Xiaomi’s $7 Billion Chip Ambition: A Decade-Long Journey Toward Semiconductor Independence

In a bold declaration that underscores the intensifying race for technological sovereignty and vertical integration, Xiaomi has unveiled plans to invest a staggering 50 billion yuan (approximately $6.93 billion) over the next decade to develop its own mobile processors. This announcement, made in May 2025 by Xiaomi co-founder and CEO Lei Jun, positions the Chinese tech giant among a growing cohort of consumer electronics firms seeking to gain greater control over their hardware-software ecosystems. The strategic decision reflects not only a desire for performance optimization and cost control but also a response to the shifting global semiconductor landscape increasingly characterized by supply chain uncertainties and geopolitical tensions.

Xiaomi’s initiative signals more than a financial commitment; it marks a philosophical shift in the company’s long-term vision. Since its inception, Xiaomi has been heavily reliant on established chipmakers like Qualcomm and MediaTek to power its smartphones. While this model allowed the company to scale quickly and remain agile in a competitive market, it left Xiaomi vulnerable to external pressures, such as component shortages, export controls, and platform limitations. By taking on the challenge of developing in-house chips—starting with the new XringO1 processor—Xiaomi is aiming to redefine its competitive edge by optimizing performance from silicon to software.

This is not Xiaomi’s first foray into chip design. In 2017, the company introduced the Surge S1, a mid-range processor that marked its initial attempt to break into the semiconductor sector. However, the endeavor faced significant technical and commercial challenges, leading Xiaomi to put its chip ambitions on hold. The current investment plan revives this ambition on an entirely different scale—both in terms of resources and strategic focus. Xiaomi is now leveraging a dedicated design team of over 2,500 engineers and aligning itself with top-tier foundry partners like TSMC to manufacture its chips using advanced process nodes such as 4nm.

This aggressive push aligns with a broader national initiative spearheaded by the Chinese government to reduce dependency on foreign semiconductor technologies. Under the "Made in China 2025" policy framework, domestic tech champions like Xiaomi are being encouraged—and in some cases, incentivized—to invest in foundational technologies that can elevate China’s position in the global tech hierarchy. By embedding itself in the chip design landscape, Xiaomi is not merely looking to enhance its own product offerings but is also contributing to a larger geopolitical and industrial movement aimed at technological self-reliance.

As the company gears up to release its first commercially viable in-house processor later this year, industry observers and competitors alike are watching closely. The implications of Xiaomi’s chip development strategy extend beyond mere technical innovation—they have the potential to reshape competitive dynamics within the smartphone industry, affect global supply chains, and influence future standards for mobile computing performance.

This blog will explore Xiaomi's $7 billion chip development plan in detail. It will trace the company's semiconductor journey, analyze the strategic motivations behind the investment, delve into the technical architecture of the XringO1 chip, evaluate the associated risks and industry impact, and ultimately assess what this move means for the future of Xiaomi and the broader tech ecosystem.

Xiaomi’s Semiconductor Journey – From Surge S1 to XringO1

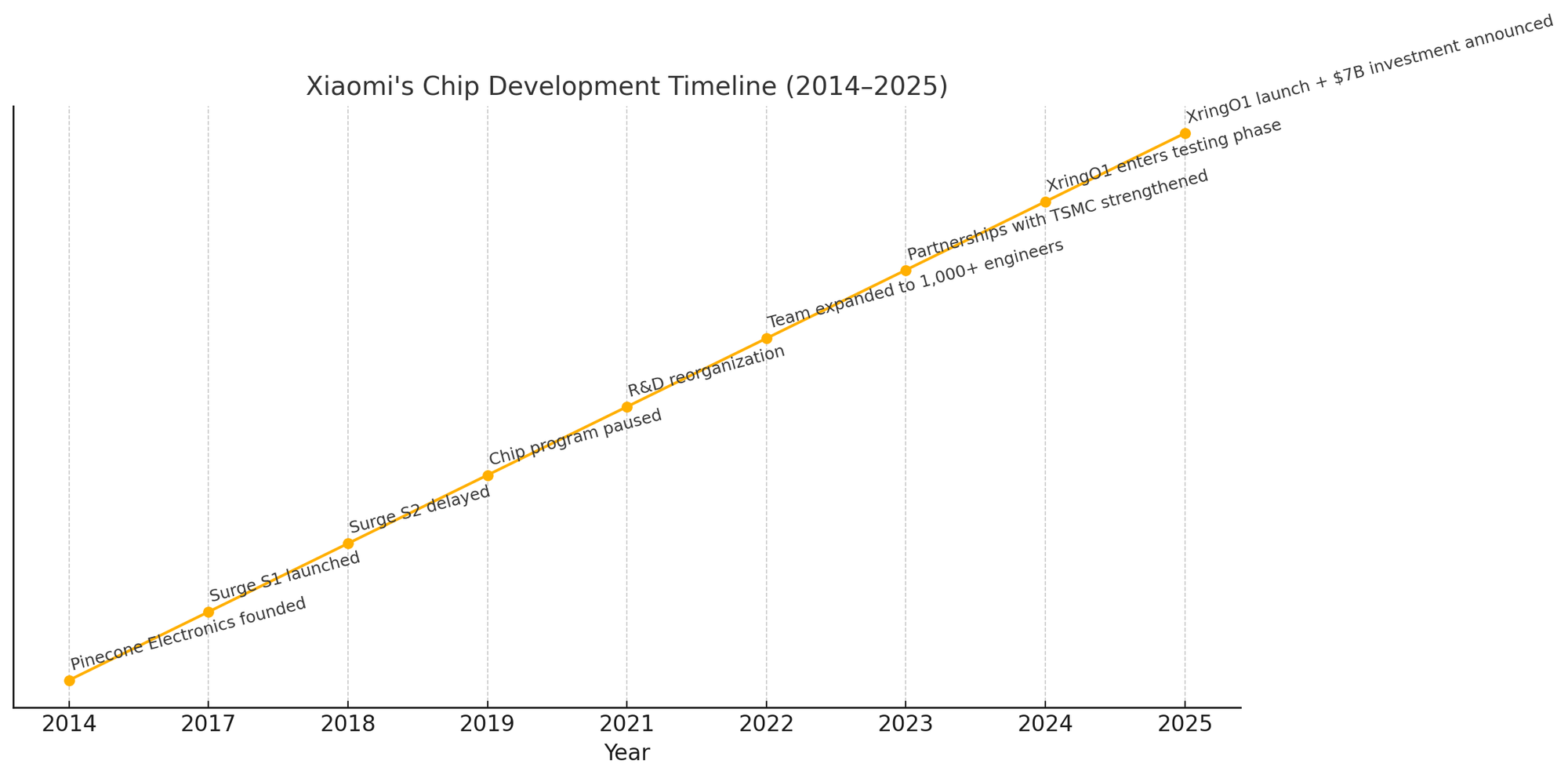

Xiaomi’s venture into semiconductor development has not been a linear path but rather a story marked by bold experimentation, temporary setbacks, and a renewed sense of purpose. From the release of its first proprietary chip—the Surge S1—in 2017 to the ambitious launch of the XringO1 in 2025, the journey reveals the company’s evolving approach toward technological self-sufficiency and performance differentiation. This section provides a chronological analysis of Xiaomi’s chip development efforts, detailing key milestones, strategic recalibrations, and the organizational expansion that set the stage for its most significant semiconductor project to date.

The Surge S1: A Cautious First Step

In 2017, Xiaomi introduced the Surge S1, its inaugural attempt at designing an in-house system-on-chip (SoC). Developed by its wholly owned subsidiary Pinecone Electronics, the Surge S1 was an octa-core processor fabricated using the 28nm process node. It featured four Cortex-A53 performance cores clocked at 2.2GHz and four energy-efficient Cortex-A53 cores at 1.4GHz, along with a Mali-T860 MP4 GPU. The chip debuted in the Xiaomi Mi 5c, a mid-range smartphone that showcased Xiaomi’s vision of controlling its hardware stack.

While the technical execution was commendable for a first-generation product, the Surge S1 failed to deliver market impact. Its performance lagged behind contemporaries from Qualcomm and MediaTek, and Xiaomi faced limitations in ecosystem optimization, software support, and long-term scalability. Additionally, the chip was limited to mid-tier devices, which constrained its commercial viability. As a result, the company put its next-generation Surge S2 on indefinite hold, leading many to believe that Xiaomi’s chip aspirations had been shelved altogether.

A Period of Dormancy and Learning

Following the tepid reception of the Surge S1, Xiaomi entered a period of strategic reflection. During this phase—spanning from 2018 to 2020—the company chose to rely on proven suppliers like Qualcomm, MediaTek, and Samsung to power its smartphones. However, this hiatus was not a complete withdrawal. Behind the scenes, Xiaomi continued to invest quietly in semiconductor R&D, talent acquisition, and partnerships with foundries and design firms. The acquisition of semiconductor startups and gradual hiring of chip engineers indicated that the ambition to design its own silicon had not been abandoned, merely deferred.

It was during this time that global dynamics began to shift. U.S.-China trade tensions, coupled with growing concerns over supply chain fragility and access to cutting-edge fabrication technologies, prompted many Chinese technology firms to reassess their dependencies. Huawei’s sanctions-induced decline in global smartphone shipments became a cautionary tale that reinforced the necessity of owning key technologies, including semiconductors. This backdrop catalyzed a more focused and long-term orientation toward chip independence within Xiaomi’s executive leadership.

The Resurgence: Laying the Groundwork for XringO1

Xiaomi’s renewed commitment to chip development became publicly evident in 2021, when the company reorganized its R&D units to include dedicated chip design divisions. By 2022, Xiaomi had established a sizable semiconductor team comprising more than 1,000 engineers, many of whom had previously worked at leading design firms such as ARM, Qualcomm, and Huawei’s HiSilicon. This marked a strategic shift: rather than chasing short-term milestones, Xiaomi began laying the groundwork for a sustainable, long-term chip development pipeline.

Between 2022 and 2024, Xiaomi gradually increased its investments in semiconductor R&D, culminating in the development of a next-generation mobile SoC under the internal codename “Xring.” Unlike the Surge S1, this new project was designed with flagship-tier performance in mind, incorporating advanced manufacturing nodes, heterogeneous compute architecture, and AI-optimized instruction sets. Notably, Xiaomi aligned itself with Taiwan Semiconductor Manufacturing Company (TSMC) to ensure access to leading-edge foundry technology.

By early 2025, Lei Jun officially announced that Xiaomi would invest at least 50 billion yuan over the next decade into its chip development initiatives. The majority of the funding was allocated to the XringO1 project, which had already consumed over 13.5 billion yuan in development costs. This chip represented not only a technical leap but also a symbolic return to the company’s original vision of integrated innovation.

The XringO1: Technical Leap and Strategic Pivot

The XringO1, set to debut in the Xiaomi 15S series, is a state-of-the-art SoC built on TSMC’s 4nm process. It reportedly features an octa-core architecture with a 1+3+4 configuration, led by a high-performance Cortex-X925 core clocked at 3.2GHz. The remaining cores include three Cortex-A725 cores for balanced performance and four Cortex-A520 cores for energy efficiency. This blend allows for a fine-tuned balance between computational power and thermal management, making it suitable for AI-heavy mobile applications, gaming, and multimedia processing.

In addition to CPU capabilities, the XringO1 integrates an upgraded neural processing unit (NPU) optimized for on-device AI inference. Xiaomi’s focus on AI stems from its broader ecosystem strategy that includes smart home devices, wearables, and IoT systems. A proprietary chip allows for tighter integration of AI workloads, reduced latency, and improved data privacy—an increasingly important consideration in global markets.

Furthermore, the XringO1 reflects a strategic pivot from Xiaomi’s previous dependency-driven approach. By owning the chip architecture, Xiaomi gains the ability to optimize its MIUI software layer specifically for its hardware. This mirrors Apple’s successful integration model, where control over both hardware and software leads to superior performance, battery efficiency, and user experience.

Organizational Expansion and Talent Strategy

To support the ambitious chip program, Xiaomi has aggressively expanded its internal semiconductor team, which now exceeds 2,500 engineers. This multidisciplinary team includes specialists in digital logic design, analog circuitry, AI acceleration, signal processing, and silicon validation. The company has also opened new R&D centers in Beijing, Shanghai, and Nanjing, all of which serve as innovation hubs in China’s tech landscape.

Talent retention has emerged as a core pillar of Xiaomi’s chip strategy. Through competitive compensation packages, stock options, and professional development programs, the company is working to ensure a stable pipeline of expertise in an industry known for its intense competition and poaching.

Conclusion of Section

Xiaomi’s journey from the modest Surge S1 to the flagship-caliber XringO1 encapsulates a decade-long learning curve that blends technical ambition with strategic pragmatism. The initial setbacks served as invaluable lessons, and the intervening years allowed Xiaomi to recalibrate its vision, acquire talent, and align with critical supply chain partners. With the XringO1, Xiaomi is no longer merely dabbling in semiconductor design—it is staking a long-term claim in one of the most crucial areas of technological differentiation. The forthcoming chip is not just about performance—it is about identity, autonomy, and the next chapter of Xiaomi’s evolution as a global technology leader.

A visual overview of Xiaomi's major milestones in semiconductor development, from the launch of the Surge S1 to the debut of the XringO1 chip and the announcement of a $7 billion investment.

Strategic Rationale Behind the $7 Billion Investment

Xiaomi's decision to allocate 50 billion yuan (approximately $7 billion) over the course of the next decade to develop proprietary mobile processors is not merely an isolated technological maneuver but a deeply strategic response to a confluence of operational, economic, and geopolitical imperatives. The announcement reflects the company’s recognition of the semiconductor as a strategic asset—one that confers autonomy, enhances product differentiation, and fortifies resilience against external disruptions. This section explores the multifaceted rationale behind Xiaomi’s investment, examining the internal corporate drivers, competitive motivations, and broader macroeconomic and policy frameworks that inform this bold initiative.

Reducing Strategic Dependency on Foreign Suppliers

One of the primary motivations behind Xiaomi’s $7 billion investment in semiconductor development is the company’s desire to reduce its dependency on external chip suppliers, particularly U.S.-based Qualcomm and Taiwan-based MediaTek. For years, Xiaomi has relied on these third-party vendors to provide application processors for its flagship and mid-range smartphones. While these partnerships have facilitated rapid scaling and cost efficiencies, they have also left Xiaomi vulnerable to supply shortages, price fluctuations, and—most critically—geopolitical constraints.

The global semiconductor supply chain is highly concentrated and politically sensitive. Export restrictions, such as those imposed by the United States on Huawei and other Chinese firms, have demonstrated how access to essential technologies can be weaponized. Though Xiaomi has not been subject to direct sanctions, the potential remains a looming threat. By developing its own chips, Xiaomi gains greater control over a crucial component of its hardware architecture, insulating itself from external shocks and potential embargoes.

Moreover, designing proprietary chips allows Xiaomi to decouple its product release cycles from those of third-party chipmakers. This autonomy could prove critical in a competitive landscape where timing and responsiveness often determine market success.

Enhancing Product Differentiation Through Vertical Integration

Another key driver behind Xiaomi’s semiconductor investment is the opportunity to improve product performance and differentiation through vertical integration. The strategy mirrors successful models adopted by companies such as Apple, which has long benefited from designing its own chips (e.g., the A-series and M-series processors) to optimize performance, energy efficiency, and integration with software.

Currently, most Android OEMs source chips from a common pool of suppliers, resulting in a certain degree of product commoditization. Xiaomi, by developing in-house processors like the XringO1, seeks to escape this mold. Proprietary chips enable deeper optimization of the MIUI operating system, tighter control over thermal and power management, and more seamless integration of artificial intelligence (AI) capabilities. These enhancements can lead to measurable improvements in user experience—from faster app launches and smoother multitasking to longer battery life and more intelligent camera processing.

Vertical integration also strengthens brand loyalty. Just as consumers associate Apple devices with performance superiority due in part to custom silicon, Xiaomi could cultivate a similar association by marketing its phones as end-to-end engineered solutions. This differentiation is especially valuable in a saturated global smartphone market where innovation cycles are tightening and competitive moats are increasingly difficult to maintain.

Contributing to National Semiconductor Sovereignty

Xiaomi’s investment aligns with broader national objectives set forth by the Chinese government, most notably under the “Made in China 2025” industrial policy framework. This initiative prioritizes technological self-sufficiency in critical areas such as artificial intelligence, aerospace, and semiconductors. China currently imports more semiconductors by value than oil, highlighting the strategic and economic urgency of reducing foreign reliance.

By committing to domestic chip development, Xiaomi not only strengthens its own strategic position but also contributes to a national imperative. The Chinese government has actively encouraged private sector participation in chip research and development (R&D) by offering subsidies, tax incentives, and policy support. While Xiaomi has not publicly confirmed whether it will receive government funding for the XringO1 project, the alignment of interests suggests that the state views Xiaomi’s semiconductor ambitions favorably.

This confluence of public and private goals creates a synergistic environment in which Xiaomi's investment serves both corporate strategy and national interest. It also positions the company as a standard-bearer for the next wave of Chinese innovation in the post-Huawei era.

Economic Prudence and Long-Term Value Creation

From a financial perspective, the $7 billion investment in chip development can be interpreted as a forward-looking bet on cost efficiency and long-term value creation. While the initial outlays are substantial—particularly in design, verification, and fabrication—owning the intellectual property of a mobile processor opens the door to future economies of scale.

Currently, Xiaomi pays licensing fees and procurement costs to external chip vendors. By internalizing these functions, the company could reduce per-unit costs over time, particularly as chip yields improve and volumes increase. Additionally, custom chips may extend the lifecycle of devices, thereby improving margins and reducing return rates associated with hardware-software misalignment.

There is also the potential for monetization beyond internal consumption. If successful, Xiaomi could license its chip architecture to other OEMs or deploy its processors in adjacent product categories such as tablets, wearables, TVs, and IoT devices. In this way, the investment transcends its immediate utility and becomes a platform for ecosystem expansion.

Responding to Market Trends and Competitive Pressures

Xiaomi’s move into in-house chip design must also be viewed within the context of escalating competitive pressures. Rivals such as Apple, Google, Samsung, and Huawei have already launched proprietary processors, gaining critical advantages in terms of performance, optimization, and branding. Even relatively smaller players like Oppo and Vivo have started to explore AI and imaging chips to enhance their flagship offerings.

In this environment, reliance on off-the-shelf components risks technological stagnation and competitive irrelevance. Xiaomi, which has long positioned itself as an innovator offering high-end specs at aggressive price points, cannot afford to fall behind. The XringO1 represents a necessary evolution of its hardware strategy to maintain relevance in a rapidly transforming industry.

Moreover, consumer expectations are evolving. Users now demand more intelligent features, seamless experiences across devices, and enhanced security—all of which benefit from a custom silicon foundation. As software and services become more tightly integrated with hardware capabilities, the role of the processor becomes even more central. Xiaomi’s investment ensures it has the architectural flexibility to meet these emerging demands.

Organizational Readiness and Capability Maturity

Finally, Xiaomi’s readiness to undertake such a capital-intensive endeavor reflects its maturation as a global technology firm. With a market capitalization exceeding $50 billion and operations spanning over 100 countries, Xiaomi now possesses the financial stability, human capital, and supply chain networks to support long-term R&D programs. The company's internal semiconductor team has grown to over 2,500 professionals, including veterans from the world’s leading chip companies.

This organizational depth allows Xiaomi to absorb the risks associated with chip development—including technical failures, cost overruns, and delayed market entry—while still maintaining operational agility in its core business lines. The decision to commit $7 billion over a ten-year horizon illustrates a measured, phased approach designed to balance innovation with sustainability.

In summary, Xiaomi’s $7 billion investment in semiconductor development is rooted in a strategic calculus that extends beyond technical ambition. It addresses vulnerabilities in supply chain dependency, seeks to differentiate Xiaomi’s products through vertical integration, aligns with national priorities for technological self-sufficiency, and opens pathways to long-term economic value creation. Moreover, it is a necessary response to competitive dynamics in an industry where custom silicon is rapidly becoming a prerequisite for relevance. This investment is not merely a cost—it is a catalyst for transformation, positioning Xiaomi at the forefront of the next era in global mobile computing.

Technical Deep Dive into XringO1

As Xiaomi transitions from a component integrator to a semiconductor innovator, the XringO1 represents its most advanced and ambitious foray into chip design to date. Unlike its predecessor, the Surge S1, which was constrained by modest performance and limited scalability, the XringO1 is designed to compete directly with flagship processors from industry leaders such as Qualcomm, MediaTek, and Apple. This section provides a detailed technical examination of the XringO1’s architecture, manufacturing process, performance benchmarks, and integration strategy—highlighting how the chip embodies Xiaomi’s strategic shift toward full-stack engineering and control.

Architectural Framework: 1+3+4 Core Configuration

The XringO1 processor is built on an octa-core CPU configuration that follows a 1+3+4 setup—an increasingly popular architecture among flagship mobile chipsets due to its balance between peak performance and energy efficiency. At the core of the XringO1 lies a single high-performance Cortex-X925 core clocked at 3.2 GHz. This primary core is optimized for compute-intensive tasks such as high-frame-rate gaming, 4K video editing, and real-time rendering.

Supporting the Cortex-X925 are three Cortex-A725 cores, designed to handle moderately demanding applications that require a blend of responsiveness and energy preservation. Finally, the chip includes four Cortex-A520 cores dedicated to background tasks and idle processes, ensuring minimal power consumption during low-load operations.

This tri-cluster approach allows Xiaomi to deploy dynamic task scheduling algorithms within its MIUI operating system, effectively directing workloads to the appropriate cores based on real-time power, thermal, and performance considerations. The result is a chip that not only excels in synthetic benchmarks but also delivers real-world responsiveness and battery longevity—two critical factors for consumer satisfaction.

Manufacturing Technology: TSMC’s 4nm Process Node

To achieve its desired performance-per-watt ratio, Xiaomi partnered with Taiwan Semiconductor Manufacturing Company (TSMC), leveraging its highly advanced 4nm (N4) fabrication process. The choice of TSMC as a foundry partner is significant, as it grants Xiaomi access to one of the most mature and high-yielding process technologies currently available.

TSMC’s N4 node is a refinement of its earlier 5nm process, offering approximately 6–7% higher performance and 10–15% lower power consumption at equivalent transistor densities. These gains are critical in a market where even incremental improvements in efficiency can translate to tangible advantages in device thickness, thermal profiles, and battery life.

Fabricating a chip at 4nm also presents significant engineering challenges, particularly in areas such as design rule compliance, signal integrity, and power delivery. Xiaomi’s ability to navigate these challenges and deliver a stable silicon implementation underscores the technical maturity of its internal design team, which now comprises more than 2,500 engineers specializing in semiconductor design, verification, and validation.

GPU and AI Acceleration

In addition to its CPU cores, the XringO1 features a custom GPU developed in collaboration with an unnamed IP vendor, likely based on ARM’s Mali or Imagination Technologies’ PowerVR architecture. This graphics processing unit supports Variable Rate Shading (VRS), Vulkan 1.3, and OpenCL 3.0—features that enable immersive gaming experiences and support for advanced rendering techniques, including ray tracing and HDR video playback.

The chip also integrates a next-generation Neural Processing Unit (NPU), designed to accelerate on-device machine learning tasks such as voice recognition, image enhancement, natural language processing, and real-time object detection. With support for INT8, FP16, and mixed-precision training models, the NPU facilitates efficient edge AI computation, reducing reliance on cloud infrastructure and improving user privacy.

The AI engine is tightly coupled with the MIUI software stack, allowing Xiaomi to deploy features such as intelligent battery management, adaptive display calibration, and real-time language translation. These enhancements are not only performance-boosting but also brand-defining, as they enable Xiaomi to deliver distinct experiences that are difficult for competitors using off-the-shelf components to replicate.

Connectivity and Peripheral Integration

The XringO1 comes equipped with an integrated 5G modem supporting both sub-6GHz and mmWave bands, ensuring compatibility with global network infrastructures. The modem offers peak download speeds exceeding 10 Gbps and is optimized for power efficiency through support for Dynamic Spectrum Sharing (DSS), carrier aggregation, and dual SIM dual standby (DSDS) capabilities.

Additional connectivity features include Wi-Fi 7 (802.11be), Bluetooth 5.4, and ultra-wideband (UWB) support. These capabilities are designed to enhance smart home integration, file transfers, and peripheral device interactions, particularly in Xiaomi’s broader product ecosystem that includes TVs, smart speakers, wearables, and home automation hubs.

Security modules embedded within the XringO1 include a dedicated Trusted Execution Environment (TEE), hardware-based cryptographic engines, and secure boot mechanisms. These features are designed to meet enterprise-grade standards for data protection and digital rights management, a critical consideration for Xiaomi as it expands its presence in enterprise and fintech applications.

System Optimization and Thermal Management

To fully leverage the XringO1’s capabilities, Xiaomi has overhauled its firmware and system software layers. The MIUI kernel has been modified to include a new power governor designed specifically for heterogeneous compute environments. Through real-time telemetry and machine-learned user behavior models, the system can predict application load and preemptively shift resources to minimize thermal spikes and latency.

Thermal management is further enhanced through a multi-layered heat dissipation system within Xiaomi’s upcoming flagship devices, combining vapor chamber cooling with high thermal conductivity materials. These enhancements ensure that sustained performance is maintained even under peak loads—a key differentiator for gaming and content creation workloads.

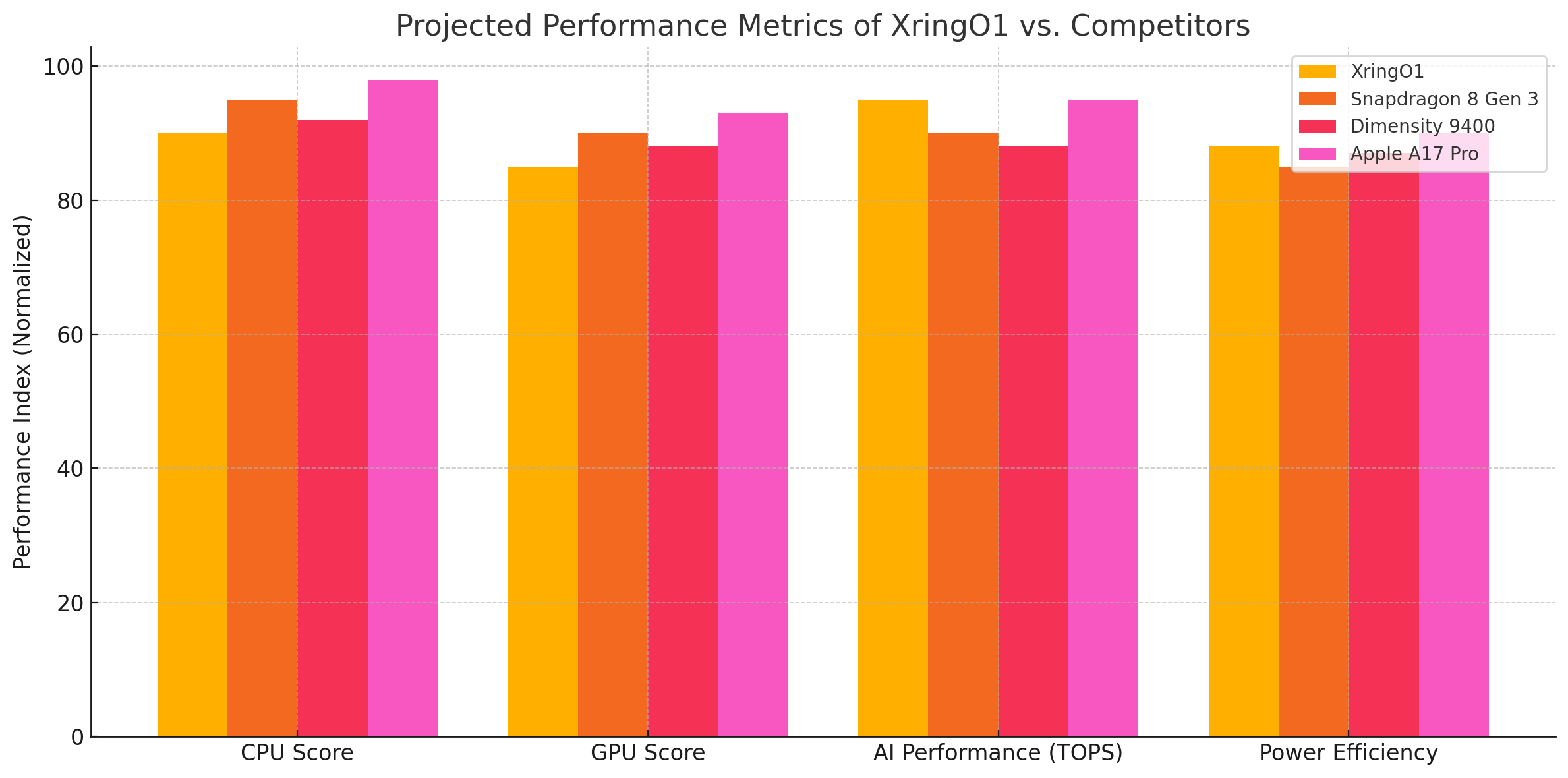

Comparative Benchmarks and Market Positioning

Preliminary benchmarks indicate that the XringO1 performs competitively against the latest Qualcomm Snapdragon 8 Gen 3 and MediaTek Dimensity 9400 processors. In Geekbench 6 single-core scores, the XringO1 reportedly achieves ~2200 points, while multi-core scores reach ~6800—placing it firmly within the high-performance tier of mobile SoCs.

In GPU benchmarks such as GFXBench and 3DMark, the chip delivers high frame rates in demanding workloads like Manhattan 3.1 and Aztec Ruins. The NPU, according to internal testing, surpasses 40 TOPS (trillions of operations per second), putting it in the same league as Apple’s A17 Pro chip in edge AI performance.

These results position the XringO1 not only as a viable alternative to existing mobile SoCs but also as a potential standard-setter for integrated device performance in the Android ecosystem. Xiaomi’s ability to deliver this level of performance with its first commercially scaled chip is a testament to its engineering rigor and long-term vision.

A comparative visualization showing how the XringO1 performs relative to Qualcomm’s Snapdragon 8 Gen 3, MediaTek’s Dimensity 9400, and Apple’s A17 Pro across CPU speed, GPU rendering, AI throughput (TOPS), and power efficiency.

Future Applications and Scalability

While the XringO1 is initially slated to debut in Xiaomi’s flagship 15S smartphone series, the architecture has been designed with modular scalability in mind. Xiaomi intends to create a family of processors derived from the Xring blueprint, including mid-range variants for the Redmi line, AI edge chips for IoT devices, and possibly even APUs (accelerated processing units) for smart TVs and automotive applications.

Furthermore, the company is exploring the use of chiplet-based design methodologies to enable faster iteration cycles and cost-effective performance scaling. This would allow Xiaomi to mix-and-match processing blocks (e.g., CPU, GPU, NPU, modem) to suit different use cases and market segments—enhancing flexibility while minimizing time-to-market.

The XringO1 marks a monumental leap in Xiaomi’s technological evolution, bringing the company from a chip integrator to a chip architect capable of delivering high-performance, power-efficient, and AI-optimized processors. The technical architecture of the chip—featuring an advanced tri-cluster CPU, state-of-the-art GPU and NPU accelerators, cutting-edge connectivity, and robust security modules—underscores Xiaomi’s ambition to play in the top echelon of global semiconductor innovation.

Backed by TSMC’s 4nm process and guided by a highly specialized internal engineering team, the XringO1 not only challenges incumbent industry leaders but also lays a foundation for a new generation of Xiaomi products characterized by tighter integration, superior performance, and greater strategic autonomy. As the chip prepares to make its commercial debut, all eyes will be on Xiaomi to deliver on the promise of this transformative technology.

Navigating Challenges and Industry Implications

While Xiaomi’s $7 billion commitment to semiconductor development represents a bold strategic leap, the journey toward chip autonomy is far from straightforward. Beyond technical execution, the company must navigate a complex matrix of operational, regulatory, geopolitical, and competitive challenges that could significantly influence the trajectory and success of its in-house chip program. This section examines the multifaceted risks Xiaomi must manage and explores the broader implications of its chip ambitions for the global smartphone industry, semiconductor ecosystem, and international trade dynamics.

Supply Chain Constraints and Foundry Dependencies

One of the most formidable challenges facing Xiaomi’s chip program is the continued reliance on external foundries—most notably Taiwan Semiconductor Manufacturing Company (TSMC)—for the fabrication of its advanced silicon. Although Xiaomi has successfully designed the XringO1, the actual manufacturing still occurs outside of China, in Taiwan, a region entangled in geopolitical sensitivities due to rising tensions across the Taiwan Strait.

TSMC’s 4nm and 3nm processes are considered among the most advanced globally, but access to such nodes is capacity-constrained and subject to prioritization. Major clients like Apple, AMD, and Nvidia often receive preferential allocation, potentially limiting Xiaomi’s ability to scale production rapidly. In a scenario where geopolitical tensions escalate or wafer allocations tighten, Xiaomi may find its supply chain bottlenecked despite having a working chip design.

Additionally, the cost structure associated with advanced nodes is substantial. Mask sets, design validation, and wafer costs for leading-edge processes often exceed hundreds of millions of dollars annually. Without sufficient volume, Xiaomi risks unfavorable unit economics compared to competitors with larger market shares or more diversified product portfolios.

Export Controls and Geopolitical Risks

The ongoing global semiconductor trade war—primarily between the United States and China—poses another significant threat to Xiaomi’s chip ambitions. U.S. export restrictions targeting China’s access to advanced semiconductor technologies, including design software, manufacturing equipment, and foundry services, have already impacted major Chinese players such as Huawei, SMIC, and others.

Although Xiaomi has not yet been subject to direct U.S. sanctions, the possibility cannot be ruled out, especially as the company moves deeper into sensitive technology sectors. Tools from American firms such as Cadence, Synopsys, and Ansys are widely used in chip design workflows, and any restriction on access could derail or delay Xiaomi’s development cycles.

Moreover, the Biden administration’s CHIPS and Science Act, alongside export control frameworks like the Foreign Direct Product Rule (FDPR), could indirectly affect Xiaomi if global foundries are barred from using U.S. tools to manufacture chips for Chinese firms. This legal architecture introduces a layer of strategic unpredictability, potentially forcing Xiaomi to diversify toward less advanced but locally controlled fabrication options—thereby undermining its performance goals.

Talent Acquisition and Retention in a Competitive Landscape

The semiconductor industry is experiencing a global shortage of skilled labor, particularly in areas such as chip architecture, analog and digital IC design, AI acceleration, and EDA tool development. Xiaomi’s ability to scale its chip program hinges heavily on the recruitment and retention of top engineering talent—a task made more difficult by intense competition from other Chinese firms, global tech giants, and government-sponsored semiconductor startups.

To date, Xiaomi has assembled a formidable team of over 2,500 engineers dedicated to chip design, many of whom have experience at leading players such as ARM, HiSilicon, Intel, and MediaTek. However, sustaining this team over a decade-long roadmap requires not only financial incentives but also a compelling technological vision and a stable innovation pipeline.

Furthermore, the location of Xiaomi’s chip R&D centers—mainly in Beijing, Shanghai, and Nanjing—must compete with cities like Shenzhen and Hangzhou, which host alternative tech hubs. Talent mobility is high in the semiconductor sector, and poaching remains a common practice. If Xiaomi fails to continuously invest in its talent ecosystem—through internal upskilling, external recruitment, and academic partnerships—it risks knowledge drain and project delays.

Market Acceptance and Ecosystem Integration

Even if the XringO1 delivers on its technical promises, market acceptance is not guaranteed. Consumers have grown accustomed to brand-name chips like Qualcomm’s Snapdragon or Apple’s A-series, and there is a level of brand trust and performance expectation attached to these processors. Xiaomi must demonstrate not only benchmark parity but also tangible, experiential advantages that justify the shift to proprietary silicon.

Ecosystem integration also remains a substantial hurdle. Third-party developers and peripheral manufacturers optimize their software and accessories based on the behavior of established SoCs. A new chip, no matter how powerful, requires robust documentation, SDK support, and developer outreach to ensure compatibility and performance optimization.

Xiaomi must therefore invest in cultivating a developer ecosystem around its silicon—similar to Apple’s tight hardware-software-app integration. Without this, the advantages of custom silicon may be underutilized, leading to consumer disappointment and reputational risk.

Strategic Implications for Global Smartphone Competition

Xiaomi’s semiconductor strategy carries far-reaching implications for the global smartphone industry. If successful, it could set a precedent for other OEMs to pursue chip independence, leading to a fragmentation of the Android SoC ecosystem. Such a trend could dilute the influence of traditional chipmakers like Qualcomm and MediaTek while pressuring them to accelerate innovation or reconsider their licensing models.

Additionally, Xiaomi’s move may prompt ecosystem competitors—such as Oppo, Vivo, and Realme—to double down on their own in-house chip initiatives, creating a technological arms race within the Android segment. While this could drive innovation, it could also lead to standardization challenges, increased software fragmentation, and ecosystem silos.

On the other hand, Xiaomi’s success could encourage more cohesive national industrial strategies in countries seeking to reduce reliance on Western chip technologies. This could reshape the competitive dynamics in global markets, especially in emerging economies where Xiaomi maintains a strong presence.

National Policy Impact and Long-Term Industrial Transformation

From a policy perspective, Xiaomi’s investment could serve as a proof-of-concept for public-private semiconductor development models in China. While the country’s previous flagship chip initiative—Huawei’s HiSilicon—has been stymied by sanctions, Xiaomi may represent a more diversified, commercially grounded approach to advancing national semiconductor capabilities.

This shift could influence regulatory attitudes and funding priorities within China’s Ministry of Industry and Information Technology (MIIT), National Development and Reform Commission (NDRC), and provincial tech bureaus. Success in the XringO1 program may lead to a new wave of incentives targeting mobile silicon, edge AI processors, and chiplet-based systems—ushering in a new era of industrial policy alignment.

However, this also places Xiaomi under heightened scrutiny. As a visible example of China’s tech resilience strategy, any perceived failure or underperformance could be politically amplified, increasing reputational and investor risk.

In conclusion, Xiaomi’s ambitious pursuit of in-house semiconductor development is fraught with challenges that extend well beyond engineering. From supply chain vulnerabilities and geopolitical entanglements to workforce competition and ecosystem integration hurdles, the road to chip independence is complex and high-stakes. Yet, it is precisely this difficulty that underscores the strategic necessity of the endeavor. If Xiaomi can overcome these obstacles, the payoff will be substantial—not only in terms of competitive differentiation and cost control, but also in terms of long-term industrial transformation and technological sovereignty.

The company’s success or failure will reverberate far beyond its own product lines, influencing the global balance of power in mobile computing, shaping semiconductor supply chain strategies, and redefining the competitive landscape of consumer electronics. As such, Xiaomi’s $7 billion chip gamble may prove to be one of the most consequential strategic decisions in the modern history of Chinese technology.

The Road Ahead for Xiaomi's Semiconductor Ambitions

Xiaomi's declaration to invest $7 billion over the next decade in proprietary chip development marks a historic inflection point—not only for the company itself but also for the broader landscape of mobile computing, Chinese industrial policy, and the global semiconductor ecosystem. Through the XringO1 initiative, Xiaomi has made it clear that its ambitions extend far beyond market share in smartphones; it is striving for long-term resilience, vertical integration, and strategic autonomy in an era where silicon is synonymous with sovereignty.

The journey from the modest and commercially constrained Surge S1 to the high-performance, 4nm XringO1 is not merely a tale of technological evolution—it is a testament to Xiaomi’s ability to absorb failure, adapt to dynamic external pressures, and execute with scale and precision. The XringO1, positioned to debut in Xiaomi’s flagship 15S smartphone series, embodies the company’s forward-looking philosophy: to design systems that tightly integrate hardware and software, to elevate user experience, and to reclaim agency over critical technology components in a volatile global supply chain.

Yet, as the preceding analysis has shown, Xiaomi’s success in this domain is contingent on overcoming a constellation of challenges. These include navigating global geopolitical fault lines, mitigating supply chain risks due to reliance on overseas foundries like TSMC, complying with evolving export control frameworks, and competing in a talent-constrained labor market. Moreover, achieving genuine market traction for its chip technology will require not only benchmark parity with incumbents like Qualcomm, MediaTek, and Apple but also broad ecosystem integration and consumer trust in a new silicon identity.

The implications of Xiaomi’s semiconductor push are significant and multifaceted. Should it succeed, Xiaomi will not only differentiate its product offerings but also inspire a new wave of vertical integration strategies among Android OEMs and broader Chinese tech enterprises. This could catalyze a reorganization of the smartphone value chain and accelerate the localization of critical technologies in China. Conversely, a failure or significant delay in the chip program could raise concerns about the viability of indigenous innovation in semiconductors under current global conditions, particularly for companies without state-owned enterprise status or direct policy insulation.

In either case, Xiaomi's chip journey is poised to become a case study in the complex interplay between innovation, national policy, and global technology markets. The next few years will be pivotal in determining whether the XringO1 is a one-off engineering showcase or the foundation of a lasting and scalable semiconductor strategy.

For Xiaomi, the path ahead is demanding but also ripe with opportunity. In a world increasingly defined by digital infrastructure and technological independence, building its own chip is more than a product decision—it is a declaration of intent, a blueprint for the future, and potentially, a defining legacy for one of China’s most globally recognized tech brands.

References

- Reuters – Xiaomi’s $6.93 Billion Chip Plan

https://www.reuters.com/business/media-telecom/xiaomi-invest-least-69-billion-chip-design-founder-says - Android Central – Xiaomi Building New Custom Smartphone Processor

https://www.androidcentral.com/phones/xiaomi/xiaomi-is-building-a-new-custom-smartphone-processor - HWBusters – Xiaomi’s In-House Chipset Surfaces

https://hwbusters.com/news/xiaomis-in-house-chipset-surfaces - Xiaomiui – Xiaomi Invests in Semiconductor Companies

https://xiaomiui.net/xiaomi-invests-in-semiconductor-companies - TechCrunch – China’s Push for Semiconductor Independence

https://techcrunch.com/china-pushes-for-semiconductor-independence - AnandTech – TSMC Advanced Node Manufacturing Explained

https://www.anandtech.com/show/tsmc-advanced-node-manufacturing - CNBC – Global Semiconductor Talent Shortage

https://www.cnbc.com/global-semiconductor-talent-shortage - Counterpoint Research – Mobile Chipset Market Trends

https://www.counterpointresearch.com/mobile-chipset-market-trends - Bloomberg – Apple’s Chip Strategy and Competitive Impact

https://www.bloomberg.com/apples-chip-strategy-impact - SCMP – China’s Tech Self-Reliance Strategy

https://www.scmp.com/tech/chinas-tech-self-reliance-strategy