Strategic Leverage: How China’s Rare Earth Controls Are Reshaping U.S. Industry and National Security

Geopolitical and Economic Background Behind China’s Export Controls

Recent developments have heightened tensions over rare earth elements – a group of 17 minerals vital for high-tech products. China has long dominated this sector, mining and refining the majority of the world’s rare earth supply. Historically, Beijing has not hesitated to “weaponize” its rare earth dominance. In 2010, China abruptly suspended rare earth exports to Japan during a territorial dispute, triggering a two-year supply crisis. This spurred Japan (and later other nations) to invest in their own magnet and materials production to reduce vulnerability.

Since then, China has tightened state control over its rare earth industry via production quotas, export licensing, and technology restrictions. In 2020, China passed an Export Control Law and amended investment rules to secure greater leverage over rare earth trade. By 2021, the government consolidated major producers into a mega-firm (China Rare Earth Group) to further coordinate output and pricing. Quotas on mining and refining are raised or lowered to manage supply – for example, the 2023 quota was increased to 240,000 tonnes of ore mining and 230,000 tonnes of oxide separation. These moves keep production high but tightly managed, ensuring China can meet domestic demand while influencing global prices.

Throughout 2023 and 2024, geopolitical tit-for-tat escalated. After the U.S. imposed sweeping semiconductor export bans on China (aimed at cutting off advanced chips), Beijing retaliated with export controls on critical minerals. In mid-2023 China announced licensing requirements limiting exports of gallium and germanium – metals essential for chips and fiber-optics – and later added controls on graphite (used in batteries). While these measures were seen as a warning shot, they had measured impact because export licenses were still granted for many shipments. More ominously, in 2023 China banned exports of rare-earth magnet manufacturing technology, on top of an existing ban on rare earth separation tech. This prevents other countries from easily developing advanced magnet industries, cementing China’s downstream advantage. By early 2025, Beijing floated draft regulations to tighten control over the entire rare earth sector, signaling possible tougher quotas and enforcement ahead.

In April 2025, these trends culminated in China’s sweeping rare earth export restrictions, widely seen as retaliation to U.S. trade measures. The new rules, effective immediately, restrict exports of certain rare earth ores, oxides, and especially finished products like powerful neodymium-iron-boron magnets. Notably, Beijing targeted heavy rare earth elements – such as dysprosium, terbium, lutetium, samarium, scandium, and yttrium – placing them on a controlled list. These heavies are crucial for high-performance magnets and other applications and are an area of near-total Chinese dominance. Although framed as broad export controls (applying to all countries), the move clearly pressures the West, especially the United States. It demonstrates China is willing to “escalate” by leveraging its resource dominance as a strategic tool. In effect, China is using rare earths as a geopolitical bargaining chip in response to U.S. sanctions – a strategy of “deny us chips, we’ll deny you minerals”.

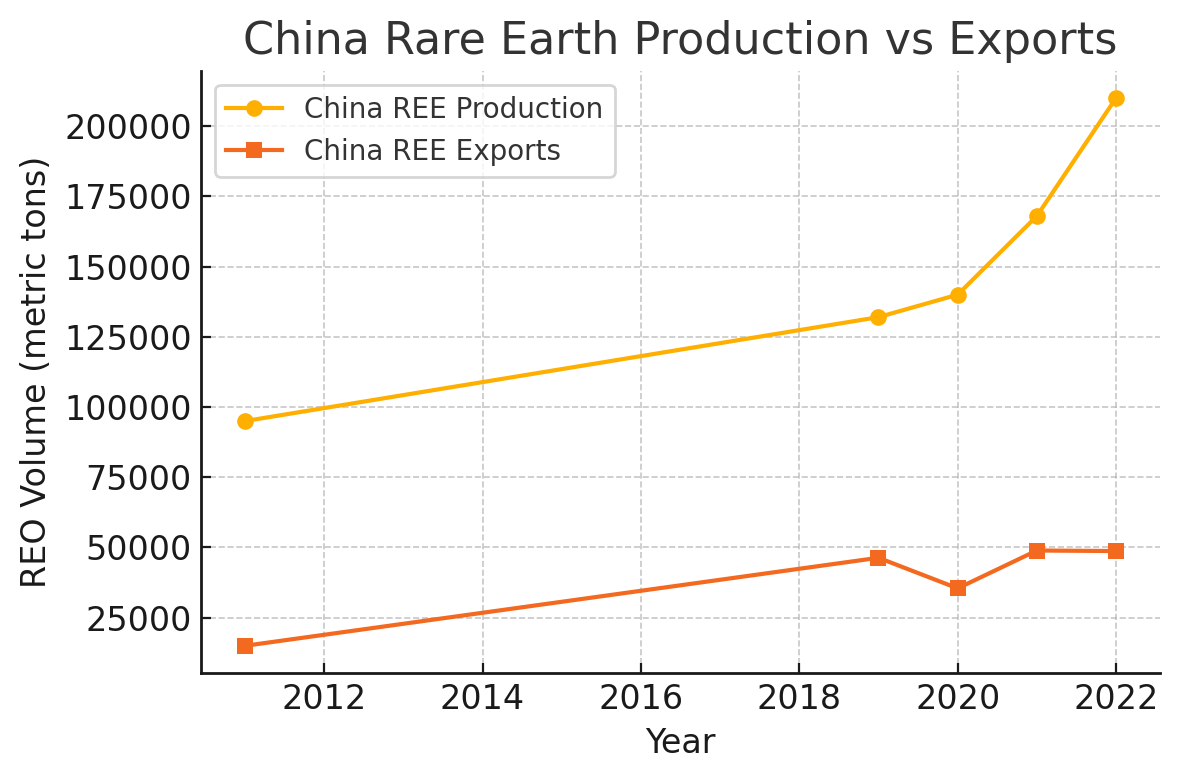

Economically, these restrictions threaten supply chains because China still produces about 60–70% of global rare earth ores and an even greater share of refined products. Even when other countries mine rare earths, they often send them to China for processing, giving Beijing chokehold control. As Chart 1 below illustrates, China’s rare earth production has grown over time and far exceeds the volume it exports – China now consumes much of its output for domestic industries, which means Western importers rely on the portion China chooses to sell abroad. When that export tap is tightened, global supply contracts sharply.

Chart 1: China’s rare earth mine production vs. exports over time (in metric tons of REO – rare earth oxide equivalent). China’s output (yellow line) has risen in recent years, reaching ~240,000 t in 2023. However, China exports only a fraction of what it produces (orange line). In 2020, exports fell to ~35,000 t – the lowest level since 2015 – as China stockpiled material for domestic use. Even in 2022, exports (~48,700 t) were barely one-fifth of China’s production. This gap highlights China’s strategy of keeping more supply for itself and limiting what reaches global markets.

By exploiting this imbalance, China’s export curbs “squeeze supply to the West”, forcing U.S. manufacturers to scramble for alternate sources. Beijing’s message is clear: it can choke off critical mineral supply chains at will, creating economic pain for U.S. industries as leverage in broader geopolitical negotiations. This backdrop sets the stage for why rare earth export restrictions are so concerning for the United States and its high-tech economy.

Rare Earth Elements in Modern Technology and Key U.S. Industries

Rare earth elements (REEs) may be obscure, but they form the hidden backbone of modern technology. They possess unique magnetic, luminescent, and electrochemical properties that make them essential in a wide array of applications. In fact, it is hard to overstate their ubiquity – from smartphones in our pockets to the defense systems that protect nations, rare earths are everywhere.

Clean energy and transportation: A major use of REEs is in permanent magnets, specifically neodymium-iron-boron (NdFeB) magnets, which are the strongest magnets known. These magnets are at the heart of electric vehicle (EV) motors and wind turbine generators. For example, the drive motors in many EVs use neodymium and praseodymium (Nd-Pr) magnets, often with dysprosium or terbium added to maintain magnetic strength at high temperatures. Similarly, most large wind turbines (especially offshore models) employ direct-drive generators with NdFeB magnet assemblies. As a result, the rapid growth of EVs and wind power has made these sectors huge drivers of rare earth demand. According to the International Energy Agency, demand for rare earth elements – primarily for EV motors and wind turbines – is projected to grow threefold by 2040 under current policies, and over sevenfold under accelerated clean energy scenarios. This reflects how critical REEs are to the green transition. Every electric car or wind turbine installed means a few more kilograms of neodymium, praseodymium, dysprosium, or terbium are needed in magnets (and there are few easy substitutes of comparable efficiency).

High-tech and consumer electronics: Rare earths also enable the miniaturization and performance of countless gadgets. Neodymium magnets are used in smartphone speakers and vibration motors, laptop hard drives, and earbuds. Europium and terbium are key to LED displays and lighting – europium provides the red phosphor in LED and LCD screens, while terbium is used in green phosphors and in compact fluorescent bulbs. Yttrium is another phosphor ingredient and is part of the red color in older TV picture tubes and modern LED lights. Without rare earth phosphors, we would not have the bright, energy-efficient displays and lights we take for granted. Furthermore, rare earth elements like lanthanum, cerium, and erbium find use in glass and optics: lanthanum enhances optical glass (such as camera lenses and smartphone lenses) by improving refractive index and reducing distortion, while erbium-doped fiber amplifiers are crucial for long-distance fiber-optic communication lines. In short, our tablets, TVs, headphones, and fiber internet owe some of their capabilities to rare earth materials working behind the scenes.

Defense and aerospace: The U.S. defense industry is heavily dependent on rare earths for advanced weapons and systems. An F-35 fighter jet, for instance, contains around 920 pounds of rare earth materials in its avionics, electric motors, and other components. Precision-guided munitions, missile fins, and control systems often rely on samarium-cobalt or neodymium magnets for actuators and guidance. Night-vision goggles use lenses made with lanthanum and phosphors with rare earths to improve image clarity. Laser targeting and rangefinders employ neodymium-YAG (yttrium aluminum garnet) lasers. Even the electric motors and generators in naval ships and aircraft are increasingly using rare-earth magnets for high power density. In sum, from stealth helicopters to satellites, rare earths are embedded in defense tech. The Pentagon has identified at least 14 critical military systems – including jets, drones, space communications, and missile defense – that rely on rare earth elements. This is why officials have warned that China’s control of these materials is a national security vulnerability: modern militaries cannot maintain their edge without steady access to rare earths.

Industrial and other uses: Several heavy industries utilize rare earths as well. Petroleum refining depends on a rare-earth catalyst (a mix of lanthanum and cerium oxides) in fluid catalytic cracking units to produce gasoline. A shortage of lanthanum/cerium could disrupt refinery outputs. Manufacturing of glass and ceramics uses cerium for polishing glass to a high sheen (like silicon wafers or camera lenses) and various rare earths for color pigments or to decolorize glass. In medicine, MRI machines use gadolinium contrast agents (a rare earth) to improve imaging, and X-ray machines use rare-earth-doped components to enhance imaging. Even agriculture and environmental tech use REEs in small amounts (for example, cerium oxide is used in catalytic converters to reduce vehicle emissions, and lanthanum is used in water treatment to remove phosphates).

This broad spectrum of uses means that any disruption in rare earth supply will ripple across multiple U.S. industries – from Silicon Valley to Detroit to the Pentagon. Notably, clean energy technologies, high-tech manufacturing, and defense – all strategic sectors for the country’s future – are the ones most sensitive to rare earth availability. Demand for these elements is only rising: industry reports estimate global consumption of rare earth oxides reached ~164,000 tonnes in 2022 and could increase by ~40% to 231,000 tonnes by 2032 due to growth in EVs, renewables, and electronics. In summary, rare earths are truly “vitamins” of modern industry – small in volume but vital in function. U.S. businesses have built products around these materials for their unique properties, and now face the challenge of securing them amid geopolitical headwinds.

U.S. Dependency on Chinese Rare Earths and Supply Vulnerabilities

For the past two decades, the United States has become deeply reliant on China as the primary source of rare earth materials. This dependency spans the entire supply chain – from mined ore to refined oxides to finished magnet products. The numbers are stark: from 2019–2022, about 72% of U.S. rare earth compound and metal imports came directly from China. The remainder mostly came from allies like Estonia, Japan, and Malaysia – but even those supplies ultimately originate from Chinese or Chinese-processed raw material (for example, Estonia and Malaysia host processing plants that refine ores shipped from China or Chinese-owned mines). In effect, well over three-quarters of U.S. rare earth supplies depend on China when one traces the source to the root. The U.S. Geological Survey has noted that America’s net import reliance for rare earths has been effectively 100% of consumption for years, and China is by far the largest contributor to that import volume.

This heavy dependency is a result of globalization and past policy choices. The U.S. was once a leading rare earth producer – e.g. the Mountain Pass mine in California was a top global supplier in the 1980s. But by the early 2000s, China’s lower-cost operations (aided by cheaper labor and lax environmental regulations) undercut U.S. mines, leading to mine closures. China also built up a complete domestic supply chain, from mining to refining to metallurgical alloying and magnet manufacturing. In contrast, the U.S. supply chain atrophied. Today, the U.S. has only one active rare earth mine – Mountain Pass – which was restarted in limited fashion by MP Materials. However, that mine currently ships its concentrated ore to China for separation and refining, due to the lack of U.S. processing capacity. In other words, even when the U.S. mines rare earth ore, it must send it to China to become usable oxides and metals! This arrangement means China effectively controls the midstream and downstream of rare earth production. As of 2023, China held around 90% of global capacity for refining rare earth oxides and an overwhelming share of capacity for producing rare earth magnets and alloys. The “chokepoint” is processing: even if rare earths are mined elsewhere, nearly all roads lead to China for refinement. American companies end up buying finished rare earth materials or components (like magnets) from Chinese producers, since those aren’t made domestically at scale.

This supply chain structure creates a serious vulnerability. The U.S. is exposed to single-source risk: a disruption in China – whether due to export restrictions, political conflict, or even internal issues in China’s industry – could instantly cut off the lifeline of critical materials. Unlike oil, where the U.S. can turn to multiple countries for supply, in rare earths there are very few alternative producers ready to meet U.S. demand in the short term. Australia’s Lynas Corp is the only significant rare earth miner/refiner outside China (producing perhaps 5–6% of global supply), and much of its output is contracted to Japan. Other countries like Myanmar, Vietnam, and India have modest production, but often those feed into China’s chain or are not readily accessible to U.S. buyers. As a result, the concentration of supply is extreme. In 2022, China accounted for about 70% of global mined rare earths and an estimated 87% of refined rare earth products. The U.S. Department of Defense has warned that such dominance gives China a strategic stranglehold: it could prioritize its domestic needs and friendly customers, while leaving U.S. companies in a lurch.

Another aspect of U.S. vulnerability is lack of stockpiles and substitutes. Some materials can be substituted in a pinch or stockpiled during good times. Rare earths are challenging on both fronts. Technically, there are some substitutes – for instance, electric motors can use non-rare-earth magnet designs (like induction motors) and some types of lasers or lighting can use alternative materials – but these substitutes generally come with performance or efficiency penalties. For many critical applications (e.g. weight-sensitive aerospace components or miniaturized electronics), using a non-rare-earth solution would mean a significant downgrade. Meanwhile, strategic stockpiles of rare earths in the U.S. have been minimal. The U.S. government did begin small-scale stockpiling recently – for example, acquiring 100 tons of NdFeB magnet blocks in FY2023 and planning for a few hundred tons of oxides and alloys in FY2024 – but these quantities are dwarfed by industry needs. (For context, a single large wind turbine can contain 2–3 tons of rare earth magnets, and a Virginia-class submarine contains over 4 tons of rare earth materials.) The current stockpile would cover only a brief disruption or a narrow set of uses. Private companies typically don’t hold big inventories either, following “just-in-time” supply practices. This means the U.S. has little buffer if imports from China suddenly stop or slow.

The present dependency also leaves little bargaining power to U.S. buyers. Chinese suppliers (often with state backing) could raise prices or allocate supply preferentially, leaving American firms facing higher costs or shortages. Indeed, in past instances when China tightened export quotas (2010) or imposed tariffs, rare earth oxide prices spiked dramatically on world markets. A ten-fold price spike occurred in 2010–2011 for some oxides when Chinese export quotas shrank, which badly hurt non-Chinese companies that depended on those materials. Such volatility can be ruinous for manufacturers’ production schedules and R&D budgets.

Finally, U.S. dependence is compounded by the fact that rare earth content is often embedded in imported components – for example, if the U.S. buys electric motors or wind turbine nacelles from overseas, it is indirectly “importing” rare earths. These indirect imports (in finished goods) are harder to track but likely increase the true dependency beyond the raw import stats. A large portion of rare earths effectively comes from China even if routed through third-party manufacturing hubs.

In summary, the U.S. finds itself in a position where it must rely on its main strategic competitor for essential inputs to cutting-edge industries. This is a precarious spot. A recent Bloomberg analysis noted that multiple U.S. sectors would be at risk if China even partially curbs rare earth exports – it’s a single point of failure in supply chains. As tensions mount, this vulnerability has become a front-burner issue for economic and national security planners.

Short-Term and Long-Term Impacts on Industries

China’s rare earth export restrictions, whether threatened or enacted, are poised to have significant ripple effects across U.S. industries. The severity of impact can be considered in two timeframes: the short term (next 0–2 years), where supply is relatively fixed and shock absorption is limited, and the long term (3–10+ years), where industries may adapt or find alternatives but also face cumulative consequences if shortages persist.

Short-Term Impacts: Supply Shocks, Price Spikes, and Production Disruptions

In the immediate term, a cutback in Chinese rare earth exports would act like a sudden supply shock. U.S. companies that depend on these materials could struggle to secure enough supply, leading to production delays, increased costs, or even shutdowns of manufacturing lines in extreme cases. Key sectors and examples of short-term effects include:

- Automotive (Electric Vehicles): U.S. and global automakers have aggressive EV production targets. These plans assume a steady availability of rare earth magnets for motors. If magnets or magnet alloys from China become scarce, EV manufacturers could face assembly line slowdowns due to missing components. Tesla, for instance, uses rare earth magnets in its Model 3 and Model Y motors; Ford and GM rely on suppliers who source magnets from China. With fewer magnets available, automakers might be forced to produce fewer EVs or substitute less efficient motor designs. In the short run, there are limited ready substitutes – redesigning motors takes time. Therefore, the likely scenario would be higher costs (as remaining magnet supply gets bid up) and potential delays in new EV model rollouts. Consumers might see longer wait times or higher prices for electric cars. Traditional gasoline vehicle production could also feel an indirect pinch: rare earths like cerium and lanthanum are used in catalytic converters and refinery catalysts, so a shortage could hamper fuel production or increase costs, eventually affecting gasoline car supply.

- Defense and Aerospace: The defense industry typically maintains some inventory of critical components, but a prolonged export restriction could deplete those quickly. Missile and precision weapon production is one area of concern – many use actuators with samarium-cobalt or NdFeB magnets. If Chinese exports of samarium or neodymium alloys are throttled, missile manufacturers might face component shortages that slow down delivery schedules for the U.S. military. Similarly, aircraft avionics and radar systems rely on specialized rare earth-containing components (garnet crystals, radar absorbent materials, etc.). Two U.S. aerospace suppliers told Reuters that certain avionics are sole-sourced from China in terms of critical rare earth inputs – meaning if those inputs dry up, production halts. While the Pentagon can prioritize defense needs (even reallocating some stockpiles for contractors), it cannot instantly make new suppliers appear. Thus, in the short term, we could see delays in weapons programs, higher costs for the DoD (as it seeks non-Chinese sources), and urgency in rationing what stock of rare earth materials exists for the most critical defense uses. On a related note, maintenance of existing platforms (jets, tanks, ships) might encounter issues if spare parts containing rare earths become scarce.

- Green Technology and Energy: Besides EVs and wind turbines, other green tech could feel strain. For example, high-efficiency solar panels use small amounts of certain rare earths (like neodymium in some thin-film technologies). Energy-efficient lighting (LEDs) uses europium and terbium. A sudden shortage might slow the deployment of renewable infrastructure or make it more expensive, just at a time when climate initiatives are accelerating. The power grid industry also uses rare-earth-based high-performance magnets in some advanced motors and sensors; grid storage battery systems sometimes use rare earth-containing components as well. In the short run, wind turbine manufacturers outside China (like GE Renewables) could face project delays if they cannot get enough magnets – potentially missing deadlines for new wind farm installations. This could set back renewable energy goals in the near term.

- Electronics and Tech Gadgets: Companies producing consumer electronics (smartphones, laptops, audio equipment) typically have diversified supply chains and can buffer short disruptions by drawing on existing inventory. However, if an export curb lasts many months, supplies of key rare earth-based components (like neodymium magnets for speakers, or terbium and europium for LED backlights) could dwindle. Tech companies might have to prioritize high-margin or flagship products for the available material, while cutting production of lower-end devices. Prices for certain electronics could creep up. The tech industry’s concern in the short term would be price volatility – even if they can get the materials, the cost might spike, squeezing profit margins in an industry used to continuously falling costs.

Across these sectors, one immediate effect of any perceived rare earth scarcity is price spikes on global markets. We already saw market reactions in 2023–2024: when China hinted at export restrictions, rare earth oxide prices climbed and buyers rushed to secure supplies. For instance, dysprosium and terbium prices (used in magnets) rose on the anticipation of tighter Chinese export quotas. In a full-blown restriction scenario, prices could shoot up dramatically (just as they did in 2010). This has the effect of raising manufacturing costs for U.S. industries in the short term. Companies might pass some of this to consumers (e.g. more expensive EVs), and in other cases they might just absorb losses or delay production hoping prices stabilize.

Finally, a short-term restriction would likely cause manufacturers to panic buy and hoard whatever rare earth materials they can find. This “scramble” was noted by analysts when China’s new controls were announced – companies would race to grab limited non-Chinese sources (such as stock from Lynas in Malaysia or recycled material from wherever available). However, alternative sources are extremely limited in the short run. Japan and South Korea do have some rare earth stock and magnet production, but not nearly enough to fulfill U.S. and global shortfalls. Such a rush could also strain relationships as countries and companies compete for scraps of supply.

In summary, the short-term impact of Chinese export restrictions would be characterized by supply scarcity and heightened costs, leading to slowdowns in manufacturing output in critical sectors. While not an immediate full stop for U.S. industry (existing inventories and partial alternate supplies might cushion the blow for a few months), it would be a significant disruption. As one U.S. magnet company executive put it, the biggest worry is whether the trade conflict “grows further,” potentially forcing firms into an untenable position if it cuts off their access to essential materials.

Long-Term Impacts: Forced Diversification, Redesign, and Competitive Shifts

If China’s rare earth restrictions were to persist over the long term (several years), or if the threat of restriction remains high, U.S. industries would undergo more profound changes. Necessity would drive adaptation, but not without costs and strategic consequences:

- Supply Chain Reconfiguration: In the long haul, U.S. companies will not sit idle in the face of chronic material shortages. They would aggressively seek to diversify their supply chains away from China. This could mean relocating manufacturing to countries where rare earths are not embargoed, or contracting suppliers in allied countries. For example, an electric motor manufacturer might invest in a magnet production facility in Vietnam or India (assuming those countries can import Chinese rare earth feedstock or develop their own mines). Some downstream production might shift to places like Malaysia, Japan, or Australia, where rare earth processing exists or is being developed. However, such reconfiguration has lead times. It might take years for new facilities to come online and qualify. In the interim, if Chinese material remains off-limits, some U.S. industries could scale down production targets. For instance, automakers might revise EV rollout plans downward if magnet supply remains constrained, potentially ceding ground to competitors (perhaps Chinese EV makers, who have secure domestic access to rare earths).

- Technology Substitution and Innovation: A prolonged shortage would spur innovation in material science to reduce dependence on rare earths. We could expect accelerated R&D into rare-earth-free alternatives. One area already under exploration is magnet technology: companies like Japan’s Nidec and U.S.-based startups are researching motors that use either no rare earths or lighter rare earths. Induction motors (which use copper windings instead of magnets) could see a comeback in EV designs if NdFeB magnets stay expensive – Tesla announced in 2023 that its next-gen motors will use no rare earths, likely in anticipation of supply risk. Similarly, wind turbine makers might invest in electromagnetic direct-drive systems without permanent magnets, albeit at efficiency costs. New magnet chemistries are another avenue: the U.S. Department of Energy is funding projects to develop iron-nitride magnets and other novel materials that could mimic rare earth magnet performance without using critical REEs. Over several years, some of these innovations could reach viability, partially mitigating demand. However, re-engineering products is expensive and time-consuming; companies would prefer not to do it unless absolutely necessary. High prices and uncertain supply over many years might provide that motivation. In defense, where design changes are difficult once a system is deployed, the Pentagon might push for developing substitute materials for things like jet engine sensors or missile components, or at least aim to thrift the amount of rare earths used (using less by improving efficiency).

- Domestic and Allied Production Growth: Long-term, one positive impact of China’s restrictions (paradoxically) could be that it galvanizes Western production. The shock of limited Chinese supply makes mining projects and processing plants elsewhere much more attractive (as investors see a guaranteed market). We could expect dormant rare earth deposits in the U.S., Australia, Canada, and Africa to receive fresh investment. Mines that were previously uneconomical could become viable as rare earth prices stay elevated. Over, say, 5–10 years, this could lead to a more diversified global production: perhaps the U.S. restarts significant operations (beyond Mountain Pass), Australia increases output, and countries like Brazil, Vietnam, or Tanzania develop new mines. Notably, Brazil’s new Serra Verde mine began producing some rare earth concentrate and could expand output. However, even in optimistic scenarios, China would likely remain a major player; it’s simply that the non-China share of supply would grow relative to today. The long-term effect could be a more resilient global supply chain by 2030 or later – but only after a difficult transition period. In the interim, industries might suffer from higher costs. There is also a risk that if China senses its leverage waning (due to new suppliers coming online), it could flood the market at a later stage to crash prices, undermining those new projects – a tactic it has used before to maintain dominance. Companies and governments will be wary of that possibility.

- Competitive Landscape Shifts: If rare earth shortages persist, some industries might see a reshuffling of competitive positions internationally. For example, Chinese companies could gain an edge in downstream products like electric vehicles, wind turbines, or electronics, because they have secure access to rare earth materials domestically, whereas their Western rivals might be constrained. In EVs, if U.S. and European automakers can’t get enough magnets and have to use alternative motors that are heavier or less efficient, their cars might have slightly lower performance or higher weight compared to Chinese EVs optimized with the best magnets. Over years, this could affect market share in the auto industry, with ripple effects on jobs and economies. Similarly, consumer electronics assembled in China might face less supply pressure (since China could prioritize domestic needs) than electronics assembled in, say, South Korea or the U.S. The center of gravity of certain tech manufacturing could tilt further toward China or countries within China’s orbit of supply. This is a long-term strategic concern for the U.S. – the risk of losing technological leadership if materials constraints hamper innovation or production.

- Environmental and Cost Impacts: Long-term scarcity of rare earths might push companies to make do with older, less efficient tech. For instance, if wind turbine manufacturers can’t source enough neodymium, some might produce more gear-driven turbines instead of direct-drive – those are heavier and require more maintenance (thus slightly reducing the efficiency gains of wind power). If EV makers use induction motors, the cars might be a bit less efficient, possibly requiring larger batteries (which in turn need more lithium, nickel, etc.). So one trickle-down effect is that solving one bottleneck (rare earths) might worsen others (demand for different critical minerals goes up). These substitutions could also be less climate-friendly or economical. In essence, a prolonged rare earth pinch could slow the clean energy transition or make it more expensive, if key technologies can’t use the optimal materials.

In summary, the long-term impacts of sustained Chinese rare earth export restrictions would be a mix of pain and progress. Pain, because U.S. industries would face higher costs, forced redesigns, and possibly lost opportunities in the interim. But also progress, in that it would likely catalyze serious efforts to establish a more resilient supply chain – from reopening mines to inventing new materials. Policymakers would be under pressure to never again allow one country to hold such sway over vital resources, meaning we’d see strategic investments in diversification. The transition, however, could take the better part of a decade, and in that time the industries affected might experience slower growth or shifts in global competitiveness. Essentially, China’s move could accelerate a decoupling in the rare earth domain, with the West working fervently to reduce reliance – but not without significant growing pains for U.S. industries in the meantime.

U.S. Responses: Building Domestic Capacity, Recycling, and Alliances

Facing the dual reality of current dependency and future threats, the United States has begun mounting a multi-pronged response to secure its rare earth supply chains. These efforts include revitalizing domestic production and processing, promoting recycling and substitutes, diversifying sources with allies, and investing in stockpiles and R&D. While still in early stages, the initiatives underway aim to reduce U.S. vulnerability and ensure that critical industries have sustainable access to rare earth materials. Below are the key strategies and actions being pursued:

- Restarting and Expanding Domestic Mining: A cornerstone of U.S. strategy is to boost the extraction of rare earths on American soil. The Mountain Pass mine in California – once the world’s top REE producer – is central to this. MP Materials, which operates Mountain Pass, has ramped up production of rare earth concentrates (approximately 43,000 tons in 2023, up from virtually zero a decade prior). However, mining is just step one; the U.S. is pushing to add value-added processing domestically so that ore doesn’t have to be sent to China. In 2021, the Pentagon (Department of Defense) awarded $45 million to MP Materials to build a rare earth oxide separation facility at Mountain Pass. This plant, now in development, aims to refine Mountain Pass ore into high-purity neodymium-praseodymium oxide and other products on-site. Likewise, DoD granted over $120 million to Australia’s Lynas Corp to establish a commercial-scale processing facility in Texas. Lynas is the largest non-Chinese miner (operating Mt. Weld in Australia and a refinery in Malaysia) and will bring its expertise to the U.S., focusing especially on heavy rare earth separation which is crucial for dysprosium and terbium. If these projects succeed, by the mid-2020s the U.S. could have the capacity to independently produce refined rare earth oxides, reducing the need to import from China.

- Developing Domestic Magnet Manufacturing: The U.S. is also targeting the end-product segment – permanent magnets – which is critical for defense and EV industries. Through Defense Production Act funding and the Inflation Reduction Act incentives, over $150 million has been invested in new magnet production facilities. For example, E‑VAC Magnetics received about $94 million from DoD to establish a factory in South Carolina to produce Neodymium-Iron-Boron magnets at scale. E-VAC also got tax credits for this plant. Similarly, MP Materials is building a magnet manufacturing plant in Fort Worth, Texas, slated to supply magnets for GM’s EV motors; it was allocated nearly $60 million in clean energy tax credits. Once operational (expected by 2025), MP’s Texas plant could produce enough magnets for 500,000 EVs per year. These investments aim to create a “mine-to-magnet” supply chain entirely within the U.S.. In other words, rare earths mined in California would be refined and then turned into finished magnets domestically, feeding directly into American manufacturing lines (for motors, generators, etc.). Achieving this would be a historic shift, as the U.S. has had virtually no magnet production for decades. It’s driven not just by economic aims but by security – e.g., ensuring missiles and fighter jets can use American-made magnets so that supply can’t be cut off. The Biden Administration even directed the U.S. Trade Representative to raise tariffs on imported Chinese magnets by 2026 to protect these nascent domestic producers from being undercut by cheap imports.

- Recycling and Urban Mining: Another prong is to reclaim rare earths from existing products and waste. Recycling can’t fully substitute for mining (given current low recycling rates), but it can provide a supplementary source and is more viable as prices rise. Companies like Phoenix Tailings and Urban Mining Co. are pioneering rare earth recycling in the U.S. Phoenix Tailings, for instance, is scaling up processes to extract rare earth oxides from electronic waste and industrial byproducts, targeting an increase from 40 tons recycled per year to 4,000 tons by 2027. This includes recovering neodymium and dysprosium from old hard drives, motors, and magnets. Another approach is magnet-to-magnet recycling: recovering magnets from end-of-life electric motors or wind turbines, reprocessing them into new magnet alloy. The Department of Energy has funded research in this area and some pilot facilities exist. While recycling currently supplies only a few percent of demand, it has potential to grow. Notably, recycling helps reduce dependence on mining and can be ramped up faster in some cases. It also mitigates environmental impact. Over the long term, establishing efficient recycling pipelines (for example, requiring EV manufacturers to help recycle motors at end-of-life) could provide a strategic reserve of rare earths independent of foreign sources. The U.S. government’s critical materials strategy includes recycling as a key component, and recent laws have offered grants for recycling projects (e.g., the DOE’s $3 billion battery supply chain investment also covers recycling facilities, which can include rare earth recovery from battery motors).

- Allied Partnerships and Diversification: The U.S. is also working closely with allies to create a collaborative supply chain outside of China. Through groups like the Minerals Security Partnership (MSP) – a coalition of countries including Australia, Canada, the EU, Japan, and others – the U.S. is supporting mining and refining projects globally. For example, the U.S. and Australia have a longstanding partnership on critical minerals: besides Lynas’s investment in the U.S., Australian mines (like Northern Minerals’ Browns Range project) aim to supply heavy rare earths such as dysprosium and terbium to the global market. The Quad nations (U.S., Japan, India, Australia) have also discussed pooling efforts on rare earth supply. Japan, which faced its own rare earth scare in 2010, has built a strategic stockpile and invested heavily in Lynas to ensure a non-Chinese supply – the U.S. benefits indirectly from those efforts as well. Additionally, the U.S. has engaged with Canada (which has several early-stage rare earth projects) and European nations on information sharing and co-investment to stand up new sources. A notable partnership is with Japan and the EU on recycling and research – sharing technology to extract rare earths from used products. On the diplomatic front, the U.S. has worked through the WTO in the past to challenge China’s export restrictions (and won a 2014 case that forced China to drop official export quotas). Now, instead of legal challenges, the emphasis is on collective resilience: essentially creating a non-China supply network. This includes potential trade agreements for critical minerals – for instance, in 2022 the U.S. and Japan signed a trade deal on EV battery minerals which, while focused more on lithium/nickel, also symbolically includes cooperation on rare earths. The U.S. and EU are discussing similar arrangements to treat critical minerals from each other’s mines as part of “domestic” supply for incentives, thereby encouraging cross-investment.

- Stockpiling and Strategic Reserves: Learning from the past (when the U.S. had a national stockpile of rare earths during the Cold War), the government has restarted modest stockpiling efforts. The National Defense Stockpile managed by the Defense Logistics Agency has been authorized to acquire certain amounts of rare earth materials. As noted, FY2023 saw purchases of NdFeB magnet blocks, and plans for FY2024 include hundreds of tons of rare earth oxides and alloys. This is still a relatively small reserve, but it’s a start toward a buffer that could supply defense contractors and critical industries for some period if imports are cut. There are proposals in Congress to allocate more funding to expand this stockpile. The idea is to have at least enough material on hand to weather a short-term crisis while other supply lines are activated. Additionally, private stockpiling might be quietly encouraged – for example, urging companies to keep larger inventories. However, holding inventory is costly, so it often requires government incentive or ownership to happen at scale. In essence, rebuilding a strategic reserve of rare earth elements is akin to having an insurance policy against supply shocks.

- Research and Development: Underpinning all these efforts is significant R&D investment. The U.S. government has increased funding for programs like ARPA-E (Advanced Research Projects Agency–Energy) and the DOE’s Critical Materials Institute to innovate on both supply and demand sides. This includes finding more efficient extraction methods (such as bio-mining or new solvents that can separate rare earths with less waste), developing alternative materials (as discussed, rare-earth-free magnets, new phosphors, etc.), and improving recycling technologies (to capture a higher percentage of REEs from used products). The Department of Defense is also funding R&D specifically for defense needs – for example, exploring whether certain defense systems can be redesigned to use fewer rare earths without performance loss. Another thrust is mapping and evaluating domestic resources: the USGS is actively surveying for rare earth deposits in the U.S. (including undersea resources and unconventional sources like coal mine byproducts) to understand what the potential is for increasing domestic mining if needed. All of this R&D is aimed at breaking the current bottleneck by innovating out of it, ensuring that in a decade the landscape of material options and sources looks very different from today.

These response measures, many initiated in the last 3–5 years, indicate a strong policy shift: the U.S. is treating rare earth supply security as a top priority for economic and national security. It is worth noting that progress will take time – mining projects can take 5–10 years to reach production, factories take a couple of years to build and ramp up, and R&D breakthroughs don’t happen overnight. But the wheels are in motion. The 2024 White House fact sheet explicitly stated that after years of ceding ground, the U.S. is “now winning the competition for the 21st century” by investing heavily in critical mineral supply chains and reducing reliance on “unreliable supply chains”. That reflects a confidence that these actions will, in time, bear fruit.

One concrete outcome to aim for is that by the late 2020s, the U.S. and partners have a sufficiently robust network – multiple mines (U.S., Australia, etc.), multiple refineries (U.S., Europe, Asia outside China), and magnet plants – such that a Chinese export ban would no longer paralyze industry. The U.S. response is essentially about creating redundancy and resilience. Meanwhile, every new announcement from China (like the 2025 export control categories) tends to redouble U.S. efforts. As Jacob Gunter of MERICS noted, China’s restrictive moves are likely to “galvanize efforts in the West to build alternative supply chains,” even if progress has been slow so far.

The coming years will test how quickly these U.S. and allied initiatives can scale up to fill the gap. The good news is that awareness is higher than ever, and significant funding – both public and private – is now flowing into this once-neglected sector, marking the beginning of a more resilient era.

Future Outlook: Policy, Innovation, and Supply Chain Resilience

Looking ahead, the interplay of Chinese policy moves and U.S./allied responses will determine how this rare earth saga unfolds. The status quo – where China is the near-monopoly supplier and the U.S. is heavily import-dependent – is poised to change over the coming decade. The big questions are: how quickly can alternatives come online, and how will China react in turn? The future likely holds a mix of continued geopolitical maneuvering, accelerated innovation, and gradual realignment of supply chains. Here are key aspects of the future outlook:

- Intensified Geopolitical Jockeying: Rare earth elements have clearly become a piece on the geopolitical chessboard. We should expect China to continue using them as leverage in broader negotiations (trade deals, tech sanctions, etc.). If U.S.–China relations remain strained, China might tighten restrictions further, possibly extending controls to light rare earths or finished products like rare earth metals and alloys. (Already, as of 2025, China’s export control list covers some magnet alloys and high-purity metals, not just raw oxides.) On the other hand, China also risks overplaying its hand – an overly aggressive restriction could backfire by permanently driving customers away and incentivizing massive investment in alternatives. Thus, China may calibrate its policies, perhaps using the “titrate effect” (restrict just enough to cause discomfort and gain negotiating points, but not so much as to collapse the market or invite a WTO challenge). The U.S. and allies, for their part, will likely strengthen their collective stance: forming coalitions to call out any Chinese export violations of trade rules and coordinating strategic stock releases among themselves if needed. We could see, for instance, G7 or Quad statements on rare earth supply security becoming regular, and even an international stockpile sharing mechanism in crises.

- Diversified Supply by 2030: By the end of this decade, the rare earth supply picture is expected to be more diversified. Projects in Australia (e.g. Lynas’s Mt Weld expansion, Northern Minerals), the U.S. (Mountain Pass fully integrated, possibly Texas heavy RE separation), Canada (various exploration projects), and Africa (projects in Tanzania, Namibia) could be producing meaningful volumes. According to industry forecasts, non-Chinese sources might double their output by 2030, potentially reducing China’s share of global production from ~70% to perhaps ~50% or even lower. If U.S. and allied governments continue to financially back these projects (recognizing that market forces alone might not suffice due to China’s price influence), this timeline could be accelerated. The creation of allied supply chains also means that Western companies might have long-term contracts or offtake agreements ensuring supply from these new sources. For example, we may see European automakers buying rare earths from a Canadian mine, or U.S. defense contractors signing deals with Australian suppliers. Supply chain resilience will improve as a result – the goal being no single point of failure.

- Emergence of Rare Earth “Free” Technologies: By 2030–2035, we will likely see some technologies that today rely on rare earths manage to lessen or eliminate that need. In automobiles, if Tesla’s promise of a rare-earth-free motor holds, competitors will follow with similar designs, especially if rare earth prices remain high. Wind turbine manufacturers are exploring hybrid designs that need fewer heavy rare earths (dysprosium/terbium). In consumer electronics, trends like moving from discrete hard drives (which use Nd magnets) to solid-state drives (which do not) automatically reduce rare earth use. Substitution won’t eliminate rare earth demand – because performance requirements in many applications will still favor rare earth magnets and materials – but it will temper demand growth. Notably, ARPA-E’s investment in iron-nitride magnet development could, if successful, yield magnets suitable for some uses (perhaps EV motors) that cut neodymium use. Additionally, engineers might find ways to “thrift” rare earth usage: e.g., magnet manufacturers could reduce the content of Dy/Tb needed through better grain alignment or new alloying techniques. Over the long term, the world could shift to a scenario where rare earths are still important but used more sparingly and cleverly, stretching each ton further. Innovation will be crucial here, and it’s an area where open collaboration among Western countries (sharing research findings) could hasten progress. The U.S. government’s continued support for such R&D is likely, given bipartisan understanding of the issue’s importance.

- Sustained High Demand and Market Growth: Even with some thrifting and substitution, the overall demand trajectory for rare earths is strongly upward through mid-century, driven by the clean energy transition and growing high-tech adoption. Electric mobility and renewable energy will keep rare earths in high demand, especially if global EV sales and wind deployments hit the aggressive targets set in climate plans. The International Energy Agency projects that in a scenario meeting global climate goals (net-zero by 2050), rare earth demand for clean energy technologies would be over seven times higher in 2040 than in 2020. So even if supply diversifies, the market will likely remain tight. We may very well see a period of structurally higher prices for rare earth elements in the coming decade relative to the 2010s, as new producers often have higher costs (complying with stricter environmental standards, etc.). This could make rare earth mining a more financially sustainable industry outside China (good for those producers), but it means industries using rare earths will need to plan for elevated input costs. It also means recycling becomes more economically attractive as prices rise.

- China’s Role Evolving: How will China respond long-term to Western supply chain shifts? One possibility is that China, to avoid losing its market, might adjust its strategy by focusing on value-added products and moving up the value chain. Rather than simply exporting raw rare earths, China may aim to dominate production of things like electric motors, generators, and advanced components – essentially saying, “if you don’t want to buy our raw materials, you’ll still end up buying the equipment from us that contains those materials.” Indeed, China has been investing in its manufacturing capabilities in EVs, wind turbines, and electronics. This implies competition may shift to the level of finished goods. However, China also has reason to maintain some level of raw exports for income and global influence. They might selectively export to allies or Belt and Road partner countries to strengthen ties, while keeping restrictions on nations seen as rivals. Over time, if alternative supplies weaken China’s leverage, China could even flood the market temporarily to undercut new mines (as it allegedly did around 2015 after the WTO ruling, causing prices to fall and some non-Chinese ventures to falter). The Western alliance will need to be prepared to weather such tactics, possibly through subsidies or joint purchasing to support new suppliers during price wars.

- Increased Cooperation and Strategy: The rare earth challenge is pushing the U.S. to formulate a more coherent critical materials strategy, akin to how it has an energy security strategy. We can expect this strategy to be continually refined. Likely elements include: establishing a permanent government-industry working group on critical minerals, expanding stockpile goals (perhaps aiming for a six-month supply of key REEs for defense needs), coordinating with allies on who develops which part of the supply chain (to avoid oversupply gluts or duplicative investments), and integrating critical minerals considerations into trade agreements. For instance, future trade deals or Indo-Pacific pacts might explicitly cover rare earth cooperation. The European Union is also working on its Critical Raw Materials Act to increase self-sufficiency; the U.S. and EU might align standards and incentivize transatlantic projects. There is also talk of using the DOD’s purchasing power to guarantee demand for new rare earth producers (like an assured buy program) to encourage market entry. All of these policy tools will shape a more resilient system.

- Environmental and Social Governance (ESG) Factor: A notable aspect of moving rare earth production out of China is ensuring it’s done sustainably. Part of China’s cost advantage historically came from lower environmental compliance – resulting in significant pollution from mining and processing. New projects in the U.S. and elsewhere will adhere to stricter standards, which is positive for the environment but also costlier. Over the long run, innovation could also improve the environmental footprint (e.g., new separation technologies that use less harmful reagents). The future supply chain will likely be marketed as “cleaner and more ethical” (avoiding issues of illegal mining or poor labor practices that have occurred in some places). This could become a selling point – for instance, automakers might advertise that their EVs use magnets sourced responsibly outside China. It aligns with broader ESG trends in industry. Governments will support this through regulations and incentives, ensuring that the quest for independence doesn’t lead to just shifting pollution elsewhere. Ideally, 10 years from now, we’ll have a rare earth supply chain that is not only more geographically diverse but also more environmentally sustainable, addressing the criticisms that plagued rare earth mining historically.

Considering all these factors, the next decade is set to be transformative for rare earths. In the best-case scenario, by the mid-2030s, we would see a balanced global supply with multiple major producers (China, North America, Australia, maybe Africa), a suite of new technologies reducing per-unit rare earth usage, and robust recycling taking hold. Prices might stabilize at a moderate level that sustains production everywhere without extreme volatility. In that world, rare earths would no longer be a strategic vulnerability for the U.S., but just another commodity (albeit still critical) traded in a relatively open market – a commodity turned from a geopolitical ace back into a normal input.

However, getting there requires navigating the current period of uncertainty and potential conflict. The path will likely have some setbacks – projects might fail, technology bets might not pan out, or new geopolitical flare-ups could occur (e.g., a Taiwan crisis could lead to sudden Chinese embargo of all rare earths to the U.S. for a period, really testing the resilience measures). Thus, contingency planning remains crucial. The U.S. defense establishment will likely keep planning for worst-case scenarios (like having to source everything domestically or from allies in an emergency).

One intangible but important outcome of this rare earths saga is the lesson being learned about resource interdependence. It has highlighted to the U.S. that being beholden to a rival for critical materials is a serious risk – a lesson now also being applied to other areas (like batteries, semiconductors, and pharmaceuticals). We may see a general trend of “selective decoupling” in supply chains for any goods deemed strategic, with rare earths at the forefront of that trend. Policies such as the Inflation Reduction Act’s local content requirements for EV credits hint at that decoupling.

In conclusion, China’s rare earth export restrictions have rung a global alarm bell that is fundamentally restructuring how and where these elements are produced and used. In the short term, they threaten U.S. industries with supply pain, but in the long term they are catalyzing a more resilient and distributed system. The transition will be complex, requiring close collaboration between government, industry, and international partners. But if successful, the outcome will be a robust supply chain for rare earths that underpins the technologies of the future without being subject to political blackmail. The U.S. aims to emerge from this challenge stronger – with secure access to the “vitamins” of modern tech – ensuring that industries from Silicon Valley to Detroit to the defense heartland can thrive without the shadow of a rare earth embargo looming over them.

References

- U.S. Geological Survey – Rare Earths Statistics and Information

https://www.usgs.gov/centers/national-minerals-information-center/rare-earths-statistics-and-information - U.S. Department of Energy – Critical Materials Strategy

https://www.energy.gov/policy/initiatives/critical-materials - MP Materials – Mountain Pass Operations Overview

https://mpmaterials.com/operations/mountain-pass/ - Center for Strategic and International Studies – The Geopolitics of Rare Earth Elements

https://www.csis.org/analysis/geopolitics-rare-earth-elements - Bloomberg – China Expands Export Controls on Rare Earths

https://www.bloomberg.com/news/articles/rare-earths-china-export-controls - Reuters – China’s Curbs on Rare Earths Raise Alarm in U.S. Defense Sector

https://www.reuters.com/business/aerospace-defense/china-rare-earth-export-controls-defense-impact - Congressional Research Service – Rare Earth Elements: Supply Chain Challenges

https://crsreports.congress.gov/product/pdf/R/R46618 - International Energy Agency – The Role of Critical Minerals in Energy Transitions

https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions - Essential Minerals Association – Rare Earth Applications and Global Supply

https://www.essentialminerals.org/rare-earth-elements - Department of Defense – Strengthening Critical Mineral Supply Chains

https://www.defense.gov/News/Strengthening-Critical-Minerals-Supply-Chains