U.S. Economy Contracts Amid Surge in Imports and Tariff Concerns: Economic Outlook for 2025

The U.S. economy's performance in the first quarter of 2025 has raised significant concerns among economists and policymakers. For the first time since early 2022, the U.S. recorded a contraction in its Gross Domestic Product (GDP), marking a stark departure from the post-pandemic recovery trajectory. The economy shrank by 0.3% during Q1 2025, a surprising turn of events given the nation's efforts to regain its economic footing after the COVID-19 pandemic and the aggressive fiscal and monetary interventions employed in recent years.

This unexpected downturn has been attributed to a series of interconnected factors, with the surge in imports and the looming threat of tariff increases playing central roles in driving the contraction. As businesses and consumers rushed to stockpile goods in anticipation of new trade tariffs, the nation's trade deficit ballooned, exacerbating the challenges faced by domestic production and growth. With imports rising sharply in Q1 2025, the U.S. faced a significant imbalance in its international trade, which ultimately contributed to the negative GDP growth.

In the context of a globalized economy, the U.S. has long been a major player in both imports and exports. However, in recent months, trade tensions have escalated, largely driven by the imposition of tariffs on foreign goods, particularly from key trading partners such as China and the European Union. The U.S. administration's approach to trade, including the introduction of new tariffs and adjustments to existing ones, has been a source of both economic optimism and concern. While tariffs are often viewed as a means to protect domestic industries and reduce trade imbalances, their long-term effects on economic growth remain uncertain.

This blog post will explore the primary factors contributing to the contraction of the U.S. economy in Q1 2025, with a particular focus on the surge in imports and the role of tariffs in reshaping trade dynamics. Through a detailed examination of the economic indicators, including consumer spending, inflation, and employment trends, we will assess the broader implications of this economic slowdown for both domestic and international markets. Additionally, we will analyze the potential risks and challenges the U.S. economy may face in the coming months, as policymakers and businesses navigate the complexities of a rapidly evolving global trade environment.

As we delve into this topic, we will explore the immediate causes of the contraction, examine the role of government policies in shaping the trade landscape, and discuss the potential strategies for recovery. By understanding the broader economic context and the implications of these key factors, we can gain a clearer picture of where the U.S. economy may be headed in the near future.

The Surge in Imports: A Pre-Tariff Stockpiling Phenomenon

One of the primary factors contributing to the contraction of the U.S. economy in the first quarter of 2025 was the significant surge in imports, a phenomenon driven largely by businesses' efforts to stockpile goods ahead of anticipated tariff increases. This behavior was particularly pronounced in industries reliant on foreign goods, where the potential for higher costs due to tariffs prompted an immediate rush to secure inventory. As a result, the surge in imports during Q1 2025 set a record, marking an unprecedented 41.3% increase compared to previous quarters.

This preemptive purchasing strategy is not a new phenomenon, as businesses have historically responded to the threat of tariffs with similar tactics. However, the scale of this surge was particularly notable due to the uncertainty surrounding the U.S. administration’s approach to international trade. With the announcement of new tariffs on foreign goods, many companies accelerated their supply chain decisions to avoid higher costs and ensure the availability of critical materials and products. This strategy was most evident in sectors such as electronics, automotive, and consumer goods, where global supply chains play a crucial role in meeting domestic demand.

The impact of this surge in imports was immediate and significant. As businesses brought in record quantities of goods from overseas, the U.S. saw a corresponding spike in its trade deficit, which in turn heavily impacted GDP calculations. According to the Bureau of Economic Analysis (BEA), the trade deficit reached a staggering $162 billion in Q1 2025, a level not seen in over two decades. This contributed to a 4.8 percentage point reduction in the overall GDP, effectively dragging down economic growth for the quarter.

In the context of these heightened import levels, the composition of goods imported also provides insight into the nature of the stockpiling behavior. A significant portion of the increase was seen in the importation of information processing equipment, such as semiconductors and telecommunications infrastructure. These goods are crucial for both consumer electronics and industrial applications, and their stockpiling was seen as essential to maintaining operations in the face of tariff hikes. The automotive sector also saw a marked increase in imports, particularly in the case of parts and components necessary for vehicle manufacturing, reflecting concerns over the potential disruption of supply chains.

For consumers, this import surge meant that goods were available in greater quantities, but it also contributed to a buildup of inventory that could potentially lead to market saturation. As businesses took advantage of low-cost imports ahead of tariff hikes, they increased the flow of goods into the country, effectively inflating the overall volume of goods in circulation. While this may have benefited consumers in the short term, the long-term economic effects of such stockpiling were more complex, as it created distortions in the trade balance and reduced the demand for domestic production in the immediate term.

The sudden influx of imported goods also placed additional strain on U.S. ports and transportation infrastructure. Increased container volumes created logistical bottlenecks, and shortages in warehouse space led to higher costs for storage and handling. These inefficiencies in the supply chain, exacerbated by the rush to import, added an additional layer of complexity to the economic situation. Businesses were forced to adjust to these operational challenges, further contributing to the economic slowdown.

This behavior also had broader implications for the labor market. As businesses focused on securing goods rather than investing in long-term growth or expansion, fewer resources were allocated to job creation or capital investments. Moreover, the inventory glut created by the surge in imports led to a slowdown in production across several sectors, as companies adjusted their output to match the excess inventory already in place. This reduction in production, coupled with a slowdown in hiring, contributed to the overall contraction of the economy during Q1 2025.

The combination of these factors—accelerated imports, a rising trade deficit, and disruptions in supply chains—highlighted the extent to which the surge in imports was a reaction to the looming threat of tariff increases. Businesses and consumers alike sought to mitigate the anticipated cost increases by purchasing goods before tariffs were implemented. While this strategy may have provided short-term relief, it ultimately contributed to the larger economic slowdown, as it created distortions in trade balances, supply chains, and production cycles.

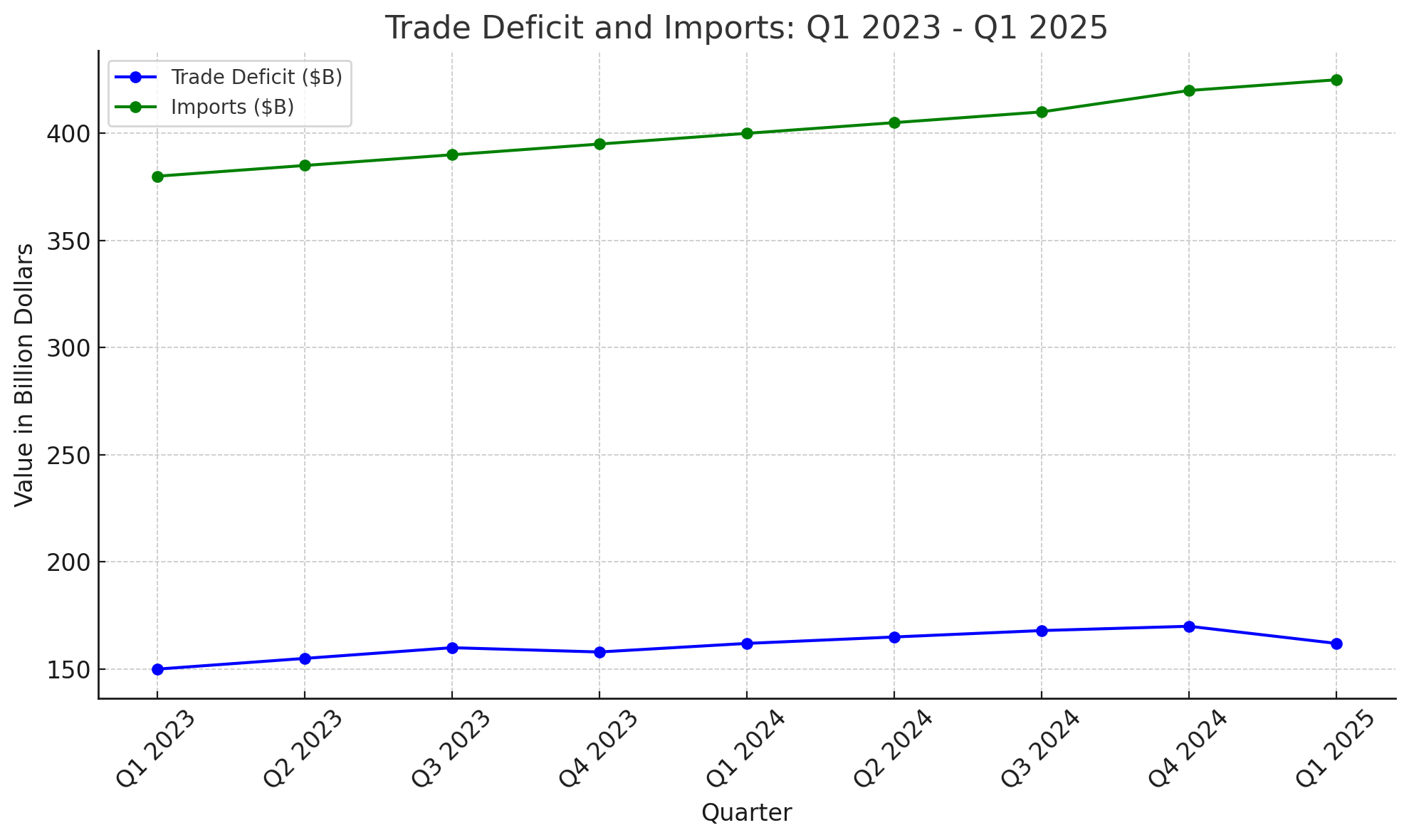

As discussed in this section, the surge in imports during the first quarter of 2025 significantly impacted the U.S. trade balance and GDP growth. To visually represent this, we can look at the trends in trade deficit and imports from Q1 2023 to Q1 2025. The chart below illustrates the sharp increase in U.S. imports and the corresponding rise in the trade deficit from Q1 2023 through Q1 2025. As businesses rushed to stockpile goods ahead of tariff increases, imports surged, leading to an unprecedented $162 billion trade deficit in Q1 2025. This imbalance significantly contributed to the contraction of the U.S. economy during this period, as indicated by the negative impact on GDP. The trend highlights the direct relationship between import activity and the widening trade deficit, offering a clear visual representation of how preemptive stockpiling created distortions in trade patterns.

In conclusion, the pre-tariff stockpiling phenomenon had a profound impact on the U.S. economy in the first quarter of 2025. While the surge in imports provided businesses with an opportunity to secure goods ahead of higher tariffs, it also led to an unsustainable increase in the trade deficit, which in turn contributed to a contraction in GDP. The longer-term effects of this surge are likely to be felt as the economy recalibrates, and as businesses adjust to the complexities of a changing global trade environment. The challenges created by this surge in imports serve as a reminder of the interconnectedness of global supply chains and the delicate balance required to maintain economic stability in the face of shifting trade policies.

Tariff Policies and Economic Implications

In the face of a rapidly changing global trade landscape, the U.S. has increasingly relied on tariff policies as a tool to address perceived trade imbalances, protect domestic industries, and leverage negotiating power in international relations. The introduction of tariffs, particularly during the first quarter of 2025, has had far-reaching implications for the economy. The U.S. administration’s decision to impose additional tariffs on imports—particularly from key trading partners such as China and the European Union—has not only disrupted global supply chains but also significantly influenced the economic trajectory in the short term.

The “Liberation Day” Tariffs: A Shift in Trade Policy

On April 2, 2025, President Donald Trump announced a sweeping tariff package known as the "Liberation Day" tariffs, which marked a decisive shift in U.S. trade policy. The package introduced a 10% baseline tariff on all imports, effective from April 5, 2025, alongside country-specific tariffs that could reach as high as 49% on certain goods from nations deemed to be manipulating trade policies in their favor. The rationale behind these tariffs was multi-faceted. On one hand, the administration argued that the new tariffs were necessary to address the long-standing trade imbalance with foreign partners, particularly China. On the other, they were framed as protective measures designed to bolster U.S. manufacturing by reducing the influx of foreign-made products that could undercut domestic production.

The introduction of these tariffs was controversial from the outset, with critics arguing that such aggressive policies could harm the broader economy, particularly in sectors that rely heavily on imports for production and supply. The U.S. economy has long been integrated into global supply chains, with many industries depending on imported raw materials, components, and finished goods. The imposition of additional tariffs introduced immediate cost pressures on businesses, which were forced to either absorb these costs or pass them on to consumers in the form of higher prices. In industries such as electronics, automotive, and consumer goods, these increased costs have the potential to disrupt production schedules, reduce profitability, and even lead to job losses.

The Impact of Tariffs on the Trade Deficit and GDP

One of the most immediate effects of the "Liberation Day" tariffs was a sharp rise in the U.S. trade deficit. As businesses rushed to import goods ahead of the new tariffs, the trade deficit ballooned to $162 billion in Q1 2025, a figure that significantly outstripped previous levels. This surge in imports, driven by the pre-tariff stockpiling phenomenon discussed earlier, put downward pressure on GDP. The increase in imports, while benefiting consumers in the short term by ensuring a steady supply of goods, ultimately resulted in a negative GDP growth rate for the first quarter of 2025, marking the first contraction since the pandemic-induced downturn of 2022.

The trade deficit directly impacts GDP calculations, as net exports (exports minus imports) are a key component of the overall economic output. With the surge in imports outpacing exports, the trade balance swung sharply negative, effectively dragging down the overall economic growth. The resulting contraction in GDP has prompted concerns about the long-term effects of tariff-driven trade policies. Economists warn that the short-term gains from reduced imports could be outweighed by longer-term negative effects, including slower growth, reduced business investment, and inflationary pressures due to higher consumer prices.

Tariffs and Inflationary Pressures

Another critical economic implication of the tariff policies is their contribution to inflationary pressures. As businesses were forced to adjust to higher input costs due to the new tariffs, they passed these increased costs onto consumers. This led to price hikes in a wide range of consumer goods, from electronics to automobiles. In particular, industries reliant on imported materials, such as electronics manufacturing, faced significant cost increases. With tariffs raising the price of foreign-made components, companies found it more expensive to manufacture products domestically, leading to an overall increase in the price of goods.

The inflationary effect of tariffs was particularly evident in the first quarter of 2025. According to the U.S. Bureau of Labor Statistics, the inflation rate for consumer goods increased by 2.6% in Q1 2025 compared to the same period in 2024. This uptick in inflation has placed additional strain on American households, particularly those with lower incomes, who are more sensitive to price increases. The rising cost of goods and services has the potential to erode real wages, diminishing purchasing power and leading to a decrease in overall consumer spending.

Inflation is not only a concern for households but also for the Federal Reserve, which must balance the need to control inflation with the desire to foster economic growth. In response to these inflationary pressures, the Fed has hinted at the possibility of tightening monetary policy, which could further dampen economic activity by making borrowing more expensive for businesses and consumers. This delicate balancing act presents significant challenges for policymakers, as they attempt to navigate the complexities of an economy facing both rising prices and slowing growth.

Global Reactions to U.S. Tariff Policies

The U.S. tariff policies have not only affected domestic economic conditions but have also sparked reactions from trading partners around the world. In response to the "Liberation Day" tariffs, countries such as China, the European Union, and Mexico have expressed concerns over the potential disruption to international trade. These countries have threatened retaliatory tariffs on U.S. exports, particularly in sectors such as agriculture, technology, and aerospace. Such trade tensions could escalate into a broader trade war, with potentially severe consequences for global supply chains and international cooperation.

Moreover, the imposition of tariffs has strained relationships with key allies, who argue that the tariffs are counterproductive and harm both U.S. businesses and consumers. The broader global economy, already grappling with challenges such as the ongoing effects of the COVID-19 pandemic, geopolitical tensions, and supply chain disruptions, could face additional headwinds if these trade disputes are not resolved in a timely and amicable manner. The potential for a prolonged trade war could exacerbate existing economic uncertainties and hinder global recovery efforts.

The Long-Term Economic Outlook: A Double-Edged Sword

While tariffs may offer some short-term benefits, such as protecting domestic industries and reducing trade deficits, their long-term effects remain highly uncertain. The risk of escalating trade tensions, higher consumer prices, and slower economic growth suggests that the tariff policies may not be as effective as hoped in achieving sustained economic stability. The imposition of tariffs also highlights the broader question of how trade policies should be structured in a globalized economy, where protectionism can have unintended consequences.

Economists argue that a more balanced approach to trade policy, focused on strategic negotiations and gradual tariff adjustments, could be more effective in fostering long-term economic growth. Rather than relying solely on tariffs as a means of reducing trade imbalances, policymakers may need to consider alternative strategies, such as investing in domestic innovation, improving supply chain resilience, and enhancing global cooperation. These approaches could help mitigate the risks associated with tariff-driven trade policies and support sustainable growth in the face of evolving global dynamics.

In conclusion, the tariff policies introduced in the first quarter of 2025 have had profound implications for the U.S. economy. While they were designed to address trade imbalances and protect domestic industries, their immediate impact has been a sharp increase in the trade deficit, rising inflationary pressures, and a contraction in GDP. The long-term effects of these policies remain uncertain, and the U.S. faces significant challenges in balancing the need for protectionist measures with the broader goals of economic stability and growth. As the situation develops, it will be critical for policymakers to carefully evaluate the consequences of these tariffs and adjust strategies accordingly to ensure the long-term health of the U.S. economy.

Broader Economic Indicators

Consumer Spending and Inflation

The economic contraction observed in the first quarter of 2025 cannot be understood solely through the lens of trade and tariff policies. Broader economic indicators, such as consumer spending, inflation, and employment trends, are crucial to gaining a comprehensive understanding of the underlying dynamics shaping the U.S. economy. Together, these indicators offer insights into how households and businesses are responding to the economic environment shaped by the surge in imports, the introduction of new tariffs, and other ongoing challenges.

Consumer Spending Trends: A Tepid Growth Outlook

Consumer spending, which traditionally drives a substantial portion of U.S. GDP growth, experienced subdued growth in the first quarter of 2025. According to data from the Bureau of Economic Analysis (BEA), consumer spending increased at a modest annual rate of 1.8% in Q1 2025, significantly below the 3.1% growth rate observed in Q4 2024. This slowdown in consumption reflects growing economic uncertainty and the effect of higher prices due to tariffs and inflation.

The relatively weak growth in consumer spending can be attributed to several interrelated factors. First, the rising cost of goods, driven in large part by the tariff hikes imposed on imports, placed upward pressure on prices, reducing purchasing power. Consumers faced higher prices for a range of goods, from electronics to automobiles, as businesses passed on the increased costs of imported materials to their customers. The impact was especially evident in sectors reliant on foreign components, such as technology and automotive industries, where price hikes were more pronounced.

Moreover, the inflationary environment prompted consumers to become more cautious in their spending habits. With the Federal Reserve signaling potential tightening of monetary policy to combat inflation, concerns about future interest rate increases dampened consumer confidence. Households, particularly those in lower-income brackets, began to adjust their expenditures in response to the rising cost of living, leading to reduced discretionary spending. Non-essential purchases, such as luxury goods and high-end services, saw a decline in demand, while consumers focused on essentials such as food, healthcare, and housing. This shift in spending patterns reflects broader trends in economic caution, with consumers seeking to preserve their purchasing power in a period of uncertainty.

The slowdown in consumer spending also reflects broader concerns about job security and wage growth. While employment figures remained relatively stable during Q1 2025, the economic uncertainty and concerns about future economic conditions led some consumers to delay significant purchases. The moderation in consumer spending growth is a key indicator of how external factors, such as trade policies and inflation, influence household decisions and contribute to broader economic trends.

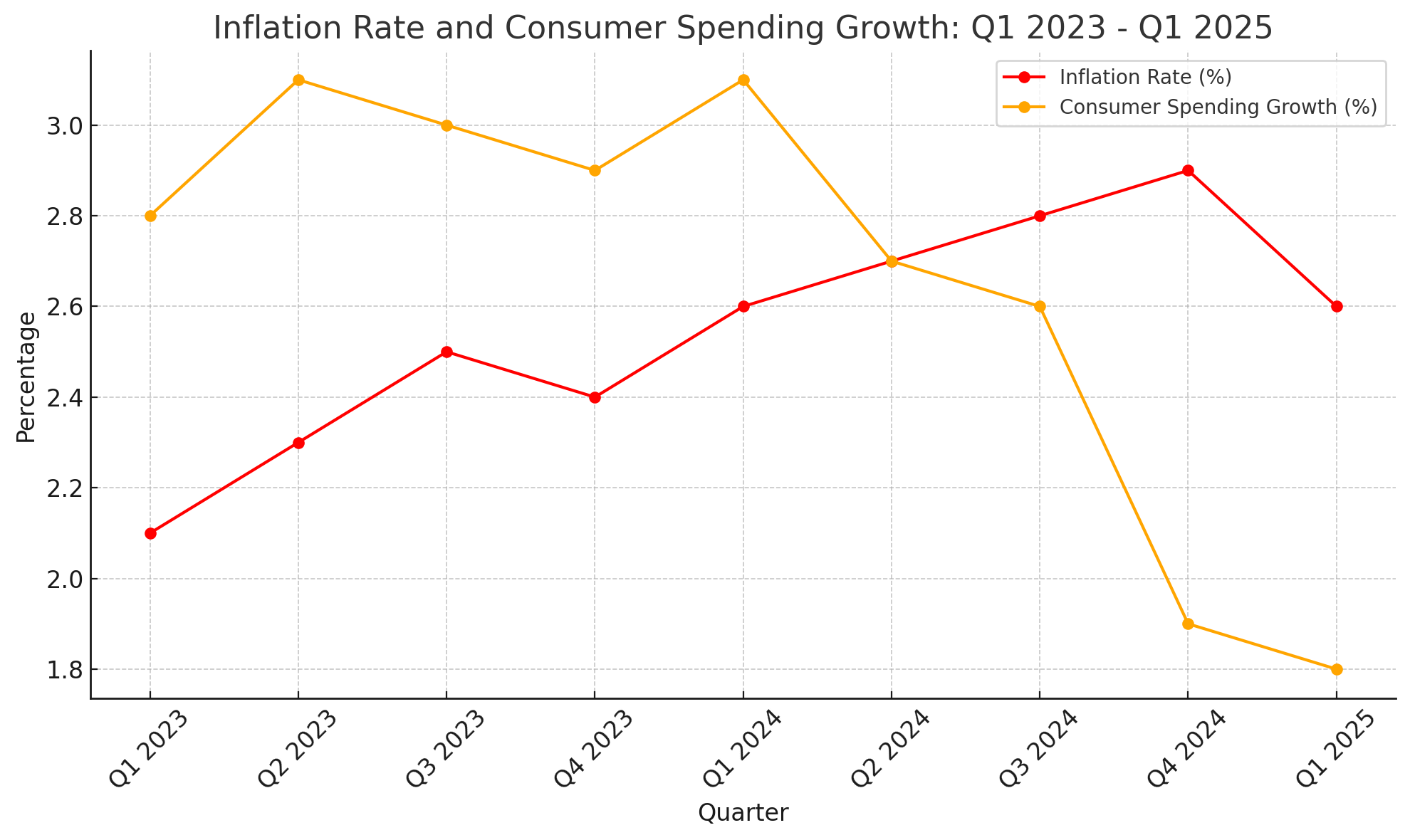

To further understand the relationship between inflation and consumer spending, the chart below compares the inflation rate and the growth of consumer spending from Q1 2023 to Q1 2025. The following chart shows the trends in inflation and consumer spending growth over the same period, offering a direct comparison of how rising prices have impacted household consumption. As the inflation rate climbed, reaching 2.6% in Q1 2025, consumer spending growth slowed significantly, dropping to just 1.8% in the first quarter of 2025. The correlation between rising inflation and the deceleration of consumer expenditure is evident, underscoring the strain placed on American households as they adjusted to higher prices on a variety of goods, especially those imported and affected by tariff increases. The chart effectively illustrates the broader economic challenge of maintaining growth amidst inflationary pressures.

Inflation: The Silent Driver of Economic Challenges

The role of inflation in the first quarter of 2025 cannot be overstated, as it emerged as one of the key economic challenges facing both consumers and businesses. Inflationary pressures were heightened by the new tariffs, which raised the prices of imported goods and disrupted domestic production schedules. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) rose by 2.6% in Q1 2025 compared to the same period in the previous year, marking a noticeable increase in the rate of inflation. This was above the Federal Reserve’s target inflation rate of 2%, signaling growing price pressures across a wide range of goods and services.

The rise in inflation was particularly evident in sectors with high reliance on imports, such as electronics, automotive, and apparel. Tariffs on these goods led to immediate price increases, which were passed on to consumers. For instance, the automotive industry experienced sharp price hikes for vehicles and parts, as manufacturers faced higher costs for both imported components and finished goods. Similarly, electronics, which rely heavily on foreign-made components, saw increased prices, particularly in consumer devices such as smartphones, laptops, and televisions. These price increases directly impacted household budgets, further straining consumers’ purchasing power.

While inflation is typically seen as an economic challenge for households, it also has significant implications for businesses. Rising input costs, coupled with higher wages demanded by workers seeking to keep pace with inflation, created a challenging environment for companies. Businesses were forced to make difficult decisions about whether to absorb the additional costs or pass them on to consumers. In many cases, the latter was the preferred option, leading to higher prices across a wide range of goods and services.

Inflationary pressures were also exacerbated by supply chain disruptions, which were a direct result of the trade tensions and the surge in imports seen during the first quarter of 2025. The stockpiling behavior of businesses, combined with the increased demand for imported goods, placed strain on logistics networks, leading to delays and shortages. These supply-side constraints further contributed to price hikes, as businesses struggled to meet demand for key products.

The Federal Reserve's Response: Tightening Monetary Policy

As inflationary pressures mounted, the Federal Reserve found itself in a difficult position, caught between the need to curb rising prices and the desire to stimulate economic growth. The Fed’s primary tool for controlling inflation is the manipulation of interest rates, and in response to the rising CPI, the central bank signaled that it would likely increase interest rates in the near future. Higher interest rates are designed to reduce inflation by making borrowing more expensive and, in turn, slowing down consumer and business spending. However, such measures also carry the risk of further slowing down economic growth and exacerbating the contraction observed in Q1 2025.

In its most recent statements, the Federal Reserve indicated that it was closely monitoring the effects of rising tariffs on both inflation and overall economic activity. Although the Fed has historically been cautious about making significant policy changes based on short-term economic fluctuations, the sustained increase in inflation and the broader slowdown in economic activity have prompted greater consideration of rate hikes. If the Fed moves forward with tightening monetary policy, it could increase the cost of credit for businesses and consumers, further dampening economic growth and possibly exacerbating the economic slowdown.

The Fed’s decisions regarding interest rates will be crucial in determining the trajectory of the U.S. economy for the remainder of 2025. While a rate hike could help bring inflation under control, it could also have negative consequences for employment, housing markets, and business investment. Policymakers will need to carefully weigh the risks of both inflation and recession as they navigate these difficult decisions.

The Broader Impact: Stagnating Growth and Potential Stagflation

The combination of rising inflation and slowing economic growth has raised concerns about the possibility of stagflation—a scenario in which high inflation is coupled with stagnant economic growth and high unemployment. Stagflation is a particularly challenging economic condition because it combines the worst aspects of inflation and recession. While unemployment levels remain relatively low for now, there is a growing concern that rising prices and slowed economic activity could lead to higher job losses in the near future.

For the time being, the U.S. economy remains in a delicate balancing act, with policymakers and businesses attempting to navigate the tensions between inflation and growth. Consumer spending, inflation, and employment trends all point toward a slowing economy, with risks of further contraction if the current policy trajectory continues. The Federal Reserve’s response, along with the long-term effects of tariff policies, will play a key role in shaping the economic outlook for the remainder of 2025.

Conclusion

In conclusion, the broader economic indicators—particularly consumer spending and inflation—offer a complex picture of the U.S. economy’s performance in Q1 2025. While consumer spending growth slowed due to rising prices and economic uncertainty, inflation surged as a result of higher import costs driven by tariffs. As businesses and households adjusted to these new realities, the Federal Reserve found itself grappling with difficult decisions about how to manage inflation without stifling growth. The economic challenges observed in the first quarter of 2025 suggest a period of adjustment for the U.S. economy, as it seeks to navigate the difficult balance between curbing inflation and fostering sustainable growth. The coming months will be crucial in determining whether the economy can recover from this contraction or whether the risk of stagflation becomes more pronounced.

Economic Outlook and Policy Considerations

As the U.S. economy grapples with the immediate aftermath of the contraction in Q1 2025, attention now turns to the future. The question on the minds of policymakers, economists, and business leaders alike is how the U.S. will navigate the economic challenges posed by a combination of rising inflation, trade tensions, and slowing growth. While the first quarter of 2025 presented significant setbacks, it also provides critical insights into the areas that require focused attention and policy intervention. The coming months will be pivotal for determining whether the economy can recover and regain its growth momentum or if it will continue to face significant headwinds.

Short-Term Economic Projections: Recovery or Continued Contraction?

In the short term, the U.S. economy is likely to face a period of continued uncertainty as the effects of the surge in imports, tariff-driven price increases, and inflation ripple through the system. Economists predict that while the economy may experience a modest rebound in Q2 2025, the trajectory will remain fraught with challenges. A number of factors will influence this outlook, including the ongoing impact of trade policies, global supply chain disruptions, and shifts in consumer behavior.

The immediate recovery prospects hinge largely on how businesses adjust to the trade environment. The surge in imports observed in Q1 2025, driven by preemptive stockpiling ahead of new tariffs, is unlikely to be sustainable in the long term. As businesses run through their inventories, the pressure on imports may ease, leading to a potential reduction in the trade deficit and a return to more balanced trade patterns. This could provide a boost to GDP growth in the second quarter, as the negative impact of the trade deficit diminishes.

However, the sustainability of this rebound remains uncertain. If inflationary pressures continue to rise and the Federal Reserve moves forward with interest rate hikes, consumer spending could face further restraint. Higher borrowing costs, combined with reduced disposable income due to rising prices, could dampen demand and slow the recovery process. Additionally, global economic conditions, particularly in major trading partners like China and the European Union, will play a significant role in shaping the outlook. If global demand remains weak or if trade tensions escalate further, the U.S. could continue to experience stagnation or even another contraction.

Despite these challenges, there are several key factors that could support a more optimistic outlook. First, the continued strength of the U.S. labor market, with low unemployment and growing wages, provides a foundation for future growth. While the pace of hiring may slow due to economic uncertainty, the ongoing demand for workers in key sectors such as healthcare, technology, and logistics suggests that employment gains will continue. Furthermore, the potential for increased domestic investment in infrastructure, technology, and energy could provide a long-term boost to economic activity.

Potential Risks: Stagflation and Global Trade Tensions

While short-term recovery is possible, there are notable risks that could undermine U.S. economic stability in the coming months. The most concerning of these risks is the potential for stagflation, a scenario in which inflation remains high while economic growth stagnates. The combination of rising prices and slowing economic activity can create a vicious cycle in which the purchasing power of consumers is eroded while businesses struggle with higher input costs. Stagflation poses significant challenges for policymakers, as traditional tools to combat inflation—such as raising interest rates—could further slow economic growth and exacerbate unemployment.

In addition to domestic inflationary pressures, global trade tensions remain a significant risk to the U.S. economy. The tariffs imposed in early 2025, particularly those targeting China and the European Union, have already strained relationships with key trading partners. While some trade partners may choose to negotiate and resolve disputes through diplomatic channels, the risk of retaliatory tariffs remains high. Such escalations could lead to a broader trade war, which could disrupt global supply chains, raise costs for consumers, and hurt the profitability of U.S. businesses with international operations.

Furthermore, global geopolitical risks—ranging from tensions in the Middle East to the ongoing war in Ukraine—pose additional uncertainties that could undermine economic growth. For instance, any significant disruptions to global energy supplies or supply chains could exacerbate inflationary pressures and dampen business investment. Additionally, as global growth slows, the demand for U.S. exports may diminish, further widening the trade deficit and weighing on overall economic performance.

Policy Considerations: Navigating a Complex Economic Landscape

In light of these challenges, U.S. policymakers face a difficult task: how to steer the economy toward sustained growth without exacerbating inflation or triggering a prolonged period of stagnation. The Federal Reserve, in particular, will need to carefully calibrate its approach to monetary policy to avoid triggering a recession while keeping inflation in check. The decision to raise interest rates—while necessary to combat inflation—must be weighed against the potential for reducing consumer and business spending. If interest rates rise too quickly or too sharply, the economy could face a sharp slowdown, leading to higher unemployment and further strain on household budgets.

To mitigate the risks of stagflation and provide a buffer against economic shocks, policymakers could focus on supporting domestic investment and innovation. For instance, targeted investments in infrastructure, renewable energy, and technology could provide long-term growth opportunities. The U.S. could also pursue policies that strengthen supply chains and reduce dependence on foreign imports, particularly in key sectors such as semiconductors, pharmaceuticals, and critical minerals. These efforts could help reduce the trade deficit, lower inflationary pressures, and support job creation in high-value industries.

At the same time, trade policies will need to be carefully reconsidered to avoid further escalating tensions with major trading partners. While tariffs may offer short-term protection for domestic industries, they can have long-term negative effects on global trade and U.S. businesses that rely on foreign markets. A more strategic approach to trade policy—one that prioritizes negotiation and cooperation over protectionism—could help reduce the risks of a global trade war and create more stable conditions for U.S. exporters.

The Role of Fiscal Policy and Government Stimulus

In addition to monetary and trade policies, fiscal policy will play a crucial role in shaping the U.S. economic recovery. While the Biden administration has already enacted significant stimulus packages in response to the COVID-19 pandemic, additional government spending may be required to bolster economic growth and address the impacts of inflation. This could take the form of targeted stimulus checks, tax relief for households, or further investments in infrastructure projects.

However, the risk of an increased fiscal deficit is a concern for many policymakers, particularly as the national debt continues to rise. Any additional stimulus measures must be carefully designed to avoid exacerbating inflation or contributing to an unsustainable increase in government debt. A balanced approach, with targeted spending aimed at stimulating key sectors of the economy, could help promote growth without fueling inflation.

Conclusion: A Critical Juncture for the U.S. Economy

As the U.S. moves further into 2025, the economy faces a critical juncture. The contraction in Q1 2025, coupled with rising inflation and trade tensions, underscores the need for a comprehensive and balanced approach to economic policy. While short-term recovery is possible, the risks of stagflation, global trade disruptions, and domestic economic pressures remain significant challenges. Policymakers must carefully navigate these uncertainties, balancing the need for inflation control with the imperative of fostering long-term growth. The coming months will determine whether the U.S. economy can successfully weather these challenges and return to a path of sustained expansion or whether further contraction and stagnation will dominate the landscape. By prioritizing strategic investments, reducing trade tensions, and managing monetary and fiscal policies prudently, the U.S. can set the stage for a more stable and prosperous economic future.

References

- U.S. Economy Faces Challenges Amid Tariff Increases https://www.wsj.com/articles/us-economy-tariff-challenges

- Imports Surge as Tariff Concerns Loom in U.S. https://www.reuters.com/article/us-imports-tariff-concerns

- Trade Deficit Widens as Businesses Stockpile Goods https://www.marketwatch.com/story/trade-deficit-impacts-gdp

- U.S. Consumer Spending Slows Amid Inflationary Pressures https://www.bloomberg.com/news/articles/consumer-spending-slows

- Federal Reserve Faces Tough Decisions as Inflation Rises https://www.cnbc.com/2025/04/fed-inflation-decision

- Tariffs and Trade Deficits: The U.S. Economic Balancing Act https://www.ft.com/content/tariffs-trade-deficits

- U.S. Economy Contraction Worsens Amid Import Surges https://www.businessinsider.com/us-economy-contraction-import-surge

- Trade Deficit and Inflation Combine to Slow U.S. Growth https://www.nytimes.com/2025/04/trade-deficit-inflation

- How Tariffs Are Impacting U.S. GDP Growth https://www.washingtonpost.com/business/2025/04/tariff-impact-gdp

- U.S. Businesses Stockpile Imports Ahead of Tariff Increases https://www.reuters.com/article/us-businesses-stockpile-imports