Shein Slashes Prices Amid Tariff Relief: Can It Win Back US Shoppers?

In recent years, Shein has rapidly ascended from a little-known Chinese online apparel seller to a dominant force in the global fast-fashion market. Known for its ultra-affordable pricing, vast inventory, and data-driven production cycle, Shein has become a go-to platform for Gen Z and millennial consumers in the United States. However, this dominance has not been immune to the geopolitical and economic turbulence stemming from the intensifying US-China trade relationship. In particular, rising tariffs on Chinese imports have threatened Shein’s price-sensitive business model, pushing the company to reassess its strategy to maintain competitiveness and consumer loyalty in its largest overseas market.

Amid mounting regulatory scrutiny and escalating import duties, Shein found itself caught in the crosshairs of evolving trade policies. The revocation of key tariff exemptions and the implementation of punitive measures—some reaching as high as 145%—severely impacted the company’s cost structure, translating to higher prices at checkout for US consumers. These changes coincided with increased competition from domestic retailers and other cross-border e-commerce firms, prompting a notable decline in Shein’s market share and online engagement. The consequences were both immediate and tangible: American shoppers, once lured by rock-bottom prices and lightning-fast trends, began shifting their attention to more stable and transparent retail alternatives.

The recent softening of the tariff regime, including a temporary 90-day reduction to 30% for small-package Chinese imports, has offered a lifeline to Shein and its peers. In a swift and calculated response, Shein initiated sweeping price cuts across its platform, with reductions averaging 13% across nearly one hundred tracked items. These reductions are not only aimed at passing tariff savings directly to the consumer but also at recapturing lost momentum in a rapidly shifting e-commerce landscape. The initiative marks a pivotal moment for the company as it attempts to navigate political uncertainty, rising operational costs, and evolving consumer preferences.

The Tariff Turmoil—A Timeline of Events

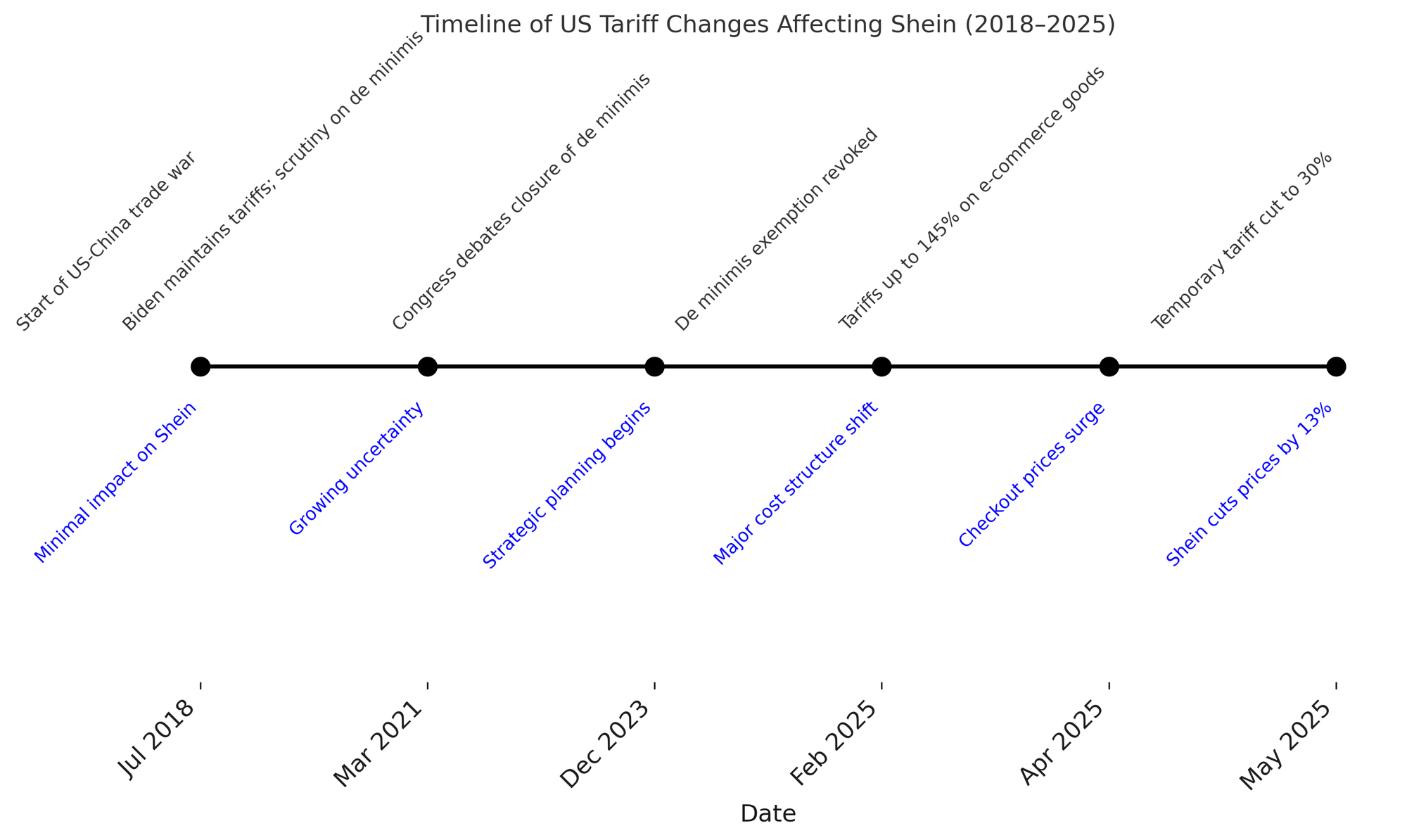

The evolution of Shein’s business trajectory in the United States cannot be fully understood without examining the broader context of US-China trade relations. Over the past several years, economic tensions between the world’s two largest economies have intensified, giving rise to a series of tariff escalations that have directly impacted cross-border e-commerce. As a China-based company heavily reliant on the export of low-cost goods to the American market, Shein’s operational model has been intricately tied to the regulatory landscape governing international trade. This section outlines the critical milestones of the tariff turmoil and its cascading effects on Shein’s market positioning and pricing strategy.

The US-China Trade War and Its Escalation (2018–2022)

The origin of the tariff disputes can be traced back to mid-2018, when the Trump administration initiated a series of punitive tariffs on Chinese imports under Section 301 of the Trade Act of 1974. The move was framed as a response to China’s alleged intellectual property violations and unfair trade practices. Over the course of two years, tariffs were expanded across multiple product categories, amounting to over $350 billion in affected goods. These measures created an uncertain operating environment for Chinese exporters and disrupted global supply chains.

Despite these developments, Shein was largely shielded from early tariff rounds due to the de minimis exemption—an import rule that allowed packages valued at $800 or less to enter the US duty-free. Leveraging this loophole, Shein thrived by shipping directly to consumers, effectively bypassing conventional distribution channels and tariff constraints. As a result, the company scaled rapidly without bearing the costs associated with traditional import duties, giving it a significant pricing advantage over domestic retailers.

The De Minimis Rule Under Scrutiny (2023–2024)

By late 2023, growing bipartisan concern in Washington over Chinese e-commerce firms exploiting the de minimis provision began to take center stage. Lawmakers raised alarms about the rule enabling billions of dollars’ worth of duty-free Chinese imports, particularly through platforms like Shein and Temu. Critics argued that the loophole undermined American retailers, deprived the US government of tariff revenue, and posed regulatory challenges in enforcing consumer safety and labor standards.

This scrutiny led to several legislative proposals aimed at tightening or eliminating the de minimis rule for imports originating from non-market economies, chiefly China. Although not immediately enacted, the political momentum made it clear that Shein’s reliance on this exemption was increasingly untenable. Internally, the company began strategizing for a future where such privileges might be curtailed or revoked altogether.

The Breaking Point: Tariff Surge in Early 2025

The tipping point arrived in early 2025, when a bipartisan bill passed both houses of Congress and was signed into law, effectively revoking the de minimis exemption for Chinese-origin shipments. This development represented a paradigm shift for firms like Shein, which had built their business models on high-volume, low-value transactions to individual consumers. Effective February 2025, all packages—regardless of value—became subject to full customs duties and tariff rates, which had now reached punitive levels for certain product categories.

By April 2025, the Biden administration, under pressure from organized labor groups and domestic manufacturing interests, implemented additional tariffs targeting e-commerce shipments from China. These ranged between 60% and 145%, depending on the product type and classification, significantly increasing the cost of exporting goods to the US through direct-to-consumer channels. In some cases, the total landed cost of apparel items doubled, forcing platforms to either raise prices or absorb the financial burden.

The immediate result was a sharp decline in cross-border e-commerce transactions. Shein, once immune to such trade headwinds, was now contending with a fundamentally altered cost structure. For price-sensitive consumers in the United States, the higher price points were a jarring shift. According to third-party tracking firms, average checkout cart abandonment rates rose sharply during this period, signaling growing consumer resistance to elevated prices and surprise surcharges.

Temporary Relief: A 90-Day Tariff Suspension in May 2025

On May 14, 2025, following several rounds of negotiations between US and Chinese trade officials, a temporary de-escalation was announced. The Biden administration agreed to reduce tariff rates on e-commerce shipments from China to 30% for a 90-day trial period. The policy was designed to ease inflationary pressures on American consumers ahead of the summer retail season, while providing room for further diplomatic engagement.

The relief, though limited in duration and scope, had an immediate impact on firms like Shein. Within days of the announcement, Shein implemented broad-based price reductions across its US platform, lowering prices by an average of 13% across nearly one hundred of its most frequently purchased items. By passing the tariff savings directly to consumers, the company hoped to restore price competitiveness and re-engage its core customer base.

This swift response contrasted starkly with Temu’s decision to continue applying import surcharges at checkout, which contributed to confusion and dissatisfaction among its US shoppers. While both firms faced the same regulatory pressures, their respective responses shaped consumer perception and purchasing behavior in divergent ways.

Strategic Shifts and Future Risk Management

In anticipation of long-term policy volatility, Shein has also accelerated efforts to diversify its supply chain. One of the most significant initiatives involves the establishment of a major distribution hub in Vietnam, which would allow Shein to route a portion of its orders through alternative logistics channels less exposed to US-China trade tensions. The Vietnam hub is projected to handle tens of thousands of daily orders and is expected to go live before the end of 2025.

Additionally, the company is exploring ways to deepen its presence in third-party e-commerce ecosystems, such as Amazon and Walmart.com, which may allow it to blend in with domestic sellers and reduce regulatory exposure. However, these moves come with trade-offs, including reduced control over branding and higher platform fees.

The escalation of tariffs between the United States and China represents a pivotal turning point for cross-border e-commerce players. For Shein, the shift from tariff immunity to cost exposure has necessitated a reevaluation of its operational model, supply chain dependencies, and consumer engagement strategy. The introduction of a 90-day reprieve offers only temporary relief. As trade dynamics continue to evolve, companies like Shein must navigate an increasingly complex geopolitical and regulatory landscape with agility and foresight. This tariff timeline not only underscores the fragility of Shein’s former advantages but also sets the stage for a broader strategic transformation that will unfold in the sections ahead.

Shein’s Strategic Price Reductions

As geopolitical pressures mounted and punitive tariffs threatened to erode its competitive advantage, Shein faced an urgent strategic inflection point. The imposition of sweeping import duties—especially following the closure of the de minimis loophole—threw the cost-efficiency of its cross-border model into disarray. In response, the company launched a bold countermeasure: widespread price reductions aimed at regaining consumer trust, defending market share, and demonstrating adaptability in the face of protectionist policy shifts. This section examines the details of Shein’s price-cutting strategy, contrasts it with competitors' approaches, and explores how these measures are being supported by structural changes within the company’s operations.

The Mechanics of the Price Cuts

On May 14, 2025, within hours of the United States announcing a temporary 90-day reduction in tariffs on small-value Chinese imports—from a high of up to 145% down to a uniform 30%—Shein responded with a targeted price-cutting initiative. The company reduced prices on a broad range of frequently purchased items, with the average price across 98 benchmarked products dropping by 13%. This translated into a decrease from $6.38 to $5.56 per item, effectively reversing the price inflation that had driven consumers away just weeks earlier.

These reductions were prominently displayed on Shein’s homepage, app banners, and in email marketing campaigns tailored to US users. The messaging emphasized “Tariff Relief Savings” and encouraged customers to take advantage of the reduced prices during the temporary window. In doing so, Shein not only passed tariff savings directly to consumers but also reframed the pricing rollback as a time-sensitive value proposition, fostering urgency and consumer re-engagement.

Importantly, these price cuts were not implemented uniformly. Higher-volume items and core fashion staples received the steepest discounts, while niche or low-turnover SKUs experienced more modest reductions. This tiered approach allowed Shein to optimize its margins while strategically positioning its most visible offerings as exceptional bargains.

Market Perception and Consumer Response

The immediate consumer response was largely positive. Social media buzz and user-generated content began to reappear on platforms like TikTok and Instagram, with influencers and casual users alike showcasing Shein “hauls” once again. Retail analytics firms reported a noticeable uptick in web traffic and time spent per session on the Shein mobile app among US users in the 72 hours following the price cuts. Cart abandonment rates—previously spiking in the wake of higher checkout costs—fell sharply as Shein’s pricing clarity was restored.

This resurgence stands in contrast to consumer sentiment just weeks earlier, when tariffs had forced checkout prices above psychological thresholds. At that time, many shoppers shifted toward domestic off-price retailers such as Nordstrom Rack and Kohl’s, which offered more predictable pricing. By removing unexpected surcharges and delivering transparent discounts, Shein has taken meaningful steps toward reestablishing consumer trust.

Moreover, Shein's decision to label the discounts explicitly as tariff-related repositioned the brand in political and economic discourse. It effectively communicated that Shein was not arbitrarily raising or lowering prices, but instead operating within the constraints of global trade policy—thereby framing itself as a responsive and customer-centric actor rather than a faceless foreign entity.

Comparative Pricing Strategies: Shein vs. Competitors

Shein’s strategic price reduction must be viewed within the competitive dynamics of cross-border e-commerce. Chief among its rivals is Temu, owned by PDD Holdings, which also relies heavily on low-cost Chinese manufacturing and the direct-to-consumer model. However, Temu’s response to the tariff shift was notably different. Rather than lowering list prices or absorbing costs, Temu introduced a separate import surcharge at the checkout stage—essentially transferring the burden to consumers without making price reductions up front.

This divergence created a notable contrast in consumer experience. While Shein shoppers saw reduced prices during browsing and checkouts, Temu users frequently encountered higher-than-expected final prices, leading to frustration and a perception of opacity. In a market where trust and simplicity are critical—especially among younger digital-native shoppers—Shein’s upfront discounting was generally perceived as a more consumer-friendly approach.

The following table offers a comparative analysis of post-tariff pricing strategies among leading players:

Operational Underpinnings of the Price Strategy

While price cuts are a surface-level tactic, Shein’s ability to implement them on short notice reflects underlying operational preparedness and flexibility. The company’s supply chain is optimized for responsiveness, with vertically integrated relationships across dozens of manufacturing hubs in China. By leveraging real-time inventory and pricing data, Shein was able to selectively implement reductions without causing operational bottlenecks or excess markdowns.

Additionally, Shein has accelerated efforts to reduce its exposure to future tariff risk. The most significant of these is the development of a massive warehousing and logistics hub in Vietnam, set to become operational later in 2025. The hub will act as a regional distribution center capable of routing US-bound orders through Southeast Asia, potentially avoiding direct classification as “Made in China” and benefiting from alternative trade agreements.

These efforts are bolstered by the company’s investments in AI-driven demand forecasting, which allows Shein to maintain lean inventory levels while still offering a wide product selection. By ensuring that discounts are applied primarily to high-volume SKUs with strong sell-through potential, Shein avoids the trap of across-the-board markdowns that could damage profitability or dilute brand equity.

Risks and Limitations

Despite the immediate boost in consumer engagement and order volume, Shein’s price reduction strategy is not without its risks. First and foremost is the temporary nature of the tariff relief itself. The 90-day reduction window is inherently unstable, tied to the outcome of ongoing trade negotiations that could sour abruptly. If tariffs return to elevated levels after this grace period, Shein may face a new round of price hikes—or the unenviable choice between absorbing costs or reducing margins.

There is also the risk of consumer habituation. Shoppers may come to expect steep discounts as the new normal, which could pressure Shein into extended or permanent price reductions. This would pose long-term profitability concerns, especially if alternative sourcing strategies fail to materialize quickly or if macroeconomic conditions erode demand.

Finally, competitors are not standing still. Domestic retailers, sensing opportunity, are actively refining their own e-commerce strategies. Many are expanding their discount offerings, investing in faster shipping, and doubling down on brand authenticity—areas where Shein still faces criticism. Thus, while price reductions may provide short-term relief, the broader challenge of sustainable differentiation remains unresolved.

Shein’s swift and substantial price reductions following the temporary US tariff rollback illustrate the company’s tactical agility and its deep understanding of consumer psychology in the fast-fashion space. By acting decisively and transparently, Shein has repositioned itself as a responsive and customer-focused brand amid a turbulent geopolitical landscape. Nevertheless, the strategy’s success depends not only on short-term consumer reaction but also on the durability of regulatory conditions and the execution of longer-term operational pivots.

Consumer Behavior and Market Dynamics

The dynamics of consumer behavior in the United States, particularly within the fast fashion and e-commerce segments, have undergone notable shifts in response to recent trade policy changes. The implementation and subsequent temporary easing of tariffs on Chinese imports have not only disrupted pricing but also altered the psychological and economic calculations that inform consumer choices. In this section, we examine how Shein’s price reductions intersect with evolving consumer sentiment, identify the broader market implications, and explore the potential long-term shifts in retail engagement strategies. Through both empirical insights and behavioral analysis, we seek to understand the role pricing, transparency, and brand trust now play in an increasingly volatile retail environment.

Consumer Reaction to Tariff-Driven Price Changes

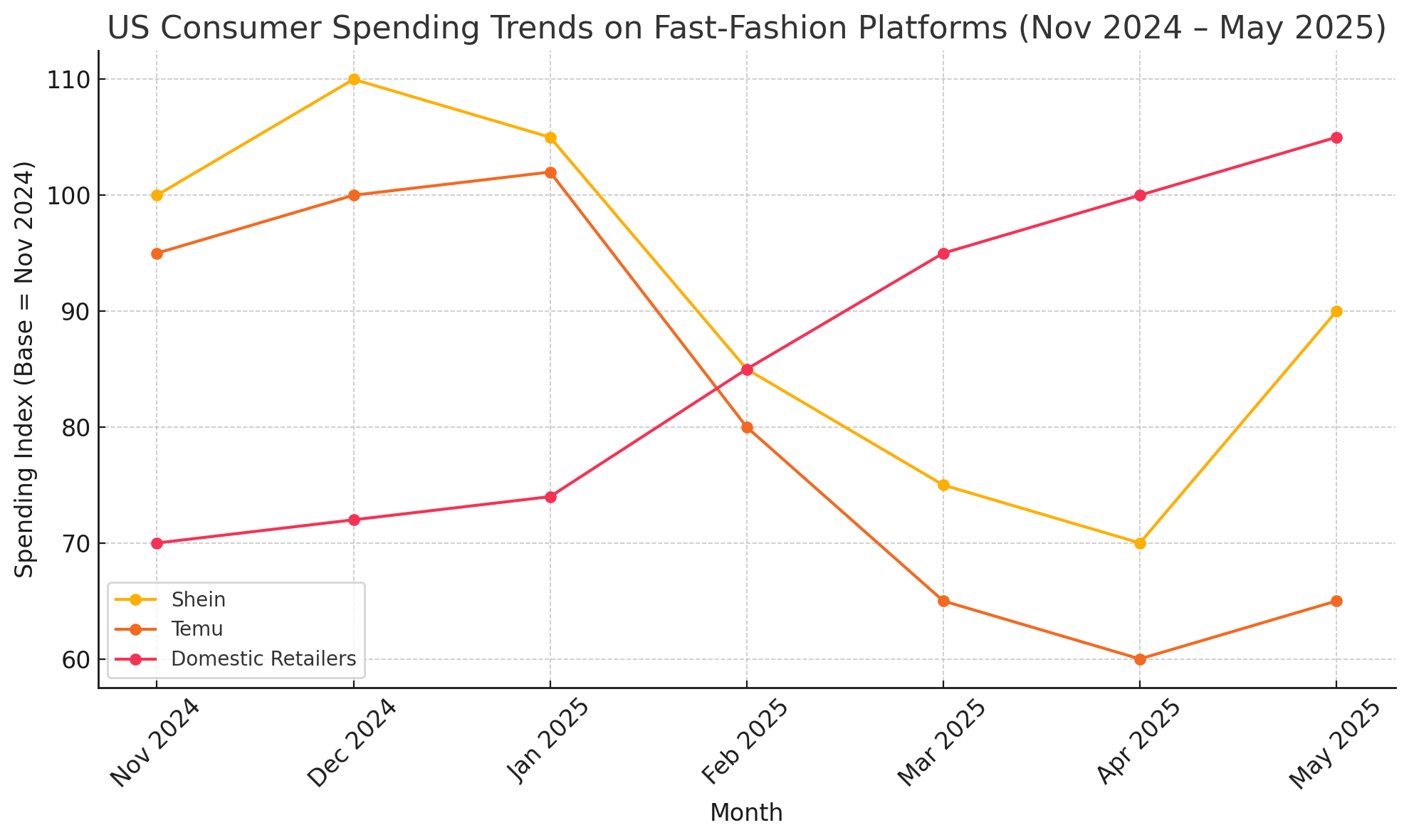

One of the most immediate impacts of tariff escalation in early 2025 was a palpable decline in purchasing activity from US consumers on platforms like Shein and Temu. Prior to these regulatory shifts, Shein had built a loyal consumer base largely driven by low prices, extensive product variety, and a user-friendly digital experience. However, the abrupt cost inflation following the removal of the de minimis exemption eroded this core value proposition. Items that once cost $5–$7 began to exceed $10–$12 after added duties and surcharges—pushing them into price brackets traditionally occupied by domestic competitors offering faster shipping and more predictable return policies.

This mismatch between consumer price expectations and actual checkout costs led to a notable spike in shopping cart abandonment. Internal analytics, supported by external reporting from retail intelligence firms, showed that cart abandonment rates rose by over 25% between February and April 2025. Simultaneously, negative sentiment regarding pricing began to appear on social media platforms, where young shoppers expressed frustration over “unexpected fees” and the perceived lack of transparency. These behavioral changes signal how tariff policy, though external to the consumer-brand relationship, can have profound ripple effects on trust and conversion.

Shein’s response—aggressive price cuts tied to the 90-day tariff reduction—helped restore some of this trust. By explicitly linking price reductions to the tariff news cycle, the company not only regained consumer interest but also framed itself as a responsive entity operating under global constraints rather than one engaging in opportunistic pricing. The framing was subtle yet effective: consumers returned not just for the lower prices but for the perception that Shein was aligning its business model with their financial concerns.

Generational Differences in E-Commerce Behavior

A deeper layer of analysis reveals that different age demographics have responded to the tariff-induced pricing shifts in distinct ways. Generation Z and younger millennials—Shein’s primary audience—have historically shown high tolerance for long delivery windows and variable quality in exchange for extreme affordability. However, this tolerance has boundaries. When affordability is compromised without a corresponding improvement in quality or service, this segment quickly seeks alternatives.

Following the tariff hikes, these younger consumers began shifting toward domestic discount retailers with strong e-commerce platforms. Nordstrom Rack, TJ Maxx, and Kohl’s saw an increase in web traffic from younger demographics, especially those searching for fashion basics and seasonal apparel. Unlike Shein, these retailers offered consistent pricing without import surcharges, making them more appealing during a period of economic uncertainty.

By contrast, older millennials and Gen X consumers—who generally favor product reliability and clear returns policies over hyper-personalized fast fashion—have been slower to adopt platforms like Shein and Temu. The tariff situation and associated unpredictability reinforced their preferences for stability, with many choosing Amazon, Target, or specialty retailers that offer blended online and in-store experiences.

This demographic divergence illustrates an important market reality: while price remains a powerful driver of behavior, it is not absolute. Consumer loyalty is increasingly contingent on predictability, transparency, and perceived fairness—factors that gain greater weight during moments of economic stress or policy volatility.

The Role of Transparency and Checkout Experience

The checkout experience has emerged as a critical battleground in determining brand loyalty in fast fashion e-commerce. In an environment where tariffs and fees can fluctuate with minimal warning, the clarity with which these costs are communicated becomes paramount. Shein’s decision to reflect price changes directly on product listings, rather than layering them at checkout, proved strategically sound. This transparency was instrumental in reversing negative trends in user retention and purchase completion.

Conversely, Temu’s continued use of post-cart import surcharges eroded user goodwill. Consumer reviews on third-party sites such as Trustpilot and Reddit began to highlight the “bait-and-switch” feeling created by attractive list prices followed by hidden costs. This feedback loop illustrates a broader behavioral insight: while consumers may accept higher prices, they are far less tolerant of price deception or post-selection surprise charges. The perceived fairness of the transaction process can weigh as heavily as the final cost itself.

This behavioral sensitivity is especially pronounced among digital-native consumers accustomed to instant feedback and public brand accountability. For such users, a frustrating or opaque checkout experience does not remain a private grievance—it becomes shared content, influencing hundreds or thousands of other prospective buyers. This viral dimension of user experience raises the stakes for platforms reliant on word-of-mouth and social amplification.

Shifts Toward Domestic Alternatives and Brand Perception

Another consequential development stemming from Shein’s tariff-induced price instability has been the modest but noteworthy shift toward domestic retailers. While Shein’s price cuts have partially reversed consumer flight, some erosion of its market share appears to be sticking—particularly among consumers who used the tariff disruption as an opportunity to explore alternatives.

Retailers such as Kohl’s, Nordstrom Rack, and even digital-native brands like ThredUp and Poshmark have capitalized on this momentum by highlighting their price stability, local warehousing, and return-friendly policies. These brands have launched marketing campaigns that implicitly critique the unpredictability of foreign platforms, positioning themselves as trustworthy, values-driven, and grounded in consumer protection.

Shein’s challenge, therefore, is not just to regain price competitiveness but to rehabilitate elements of brand trust. This effort is complicated by ongoing political scrutiny around labor practices and sustainability, both of which reemerge in public discourse whenever the company is spotlighted by macroeconomic events such as tariff legislation.

Anticipating Long-Term Behavioral Shifts

While Shein’s tactical response has been largely successful in recapturing some of its user base, it remains unclear whether consumer behavior will revert entirely to pre-tariff norms. Several long-term behavioral shifts appear to be taking shape:

- Greater Emphasis on Total Cost Transparency: Consumers now actively evaluate not just sticker price but final cost including fees, taxes, and delivery charges. Platforms that offer upfront clarity are more likely to retain engagement.

- Heightened Risk Aversion: In periods of economic uncertainty, consumers gravitate toward brands perceived as stable. This benefits domestic retailers, especially those with omnichannel infrastructure.

- Value Beyond Price: Increasingly, shoppers are evaluating brands on factors such as return policy, delivery speed, ethical sourcing, and customer service. While price remains a key metric, it is increasingly part of a broader value calculus.

- Loyalty Fluidity: Younger consumers, while brand-aware, are not brand-loyal in the traditional sense. Their loyalty is transactional and can shift quickly based on perceived value and alignment with personal values.

Understanding these evolving dynamics is critical for any brand seeking to maintain relevance in the post-pandemic, post-globalization era of e-commerce.

The tariff-induced disruption of early 2025 has served as a stress test for consumer-brand relationships in fast fashion e-commerce. Shein’s strategic price reductions have mitigated some of the initial fallout, but the broader behavioral shifts among US shoppers suggest that trust, transparency, and perceived fairness are now as important as affordability. As price sensitivity interacts with evolving expectations around service and brand ethics, the future of cross-border retail will depend not just on competitive pricing, but on the ability to foster resilient and adaptive consumer relationships. The next section will analyze how these changing dynamics are reshaping the e-commerce landscape and creating new opportunities and challenges for global retailers.

Implications for the E-Commerce Landscape

The developments surrounding Shein’s tariff-induced price strategy and the subsequent shifts in consumer behavior are not isolated events, but indicators of broader transformations within the global e-commerce landscape. As regulatory scrutiny intensifies and consumer expectations evolve, online retailers—especially those operating across borders—face increasing pressure to adapt. In this section, we examine the implications of the current situation for international and domestic e-commerce players, exploring how platform strategies, supply chain models, competitive positioning, and policymaking are being reshaped by this pivotal moment.

Strategic Pressures on Cross-Border E-Commerce

Cross-border e-commerce has long thrived on the principle of cost arbitrage: sourcing products from low-cost manufacturing hubs and shipping them directly to consumers in higher-income markets at attractive prices. For companies like Shein and Temu, the United States represented a lucrative destination, enabled by regulatory loopholes such as the de minimis provision and inexpensive last-mile delivery subsidies via international postal agreements. However, the recent imposition and adjustment of tariffs underscore a growing trend among developed economies to reassert control over the terms of digital trade.

As tariffs rise and exceptions diminish, the core model underpinning Shein’s low-cost advantage becomes increasingly untenable without strategic restructuring. The same applies to other Chinese and Southeast Asian exporters reliant on small-package exemptions and minimal regulatory oversight. In this sense, the Shein case is emblematic of a broader recalibration in how nations regulate digital imports—and by extension, how global e-commerce platforms must reengineer their logistics and pricing infrastructure to remain viable in protectionist climates.

This regulatory tightening has significant implications for scalability. Smaller cross-border platforms may struggle to absorb the added costs of tariffs, warehousing, and compliance, potentially leading to consolidation in the sector. At the same time, it creates opportunities for larger players with the capital and operational flexibility to localize elements of their value chain in key markets.

Supply Chain Diversification as a Strategic Imperative

One of the most direct consequences of increased trade barriers has been a renewed focus on supply chain diversification. For Shein, the development of a massive warehouse and fulfillment hub in Vietnam marks a deliberate shift in strategy aimed at reducing reliance on China-centric logistics. This move offers several advantages: it may allow the company to take advantage of regional trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), while also positioning it to better serve Western markets through faster shipping and reduced customs scrutiny.

This trend toward decentralization is being replicated across the industry. E-commerce giants are increasingly looking to “China +1” strategies, establishing additional production and distribution centers in countries such as India, Bangladesh, and Mexico. The goal is to mitigate the risk of single-country dependencies and to create regional buffers that can absorb shocks from tariffs, supply chain disruptions, or political instability.

However, diversification is not without cost. Establishing redundant facilities, training new labor forces, and negotiating new logistics contracts all require capital outlays and time. The question becomes one of speed and execution—platforms that can realign quickly without compromising service levels or inflating prices will be best positioned to capitalize on the next wave of cross-border commerce.

Opportunities for Domestic Retailers and Hybrid Models

While cross-border platforms are being pressured by trade policy, domestic retailers are simultaneously benefiting from a renewed consumer focus on price transparency, reliable service, and brand accountability. The tariff shocks of early 2025 created an unexpected opportunity for retailers such as Kohl’s, Nordstrom Rack, and Walmart to win back customers who had previously migrated to ultra-low-cost platforms.

These retailers, many of whom had already begun investing heavily in digital transformation, now find themselves in a favorable position. They can offer faster shipping, easier returns, and consistent pricing—attributes that have grown in importance in the eyes of the consumer. Furthermore, many are beginning to experiment with hybrid models that blend domestic inventory with select international products, allowing them to compete on price while retaining control over the consumer experience.

For instance, retailers may source low-cost goods via vetted suppliers in Vietnam or Indonesia but distribute them from US-based warehouses to avoid customs delays. These hybrid strategies not only insulate against geopolitical shocks but also offer a middle ground between value and service quality—an increasingly appealing proposition in a fragmented e-commerce landscape.

In addition, domestic platforms are exploring third-party marketplace integrations with greater caution. While partnering with overseas sellers can expand inventory and revenue, it also introduces risks related to quality control, intellectual property, and regulatory compliance. In a post-tariff environment, platforms that carefully vet and onboard foreign sellers while maintaining oversight of fulfillment practices will likely outperform those with looser controls.

Regulatory Ripple Effects and Future Policy Directions

The current episode involving Shein and US tariffs is likely a harbinger of broader regulatory recalibrations to come. Governments around the world are beginning to reconsider how digital trade is regulated, especially as e-commerce accounts for an ever-larger share of retail activity and tax revenue. In the US, the closure of the de minimis loophole for Chinese imports reflects a growing consensus that consumer protections, fair trade, and national competitiveness must extend to digital channels as well.

Future policy directions may include stricter enforcement of origin labeling, requirements for transparent pricing including all duties and fees, and even ESG disclosures for platforms operating across borders. Countries may also move to tax cross-border digital sellers more aggressively or require localized customer service operations to ensure accountability.

From a business perspective, these changes introduce a new compliance overhead—but they also raise the bar for market entry. Established platforms with legal teams, global infrastructure, and brand equity may find themselves advantaged relative to newer entrants. This could produce a new era of digital trade characterized not by price alone, but by trust, regulatory adherence, and operational maturity.

In parallel, consumer advocacy organizations are likely to play a larger role. As shoppers demand more clarity on sourcing, labor practices, and environmental impact, brands that fail to meet these expectations will face reputational risks. Regulatory regimes may eventually codify these expectations into law, creating a feedback loop where public sentiment drives policy, and policy in turn shapes platform behavior.

Competitive Innovation in the New E-Commerce Order

Ultimately, the shake-up in global e-commerce caused by tariff realignments and shifting consumer sentiment is fostering a wave of competitive innovation. Companies are experimenting with AI-based demand forecasting, local manufacturing partnerships, blockchain-enabled supply chains, and new payment systems that offer greater price transparency. These technologies are not just incremental improvements—they are enabling new business models designed for agility, compliance, and consumer engagement.

For example, platforms are exploring predictive shipping, wherein inventory is pre-positioned based on algorithmic forecasts of regional demand. This allows faster fulfillment with lower overhead and minimizes reliance on long-haul cross-border logistics. Others are investing in virtual try-on features and sizing algorithms to reduce return rates and improve the online shopping experience—critical differentiators as product cost advantages erode.

In this environment, success will depend less on scale alone and more on strategic execution. Shein’s price reductions, while effective in the short term, are a tactical response. The real test lies in the platform’s ability to embed resilience, transparency, and adaptability into its long-term operating model. Likewise, domestic retailers and emerging competitors must decide how to balance innovation with cost control and policy alignment.

The recent turbulence in Shein’s US operations is more than a case study in reactive pricing—it is a window into the evolving architecture of global e-commerce. As protectionist policies rise and consumers demand more from digital retailers, the entire industry is being reshaped by forces that extend well beyond pricing alone. Platforms must now navigate a complex matrix of regulatory compliance, supply chain reengineering, consumer trust-building, and technological adaptation. Those that succeed will not only weather the current storm but emerge as leaders in a new, more disciplined era of cross-border digital commerce.

Conclusion

The recent sequence of events involving Shein’s strategic price reductions in response to shifting US tariff policies provides a powerful lens through which to examine the fragile yet rapidly evolving nature of global e-commerce. As a leader in fast fashion, Shein’s actions have not only shaped its immediate commercial trajectory but also cast a spotlight on the broader structural vulnerabilities and strategic imperatives now facing international digital retailers. The company’s ability to swiftly implement a 13% average price cut—targeted at regaining the favor of US consumers—demonstrates tactical agility, yet also underscores the limits of a business model heavily reliant on regulatory exemptions and ultra-low-cost sourcing from China.

The US decision to temporarily reduce tariffs on small-package Chinese imports has created a narrow window of opportunity for Shein to recover some of the momentum it lost in the wake of earlier tariff hikes and the closure of the de minimis loophole. However, this relief is short-term and conditional, highlighting the degree to which global e-commerce platforms are increasingly exposed to political and policy volatility. Moreover, shifts in consumer behavior—marked by heightened sensitivity to pricing transparency, growing concern over brand trust, and a rediscovered appreciation for domestic reliability—suggest that the competitive landscape will continue to shift, even as prices normalize.

In this new environment, Shein and its peers must not only respond to short-term disruptions but also commit to long-term operational resilience. This includes diversifying supply chains beyond China, investing in domestic warehousing, and adapting business models to meet both regulatory demands and evolving consumer expectations. Meanwhile, domestic retailers and hybrid platforms stand to gain from a renewed focus on transparency, ethics, and service reliability—factors increasingly valued alongside cost.

The e-commerce marketplace is entering a post-advantage phase, where cost leadership alone is no longer sufficient to ensure loyalty or longevity. Trust, agility, compliance, and experience are becoming the new benchmarks of success. Shein’s case illustrates both the challenges of this transition and the kinds of strategic pivots that may define the next generation of global retail leadership. As the tariff clock continues to count down, the real question is not whether Shein can reclaim its US audience temporarily—but whether it can build a sustainable, adaptable model for the long term.

References

- Bloomberg – Shein Lowers Prices to Lure Back US Shoppers After Tariff Cut

https://www.bloomberg.com/news/articles/shein-lowers-prices-to-lure-back-us-shoppers-after-tariff-cut - Modern Retail – Shein Cuts Prices Amid Temporary US-China Tariff Relief

https://www.modernretail.co/operations/shein-cuts-prices-amid-temporary-us-china-tariff-relief - Reuters – Shein to Set Up Massive Vietnam Warehouse to Hedge Tariff Risks

https://www.reuters.com/world/china/shein-set-up-huge-vietnam-warehouse-us-tariff-hedge-sources-say - NY Post – Tariffs Slam Temu and Shein, Sending Shoppers to US Department Stores

https://nypost.com/2025/05/14/business/tariffs-slam-temu-shein-and-send-shoppers-to-us-department-stores - CNBC – What the End of the De Minimis Rule Means for Chinese Retailers

https://www.cnbc.com/what-the-end-of-de-minimis-means-for-chinese-retailers - The Information – Temu’s Hidden Tariffs and Checkout Transparency Issues

https://www.theinformation.com/articles/temu-hidden-tariffs-and-user-dropoff - TechCrunch – Shein Expands Southeast Asia Footprint Amid Regulatory Pressure

https://techcrunch.com/shein-expands-southeast-asia-footprint - Vox – The Fast Fashion Loophole and Why It’s Closing

https://www.vox.com/the-fast-fashion-loophole - Business of Fashion – Shein’s Global Supply Chain Strategy Explained

https://www.businessoffashion.com/articles/shein-global-supply-chain-strategy - The Wall Street Journal – US Retailers Reclaim Market Share from Chinese Rivals

https://www.wsj.com/articles/us-retailers-reclaim-market-share-from-chinese-rivals