Trump’s 100% Tax Threat to TSMC: Implications for Chips, Geopolitics, and Investors

Former U.S. President Donald Trump recently warned that Taiwan Semiconductor Manufacturing Company (TSMC) – the world’s leading contract chipmaker – could face a 100% tax penalty on its products if it does not build more chip fabrication plants in the United States. This bold statement has raised eyebrows across the tech and business world. In this post, we will break down Trump’s warning and explore its potential impact through several lenses:

- Trump’s statement and what it implies for TSMC and U.S. policy

- TSMC’s global role in chip manufacturing and its current (and planned) U.S. presence

- The broader geopolitical and economic context (U.S.-China tech competition, the CHIPS Act, etc.)

- Ramifications for the global semiconductor supply chain, U.S. economic security, and international trade

- How investors and the tech industry might interpret or respond to this development

The goal is to provide a clear, objective analysis accessible to a general audience with some tech/business knowledge, while also offering insights for tech investors. Let’s dive in.

Trump’s Warning: A 100% Tax Penalty – What Does It Mean?

When Donald Trump suggests a “100% tax” on TSMC’s products, he is essentially threatening a 100% tariff – a surcharge doubling the cost of semiconductors imported from TSMC’s overseas fabs into the U.S. Such a move would be unprecedented in scale. For context, the Trump administration’s China trade war peaked at 25% tariffs on many goods; 100% is an extreme penalty that would make TSMC’s Taiwan-made chips prohibitively expensive in the U.S. market.

Implications of the Statement: At face value, Trump’s message to TSMC is a blunt ultimatum: “Build chips in America, or lose access to the American market.” The implications include:

- Pressure to Onshore Production: TSMC would be under intense pressure to accelerate building fabs on U.S. soil to avoid losing U.S. customers. Trump’s stance reflects an effort to stop outsourcing and make the U.S. a manufacturing superpower (one of his platform promises), indicating he would use tariffs as leverage.

- Trade Tensions with Allies: Unlike past tariffs aimed at strategic rivals (like China), this threat targets a company from Taiwan – a U.S. ally. It underscores that Trump’s “America First” approach could extend even to friendly nations if U.S. manufacturing isn’t prioritized. This could strain relations with Taiwan, which relies on TSMC as a strategic asset.

- Business Uncertainty: Such unpredictability in trade policy would create major uncertainty for tech companies. U.S. firms like Apple, NVIDIA, AMD, and Qualcomm heavily depend on TSMC’s chips. A 100% import tax could force these companies to scramble for alternatives or absorb huge cost increases, disrupting supply chains and product plans.

- Signaling a Policy Shift: The statement also serves as a political signal. It differentiates Trump’s approach (a hardline tariff-based stick) from the current Biden administration’s approach (which has favored subsidies and incentives via the CHIPS Act). It tells voters and companies that if Trump returns to office, aggressive measures might be on the table to bring high-tech manufacturing home.

It’s worth noting that this warning didn’t come out of thin air. During Trump’s presidency, his administration had already pushed for TSMC to invest in the U.S. In fact, TSMC’s decision in 2020 to build its first Arizona fab came after the Trump administration raised concerns about the security of having so much electronics manufacturing outside the U.S. Trump often touts that accomplishment. Now, as a former President campaigning for a possible return, he’s effectively saying he would up the ante to ensure critical chip production happens on American soil.

Feasibility and Risks: Implementing a 100% tariff would be a double-edged sword. On one hand, it could indeed coerce companies to localize production. On the other hand, it could backfire economically if done abruptly:

- In the short term, U.S. industries could face acute chip shortages or skyrocketing costs if TSMC’s Taiwan-made chips were suddenly priced out. The U.S. currently cannot meet its own demand for advanced chips domestically, so an import tax is essentially a tax on U.S. tech firms and consumers unless substitutes are in place.

- TSMC cannot overnight duplicate in America the massive capacity it has in Taiwan. Building fabs takes years and tens of billions of dollars. A punitive tariff without sufficient transition time could disrupt production of smartphones, computers, cars, and even military systems that rely on TSMC’s chips.

- Such a move could further roil global trade and possibly invite retaliation or legal challenges (though Taiwan, being a close partner, would likely seek a diplomatic solution rather than retaliation).

In summary, Trump’s warning is a dramatic negotiating stance – one that underscores U.S. desire for onshore chipmaking, but that carries significant implementation risks. It sets the stage for a high-stakes showdown between U.S. policymakers and the world’s most important chip manufacturer.

TSMC’s Outsized Role and U.S. Footprint

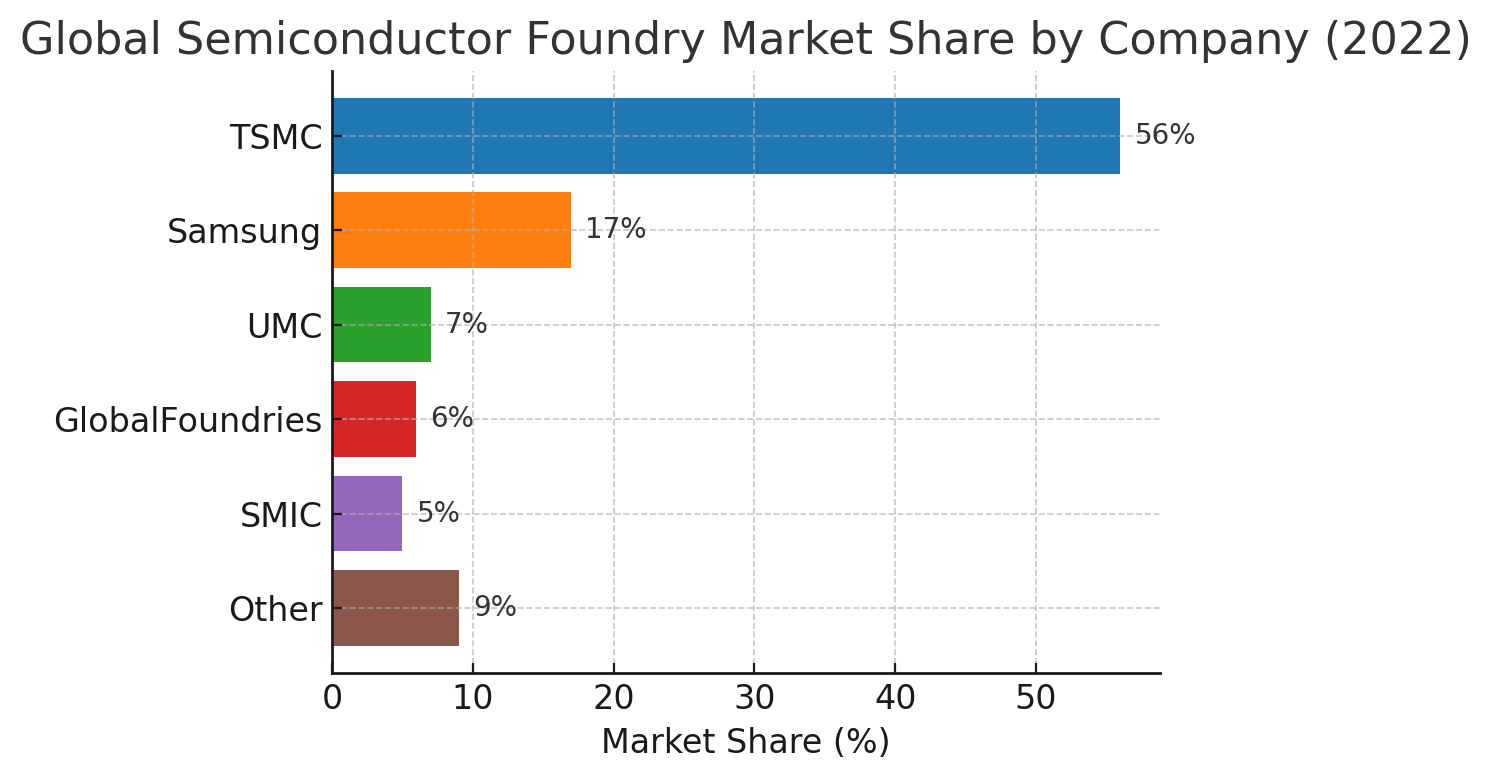

To grasp the weight of Trump’s demand, one must understand TSMC’s global role in chip manufacturing. TSMC is the dominant player in the semiconductor foundry business (contract manufacturing of chips). It is the world’s largest dedicated chip foundry, far surpassing any competitors. As of recent years, TSMC alone has been responsible for over 50% of global foundry market share, by revenue – more than all other competitors combined. For advanced chips (the tiny, powerful processors running our iPhones, data centers, and advanced military hardware), TSMC’s dominance is even more striking: it is estimated to fabricate around 90%+ of the world’s most cutting-edge chips (at 7nm, 5nm, 3nm process nodes), with only Samsung as the distant second source.

Figure 1: Global semiconductor foundry market share by company (2022). TSMC holds by far the largest share, at over half of the total market, reflecting its critical importance to worldwide chip supply.

TSMC’s importance comes from its unrivaled manufacturing prowess. Most fabless chip companies rely on TSMC to turn their designs into reality. This includes American tech giants: Apple’s entire A-series and M-series processors (the brains of iPhones and Macs) are made by TSMC; AMD’s PC and server CPUs, Nvidia’s GPUs, Qualcomm’s mobile SOCs – all manufactured by TSMC. This means any disruption to TSMC’s production or pricing reverberates across the tech ecosystem. It’s not an exaggeration to call TSMC’s fabs in Taiwan the beating heart of today’s digital economy.

TSMC’s Current U.S. Presence: Until recently, TSMC manufactured almost exclusively in Taiwan. (The company’s headquarters and the bulk of its fabs are located in Hsinchu and Tainan, Taiwan.) It has a few older, much smaller facilities abroad – for example, a fab in Camas, Washington, and another in Shanghai – but these contribute only a tiny fraction of output. By 2020, about 92% of TSMC’s production capacity (including virtually all advanced capacity) was in Taiwan, with a single-digit percent in China and the remainder in a U.S. legacy fab. In other words, the vast majority of TSMC’s 13 million wafer per year capacity (as of 2020) is concentrated in Taiwan.

However, in the last couple of years – spurred by geopolitical concerns and encouragement from multiple governments – TSMC has started to expand its footprint:

- Phoenix, Arizona: In 2020, TSMC announced a plan to build a major fab in Phoenix. Initially billed as a $12 billion investment for a single 5-nanometer-capable plant, the project has since expanded to a $40 billion investment for two fabs. The first fab is slated to produce 4nm chips (a slightly updated version of 5nm) by 2024-2025, and a second fab is planned to produce 3nm chips by 2026-2027. This is a significant break from TSMC’s old practice of limiting overseas fabs to older technologies – a direct result of U.S. pressure and incentives. Trump often claims credit for initiating the Arizona fab (“I got them to build in the U.S.”), and indeed the decision was made during his tenure. Local officials approved the project after U.S. national security officials highlighted risks of over-reliance on overseas chips. President Biden later hailed the expanded $40B investment as a victory for his administration’s industrial policy.

- Challenges in Arizona: Building cutting-edge fabs in the U.S. has proven challenging for TSMC. The company has cited much higher costs and a shortage of skilled workers in the U.S. For example, TSMC’s founder Morris Chang noted that making chips in Arizona may cost at least 50% more than making them in Taiwan. Construction costs are 4-5× higher due to labor and regulatory expenses, and TSMC struggled to find enough experienced semiconductor construction talent, leading to delays. In fact, in mid-2023 TSMC announced the Arizona fab’s opening would be pushed back to 2025 because of these issuese. (They even had to fly in teams of veteran technicians from Taiwan to train the local workforce.) This underscores a key point: simply demanding onshore production doesn’t solve the practical hurdles – time, money, and people – required to actually do it.

- Japan (Kumamoto): TSMC has a joint venture project in Japan, building a fab in Kumamoto in partnership with Sony and Denso. This fab (operated by “JASM”) will produce 22nm and 28nm chips starting ~2024, mainly targeting the auto industry and Sony’s needs. While not in the U.S., this diversification shows TSMC responding to geopolitical allies’ desire for local capacity (with hefty subsidies from Japan). A second phase in Japan with somewhat more advanced 12/16nm tech is also planned.

- Prospects in Europe: TSMC has been in talks about a potential fab in Germany (focused on automotive-grade chips), though as of now no concrete plan has been finalized. Europe, like the U.S., is offering incentives to attract chip plants as part of its own “EU Chips Act.” If that materializes, TSMC’s global presence would spread further.

- Existing China Fabs: TSMC does operate a fab in Nanjing, China, which makes 28nm and 16nm chips, mainly to serve Chinese fabless clients. However, due to U.S. pressure, TSMC has capped its expansion in China (it froze further advanced node upgrades there to comply with U.S. export controls). The current U.S. policy is actually to prevent TSMC from building too advanced facilities in China, to ensure cutting-edge capabilities remain out of China’s direct reach. This adds another angle: Trump’s threat might implicitly also mean “don’t build elsewhere (like China) – build in the U.S., or face penalties.”

In short, TSMC is gradually globalizing beyond Taiwan, but its non-Taiwan fabs (even including the upcoming Arizona plants) will remain a small fraction of its total output for the next several years. Table 1 summarizes some of TSMC’s and other chipmakers’ major U.S. expansion plans:

Table 1: Selected new semiconductor fabrication facilities announced in the U.S. in recent years (indicative of the industry’s shift). These investments have been driven by government incentives and strategic concerns.

As Table 1 shows, TSMC’s Arizona fabs are among the largest single foreign investments in U.S. chip history, on par with domestic giants like Intel and memory maker Micron making big moves after the CHIPS Act. Yet even when these projects come online, consider that TSMC’s Taiwan operations are an order of magnitude larger – its flagship fab complex in Tainan, Taiwan (the “Fab 18” where 5nm/3nm are made) cost around $17 billion for a single phase and produces far more wafers per month than the planned Arizona facility will. The U.S. fabs will help, but they don’t eliminate dependence on TSMC’s home base.

This disparity is at the heart of U.S. concerns: America’s tech sector still relies on a supply chain centered in Taiwan. Trump’s ultimatum to TSMC is one approach to try and change that fast. To evaluate it, we need to understand the geopolitical backdrop and what’s already being done under current policies.

Geopolitical and Economic Context: Tech Rivalry and Chips Act

U.S.-China Tech Competition and Taiwan’s Strategic Role

Trump’s tough talk on TSMC cannot be separated from the larger tech tussle between the United States and China. Semiconductors are the frontline of this great-power competition. The U.S. has explicitly stated that cutting-edge chips should not end up in the hands of its rivals’ militaries, and that the U.S. must maintain leadership in this foundational technology. Under both Trump and Biden, we’ve seen aggressive steps to control chip technology flows to China and to bolster domestic capabilities:

- During Trump’s term, Chinese telecom giant Huawei was effectively cut off from TSMC’s foundry services by U.S. export bans in 2020. This was a seismic move: Washington leveraged its export control rules (since U.S. intellectual property and equipment are used by TSMC) to bar TSMC from making advanced chips for Huawei. It demonstrated U.S. willingness to intervene in TSMC’s business for strategic aims.

- The U.S. has since imposed broader export controls on advanced chip tech to China (October 2022 rules, for example) aiming to slow China’s progress in AI and supercomputing. And it’s leaned on allies (Netherlands, Japan) to restrict sales of chipmaking equipment to China. All this heightens China’s incentive to become self-sufficient, while the U.S. tries to keep China a step behind.

- Taiwan is in a unique and precarious position. China claims Taiwan as its territory and has not renounced the possibility of forceful unification. TSMC’s presence in Taiwan is sometimes called a “silicon shield” – the idea that global dependence on Taiwanese chips gives China pause (because an invasion could destroy TSMC’s fabs and shock the world economy) and gives the U.S. extra motive to defend Taiwan. However, that “shield” is also a single point of failure for the world. U.S. officials have described the scenario of a Chinese attack on Taiwan as potentially catastrophic for the global (and U.S.) economy, calling the current concentration of chip supply “untenable” and a serious national security risk. In fact, U.S. Commerce Secretary Gina Raimondo warned that a disruption in Taiwan’s chip supply could trigger a major recession. This is the strategic rationale for pushing companies like TSMC to build redundancy on U.S. soil.

- Therefore, Trump’s stance, though extreme in tone, addresses a real strategic worry: If TSMC stays heavily concentrated in Taiwan and something goes wrong – whether geopolitical conflict or even natural disaster – the U.S. could be crippled by a chip shortage. By forcing TSMC to build more in America, that risk is mitigated (at least for U.S. supply).

It’s also worth noting that Trump’s broader trade philosophy has been confrontational – not only with China but even allies if he feels America is at a disadvantage. In 2018-19 he imposed tariffs on steel and aluminum imports globally (including from allies), threatened auto tariffs on Europe and Japan, etc., to compel new trade terms. So his willingness to target TSMC (despite Taiwan’s friendship) fits that pattern of using U.S. market access as leverage. In his view, allies should welcome moving their production to America (“it’s for their own good, too”). Still, such moves could put allied governments in tough spots – Taiwan’s leadership, for instance, counts on TSMC as a national champion and would prefer it remains primarily in Taiwan.

The CHIPS Act and the Current Policy Approach

While Trump advocates a stick (punitive tariffs), the current U.S. policy under the CHIPS and Science Act of 2022 is more about carrots (financial incentives). The CHIPS Act set aside $52.7 billion to revitalize the domestic semiconductor industry. This includes $39 billion in direct subsidies for building chip fabs in the U.S., a 25% investment tax credit for semiconductor manufacturing equipment, and around $13 billion for R&D and workforce development.

The goals of the CHIPS Act are twofold: economic/industrial revitalization (making the U.S. a leader in making the chips it designs) and national security (securing supply chains for critical components). Crucially, companies that take the money must agree not to expand certain advanced operations in China – a guardrail aimed at China.

Rather than forcing companies via tariffs, the CHIPS Act essentially pays them to come. TSMC, Intel, Samsung, Micron – all the companies in Table 1 – are expected to apply for these subsidies to help fund their U.S. projects. For example, TSMC is likely seeking billions from CHIPS Act funds to offset the cost overruns in Arizona (though TSMC has reportedly been hesitant about some strings attached, like sharing excess profits with the government in case of windfalls). Intel’s Ohio project and others are also banking on CHIPS grants.

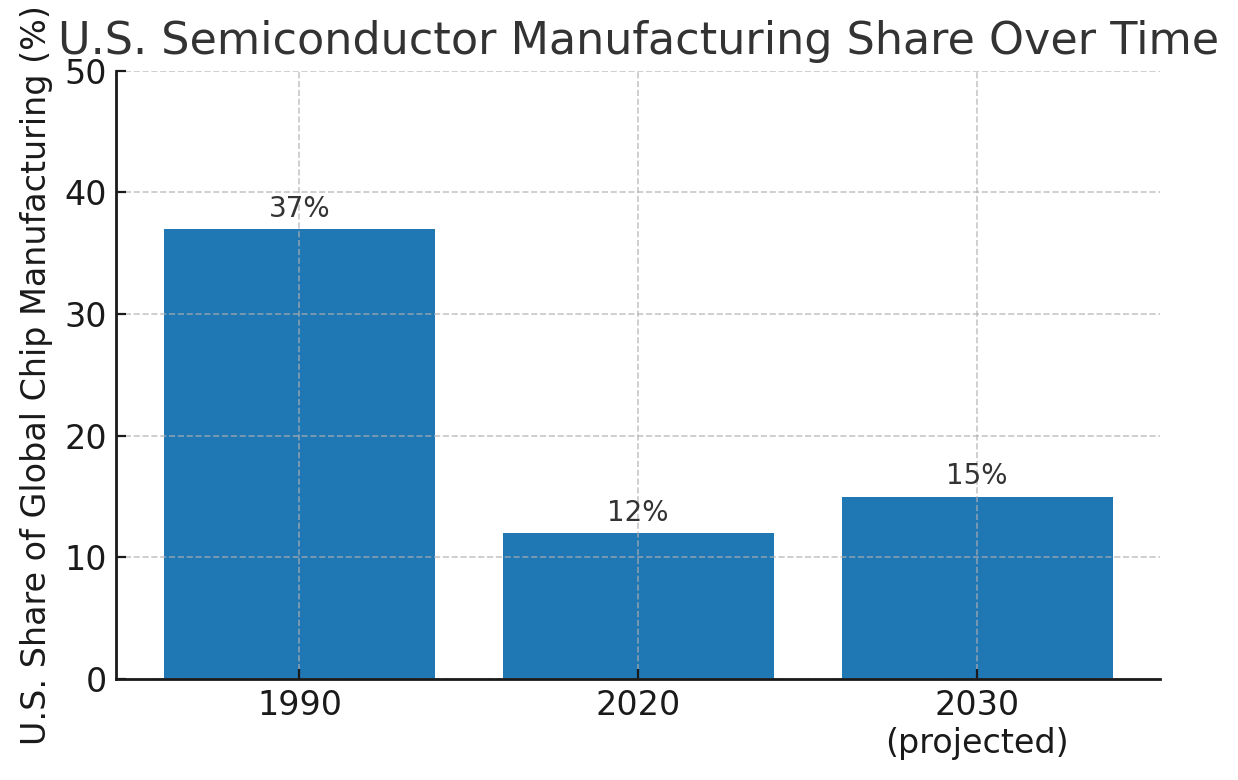

How effective will CHIPS Act be? It will certainly boost U.S. capacity, but it’s not a panacea. Industry experts note that even with $50B, the U.S. might only increase its share of global production modestly by the end of the decade. In 1990, the U.S. accounted for ~37% of world semiconductor manufacturing; by 2020, that fell to about 12%. One analysis projects that, with the CHIPS Act investments, U.S. share might climb to roughly 14-15% by 2030 – better than 12%, but nowhere near past levels or Taiwan’s current share. The reality is $52B is significant but the semiconductor industry is so large (global capital expenditure is on the order of $100B per year) that it won’t completely change the landscape overnight.

Figure 2: U.S. share of global semiconductor manufacturing over time. In 1990, the U.S. produced 37% of the world’s chips; by 2020, it was only ~12%. With initiatives like the CHIPS Act, the share is expected to rise slightly (projected ~15% by 2030), but Asia will continue to dominate without further action.

The CHIPS Act approach has generally been welcomed by industry – it’s a positive-sum idea (increase capacity, everyone benefits) rather than zero-sum. However, it also reflects an urgency in Washington about the strategic dependency on Asia. In a way, both political parties share the same end goal: bring critical chip manufacturing back home. They only differ in method and degree of coercion. Trump’s comments up the pressure by threatening pain if companies don’t comply, whereas the CHIPS Act offers rewards for compliance. Some analysts even suggest that a combination of both might ultimately come into play – e.g. a future U.S. administration might use CHIPS Act money plus selective tariffs to accelerate onshoring.

It’s also crucial to consider China’s reaction. China is watching all this warily, because TSMC is also vital to China’s tech industry (many Chinese firms buy from TSMC, and China can ill afford TSMC cutting them off under U.S. pressure – as already happened to Huawei). If TSMC moves too much capacity to the U.S., some in China fear it weakens the “silicon shield” – making the U.S. less dependent on chips in Taiwan, potentially reducing the deterrent against U.S.-China conflict over the island. On the other hand, China knows it cannot currently make the advanced chips TSMC does; so in the short term, China would also be hurt by any disruption to TSMC’s operations or high tariffs on TSMC (since that would affect chips available to everyone, not just the U.S.).

In summary, the geopolitical context is a delicate triangle: the U.S., China, and Taiwan (TSMC) are in a complex strategic dance. The U.S. wants to secure the chip supply away from potential Chinese interference; China wants to secure access to advanced chips (or develop its own) and sees U.S. efforts as containment; Taiwan/TMSC is stuck in between, trying to expand business but not lose its home importance. Trump’s tariff threat is a dramatic twist in this saga – essentially an American bid to win the chip security race decisively by brute force.

Potential Ramifications for Supply Chain, Security, and Trade

If Trump’s warning were to translate into actual policy (for instance, if a Trump (or similarly-minded) administration came into power and imposed such a penalty), the ramifications would be far-reaching. Let’s break down a few key areas:

1. Global Semiconductor Supply Chain Disruptions: The modern chip supply chain is highly complex and globalized – by design, it chases efficiency and specialization. Suddenly slapping a huge tariff on chips made by TSMC in Taiwan would throw a wrench in this machine. Potential effects include:

- Short-term Shock: Many technology products have no immediate substitute for TSMC’s output. For example, Apple cannot overnight move A16 chip production from TSMC to another foundry; neither can AMD or Qualcomm for their latest chips. A 100% import tax would either force prices of gadgets way up or cause companies to halt shipments while scrambling for solutions. It would be akin to an overnight supply shock. Even if some production could shift to Samsung or Intel, those companies would need time to absorb the volume (and may not have spare capacity at comparable tech levels).

- Reconfiguring Supply Lines: Longer term, if such a policy persisted, we’d likely see a more fragmented supply chain. U.S. companies might dual-source chips – e.g. design one version for TSMC’s U.S. fab (or Intel’s fab) to sell in the U.S., and another version from Asia for other markets. This redundancy could improve resilience but at the cost of significant duplication and inefficiency. It’s essentially undoing the scale efficiencies TSMC provides.

- Higher Costs Industry-wide: Tariffs are essentially a tax. In the semiconductor world, suddenly shifting production locations or splitting volumes generally raises per-unit cost (new fabs are expensive and less optimized at the start). One study by the Semiconductor Industry Association (SIA) found that building a fully self-sufficient semiconductor supply chain domestically would cost an extra $1 trillion+ and result in 35-65% higher chip prices for consumersen.wikipedia.org. While 100% tariffs might not equate to full self-sufficiency, they push in that direction by disincentivizing imports. Ultimately, that cost would likely be borne by consumers and businesses in the form of pricier electronics.

- Supply Chain Relocation and “Decoupling”: On a strategic level, heavy-handed measures would accelerate the “decoupling” of the tech supply chain between U.S. and China spheres. We might see TSMC and others concentrate certain production for the U.S. market in the U.S/allied countries, while China (and possibly other emerging markets) invest in separate domestic supply chains. The result could be a bifurcation: a U.S.-led chip ecosystem and a Chinese-led one, each less interdependent. This is already starting to some extent, but such a tariff would turbocharge it. While that might benefit security, it could diminish the global nature of innovation diffusion, as each bloc might have less access to the other’s tech.

2. U.S. Economic Security and Defense Readiness: From a national security perspective, proponents of onshoring (like Trump) would argue that any short-term economic pain is worth the long-term security of having secure chip supply:

- Reduced Vulnerability: If TSMC builds more fabs in America, the U.S. would be less vulnerable to a Taiwan Strait crisis or blockade. In a sense, Trump’s threat, if it succeeded in relocating production, could neutralize China’s potential leverage over U.S. tech that comes from the current Taiwan-centric production. This would bolster U.S. economic security – ensuring that critical infrastructure (from cloud servers to advanced weapons) have a reliable chip source domestically.

- Defense and Aerospace Supply Chain: Many defense systems use specialty chips that are made in very limited facilities (sometimes only overseas). The Pentagon has been worried about this for years. If TSMC (and others) create cutting-edge fabs on U.S. soil, the DoD can source chips for fighters, satellites, etc., domestically or at least not from a potential adversary’s backyard. That is a clear strategic upside.

- Retaliation and Unintended Consequences: However, one must consider that how this is done matters. An abrupt tariff could cause chaos that itself harms U.S. economic security. For instance, if companies like Apple face massively higher costs, they might cut R&D or lay off workers, harming U.S. tech leadership. Or if inflation of electronics spikes, it could hurt consumers and broader economy. In a worst-case scenario, if mishandled, it could even tip financial markets (imagine if a major company misses earnings or delays products due to chip shortages – stock prices could swing). A stable transition is key to avoid shooting ourselves in the foot.

3. International Trade and Relations: Imposing a huge tariff on a specific foreign company’s goods would be unusual in the annals of trade (tariffs are usually by category/country, not one company, but presumably it’d be framed as “chips not made in U.S.” which de facto hits TSMC). This has several ramifications:

- WTO and Trade Partners: Such a move could violate World Trade Organization rules or at least spirit, and allies might oppose it. Taiwan’s government would likely lobby intensely against a U.S. tariff on TSMC, as it directly hits one of their crown jewels. They may argue Taiwan has been a faithful partner and that this punishment is unwarranted and harms both sides. It could lead to diplomatic friction with Taiwan, and possibly require side negotiations or compensations. (Taiwan might press the U.S. to instead use gentler means – e.g. “let’s solve this with more incentives, not penalties.”)

- China’s Stance: Interestingly, China might quietly be pleased to see TSMC forced to invest outside of Taiwan, as it could weaken Taiwan’s importance. But China would not be happy about the larger context of U.S. tech containment. If the U.S. effectively pulls major production out of Taiwan, Beijing loses some leverage but also might perceive it as the U.S. fortifying itself for a possible confrontation. It could either deter Chinese aggression (knowing the U.S. is less vulnerable) or in a darker view, remove a factor that was restraining China from acting on Taiwan. Geopolitically, this is a double-edged consideration.

- Global Trade Patterns: In tech trade, we could see realignments. Countries in Southeast Asia or India might try to attract whatever TSMC doesn’t put in the U.S. (for instance, if TSMC feels it’s too risky to put all new capacity in one place, it might diversify to Singapore, Japan, etc., for other markets). The U.S. tariff might not directly affect those other markets, but if TSMC finds the U.S. market hard to serve from Taiwan, it could reorient its Taiwan capacity toward servicing China/Asia, while U.S. capacity services U.S./Europe. Essentially a geographic segmentation of tech markets could occur.

- Risk of Escalation: If other countries see the U.S. doing this, some might copy the approach for their own strategic sectors. Trade wars could expand beyond U.S.-China. However, given few countries have the market clout of the U.S. or the unique dependency on one supplier, this exact scenario is somewhat unique to chips and U.S. market size.

In summary, the global semiconductor supply chain is like a finely tuned orchestra – introducing a new harsh note (100% tariffs) suddenly could cause cacophony. It would ultimately push the industry toward a new equilibrium with more regional self-sufficiency, but not without pain and cost during the adjustment. It’s a high-stakes gambit: potentially strengthening U.S. long-term resilience at the risk of short- to mid-term turmoil and significant cost increases.

Investors’ and Tech Industry’s Perspective

Whenever political rhetoric ratchets up around key industries, investors and companies pay close attention. Trump’s warning to TSMC is no exception, as it touches the core of the tech sector. Here’s how investors and the tech industry might interpret or respond to this threat:

1. Investor Sentiment on Semiconductor Stocks: The prospect of tariffs and forced supply chain moves introduces uncertainty – and markets famously hate uncertainty. If investors believe there’s a real chance of a 100% tariff on TSMC-made chips:

- TSMC Stock Impact: TSMC’s share price could face pressure. Already, geopolitical worries have at times weighed on TSMC’s valuation. (Notably, Warren Buffett’s Berkshire Hathaway bought a large stake in TSMC in 2022, only to sell most of it a few months later, with Buffett citing geopolitical tensions as “a consideration” for the quick exit. Even an investing legend got spooked by the Taiwan risk.) If U.S. tariffs threatened to cut off a chunk of TSMC’s business or force costly moves, investors would worry about lower future profits or expensive capital outlays. TSMC’s revenue from U.S. customers (Apple, etc.) is substantial – losing margin on that due to tariffs or duplication of fabs could dent earnings.

- U.S. Tech Stocks: On the other hand, some U.S. semiconductor companies might be seen as relative beneficiaries or safe havens. For example, Intel – as a U.S. manufacturer trying to catch up in technology – could see a strategic boost if foreign-made chips become pricier. Intel’s plan to offer foundry services might attract more customers if TSMC faces tariffs. Similarly, smaller U.S.-based foundries (GlobalFoundries, SkyWater Technology, etc.) could gain opportunities. Memory makers like Micron (which manufactures a lot in the U.S.) would also be insulated from such tariffs, potentially improving their competitive position.

- Customer Industries: However, the broader tech sector could see volatility. Companies like Apple that rely on TSMC might see stock swings depending on how likely this policy is to be enacted. If investors sense iPhone production could be at risk or more expensive, they might reevaluate Apple’s margins or growth prospects. The same goes for AMD, Nvidia, Qualcomm – their ability to deliver competitive products on time could be questioned if their fab partner is in the crosshairs of U.S. trade policy. In general, the market might initially react negatively to the specter of supply disruption, then selectively pick winners (like Intel) who might fill the gap.

- Long-Term Realignment Bets: Some investors could take a longer view and start reallocating toward sectors that will benefit from onshoring. For instance, companies that build semiconductor equipment (Applied Materials, ASML, Lam Research) will get tons of orders if new fabs are built in the U.S. (though ASML is Dutch, it’s a key supplier that could see increased demand from multiple regions building redundant capacity). Construction firms specialized in fab building, chip packaging companies setting up in the U.S., etc., are also part of the “investment ripple effects.”

2. Reactions within the Tech Industry:

- Tech Companies (Apple, Qualcomm, etc.): The big chip buyers are likely extremely uneasy with Trump’s proposal. They have carefully managed supply chains optimized for cost and performance. A tariff means higher costs – either they pay more to TSMC (if TSMC lowers price to offset tariff, which squeezes TSMC’s margins) or they pay the tariff itself. Either way, their costs go up or they must invest in re-tooling designs for alternate fabs. We might expect industry lobbying against such extreme measures, or at least for a very slow phase-in. These companies absolutely want TSMC (and others) to build in the U.S., but they’d prefer the carrot approach (subsidies) not a sudden stick that could cause a supply shock. Many of them publicly supported the CHIPS Act. They might quietly push back on a tariff by providing data on how it could hurt the economy or U.S. competitiveness if done rashly.

- TSMC’s Response: TSMC’s leadership has to tread carefully. They have consistently said they are for globalization and that having all eggs in one basket (Taiwan) might not be ideal long-term. But they also are proud of their Taiwanese roots and efficiency. Faced with a potential tariff, TSMC would likely accelerate plans in the U.S. (and maybe seek more U.S. government aid to do so, arguing “if you want us there faster, make it worth our while and help with the cost difference”). TSMC might also emphasize how much it’s already doing – pointing to the Arizona project (and its expansion to $40B) as evidence they are committed to U.S. manufacturing. They could try to negotiate – e.g., “we will consider a third and fourth fab in the U.S. if you, the U.S. government, share more of the cost and assure stable policies.”

- Global Tech Reconfiguration: The industry as a whole might start making contingency plans. We could see more R&D in chip design toward multi-source capability (designing chips that can be made at either TSMC or Intel or Samsung with minimal changes – historically difficult, but companies might invest in that flexibility). Companies might also stockpile critical chips if they fear abrupt tariffs or supply cutoff – similar to how some firms built inventory ahead of previous tariff deadlines in the China trade war. This can lead to short-term spikes in orders (as everyone rushes to buy before a tariff hits) followed by lulls.

- Investments in Alternatives: A big positive might be that the domestic semiconductor ecosystem gets a confidence boost. If policies clearly favor U.S. production, more venture capital and investment may flow into domestic chip startups, manufacturing technologies, and workforce training. The prospect of high tariffs could be seen as a sort of protection for new U.S. fabs – they could operate knowing imported competition is handicapped, which may make the business case for building new fabs more attractive. In effect, it’s a form of market assurance. This could spur a renaissance of sorts in U.S. chip manufacturing know-how (at the expense of higher consumer prices in the short term).

3. Global Investors and Supply Chain Diversification: It’s not just U.S. investors – globally, people will respond. For instance:

- Taiwanese Reaction: TSMC is Taiwan’s largest company by market cap, and a cornerstone of many portfolios. If its operations become bifurcated (Taiwan vs U.S.) and possibly less efficient, investors might re-price it. Also, Taiwanese investors might worry that moving production out reduces Taiwan’s strategic importance, possibly increasing geopolitical risk. On the flip side, some might welcome diversification in case of regional conflict.

- Chinese Reaction: Chinese tech firms will closely watch if TSMC prioritizes U.S. expansion. If TSMC has to allocate more capacity to U.S. fabs (which might come with restrictions that those outputs can’t serve Chinese clients due to U.S. tech export rules), Chinese companies might lose access to some of TSMC’s future cutting-edge capacity. This may lead Chinese chip designers to hedge by moving some chip production to SMIC (China’s domestic foundry) or other emerging Chinese foundries despite their technology lag, just to ensure supply. It could ironically give a boost to Chinese semiconductor independence efforts – aligning with China’s goals to have its own TSMC equivalents (though that will take time and significant advancement in capability).

- Market Volatility: We should acknowledge that a lot of this is scenario analysis. If investors sense that Trump’s statement is more posturing than an actual imminent policy (especially if he’s not in power currently), markets might not react strongly yet. But they will keep it in mind as a “tail risk.” If political odds shift (say, polls indicating a high chance of a return or similar hardline stance from any administration), then the market reactions could become more pronounced.

In essence, the tech industry thrives on predictability and global access – Trump’s tariff threat introduces the opposite. Thus, while some strategic investors may position to benefit from an onshoring wave, many industry stakeholders will be nervous. We’re likely to see a flurry of contingency planning behind the scenes. The situation also puts a spotlight on companies like Intel: will they be ready to fill the gap and reassure U.S. tech firms that they have a plan B foundry if TSMC abroad is less accessible? The coming years – with or without Trump’s tariff – are already set to be transformative as the CHIPS Act money gets spent. Trump’s remarks just add more fuel to that fire of change.

Conclusion

Donald Trump’s aggressive warning to TSMC about a potential 100% tax penalty encapsulates the increasingly high stakes surrounding semiconductor supply chains. It dramatizes a core issue: the United States’ dependence on foreign-made chips – especially those from TSMC in Taiwan – at a time of intensifying geopolitical rivalry. While the idea of such a steep tariff is alarming to many in the industry, it underscores the lengths to which policymakers might go to secure critical technology supply lines.

We’ve examined how TSMC, as the linchpin of global chip production, is being pulled into the U.S.-China strategic tug-of-war. TSMC’s moves to build fabs in America (and elsewhere) are already a response to these pressures, supported by incentives from laws like the CHIPS Act. A punitive U.S. tariff threat is the stick to that carrot – a reflection of impatience from some corners to accelerate the decoupling from risky dependencies.

The broader context reveals a delicate balancing act: ensuring economic and national security without fracturing the efficiencies of a globalized industry. If executed carefully, encouraging more U.S. and allied chip production will indeed reduce the risk of disruption and possibly create high-tech jobs domestically. But if handled rashly, moves like an extreme tariff could cause supply shocks and higher costs that reverberate through the economy – affecting everything from consumer electronics prices to stock market valuations and international relations.

For investors and tech companies, the writing on the wall is that supply chain resilience is now as important as cost or speed. Firms are likely to increase their focus on diversification of manufacturing and may welcome policies that help (subsidies) while lobbying against those that hurt (sudden tariffs). We can expect ongoing negotiations – political and commercial – among the U.S. government, TSMC, and its major customers to find a path forward that improves U.S. supply security gradually rather than chaotically.

In conclusion, Trump’s pronouncement, whether it comes to pass or not, serves as a bold reminder of how crucial semiconductors have become to national strategy. It has sparked debate on the right mix of incentives and penalties to rebuild America’s tech manufacturing base. The coming years will reveal how much of this rhetoric turns into reality, and whether the global semiconductor landscape can be reshaped without breaking it. One thing is clear: chips are no longer just a business concern, but a top-tier geopolitical priority – and both governments and investors will be closely watching every development in this semiconductor saga.

References

- Reuters – Trump warns TSMC of 100% tariff if it doesn't make chips in the U.S.

https://www.reuters.com/technology/trump-threatens-100-tariff-tsmc-over-chip-production-usa - Bloomberg – TSMC Faces Pressure Over U.S. Chip Production

https://www.bloomberg.com/news/articles/tsmc-under-pressure-to-expand-us-manufacturing - TSMC Corporate – Company Overview and Global Manufacturing

https://www.tsmc.com/english/aboutTSMC/company_profile - The White House – Fact Sheet on CHIPS and Science Act

https://www.whitehouse.gov/briefing-room/statements-releases/fact-sheet-chips-science-act - Semiconductor Industry Association – U.S. Chip Industry Data

https://www.semiconductors.org/resources/facts-about-semiconductors - CNBC – U.S. Chip Manufacturing and the Role of TSMC

https://www.cnbc.com/tsmc-us-chip-factory-analysis - ASML – The Critical Role of Advanced Lithography in Chip Manufacturing

https://www.asml.com/en/technology/all-about-chips - Nikkei Asia – TSMC’s Arizona Fab and U.S. Expansion Challenges

https://asia.nikkei.com/Business/Tech/Semiconductors/TSMC-faces-hurdles-in-U.S.-chip-plant-construction - TechCrunch – Semiconductor Geopolitics Explained

https://techcrunch.com/semiconductor-geopolitics-china-taiwan-us - New York Times – Trump’s Trade Policy and Its Impact on Global Supply Chains

https://www.nytimes.com/trump-trade-policy-global-supply-chains