Shein's IPO Pivot — From London to Hong Kong

Shein, the fast-fashion juggernaut that transformed from a little-known Chinese e-commerce brand into a global fashion phenomenon, is once again making headlines—this time not for its viral outfits but for its increasingly complex IPO saga. The company, headquartered in Singapore but with deep operational ties to China, has become a symbol of the growing tension between East and West, globalization and protectionism, and ambition and regulation. As of May 2025, Shein is reportedly reconsidering its plan to list on the London Stock Exchange, exploring a pivot to the Hong Kong bourse due to ongoing geopolitical and regulatory challenges.

Founded in 2008 by Chris Xu, Shein initially built its business on a model that blended agile supply chains, influencer-driven marketing, and ultra-low prices to become one of the most downloaded shopping apps globally. By 2023, the company was valued at over $60 billion and began eyeing public markets to sustain its explosive growth. However, its journey toward an initial public offering has been anything but straightforward.

Shein’s IPO ambitions initially targeted the U.S. market. Given its size and global footprint, a listing on the New York Stock Exchange or NASDAQ would have made strategic sense. However, growing scrutiny from U.S. lawmakers over alleged labor practices in Xinjiang, along with concerns around data privacy and product safety, created substantial headwinds. Mounting pressure from both Republican and Democratic lawmakers made a U.S. IPO untenable, effectively forcing Shein to turn its attention to other international markets.

The next logical option appeared to be London, which has been seeking high-profile tech listings post-Brexit to revitalize its financial markets. At first, Shein’s interest in a London IPO was welcomed with optimism, and early regulatory steps were reportedly underway. However, even the UK proved to be less accommodating than expected. Concerns about Shein’s opaque supply chain practices and the need for clearance from the China Securities Regulatory Commission (CSRC) created delays. London’s stricter environmental, social, and governance (ESG) expectations, coupled with growing media scrutiny, further complicated the listing process.

Now, according to multiple reports, Shein is said to be weighing a third option: the Hong Kong Stock Exchange (HKEX). This marks a significant strategic shift. Although Hong Kong has seen a decline in major listings over the past few years due to political instability and tighter regulations from Beijing, it remains an attractive venue for Chinese-linked enterprises. Shein’s reconsideration underscores not only its frustration with Western regulatory frameworks but also its pragmatic alignment with a market that may offer fewer political risks and more predictable oversight.

The potential pivot to Hong Kong raises important questions: What does this mean for Shein’s valuation and investor pool? Will it affect the company’s reputation in Western markets? Can a Hong Kong IPO provide the financial ammunition Shein needs to further expand globally and challenge incumbents like Zara, H&M, and even Amazon in the fashion vertical?

This blog post will dissect the latest chapter in Shein’s IPO story by examining the multifaceted reasons behind the potential shift from London to Hong Kong. We will analyze the regulatory landscape, compare market dynamics, evaluate operational implications, and discuss the broader ramifications for the fast-fashion industry. With insights supported by charts and tables, this comprehensive analysis aims to provide a nuanced understanding of the stakes involved in one of the most closely watched IPOs of the decade.

As global capital markets become more fragmented and geopolitics increasingly shapes corporate decisions, Shein’s experience may set a precedent for other multinational companies navigating similarly turbulent waters. Whether the company ultimately lists in Hong Kong, London, or elsewhere, its journey offers a revealing lens into the intersection of commerce, regulation, and strategy in the modern age.

Regulatory Roadblocks: Navigating Global Compliance

As Shein eyes a shift in its IPO destination from London to Hong Kong, the underlying catalyst driving this potential strategic reorientation is not market opportunity alone, but the increasingly complex web of global compliance and regulatory hurdles. For a company of Shein’s scale—operating across multiple jurisdictions, with a supply chain rooted in China and a consumer base scattered across Europe, North America, and Asia—adhering to disparate regulatory regimes has become both an operational and reputational battleground.

The Role of Chinese Regulators

At the heart of the delay in Shein's IPO trajectory is the China Securities Regulatory Commission (CSRC), which must approve any offshore listing for companies with substantial operations in China. Despite relocating its headquarters to Singapore in 2022, Shein remains deeply integrated with Chinese manufacturing networks and data infrastructure, triggering the need for CSRC clearance under China’s tightened overseas listing regulations.

The CSRC’s recent tightening of its guidelines stems from Beijing’s broader national security concerns and its desire to exert greater control over how and where domestic companies raise capital. These updated rules—issued in 2023—require companies like Shein to disclose detailed operational and data-handling protocols. While this regulatory scrutiny is intended to protect China’s sovereign interests, it has the downstream effect of slowing IPO approvals, especially when the listing venue lies outside China's political orbit, such as in London or New York.

For Shein, this regulatory drag has compounded existing delays, prompting internal recalibration. Even after receiving preliminary backing for a London listing from UK financial authorities, the absence of a green light from the CSRC has become a roadblock. Without the necessary Chinese approval, Shein risks violating both Chinese and British regulatory frameworks, exposing itself to legal and financial penalties.

Labor Rights and ESG Scrutiny in the West

Beyond China, Shein faces stiff resistance from Western governments and institutions, driven primarily by mounting concerns over environmental, social, and governance (ESG) issues. Chief among them is the allegation that Shein’s supply chain may be linked to forced labor practices in the Xinjiang Uyghur Autonomous Region. While Shein has denied these claims and stated that it uses third-party audits to monitor its suppliers, skepticism remains pervasive in both the United States and the United Kingdom.

In the U.S., bipartisan legislative pressure has already stalled Shein’s IPO ambitions. The 2021 Uyghur Forced Labor Prevention Act (UFLPA), which bans imports made with forced labor from Xinjiang, presents a reputational and legal risk for Shein. American lawmakers have written to the Securities and Exchange Commission urging it to block any Shein IPO until the company provides transparent evidence that its products are free of forced labor. These same pressures have begun to emerge in the UK as well, where the House of Commons has held hearings scrutinizing the company's labor and environmental practices.

The London Stock Exchange, eager to rebuild its listing profile post-Brexit, initially welcomed the possibility of a Shein IPO. However, mounting political resistance and negative press coverage have transformed a strategic opportunity into a regulatory liability. The Financial Conduct Authority (FCA), Britain’s financial regulator, is reportedly engaging in rigorous due diligence, particularly focused on ESG compliance—another factor contributing to delays and uncertainty.

Comparative Flexibility in Hong Kong

Hong Kong, while still operating under the “One Country, Two Systems” principle, offers a more compatible regulatory environment for Shein’s circumstances. The Hong Kong Exchanges and Clearing Limited (HKEX) has a track record of accommodating listings from mainland Chinese firms, particularly those with complex supply chains and politically sensitive operations. Unlike regulators in London or New York, HKEX is less likely to challenge Shein on ESG grounds or delay the process over allegations rooted in international human rights law.

Moreover, Hong Kong’s listing regime has become more sophisticated and flexible in recent years. Reforms have enabled pre-revenue tech companies and dual-class share structures to list, making the city a magnet for fast-growing, investor-backed firms like Shein. The city’s familiarity with Chinese data practices and its legal alignment with mainland policies further reduces friction in securing regulatory approvals from Beijing. This level of synergy is difficult to replicate in Western markets where political scrutiny and transparency demands can often derail IPO proceedings.

That said, a Hong Kong listing is not without risks. The city’s capital markets have faced declining investor confidence since 2020, exacerbated by political unrest and tighter Chinese oversight. Additionally, international investors may perceive a Hong Kong IPO as a signal that Shein is retreating from Western accountability standards, which could impact its valuation and broader global appeal.

Data Security and Digital Sovereignty

Another layer of regulatory concern is data governance. As a company that collects extensive user data from global consumers, Shein must adhere to evolving data privacy regulations such as the EU’s General Data Protection Regulation (GDPR), the U.S. state's data privacy laws, and China’s own Personal Information Protection Law (PIPL). Balancing these conflicting requirements creates compliance headaches and raises the risk of enforcement actions in multiple jurisdictions.

Western regulators are particularly wary of how Shein processes and stores data, given the company’s roots in China and the geopolitical tensions surrounding data sovereignty. Any indication that user data might be accessible to Chinese authorities could trigger investigations or sanctions, further complicating Shein’s path to listing in London or New York. In contrast, a listing in Hong Kong may help Shein sidestep immediate concerns about data flows across borders, though it may also limit its long-term potential in Western markets.

In conclusion, regulatory challenges have become the defining variable in Shein’s IPO equation. The company’s consideration of a Hong Kong listing reflects a calculated response to the divergent compliance environments it faces across major global markets. While Hong Kong offers regulatory relief and strategic alignment with Chinese authorities, it also presents risks tied to international perceptions and investor expectations. Navigating these trade-offs will be crucial as Shein prepares for what may be one of the most consequential IPOs of the decade.

Market Dynamics: Evaluating Hong Kong vs. London

As Shein reconsiders its IPO strategy, the debate between choosing Hong Kong or London as the listing venue goes beyond mere regulatory convenience. It touches on deeper questions of market resilience, investor sentiment, valuation impact, and long-term brand positioning. Both cities have their strengths and challenges as financial hubs, and for a company of Shein’s scale and sensitivity, the differences between them carry significant strategic consequences.

Investor Sentiment and Capital Market Performance

In recent years, London and Hong Kong have each faced unique headwinds affecting investor sentiment and IPO performance. London’s IPO market has suffered from the prolonged uncertainty following Brexit, which has contributed to lower risk appetite and a thinning pipeline of tech and consumer IPOs. Major companies like ARM opted for U.S. listings despite political pressure to float domestically, reflecting diminished confidence in the London Stock Exchange's ability to attract and sustain high-growth tech stocks.

Hong Kong, on the other hand, has dealt with political instability stemming from Beijing's tightened grip on the region. The city’s appeal to Western investors has declined due to perceived risks to judicial independence and capital controls. Despite these challenges, Hong Kong remains a cornerstone of capital raising for companies with Chinese operational roots. Its proximity to China and deep integration with the Chinese investor ecosystem make it a natural destination for firms like Shein that face headwinds in Western markets.

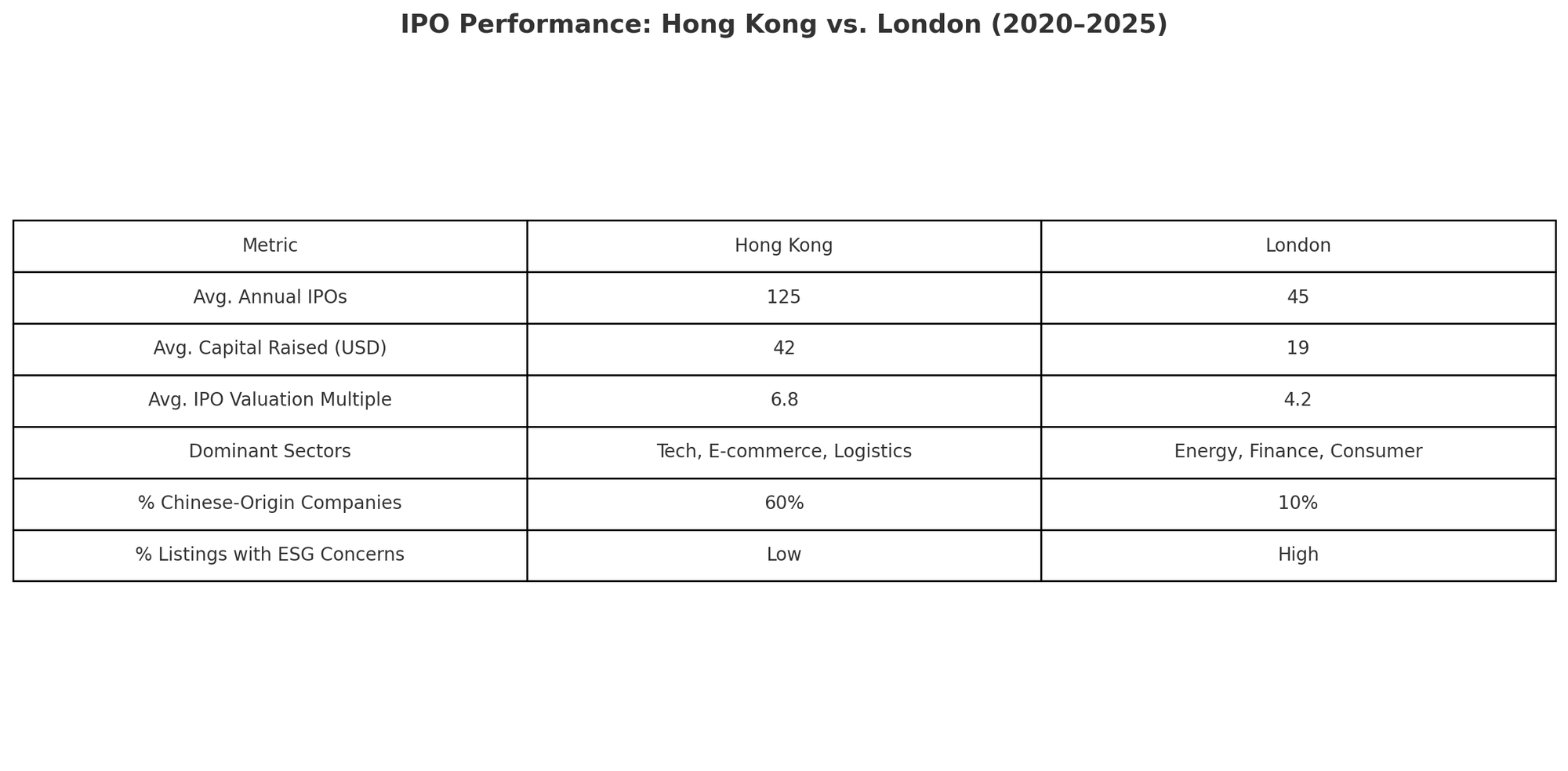

Statistically, Hong Kong has outperformed London in IPO volume and proceeds raised from 2020 through 2023, largely due to a stream of Chinese tech and consumer firms choosing it as their listing venue. However, in 2024, the city experienced a slowdown in listings amid global economic headwinds and U.S.-China tech decoupling. London experienced a similar slump, though its underperformance has been more structural in nature.

Valuation Implications

Valuation is a central concern in Shein’s IPO calculus. The market in which a company lists often directly impacts the multiple it can command. A listing in London, while offering exposure to European institutional investors, may not provide Shein with the same valuation uplift it might secure in a region more accustomed to tech-enabled e-commerce business models.

Hong Kong investors are more familiar with Chinese consumer internet firms and are often more tolerant of aggressive growth narratives with thin margins. This familiarity translates into higher valuation multiples for e-commerce firms compared to their Western counterparts. Companies like JD.com and Meituan have historically enjoyed favorable pricing in Hong Kong, driven by strong demand from local and mainland Chinese investors.

Additionally, Chinese retail investors—via Stock Connect and other cross-border investment mechanisms—can access Hong Kong listings with relative ease. This dynamic injects liquidity and speculation into IPOs, which can drive short-term valuation surges. While such volatility may concern Western investors, it is often viewed positively by companies looking to maximize proceeds and generate market buzz.

In contrast, London’s valuation landscape is more conservative, especially for consumer brands perceived as lacking transparency. The city’s investor base is dominated by value-oriented institutional investors who weigh ESG considerations heavily. If Shein were to list in London amid ongoing labor rights and sustainability criticisms, it might suffer a “governance discount,” thereby lowering its valuation floor. This possibility may be a decisive factor in tilting Shein toward Hong Kong.

Brand Positioning and Public Perception

Brand equity is another important dimension when evaluating IPO markets. Shein has grown rapidly in part due to its image as a global, accessible, and trend-responsive fashion platform. While a London listing could reinforce this cosmopolitan branding and lend credibility among Western consumers, it would also expose the company to intensified ESG scrutiny and media attention. This could put additional pressure on its operations and corporate governance structures post-IPO.

A Hong Kong listing, in contrast, is less likely to draw such aggressive Western media examination but could carry the stigma of aligning too closely with China. In markets like the U.S. and parts of Europe, this association might tarnish Shein’s brand, especially among younger, socially conscious consumers who place a premium on ethical sourcing and sustainability. Thus, while Hong Kong might offer short-term financial gains, it could also create longer-term reputational challenges that extend beyond investor relations and into consumer behavior.

From a marketing standpoint, Shein must weigh whether the reputational capital gained from a Western listing outweighs the regulatory and valuation trade-offs. Alternatively, the company may choose to list in Hong Kong while simultaneously investing in ESG upgrades and public relations campaigns in the West to mitigate reputational fallout.

Market Infrastructure and Institutional Support

Both Hong Kong and London boast world-class market infrastructures, but their institutional support frameworks differ in terms of sectoral expertise and post-IPO development opportunities. The London Stock Exchange has extensive experience working with global fashion and consumer goods companies, providing seasoned analysts, institutional investors, and advisory services tailored to the retail sector. This makes London an attractive choice for long-term strategic investors focused on operational excellence and sustainability.

Hong Kong, on the other hand, is more tech and finance-heavy in its institutional composition. While it lacks deep fashion sector expertise, it compensates with investor familiarity in digital commerce, logistics, and consumer platforms. For a company like Shein that straddles the lines between fashion, technology, and logistics, this ecosystem may offer more relevant strategic partnerships and investor engagement.

Furthermore, Hong Kong’s capital market reforms—especially the inclusion of dual-class share structures—align well with Shein’s interest in maintaining control while accessing public capital. London has historically resisted such governance arrangements, which could make the UK less appealing to founder-led companies seeking autonomy after listing.

In conclusion, the choice between Hong Kong and London as Shein’s IPO destination is not merely a matter of location—it is a reflection of deeper trade-offs between valuation, investor trust, brand positioning, and regulatory scrutiny. While Hong Kong presents a smoother path with higher short-term valuation potential, it also entails reputational risks and limits Western investor access. London, though fraught with political and ESG hurdles, could enhance Shein’s legitimacy as a global brand—if it is willing to accept a lower valuation and stricter post-IPO obligations.

The decision will likely hinge on Shein’s priorities: maximizing immediate capital intake or securing long-term brand trust in its biggest markets. In either case, the company's IPO will serve as a defining moment not just in its own corporate trajectory, but also in the evolving relationship between global capital and geopolitical fault lines.

Operational Implications – Supply Chain and Business Model

As Shein evaluates a shift in its IPO destination from London to Hong Kong, the operational underpinnings of such a move merit close examination. The company's supply chain design, tax structure, logistics strategy, and ESG compliance mechanisms all play pivotal roles in determining which financial market aligns best with its core business model. While the public spotlight often centers on valuation and investor sentiment, a company’s listing venue can have significant downstream effects on operations—especially for a global enterprise like Shein, whose rapid expansion is built on razor-thin margins and high-volume turnover.

China-Centric Supply Chain and Proximity Advantages

Shein's business model is deeply integrated with China's manufacturing ecosystem. The company sources the vast majority of its apparel from a dense network of suppliers in regions such as Guangzhou and Zhejiang. Its "small-batch, test-and-repeat" approach depends on short production lead times, hyper-responsive manufacturing, and real-time feedback loops enabled by digital demand forecasting. This model minimizes inventory risk and maximizes consumer responsiveness, allowing Shein to launch thousands of new items every week.

A Hong Kong listing provides operational coherence with this supply chain architecture. Hong Kong's geographical proximity to southern China enables tighter logistical coordination and faster access to both suppliers and ports. Furthermore, the city serves as a key financial and legal intermediary for cross-border transactions with the mainland, reducing the friction associated with foreign exchange, tax remittances, and supplier payments.

In contrast, a London listing—while symbolically powerful—adds layers of regulatory complexity for Shein’s supply chain. The need to navigate dual compliance obligations across UK and Chinese jurisdictions may increase operational overhead. More importantly, regulatory inquiries into supply chain ethics, traceability, and carbon emissions are more aggressive in the UK, posing a threat to the very operational model that has made Shein successful.

Import Regulations and Trade Barriers

Recent developments in global trade policies have significantly affected Shein’s logistical strategy. The United States and European Union have both introduced or expanded tariffs on imports from China, particularly targeting sectors with high labor intensity and environmental concerns. These measures are aimed not just at protecting domestic industries but also at enforcing labor rights and sustainability benchmarks, especially amid rising concerns about the use of forced labor in Xinjiang.

A listing in London would place Shein under the direct scrutiny of European trade regulations, potentially exposing it to additional compliance checks and reputational damage. Given that a large portion of Shein’s sales come from Western markets, this scrutiny could necessitate costly adaptations to its supply chain, such as shifting to alternate suppliers, adopting more transparent sourcing practices, or investing in ESG-compliant logistics solutions.

In contrast, a Hong Kong listing allows Shein to align more naturally with China's foreign trade strategy, which is increasingly focused on regionalization and intra-Asia commerce. The Regional Comprehensive Economic Partnership (RCEP), the world's largest free trade agreement, includes both China and key Southeast Asian nations. Hong Kong’s participation in this trade zone—though indirect—could facilitate Shein’s ambitions to diversify its market exposure away from Western economies and into emerging markets like Southeast Asia, India, and the Middle East.

Tax Optimization and Financial Structuring

Shein’s corporate structure is engineered to optimize tax liabilities and simplify capital flows. Officially headquartered in Singapore, the company maintains operational centers in China and strategic hubs in the U.S., Europe, and Latin America. This international footprint is supported by a labyrinth of holding companies, transfer pricing agreements, and intellectual property licensing arrangements designed to minimize global tax exposure.

From a tax structuring perspective, a Hong Kong IPO offers more flexibility and alignment. Hong Kong maintains a low corporate tax rate (16.5%) and does not impose capital gains taxes—an attractive proposition for Shein’s founders and investors. Additionally, the city's numerous double taxation treaties and its financial openness make it a favorable venue for capital repatriation and revenue cycling across Asia.

By contrast, the UK has increasingly tightened its tax rules on multinational corporations. In line with OECD’s Base Erosion and Profit Shifting (BEPS) framework, the UK requires extensive disclosures on intercompany transactions, beneficial ownership, and ultimate control. A listing in London would place Shein under greater tax scrutiny, both from UK authorities and its global partners. Such exposure could diminish the cost advantages currently embedded in Shein’s cross-border e-commerce operations.

Sustainability, Labor, and Ethical Oversight

Despite its meteoric rise, Shein continues to face sustained criticism over its environmental footprint and labor practices. Its fast-fashion model, while efficient and profitable, generates large quantities of textile waste and carbon emissions. Investigations have also raised questions about the working conditions in supplier factories, including wage violations and lack of safety standards.

A London IPO would make ESG compliance a non-negotiable obligation. The Financial Conduct Authority (FCA) and the London Stock Exchange have embedded ESG requirements into their listing regimes, necessitating comprehensive disclosure of labor standards, sustainability metrics, and governance structures. For Shein, compliance would require not only public ESG reporting but likely real changes to its business practices—including greater supplier audits, emissions tracking, and product lifecycle analysis.

Conversely, while Hong Kong is progressively incorporating ESG standards, enforcement remains relatively relaxed. Listing on the HKEX would allow Shein to continue operating with minimal structural changes in the short term, even as it gradually develops ESG policies to appeal to international investors. However, the long-term risk of ESG non-compliance includes exclusion from Western investment portfolios and potential consumer backlash, especially in markets where ethical consumption is on the rise.

Technological Integration and Fulfillment Infrastructure

A lesser-discussed but critical element of Shein’s business model is its backend technology stack. The company uses a proprietary AI-driven system to forecast fashion trends, allocate inventory, and manage vendor relationships. These systems are hosted across cloud platforms and require real-time data feeds from multiple jurisdictions.

Hong Kong’s advanced ICT infrastructure, regulatory tolerance for data localization, and its role as a connectivity gateway to mainland China make it an ideal host for Shein’s backend operations. The city’s robust logistics sector, including port and air freight capabilities, also supports Shein’s promise of fast international shipping at low cost.

London, while technologically advanced, operates under stricter data sovereignty laws—especially in the post-GDPR era. Hosting and processing data about EU or UK consumers from outside the region requires compliance with cross-border data transfer protocols, which could necessitate infrastructure duplication and added costs for Shein.

In summary, Shein’s operational blueprint is heavily skewed toward Asia, with China at its core. From supply chain responsiveness to tax efficiency, data operations to compliance costs, Hong Kong aligns more closely with the company’s foundational structure. While London offers reputational benefits and potential consumer trust, it also imposes higher operational burdens that may erode the efficiencies Shein relies upon to remain competitive.

The choice of IPO venue, therefore, is not merely a financial or political decision—it is a strategic pivot that could reshape the internal mechanics of one of the most innovative, albeit controversial, companies in the global retail landscape.

Strategic Outlook and Future Prospects

The trajectory of Shein’s IPO ambitions—spanning from the U.S. to the U.K., and now potentially Hong Kong—encapsulates a broader narrative about globalization, regulatory fragmentation, and corporate adaptability. As the fast-fashion giant navigates geopolitical headwinds, investor expectations, and operational complexity, its IPO decision will not merely reflect a financial preference but a deeply strategic move with implications extending well beyond capital markets.

At the core of Shein’s dilemma is a fundamental tension between East and West: operating within a China-centric supply and logistics model while seeking global legitimacy and investor access. The United States, once the default destination for ambitious startups, has become a non-starter due to political scrutiny and regulatory challenges related to forced labor, data security, and ESG compliance. The United Kingdom, though initially seen as a compromise between scale and credibility, now poses similar obstacles through its elevated expectations around corporate governance, sustainability, and transparency.

Hong Kong thus emerges as a pragmatic alternative. The city offers regulatory predictability, proximity to Shein’s operational backbone, and investor familiarity with Chinese internet and e-commerce firms. It enables Shein to execute its IPO within a framework that prioritizes expedience and valuation, rather than one mired in ESG due diligence and political posturing. For a company aiming to raise significant capital while preserving strategic autonomy, Hong Kong aligns closely with both structural and tactical priorities.

However, this alignment does not come without trade-offs. The perception of retreating into a friendlier, but more opaque, listing environment may erode Shein’s appeal in key Western markets. A Hong Kong IPO could signal to consumers and institutional investors that Shein is unwilling—or unable—to comply with the rising standards of corporate responsibility demanded by the global investment community. Such a perception, even if not entirely fair, may influence portfolio allocations, media narratives, and consumer sentiment for years to come.

This reputational risk is magnified by Shein’s reliance on Gen Z and millennial consumers in the U.S. and Europe—demographics known for their sensitivity to ethical sourcing and climate impact. A listing choice perceived as evasive may undermine brand loyalty among these cohorts, particularly if competitors like Zara or H&M capitalize on the moment to highlight their ESG advancements. In this sense, Shein’s IPO venue decision could have tangible downstream effects on customer acquisition, brand equity, and market share.

Moreover, from an investor standpoint, the differences in valuation multiples and post-IPO performance between London and Hong Kong deserve strategic contemplation. While Hong Kong may offer higher near-term valuations, it is subject to volatility due to regulatory unpredictability from Beijing, political unrest, and reduced participation by Western funds. London, on the other hand, provides a steadier albeit less glamorous runway for long-term growth and brand institutionalization.

In evaluating these dimensions, Shein must adopt a multidimensional lens—one that balances financial engineering with reputational calculus, operational alignment with geopolitical awareness, and short-term gain with long-term sustainability. It is no longer sufficient to choose a listing venue based on market liquidity or tax benefits alone. The decision must be an extension of corporate philosophy, global positioning, and consumer trust.

Looking ahead, Shein’s path will likely be shaped by several external factors. First is the evolving regulatory stance of the Chinese government, whose approval remains essential regardless of the listing location. Second is the pace at which Shein addresses ESG concerns—whether by proactively improving supply chain transparency, reducing waste, or embracing labor accountability. These reforms, if genuine and verifiable, could open doors to global markets in the future, even if they are initially deferred in favor of a Hong Kong IPO.

Third is the macroeconomic climate. With rising interest rates, global inflation, and deteriorating consumer confidence, public markets are in flux. Shein may find that investor appetite—regardless of location—is moderated by broader market conditions. This introduces timing risk, and could lead the company to delay its IPO until sentiment improves or regulatory clarity emerges.

Fourth, and perhaps most critically, is the rise of AI-driven fashion and decentralized commerce. As the digital retail landscape transforms, Shein’s agility in integrating machine learning, on-demand manufacturing, and hyper-localized marketing will determine whether it remains a category leader. The IPO is merely one step in this journey. Whether it occurs in Hong Kong or elsewhere, it must serve as a catalyst for innovation rather than a culmination of growth.

From a macro perspective, Shein’s IPO saga is emblematic of the pressures facing modern multinationals. In an era of supply chain de-risking, data sovereignty, ESG awakening, and geopolitical rivalry, the global marketplace is no longer flat. Companies must make choices that reflect not just where they are financially anchored, but also where they are ideologically positioned. Shein’s deliberations signal a broader shift among tech-enabled firms from the unipolar optimism of the 2010s to the bifurcated realism of the 2020s.

Ultimately, Shein’s final decision—whether to proceed with a Hong Kong listing or continue to pursue London—will set a precedent. It will influence how other cross-border companies, particularly those with Chinese roots and global ambitions, assess their own IPO trajectories. It will also serve as a case study for regulators, policymakers, and investors who are trying to understand the shifting dynamics of capital flows, corporate accountability, and market access.

For now, Shein continues to walk a tightrope between opportunity and risk, growth and governance, proximity and perception. Its next move will not only redefine its financial destiny but may also reshape the architecture of global retail investment for years to come.

References

- Bloomberg – Shein Weighs Hong Kong IPO as London Plan Stalls

https://www.bloomberg.com/news/articles/shein-weighs-hong-kong-ipo - Reuters – Shein's IPO Path Faces Regulatory Scrutiny

https://www.reuters.com/business/retail-consumer/shein-ipo-regulatory-delay - Financial Times – Shein Considers Hong Kong Listing

https://www.ft.com/content/shein-hong-kong-ipo - South China Morning Post – Shein's IPO Road Shifts to Hong Kong

https://www.scmp.com/business/china-business/article/shein-switches-hong-kong - CNBC – Shein Faces ESG Challenges Amid IPO Deliberations

https://www.cnbc.com/shein-esg-ipo-analysis - BBC – Shein and Forced Labor Allegations Explained

https://www.bbc.com/news/business-shein-labor-rights - The Guardian – Shein’s Fast Fashion Model Under Fire

https://www.theguardian.com/business/shein-fast-fashion - Nikkei Asia – London’s IPO Market Faces Post-Brexit Headwinds

https://asia.nikkei.com/Business/Markets/London-stock-listing-brexit - TechCrunch – Shein and the Rise of China’s E-Commerce Giants

https://techcrunch.com/shein-china-ecommerce-ipo - HKEX – Rules for Overseas Listings on the Hong Kong Stock Exchange

https://www.hkex.com.hk/Listing/Rules-and-Guidance/Listing-Rules