Trump’s Trade Legacy: Redrawing Global Commerce Through Tariffs, Treaties, and Tensions

The trade policies of former U.S. President Donald J. Trump mark a pivotal shift in the modern history of international commerce. Diverging significantly from the free trade consensus that had dominated American economic policy since the mid-20th century, the Trump administration introduced a bold and controversial agenda under the banner of “America First.” This policy framework emphasized bilateralism over multilateralism, prioritized the reduction of trade deficits, and aggressively deployed tariffs as a strategic tool to renegotiate global economic relationships. While Trump’s rhetoric was often polarizing, his administration’s actions significantly altered the dynamics of global trade, sending ripples across virtually every major economy.

At the heart of Trump’s approach was a belief that existing trade arrangements disadvantaged the United States. Agreements like the North American Free Trade Agreement (NAFTA), the World Trade Organization (WTO) framework, and the Trans-Pacific Partnership (TPP) were cast as poorly negotiated deals that enabled foreign nations to exploit American workers and manufacturers. The Trump administration sought to reverse this trend by confronting trading partners with a mix of threats, tariffs, and direct negotiations—often outside the bounds of traditional diplomatic norms. In doing so, it catalyzed a period of volatility and strategic reassessment in global markets.

Trump’s trade policy was far more than an economic doctrine—it was a geopolitical maneuver intended to reshape the balance of power. By imposing unilateral tariffs on steel, aluminum, automotive parts, and hundreds of billions of dollars in Chinese imports, the administration leveraged America’s market size to extract concessions and rewrite trade rules. While some sectors benefited from temporary protections and increased leverage in negotiations, others suffered from supply chain disruptions, retaliatory tariffs, and long-term uncertainty.

The most prominent manifestation of Trump’s trade doctrine was the escalation of the U.S.–China trade war. Beginning with targeted tariffs and eventually expanding to cover more than $500 billion in bilateral goods, the dispute redefined the global trading system. It not only affected bilateral relations between the two largest economies but also forced businesses, investors, and governments to reconsider the resilience and configuration of their supply chains. The impact was not confined to the U.S. and China; it extended to third-party nations, many of which were compelled to recalibrate their trade strategies to avoid collateral damage.

Beyond China, the Trump administration’s trade actions had significant ramifications for America’s traditional allies. Europe faced tariff threats over automobiles, luxury goods, and digital services taxation. Mexico and Canada endured a high-stakes renegotiation of NAFTA, culminating in the USMCA, which introduced stricter rules on automotive content and labor standards. The withdrawal from the TPP—a trade agreement designed to strengthen U.S. influence in the Asia-Pacific—signaled a retreat from multilateral leadership and created a vacuum that was quickly filled by other regional powers, particularly China.

Moreover, Trump’s trade policy fundamentally challenged the institutions that had governed global commerce for decades. By openly criticizing and circumventing the WTO, the administration contributed to a growing skepticism about the effectiveness and impartiality of international economic governance. This has had lasting implications for the global rules-based order, with subsequent administrations grappling with how to reengage with multilateral bodies without appearing weak or yielding to international pressure.

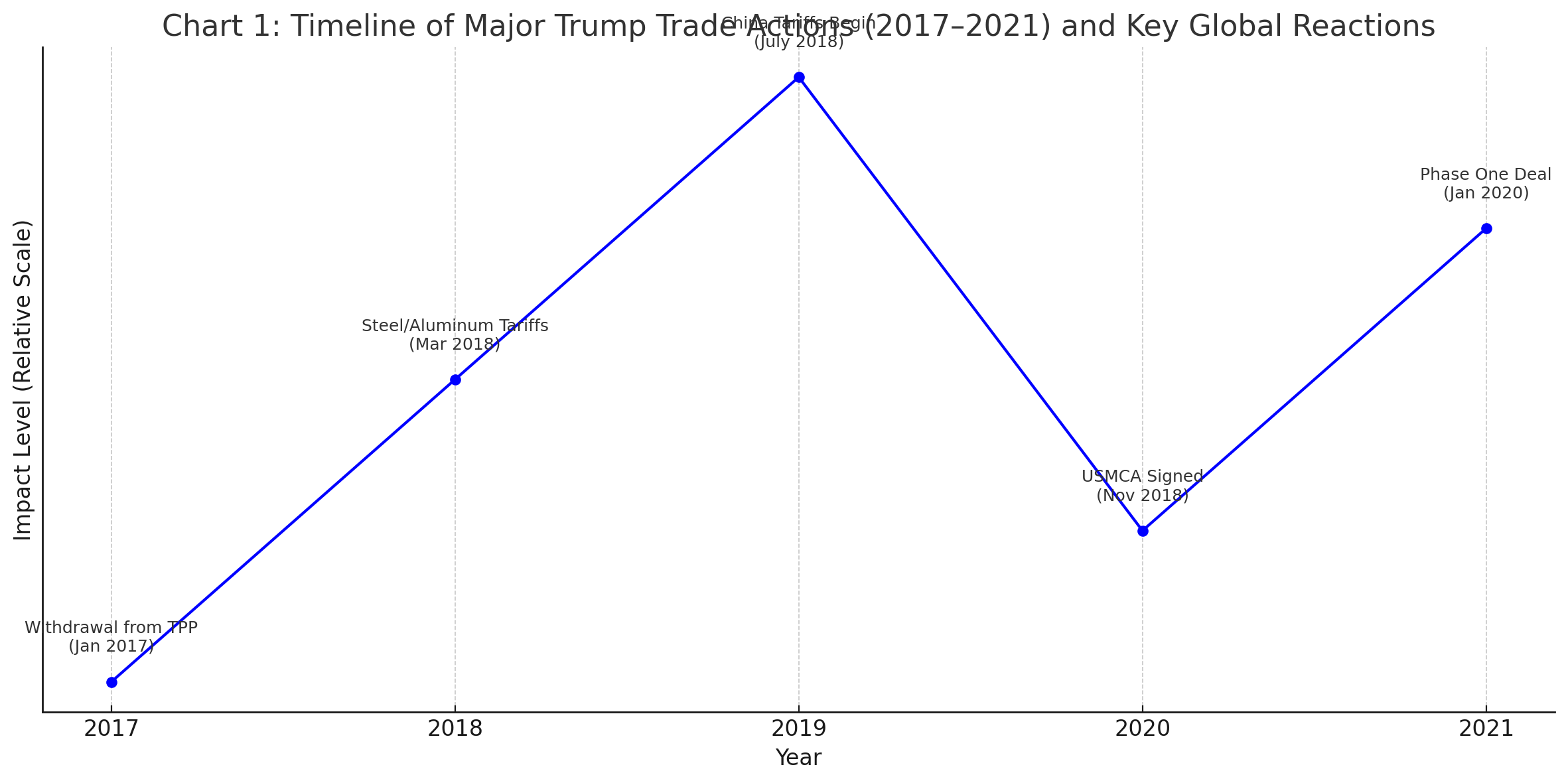

This blog post seeks to offer a comprehensive analysis of Trump’s global trade policy and its enduring effects on the world economy. It will examine the ideological and strategic foundations of his approach, assess its regional impacts, and explore the broader consequences for global trade flows and institutions. By integrating qualitative analysis with empirical data—including two visual charts and a comparative table—this piece will illuminate both the immediate and structural transformations triggered by Trump’s actions.

In Section 2, we will dissect the framework of Trump’s trade doctrine, identifying its philosophical origins, strategic mechanisms, and key turning points. In Section 3, the focus will shift to the regional impacts of Trump’s policies, highlighting both the winners and the losers across North America, Europe, Asia, and the developing world. Section 4 will delve into the reshaping of global supply chains and trade flows, while Section 5 will address the lasting implications for trade institutions and international governance. Finally, Section 6 will offer a forward-looking conclusion, evaluating the legacy of Trump's trade policies and what they mean for the future of global commerce.

As nations continue to grapple with the aftershocks of the Trump era and recalibrate their own trade strategies in response, understanding this policy shift is more than a historical exercise—it is a necessity. The global economy may never return to the pre-2017 status quo, and the contours of the new order are still being drawn. In this evolving landscape, the legacy of Trump’s trade agenda will remain a central point of reference for scholars, policymakers, and business leaders alike.

The Framework of Trump’s Trade Doctrine

The trade doctrine espoused by President Donald J. Trump represented a decisive departure from the long-standing bipartisan consensus that had guided U.S. trade policy for decades. At its core, Trump’s approach to international trade was shaped by the principles of economic nationalism, bilateralism, and transactional diplomacy. It was framed not within the context of mutual gain through global integration but rather as a zero-sum competition between nation-states in which the United States, according to Trump, had been consistently outmaneuvered and exploited.

Trump’s trade philosophy, often described as “America First,” rejected multilateralism as both inefficient and unfavorable to U.S. interests. This ideological orientation emerged from decades of skepticism toward globalization, trade liberalization, and the institutions that uphold the global trade architecture, such as the World Trade Organization (WTO). Trump argued that prior trade deals had hollowed out America’s industrial base, encouraged outsourcing, and contributed to chronic trade deficits that symbolized national weakness. By reasserting economic sovereignty and aggressively renegotiating trade arrangements, the administration sought to rebalance the terms of U.S. engagement with the global economy.

One of the central mechanisms of Trump’s trade policy was the unilateral imposition of tariffs, which the administration deployed not only as economic instruments but also as negotiating leverage. These tariffs were justified under various legal authorities, including Section 232 of the Trade Expansion Act of 1962 (national security grounds) and Section 301 of the Trade Act of 1974 (unfair foreign practices). This tactical use of tariffs enabled the administration to bypass both congressional oversight and multilateral forums, allowing for rapid and unilateral action.

A landmark moment in this approach was the imposition of tariffs on steel and aluminum imports in 2018. Ostensibly framed as a national security measure, this policy drew sharp criticism from allies in Europe, Canada, and Mexico—many of whom had historically coordinated defense policy with the United States. The decision was emblematic of Trump’s broader posture: prioritizing domestic industrial capacity even at the expense of strategic alliances. It also set a precedent for future actions that would further unsettle the global trade order.

Perhaps the most consequential theater of Trump’s trade policy was the escalation of the U.S.–China trade war. The administration’s grievances against China were extensive: forced technology transfers, intellectual property theft, state subsidies to national champions, currency manipulation, and an opaque regulatory environment. These concerns were not unique to Trump; however, the manner in which they were addressed was unprecedented in both scale and aggression. By levying tariffs on more than $500 billion of Chinese goods over the course of 2018–2020, the administration triggered a retaliatory spiral that disrupted global supply chains and undermined investor confidence.

The strategic intent behind the China tariffs extended beyond short-term economic pressure. They were designed to force structural reforms within the Chinese economy, curtail the advance of strategic sectors under initiatives like Made in China 2025, and realign trade in a way that would benefit American manufacturing and technology firms. While some partial agreements were reached—most notably the Phase One trade deal signed in January 2020—many of the structural issues remained unresolved, and numerous tariffs remained in place even after Trump left office.

Another cornerstone of Trump’s trade strategy was the renegotiation of existing trade agreements, most notably the North American Free Trade Agreement (NAFTA). Rebranded as the United States-Mexico-Canada Agreement (USMCA), the revised pact incorporated provisions aimed at increasing North American content in automobile production, enhancing labor protections in Mexico, and updating rules related to digital trade and intellectual property. The renegotiation was framed as a success for American workers and manufacturers, though its long-term economic impact remains a subject of debate among economists and trade analysts.

The Trump administration also targeted long-standing trade relationships with European allies. Tariff threats were levied against European automobiles, and retaliatory measures were enacted in the wake of disputes over digital services taxes and subsidies to aircraft manufacturers (Airbus vs. Boeing). These moves exacerbated transatlantic tensions and further eroded the sense of reliability and predictability that had historically underpinned U.S.–EU trade relations.

In addition, Trump’s withdrawal from the Trans-Pacific Partnership (TPP) on his first full day in office signaled a broader retreat from multilateral trade leadership. The TPP, negotiated under the Obama administration, was designed to counterbalance China’s growing economic influence in the Asia-Pacific and establish high-standard trade rules for the 21st century. By abandoning the agreement, the U.S. ceded strategic ground to regional powers and weakened its influence over the economic architecture of the Indo-Pacific.

The administration also expressed open hostility toward the World Trade Organization (WTO). Trump criticized the WTO’s dispute resolution system as biased and ineffective, and his administration effectively paralyzed the appellate body by blocking the appointment of new judges. This move weakened one of the central institutions of global trade governance and contributed to a broader erosion of confidence in multilateralism. While the administration did support some WTO reforms, its broader posture suggested a preference for bilateral negotiation over institutional rule-making.

Collectively, these policies amounted to a reconfiguration of U.S. trade strategy—from an approach rooted in liberal internationalism to one defined by unilateralism, conditional reciprocity, and transactionalism. Supporters argued that Trump’s confrontational stance was necessary to correct long-standing imbalances and bring trading partners to the negotiating table. Critics, however, warned that this approach sacrificed global leadership, undermined international norms, and invited retaliation that ultimately hurt American consumers and exporters.

In conclusion, the framework of Trump’s trade doctrine was characterized by its clear departure from established norms and its aggressive pursuit of national advantage. Through the strategic deployment of tariffs, renegotiation of agreements, and confrontation with global institutions, the administration fundamentally altered the landscape of international trade. While the efficacy and consequences of these policies continue to be debated, their impact is undeniable—and their legacy remains deeply embedded in current policy discourse. The next section will explore how these strategies reverberated across global regions, reshaping alliances, supply chains, and economic outcomes worldwide.

Regional Impacts: Winners, Losers, and Strategic Realignments

The global impact of President Donald Trump’s trade policies was far from uniform. While some regions adapted strategically or even benefited under specific circumstances, others endured significant economic strain, political uncertainty, and structural dislocation. Trump’s “America First” agenda disrupted long-standing trade patterns and reconfigured diplomatic relationships, forcing nations across the world to reassess their trade strategies, economic dependencies, and geopolitical alliances. This section provides a region-by-region analysis of the consequences of Trump’s trade policy, highlighting the complexity and asymmetry of its global effects.

China: The Epicenter of Trade Retaliation

No country experienced a more direct and confrontational shift in trade relations under the Trump administration than China. The bilateral trade war, ignited by Section 301 investigations into Chinese intellectual property practices, resulted in tariffs on over $500 billion worth of goods exchanged between the two nations. The imposition of successive rounds of tariffs on consumer electronics, industrial inputs, and agricultural commodities disrupted supply chains and eroded commercial trust.

The Phase One trade agreement signed in January 2020 provided temporary relief by committing China to increase purchases of U.S. goods and improve intellectual property enforcement. However, many structural issues—such as state subsidies, market access barriers, and data security regulations—remained unaddressed. In response, Chinese firms began seeking alternate sources for inputs, and Beijing accelerated its “dual circulation” strategy to reduce external dependencies.

The cumulative effect of Trump’s trade war with China has been a strategic decoupling of two major economies. This decoupling continues to shape the global economic landscape, prompting multinational firms to shift operations out of China and reconfigure their supply chains to include countries such as Vietnam, Malaysia, and India.

European Union: Trade Tensions with Strategic Allies

Despite being longstanding allies, the European Union and the United States encountered heightened trade frictions during the Trump years. The administration imposed steel and aluminum tariffs on EU members in 2018, citing national security grounds. This unexpected move triggered reciprocal tariffs from the EU on American products such as bourbon, motorcycles, and orange juice.

Additionally, digital services taxes implemented by France and other European nations became a flashpoint for conflict, as the U.S. threatened retaliatory tariffs on French luxury goods. The long-running Airbus-Boeing subsidy dispute also intensified under Trump, leading to tit-for-tat tariffs on billions of dollars in goods.

These tensions contributed to a broader erosion of transatlantic economic cooperation. European leaders began advocating for greater “strategic autonomy,” seeking to reduce reliance on the U.S. in matters of trade, defense, and technology. Although the damage did not result in outright trade disintegration, the Trump era introduced a level of unpredictability that strained diplomatic channels and complicated future negotiations.

Mexico and Canada: Renegotiation and Realignment through USMCA

North America was perhaps the most directly affected region in terms of formal trade agreement renegotiation. Trump’s long-standing criticism of the North American Free Trade Agreement (NAFTA) culminated in the adoption of the United States–Mexico–Canada Agreement (USMCA), which came into force in July 2020.

USMCA introduced significant updates to digital trade, intellectual property, and dispute resolution mechanisms. Importantly, it established stricter rules of origin for automobiles, requiring a higher percentage of North American content and improved labor standards in Mexican manufacturing facilities. While these changes were designed to incentivize onshoring and higher wages, they also increased compliance costs and introduced regulatory complexities.

Meanwhile, both Mexico and Canada were temporarily affected by the Trump administration’s tariffs on steel and aluminum. Though eventually lifted through side agreements, these measures injected volatility into regional trade and raised concerns about the durability of trilateral economic cooperation.

Asia-Pacific (Excluding China): Strategic Gaps and Shifting Alliances

Trump’s abrupt withdrawal from the Trans-Pacific Partnership (TPP) created a power vacuum in the Asia-Pacific region, eroding U.S. influence in a part of the world experiencing rapid economic growth and integration. The remaining eleven countries moved forward without the United States, finalizing the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in 2018.

This decision inadvertently enabled China to expand its economic footprint in the region through initiatives such as the Regional Comprehensive Economic Partnership (RCEP) and the Belt and Road Initiative (BRI). U.S. allies in the region, such as Japan, South Korea, and Australia, were left to navigate a more fragmented and unpredictable trade landscape.

The absence of U.S. leadership in regional economic architecture undermined its soft power and strategic leverage in the Indo-Pacific, while China capitalized on the opportunity to position itself as a more consistent economic partner.

Emerging Markets: Collateral Damage and Capital Volatility

Emerging markets were not the primary targets of Trump’s trade agenda, yet many suffered indirectly from the broader destabilization of global trade norms. The uncertainty generated by frequent tariff changes, threats of new sanctions, and the breakdown of multilateral dispute resolution mechanisms led to currency volatility, reduced investment confidence, and capital outflows.

Export-oriented economies in Southeast Asia, Sub-Saharan Africa, and Latin America—many of which depend on predictable access to U.S. or Chinese markets—found themselves navigating an increasingly fragmented global trade regime. While some countries benefited from supply chain diversification away from China, these gains were often offset by the broader decline in trade growth and rising protectionism.

Moreover, many developing countries experienced price instability in commodities due to shifting demand patterns and trade rerouting. From soybeans in Brazil to rare earth minerals in Africa, the global commodity market entered a period of recalibration in response to the U.S.–China tariff war.

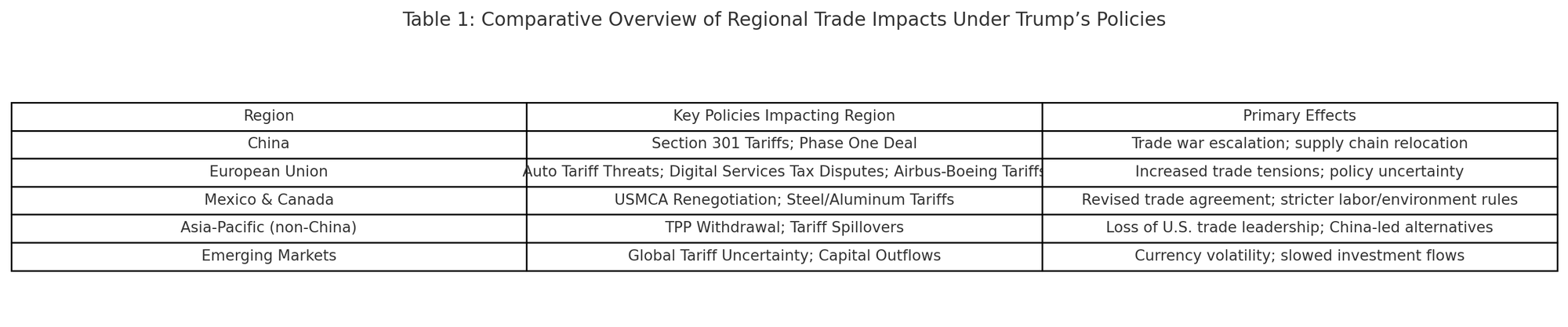

This table summarizes key policies and their primary effects across five global regions, offering a structured comparison of the trade disruption and realignment initiated by the Trump administration.

Global Supply Chains and Trade Flows

One of the most transformative effects of the Trump administration’s trade policies was the reshaping of global supply chains and trade flows. By imposing tariffs on strategic imports and signaling a broader shift toward economic nationalism, the administration forced companies, investors, and governments to reconsider the foundations of global manufacturing and distribution networks. While intended to protect U.S. industries and reduce dependency on foreign inputs—especially from China—the outcome was a more fragmented, regionally focused, and risk-conscious model of global trade.

Tariff-Induced Disruption and Trade Diversion

The Trump administration’s most significant tool in altering trade flows was the implementation of tariffs on hundreds of billions of dollars in imported goods. The most notable of these actions were the Section 301 tariffs on Chinese products, which affected more than $350 billion worth of imports. Additional tariffs were imposed on steel, aluminum, washing machines, and automobiles from a wide range of trade partners, including allies.

These measures had the immediate effect of increasing the cost of importing goods from targeted countries, leading to what economists describe as “trade diversion.” Rather than sourcing goods from China, many U.S. importers began shifting procurement to alternative suppliers in Southeast Asia, Latin America, and even the United States. Countries such as Vietnam, Mexico, and Taiwan saw substantial increases in exports to the U.S., as they absorbed production previously located in China.

However, the broader implications were more complex. Companies that had spent decades building intricate and cost-efficient global supply chains were suddenly confronted with rising compliance costs, logistical uncertainty, and pricing volatility. Some responded by accelerating efforts to localize or regionalize production, while others adopted a wait-and-see approach, wary of overreacting to what they feared might be temporary policy changes.

The Rise of “China+1” and Regionalization Strategies

One of the most prominent corporate responses to the Trump administration’s tariff regime was the adoption of “China+1” strategies. These approaches involve maintaining a production base in China while adding at least one other location to diversify risk. The aim is not to abandon China altogether—given its infrastructure, scale, and market size—but to reduce exposure to tariff shocks, regulatory uncertainty, and geopolitical tension.

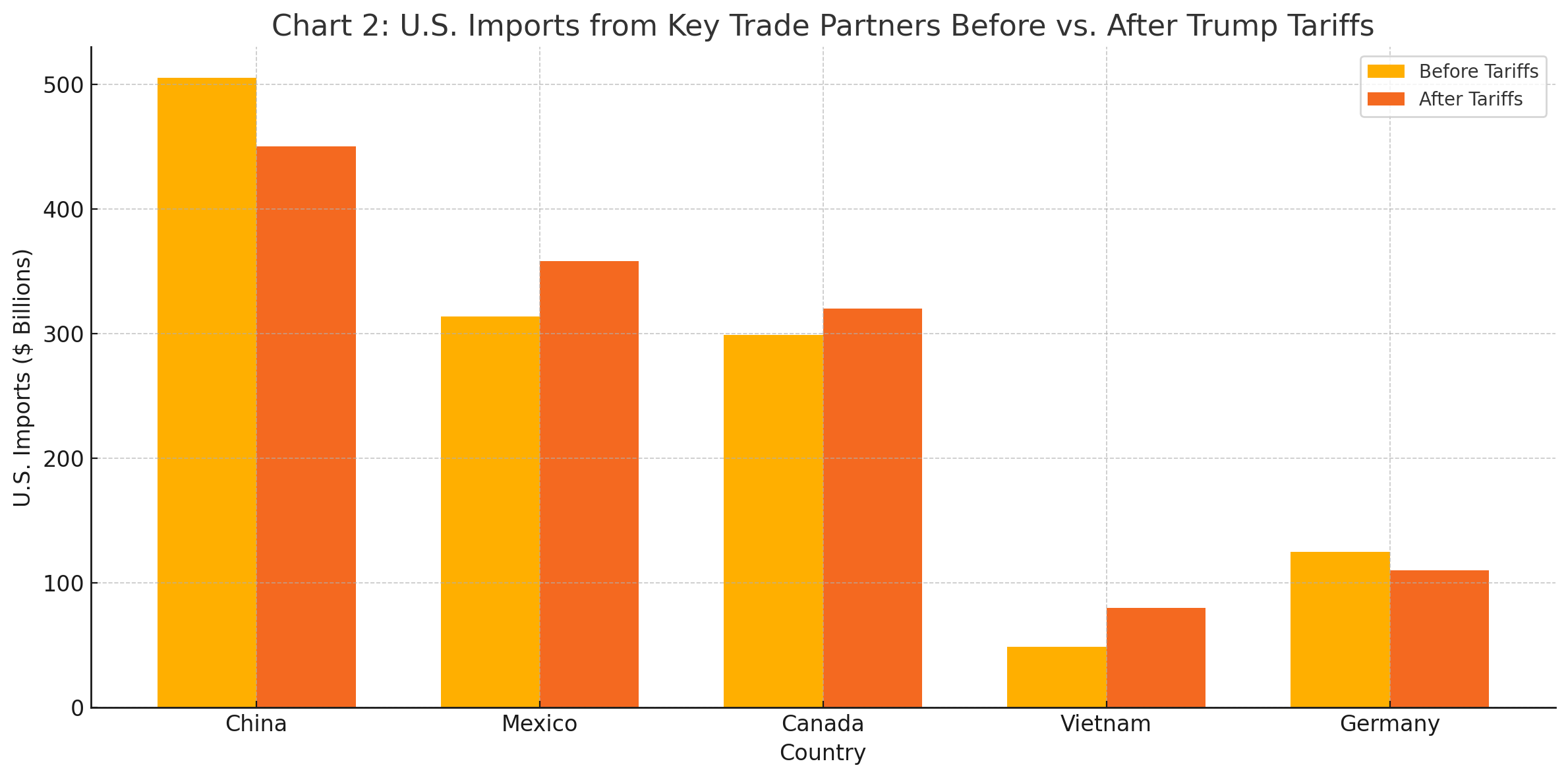

Vietnam emerged as a leading beneficiary of this shift, particularly in industries such as textiles, electronics, and consumer goods. U.S. imports from Vietnam increased significantly between 2017 and 2021, while Chinese exports to the U.S. declined in relative terms. Chart 2 illustrates this trend by comparing U.S. import volumes from major trade partners before and after the implementation of Trump’s tariffs.

Mexico also played a key role in this realignment, aided by the United States-Mexico-Canada Agreement (USMCA), which enhanced North American trade integration. U.S. manufacturers looking to reduce tariff exposure found Mexico’s proximity and trade-friendly environment particularly attractive for nearshoring operations. Similarly, Taiwan and India gained ground in sectors such as semiconductors, pharmaceuticals, and information technology services.

This move toward regionalization represents a fundamental shift in supply chain strategy. Rather than optimizing purely for cost, firms are now balancing resilience, proximity, and political stability. The post-Trump era is likely to see further diversification of sourcing models, with companies favoring multi-node supply chains that are less vulnerable to unilateral trade disruptions.

This chart compares the volume of U.S. imports from five major trade partners before (2017) and after (2020–2021) the implementation of Trump’s tariff regime. It illustrates the substantial decrease in imports from China and the corresponding increases from countries like Vietnam and Mexico.

Impact on Industrial Sectors and Commodity Flows

The Trump administration’s trade policies affected not only where goods were produced but also which sectors were most impacted. Industries with long, cross-border supply chains—such as automotive, electronics, aerospace, and consumer goods—were disproportionately affected by the rising complexity and cost of international trade.

Automotive manufacturers, for example, faced increased costs due to tariffs on steel and aluminum, as well as rules of origin provisions under the USMCA. Many firms reassessed the structure of their North American operations to remain compliant while preserving cost competitiveness.

The semiconductor industry, a cornerstone of advanced manufacturing, was heavily affected by export controls and restrictions related to U.S.–China tensions. American firms faced new compliance burdens, while Chinese companies accelerated their pursuit of domestic chipmaking capabilities, reshaping global flows of intellectual property, R&D investment, and raw materials.

Agricultural commodities were also impacted. Retaliatory tariffs by China and other nations reduced demand for U.S. soybeans, pork, and corn. This led American exporters to seek alternative markets, resulting in a temporary oversupply and price declines that affected domestic farm income. While some export flows were eventually restored via partial trade agreements, the long-term trust between U.S. producers and international buyers was damaged.

The Normalization of Trade Uncertainty

One of the most lasting effects of the Trump administration’s trade policies is the normalization of trade-related uncertainty as a systemic business risk. For decades, trade policy had been largely predictable, governed by international rules and bilateral agreements negotiated through diplomatic channels. The Trump era upended this assumption.

Sudden tariff announcements via presidential tweet, threats of import restrictions based on national security grounds, and the rejection of multilateral dispute mechanisms created an environment of persistent ambiguity. Businesses could no longer rely on the stability of existing agreements, and investors had to price in geopolitical variables as never before.

While some of these dynamics have moderated under the Biden administration, the underlying message to global business leaders remains clear: the era of frictionless globalization has ended, and resilience has overtaken efficiency as the guiding principle in trade and supply chain strategy.

Trump’s trade policies catalyzed a fundamental reshaping of global trade flows and supply chain architectures. While the immediate objective was to boost U.S. manufacturing and reduce dependency on foreign imports—particularly from China—the broader result has been a reorganization of global production networks, a rise in regionalization, and a more cautious approach to trade risk. The long-term legacy of these changes will be felt for years to come, as companies continue to navigate a world where economic strategy is inextricably linked to political uncertainty and national security considerations.

Long-Term Effects on Trade Institutions and Global Governance

The Trump administration's trade policy not only disrupted bilateral trade relationships but also challenged the very foundations of the global trading system. Through a sustained campaign of unilateral actions, the administration bypassed and, in some cases, actively undermined key multilateral institutions that had served as the cornerstones of international economic governance for decades. As a result, the global rules-based order governing trade was severely weakened, with consequences that continue to reverberate well beyond Trump’s tenure in office.

At the heart of this institutional disruption was a deep skepticism toward the World Trade Organization (WTO). Established in 1995 as the successor to the General Agreement on Tariffs and Trade (GATT), the WTO was designed to enforce international trade rules, facilitate negotiations, and adjudicate disputes. While successive U.S. administrations had voiced concerns about aspects of the WTO’s functioning, the Trump administration adopted an unprecedented stance: not only criticizing the organization but also obstructing its ability to function.

The most consequential action in this regard was the Trump administration’s decision to block appointments to the WTO Appellate Body, effectively disabling the organization’s dispute resolution mechanism. By December 2019, the Appellate Body lacked the quorum needed to hear appeals, rendering the WTO’s judicial process inoperative. This move, framed by the administration as a response to judicial overreach and bias against U.S. interests, sent a clear signal that the United States was no longer willing to play by the rules of multilateral adjudication.

This paralysis created a vacuum in the international system. Without a credible dispute settlement mechanism, trade conflicts that would have previously been resolved through legal arbitration now risked escalating into tit-for-tat retaliation. The erosion of dispute resolution capabilities also weakened confidence in the WTO's ability to ensure a level playing field, particularly for smaller economies that lack the leverage to confront major powers directly.

In parallel, the Trump administration pursued a strategy of bilateralism over multilateralism. It withdrew from the Trans-Pacific Partnership (TPP), criticized existing multilateral trade agreements like NAFTA and the WTO, and instead favored one-on-one negotiations where the United States could exert maximal influence. This approach marked a departure from the post-World War II U.S. trade strategy, which had prioritized international cooperation and institution-building as pillars of economic and geopolitical stability.

While bilateralism enabled the Trump administration to renegotiate agreements on its own terms—such as the transformation of NAFTA into the United States-Mexico-Canada Agreement (USMCA)—it also contributed to a growing sense of fragmentation in the global trade system. Countries increasingly found themselves navigating a web of inconsistent rules, standards, and enforcement mechanisms, often tailored to the political imperatives of the moment rather than to long-term economic principles.

The emphasis on national security as a justification for trade restrictions further blurred the line between economic policy and geopolitical strategy. The use of Section 232 of the Trade Expansion Act of 1962 to impose tariffs on steel and aluminum imports from both adversaries and allies raised concerns about the erosion of a rules-based system. If national security could be invoked so broadly, many feared that trade liberalization commitments could be easily circumvented under the guise of sovereign defense, thereby undermining the credibility of international trade law.

In this environment, countries began to develop parallel institutions and regional trade frameworks. With the United States withdrawing from the TPP, the remaining eleven countries finalized the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Simultaneously, the Regional Comprehensive Economic Partnership (RCEP)—spearheaded by China and involving 15 Asia-Pacific nations—emerged as the world’s largest free trade agreement. These developments not only filled the void left by U.S. retrenchment but also signaled a shift in the epicenter of trade diplomacy away from Washington.

Another long-term consequence of Trump’s trade policy is the normalization of trade weaponization. While previous administrations had used trade tools for narrow, strategic purposes, the Trump administration embraced tariffs as a multi-use instrument of leverage. This normalization has made future use of such tools more likely by subsequent administrations and by other countries. The proliferation of export controls, investment screening mechanisms, and digital trade restrictions suggests that geoeconomics is now a defining feature of global governance, with economic interdependence increasingly treated as a potential liability rather than a strength.

Moreover, the Trump administration’s actions catalyzed a reassessment of trade justice and domestic resilience. Critics of globalization—both in the United States and abroad—began to reframe the trade debate in terms of labor rights, environmental protection, and national sovereignty. The resulting policy discussions have prompted governments to consider how trade agreements can better serve domestic constituencies without sacrificing international cooperation.

The Biden administration has, to some extent, continued this shift. While adopting a more diplomatic tone and expressing support for multilateralism, it has retained many of Trump’s tariffs and protectionist policies, especially those targeting China. The continuation of such measures suggests a broader consensus emerging in Washington around a more confrontational and strategic approach to trade, one less rooted in traditional liberalism and more aligned with industrial policy and strategic competition.

Internationally, efforts are underway to revive and reform the WTO. Some countries have proposed establishing a plurilateral dispute settlement mechanism, while others advocate for updating WTO rules to address digital trade, state-owned enterprises, and sustainability. However, the success of such initiatives will depend largely on U.S. willingness to reengage and on China’s openness to reforms that reduce its structural advantages under the current system.

The long-term effects of Trump’s trade policies on global trade institutions and governance have been both profound and far-reaching. By challenging the authority of the WTO, rejecting multilateralism, and weaponizing trade tools, the administration accelerated a shift toward fragmentation, strategic competition, and institutional erosion. While some of these trends predated Trump and others have been moderated under subsequent leadership, the legacy of his approach continues to shape how nations interact, negotiate, and regulate the global economy.

As the world transitions toward a more multipolar and contested economic landscape, the viability of global governance mechanisms will hinge on their ability to adapt to new realities—realities marked by political divergence, technological disruption, and growing skepticism of globalization’s benefits. Whether the post-Trump era will see a renewal of cooperative trade frameworks or a further slide into fragmentation remains one of the most consequential questions in international political economy today.

Conclusion and Forward Outlook

The Trump administration’s trade policy has had a profound and lasting impact on the global economic order. Emerging from a deeply protectionist ethos and guided by a distinct rejection of multilateralism, the policy framework recalibrated the United States’ approach to international commerce and forced other nations to reassess their own trade priorities, strategic dependencies, and institutional commitments. As the global community continues to grapple with the ramifications of the Trump era, it is imperative to evaluate both the measurable outcomes and the underlying shifts in doctrine that will influence trade for years to come.

The overarching narrative of Trump’s trade policy was framed around the principle of “America First,” a doctrine that redefined trade not as a vehicle for mutual benefit, but as a battlefield in which nations vied for dominance. This conceptual shift translated into a foreign economic policy that prioritized short-term bilateral gains over long-term global cooperation. The administration’s aggressive use of tariffs, emphasis on trade deficits, and abandonment of multilateral agreements such as the Trans-Pacific Partnership (TPP) served to isolate the United States from traditional allies and reposition it as a transactional power in the global economy.

From a domestic standpoint, the Trump administration succeeded in bringing issues such as supply chain vulnerability, unfair trade practices, and industrial decline to the forefront of national discourse. In doing so, it galvanized a reevaluation of globalization’s impacts on American workers and manufacturing sectors. The renegotiation of NAFTA into the United States-Mexico-Canada Agreement (USMCA) introduced more stringent labor and environmental standards, while the “Phase One” trade deal with China was lauded by some as a tactical victory in asserting American leverage.

However, these achievements were accompanied by considerable costs. The use of tariffs as a blunt policy instrument inflicted substantial economic harm on both American consumers and producers. Studies from institutions such as the Federal Reserve and the Peterson Institute for International Economics found that while the tariffs did lead to a reduction in imports from targeted countries, they also raised consumer prices, disrupted investment flows, and invited retaliatory measures that adversely impacted U.S. exporters—particularly in agriculture and manufacturing.

The broader geopolitical consequences were equally significant. Trump's unilateralism and erratic trade maneuvering strained relations with long-standing allies in Europe and Asia, eroded confidence in the United States as a stable economic partner, and empowered rival powers—most notably China—to fill the leadership vacuum in global trade governance. The weakening of institutions like the World Trade Organization (WTO), through both neglect and active sabotage, further complicated efforts to resolve disputes and foster cooperation during a time of increasing economic interdependence and geopolitical rivalry.

Notably, the structural legacy of Trump’s trade doctrine has outlived his presidency. Despite signaling a return to diplomatic norms, the Biden administration has preserved many of Trump’s tariffs and adopted a cautious stance toward re-engagement with multilateral trade agreements. This continuity suggests the emergence of a bipartisan consensus around the need for economic nationalism, industrial policy, and strategic decoupling—particularly with regard to China. In this sense, Trump did not merely disrupt U.S. trade policy; he redefined its trajectory.

Looking ahead, several strategic challenges and questions dominate the outlook for global trade:

- Will multilateralism recover? Institutions like the WTO face a crisis of relevance and functionality. Their survival depends on meaningful reforms that reflect contemporary economic realities, including digital trade, state capitalism, and environmental sustainability.

- Can global supply chains regain stability? The shift toward regionalization and resilience, accelerated by the Trump tariffs and exacerbated by the COVID-19 pandemic, will continue to shape sourcing decisions and industrial strategies. The challenge lies in balancing efficiency with redundancy in a fragmented world.

- What role will the U.S. play in the new global trade order? Having ceded ground to regional pacts such as the CPTPP and RCEP, the U.S. must decide whether to reclaim leadership through re-engagement or accept a more diminished, reactive role.

- How will emerging technologies and environmental priorities reshape trade rules? The digital economy, green energy transition, and the regulation of artificial intelligence and data flows will demand new frameworks that transcend the industrial-era rules that currently govern trade.

- Will trade continue to be used as a geopolitical weapon? The Trump administration normalized the practice of using trade tools for strategic ends. As this approach proliferates globally, trade policy is becoming increasingly entangled with national security, diplomacy, and ideological competition.

In light of these challenges, the international community must embrace a new pragmatism—one that acknowledges the geopolitical dimensions of trade while striving to uphold norms of transparency, fairness, and cooperation. Policymakers must also take seriously the domestic pressures that feed protectionist sentiments, addressing them through inclusive economic policies, labor market support, and transparent public dialogue about the costs and benefits of global engagement.

From a business perspective, resilience and adaptability will remain essential. Firms must continue to invest in risk management, geographic diversification, and compliance strategies that account for volatile regulatory environments. At the same time, they must engage with policymakers and multilateral institutions to ensure that the new trade frameworks accommodate both commercial innovation and social responsibility.

Academics and analysts, for their part, must continue to monitor and assess the evolving landscape, offering evidence-based insights that inform policy and empower stakeholders to navigate complexity. A nuanced understanding of Trump’s trade legacy requires more than ideological judgment—it demands rigorous analysis of data, geopolitical trends, and institutional behavior.

Final Reflection

The Trump administration’s trade policy was a watershed moment in the evolution of global commerce. Its influence has been both disruptive and catalytic, forcing a reckoning with the assumptions that underpinned decades of trade liberalization. Whether viewed as a necessary corrective to globalization’s excesses or as a destabilizing force that weakened global cooperation, Trump’s approach has indelibly reshaped how nations perceive, negotiate, and execute trade policy.

In an era defined by uncertainty, interdependence, and great-power competition, the future of global trade will depend on the world’s ability to reconcile sovereignty with solidarity, strategy with stability, and competition with collaboration. The road ahead is complex—but it begins with understanding where we have been. In that respect, the impact of Trump’s global trade policy offers not just a cautionary tale, but also a critical starting point for reimagining a more balanced and resilient international economic system.

References

- Office of the United States Trade Representative – Trade Policy Highlights

https://ustr.gov/about-us/policy-offices/press-office/reports-and-publications - World Trade Organization – United States Trade Policy Review

https://www.wto.org/english/tratop_e/tpr_e/tp_rep_e.htm - Peterson Institute for International Economics – U.S.–China Trade War Tracker

https://www.piie.com/research/trade-investment/us-china-trade-war-tariffs - Brookings Institution – Analysis of Trump’s Trade Policies

https://www.brookings.edu/topic/trade/ - Congressional Research Service – U.S. Trade Policy Tools and Actions

https://crsreports.congress.gov/ - Center for Strategic and International Studies – Global Economic Policy Analysis

https://www.csis.org/programs/economics - International Monetary Fund – U.S. Trade Balance and Global Impact

https://www.imf.org/en/Publications/WEO - Council on Foreign Relations – U.S. Tariff Policy Under Trump

https://www.cfr.org/backgrounder/what-us-tariff-policy - The Economist – Trade Disruption and Globalization Trends

https://www.economist.com/topics/international-trade - Reuters – Timeline and Impact of Trump-Era Trade Moves

https://www.reuters.com/markets/