TSMC Explores UAE Chip Plant as Global Semiconductor Race Reaches Middle East

In the fast-evolving landscape of global semiconductor manufacturing, Taiwan Semiconductor Manufacturing Company (TSMC) continues to play a pivotal role in shaping the future of advanced chip production. As the world’s largest and most influential foundry, TSMC has strategically expanded its manufacturing footprint across the globe, establishing critical facilities in the United States, Japan, and Europe. Its ability to remain agile while pushing the boundaries of chip miniaturization and performance has made it indispensable to the global technology supply chain. Against this backdrop, reports have recently surfaced suggesting that TSMC is in preliminary discussions to evaluate the feasibility of constructing an advanced semiconductor plant in the United Arab Emirates (UAE), marking what could be a historic pivot into the Middle East.

This potential development holds profound implications for the geopolitical alignment of high-tech industries, especially at a time when semiconductors are increasingly viewed through the lens of national security, economic sovereignty, and global competitiveness. The UAE, through state-backed initiatives and investment vehicles such as MGX—a technology-focused investment firm linked to Abu Dhabi’s leadership—has aggressively sought to position itself as a hub for artificial intelligence, data centers, and advanced technologies. The possibility of TSMC establishing a fab in the region aligns with the UAE’s broader economic diversification goals under Vision 2030 and signals a shift in how global semiconductor supply chains may evolve to include new regional players.

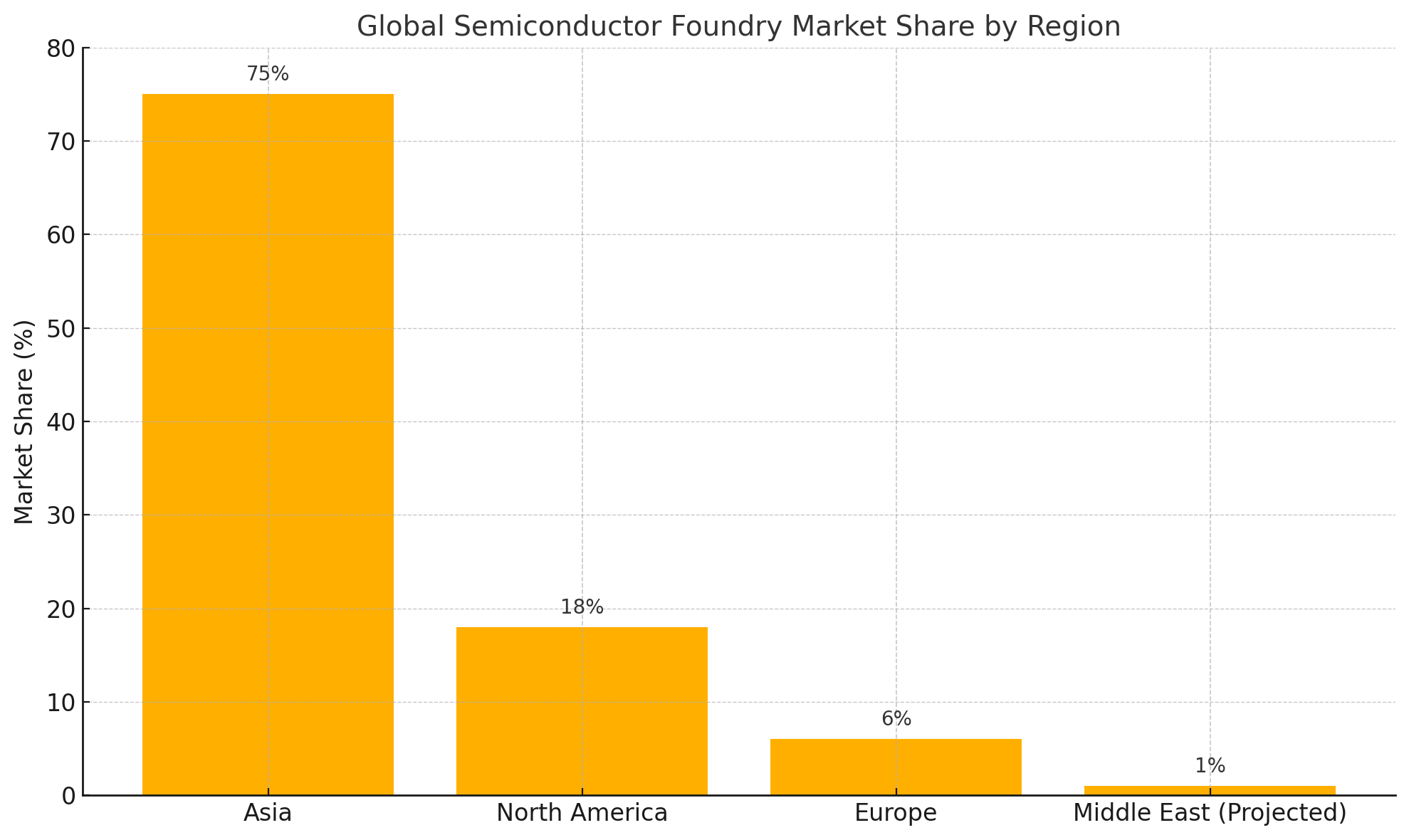

Moreover, the Middle East has long been overlooked in the global semiconductor narrative, overshadowed by East Asian dominance and recent Western reshoring efforts. Yet the region’s vast financial resources, energy availability, and strategic geographic location bridging Asia, Europe, and Africa present a compelling case for its emergence as a viable contender in the chip manufacturing ecosystem. For TSMC, such a move would not only represent a novel geographic expansion but also a potential strategy to hedge against rising tensions between the U.S. and China, diversify its manufacturing risk, and gain access to new and rapidly digitizing markets.

At the same time, the announcement has sparked considerable debate and scrutiny, particularly from U.S. stakeholders who remain wary of technology diffusion in geopolitically complex regions. Concerns over workforce readiness, regulatory compliance, and potential disruption to TSMC’s ongoing projects in the U.S. and Europe have added further complexity to the discussion. This blog delves deep into the rationale behind TSMC’s potential UAE expansion, the strategic calculus at play, the challenges that must be addressed, and the broader implications for the global semiconductor industry.

As we explore this multifaceted story, we will examine the motivations behind TSMC’s exploration of the UAE market, assess the regional advantages and obstacles, evaluate the geopolitical ramifications, and consider how this move fits into TSMC’s overarching global strategy. Through a combination of data visualization, comparative analysis, and industry insight, this piece aims to provide a comprehensive understanding of one of the most intriguing potential developments in the chip industry today.

Strategic Rationale Behind the UAE Expansion

The strategic rationale for TSMC evaluating a potential advanced semiconductor fabrication plant in the United Arab Emirates (UAE) can be understood through a confluence of geopolitical, economic, infrastructural, and market access considerations. As the semiconductor industry becomes increasingly interwoven with national development agendas and global power dynamics, TSMC’s move to assess the UAE as a viable location reflects a forward-looking approach aimed at diversifying production risk, gaining regional footholds, and aligning with future demand centers.

Geopolitical and Economic Realignment

One of the most pressing motivations behind TSMC’s interest in the UAE stems from the ongoing geopolitical realignments affecting global supply chains. The increasing polarization between the United States and China has intensified concerns over the concentration of semiconductor manufacturing in East Asia—particularly in Taiwan, which lies at the heart of a potential flashpoint. Given that more than 90% of the world’s most advanced chips are currently manufactured in Taiwan, TSMC is under growing pressure from its clients and governments alike to mitigate risk by establishing geographically dispersed production capabilities.

The UAE, positioned at the crossroads of Asia, Europe, and Africa, presents a compelling alternative. Its political stability, proactive foreign policy, and longstanding relationships with both Western and Eastern powers make it an ideal neutral ground for manufacturing operations that need to maintain global accessibility. Furthermore, the UAE has demonstrated a consistent commitment to becoming a non-aligned technology hub, positioning itself as a diplomatic intermediary while securing economic partnerships with major players across geopolitical divides.

Economic Diversification and Government Incentives

From the UAE’s perspective, attracting a leading-edge foundry like TSMC fits seamlessly into its economic diversification strategy. The country’s Vision 2030 and broader post-oil economic agenda emphasize the development of high-tech industries, knowledge-based economies, and sovereign capabilities in artificial intelligence, quantum computing, and digital infrastructure. A partnership with TSMC would offer a dual advantage: importing cutting-edge manufacturing expertise while exporting locally produced chips to emerging regional markets.

Abu Dhabi’s MGX—an AI and advanced technology investment firm backed by Sheikh Tahnoun bin Zayed Al Nahyan—has reportedly held early discussions with TSMC, signaling strong top-down political and financial support. It is likely that, should the plan proceed, the UAE would provide considerable incentives including tax exemptions, land grants, expedited regulatory approvals, and infrastructure development support. Such incentives could meaningfully reduce the capital intensity and regulatory friction associated with fab construction and operational ramp-up.

Infrastructure and Energy Advantages

A key prerequisite for any advanced semiconductor fabrication plant is the availability of reliable infrastructure, particularly in power supply, clean water, and logistics. The UAE already boasts world-class infrastructure, with state-of-the-art logistics hubs like Khalifa Port, a robust highway network, and advanced utility grids. Perhaps most compelling is the UAE’s surplus of energy resources—an essential factor for the operation of energy-intensive chip fabs.

In particular, the UAE’s growing investments in clean energy, such as solar farms and nuclear energy via the Barakah plant, could support sustainable and scalable operations for a future TSMC facility. Water supply, traditionally a constraint in desert climates, is being addressed through desalination technologies and closed-loop industrial cooling systems, both of which are being integrated into the country’s tech parks and industrial free zones.

Market Access and Regional Demand

Another powerful driver behind TSMC’s evaluation is the increasing demand for semiconductors from the Middle East and Africa—regions undergoing rapid digitization and technological transformation. Countries such as Saudi Arabia, Egypt, and South Africa are investing heavily in AI, autonomous vehicles, fintech, and industrial automation. These developments necessitate reliable, high-performance computing hardware—most of which currently must be imported from Asia, Europe, or the U.S.

A UAE-based fab would enable TSMC to significantly shorten supply chains, reduce lead times, and improve service reliability to customers across the region. It could also give TSMC first-mover advantage in securing contracts from national governments and regional tech firms keen on sourcing from locally situated manufacturers. In addition, by operating within the Gulf Cooperation Council (GCC) region, TSMC could leverage favorable trade frameworks, regional integration efforts, and an increasingly cooperative regulatory landscape.

Risk Diversification in Global Strategy

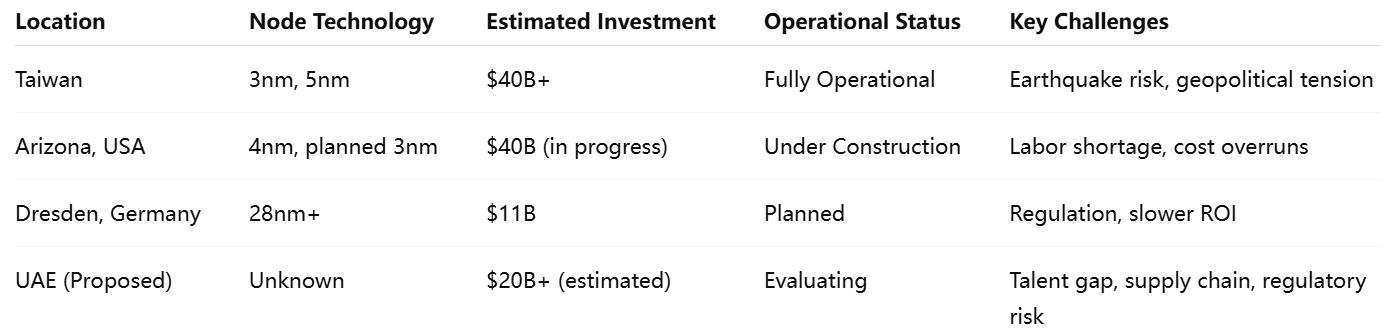

Beyond the immediate regional advantages, this potential UAE expansion should be understood as part of TSMC’s broader risk mitigation strategy. The company is navigating a landscape in which governments are asserting more control over where strategic technologies are produced. U.S. efforts through the CHIPS Act aim to repatriate semiconductor manufacturing, while the European Chips Act promotes localized production in the EU. At the same time, rising costs, logistical complexity, and project delays in these regions have prompted TSMC to explore additional alternatives.

The UAE represents an opportunity to diversify not just geographically, but also operationally and financially. By establishing a presence in a market less encumbered by trade disputes and political bottlenecks, TSMC may be able to maintain operational agility while maintaining access to global clients. Additionally, the UAE’s sovereign wealth funds and public-private partnerships could help co-finance the initiative, reducing upfront investment risk.

In summary, TSMC’s interest in the UAE is neither speculative nor symbolic—it reflects a calculated alignment between the company’s global expansion goals and the UAE’s national technological ambitions. The UAE offers TSMC a unique combination of geographic neutrality, state-backed support, infrastructure readiness, and proximity to emerging digital markets. While significant challenges remain, the strategic rationale for pursuing this expansion is deeply rooted in both global dynamics and regional opportunity.

Challenges and Considerations

While the potential establishment of a TSMC advanced semiconductor fabrication plant in the United Arab Emirates offers a host of strategic benefits, it is imperative to examine the multifaceted challenges that such a bold endeavor would entail. The semiconductor manufacturing industry is one of the most capital- and knowledge-intensive sectors in the global economy. It demands not only robust financial commitment but also exceptional technical expertise, a resilient supply chain, and a regulatory environment that ensures long-term operational stability. The UAE, although ambitious and well-resourced, must address several systemic and contextual issues if it is to successfully accommodate such a high-stakes industrial venture. For TSMC, these considerations form critical risk factors that must be meticulously evaluated before making any long-term commitments.

Skilled Workforce Shortage

One of the most pressing challenges confronting the proposed expansion is the acute shortage of local expertise in semiconductor design, fabrication, and process engineering. Unlike Taiwan, the United States, or Germany—regions with decades-long histories of microelectronics research and education—the UAE does not currently possess a deep reservoir of semiconductor talent. While the country has made strides in developing STEM capabilities and funding technical education, the talent pipeline for this specific industry remains in its infancy.

Advanced fabs require not only a large pool of engineers trained in photolithography, materials science, and circuit design, but also highly experienced technicians to manage ultra-clean environments and complex tool maintenance. TSMC would likely be compelled to import a significant proportion of its workforce during the initial phases of the plant’s operation. This introduces logistical and regulatory complexities, including visa procurement, housing, and cultural integration, all of which can affect productivity and retention.

To mitigate this challenge, both TSMC and the UAE government would need to establish comprehensive education and training programs, possibly through partnerships with global universities and industry leaders. However, such efforts would take years to bear fruit and may not meet the urgent staffing demands of a cutting-edge manufacturing facility.

Supply Chain and Ecosystem Immaturity

Another major concern is the lack of a mature semiconductor ecosystem in the UAE. The success of a semiconductor fab is contingent not only on internal excellence but also on the seamless integration of external vendors, suppliers, and logistics partners. This includes companies specializing in specialty gases, ultrapure chemicals, silicon wafers, photomasks, and advanced lithography equipment. In regions like Taiwan and South Korea, these suppliers operate in close proximity to foundries, enabling just-in-time delivery, rapid response, and tight process integration.

The UAE currently lacks this ecosystem. Essential materials and equipment would need to be imported, likely over long distances and under strict environmental and security controls. This reliance on external supply chains introduces vulnerabilities—particularly in light of global shipping disruptions, export control restrictions, and the increasingly protectionist stance of governments overseeing critical semiconductor inputs. Moreover, the time-sensitive nature of semiconductor fabrication means that any delays or inconsistencies in supply can lead to costly production stoppages and yield losses.

Establishing a localized supply chain network would be a monumental task requiring years of industrial policy coordination, international partnerships, and infrastructure development. Even then, replicating the agility and responsiveness of East Asia’s supply chain clusters would be difficult.

Technology Transfer and Export Control Risks

From a regulatory standpoint, the proposed UAE expansion also introduces complex legal and geopolitical hurdles related to technology transfer and export controls. Advanced semiconductor manufacturing is a strategic industry, and its technologies are often subject to strict export control regimes, especially by the United States and its allies. TSMC, as a critical node in the global semiconductor supply chain, operates under licensing and compliance frameworks that limit where and how its most sophisticated technologies can be deployed.

The establishment of a cutting-edge fab in the UAE could invite heightened scrutiny from the U.S. government, which has already expressed reservations about potential leakages of intellectual property and the risk of advanced manufacturing capabilities being accessed by geopolitical rivals. This is particularly relevant given the UAE’s policy of maintaining diplomatic and trade relations with a broad array of global actors, including China and Russia.

TSMC would likely need to obtain multiple layers of regulatory approval from foreign governments, which may impose conditions limiting the plant’s process node capabilities or customer base. These constraints could, in turn, affect the commercial viability of the fab and its ability to attract anchor clients.

Capital Intensity and Financial Uncertainty

Semiconductor fabs are among the most capital-intensive industrial projects in the world. State-of-the-art facilities operating at nodes of 5nm and below can cost upwards of $20 billion to build and bring online. These investments must be justified not only through volume commitments but also through long-term profitability, which depends on yield rates, customer contracts, and competitive pricing.

Although the UAE has substantial financial resources, the sustainability of such a project remains uncertain. A robust return on investment would depend on the plant achieving economies of scale, minimizing waste, and ensuring a steady stream of orders from large customers—conditions that are difficult to guarantee in a nascent market. Furthermore, the time horizon for such projects is exceptionally long: from site selection to full-volume production often takes 3 to 5 years or more.

TSMC would need to negotiate financing structures, cost-sharing arrangements, and potential revenue guarantees to derisk its exposure. Even with generous subsidies or public-private partnerships, the opportunity cost of diverting funds and managerial attention from other global projects—such as the delayed Arizona fab or the new site in Dresden—could be significant.

Environmental and Operational Constraints

Finally, the environmental sustainability and operational viability of building a fab in the UAE must be carefully scrutinized. Advanced semiconductor manufacturing consumes vast amounts of electricity and ultra-pure water, and it generates hazardous waste that must be meticulously managed. The UAE’s desert climate and limited freshwater reserves pose natural constraints that must be overcome through technological innovation and infrastructure investment.

Although the country has pioneered large-scale desalination and is investing in renewable energy, questions remain regarding the scalability and environmental impact of meeting the high demands of semiconductor manufacturing. TSMC, which has made commitments to environmental sustainability, would need to ensure that any UAE facility aligns with its broader ESG (Environmental, Social, Governance) goals. Failure to do so could attract criticism from investors, environmental groups, and regulatory agencies.

In conclusion, the path toward establishing an advanced TSMC fabrication plant in the UAE is fraught with significant challenges. From human capital limitations and ecosystem immaturity to geopolitical sensitivities and environmental concerns, each factor requires careful analysis and strategic foresight. While the UAE’s aspirations are bold and well-funded, transforming those ambitions into a world-class semiconductor manufacturing operation will demand extraordinary coordination between public institutions, private partners, and global regulators. TSMC, for its part, must navigate these risks judiciously to ensure that any expansion strengthens rather than dilutes its global leadership.

Stakeholder Perspectives

The proposed establishment of a TSMC advanced semiconductor plant in the United Arab Emirates has elicited a spectrum of reactions from key stakeholders. These perspectives reflect a range of strategic priorities, regulatory concerns, and long-term objectives across both the public and private sectors. Understanding the motivations and reservations of each party—namely, TSMC, the UAE government, the United States, and other ecosystem actors—is essential for evaluating the viability and future trajectory of this potential venture. The project lies at the confluence of global industrial strategy, geopolitics, economic diversification, and technological sovereignty, and the degree to which stakeholder interests align will determine whether it progresses beyond the feasibility phase.

TSMC’s Strategic Calculus

From TSMC’s standpoint, evaluating a fab in the UAE is an exercise in long-range strategic planning. The company has long acknowledged the risks associated with geographic concentration of production, particularly in Taiwan, which remains vulnerable to seismic activity and geopolitical instability. While diversification of manufacturing has already begun—with fabs underway in the United States, Japan, and Germany—the UAE offers a distinctive value proposition that merits serious consideration.

TSMC’s interest in the UAE appears to be driven by a mix of proactive hedging and calculated experimentation. The Middle East represents a largely untapped market with strong sovereign wealth backing, burgeoning technological ambitions, and growing demand for digital infrastructure. By exploring a foothold in the region, TSMC positions itself as a first mover and potentially opens a new revenue frontier. Additionally, the UAE’s offer to co-finance or subsidize such a facility through public-private partnerships could reduce capital risk and improve return on investment.

However, the company’s official posture has remained cautious and non-committal. TSMC is acutely aware that any misstep in global expansion could strain its operational bandwidth, invite political backlash, or compromise proprietary process technologies. Its decision-making will be guided by both commercial imperatives and its obligations to regulatory frameworks, investors, and long-standing customers.

The UAE Government’s Vision and Ambitions

For the UAE, the pursuit of hosting a TSMC fab aligns seamlessly with its long-term economic transformation agenda. The Emirati leadership has made no secret of its intention to move beyond oil dependency and become a global hub for high technology, artificial intelligence, and advanced manufacturing. A TSMC facility would not only bring prestige but also anchor a broader ecosystem of innovation, research, and talent development within the country.

From a policy standpoint, the UAE has signaled its willingness to invest heavily in this initiative. Government-backed entities such as MGX, Mubadala, and the Advanced Technology Research Council (ATRC) are likely to be instrumental in shaping the financial and regulatory contours of any deal. These institutions possess both the capital and administrative latitude to support a project of this magnitude through infrastructure development, training incentives, and cross-border partnerships.

Moreover, the UAE sees this opportunity as part of a broader strategy to secure technological sovereignty. By bringing chip manufacturing capabilities to the region, the country aims to reduce reliance on foreign imports, strengthen digital resilience, and catalyze regional supply chains. The geopolitical symbolism of attracting the world’s leading foundry is also not lost on Emirati leadership, which seeks to solidify its status as a neutral yet globally connected power.

The United States: Supportive but Cautious

The U.S. government’s view on the potential TSMC-UAE deal is nuanced. On one hand, the United States has actively encouraged TSMC to diversify its manufacturing footprint away from Taiwan. This has included direct subsidies and incentives under the CHIPS and Science Act, aimed at revitalizing America’s domestic chip manufacturing capabilities and reducing dependence on foreign supply chains.

However, the idea of TSMC building a cutting-edge facility in the Middle East—especially in a non-aligned nation like the UAE—has triggered concern among U.S. policymakers and national security analysts. The central fear is that advanced manufacturing capabilities and know-how could be exposed to foreign actors deemed adversarial to U.S. interests. These concerns are compounded by the UAE’s relationships with countries like China and Russia, as well as by previous scrutiny of Emirati tech partnerships involving surveillance and dual-use technologies.

U.S. export control regulations, particularly those administered by the Department of Commerce’s Bureau of Industry and Security (BIS), may impose constraints on what technologies TSMC can transfer to or develop within the UAE. This includes restrictions on extreme ultraviolet (EUV) lithography equipment, certain advanced nodes, and the use of American-origin intellectual property. Consequently, any UAE fab would likely require significant diplomatic negotiation, compliance safeguards, and technological firewalls to gain approval from Washington.

Global Clients and Industry Partners

Another important set of stakeholders consists of TSMC’s global clientele and technology partners. These include some of the largest companies in the world—Apple, NVIDIA, AMD, Qualcomm, and MediaTek—whose competitiveness relies on the uninterrupted flow of advanced chips from TSMC’s fabs. Any disruption to production, misallocation of engineering resources, or dilution of technological focus is a potential threat to these companies’ roadmaps and supply chain stability.

From a customer perspective, the location of fabs matters insofar as it affects time-to-market, security of supply, and cost competitiveness. Some clients may view a UAE facility as a welcome development, particularly if it brings production closer to emerging markets in the Middle East, North Africa, and South Asia. Others may be more cautious, preferring TSMC to concentrate on stabilizing its delayed Arizona fab or advancing process nodes in Taiwan.

In parallel, equipment suppliers such as ASML, Tokyo Electron, and Applied Materials will play a critical role in determining the feasibility of a UAE-based fab. These companies must be willing and able to deliver their highly specialized tools to the region, navigate export compliance issues, and provide ongoing maintenance and technical support. Their willingness to engage will depend heavily on the geopolitical risk assessments of their home governments and the commercial viability of serving a new market.

Regional and Emerging Market Interests

Finally, regional stakeholders across the Middle East and North Africa are closely watching this development. Governments in Saudi Arabia, Egypt, and the Gulf Cooperation Council (GCC) states have all announced ambitious digital transformation plans requiring advanced semiconductor components. The presence of a TSMC fab in the UAE could serve as a regional anchor, enabling greater technological self-sufficiency, enhancing supply chain resilience, and catalyzing intra-regional collaboration.

At the same time, the emergence of such a powerful manufacturing entity could shift competitive dynamics within the region. Local foundries or chip design startups may face pressure to consolidate or align with the UAE’s vision. For international firms looking to invest in the Middle East, the presence of TSMC could either serve as a magnet for innovation or as a barrier to entry, depending on the inclusivity of the ecosystem that emerges around the fab.

In sum, the proposed TSMC fab in the UAE has generated a wide array of responses from key global and regional stakeholders. While the UAE government views the opportunity as transformative, and TSMC sees strategic potential, the project is entangled in a web of geopolitical sensitivities, operational constraints, and complex regulatory frameworks. The alignment—or misalignment—of stakeholder interests will ultimately determine whether this initiative can move from concept to concrete reality. Success will hinge not only on financial capital, but also on trust, transparency, and multilateral cooperation.

Weighing the Pros and Cons

The possibility of Taiwan Semiconductor Manufacturing Company (TSMC) establishing an advanced semiconductor fabrication plant in the United Arab Emirates marks a significant moment in the evolution of global technology supply chains. It represents not only the growing strategic ambitions of the UAE to position itself as a technology leader but also TSMC’s acknowledgment of the need for geographical diversification in an increasingly volatile geopolitical environment. While the plan is still in the evaluation stage, the ramifications of such a decision would extend far beyond commercial considerations, touching upon national security, global competition, regional development, and technological sovereignty.

On the pro side, the strategic rationale for TSMC’s potential expansion into the UAE is compelling. The country offers a rare combination of political stability, abundant capital, modern infrastructure, and a forward-looking digital economy policy framework. It is geographically well-positioned to serve markets across the Middle East, Africa, South Asia, and parts of Europe, offering proximity to emerging demand centers that are becoming increasingly dependent on advanced computing. Moreover, through institutions like MGX and Mubadala, the UAE government is well-prepared to provide financial and logistical support to de-risk the venture and accelerate its implementation.

The UAE’s willingness to align its national development vision with the operational needs of an advanced chip manufacturer reflects a high level of strategic intent. For TSMC, this presents a unique opportunity to expand into an underrepresented region and hedge against geopolitical risks affecting its core facilities in Taiwan and delayed projects in the United States and Europe. A UAE-based fab could also serve as a diplomatic bridge, enhancing TSMC’s global brand, deepening regional relationships, and laying the groundwork for future high-tech collaboration.

However, the challenges are no less significant. Building and operating a state-of-the-art semiconductor facility in a region with limited human capital, an immature industrial ecosystem, and heightened geopolitical sensitivity requires an extraordinary level of coordination and risk management. TSMC would need to overcome talent shortages, establish a reliable local supply chain, and secure permissions from international regulators wary of advanced technology proliferation. The sheer cost and complexity of the endeavor—likely exceeding $20 billion in investment and several years in development—cannot be underestimated.

From a broader stakeholder perspective, the proposal generates a diverse set of reactions. While the UAE sees the move as a symbol of its rising technological stature, U.S. officials may view it as a strategic vulnerability requiring tight oversight. Global clients, meanwhile, may express both hope and hesitation, depending on how the expansion affects delivery timelines, cost structures, and innovation cycles.

In assessing the feasibility of the proposed UAE fab, one must take into account not just the immediate business case, but the broader strategic calculus. This includes considerations about supply chain resilience, global competitiveness, and the emerging role of the Middle East in the high-tech global economy. The intersection of these forces defines both the promise and the peril of TSMC’s possible move.

If successful, a TSMC facility in the UAE could reshape the semiconductor landscape, diversify global production hubs, and ignite a new era of regional technological development. If mishandled, it could strain relationships, divert valuable resources, and risk operational fragmentation. For now, the world watches closely as two ambitious entities—TSMC and the UAE—contemplate a partnership that could redefine the future of chip manufacturing.

References

- https://www.reuters.com/technology/tsmc-talks-build-chip-plant-uae

- https://www.bloomberg.com/news/articles/tsmc-uae-expansion-mgx

- https://www.wsj.com/articles/tsmc-eyes-middle-east-chip-investment

- https://www.ft.com/content/tsmc-mgx-deal-uae

- https://www.semi.org/en/news-resources/global-semiconductor-outlook

- https://www.techcrunch.com/tsmc-global-expansion-overview

- https://www.cnbc.com/2023/tsmc-plans-new-fab-in-arizona-delays

- https://www.nytimes.com/technology/tsmc-semiconductor-politics

- https://asia.nikkei.com/Business/Tech/Semiconductors/tsmc-diversification-strategy

- https://www.arabnews.com/node/uae-tech-ambitions-tsmc