Tesla Trade-Ins Hit Record High in 2024: Brand Loyalty Drops to New Lows

Tesla has long been the poster child for electric vehicle innovation—an automotive disruptor that took the world by storm. With sleek designs, a tech-first approach, and a cult-like fan base, Tesla wasn’t just building cars—it was building a movement. For years, its customers were among the most brand-loyal in the auto industry, proudly upgrading from one Tesla model to the next and singing the company's praises in the process.

But times are changing.

In 2024, the company hit a surprising milestone: a record number of Tesla vehicles were traded in—by Tesla owners themselves. Even more telling, a growing percentage of those trade-ins were not for newer Tesla models, but for competing EVs or even internal combustion vehicles. For a brand once hailed for its sticky customer loyalty, this marks a significant and potentially concerning shift.

While Tesla remains the dominant EV player globally, these recent numbers point to something deeper than just a normal product lifecycle. The cracks in customer satisfaction and loyalty may be widening, and the competition is now fiercer than ever. Rivian, Lucid, Ford, Hyundai, and others are offering compelling electric alternatives—many boasting features and refinements Tesla has yet to deliver.

This post dives into the heart of the issue. We’ll examine the hard data behind the rising trade-in numbers and declining brand loyalty. We’ll explore the customer experience, the impact of volatile pricing, the influence of Elon Musk’s public persona, and what this means for Tesla’s future in a maturing EV market.

To better understand the trend, we’ll start with a look at the numbers behind Tesla's recent trade-in boom—and what they reveal about shifting consumer behavior.

A Look at the Numbers

Tesla’s latest numbers paint a story that may come as a surprise to those who’ve followed the brand’s meteoric rise. For a company once defined by unwavering customer loyalty, the past five years show a different narrative unfolding—one marked by growing discontent, increased turnover, and a more competitive marketplace luring away once-devoted Tesla owners.

The Rise in Tesla Trade-Ins

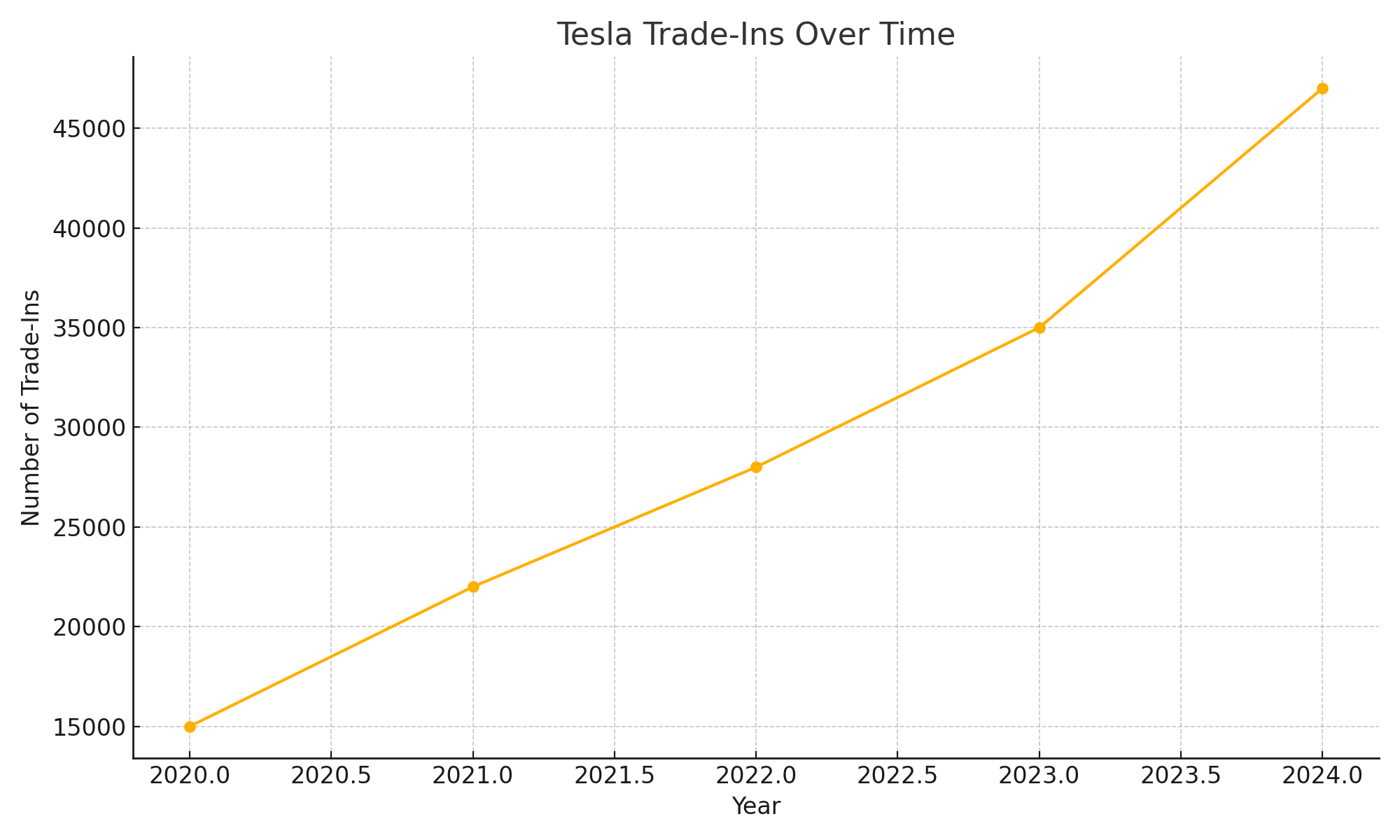

Let’s begin with the headline statistic: the number of Tesla vehicles being traded in has grown dramatically. In 2020, just 15,000 Teslas were traded in by their owners. Fast forward to 2024, and that figure has more than tripled, reaching 47,000.

Chart 1: Tesla Trade-Ins Over Time (2020–2024)

A line graph showing a steep, consistent rise in Tesla trade-ins, peaking in 2024.

This sharp increase reflects more than just a growing customer base—it’s an indicator of churn. In the early 2020s, Tesla owners were fiercely loyal. Most upgrades went from Model 3 to Model Y, or from one Model S to a refreshed version. Now, many of those same owners are choosing to leave the Tesla ecosystem altogether.

While some level of turnover is expected as vehicles age or needs change, the sheer pace of the increase points to more systemic challenges: dissatisfaction with quality, frustration with service, pricing volatility, or simply the lure of better alternatives.

Brand Loyalty: From Industry Leader to Slipping Challenger

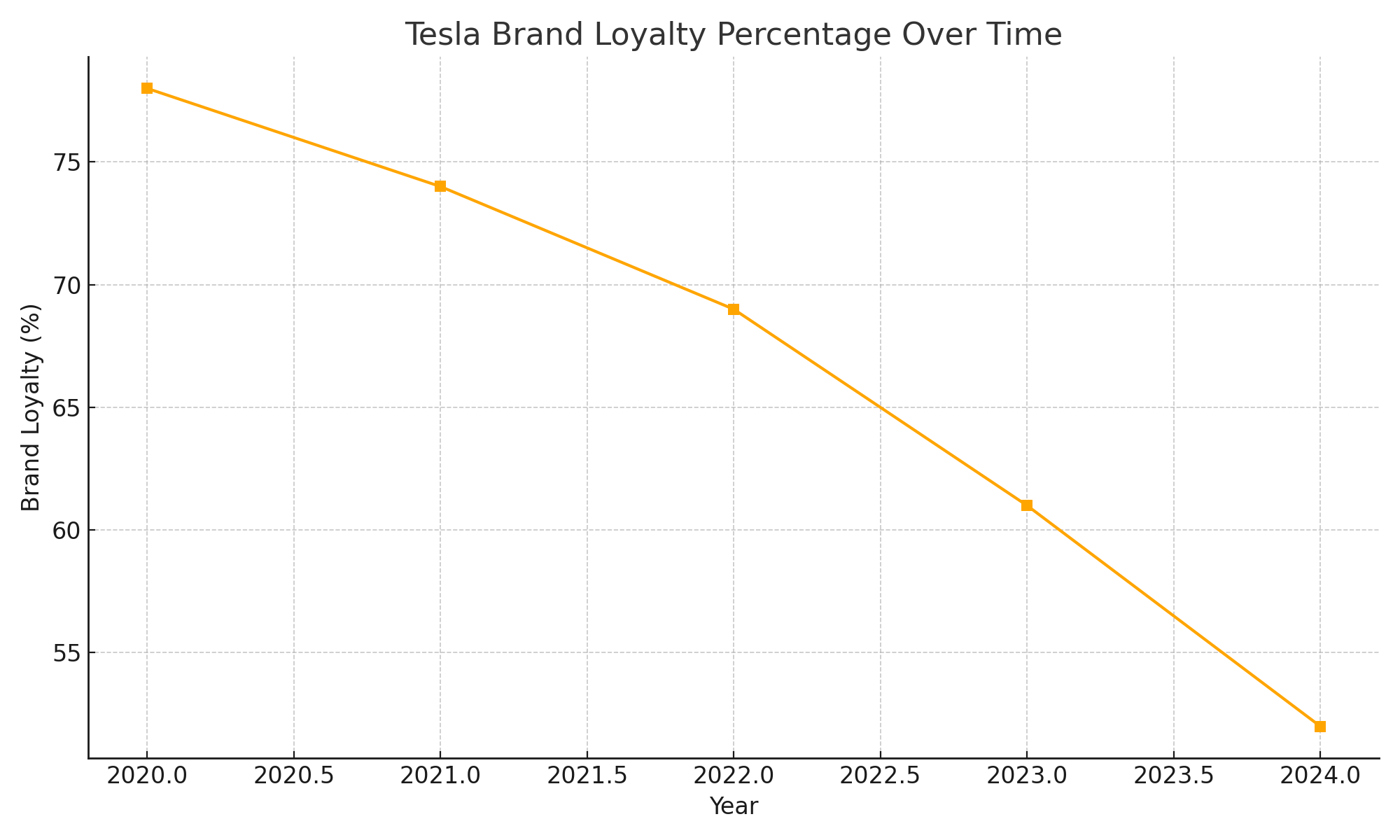

Perhaps even more telling is the drop in Tesla's brand loyalty percentage—a key metric used in the auto industry to gauge how many customers stick with a brand for their next vehicle.

In 2020, Tesla’s loyalty rate stood at an impressive 78%, among the highest in the automotive world. But by 2024, that number had plunged to 52%.

Chart 2: Tesla Brand Loyalty Over Time (2020–2024)

A line graph showing a downward trend in Tesla’s brand loyalty, with each year marking a notable decline.

This decline is not just a statistic—it represents a transformation in consumer sentiment. A 26-point drop over five years signals that Tesla is no longer the automatic choice for many EV buyers, especially repeat customers who now have more EV experience and higher expectations.

Summarizing the Trends

To make sense of the intersection between rising trade-ins and declining loyalty, let’s look at the data side-by-side:

Table: Tesla Trade-Ins and Brand Loyalty (2020–2024)

| Year | Tesla Trade-Ins | Brand Loyalty (%) |

|---|---|---|

| 2020 | 15,000 | 78% |

| 2021 | 22,000 | 74% |

| 2022 | 28,000 | 69% |

| 2023 | 35,000 | 61% |

| 2024 | 47,000 | 52% |

The table highlights a clear inverse relationship: as the number of trade-ins climbs, loyalty steadily declines. This kind of trend isn’t random—it typically points to a series of structural or experiential issues within the brand.

It’s also worth noting that the steepest drop in loyalty came between 2022 and 2024, a period when Tesla faced increased criticism over quality control issues, ongoing service delays, a sharp rise in software complaints, and a slew of pricing adjustments that left many customers feeling burned.

Tesla’s Changing Customer Base

Another factor to consider is Tesla’s rapidly expanding customer base. In the early days, Tesla owners were mostly tech enthusiasts and early adopters—willing to forgive flaws for the sake of innovation. But as the brand has gone mainstream, its customer profile has shifted. Today’s buyer expects more polish, more reliability, and a more conventional luxury experience.

For some of these newer buyers, the Tesla experience hasn’t lived up to the hype—resulting in higher churn and less brand stickiness.

What’s Driving the Surge in Trade-Ins?

The record-high number of Tesla trade-ins isn’t happening in a vacuum. It’s the result of a confluence of factors reshaping how consumers view the brand—and what they expect from their next car. To fully grasp the shift, we need to unpack the forces behind this churn: a maturing EV market, concerns about quality and service, changes in Tesla’s public image, and the increasingly diverse preferences of mainstream EV buyers.

The EV Market Has Grown Up

When Tesla first arrived on the scene, it was a beacon of innovation. It had no real rivals. Early adopters weren’t just buying a car—they were buying into a movement. But that exclusivity is gone. The electric vehicle market has matured dramatically, and with that maturity has come choice.

Legacy automakers like Ford, General Motors, and Hyundai have rapidly expanded their EV portfolios. Ford’s Mustang Mach-E and F-150 Lightning, GM’s EV lineup under Cadillac and Chevrolet, and Hyundai’s sleek Ioniq series offer options that feel familiar and fresh. Meanwhile, startups like Rivian and Lucid are offering premium alternatives that some say outclass Tesla in build quality and user experience.

Today, Tesla is no longer the only aspirational EV brand. Consumers now shop with comparisons in mind: interior refinement, service availability, software compatibility, and overall ownership experience. This increased competition has inevitably chipped away at Tesla's once-dominant loyalty metrics.

Quality Control and Product Consistency Issues

For years, Tesla has battled persistent complaints about quality. From misaligned panels and inconsistent paint jobs to buggy software and fit-and-finish problems, the brand’s commitment to innovation sometimes seems to outpace its commitment to reliability.

While Tesla fans may have once brushed these off as growing pains, today’s EV buyer is less forgiving—especially when premium prices are on the table. Owners are now comparing Tesla’s build quality not to niche competitors but to established brands known for decades of manufacturing excellence.

A few problematic experiences can quickly sour repeat customers. And when those owners are faced with a trade-in decision, many are opting for brands that promise a more refined experience.

Elon Musk’s Public Persona

No discussion of Tesla is complete without acknowledging the influence of Elon Musk. His charisma, vision, and bold promises helped propel the company to where it is today. But in recent years, Musk’s increasingly polarizing behavior—especially on social media—has begun to affect Tesla’s image.

From controversial tweets to divisive political statements and public feuds, Musk’s online activity has turned off segments of Tesla’s customer base. Some former fans now find themselves questioning whether they still align with the values and direction of the company.

This is particularly true among younger, socially conscious consumers—many of whom were Tesla’s earliest and most enthusiastic adopters. For these buyers, brand alignment goes beyond product specs. It’s about identity and values. And when that alignment slips, loyalty erodes.

Service and Support Limitations

Tesla revolutionized the buying experience by bypassing traditional dealerships. But as the company has scaled, its service infrastructure hasn’t kept pace.

Common complaints include:

- Long wait times for repairs and service appointments.

- Shortages of parts or replacement components.

- Difficulty reaching human customer service representatives.

- A mobile app-based service model that sometimes leaves users feeling abandoned.

These issues may seem minor in isolation, but they add up—especially when owners need support and can’t get it quickly. Frustrated customers are less likely to stay loyal, particularly when rival automakers offer traditional service networks with shorter turnaround times and clearer accountability.

Pricing Volatility and Resale Value Instability

Another major contributor to the surge in trade-ins is Tesla’s unpredictable pricing strategy. The company has made frequent and sometimes dramatic adjustments to vehicle prices, sometimes multiple times in a single quarter. While this may benefit new buyers, it’s created disillusionment among existing owners who feel shortchanged when their vehicles suddenly lose value.

This pricing volatility, combined with a softening used EV market, has led to disappointing trade-in values for many Tesla owners. What they once believed to be a solid investment now feels unstable—and in some cases, financially punishing.

For these owners, trading in their Tesla is both a reaction to disappointment and a strategic move to regain value elsewhere.

Brand Loyalty in the Auto Industry: Why It Matters

Brand loyalty is the golden currency of the automotive world. It’s what allows manufacturers to confidently predict future sales, streamline product roadmaps, and build long-term customer relationships. When a brand wins customer loyalty, it reduces the cost of acquiring new buyers and creates a cycle of repeat purchases that fuels growth. Tesla understood this early—and thrived on it.

In its early years, Tesla didn’t just have customers; it had evangelists. These early adopters weren’t just buying cars; they were joining a mission to accelerate the world’s transition to sustainable energy. That emotional connection gave Tesla a rare and powerful advantage.

But as Tesla transitions from a disruptor to a mainstream automaker, it’s learning a hard truth: keeping customers is harder than attracting them.

The Loyalty Benchmark

In the traditional auto industry, loyalty rates are closely monitored. Brands like Toyota and Honda consistently score high thanks to their reputation for reliability and customer service. Luxury brands like BMW and Lexus retain loyalists through refinement and service quality. The average brand loyalty across the industry tends to hover between 45% and 65%, depending on market trends.

Tesla once topped that range—peaking around 78% in 2020. But with the decline to 52% in 2024, it’s now squarely in the middle of the pack.

A drop in loyalty doesn’t just impact sales. It signals deeper issues:

- A mismatch between expectations and experience.

- Frustration over service, support, or quality.

- Erosion of brand trust due to public relations or leadership issues.

Tesla’s challenge is compounded by the fact that many of its original customers were first-time EV owners. Their second purchase is more informed, less driven by novelty, and more focused on comfort, quality, and service.

Tesla’s evolution into a mass-market manufacturer means it must now win on the same terms as every other automaker: performance, price, reliability, and trust. The emotional connection that once carried the brand is still valuable—but it’s no longer enough.

In this environment, loyalty becomes harder to earn and easier to lose. To win it back, Tesla must close the gap between its promises and the reality its customers experience.

Where Are Tesla Owners Going?

With Tesla trade-ins reaching record highs, the natural follow-up question is: Where are these customers going? Who is winning over the drivers that once swore allegiance to the brand that revolutionized the electric vehicle market?

The answer reveals a lot about the evolving EV landscape—and about what today’s EV shoppers value most.

Embracing New EV Alternatives

A significant portion of ex-Tesla owners aren’t abandoning electric altogether—they’re simply choosing different EV brands. Among the most popular replacements:

- Rivian: Known for its rugged R1T pickup and R1S SUV, Rivian appeals to outdoor enthusiasts and those looking for adventure-ready EVs. The company’s focus on quality, customer service, and premium materials has won over many disenchanted Tesla owners.

- Lucid Motors: With its luxurious Air sedan, Lucid offers a high-end experience that blends cutting-edge tech with elevated design and ride comfort. Many former Model S owners looking for a more refined premium EV have made the switch.

- Hyundai & Kia: The Ioniq 5, Ioniq 6, and Kia EV6 have surprised many with their affordability, design, and feature sets. These models support Android Auto and Apple CarPlay—something Tesla still lacks—and boast strong reliability records.

- Ford & General Motors: The Ford Mustang Mach-E and F-150 Lightning are particularly appealing to buyers looking for familiarity with a modern EV twist. GM’s Ultium-based vehicles are gaining momentum too, offering more traditional cabin layouts and broad service networks.

Returning to Hybrids and Gas Vehicles

Surprisingly, a segment of Tesla owners is reverting to hybrids or ICE vehicles. While not a huge percentage, it signals frustration with:

- Charging infrastructure inconsistencies.

- Long road trip planning complexity.

- Diminished resale values and high repair costs.

Brands like Toyota, Lexus, and Honda are benefitting from this trend, particularly with their popular hybrid models, offering a middle ground between sustainability and convenience.

Tesla to Tesla... Less Often

In years past, the most common trade-in for a Tesla Model 3 or Model S was another Tesla. But this is no longer the case. The declining brand loyalty data shows that fewer owners are replacing their Model 3 with a Model Y or trading their Model S for a Plaid upgrade. Instead, many are casting a wider net—and Tesla is losing that second sale.

What’s Driving the Shift?

- Interior quality: Competing brands now offer superior materials, tactile feedback, and ergonomic design.

- Infotainment & compatibility: Apple CarPlay and Android Auto remain absent in Teslas—a sticking point for many buyers.

- Traditional controls: Not everyone wants to use a touchscreen to adjust wipers or change air vents.

- Service experience: Established brands offer more responsive service centers and better post-sale support.

As more brands refine their EV offerings, the bar keeps rising—and Tesla is no longer the only name in the game.

The Pricing and Resale Problem

Tesla’s pricing strategy has always been unconventional. Unlike most automakers that plan price adjustments annually, Tesla regularly makes abrupt price changes, often announced on Twitter or quietly implemented overnight on its website.

While this strategy gives Tesla flexibility, it also causes chaos for existing customers—especially those who’ve recently purchased a vehicle at a higher price.

Frequent Price Cuts

Throughout 2023 and 2024, Tesla made aggressive price cuts across nearly all models. For instance, the Model Y saw as much as $13,000 slashed from its MSRP within a few months. While this spurred new sales, it also left recent buyers furious, watching their vehicle depreciate faster than expected.

In traditional auto markets, such volatility is rare. For Tesla buyers, it introduced an unfamiliar feeling: buyer’s remorse.

Declining Resale Values

The ripple effect of rapid price changes is a weakened secondary market. Dealerships and trade-in platforms adjusted quickly, lowering their offers for used Teslas. Owners who had planned to upgrade or swap models found themselves underwater—owing more than the car was worth or receiving shockingly low trade-in offers.

Compared to 2020–2021, when used Teslas often sold above MSRP, the 2024 market paints a different picture. Residual value—a key factor in brand perception—has taken a hit.

Trust Erosion

Beyond the economics, this pricing instability has eroded trust. Buyers now hesitate to purchase a Tesla, worried that another price drop could be around the corner. This unpredictability can make loyal customers feel expendable—a dangerous sentiment in any consumer brand.

Tesla must decide whether to continue using pricing as a tactical weapon or return to a more stable strategy that rebuilds long-term trust.

Tesla’s Software-First Philosophy

A Double-Edged Sword

Tesla has always prided itself on being a software-first car company. Its vehicles are less like traditional automobiles and more like smartphones on wheels. Over-the-air (OTA) updates, app-based controls, and minimalist digital dashboards are part of what makes Tesla... Tesla.

But that same philosophy is now alienating some of its customers.

The Pros

- OTA Updates: Tesla’s ability to deliver new features and bug fixes remotely is a game-changer. Other automakers are only beginning to catch up.

- Continuous Improvement: Owners often wake up to a “new” car with updates like enhanced driving visualization, better range optimization, or new entertainment apps.

- Streamlined Interface: Tesla’s UI is intuitive, consistent, and surprisingly fast.

The Cons

- Feature Removal: Some updates have removed features or restricted options. For example, Tesla controversially limited some battery performance or took away ultrasonic sensors in newer vehicles, forcing customers to rely on unfinished camera-based systems.

- Lack of Standard Integration: Still no Apple CarPlay or Android Auto—both of which are now standard in almost every competing vehicle.

- Touchscreen-Only Controls: Simple tasks like opening the glove box or adjusting climate vents require navigating menus—a pain point for many.

Tech Fatigue

Some Tesla owners—especially those outside the early adopter crowd—have reported tech fatigue. They want a great EV, but also one that just works. They’re less interested in “beta” features like Full Self-Driving and more focused on quality of life and comfort.

Tesla’s software edge is still formidable, but it must now balance innovation with reliability and customer choice—or risk losing buyers to more conventional (but more user-friendly) alternatives.

The Road Ahead: Can Tesla Reverse the Trend?

The recent decline in Tesla’s brand loyalty and the surge in trade-ins represent a pivotal juncture for the company. Once celebrated as the unchallenged leader in the electric vehicle (EV) sector, Tesla now finds itself confronting the realities of a rapidly maturing market and a more discerning customer base. While the company continues to lead in several key areas—most notably in battery efficiency, software capabilities, and charging infrastructure—the dynamics of consumer loyalty have shifted significantly.

The question before Tesla is not whether it can continue to innovate, but whether it can evolve into a customer-centric, stable, and trust-driven automaker capable of sustaining its leadership in the long term. Reversing current trends will require a multifaceted approach. Below, we examine the strategic areas Tesla must address to restore brand loyalty, retain customers, and reinforce its competitive position.

Reinventing the Ownership Experience Through Service Excellence

Tesla’s service model was originally designed to eliminate the frustrations associated with traditional dealership experiences. However, as the customer base has expanded, the company’s service infrastructure has struggled to scale in proportion to its growth. Long wait times, limited service locations, parts shortages, and inconsistent customer support have become recurring themes in ownership feedback.

- Invest heavily in service center expansion to ensure geographic accessibility for all customers, not just those in high-density metropolitan areas.

- Enhance technician training and increase staffing to reduce turnaround times for common maintenance and repair issues.

- Develop a responsive and transparent communication framework that informs customers of service status updates, parts availability, and expected wait times.

Improving the service experience is one of the most direct ways to increase customer satisfaction and encourage repeat purchases. It also aligns Tesla with industry best practices, where service performance is a key driver of brand loyalty.

Price Stability and Transparent Value Communication

Tesla’s pricing strategy has been a topic of contention in recent years. While dynamic pricing has enabled the company to respond quickly to supply chain fluctuations and competitive pressures, it has also introduced a sense of unpredictability for consumers. Sudden price reductions—sometimes announced weeks after a customer has taken delivery—undermine trust and depreciate the perceived value of ownership.

- Adopting a more structured and transparent pricing framework, similar to those employed by legacy automakers, with predefined promotional periods or model-year updates.

- Offering trade-in value protection or limited-time price assurance for recent buyers who may otherwise feel penalized by abrupt changes.

- Introducing loyalty-based incentives such as discounts on future purchases, early access to new features or models, or service credit for returning customers.

These measures would not only stabilize resale values but also reinforce the notion that Tesla values and rewards its long-term customers.

Emphasizing Product Quality and Consistency

Tesla’s innovative spirit is one of its defining characteristics. However, the company’s rapid production cycles and aggressive iteration strategies have occasionally resulted in quality control issues. Reports of paint imperfections, alignment problems, and inconsistent build standards have surfaced with regularity—particularly in higher-volume models like the Model 3 and Model Y.

To address these concerns and meet the expectations of a more mainstream consumer base, Tesla should:

- Implement stricter quality assurance protocols at its manufacturing facilities worldwide, including standardized inspections and customer satisfaction benchmarks.

- Enhance post-delivery support to resolve minor defects promptly and at no cost to the owner.

- Prioritize the refinement of interior design and materials, ensuring that build quality matches the vehicle’s price point, especially in higher-end configurations.

Consumers in the premium vehicle segment expect a seamless blend of innovation and craftsmanship. Tesla’s ability to match or exceed the quality standards of German and Japanese automakers will be pivotal to its long-term appeal.

Aligning Leadership Visibility with Brand Strategy

Elon Musk has been integral to Tesla’s rise. His visionary leadership, willingness to take risks, and commitment to electrification have set the company apart. Yet, his increasingly polarizing public persona has, in recent years, introduced reputational challenges for the brand.

While Musk’s influence on Tesla’s innovation culture remains critical, the company might benefit from:

- Elevating other senior executives to become more visible in public communications, especially in areas related to product development, customer engagement, and sustainability.

- Separating brand identity from individual identity, allowing Tesla to stand as a product- and mission-driven company rather than a platform for its CEO’s broader views.

- Implementing structured communications protocols to ensure consistency between product strategy and public messaging.

As the EV market broadens, Tesla must appeal to a more diverse and global audience. A depersonalized, institutional brand image—focused on product excellence and customer well-being—could help recapture trust among disaffected or hesitant buyers.

Thoughtful Launches of New Models and Technologies

Tesla has announced several highly anticipated models, including the Cybertruck, next-generation Roadster, and a potential autonomous “robotaxi” platform. Each of these vehicles has the potential to reinvigorate customer interest and further differentiate Tesla in a crowded EV landscape.

However, to ensure these launches contribute positively to brand perception, Tesla must:

- Deliver on promised timelines, or, where delays are unavoidable, maintain transparent communication with prospective buyers.

- Avoid overpromising features that are not fully developed or ready for public use, particularly in areas such as Full Self-Driving (FSD).

- Ensure new products meet elevated expectations for quality, functionality, and value relative to market alternatives.

A successful Cybertruck launch, for example, could draw in a new segment of buyers while re-engaging current owners with a renewed sense of innovation. Conversely, a mismanaged release could exacerbate existing concerns around overhype and underdelivery.

Strengthening Customer Engagement and Loyalty Programs

One area where Tesla has underperformed relative to traditional automakers is in structured customer retention programs. While early adopters were content with minimal incentives, today’s consumers expect their loyalty to be acknowledged and rewarded.

Tesla could strengthen this connection by:

- Creating formal loyalty programs that offer tiered benefits based on ownership history, referral activity, or mileage milestones.

- Hosting owner events, meetups, and service clinics to cultivate community among existing customers.

- Enhancing digital touchpoints through the Tesla mobile app and online portals to provide ongoing value, including educational content, service scheduling, and feature demonstrations.

Such initiatives would contribute to a more relationship-driven ownership model—one that keeps Tesla top-of-mind when customers consider their next vehicle.

Renewing the Customer-Centric Mission

Tesla’s founding mission—accelerating the world’s transition to sustainable energy—resonated deeply with its earliest customers. As the company matures, it must ensure that this mission continues to permeate its operations, marketing, and product decisions.

A renewed focus on environmental stewardship, supply chain transparency, ethical labor practices, and global accessibility could help restore emotional alignment with the brand. Public reporting on sustainability efforts, diversity, and inclusion metrics, and ethical sourcing could also serve to reinforce Tesla’s values-driven identity.

Broader Implications for the EV Market

The sharp increase in Tesla trade-ins and the concurrent decline in brand loyalty carry implications that extend well beyond Tesla itself. As the electric vehicle (EV) industry continues its transition from early adoption to mass-market acceptance, these shifts offer a revealing case study into the dynamics of a maturing market, the challenges of sustaining innovation leadership, and the evolving expectations of consumers in an increasingly competitive landscape.

The End of First-Mover Advantage

Tesla’s rise was, in large part, fueled by its early-mover advantage. At a time when the rest of the automotive industry was slow to embrace electrification, Tesla offered compelling electric alternatives with performance, range, and software capabilities that were unmatched. This head start allowed Tesla to dominate the EV market for over a decade.

However, as more automakers enter the EV space with increasingly competitive offerings, the protective moat once enjoyed by Tesla has narrowed. Consumers are now more educated, discerning, and aware of the broader EV market. The loyalty that once stemmed from a lack of viable alternatives is dissipating in an environment where nearly every major manufacturer has launched or is preparing to launch multiple EV models.

Tesla’s recent struggles highlight the reality that first-mover advantage is not indefinite. It must be sustained through continuous innovation, customer satisfaction, and a refined ownership experience. Without these pillars, even the most disruptive companies can find themselves outpaced.

The Rise of Consumer-Centric EV Design

One of the most salient takeaways from Tesla’s loyalty downturn is that consumer expectations for EVs have expanded beyond range and acceleration. While Tesla still leads in areas such as drivetrain performance, battery efficiency, and charging infrastructure, competitors have focused on improving areas that significantly influence daily user satisfaction: cabin comfort, infotainment integration, intuitive controls, service convenience, and perceived value.

Brands like Hyundai, Kia, and Ford have capitalized on these preferences, designing EVs that integrate widely-used features such as Apple CarPlay and Android Auto—features Tesla still omits. In doing so, they have attracted drivers who may appreciate Tesla’s innovation but prefer a more familiar or feature-complete user experience.

The success of these competitors signals a shift: future EV success will depend not only on technical prowess but also on delivering a holistic customer experience. This includes the vehicle’s interface, its ease of service, post-sale support, and the emotional connection built through the brand narrative.

The Importance of Stability in Pricing and Policy

Tesla’s erratic pricing strategy—frequently adjusting vehicle costs without prior notice—has introduced volatility into the resale market. This approach, while useful for managing demand or production cycles, has led to consumer disillusionment. Customers who purchased a vehicle weeks prior to a major price cut often feel penalized and undervalued.

Such volatility poses broader questions for the EV market. As EV adoption increases, pricing stability becomes crucial for maintaining consumer trust and resale value. Automakers that can offer a predictable value proposition may be more successful in the long term, particularly as EVs transition from luxury goods to mass-market products.

Additionally, the resale market is foundational to fleet turnover, leasing programs, and financing structures. If early EVs depreciate too quickly, they could undermine the used EV market, deterring new buyers concerned about long-term value retention. Tesla’s experience may serve as a cautionary tale, prompting other manufacturers to be more measured in how they manage pricing and product updates.

EV Infrastructure and Support as Differentiators

Tesla’s direct-to-consumer model, enabled by online sales and a proprietary Supercharger network, was initially a major strength. However, its challenges with scaling customer service and repair facilities have shown the limits of vertical integration without sufficient infrastructure.

This development holds implications for other EV makers considering a Tesla-like approach. As more brands adopt direct sales models or limit dealership involvement, they must prepare to meet growing service demands with responsive, well-staffed support channels. Failing to do so risks alienating customers, especially those new to EV ownership who may require more guidance and assurance.

Moreover, while Tesla’s Supercharger network remains a significant asset, the industry-wide move toward shared charging standards (e.g., Tesla opening its network to other EV brands via NACS) suggests that charging infrastructure itself may soon become commoditized. In this future, customer retention will be less about who offers the fastest charger, and more about who provides the most dependable and user-friendly ownership journey.

Leadership, Brand Narrative, and Trust

Tesla’s declining brand loyalty is also a reflection of the complex relationship between corporate leadership and consumer trust. Elon Musk’s prominent public presence has undoubtedly elevated Tesla’s visibility, but it has also become a polarizing force.

The EV market is now entering a phase where alignment with customer values—on social, environmental, and ethical issues—is increasingly important. Consumers, particularly younger generations, are making purchase decisions that reflect personal identity and belief systems. As a result, brand loyalty is becoming more fluid, sensitive not only to product quality but also to corporate ethos and leadership behavior.

Other EV manufacturers would do well to observe Tesla’s experience and recognize that public perception can change quickly. In the age of social media and rapid information cycles, cultivating brand trust requires consistency, accountability, and a leadership approach that resonates with a broad audience.

A New Era of Competition and Choice

Ultimately, the shifting tide for Tesla represents a maturation of the EV market. For years, consumers had limited choices, and Tesla’s head start allowed it to command both loyalty and market share. Today, the proliferation of well-designed, competitively priced EVs from legacy and startup automakers means that consumers have real, credible alternatives.

This trend is healthy for the industry. It signals that EV adoption is no longer dependent on a single brand or personality. Instead, we are entering a new era where competition drives better products, stronger service, and more balanced power between manufacturers and buyers.

In that sense, Tesla’s trade-in crisis may be less of an existential threat and more of a turning point—for the company, and for the EV industry as a whole.

Conclusion

The rise in Tesla trade-ins and the parallel decline in brand loyalty serve as a crucial inflection point—not only for the company but for the entire electric vehicle industry. These trends are not the result of a single misstep but the cumulative impact of shifting market dynamics, evolving consumer expectations, and heightened competition.

Tesla’s initial success was built on a foundation of innovation, ambition, and a loyal customer base willing to embrace disruption. Yet as the company moves from trailblazer to incumbent, it faces a new challenge: delivering consistent quality, transparent value, and a compelling ownership experience in a market that no longer lacks alternatives.

The data is clear: more Tesla owners are leaving the brand, and fewer are coming back. While Tesla remains a technological leader, loyalty is no longer guaranteed. Buyers now weigh interior refinement, service availability, brand values, and pricing predictability alongside range and acceleration. Tesla’s competitors are closing the gap—and in some areas, surpassing it.

Still, Tesla’s story is far from over. The company possesses powerful assets: a widely recognized brand, industry-leading software, unmatched manufacturing scale, and an early foothold in charging infrastructure. If it can reorient its strategy to emphasize reliability, customer satisfaction, and long-term value—while moderating the volatility that has defined recent years—there remains ample opportunity for Tesla to rebuild trust and loyalty.

What Tesla does next will not only determine its future, but will also set the tone for the broader EV market. In an era where sustainability, innovation, and customer empowerment intersect, automakers must evolve or be left behind.

The EV revolution is no longer on the horizon—it’s here. And while Tesla may have sparked the movement, it must now earn its place in a more competitive, more demanding, and more discerning marketplace.

References

- S&P Global Mobility – Brand Loyalty in the Automotive Industry Report

https://www.spglobal.com - Edmunds.com – Tesla Trade-In Trends and Used EV Market Data

https://www.edmunds.com/industry/insights/ - Cox Automotive – Electric Vehicle Sales and Consumer Sentiment Reports

https://www.coxautoinc.com/market-insights/ - JD Power – 2024 U.S. Customer Service Index (CSI) Study

https://www.jdpower.com/business - Reuters – “Tesla Cuts Prices Again, Impacting Used Vehicle Market”

https://www.reuters.com - Automotive News – “Why EV Buyers Are Ditching Tesla for Rivian and Hyundai”

https://www.autonews.com - Bloomberg – “Tesla Faces Customer Backlash Over Repeated Price Changes”

https://www.bloomberg.com - Consumer Reports – EV Reliability and Owner Satisfaction Rankings

https://www.consumerreports.org - CNBC – “Tesla Loyalty is Slipping—Here’s Where Buyers Are Going”

https://www.cnbc.com - InsideEVs – “Tesla Trade-Ins Are Increasing: Here's Why”

https://insideevs.com - Electrek – “Tesla’s Brand Power Tested as Competition Heats Up”

https://electrek.co - Tesla Investor Relations – 2024 Q4 Earnings Report

https://ir.tesla.com - McKinsey & Company – The Future of Automotive Loyalty

https://www.mckinsey.com - AAA (American Automobile Association) – EV Consumer Behavior Survey

https://newsroom.aaa.com - EVAdoption – “Tesla Supercharger Advantage May Diminish as NACS Standard Grows”

https://evadoption.com