success of the SU7 allows Xiaomi to generate critical momentum. It demonstrates proof-of-concept for the company’s manufacturing and supply chain readiness, while also validating consumer appetite for an EV that aligns with the Xiaomi brand promise of “innovation for everyone.” The initial market response will also help inform future product iterations, including the planned SUV and compact car models currently under development.

However, challenges remain. Xiaomi must ensure that supply chain constraints, particularly around semiconductors and batteries, do not disrupt production. Quality assurance will also be paramount, as even minor defects in early production batches can significantly harm brand perception in a highly scrutinized market. Moreover, Xiaomi’s service and maintenance infrastructure for automobiles is still in its infancy compared to traditional car manufacturers, necessitating rapid expansion and refinement.

Regulatory compliance and export logistics will become increasingly relevant as Xiaomi aims to scale internationally. Although the SU7 is currently focused on the Chinese domestic market, interest from Southeast Asia, the Middle East, and Europe has begun to surface. Expansion into these markets will require not only adherence to international vehicle safety and emission standards but also cultural and branding adjustments to appeal to diverse consumer bases.

In conclusion, the SU7 represents a successful debut for Xiaomi’s automotive ambitions, combining technological excellence, brand synergy, and market acumen. The positive reception from consumers and critics alike offers a promising glimpse into the company’s potential in the EV sector. As subsequent models are introduced and international strategies take shape, the SU7 may be remembered not just as Xiaomi’s first car, but as the vehicle that drove the company into a new era of smart mobility.

Path to Profitability: Forecast and Financial Outlook

Xiaomi’s bold entry into the electric vehicle (EV) market is not merely a demonstration of technological capability but a strategic financial gamble that the company believes is now beginning to yield returns. The announcement by founder and CEO Lei Jun that the EV arm is expected to turn profitable shortly after the launch of the SU7 has garnered widespread attention. Given the capital-intensive nature of the automotive industry—especially for electric vehicles—this projection raises important questions about cost structures, production efficiencies, pricing strategy, and market scale. This section provides a detailed analysis of Xiaomi’s profitability trajectory, revenue forecasts, and the financial architecture underpinning the company’s EV strategy.

The electric vehicle business is notorious for its extended gestation periods and high burn rates. Historically, even market leaders such as Tesla took over a decade to reach consistent profitability, and numerous EV startups remain in the red despite substantial funding. Against this backdrop, Lei Jun’s optimistic profitability projection for Xiaomi’s EV arm appears ambitious. Yet it is rooted in several structural advantages that Xiaomi brings to the table, which many of its peers lack.

Firstly, Xiaomi’s legacy as a high-efficiency electronics manufacturer has instilled a corporate culture of cost discipline. The company is known for operating on razor-thin hardware margins, often below 5%, while generating profits through ecosystem services, software, and platform integration. This business model is now being adapted to the EV sector. By internalizing core vehicle technologies—including batteries, electric motors, vehicle operating systems, and autonomous driving stacks—Xiaomi has been able to reduce its dependence on external suppliers, thus gaining tighter control over production costs and pricing flexibility.

The company’s manufacturing facility in Yizhuang, Beijing, is a cornerstone of its financial strategy. Designed for high scalability and automation, the factory boasts a planned capacity of 300,000 vehicles annually at peak operation. Automated assembly lines, AI-powered quality control, and integrated logistics are aimed at maximizing operational efficiency and minimizing waste. By concentrating production in a single, high-output facility and localizing component sourcing wherever possible, Xiaomi is optimizing economies of scale, which is crucial for achieving positive margins in the early stages of automotive manufacturing.

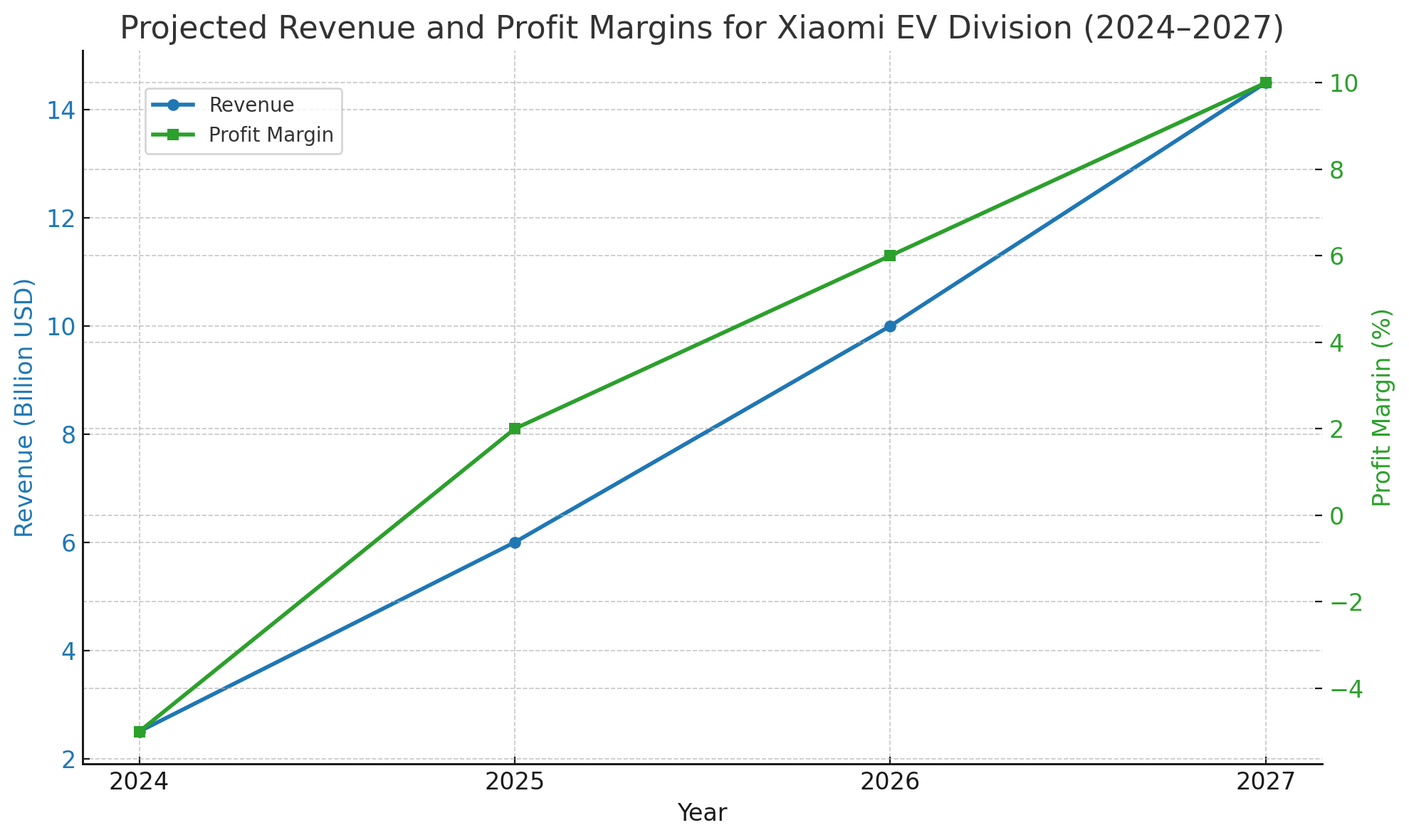

Furthermore, the pricing strategy for the SU7 has been calibrated to drive volume while ensuring a pathway to profitability. Positioned in the $30,000–$40,000 range, the SU7 undercuts rivals such as Tesla and NIO while offering comparable, if not superior, features. The strategy hinges on high turnover volumes that spread fixed costs across a large number of units—a classical economic principle that Xiaomi has already mastered in the smartphone industry. Reports suggest that the company is nearing break-even on the SU7 at its current volume and margin structure, making profitability within reach as sales scale.

Xiaomi has also diversified its revenue model for the EV business, integrating ancillary services that generate recurring income. These include premium software features accessible via subscription (e.g., enhanced driver-assistance systems, real-time traffic updates, cloud storage for dashcam footage), in-car app purchases, maintenance services, and charging network partnerships. This hybrid model of hardware-plus-software monetization aligns closely with Xiaomi’s existing ecosystem approach and is likely to play a significant role in driving sustainable profit margins over the long term.

From a capital structure perspective, Xiaomi has financed its EV division through a mix of internal funds, strategic investments, and government subsidies. The company committed an initial $10 billion to the automotive venture over a 10-year period, with approximately $6 billion already deployed by the time the SU7 entered production. In addition, favorable policy support from the Chinese government—including land grants, tax incentives, and subsidies for new energy vehicles—has provided a financial cushion that reduces both upfront and ongoing costs. These advantages, coupled with a debt-light balance sheet, place Xiaomi in a favorable position to withstand the volatility inherent in the automotive sector.

To illustrate Xiaomi’s financial trajectory, the following chart outlines projected revenue growth and profit margins for the company’s EV business from 2024 through 2027:

Beyond the SU7, Xiaomi’s product roadmap includes additional vehicle models aimed at broadening its addressable market. An electric SUV and a compact city car are reportedly in development, both leveraging the same modular platform as the SU7 to reduce R&D and manufacturing overhead. These models are expected to cater to segments that are currently underserved in Xiaomi’s portfolio and are anticipated to offer better margin profiles due to shared components and platform efficiencies.

Xiaomi's financial outlook also benefits from its massive user base and marketing ecosystem. With hundreds of millions of smartphone users globally, the company has an unparalleled ability to promote its vehicles directly to consumers through its proprietary channels, including the Mi Store app, online retail platforms, and in-person experience centers. This integrated sales strategy reduces customer acquisition costs (CAC) and enhances conversion rates—two metrics that significantly influence profitability in both the technology and automotive industries.

However, risks remain. Global supply chain disruptions, particularly in semiconductors and battery materials, could impact production and delivery timelines. Currency fluctuations, trade tensions, and evolving regulatory frameworks in international markets could also introduce financial volatility. Moreover, as Xiaomi eyes expansion beyond China, logistical costs and compliance expenditures are expected to rise, potentially impacting near-term margins.

There is also the question of competition. The EV space, particularly in China, is saturated with both legacy automakers and aggressive startups. Companies like BYD benefit from deep vertical integration, while firms such as NIO and XPeng leverage premium branding and differentiated technologies. Tesla continues to dominate the high-performance segment with global reach and brand prestige. In this competitive environment, Xiaomi must continuously innovate and maintain operational excellence to safeguard and grow its profit margins.

On balance, the financial blueprint that Xiaomi has laid out for its EV business is characterized by discipline, scalability, and ecosystem integration. The strategy relies on leveraging existing strengths—cost efficiency, brand loyalty, and software monetization—while building new competencies in automotive engineering and large-scale manufacturing. If executed effectively, this approach positions Xiaomi not only to achieve profitability in the near term but also to become a sustainable and influential player in the EV sector.

In conclusion, Lei Jun’s forecast of turning Xiaomi’s EV arm profitable after the SU7 launch is supported by a confluence of favorable factors: strategic pricing, operational efficiency, integrated services, and government backing. While challenges persist, the financial foundations are solid, and the roadmap to profitability is both credible and compelling. Xiaomi's transition from smartphones to smart vehicles may soon be recognized as one of the most financially successful pivots in the history of consumer technology.

Industry Impact and Broader Implications for Xiaomi’s Future

Xiaomi’s strategic entry into the electric vehicle (EV) industry reverberates far beyond its corporate balance sheet—it signals a broader transformation in how technology companies are redefining the boundaries of traditional manufacturing sectors. The debut and promising trajectory of the SU7 are not only reshaping competitive dynamics within China’s automotive landscape but are also catalyzing changes across the global EV ecosystem. As the line between consumer electronics and automotive engineering becomes increasingly blurred, Xiaomi’s rise as an EV player introduces a new template for industrial convergence, platform economics, and digital mobility.

At the national level, Xiaomi’s EV success reinforces China’s ambition to dominate the next era of transportation. The country has long prioritized the EV sector through aggressive industrial policy, subsidies, and innovation hubs. Companies like BYD, NIO, and XPeng have already made substantial strides, but Xiaomi’s entrance adds a formidable new dimension. Unlike many automotive startups, Xiaomi arrives with pre-established brand equity, a robust user base, and deep expertise in smart ecosystems. Its presence accelerates the shift towards intelligent vehicles designed not only for efficiency and sustainability but also for digital interactivity and data-driven personalization.

The impact on China’s auto industry is therefore twofold. First, it intensifies competition by forcing legacy automakers to innovate at a faster pace, particularly in digital integration and user experience. Second, it fosters a new generation of smart cars that reflect broader consumer expectations of seamless connectivity across devices, services, and mobility. This ecosystem-centric approach is increasingly becoming a competitive necessity rather than a market differentiator, and Xiaomi is arguably leading that trend within the Chinese market.

Internationally, Xiaomi’s automotive ambitions send a clear message to tech firms and automakers alike: the barriers to entering the EV market are surmountable for companies that can leverage cross-domain synergies and economies of scope. This paradigm shift challenges the traditional assumption that large-scale automobile manufacturing must be the exclusive domain of companies with a century of automotive engineering experience. Instead, it validates a new industrial model where software-defined vehicles, powered by AI and connected services, are designed with the same user-centric principles that have driven innovation in smartphones and consumer electronics.

The success of Xiaomi's SU7 also pressures global incumbents like Tesla, Volkswagen, and Toyota to re-evaluate their software strategy and ecosystem development. Tesla, for instance, has historically operated in a closed-loop system with proprietary software and vertical integration. Xiaomi mirrors this model but adds the unique advantage of interoperability across a broader consumer product spectrum—from wearables to smart homes. If this approach proves scalable, it may compel other players to develop broader ecosystem partnerships or vertically integrate their tech offerings in a similar fashion.

Moreover, Xiaomi’s trajectory could redefine investor expectations for automotive startups. In contrast to many loss-leading EV companies whose business models depend heavily on long-term scaling and capital injections, Xiaomi is positioning its automotive division for relatively early profitability. This signals to investors that it is possible to build a financially sustainable EV business without compromising on innovation or scale—provided that operational efficiency, product-market fit, and cross-product monetization are intelligently designed. This shift in narrative could influence funding dynamics and capital allocation trends within the broader EV venture space.

On a corporate strategy level, the success of the EV arm transforms Xiaomi from a consumer electronics company into a comprehensive technology conglomerate with multidimensional revenue streams. The addition of EVs to its portfolio provides several strategic advantages. First, it diversifies the company’s income sources, reducing its dependence on smartphones, which have seen slowing growth globally. Second, it strengthens Xiaomi’s brand image as an innovator that is capable of delivering premium, large-format products. Third, it positions the company to leverage mobility data for future services, ranging from predictive maintenance and insurance to personalized in-car commerce and entertainment.

This transformation also demands changes in Xiaomi’s internal operations and governance. The automotive business introduces new regulatory challenges, supply chain complexities, and quality assurance expectations. Scaling up after the success of the SU7 will require significant investments in customer service, physical infrastructure (e.g., showrooms, service centers), and global compliance. Moreover, as Xiaomi explores potential international expansion, it must navigate trade barriers, environmental regulations, and geopolitical sensitivities—especially in regions wary of Chinese technological influence.

The implications for the broader technology sector are equally profound. Xiaomi’s entry into the EV market illustrates the growing strategic overlap between mobility, cloud computing, AI, and edge devices. This convergence is not coincidental but a reflection of structural shifts in how technologies are being deployed to improve everyday experiences. Companies that can orchestrate this convergence—by controlling both the hardware and software stack across multiple domains—stand to gain not only market share but also influence over emerging standards and platforms.

Finally, there is a sociocultural dimension to Xiaomi’s expansion. As consumers increasingly adopt products that integrate mobility with digital life—such as cloud-synced EV dashboards, smartphone-activated vehicles, and smart charging systems—brand affinity and ecosystem familiarity become more important than ever. Xiaomi’s ability to meet consumers where they already are, through familiar interfaces and seamless transitions between devices, strengthens user loyalty and community-building. This creates not only a commercial advantage but also a cultural one, where Xiaomi becomes synonymous with the future of mobility itself.

In conclusion, Xiaomi’s entry into the EV sector and its forecasted profitability post-SU7 launch carry implications that extend far beyond product sales or quarterly earnings. The move reflects a deeper strategic realignment of the company and signals a structural evolution in the global EV and technology markets. By leveraging its strengths in software, hardware, and ecosystem design, Xiaomi is not merely participating in the automotive revolution—it is helping to define it. As the boundaries between industries continue to blur, Xiaomi stands as a compelling example of how adaptability, innovation, and platform thinking can unlock entirely new frontiers for growth and influence.

References

- Xiaomi Official Announcement on EV Plans

https://www.mi.com/global/newsroom - Bloomberg Report on Xiaomi SU7 Launch

https://www.bloomberg.com/news/articles/xiaomi-ev-launch-su7 - Reuters Coverage on Xiaomi’s EV Business Model

https://www.reuters.com/technology/xiaomi-electric-vehicle-strategy - CNBC Analysis of Xiaomi’s Entry into the EV Sector

https://www.cnbc.com/xiaomi-electric-car-market - TechCrunch: Xiaomi’s Investment in EV R&D

https://techcrunch.com/xiaomi-ev-rd-investment - Financial Times: EV Competition in China

https://www.ft.com/content/china-ev-market-competition - South China Morning Post: Xiaomi SU7 Orders Surge

https://www.scmp.com/business/xiaomi-su7-sales - Autocar Review of Xiaomi SU7 Specs

https://www.autocar.co.uk/car-review/xiaomi-su7-overview - Nikkei Asia: Xiaomi’s Factory Capabilities

https://asia.nikkei.com/Business/Automobiles/xiaomi-ev-manufacturing - Electrek: Xiaomi vs Tesla Comparison

https://electrek.co/2024/03/27/xiaomi-su7-vs-tesla-model3