Trade Tensions Redefined: China’s 34% Tariffs on U.S. Goods Signal a New Global Economic Order

In a dramatic escalation of trade tensions between the world’s two largest economies, China has announced a sweeping 34% retaliatory tariff on a broad array of U.S. imports. This move represents one of the most aggressive measures Beijing has taken since the onset of trade hostilities with Washington and marks a significant turning point in a conflict that has seen years of tit-for-tat economic measures. As global markets reel and policymakers scramble to respond, it has become evident that the ramifications of this latest development will be profound, both economically and geopolitically.

The imposition of these tariffs comes in direct response to the recent intensification of U.S. trade policy, characterized by a renewed wave of protectionist measures aimed at curbing Chinese technological advancement and altering the global trade balance. While the U.S. administration has framed its tariffs as a corrective tool to address unfair trade practices and protect domestic industries, China’s countermeasures are a forceful assertion of economic sovereignty and an unmistakable signal that it will not acquiesce to unilateral pressure.

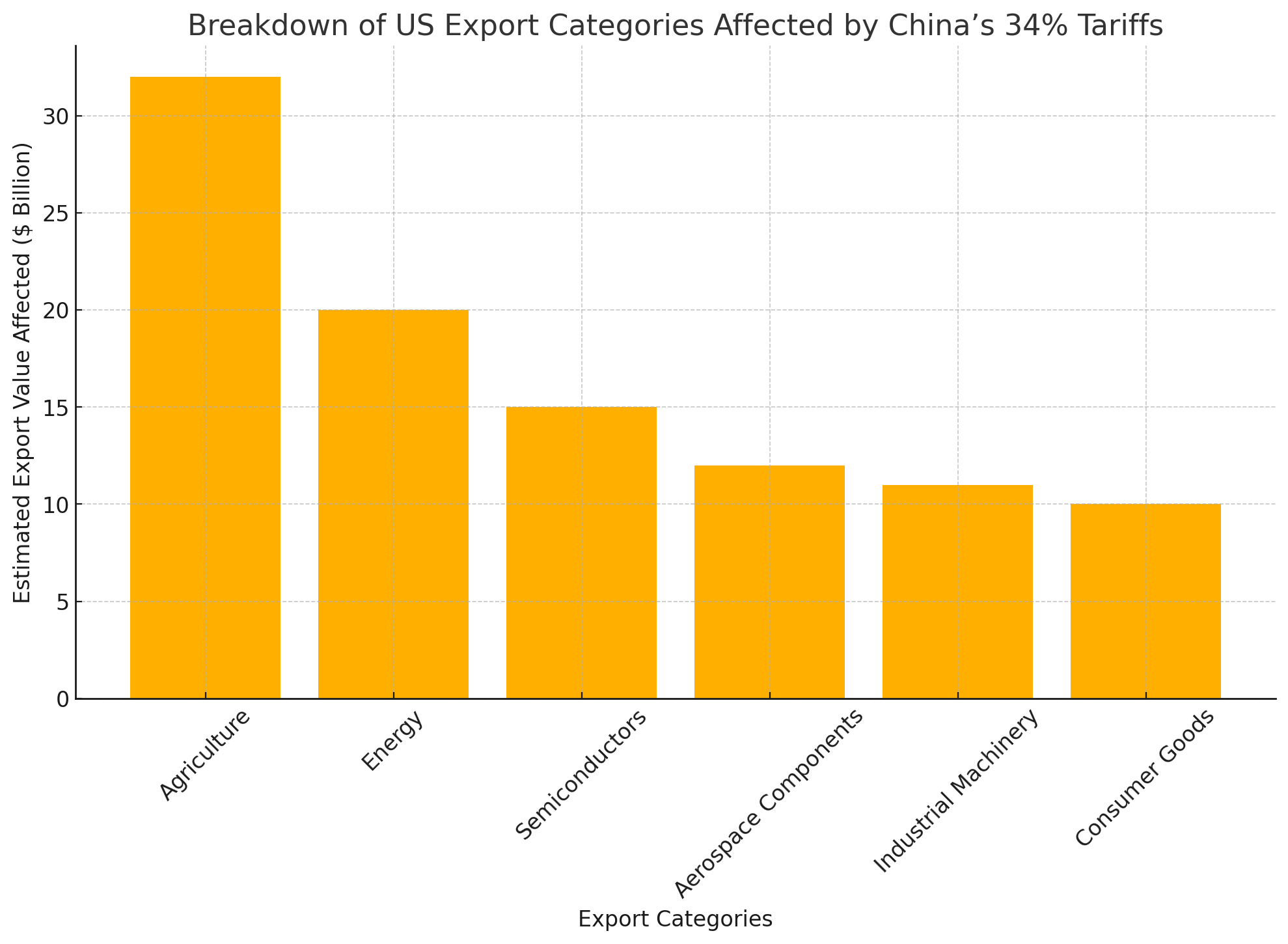

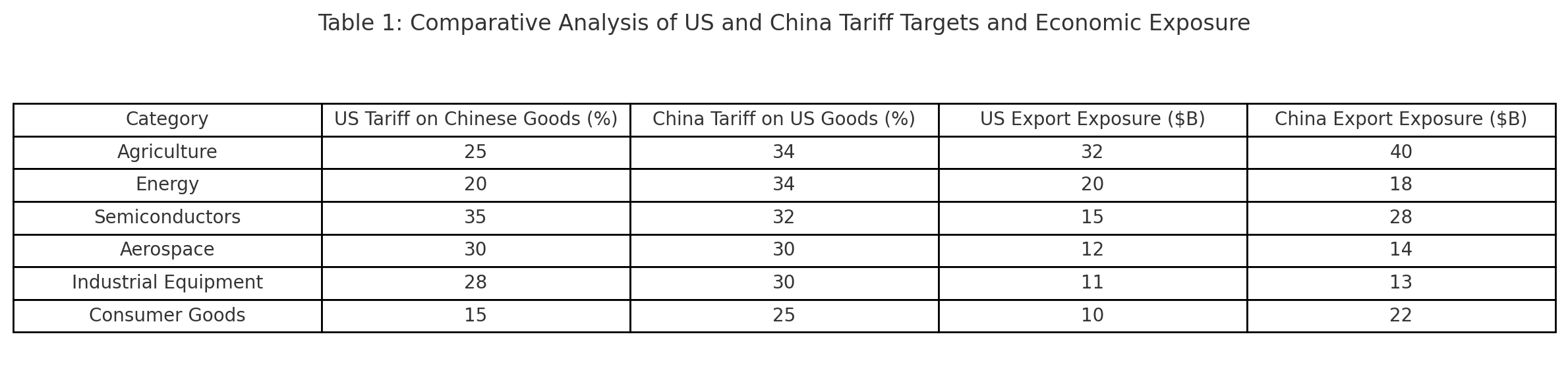

This latest round of tariffs, targeting key sectors such as agriculture, automotive components, semiconductors, and energy exports, is expected to impact over $120 billion worth of U.S. goods. For American farmers and manufacturers already contending with supply chain disruptions and shifting global demand, the additional costs imposed by these levies could further erode competitiveness and profitability. In parallel, Chinese importers, businesses, and ultimately consumers are also likely to feel the strain, as elevated costs ripple through domestic markets.

Beyond the bilateral implications, the tariff escalation has reignited fears of a global economic slowdown. Investors have responded with heightened caution, as evidenced by volatile equity markets, surging commodity prices, and a renewed flight to safe-haven assets such as gold and U.S. Treasury bonds. Multinational corporations operating across both economies face increased uncertainty, while emerging markets are bracing for secondary shocks through disrupted trade flows and currency volatility.

Moreover, the move by Beijing underscores a broader strategic shift in how China engages with the United States and the global trade system. No longer content to absorb economic pressure passively, China’s retaliatory tariffs reflect a recalibrated approach that balances economic self-preservation with assertive diplomacy. This stance is bolstered by the Chinese government’s dual circulation strategy, which seeks to reduce reliance on foreign markets and enhance domestic innovation and consumption.

On the diplomatic front, the tariffs are likely to further strain already tenuous U.S.-China relations. With trade negotiations stalled and communication channels increasingly limited, the potential for miscalculation or escalation remains high. Analysts warn that the trade war is morphing into a broader geopolitical contest encompassing technology, finance, and ideological influence, thereby complicating prospects for resolution.

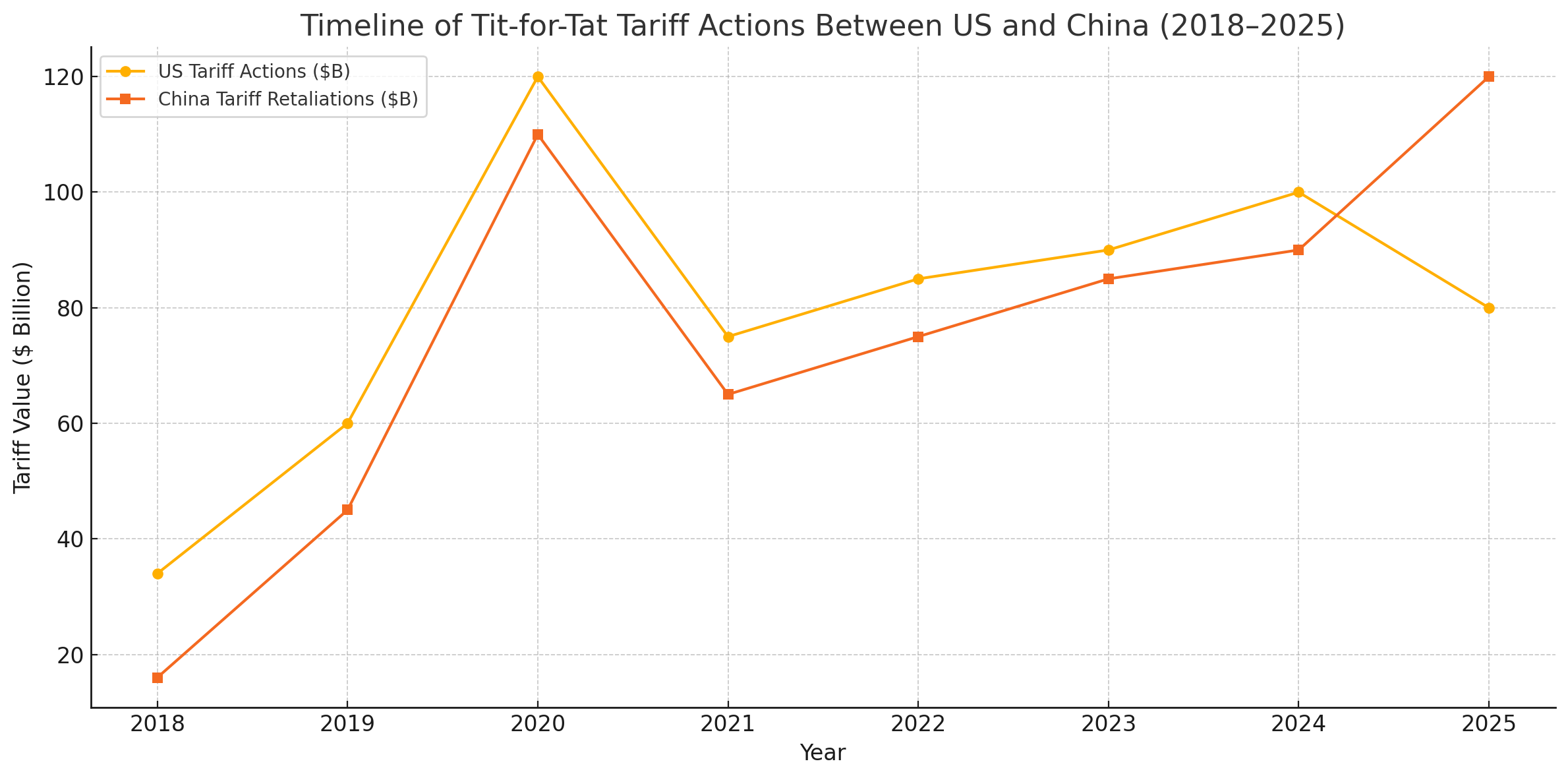

In this blog post, we delve deeply into the context and consequences of China’s 34% retaliatory tariffs on U.S. imports. We begin by examining the immediate triggers for this aggressive policy move and tracing the historical trajectory of the trade dispute. We then analyze the economic sectors most affected, the global reverberations, and the strategic calculus guiding both Washington and Beijing. A set of data visualizations—including a timeline of tariff actions and a breakdown of sectoral impacts—will provide empirical clarity. Finally, we explore potential pathways forward, assessing whether this latest development signals the beginning of a new era in global trade or a prelude to eventual reconciliation.

As the international community watches this confrontation unfold, the stakes are undeniably high. The outcome of this prolonged economic conflict will not only shape the future of U.S.-China relations but also redefine the rules of global commerce for decades to come. Policymakers, investors, and citizens alike must grasp the full implications of these actions to make informed decisions in an increasingly volatile world order.

What Triggered the Retaliation?

The imposition of 34% retaliatory tariffs by the Chinese government is not an isolated act of economic brinkmanship; rather, it is a carefully calibrated response to a series of aggressive trade policy maneuvers initiated by the United States. To understand the rationale and timing of China’s latest move, it is necessary to revisit the complex sequence of events that have defined the bilateral trade relationship in recent years, culminating in this new and significant escalation.

The immediate catalyst for China’s retaliatory tariffs was the U.S. Trade Representative’s announcement in late March 2025 of a fresh round of tariffs on approximately $80 billion worth of Chinese imports. This new tariff tranche targeted a wide range of advanced manufacturing inputs and consumer electronics, with duties reaching up to 35% on select goods such as lithium-ion batteries, electric vehicle (EV) components, solar panel materials, and semiconductors. The Biden administration, under increasing political pressure to address domestic economic anxieties and reinvigorate industrial policy, justified these measures on the grounds of national security and supply chain resilience.

In particular, Washington cited concerns over intellectual property theft, state subsidies to Chinese technology firms, and strategic overcapacity in critical industries. The U.S. policy narrative emphasized the need to “level the playing field” and reduce dependency on Chinese imports that underpin key sectors such as clean energy, artificial intelligence, and electric mobility. This posture is consistent with the broader geopolitical reorientation that frames the U.S.-China relationship as one of strategic competition rather than cooperative engagement.

However, from Beijing’s perspective, these justifications were thinly veiled protectionism aimed at stifling China’s technological ascent and preserving U.S. economic primacy. The Chinese Ministry of Commerce, in its official statement, characterized the U.S. tariffs as a "reckless and discriminatory assault on global trade norms" and warned of "strong and necessary countermeasures to defend national interest and industrial integrity." The response materialized swiftly in the form of a 34% blanket tariff on over 150 categories of U.S. goods, encompassing agricultural products, liquefied natural gas (LNG), aerospace components, and various high-tech manufacturing exports.

It is important to contextualize this response within the broader history of the U.S.-China trade conflict, which has evolved through several distinct phases since its inception in 2018 under the Trump administration. The original trade war began with Washington imposing tariffs on Chinese steel and aluminum exports, citing national security under Section 232 of the Trade Expansion Act of 1962. China responded in kind, targeting key U.S. export sectors such as soybeans, pork, and automobiles. Over the following years, multiple rounds of tariff exchanges ensued, punctuated by moments of temporary détente, such as the "Phase One" trade agreement signed in January 2020.

However, the structural issues underpinning the dispute—such as forced technology transfers, market access restrictions, and the role of state-owned enterprises in China—remained unresolved. Despite a brief lull in tariff escalation during the early years of the Biden administration, the underlying tensions persisted. The pandemic-era supply chain disruptions and growing bipartisan consensus on the need to confront China economically laid the groundwork for renewed friction. In 2023 and 2024, additional U.S. measures on Chinese data infrastructure, cloud computing access, and outbound investment screening reignited hostilities.

The March 2025 tariff package represented a culmination of these developments, signaling a hardening of U.S. policy that Beijing could no longer afford to ignore. According to analysts, China’s decision to impose an unusually steep 34% tariff rate—rather than a more symbolic figure—reflects both the severity of its grievance and a calculated effort to deliver economic pain to key U.S. constituencies ahead of the 2026 midterm elections. In targeting sectors like agriculture and energy, China is aiming squarely at states and regions with political clout, thereby leveraging its trade arsenal to influence domestic American politics.

Furthermore, the retaliatory tariffs must also be understood within the context of China’s broader economic challenges and ambitions. Facing slowing GDP growth, high youth unemployment, and lingering property sector instability, the Chinese leadership is under pressure to assert control over external risks while preserving internal stability. By taking a firm stand against perceived U.S. economic aggression, the Chinese government reinforces its domestic narrative of resilience and sovereignty, which is vital for political cohesion in a critical period leading up to the 21st Party Congress in 2027.

At the same time, China’s retaliation is not without risk. Imposing tariffs on U.S. agricultural and energy products—items for which alternative sources may not be immediately or affordably available—could lead to price volatility and supply bottlenecks within China. Moreover, by engaging in a direct escalation, Beijing runs the risk of inviting further retaliatory measures from Washington or alienating trading partners wary of choosing sides. Nonetheless, the decision appears to reflect a calculated judgment that demonstrating strength is essential, even at the cost of short-term economic strain.

Finally, the rapidity of China's response suggests that Beijing had anticipated this scenario and had a counterstrategy in place. This is indicative of a new phase in the trade war—one marked by greater preparedness, institutional resilience, and strategic symmetry. While early stages of the conflict saw China absorbing much of the economic shock in order to preserve dialogue, the current approach favors reciprocal assertiveness, signaling a prolonged and potentially more volatile trajectory in the bilateral trade relationship.

In sum, China’s 34% retaliatory tariffs were triggered by a combination of immediate policy provocation from the United States and long-standing structural grievances that have deepened over the past several years. The escalation is emblematic of a broader decoupling trend and sets the stage for a complex geopolitical contest that transcends traditional notions of trade conflict. As the next sections will explore, the consequences of this decision are likely to be felt not only in the economic domain but across the entire global order.

Affected Sectors and Economic Impact

The imposition of a 34% retaliatory tariff by China on a wide range of U.S. imports has sent shockwaves through numerous sectors of the American economy. While the effects of this sweeping trade measure will be felt across the entire U.S.-China trade corridor, certain industries are particularly vulnerable due to their dependence on Chinese markets or exposure to global supply chains. This section examines the most heavily impacted sectors, explores the direct and indirect economic consequences, and assesses the broader implications for trade-dependent businesses and investors.

Agriculture: Renewed Pressure on American Farmers

Among the most severely affected sectors is American agriculture, a traditional target in China’s retaliatory playbook. The 34% tariffs have been applied to a broad swath of U.S. farm exports, including soybeans, corn, wheat, dairy products, pork, and citrus fruits. China, historically one of the largest markets for U.S. agricultural commodities, has strategically targeted these goods to exert maximum economic and political pressure. This move is especially damaging for Midwestern farmers who were already contending with reduced exports during the earlier phases of the trade war and were just beginning to recover their market share.

The agricultural sector's exposure is not merely a function of volume but also of timing and perishability. Delays in shipments or shifts in demand due to elevated costs can result in unsold inventory, revenue losses, and long-term erosion of business relationships with Chinese buyers. U.S. agribusinesses have expressed concern that Chinese importers may permanently pivot toward alternative suppliers in Brazil, Argentina, or Australia, leading to structural market displacement.

Energy and Natural Resources: Export Disruption and Pricing Volatility

China’s retaliatory tariffs also encompass energy commodities, including liquefied natural gas (LNG), crude oil derivatives, and coal exports from the United States. The energy trade between the two countries has grown significantly in recent years, with China emerging as a major destination for U.S. LNG, particularly as Beijing attempts to transition to cleaner energy sources. The newly imposed tariffs effectively reduce the competitiveness of U.S. LNG, prompting Chinese firms to seek alternative suppliers in Qatar, Russia, and Australia.

This disruption has broader implications for global energy markets. The redirection of trade flows could lead to price dislocations, contract renegotiations, and increased volatility in spot markets. Furthermore, U.S. energy producers—many of whom operate under thin margins and high capital expenditure obligations—face significant financial stress if they are unable to secure substitute markets in time.

Manufacturing and Industrial Components: Complex Supply Chain Impacts

China's tariff retaliation extends into industrial and high-value manufacturing goods, including aerospace components, construction machinery, and industrial chemicals. For instance, U.S.-based manufacturers of aircraft parts, engines, and electronic control systems are directly affected by the new tariff regime. Many of these firms rely on access to China not only as a market but also as part of vertically integrated production networks.

The rise in export costs disrupts long-established supply chain configurations, compelling manufacturers to reevaluate sourcing, pricing, and logistics. Companies that have spent years cultivating Chinese partnerships now find themselves at risk of disintermediation, as Chinese buyers turn to European or domestic alternatives. In the longer term, such developments may lead to a realignment of global supply chains, with profound effects on production costs, operational efficiency, and international collaboration.

Technology and Semiconductors: Heightened Strategic Vulnerability

Though not new to trade friction, the U.S. technology sector finds itself in an increasingly precarious position under the latest Chinese tariffs. Semiconductor components, precision sensors, and advanced computing hardware are among the categories affected. These exports are critical to China’s high-tech industries, including consumer electronics, telecommunications, and artificial intelligence. By imposing steep tariffs on these goods, China is signaling its willingness to absorb short-term pain in exchange for long-term independence in strategic technology domains.

For American chipmakers and hardware producers, this development is particularly concerning. China accounts for a significant portion of global semiconductor demand, and any restriction—be it through tariffs, export controls, or informal pressure—threatens to erode revenues and stifle R&D investment. In response, some U.S. tech firms may accelerate diversification into alternative markets such as India and Southeast Asia, though such transitions are fraught with logistical and regulatory challenges.

Consumer Goods: Reduced Market Access and Reputational Risk

U.S. consumer brands, including those in the apparel, luxury goods, and packaged food industries, are also adversely affected by the tariffs. While many of these companies have manufacturing operations within China to serve the domestic market, they also export premium or niche products from the U.S. to cater to high-end Chinese consumers. The additional 34% cost burden renders these goods less competitive, potentially reducing market share and brand visibility.

Moreover, Chinese public sentiment may further amplify the impact of tariffs on consumer-facing firms. In past episodes of economic tension, nationalist boycotts and viral campaigns have pressured domestic retailers and consumers to distance themselves from American brands. While the Chinese government has not officially endorsed such actions, the broader political climate increases reputational risk for foreign firms operating in China.

Broader Economic Implications

The cumulative effect of these sectoral shocks is likely to be substantial. U.S. export volumes are expected to decline in the short term, adding downward pressure on GDP growth. Business confidence, particularly in export-oriented regions, may deteriorate, leading to reduced capital expenditure and hiring. Additionally, the uncertainty surrounding future tariff escalations undermines long-term planning and may trigger a more cautious approach to global expansion among American firms.

Conversely, the Chinese economy will also incur costs, albeit in a more diffuse manner. Tariffs on U.S. goods may lead to inflationary pressures, especially in segments where domestic production is insufficient or where alternatives are more expensive. Furthermore, the retaliatory action introduces friction into bilateral investment flows, which may hinder technological development and constrain industrial upgrading.

In summary, the 34% retaliatory tariffs imposed by China strike at the heart of several critical U.S. industries, with agriculture, energy, manufacturing, and technology bearing the brunt of the impact. The economic consequences are likely to be far-reaching, affecting not only corporate profits and employment but also the broader structure of global trade. These developments necessitate a recalibration of business strategy and public policy to navigate an increasingly volatile and fragmented international economic landscape.

Strategic Calculations on Both Sides

The recent escalation in the U.S.-China trade war—marked by China’s imposition of 34% retaliatory tariffs—reflects a confluence of calculated strategic considerations by both parties. Far from being merely reactive or economically motivated, the decisions on both sides are deeply rooted in broader geopolitical, domestic political, and long-term industrial policy objectives. This section examines the underlying strategic calculus informing the actions of Washington and Beijing, emphasizing how both nations are maneuvering within a shifting global order to advance their respective agendas.

China’s Strategic Posture: Asserting Sovereignty and Economic Resilience

China’s decision to respond with an aggressive 34% tariff on over 150 categories of U.S. imports demonstrates a deliberate strategy to project strength and reinforce its sovereign authority in global economic affairs. Beijing has long been wary of external pressure influencing its domestic policymaking, and the current measures underscore its resolve to reject perceived coercion by foreign powers.

One of the key pillars of China’s response is its dual circulation strategy, a national policy initiative launched in 2020 aimed at reducing dependency on foreign markets and focusing on internal economic development. By fostering a robust domestic market (internal circulation) while selectively engaging with international trade partners (external circulation), China seeks to insulate its economy from external shocks such as tariffs, sanctions, and supply chain disruptions.

In targeting U.S. agricultural and energy exports, China is tactically selecting goods that are politically sensitive in the U.S. electoral landscape. By increasing the cost of these goods through tariffs, China not only inflicts economic damage but also amplifies domestic political pressure on U.S. leaders, particularly in key swing states dependent on exports to China. This approach aligns with previous Chinese retaliatory strategies observed during the Trump administration.

Furthermore, Beijing’s long-term industrial goals—articulated in frameworks such as Made in China 2025 and China Standards 2035—have positioned the country to gradually reduce reliance on foreign technology. The imposition of tariffs on advanced U.S. components such as semiconductors and aerospace equipment, though potentially disruptive in the short term, is part of a broader effort to encourage domestic innovation, develop indigenous alternatives, and support local firms through subsidies and state-directed financing.

Domestically, the tariffs also serve a symbolic function. By demonstrating a firm stance against U.S. economic pressure, the Chinese Communist Party (CCP) reaffirms its legitimacy and ability to defend national interests. This message is particularly critical as the Party seeks to maintain social cohesion amid slowing economic growth, demographic challenges, and lingering property market instability.

The U.S. Strategic Perspective: Economic Security and Political Optics

From the perspective of Washington, the escalation in tariffs that precipitated China’s response is closely tied to a growing emphasis on economic security and strategic decoupling from China. The Biden administration, continuing certain elements of its predecessor’s trade policy, has prioritized reshoring of critical supply chains, safeguarding emerging technologies, and reducing vulnerabilities in sectors deemed vital to national security.

The March 2025 tariff package that triggered China’s retaliation focused heavily on high-tech imports, particularly those related to electric vehicles (EVs), semiconductors, rare earth materials, and renewable energy infrastructure. This aligns with broader efforts to curb China’s advancement in strategically significant sectors and to reclaim industrial leadership in areas viewed as essential to future geopolitical competition.

There is also a domestic political calculus at play. With public support for a tough stance on China at historically high levels, and with bipartisan consensus increasingly framing China as a systemic rival, trade restrictions serve a dual purpose: they appeal to voters concerned about job losses and unfair competition, while also reinforcing a foreign policy stance grounded in deterrence and economic containment.

Additionally, the U.S. is strategically leveraging alliances and trade partnerships outside the China sphere to reduce dependency on Chinese inputs. This includes increased collaboration with countries like India, Vietnam, Mexico, and allies in the European Union and Indo-Pacific. The goal is to develop a more diversified and secure economic ecosystem that can weather future geopolitical tensions. However, such a shift is neither immediate nor without cost; the realignment of supply chains is a long-term endeavor that demands sustained political will and capital investment.

Mutual Constraints and Asymmetries

Despite their assertive postures, both nations face significant constraints that limit the scope of their strategic options. For China, the imposition of high tariffs on essential U.S. imports could contribute to inflationary pressures at home, particularly in sectors where substitute suppliers are limited or less efficient. Likewise, prolonged tension with the U.S. could deter foreign direct investment, hamper innovation ecosystems, and stifle economic growth at a time when Beijing is already confronting internal economic headwinds.

On the U.S. side, a continued escalation of tariffs risks alienating key domestic stakeholders such as multinational corporations, agricultural associations, and export-dependent states. Moreover, the use of tariffs as a policy instrument may prove less effective over time if China succeeds in localizing production and cultivating alternative markets. The loss of access to the world’s second-largest economy also raises concerns about lost revenue opportunities and reduced global competitiveness for U.S. firms.

There are also asymmetries in the tools each side can deploy. While the U.S. holds greater influence over global financial infrastructure and technology export control regimes, China possesses unparalleled leverage in certain strategic resources, including rare earth elements and critical manufacturing capacity. This dynamic ensures that neither side can unilaterally dictate the terms of economic engagement without incurring substantial costs.

Signals of Escalation or Openings for Dialogue?

Though the current trajectory appears to favor continued confrontation, analysts have not ruled out the possibility of renewed dialogue. Historically, both countries have shown a willingness to re-engage diplomatically after periods of escalation. However, the preconditions for meaningful negotiations have become more complex, as both sides demand structural changes that touch upon sensitive aspects of their respective economic systems.

Moreover, public statements from both governments suggest a hardening of ideological lines. Washington increasingly emphasizes transparency, market discipline, and democratic norms, while Beijing asserts the legitimacy of its development model and its right to state-led economic governance. This divergence makes compromise more elusive and reinforces the perception that the trade war is merely one front in a broader strategic rivalry.

Nonetheless, it is in neither country’s interest to allow the economic conflict to spiral unchecked. The global economy, already grappling with post-pandemic recovery, inflation, and geopolitical instability, cannot afford the uncertainty of an extended trade war between its two largest pillars. As such, backchannel communications, international mediation, or phased de-escalation may eventually emerge as pragmatic paths forward.

The strategic calculations underpinning the current phase of the U.S.-China trade war reflect a deepening contest over economic influence, national resilience, and global norms. Both Washington and Beijing are pursuing policies designed to insulate themselves from external vulnerabilities, even as the costs of confrontation mount. Understanding these motivations is essential to interpreting recent developments and anticipating future scenarios. In the next section, we turn our focus to the broader global repercussions of this escalating conflict and the reactions it has provoked among key stakeholders around the world.

Global Repercussions and Reactions

The imposition of 34% retaliatory tariffs by China on U.S. imports, and the corresponding escalation in U.S. trade barriers, has not occurred in a vacuum. As the world’s two largest economies clash over trade, investment, and technology, the repercussions are rippling across global markets, influencing policy decisions, business strategies, and geopolitical alignments. This section explores the global economic and political consequences of the latest phase of the U.S.-China trade conflict, with particular attention to how other nations, multinational institutions, and financial markets are reacting.

International Trade Partners: Realignment and Risk Management

Many of the United States' and China’s trade partners now find themselves caught in the crossfire of an increasingly polarized global economy. Export-dependent countries, particularly in Southeast Asia, the European Union, and Latin America, are watching the escalation with growing concern. While some stand to benefit from the redirection of supply chains and investment, others face mounting uncertainty about market access, pricing volatility, and regulatory alignment.

For example, countries like Vietnam, Mexico, and India have emerged as potential beneficiaries of supply chain diversification, as U.S. and Chinese companies seek to mitigate the impact of tariffs by shifting production. Vietnam’s electronics and textile industries, in particular, have seen increased foreign direct investment (FDI), while Mexico's proximity to the U.S. market and its participation in the USMCA trade agreement make it an attractive alternative for North American manufacturers.

Conversely, European manufacturers and exporters, especially those in Germany and France, have raised concerns over the deteriorating trade environment. The EU faces pressure to take a clearer stance on China-related issues, particularly in technology and human rights, while preserving its own trade interests. Several European leaders have called for a more unified and autonomous EU trade strategy that balances transatlantic alignment with commercial engagement in Asia.

Financial Markets: Volatility and Safe-Haven Movements

The immediate financial response to the latest tariff escalation has been characterized by increased volatility, as equity markets around the world absorb the potential for reduced trade flows and slower global growth. Major indices, including the S&P 500, the FTSE 100, and the Nikkei 225, experienced notable declines in the days following China’s announcement, with technology and industrial sectors leading the downturn.

Investors have turned to traditional safe-haven assets amid the growing uncertainty. U.S. Treasury yields have fallen sharply, reflecting increased demand for low-risk government bonds. Gold prices have surged to multi-year highs, as investors hedge against currency fluctuations and geopolitical instability. Meanwhile, oil markets have experienced mixed reactions, with concerns about energy demand outweighing supply risks linked to the trade dispute.

Currency markets have also reacted to the trade tension. The Chinese yuan has faced downward pressure, as markets speculate on the potential for monetary easing and capital outflows. The U.S. dollar, in contrast, has strengthened against most major currencies, driven by safe-haven demand and expectations of relative economic stability. However, this appreciation poses challenges for U.S. exporters, whose goods become more expensive on global markets.

Commodity and Supply Chain Disruptions

The imposition of tariffs on agricultural goods, energy commodities, and key manufacturing inputs has already begun to disrupt global commodity flows and supply chains. Soybean and corn markets, for example, are experiencing price volatility as Chinese buyers seek to replace U.S. imports with South American alternatives. This has triggered secondary effects on shipping rates, storage capacity, and futures contracts.

Similarly, the LNG market is in a state of flux. China’s reduced demand for U.S. LNG is likely to increase competition for alternative suppliers in the Middle East and Australia, thereby impacting global pricing structures and contract terms. For energy traders and shipping firms, the reconfiguration of trade routes may entail higher costs and operational complexity.

On the manufacturing side, tariffs on semiconductors and industrial machinery are causing delays and cost increases across electronics, automotive, and aerospace supply chains. Many multinational corporations are accelerating their “China+1” strategies—where they maintain a presence in China but diversify production to another country—as a means of risk management. However, reconfiguring supply networks is costly, time-consuming, and fraught with regulatory hurdles.

Multinational Institutions and Policy Coordination

The escalating trade conflict has prompted renewed debate over the role of multilateral institutions such as the World Trade Organization (WTO), the International Monetary Fund (IMF), and the Group of Twenty (G20). While these organizations have historically served as forums for dispute resolution and policy coordination, their influence has waned amid rising nationalism and bilateralism.

The WTO, in particular, faces a legitimacy crisis. Both the U.S. and China have increasingly acted outside the bounds of multilateral norms, imposing tariffs without the exhaustive adjudication process the organization requires. Although China has lodged formal complaints at the WTO, and U.S. trade officials continue to invoke national security exceptions, the practical effect of these measures is limited in the absence of enforceable rulings and compliance mechanisms.

The IMF has warned that prolonged trade tensions between the U.S. and China could reduce global GDP by as much as 1% annually, primarily due to decreased investment and consumer confidence. In response, several G20 nations have urged both sides to re-engage in dialogue and restore predictability to the international trading system. However, with both countries prioritizing domestic agendas and long-term rivalry, near-term resolution appears unlikely.

Geopolitical and Strategic Implications

Beyond the economic domain, the trade conflict is reshaping global alliances and strategic partnerships. The U.S.-China rivalry is increasingly viewed not just as a trade dispute, but as a broader contest for geopolitical influence. Countries in Africa, Latin America, and the Middle East find themselves under pressure to align with one side or the other, as Washington and Beijing compete for access to markets, resources, and diplomatic support.

This dynamic is evident in infrastructure initiatives such as China’s Belt and Road Initiative (BRI) and the U.S.-backed Partnership for Global Infrastructure and Investment (PGII). These programs, while framed as development efforts, are also vehicles for strategic influence. Trade tensions exacerbate this competition, as each side seeks to shape the global economic order to reflect its values and interests.

Furthermore, the conflict raises questions about the future of global economic governance. As nations turn inward and prioritize self-reliance, the post–World War II consensus on free trade, open markets, and multilateralism is under strain. The growing emphasis on industrial policy, export controls, and economic security suggests that globalization, as it has been practiced for decades, is undergoing a profound transformation.

The global repercussions of the U.S.-China trade escalation are multifaceted and far-reaching. From market volatility and supply chain disruptions to strategic realignments and institutional challenges, the conflict is reshaping the contours of the international economic system. While some nations and industries may find opportunities amid the disruption, the broader trend points toward a more fragmented and uncertain global landscape. In the final section of this analysis, we turn our attention to future outlooks and strategic takeaways, exploring whether this is a temporary episode or a defining feature of the 21st-century global economy.

Outlook: Endgame or New Normal?

The intensification of the U.S.-China trade conflict, culminating in China’s imposition of 34% retaliatory tariffs on a wide range of U.S. imports, raises a critical question for policymakers, investors, and global businesses alike: are we witnessing the final chapter of a volatile but ultimately resolvable trade dispute, or are we entering a new, prolonged phase of structural decoupling and economic fragmentation? The answer will have profound implications not only for bilateral relations but also for the broader configuration of the global economic order.

Short-Term Scenarios: Escalation, Stalemate, or Partial De-escalation

In the immediate future, three broad scenarios appear plausible. The first is continued escalation, in which both sides impose additional rounds of tariffs, expand the scope of non-tariff barriers (such as export controls and investment restrictions), and further reduce diplomatic engagement. Under this scenario, global markets would likely experience sustained volatility, while multinational firms operating across the U.S.-China axis would face deepening uncertainty.

A second, and perhaps more likely, scenario is stalemate. In this case, both countries maintain their current tariff regimes while refraining from further escalation. Negotiations may stall, but neither side takes dramatic new steps to inflame tensions. While such a standoff could stabilize markets to a degree, it would also solidify the present fragmentation, with long-term consequences for supply chain configuration and capital allocation.

The third scenario is a partial de-escalation—not a comprehensive resolution, but a series of targeted confidence-building measures. These might include tariff exemptions for critical sectors, renewed backchannel diplomacy, or agreements on specific issues such as climate collaboration or data security. While this path offers a reprieve from sustained conflict, it requires political capital and mutual trust that may currently be in short supply.

Structural Shifts: Decoupling and Strategic Autonomy

Regardless of the near-term trajectory, the long-term implications of the trade conflict point toward a growing trend of strategic decoupling. Both the United States and China are pursuing parallel efforts to reduce their mutual economic dependencies, particularly in sectors deemed vital to national security. This includes semiconductors, rare earth materials, artificial intelligence, biopharmaceuticals, and advanced manufacturing.

In the United States, this strategy is evident in recent legislation such as the CHIPS and Science Act and the Inflation Reduction Act, both of which seek to bolster domestic production capacity and reduce reliance on foreign—especially Chinese—inputs. Similarly, China is investing heavily in indigenous innovation and supply chain localization through its 14th Five-Year Plan and industrial policy mechanisms targeting key technologies.

This dual pursuit of strategic autonomy is fundamentally altering the structure of global trade. For decades, globalization was characterized by efficiency-driven integration; supply chains were optimized for cost and scale, often leading to complex interdependencies across borders. The current environment, by contrast, favors resilience, redundancy, and geopolitical alignment. These changes may reduce efficiency in the short term but are increasingly viewed as necessary for long-term national competitiveness.

Business Adaptation: Risk Mitigation and Regionalization

Global businesses, particularly those with exposure to both U.S. and Chinese markets, are responding with a mixture of caution and innovation. Many have accelerated their adoption of “China+1” or “China+2” strategies, seeking to retain access to the vast Chinese consumer base while diversifying manufacturing operations into alternative jurisdictions such as India, Vietnam, and Indonesia.

At the same time, firms are investing in scenario planning, geopolitical risk modeling, and operational agility. Business continuity strategies now include not only inventory buffers and multiple supplier relationships but also considerations of regulatory exposure, data localization mandates, and capital flow restrictions. This new normal demands a higher degree of coordination between corporate strategy, legal compliance, and international affairs departments.

The rise of regional trade blocs and plurilateral agreements, such as the Regional Comprehensive Economic Partnership (RCEP) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), also reflects a broader shift toward regionalization. Companies are increasingly aligning their value chains with regional economic architectures, thus reducing exposure to global friction points.

Implications for Global Governance and Trade Norms

The shift away from multilateralism, hastened by the trade war, has weakened institutions such as the World Trade Organization (WTO) and World Bank, which traditionally served as platforms for conflict resolution and policy coordination. In their place, bilateral and mini-lateral arrangements are gaining prominence, often governed by geopolitical considerations rather than purely economic logic.

This erosion of rules-based trade governance raises concerns about a fragmented and politicized global economy, where power dynamics, rather than mutually agreed norms, dictate outcomes. The resulting unpredictability may discourage cross-border investment, constrain innovation, and entrench inequality between advanced and developing economies. Moreover, the weakening of dispute resolution mechanisms increases the risk of future conflicts, as aggrieved parties have fewer peaceful avenues for recourse.

That said, the current crisis may also serve as a catalyst for institutional reform. There is growing momentum behind proposals to revitalize the WTO’s appellate body, expand the mandate of the IMF to monitor trade-related financial flows, and establish new global compacts on emerging technologies, data governance, and climate-linked trade measures. Whether such efforts succeed will depend on the political will of major powers to re-engage constructively on the world stage.

Policy Recommendations and Strategic Takeaways

For policymakers, the present moment calls for a balanced approach that combines the protection of national interests with the pursuit of stable economic relations. U.S. and Chinese authorities should consider establishing emergency communication channels, adopting sector-specific negotiation tracks, and engaging third-party mediators where appropriate. De-risking does not need to mean disengagement; managed competition can coexist with targeted cooperation.

For business leaders, strategic foresight, diversification, and regulatory literacy are no longer optional. The firms most likely to thrive in this environment are those that invest in supply chain transparency, legal agility, and cultural competency across jurisdictions. Stakeholder capitalism—where social license and environmental responsibility are integral to business models—also provides a buffer against geopolitical volatility.

For investors, the future entails a careful reassessment of exposure, risk premiums, and long-term value creation. ESG factors, political risk analysis, and regional economic trajectories must all be integrated into portfolio strategies. Sectors that contribute to strategic resilience—such as green technology, cybersecurity, and localized manufacturing—may represent opportunities in an otherwise turbulent landscape.

A Defining Inflection Point

The trade war between the United States and China, reignited by China’s 34% retaliatory tariffs, marks more than just a temporary policy dispute; it signifies a fundamental shift in the architecture of global commerce. Whether this represents an endgame to current tensions or the emergence of a new, fragmented global order remains to be seen. What is certain, however, is that the decisions made in the coming months will shape the global economy for decades to come.

The world now faces a defining inflection point. Stakeholders across government, business, and civil society must adapt to a more complex and contested global environment—one where traditional assumptions about economic integration and interdependence no longer apply. In this new normal, resilience, strategy, and foresight will be the most valuable currencies.

References

- Office of the United States Trade Representative – “U.S.-China Trade Facts”

https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china - China Ministry of Commerce – Official Statement on U.S. Trade Measures

http://english.mofcom.gov.cn/ - World Trade Organization – Dispute Settlement: U.S.–China Trade Measures

https://www.wto.org/english/tratop_e/dispu_e/dispu_subjects_index_e.htm - International Monetary Fund – Impact of U.S.-China Trade Conflict on Global GDP

https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19 - Peterson Institute for International Economics – U.S.-China Trade War Tracker

https://www.piie.com/research/trade-investment/us-china-trade-war-tariffs - Congressional Research Service – China’s Retaliatory Tariffs on U.S. Goods

https://crsreports.congress.gov/ - Brookings Institution – Strategic Decoupling and U.S. Trade Policy

https://www.brookings.edu/research/ - Center for Strategic and International Studies – U.S.-China Economic Competition

https://www.csis.org/programs/trade-and-international-business - Bloomberg – Market Reaction to China’s Latest Tariffs on U.S. Exports

https://www.bloomberg.com/markets - Reuters – Global Supply Chains Shift Amid U.S.-China Trade War

https://www.reuters.com/markets/