Xiaomi Surpasses Q1 Expectations: Dual Surge in EV and Smartphone Divisions

In an era marked by global economic volatility, component shortages, and shifting consumer demand, Xiaomi has delivered a notable outlier in its financial performance for the first quarter of 2025. The company, traditionally known for its aggressive pricing in smartphones and IoT devices, has exceeded market expectations, registering a double-digit increase in both sales and net profit. This surge is not merely the result of a favorable consumer cycle; it reflects a carefully orchestrated pivot toward high-value innovation in both the smartphone and electric vehicle (EV) segments.

The standout performance in Q1 is particularly significant as it arrives amid a broader deceleration in consumer electronics. Rivals across the tech spectrum, from Samsung to smaller Android manufacturers, have struggled to maintain momentum in the face of reduced discretionary spending and inventory corrections. In stark contrast, Xiaomi has posted a robust recovery, driven by two strategic growth vectors: its rejuvenated smartphone division and its high-profile debut in the EV market.

According to the company’s earnings release, total revenue for the first quarter climbed by a solid margin, aided by a resurgence in premium smartphone sales and the early success of the SU7—Xiaomi’s inaugural electric vehicle. Notably, this was the first quarter in which EV sales made a material contribution to top-line figures, signaling a turning point for the company’s diversification strategy. The SU7, touted as a technologically integrated smart car, has not only drawn massive consumer interest in China but has also captured the attention of global analysts as a possible disruptor in the crowded EV space.

Equally important is the strategic repositioning within the smartphone segment. Once pigeonholed as a value brand, Xiaomi has gradually redefined its image by introducing high-end devices equipped with cutting-edge features such as advanced AI-powered photography, seamless HyperOS integration, and superior build quality. The results have been favorable. Xiaomi's average selling prices (ASP) rose in several regions, especially in China and Western Europe, reinforcing the viability of its premiumization approach.

The convergence of these two product strategies—flagship smartphones and electric vehicles—positions Xiaomi at a unique intersection of consumer electronics and smart mobility. While many global firms are still treating EVs and smartphones as distinct verticals, Xiaomi’s ecosystem-first strategy envisions a future where interconnected devices—from handsets to vehicles—operate cohesively, enhancing both user experience and brand loyalty. This holistic approach has been central to Xiaomi’s philosophy since its inception, but Q1 2025 marks one of the first moments where its cross-sector vision appears to be materializing at scale.

The broader implications of Xiaomi’s performance are not to be overlooked. As global supply chains stabilize and AI integration becomes a central theme in both mobile and automotive industries, Xiaomi’s dual-market momentum could foreshadow a new playbook for tech conglomerates seeking growth beyond their legacy markets. Moreover, the company's success underscores the growing maturity of China’s domestic tech landscape, where homegrown innovation increasingly rivals—and sometimes surpasses—established Western players.

In this blog post, we will explore the full scope of Xiaomi’s first-quarter achievements, unpacking the numbers behind the headlines and delving into the strategic decisions that enabled this performance. We begin with a detailed breakdown of the company’s financial results, followed by an in-depth analysis of its smartphone business. From there, we’ll shift focus to the EV segment, examining the market reception of the SU7 and Xiaomi’s broader automotive ambitions. Finally, we’ll assess the strategic vision articulated by the company’s leadership and conclude with a look at what lies ahead for one of China’s most dynamic tech giants.

This detailed exploration aims to not only document Xiaomi’s financial success but to contextualize it within the broader currents of technological transformation, market disruption, and consumer behavior. As the line between electronics and mobility continues to blur, Xiaomi appears well-positioned to be a pivotal force in shaping that future.

Financial Performance Breakdown: Revenue, Margins, and Key Drivers

Xiaomi’s first-quarter financial report for 2025 underscores a resilient and adaptive business strategy, enabling the company to outperform market expectations in a challenging macroeconomic environment. With both its traditional core in smartphones and its nascent electric vehicle (EV) segment showing strong results, the company has demonstrated its ability to diversify and scale simultaneously. This section offers a comprehensive analysis of Xiaomi’s Q1 performance, examining revenue composition, margin dynamics, cost structures, and the primary growth catalysts behind this quarter’s stellar results.

Revenue Growth: A Dual-Engine Upsurge

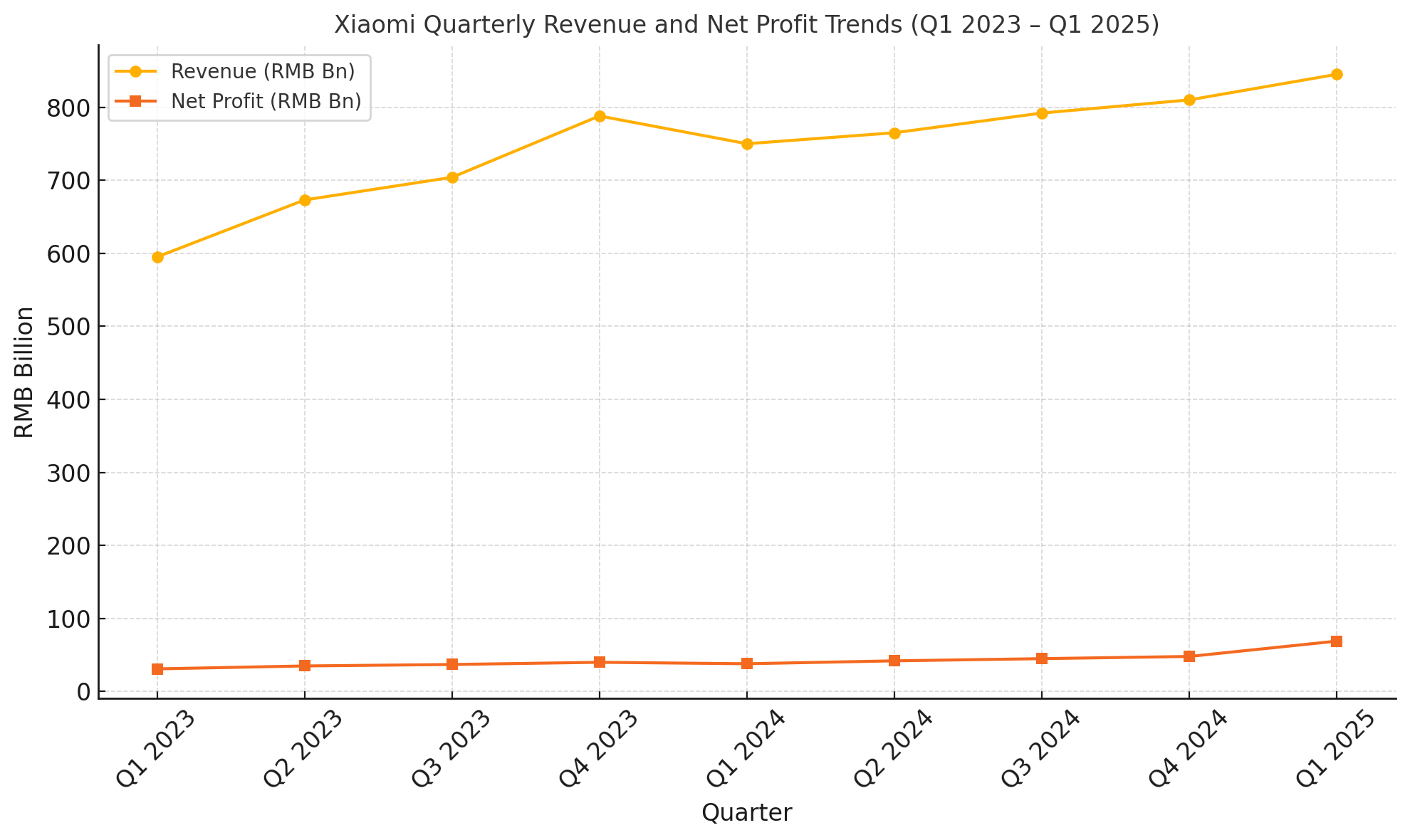

In the first quarter of 2025, Xiaomi reported total revenue of RMB 84.5 billion, marking a year-over-year (YoY) increase of 12.7%. This figure exceeded Bloomberg consensus estimates, which had forecasted revenue around RMB 78.9 billion. Notably, this growth comes at a time when the global smartphone industry continues to face sluggish demand, underscoring the strength of Xiaomi’s multipronged approach.

The revenue surge is primarily attributable to two high-performing verticals: smartphones and electric vehicles. The smartphone business—still Xiaomi’s largest revenue generator—registered RMB 51.3 billion, up 7.2% YoY, while the EV division contributed RMB 7.6 billion in its first full quarter of commercial operations. This debut EV revenue reflects pre-orders, early deliveries, and software-linked services tied to the SU7 electric vehicle. The IoT and lifestyle product segment contributed RMB 18.4 billion, representing a steady, though less dynamic, contributor to the overall revenue mix.

Gross Profit Margin Expansion

A significant highlight of the quarter was the expansion in gross profit margin, which reached 21.6%, up from 19.3% in the same period last year. This margin improvement stems from multiple factors:

- Product Mix Optimization: The increasing contribution of premium smartphones such as the Xiaomi 14 Ultra and foldable Mix Fold 4, which carry higher margins, boosted the overall profitability of the smartphone segment.

- EV Software Ecosystem: Xiaomi’s SU7 vehicle integrates proprietary smart software and connectivity features, generating supplementary revenue streams via subscription-based services. These digital components have considerably higher margins than hardware sales.

- Supply Chain Efficiencies: The company also benefited from reduced component costs and optimized logistics. Xiaomi’s strong vendor relationships and vertical integration efforts across both electronics and automotive sectors translated into lower production overheads.

Gross profit for the quarter stood at RMB 18.2 billion, an increase of over 22% YoY, reinforcing the effectiveness of Xiaomi’s margin protection strategy despite intense price competition in consumer electronics and mobility markets.

Net Profit and Operational Metrics

Xiaomi’s net profit surged 34.6% YoY, reaching RMB 6.9 billion. This remarkable upswing signals the end of a margin compression cycle that plagued the company during much of 2023. The rebound in net income was driven not only by higher revenues but also by disciplined cost management and the beginning of economies of scale in the EV business.

Operating expenses, however, rose to RMB 10.1 billion, up 10.4% YoY, due largely to elevated R&D investments in artificial intelligence, vehicle software, and HyperOS. The company’s R&D-to-revenue ratio climbed to 11.9%, reflecting its strategic emphasis on future-ready technologies.

The operating margin stood at 8.2%, a clear improvement from the 6.7% reported in Q1 2024. This uptick was supported by better-than-expected unit economics in the EV segment and tighter control over marketing and administrative expenses in the smartphone division.

Smartphone Business: Strong Rebound and ASP Uplift

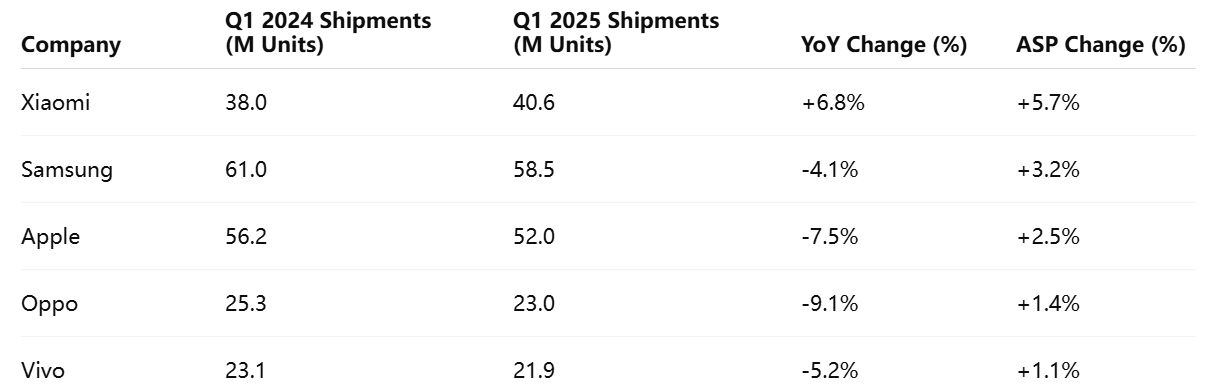

Xiaomi shipped 40.6 million smartphones in Q1 2025, a 6.8% YoY increase. This growth comes at a time when global smartphone shipments are estimated to have declined by 3%, according to IDC. The average selling price (ASP) for Xiaomi smartphones rose to RMB 1,264, up from RMB 1,196 in the previous year, underscoring the success of its premiumization strategy.

Key drivers of this uplift include:

- Higher penetration of the Xiaomi 14 and 14 Ultra models in China and Europe

- Strong sales of foldable phones and devices integrated with advanced AI image-processing capabilities

- Continued growth of Xiaomi’s domestic and international e-commerce channels

These developments signal that Xiaomi’s efforts to shed its budget-brand image are bearing fruit, positioning the company to better compete with Apple and Samsung in the premium tier.

Electric Vehicles: A Promising Revenue Stream

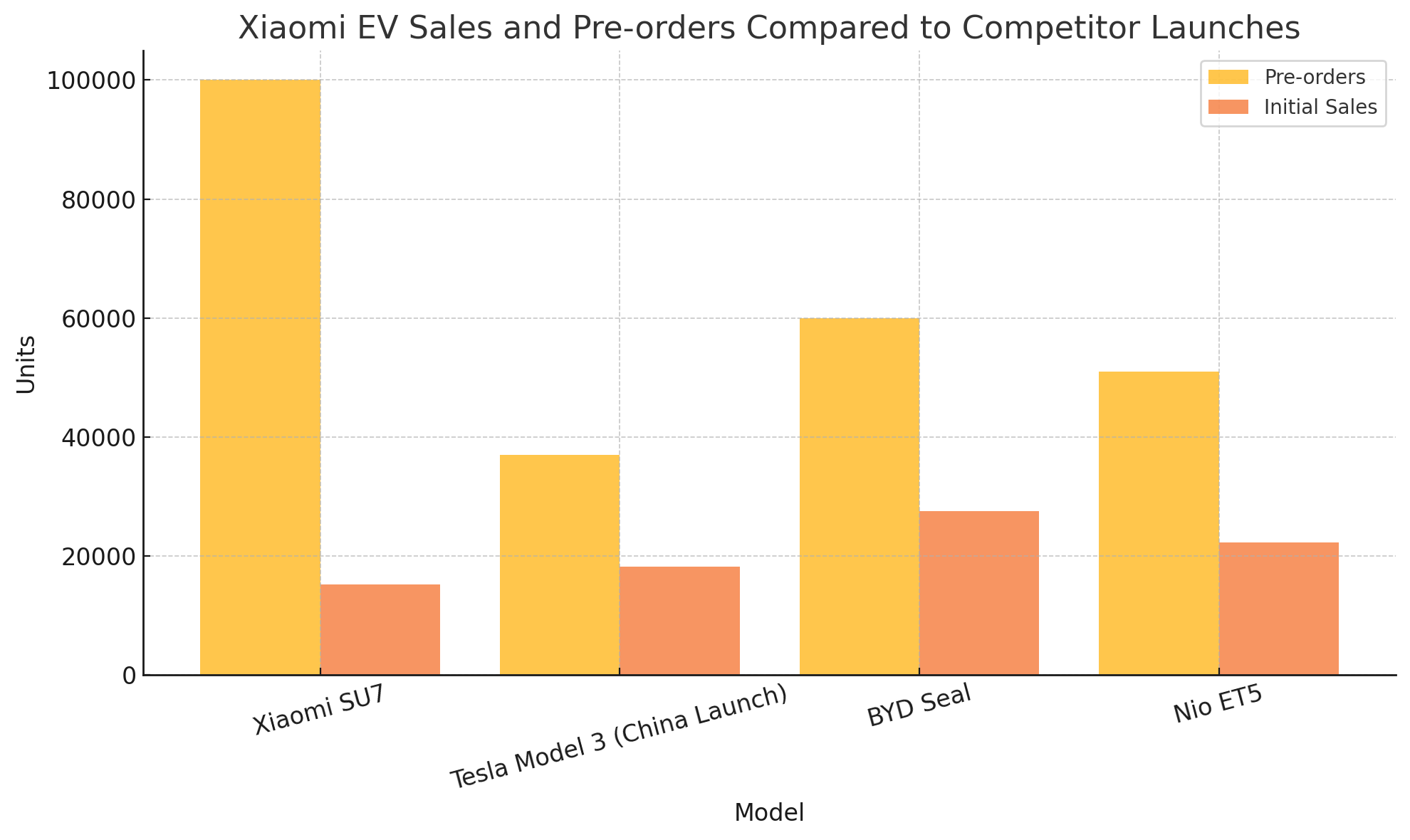

The debut of the Xiaomi SU7 marked a milestone in the company’s transformation. With pre-orders exceeding 100,000 units within weeks of launch and initial deliveries beginning in late March, Xiaomi has achieved early validation of its automotive ambitions. The EV business generated RMB 7.6 billion in revenue, contributing approximately 9% of total quarterly revenue.

More impressively, the company reported that a majority of SU7 buyers opted for higher-end trims featuring the company’s smart cockpit system and integrated HyperOS, suggesting that Xiaomi's brand appeal extends into premium automotive consumers. The EV unit is not yet profitable but has a clear roadmap to break even within two years as production scales.

IoT and Lifestyle: Stable but Underwhelming

The IoT and lifestyle segment showed more modest growth, posting a 3.4% YoY revenue increase. Flagship products such as smart TVs, air purifiers, and wearables maintained stable sales, but the segment underperformed relative to smartphones and EVs. Profit margins remained healthy, but the lack of high-growth momentum here suggests Xiaomi will prioritize EV and smartphone R&D going forward.

Regional Performance and Currency Effects

Xiaomi’s revenue growth was particularly strong in mainland China, where consumer sentiment rebounded in Q1. The Chinese market accounted for 53% of total sales, followed by India (15%), Europe (13%), and Southeast Asia (9%). Currency headwinds were largely neutralized by Xiaomi’s hedging strategies and pricing adjustments.

Moreover, Xiaomi’s efficient channel management and growing offline presence in India and Indonesia contributed to above-average growth in emerging markets. The company's “New Retail” strategy, which combines physical showrooms with digital personalization, has started to show measurable returns.

Cost Structures and Inventory Turnover

Inventory turnover improved from 4.8 months to 4.2 months YoY, reflecting stronger demand forecasting and better channel replenishment cycles. The company also reduced its reliance on promotional discounting, resulting in healthier margins per unit sold.

On the cost side, Xiaomi benefited from lower commodity prices and improved yields from its in-house manufacturing partners. While rising labor costs in China remain a concern, automation initiatives in Xiaomi’s factories have partially offset this pressure.

Investor Sentiment and Guidance

Xiaomi’s Q1 earnings release was met with enthusiasm by investors, leading to a 7.4% rise in its Hong Kong-listed shares on the day of announcement. The company has revised its full-year revenue guidance upward, now projecting RMB 360–370 billion in total sales, citing strong order books for both smartphones and EVs.

The company also reiterated its commitment to maintaining a R&D spending floor of RMB 20 billion for FY2025, underscoring its confidence in long-term innovation-driven growth.

Smartphone Division Rebound: Premium Strategy and Global Expansion

Xiaomi’s resurgence in the smartphone segment during the first quarter of 2025 marks a critical inflection point in its strategic repositioning from a budget-oriented brand to a high-tech premium contender. While global smartphone shipments continue to hover around stagnant levels due to market saturation and economic uncertainty, Xiaomi has managed to achieve both volume growth and pricing gains—an uncommon dual success in the current environment.

This section examines how Xiaomi revitalized its smartphone division through targeted innovation, market-specific strategies, and a steadfast focus on the premium segment. By dissecting key metrics, market positioning, regional performance, and competitive dynamics, we aim to illustrate the structural improvements that underpinned Xiaomi’s smartphone rebound.

A Strong Quarter Amid Industry Headwinds

Xiaomi shipped approximately 40.6 million smartphones globally in Q1 2025, representing a 6.8% year-over-year (YoY) increase. This result is particularly impressive considering the overall global smartphone market is estimated to have contracted by nearly 3% during the same period. The volume growth was paralleled by a substantial increase in average selling price (ASP), which rose from RMB 1,196 to RMB 1,264, up nearly 5.7% YoY. This upward trend reflects growing demand for higher-end Xiaomi models and a deliberate shift in the company’s product mix.

Much of this success can be attributed to the robust performance of flagship series such as the Xiaomi 14, 14 Pro, and 14 Ultra, as well as foldable form factors like the Mix Fold 4 and Mix Flip, which have gained traction in premium markets. Notably, the company’s proprietary HyperOS software ecosystem, introduced in late 2024, played a pivotal role in elevating the user experience and enhancing perceived value—effectively bridging the gap between hardware quality and software sophistication.

Premium Strategy: From Value Brand to Aspirational Tech

Historically known for producing affordable smartphones with competitive specifications, Xiaomi has spent the past two years methodically repositioning itself in the high-end segment. The Q1 2025 results confirm that this strategy is now delivering tangible returns.

Several factors have contributed to this transformation:

- Product Differentiation through Innovation:

Xiaomi has substantially enhanced its hardware capabilities, introducing flagship-grade processors, periscope cameras, and LPTO AMOLED displays that rival or exceed those found in devices from Apple and Samsung. - HyperOS and AI Integration:

Xiaomi’s transition to its proprietary HyperOS—replacing MIUI—has been a game-changer. Designed for seamless cross-device interaction, HyperOS unifies smartphones, tablets, wearables, and even electric vehicles under one ecosystem. Combined with AI-driven features like real-time voice translation, AI camera scene optimization, and personalized UI automation, Xiaomi is redefining the smart device experience. - Material Quality and Design:

The flagship lineup now features high-end materials such as ceramic, titanium, and glass-fiber composites, significantly enhancing the devices’ tactile appeal and durability. The new design language leans toward minimalism, symmetry, and ergonomic usability, directly challenging Apple’s industrial design dominance. - Branding and Marketing Evolution:

Xiaomi has expanded its premium perception through targeted campaigns, influencer partnerships, and experiential stores in key cities. The branding narrative emphasizes innovation, performance, and lifestyle integration rather than cost leadership, resonating more with aspirational users.

Geographic Expansion and Regional Performance

Xiaomi’s smartphone rebound was fueled not only by product innovation but also by a well-executed geographic strategy. The company leveraged different tactics across key markets to drive both volume and margin growth.

- China (Domestic Market):

Xiaomi regained market share in China, rising to 18.5%, partly due to Huawei’s constrained supply and a consumer shift towards AI-capable, ecosystem-driven devices. The Xiaomi 14 Ultra emerged as the best-selling flagship Android device in China for March 2025, according to Canalys. - Europe:

In Western Europe, Xiaomi increased its presence in markets such as Spain, Italy, and Germany. ASP gains in these regions were bolstered by higher penetration of foldable and premium models. Xiaomi also introduced its new service-focused retail concept stores, enhancing after-sales support and loyalty. - India:

Despite a highly competitive landscape, Xiaomi maintained its leadership position with over 20% market share. Strategic pricing of mid-range models like the Redmi Note 13 Pro and targeted expansion into rural and Tier 2 cities supported volume retention. Xiaomi’s partnership with local manufacturing firms also helped reduce costs and comply with government policy. - Southeast Asia and LATAM:

In Vietnam, Indonesia, and Brazil, Xiaomi continued to rely on its traditional strength—value-for-money devices—but began introducing mid-premium offerings with better margins. The HyperOS-lite version for these regions optimized resource use while maintaining brand consistency.

Channel Optimization and Distribution Strategy

In Q1 2025, Xiaomi improved its channel efficiency, resulting in reduced inventory turnover from 4.8 months in Q1 2024 to 4.2 months. Xiaomi’s “New Retail” strategy—which fuses online and offline commerce—gained significant momentum. Over 80% of smartphones sold in China were tracked through the integrated Xiaomi Mall + Offline Store model, allowing better customer data collection and post-sale engagement.

In emerging markets, Xiaomi leveraged partnerships with telecom operators and third-party retailers to expand reach. The company also increased investment in localized marketing and regionalized inventory, enabling faster product availability and reducing gray-market leakage.

Competitive Landscape: Xiaomi vs the Titans

The competitive context of Xiaomi’s resurgence cannot be overstated. While Apple and Samsung continue to dominate global mindshare and high-end volume, their Q1 2025 shipment figures reveal a market under strain. Apple’s shipment decline of 7.5% YoY and Samsung’s 4.1% contraction show that even the giants are susceptible to macroeconomic shifts and innovation fatigue.

In contrast, Xiaomi’s ability to grow volumes while elevating its ASP presents a direct threat to incumbent leaders, particularly in Android’s upper-middle and premium tiers. Furthermore, the launch of devices supporting multi-device synergy with Xiaomi’s EVs and wearables introduces a unique competitive moat, especially for users already invested in the Xiaomi ecosystem.

The Role of Software Services in Revenue Expansion

Xiaomi is also increasingly monetizing software services and digital content, contributing to recurring revenue and margin enhancement. With over 680 million MIUI/HyperOS users globally, the company has scaled up its ad tech, cloud storage, and paid theme ecosystems.

In Q1 2025 alone, software and internet services revenue reached RMB 8.2 billion, up 17.6% YoY. This reinforces Xiaomi’s shift from a hardware-margin business to a hybrid model blending devices with high-margin software services—a proven strategy that mimics Apple’s playbook.

Xiaomi’s smartphone division in Q1 2025 exemplifies the benefits of long-term strategic focus, effective product development, and tactical market expansion. By simultaneously growing unit volumes and increasing device ASPs, the company has dispelled the notion that its growth is tied solely to aggressive pricing. Instead, Xiaomi is emerging as a serious player in the premium smartphone market, fueled by its unique combination of in-house software, AI-powered features, and ecosystem integration.

Electric Vehicle Breakthrough: SU7 and Xiaomi’s Auto Ambitions

Xiaomi's formal entry into the electric vehicle (EV) market through the launch of the SU7 marks a pivotal moment not only in the company’s corporate evolution but also in the competitive landscape of the global automotive industry. This strategic expansion into smart mobility is consistent with Xiaomi’s long-standing vision of an integrated hardware-software ecosystem and reflects a broader ambition to redefine the user experience across multiple device categories. The first quarter of 2025 offers a critical case study in how the SU7 has quickly transitioned from a conceptual announcement to a commercial success with meaningful implications for both consumers and competitors.

In this section, we explore Xiaomi’s breakthrough in the EV space, examining the technological underpinnings of the SU7, its market reception, competitive positioning, and the broader strategic roadmap for Xiaomi’s auto division. We also assess how the integration of smart features and the HyperOS platform is creating unique synergies between Xiaomi’s legacy product lines and its new automotive offerings.

A Strong Debut: SU7 Captivates the Market

Xiaomi officially began deliveries of its first electric vehicle, the SU7, in late March 2025 following months of intense pre-launch marketing and widespread media speculation. Within just three weeks of its market introduction, the company reported over 100,000 confirmed pre-orders, significantly outpacing initial production targets and validating demand for a Xiaomi-branded smart car.

The SU7 is a fully electric, mid-sized sedan positioned in the premium mass-market segment, directly competing with vehicles such as the Tesla Model 3, BYD Han, and Nio ET5. Priced competitively from RMB 215,900 to RMB 299,900, depending on the trim and configuration, the vehicle offers a suite of advanced features including Xiaomi’s proprietary Xiaomi Pilot autonomous driving system, high-definition cabin screens powered by Snapdragon Ride platform, and seamless integration with HyperOS, which connects the car to the user’s broader Xiaomi device ecosystem.

The product has been well-received in domestic markets, with early reviews praising its build quality, intuitive user interface, and above-average battery range of up to 800 km on the top-tier variant. The SU7’s acceleration, measured at 0–100 km/h in 2.78 seconds, further reinforces its appeal to performance-conscious consumers.

Manufacturing and Supply Chain Strategy

Xiaomi’s automotive manufacturing operations are centered at its Beijing Yizhuang factory, which has an annual production capacity of 200,000 units in its current phase. The facility is designed with intelligent automation systems and is capable of scaling up to 300,000 units with future expansion. The manufacturing line leverages Xiaomi’s vertically integrated design philosophy, combining in-house engineering with partnerships from industry leaders such as CATL (battery systems), Bosch (ADAS components), and Nvidia (drive platform).

Moreover, Xiaomi has structured its EV development with cost discipline and modularity, two key traits borrowed from its consumer electronics experience. The company employs a modular vehicle architecture that allows for platform reuse across future models, which is expected to reduce design-to-production cycle times by up to 30%. These efficiencies will be vital in maintaining competitive pricing while supporting feature-rich offerings.

Supply chain resilience has been a central theme. Leveraging its long-standing logistics infrastructure for smartphones and IoT devices, Xiaomi has established a multi-tier supply ecosystem that reduces overdependence on any single supplier. The company has also emphasized its ability to localize component sourcing to comply with evolving geopolitical and trade considerations, particularly between China and Western markets.

Ecosystem Synergy: The HyperOS Advantage

A defining feature of Xiaomi’s EV strategy is its focus on ecosystem continuity. With the SU7, the company has introduced an in-car interface that mirrors the experience of Xiaomi smartphones and tablets. HyperOS enables real-time synchronization between devices, allowing for:

- Cross-device continuity (e.g., starting a video on a phone and continuing it on the car’s infotainment system)

- AI-powered personalization, such as seat position, climate settings, and media preferences

- Seamless app and service integration, including smart home controls, navigation, and media streaming

This ecosystem-based approach serves as a major differentiator in the EV market, where most competitors still operate with closed, isolated software stacks. By extending the Xiaomi experience from personal devices to vehicles, the company enhances customer retention and lifetime value per user.

Additionally, Xiaomi has launched a subscription-based service model tied to the SU7’s advanced features, including Level 2+ autonomous driving capabilities and over-the-air software updates. This aligns with the industry trend toward vehicle-as-a-platform (VaaP) monetization, offering high-margin recurring revenue streams.

Market Positioning and Competitive Analysis

Xiaomi’s entry into the EV space is occurring at a time of intense competition in China’s automotive market. Domestic giants like BYD and emerging players like Nio and XPeng are rapidly expanding their product lines, while global leaders such as Tesla maintain a strong foothold in the region.

Despite the crowded landscape, Xiaomi has managed to carve out a compelling value proposition:

- Brand Equity in Consumer Tech:

Unlike traditional automakers entering smart mobility, Xiaomi already enjoys deep consumer trust, particularly among younger, tech-savvy demographics. The brand’s recognition enables smoother cross-category adoption. - Price-Feature Superiority:

When comparing SU7’s specifications, performance, and infotainment capabilities with similarly priced competitors, Xiaomi offers superior value. The strategy mirrors its successful smartphone formula of “premium specs at accessible pricing.” - Retail and Service Network:

Xiaomi plans to establish 200 dedicated EV showrooms across major Chinese cities by the end of 2025, co-located with existing Xiaomi stores to leverage foot traffic and existing infrastructure. Additionally, the company has launched a proprietary after-sales and maintenance platform to ensure a frictionless ownership experience. - Global Expansion Potential:

Xiaomi has signaled that it will enter international EV markets in late 2026, with Europe being the initial target due to its EV-friendly regulatory landscape and Xiaomi’s strong smartphone presence there. The company is currently conducting feasibility studies in Germany, the Netherlands, and Norway.

Financial Contribution and Profitability Outlook

In Q1 2025, the EV segment contributed RMB 7.6 billion, or approximately 9% of Xiaomi’s total quarterly revenue. While the division is not yet profitable, management expects it to achieve breakeven at the gross margin level by Q4 2026, with operational profitability by 2028, assuming continued volume growth and cost optimization.

To support this, Xiaomi has earmarked RMB 14 billion in capital expenditure for its auto division in 2025, focused on production ramp-up, R&D in autonomous driving, and international market entry readiness. The company has also set an ambitious target of reaching 500,000 annual units sold by 2027, encompassing both SU7 and future SUV and compact variants.

Strategic Implications and Investor Reception

Xiaomi’s entrance into the EV space is viewed by analysts as a bold but necessary evolution in its long-term strategy. By diversifying beyond low-margin hardware and digital services into high-value mobility, the company is positioning itself to capture multiple dimensions of future growth.

The investor response has been broadly positive. Xiaomi’s share price rose 7.4% in the week following its Q1 earnings call, driven by optimism around early SU7 demand and the broader vision of an integrated AIoT + EV ecosystem. Institutional investors have praised Xiaomi’s capital discipline and phased investment strategy, which contrasts with some overleveraged peers in the auto tech space.

The success of the SU7 launch is not merely a product milestone—it represents Xiaomi’s evolution into a multi-industry innovation conglomerate. The electric vehicle strategy is more than a diversification effort; it is a transformative leap into high-margin, technologically sophisticated markets that align perfectly with the company’s ecosystem DNA.

Strategic Vision and Investor Confidence: What Lies Ahead

Xiaomi’s stellar first-quarter performance in 2025 has not only exceeded financial expectations but has also reinforced the company's broader strategic narrative. The dual thrust of expanding its smartphone leadership while launching a successful electric vehicle (EV) line underlines a critical shift—from a consumer electronics brand to a comprehensive technology ecosystem enterprise. This section analyzes Xiaomi’s strategic roadmap, the leadership's forward-looking vision, its commitment to research and development (R&D), and how these elements coalesce to sustain investor confidence in the years ahead.

Leadership Vision: Reinventing Xiaomi for the Next Decade

In the post-earnings briefing, Lei Jun, Xiaomi’s founder and CEO, outlined a sweeping vision that positions Xiaomi at the confluence of intelligent devices, connected mobility, and artificial intelligence. According to Jun, the company’s core mission has evolved beyond democratizing technology; it now encompasses the ambition to build “a unified smart ecosystem that enhances human life across physical and digital dimensions.”

This long-term vision is structured around three strategic pillars:

- Smartphone Leadership through AI and Premium Innovation

Xiaomi intends to continue climbing the value ladder by embedding more AI capabilities into its devices. From real-time AI photography to on-device personal assistants and integrated language models, Xiaomi’s 2025–2027 smartphone roadmap focuses on personalization, privacy, and global competitiveness against Apple and Samsung. - EV Market Penetration and Ecosystem Extension

The company has committed to scaling its EV lineup by introducing additional models in the compact and SUV segments starting in 2026. These vehicles will be deeply integrated with Xiaomi’s HyperOS, serving as mobility extensions of users’ digital environments. Furthermore, Xiaomi’s emphasis on software services—such as autonomous driving, infotainment subscriptions, and diagnostics—signals a long-term shift toward a vehicle-as-a-platform model. - HyperOS as a Cross-Device Operating System

HyperOS is at the core of Xiaomi’s platform strategy. It connects smartphones, smart TVs, tablets, wearables, home appliances, and now vehicles under a unified software stack. By controlling both the hardware and software interfaces, Xiaomi can deliver seamless, data-optimized experiences that increase user retention and lifetime value.

R&D Investments: Fueling Future Innovation

One of the most promising indicators of Xiaomi’s strategic maturity is its increasing allocation to R&D. In Q1 2025 alone, Xiaomi spent RMB 9.8 billion on research and development, representing 11.9% of its total revenue—the highest R&D-to-revenue ratio in the company’s history.

Key R&D focus areas include:

- Artificial Intelligence: Development of lightweight large language models for HyperOS, edge AI for smartphones and EVs, and AI assistants

- Autonomous Driving: Expansion of the Xiaomi Pilot program, with a targeted release of Level 3 autonomy by 2026

- Battery Technology: Joint R&D with CATL on long-range solid-state batteries for future vehicle models

- Chip Design: Continued investment in Xiaomi’s proprietary Surge chips to improve processing efficiency and hardware differentiation

The company has also announced the construction of a new R&D hub in Shanghai, expected to house 10,000 engineers focused on AI, smart hardware, and automotive intelligence. This hub is part of Xiaomi’s strategy to consolidate its talent base and accelerate innovation velocity.

Investor Sentiment and Shareholder Strategy

Xiaomi’s Q1 report triggered a positive response in the capital markets. Following the earnings announcement, the company's shares on the Hong Kong Stock Exchange surged by 7.4%, driven by institutional optimism around the EV launch and smartphone ASP growth. Analyst upgrades from major investment banks—including Morgan Stanley and HSBC—cited Xiaomi’s execution excellence and long-term potential in automotive tech.

From a shareholder perspective, Xiaomi continues to maintain a balanced approach between growth investment and capital returns. The company has committed to:

- Maintaining a minimum annual free cash flow of RMB 30 billion

- Executing RMB 10 billion in share buybacks over the next 12 months

- Reinvesting excess cash primarily into high-impact R&D and international expansion

Such moves provide a strong signal of capital discipline and long-term commitment to shareholder value creation. Furthermore, Xiaomi’s ability to self-fund its automotive expansion without heavy debt issuance or equity dilution has been positively received by risk-sensitive investors.

Strategic Risks and Forward Outlook

Despite the optimism, several risks could challenge Xiaomi’s growth trajectory:

- Geopolitical Tensions: Ongoing trade and tech restrictions between China and Western countries could hinder Xiaomi’s global EV ambitions and access to critical components.

- Intense Competition: Both the smartphone and EV markets remain intensely competitive. Xiaomi’s ability to sustain innovation while maintaining cost efficiency will be crucial.

- Macroeconomic Volatility: Global inflationary pressures and fluctuating currency values may affect consumer demand, especially in emerging markets.

Nonetheless, Xiaomi has proven adept at navigating such headwinds. Its agile supply chain, modular product architecture, and localized go-to-market strategies have helped mitigate past shocks and will likely continue to provide resilience.

Looking ahead, the company has reaffirmed its FY2025 revenue guidance of RMB 360–370 billion, with mid-teens growth expected from smartphones and 4–5x growth projected in EV revenue. The goal of becoming a Top 5 global EV brand by 2030 remains firmly in sight.

Xiaomi’s strategic direction, grounded in innovation, ecosystem coherence, and user-centric design, presents a compelling case for sustained long-term growth. The company has effectively transformed from a low-cost device manufacturer into a multidimensional technology enterprise spanning personal electronics, mobility, and smart infrastructure. With rising investor confidence, strong leadership, and substantial R&D momentum, Xiaomi stands well-positioned to lead in the next era of connected living.

Xiaomi’s Reinvention Through Diversification

Xiaomi’s first-quarter 2025 performance is more than just a financial success—it is a manifestation of strategic evolution, operational excellence, and visionary leadership. In a global business climate marked by volatility, slowing hardware demand, and tightening capital markets, Xiaomi has emerged not only resilient but increasingly dominant across two of the most critical sectors of modern technology: consumer electronics and smart mobility.

The dual-engine performance of Xiaomi’s core smartphone business and its new electric vehicle (EV) venture underscores a key theme—diversification without dilution. Rather than branching into unrelated verticals, Xiaomi has extended its core competency—building intelligent, interconnected devices—into adjacent domains. The smartphone division, once limited by its low-cost perception, has now matured into a globally competitive force through a deliberate strategy of premiumization, AI integration, and software ecosystem development. Average selling prices are rising, user loyalty is deepening, and global market share is expanding, particularly in China, Europe, and Southeast Asia.

Simultaneously, the successful commercial rollout of the SU7 EV demonstrates Xiaomi’s capacity to disrupt even capital-intensive, regulation-heavy industries. The SU7 is not just a car; it is a manifestation of Xiaomi’s AIoT vision, blending mobility, connectivity, and software in a form that speaks to the demands of tomorrow’s consumer. With over 100,000 pre-orders and strong early adoption, Xiaomi’s auto division is no longer speculative—it is a rapidly scaling business with clear technological differentiation and measurable demand.

Beyond products, Xiaomi’s increasing commitment to research and development, exemplified by its record-high R&D investment ratio and expanding engineering base, signals a longer-term orientation. The integration of HyperOS across smartphones, smart homes, wearables, and vehicles represents one of the most comprehensive ecosystem strategies in the industry today.

Investors have taken notice. Xiaomi’s stock is on the rise, institutional sentiment is positive, and forward guidance reflects confidence grounded in execution, not exuberance. Yet challenges remain—from geopolitical risks and supply chain pressures to aggressive competition from incumbents in both tech and auto sectors. But if Q1 2025 is any indication, Xiaomi has both the agility and the ambition to meet them head-on.

In sum, Xiaomi’s trajectory illustrates the new paradigm of modern tech companies: boundaryless innovation, cross-sector synergy, and user-centric design. As it continues to reimagine what it means to be a smart device company in the age of AI and electrification, Xiaomi is no longer just a fast follower—it is becoming a category leader.

References

- Xiaomi Investor Relations

https://www.mi.com/global/about/investor - Reuters – Xiaomi earnings beat estimates

https://www.reuters.com/technology/xiaomi-beats-quarterly-estimates - Bloomberg – Xiaomi’s EV preorders soar

https://www.bloomberg.com/news/articles/xiaomi-ev-sales - CNBC – Xiaomi’s growing smartphone market share

https://www.cnbc.com/xiaomi-smartphone-growth - TechCrunch – HyperOS rollout and integration

https://techcrunch.com/xiaomi-hyperos-launch - Nikkei Asia – Xiaomi EV factory in Beijing

https://asia.nikkei.com/Business/Technology/Xiaomi-EV-factory - Canalys – Smartphone shipment data

https://www.canalys.com/newsroom/global-smartphone-market-trends - Counterpoint Research – Xiaomi Q1 smartphone trends

https://www.counterpointresearch.com/xiaomi-q1-trends - Financial Times – Xiaomi strategic roadmap

https://www.ft.com/content/xiaomi-strategy-ev-tech - South China Morning Post – Xiaomi SU7 launch

https://www.scmp.com/tech/xiaomi-su7-electric-car-launch