Shein and Temu Warn Tariffs Will Raise Prices in the U.S.: A Deep Dive into the Impacts of New Trade Policies

The Rise of Shein and Temu in the U.S. Market

In the past decade, the global e-commerce landscape has undergone a dramatic transformation, largely driven by the rise of ultra-fast fashion platforms and low-cost online marketplaces. Among the most prominent players are Shein, a China-based fashion retailer known for its ultra-low prices and high turnover of styles, and Temu, an aggressive entrant offering a vast array of discounted goods, from clothing to electronics. These two platforms have not only revolutionized how U.S. consumers shop online but have also challenged long-established retail norms by leveraging supply chain innovations, data-driven marketing, and an unprecedented reliance on cross-border shipping advantages.

Shein was founded in 2008 and initially operated as a small-scale online retailer focused on women's fashion. Over the years, it refined its supply chain by integrating digital feedback loops and rapid prototyping into its manufacturing operations. Unlike traditional fashion houses that operate on seasonal calendars, Shein's real-time data approach allows it to produce thousands of new items weekly, based on live consumer preferences and social media trends. With this agility, Shein disrupted the U.S. fast fashion sector, drawing comparisons with giants such as H&M and Zara, yet outpacing them in digital engagement and pricing strategy.

Temu, a subsidiary of the Chinese e-commerce behemoth PDD Holdings (parent company of Pinduoduo), entered the U.S. market in 2022 with an audacious value proposition: offer shockingly low prices on everyday goods by shipping directly from Chinese factories to American doorsteps. In doing so, Temu eliminated multiple layers of traditional retail markup. Leveraging PDD’s established manufacturing and logistics ecosystem, Temu quickly gained traction in the U.S., particularly among price-sensitive consumers. Its aggressive use of digital advertising and influencer partnerships further amplified its reach, making it one of the most downloaded shopping apps in the country by 2024.

The United States has been central to the growth strategy of both Shein and Temu. The combination of a large consumer base, high internet penetration, and a culture of online shopping created fertile ground for their success. Moreover, both companies have benefited from the “de minimis” exemption under U.S. customs law, which allows imported packages valued at less than $800 to enter duty-free. This policy, designed to facilitate small-scale international purchases, inadvertently became a cornerstone of Shein and Temu’s business models. By shipping small packages directly from overseas sellers to individual U.S. consumers, they avoided many of the import duties and taxes that traditional retailers face, thus maintaining their competitive pricing.

However, this growth has not come without scrutiny. Critics have raised concerns about product quality, labor practices, environmental impact, and the potential for counterfeit goods. Traditional retailers and lawmakers have also voiced strong opposition to the exploitation of trade loopholes, arguing that companies like Shein and Temu enjoy unfair advantages that undermine domestic businesses. These tensions have led to a push for regulatory reforms aimed at leveling the playing field.

In 2024 and early 2025, calls for trade policy changes intensified as lawmakers began targeting the very mechanisms that allowed Shein and Temu to flourish. The de minimis rule, once considered a benign regulatory detail, suddenly found itself at the center of trade debates in Washington. As bipartisan momentum grew to address perceived abuses of the rule, new tariffs and restrictions were proposed, many of which would directly impact Chinese e-commerce players.

The situation escalated further with the announcement of new tariff policies by the U.S. government. These policies aim to impose steep duties on a wide range of Chinese imports, including those sold by Shein and Temu, while simultaneously phasing out the de minimis exemption. The move, presented as a necessary correction to an imbalanced trade system, threatens to fundamentally alter the operating landscape for these companies.

Both Shein and Temu have responded swiftly and vocally to these developments. In public statements and internal communications, they have warned that the new tariffs will inevitably lead to higher prices for American consumers. These warnings are not mere speculation; they reflect the very real cost pressures that tariffs impose on importers. With their margins already thin and their customer base highly price-sensitive, Shein and Temu face difficult decisions about how much of these additional costs they can absorb versus how much must be passed on to consumers.

This blog post aims to provide a comprehensive analysis of this evolving situation. We will delve into the specifics of the new tariff policies, examine how they disrupt the operational models of Shein and Temu, and assess the broader implications for U.S. consumers and the retail ecosystem. Additionally, we will consider the long-term strategic ramifications for cross-border e-commerce and explore potential adaptation strategies that Shein, Temu, and their competitors may pursue.

As the dynamics of global trade continue to shift, this moment serves as a critical inflection point for digital commerce. The clash between low-cost international retailers and domestic regulatory interests encapsulates broader debates about globalization, fairness, and the future of consumer choice. In this context, the fate of Shein and Temu is not just a story about two companies—it is a window into the forces reshaping 21st-century retail.

Understanding the New Tariff Policies

To fully grasp the urgency behind Shein and Temu's warnings about impending price hikes, one must first understand the nature and scope of the new tariff regulations introduced by the United States government. These policies mark a significant shift in U.S. trade policy toward Chinese imports and are specifically designed to close longstanding loopholes that have disproportionately benefited foreign e-commerce platforms operating outside traditional regulatory frameworks. The policies have far-reaching implications for not only Shein and Temu, but also for U.S. consumers, domestic retailers, and the broader architecture of international commerce.

Overview of the Tariff Changes

The most critical changes impacting Shein and Temu stem from a series of executive orders and legislative actions aimed at curbing the trade advantages leveraged by foreign e-commerce platforms. Chief among these is the termination of the “de minimis” exemption for Chinese-origin goods. Under the former rule, shipments entering the United States with a declared value under $800 were exempt from duties and taxes. This policy, while originally intended to facilitate efficient customs processing of low-value items, evolved into a key strategic lever for platforms like Shein and Temu, who shipped millions of low-cost parcels directly from China to American consumers without incurring tariffs.

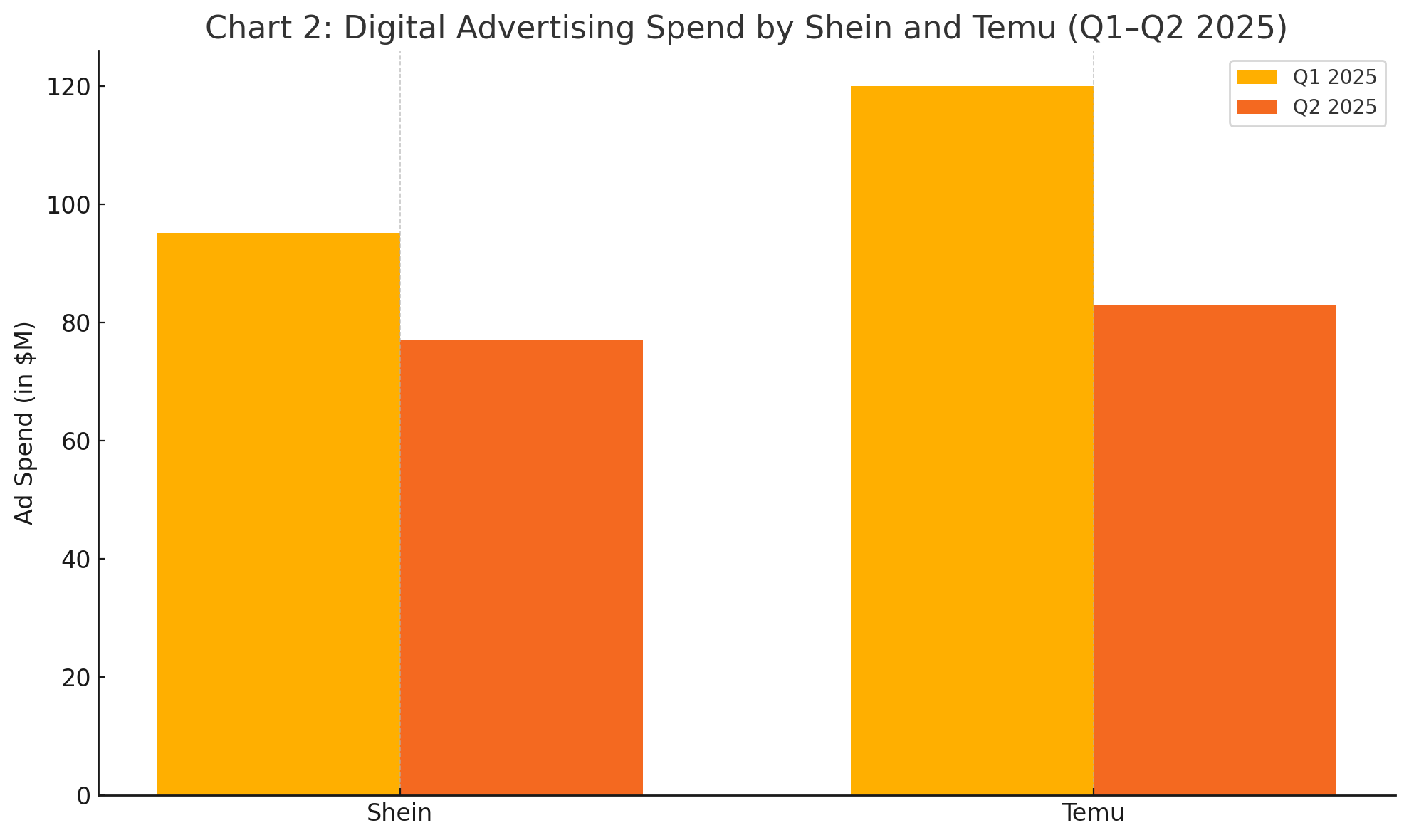

The policy reversal effectively dismantles this advantage. Beginning on May 2, 2025, goods imported from China are no longer eligible for the de minimis exemption. This change forces Shein, Temu, and similar platforms to pay full import duties on every package regardless of value, leveling the playing field with domestic retailers and other importers who already comply with such obligations.

In addition, a second wave of tariff increases is scheduled to take effect on June 1, 2025. These tariffs will impose significantly higher fees—up to $150 per item—on a broad spectrum of goods, including apparel, electronics, accessories, and home products, which constitute the core of Shein and Temu’s catalogues. The new tariff rates represent increases of up to 145% on certain product categories, which could render current pricing models unsustainable.

To prepare the market for these changes, a transition period began in April 2025, during which companies were permitted to adjust their operations and pricing structures. Starting on April 25, 2025, both Shein and Temu began issuing advisories to customers regarding forthcoming price increases. Internal pricing models were revised to incorporate expected duties, and the companies initiated cost simulations to assess margin erosion under the new tariff structures.

Legal and Political Context

The policy changes are part of a broader realignment of U.S. trade priorities, particularly with respect to China. The Biden administration, continuing the protectionist trend initiated under former President Trump, has taken a more assertive stance on trade fairness, intellectual property protection, and national security. Key concerns fueling this policy shift include:

- Unfair Competition: U.S. retailers have long argued that foreign platforms exploiting the de minimis loophole enjoy an unfair price advantage. By avoiding import duties, Shein and Temu can undercut domestic competitors by 20–30%, distorting market dynamics.

- Product Safety and Counterfeits: Regulators have raised red flags about the influx of unregulated products through de minimis channels. Reports of counterfeit items, non-compliant electronics, and unsafe children’s goods have led to bipartisan support for increased scrutiny and control.

- Labor and Environmental Standards: Lawmakers have expressed concern that goods sold by Shein and Temu may originate from factories operating under exploitative labor conditions or with minimal environmental oversight. The new tariffs are thus also framed as tools for enforcing ethical supply chain behavior.

- National Security Considerations: Amid broader geopolitical tensions between the U.S. and China, economic dependency on Chinese supply chains is increasingly viewed as a vulnerability. By reshaping the regulatory framework, U.S. policymakers aim to encourage diversification and resilience in sourcing strategies.

These factors coalesced into a legislative push backed by both political parties, resulting in the Trade Compliance and Fair Import Act of 2025, which provided the legal foundation for ending the de minimis exemption and authorizing the new tariff schedules.

Industry and Retail Sector Reaction

The response from industry stakeholders has been immediate and multifaceted. Traditional U.S. retailers and trade groups have applauded the measures as long-overdue reforms that correct structural imbalances. Organizations such as the National Retail Federation (NRF) and American Apparel & Footwear Association (AAFA) issued statements welcoming the changes and expressing hope that the new rules will foster more equitable competition.

Conversely, global logistics providers, freight companies, and platform-based sellers have expressed concern about the impact of increased regulatory burden. With millions of small parcels entering the U.S. daily under the de minimis threshold, the removal of the exemption is expected to significantly strain customs infrastructure, increasing delays and administrative complexity. Some industry analysts have warned of potential bottlenecks as customs officials adjust to handling a higher volume of tariff-assessed packages.

From the consumer perspective, early surveys suggest a mixed reaction. While a majority of respondents support measures to protect domestic jobs and product safety, a significant portion expresses concern about losing access to low-cost goods. For millions of budget-conscious shoppers, platforms like Shein and Temu represent a critical lifeline for affordable clothing and household essentials. As such, the tariff changes may have disproportionate effects on lower-income populations.

Implementation Timeline and Phased Enforcement

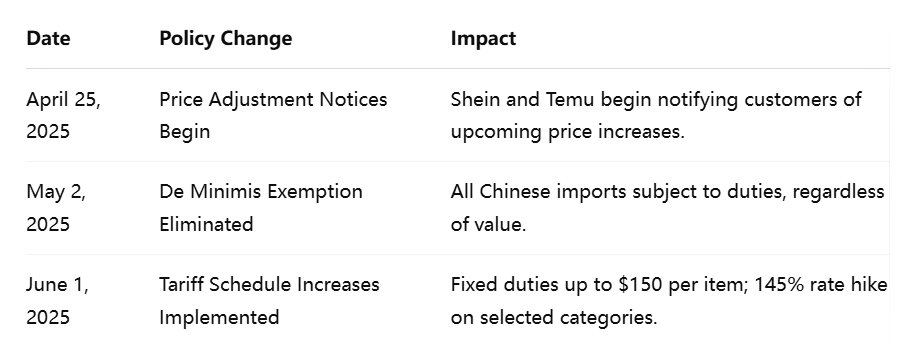

The rollout of the new tariffs and de minimis repeal is structured across three key milestones:

This phased approach is designed to allow businesses to adapt while giving regulators the opportunity to fine-tune enforcement mechanisms. Customs and Border Protection (CBP) is concurrently rolling out new digital tracking and classification systems to handle the increased inspection workload.

See Chart 1 below for a timeline of key tariff milestones and the projected price impacts on Shein and Temu’s offerings.

Strategic Responses from Affected Firms

Both Shein and Temu have initiated early-stage adaptation efforts. These include exploring options for establishing domestic distribution hubs, restructuring supplier relationships, and revising product catalogs to prioritize higher-margin items. However, the scale and speed required for these adjustments make them operationally and financially daunting.

Moreover, internal reports suggest that both companies are engaging in lobbying efforts to delay or modify implementation of the new rules. Industry sources indicate that lobbying firms retained by Shein and Temu have approached congressional offices with proposals for exemption carve-outs or phased duty caps to mitigate short-term disruption.

Despite these efforts, the regulatory direction appears resolute. Policymakers have signaled that further trade restrictions targeting e-commerce may be under consideration, including enhanced data disclosure requirements and origin tracing mandates.

Conclusion

The new tariff regulations represent one of the most consequential shifts in U.S. trade policy in recent years, particularly for cross-border e-commerce platforms. By targeting the very mechanisms that enabled their rise, these policies force companies like Shein and Temu to reevaluate their cost structures, operational models, and long-term strategies. While the intention is to foster fairer competition and better consumer protections, the path forward is laden with complexity, uncertainty, and economic friction.

Impact on Shein and Temu's Business Models

The imposition of new U.S. tariff policies and the elimination of the de minimis exemption present a formidable challenge to the operational viability of Shein and Temu in their current form. These regulatory developments are not minor adjustments to business costs; rather, they represent fundamental disruptions to the underlying economics of ultra-low-cost cross-border e-commerce. The effects reverberate across several key dimensions of the companies’ business models, including pricing, logistics, advertising, consumer engagement, and supply chain strategy.

Cost Structure Disruption and Margin Compression

At the core of Shein and Temu’s competitive advantage lies a cost structure optimized for minimal overhead. Both companies operate on lean business models that rely on direct-from-manufacturer shipping, limited warehousing, and low customer acquisition costs. The removal of the de minimis exemption and the imposition of steep tariffs threaten to unravel this foundation.

Prior to the regulatory changes, Shein and Temu avoided substantial import duties by shipping packages under the $800 threshold. This allowed them to maintain razor-thin margins while offering prices far below those of domestic retailers. With the new tariffs in effect—some as high as $150 per item or 145% of the item’s value—margins are expected to collapse unless prices are significantly increased. For platforms that thrive on affordability and volume, this scenario is particularly precarious.

A recent internal analysis shared with investors by Shein reportedly projects that average per-unit cost could rise by 25–40% across its top-selling product lines. Temu’s projections are even more dire, particularly for bulkier, low-margin categories like home goods and electronics, where added duties exceed existing profit margins. Without price increases, continued operations under the new tariff regime would likely result in unsustainable losses.

Implications for Pricing Strategy and Consumer Demand

Faced with mounting import costs, both Shein and Temu are being forced to reconsider their pricing strategies. Historically, these companies have positioned themselves as champions of extreme affordability—offering dresses for under $10 and accessories for less than $2. This value proposition has been central to their brand identity and a primary driver of customer loyalty.

In the wake of the policy changes, both companies have issued advisories indicating that prices will rise in May and June 2025. Early pricing adjustments have already begun, with certain product categories seeing increases of 15–20%. While these adjustments are modest compared to the projected tariff burden, they represent only the first wave of recalibrations. More significant increases are expected as the full weight of the new regulations takes effect.

The consequences of these price hikes on consumer demand remain to be fully seen, but early indicators suggest the impact could be substantial. Shein and Temu cater disproportionately to younger, price-sensitive shoppers—particularly Gen Z and low-income households—who may be unwilling or unable to absorb higher costs. For many of these consumers, a 30% increase in product prices could trigger a shift toward alternative shopping options, including domestic discount retailers, secondhand platforms, or even a reduced overall consumption of non-essential items.

Advertising Budget Cuts and Brand Visibility

Another critical dimension affected by the regulatory shift is advertising and marketing spend. Both Shein and Temu have historically relied heavily on digital advertising to drive growth in the U.S. market. Their marketing strategies include widespread use of social media influencers, Google Shopping ads, and in-app promotions designed to trigger impulse purchases.

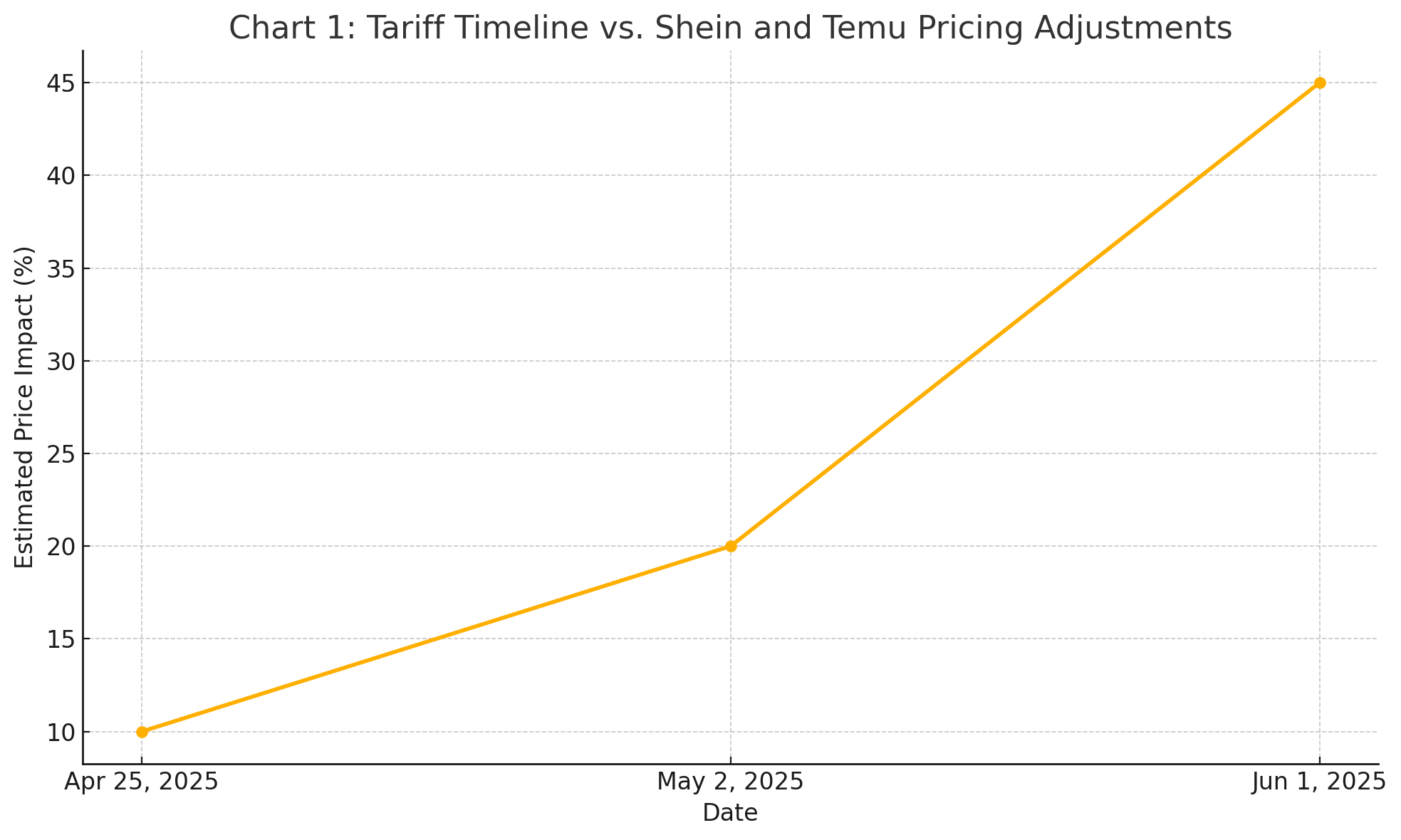

However, with shrinking profit margins and increasing compliance costs, both companies are scaling back on these expenditures. According to internal figures released by media buying agencies, Temu has reduced its digital advertising budget by 31%, while Shein has made a 19% cut in recent months. This retrenchment is likely to diminish brand visibility at a time when consumer loyalty is already under pressure due to rising prices.

Chart 2 below illustrates the sharp decline in digital advertising investment by both companies between Q1 and Q2 2025.

The cuts also signal a shift in strategic priorities—from growth and customer acquisition to cost containment and financial resilience. While this is a rational response to margin erosion, it risks diminishing the brand momentum both companies have worked hard to establish. With a less visible presence across digital channels, Shein and Temu could struggle to attract new users or maintain engagement levels with existing ones, particularly in a competitive retail environment where U.S.-based alternatives are intensifying their own marketing efforts.

Operational Realignment and Supply Chain Adjustments

In response to the changing trade landscape, Shein and Temu are exploring operational realignments to preserve market share and competitiveness. Among the most discussed options is the establishment of U.S.-based fulfillment and warehousing infrastructure. By importing bulk shipments and distributing domestically, the companies could mitigate per-unit tariff costs and improve delivery timelines.

Shein has already begun pilot programs involving domestic warehousing in key regions such as California and Texas, partnering with third-party logistics providers to test regional distribution models. Temu is reportedly considering similar initiatives, including negotiations with East Coast fulfillment centers to reduce last-mile delivery costs and enhance inventory control.

While these efforts offer potential advantages, they also require substantial capital investments, changes in inventory management systems, and new layers of regulatory compliance. Moreover, the transition to domestic fulfillment would mark a significant departure from their existing direct-to-consumer shipping model, which is predicated on avoiding intermediary handling and warehousing expenses. The shift may be necessary to remain compliant and competitive, but it introduces new complexities that will take time to address.

Additionally, both firms are evaluating diversification of sourcing and manufacturing as part of long-term strategy. This includes exploring production capacities in Vietnam, India, and Latin America—regions that are not currently subject to the same tariffs as China. However, sourcing outside of China poses its own set of challenges, including higher production costs, weaker infrastructure, and less established supply networks.

Impact on Product Assortment and Quality Control

Given the cost pressures, Shein and Temu may also need to rationalize their product assortments. This could involve focusing on higher-margin categories while scaling back offerings that are no longer financially viable under the new tariff structure. Such a strategy could improve unit economics but may undermine the core appeal of these platforms—their vast selection and rapid product turnover.

Moreover, any attempts to offset tariffs by further reducing product costs raise concerns about quality control. Both companies have faced criticism in the past for product inconsistencies and low durability. If new constraints lead to cost-cutting in materials or manufacturing oversight, customer satisfaction could further deteriorate, compounding the impact of higher prices.

Financial Viability and Investor Sentiment

The long-term financial implications of the new trade environment are beginning to influence investor sentiment. Private equity firms and venture capital stakeholders—many of whom have backed Shein and Temu during their hyper-growth phases—are reportedly reevaluating their positions. Analysts from global investment banks have downgraded near-term revenue forecasts and increased risk premiums associated with cross-border e-commerce investments.

Although both companies remain well-capitalized and continue to post strong top-line growth, the margin compression and regulatory uncertainty have dampened expectations for profitability and scalability in the U.S. market. This shift in investor perception could have cascading effects on future fundraising rounds, valuation assessments, and expansion strategies.

Conclusion

The recent trade policy changes enacted by the U.S. government represent an existential challenge to the business models of Shein and Temu. By eliminating the de minimis exemption and imposing steep tariffs, regulators have dismantled a key pillar of their cost advantage and forced a reevaluation of nearly every aspect of their operations. From pricing and advertising to logistics and inventory, both companies must now navigate a more complex and less forgiving commercial landscape.

Broader Implications for U.S. Consumers and the E-Commerce Landscape

The tariff measures imposed by the United States on low-cost Chinese imports are not limited to their impact on Shein and Temu alone. These policies will likely have a profound and lasting influence on the wider e-commerce ecosystem and on consumer behavior in the U.S. As price-sensitive goods become more expensive and consumer choice narrows, the retail landscape is undergoing a significant transformation. The broader implications encompass rising consumer costs, changing market dynamics, evolving shopper habits, and opportunities for domestic competitors to reclaim market share.

Increased Consumer Costs and Shrinking Affordability

One of the most immediate and tangible effects of the new tariffs is the expected increase in consumer prices. Shein and Temu have historically offered goods at exceptionally low prices—frequently below cost levels feasible for traditional U.S. retailers. With new import duties in place, this pricing model is being directly challenged, and the burden is increasingly being passed on to consumers.

According to estimates from the U.S. Chamber of Commerce, the average basket of goods from these platforms could rise in cost by 20–45%, depending on product type. For example, an apparel order that previously cost $50 may now exceed $70 after tariffs and surcharges are accounted for. This change is particularly concerning for lower-income consumers and students who rely on these platforms for affordable clothing, accessories, and household items. The loss of the de minimis exemption—once a backstop against these duties—has removed a key tool for maintaining affordability in cross-border e-commerce.

While higher prices may lead to more equitable competition in theory, they simultaneously risk shrinking the consumer base for affordable fashion and utility items. In a country where inflationary pressures are already straining household budgets, an additional increase in the cost of basic consumer goods may amplify existing economic stresses, particularly for vulnerable demographics.

Shifting Consumer Behavior and Shopping Preferences

As prices increase, consumer behavior is expected to shift in several notable ways. First, consumers may begin to seek out alternative channels for low-cost goods. One potential beneficiary of this shift is the secondhand and thrift economy, which has experienced a significant revival in recent years. Platforms such as ThredUp, Poshmark, and Depop may attract more users as consumers look for sustainable, cost-effective alternatives to imported fast fashion.

Second, domestic discount retailers such as Walmart, Target, and TJX Companies (parent of T.J. Maxx and Marshalls) could regain market share. These retailers have already made substantial investments in online shopping and private label brands, many of which compete on price with overseas imports. With the added advantage of tariff-free inventory, U.S.-based retailers may be able to present themselves as better-value options for budget-conscious shoppers.

Third, consumer expectations around speed and quality may also evolve. One of the trade-offs in using platforms like Shein and Temu has been longer delivery times, sometimes exceeding two weeks. As these companies explore domestic warehousing to reduce shipping delays, they may lose the cost advantage that previously justified the wait. Consumers, increasingly accustomed to two-day delivery or faster, may recalibrate their decisions based on a new balance of price, speed, and reliability.

E-Commerce Ecosystem Disruption and Market Rebalancing

The ripple effects of the tariff changes are also being felt across the broader e-commerce sector. Over the past five years, Chinese platforms like Shein and Temu have reshaped American online shopping, introducing millions of U.S. customers to direct-from-manufacturer purchasing models. Their success has inspired numerous copycats and redefined expectations regarding price points and selection.

With their operational models now disrupted, the U.S. e-commerce market is entering a period of rebalancing. Domestic sellers—many of whom had been forced to compete with prices made possible by trade loopholes—now see an opportunity to reclaim digital shelf space. Marketplaces such as Amazon, eBay, and Etsy may benefit from this realignment, particularly those that emphasize locally sourced or domestically warehoused goods.

Moreover, the restructuring of Shein and Temu’s operations may prompt a broader reassessment of how global e-commerce platforms approach the U.S. market. Rather than relying solely on cross-border logistics, companies may prioritize hybrid models that combine international sourcing with localized inventory and customer service. This could usher in a wave of infrastructure investment, including the establishment of regional fulfillment centers, customer support hubs, and returns processing facilities.

Additionally, logistics providers and customs brokers may experience increased demand for support services as more companies navigate the complexities of a post-de minimis regulatory environment. However, this demand is coupled with rising compliance requirements and operational costs, which may prove challenging for smaller vendors and startups seeking entry into the U.S. market.

Retail Employment and Domestic Supply Chain Effects

Another dimension of the broader impact concerns domestic employment and supply chains. For years, U.S. retailers and manufacturers have complained that platforms like Shein and Temu siphon sales away from local businesses, contributing to store closures and job losses. By restoring tariff parity and removing preferential treatment for low-value imports, policymakers hope to stimulate resurgent demand for domestic goods and services, potentially supporting jobs in retail, logistics, and manufacturing.

While it is too early to assess whether these outcomes will materialize in full, some evidence suggests that U.S. manufacturers and wholesalers are beginning to ramp up production in anticipation of shifting consumer demand. However, reconstituting domestic supply chains takes time and capital, and many firms lack the agility to respond rapidly to demand shifts. In the near term, inventory shortages and pricing mismatches may occur as the retail sector adapts to the new reality.

There is also the potential for a renewed emphasis on "Made in USA" branding, as domestic retailers seek to leverage the patriotism and perceived quality associated with local production. Marketing campaigns emphasizing ethical sourcing, environmental responsibility, and short delivery times may resonate with consumers disenchanted by higher prices on imported goods.

Challenges and Unintended Consequences

Despite the policy’s intention to level the playing field, some unintended consequences are emerging. For instance, tariff escalation may lead to a black market for non-compliant imports, especially if enforcement capacity lags behind the scale of shipments. Moreover, smaller foreign sellers that previously operated through marketplaces like Amazon or Wish may be unable to absorb the compliance and logistics costs now required to serve U.S. customers. This could inadvertently reduce product diversity and innovation in the marketplace.

Furthermore, tariff-induced inflation in e-commerce may accelerate consolidation, as only the largest firms can navigate the regulatory complexity and scale their operations efficiently. This could further entrench dominant players in the sector, potentially stifling competition in the long run.

Environmental concerns are also relevant. In recent years, fast fashion has been heavily criticized for its environmental footprint, including carbon emissions, overproduction, and textile waste. While fewer shipments from overseas may reduce cross-border emissions, the shift to domestic warehousing and same-day delivery may not necessarily produce net environmental gains. The impact of these changes on sustainability must therefore be evaluated holistically.

Conclusion

The implementation of new tariff policies targeting Chinese e-commerce giants has triggered a broad recalibration of the U.S. retail and consumer environment. While Shein and Temu are the most directly affected, the consequences extend to American shoppers, domestic retailers, supply chains, and the entire architecture of digital commerce. Rising prices, evolving consumer preferences, and renewed interest in domestic production signal a turning point in how value is delivered and perceived in the e-commerce sector.

Future Outlook and Strategic Considerations

As the new U.S. tariff policies take hold, Shein and Temu—as well as other global e-commerce players—are entering a pivotal juncture that will shape their strategic direction for years to come. The convergence of regulatory constraints, shifting consumer expectations, and rising operational costs has created an inflection point. This moment necessitates not only immediate tactical responses but also far-reaching strategic rethinking. The long-term future of these platforms in the U.S. market will hinge on their ability to innovate, localize, and adapt amid an increasingly protectionist and complex trade environment.

Prospects for Policy Reversal or Moderation

One potential source of future relief for Shein and Temu lies in the political and legislative process itself. While the current administration has signaled a firm commitment to tightening trade regulations, the political landscape is inherently fluid. Trade policy, particularly with respect to China, is frequently influenced by macroeconomic conditions, lobbying efforts, and evolving diplomatic relations. Should inflationary pressures re-emerge or consumer discontent grow over rising prices, future administrations may face pressure to revisit or soften some of the more aggressive tariff measures.

Already, industry lobbying groups and policy think tanks are calling for a reevaluation of the complete elimination of the de minimis exemption, arguing that such a move disproportionately harms small businesses and price-sensitive consumers. Some proposals have suggested a compromise approach, such as reinstating the exemption but capping its annual usage per vendor or introducing graduated duty rates based on parcel frequency or aggregate volume.

However, the likelihood of a full reversal appears remote in the near term. Bipartisan support for trade fairness, combined with rising concerns over data security, labor standards, and geopolitical leverage, makes it more plausible that the policy direction will continue toward greater scrutiny and regulation. Thus, Shein and Temu must prepare for an operating environment in which low-duty or duty-free access is no longer assumed.

Strategic Adaptation by Shein and Temu

To survive and thrive under the new trade framework, Shein and Temu must undergo significant strategic transformation. Several key areas are likely to dominate their future roadmaps:

1. Investment in U.S.-Based Infrastructure

The most immediate and actionable adaptation is the establishment or expansion of U.S.-based logistics and fulfillment centers. By transitioning from direct cross-border shipping to domestic warehousing, both companies can reduce per-unit shipping costs, improve delivery times, and distribute goods more efficiently. More importantly, consolidating shipments before entry into the United States allows them to pay bulk tariffs at reduced rates rather than per-item fees.

Shein has already launched experimental distribution hubs in California and Georgia and is expected to announce further investments in warehousing and returns processing facilities. Temu, while newer to the U.S. market, is reportedly evaluating partnerships with third-party logistics firms to expedite its shift toward a hybrid supply model. These infrastructure developments, while capital-intensive, may prove essential for preserving scale and service quality.

2. Diversification of Sourcing and Production

Another strategic imperative is the diversification of global sourcing and production networks. Overreliance on Chinese manufacturing has exposed Shein and Temu to heightened regulatory risk. As tariffs and geopolitical tensions escalate, moving portions of their supply chain to alternative low-cost regions—such as Vietnam, India, Bangladesh, Turkey, and Latin American countries—offers both economic and regulatory hedging opportunities.

Shein is particularly well-positioned to execute such a transition, having already developed relationships with garment factories in Southeast Asia. Temu, whose product range is broader and more reliant on Chinese electronics and general merchandise suppliers, faces a more complex challenge in replicating quality and scale outside China. Nonetheless, investments in supplier diversification will likely become a cornerstone of their operational strategy over the next three to five years.

3. Product Line Rationalization and Brand Evolution

Given the compression in margins and rising logistics costs, both companies are expected to rationalize their product assortments. Low-margin, heavy, or low-turnover products may be phased out in favor of high-margin, high-velocity SKUs that can justify the cost of duties and warehousing. This rationalization may also coincide with a shift in brand positioning—from ultra-fast fashion to value-oriented, trend-savvy retail with greater emphasis on quality, ethical sourcing, and sustainability.

This evolution could also lead to product line segmentation, where premium lines are fulfilled domestically while low-cost items are maintained only for international customers outside of tariff-affected markets. Shein, for instance, has experimented with higher-end fashion collaborations and sustainable fashion collections. A more diversified brand portfolio could allow the company to retain its customer base while expanding into new market segments.

4. Enhanced Regulatory Compliance and Transparency

With increased scrutiny on imports, both Shein and Temu must strengthen their compliance mechanisms. This includes stricter documentation for product origin, materials, and labor standards. They may also need to provide more transparent disclosures about environmental impact, product safety, and factory working conditions.

Failure to do so could result in not just reputational damage but also exclusion from key digital platforms. For instance, major app stores and payment processors have begun instituting requirements for compliance with local and international trade laws, particularly in jurisdictions like the U.S., EU, and Canada.

Proactive transparency can also serve as a differentiator. As consumer awareness grows around ethical and sustainable consumption, demonstrating verifiable commitments to compliance and social responsibility may help retain trust—even amid rising prices.

Global Implications and the Future of Cross-Border E-Commerce

The challenges faced by Shein and Temu are emblematic of broader trends in global e-commerce. As more countries reassess their trade and taxation frameworks to address digital and cross-border commerce, the “golden era” of frictionless globalization is giving way to a more fragmented, regulated landscape.

For e-commerce giants, this means an increasing need to develop localized strategies. The global one-size-fits-all model is gradually becoming obsolete. Companies that wish to operate at scale in multiple jurisdictions must tailor their supply chains, fulfillment practices, compliance protocols, and marketing strategies to suit regional regulatory and cultural nuances.

Additionally, the regulatory squeeze on low-cost Chinese imports may spark innovation in other sectors. Nearshoring—the practice of relocating production closer to end markets—is gaining popularity, as is the use of AI-driven demand forecasting and inventory management, which can minimize overproduction and streamline logistics. These technological shifts may reduce cost gaps and empower a new generation of e-commerce startups capable of operating competitively within stricter legal boundaries.

The global logistics sector is also likely to evolve in response. Companies such as FedEx, UPS, and DHL may find new opportunities in providing integrated compliance and fulfillment solutions tailored to cross-border sellers navigating complex regulatory environments.

Risks and Strategic Uncertainty

Despite the potential pathways forward, significant risks remain. Chief among them is regulatory unpredictability. A sudden escalation in U.S.-China tensions, additional trade restrictions, or new data localization requirements could derail even well-laid strategic plans. Similarly, consumer backlash against price increases, particularly in the U.S. where purchasing power is already strained, could lead to a loss of market share that is difficult to recover.

Another concern is the capital intensity of required transformations. Building warehouses, revamping supply chains, and establishing new sourcing networks require substantial upfront investment. For Temu, which is still in a growth phase and heavily subsidized by its parent company, the viability of this investment hinges on long-term market confidence. For Shein, which is reportedly preparing for a public offering, the capacity to invest in strategic adaptation while preserving valuation will be closely scrutinized by investors.

Conclusion

The road ahead for Shein and Temu is complex, uncertain, and fraught with strategic challenges. Yet it is also a moment of possibility. The companies that emerge successfully from this transition will be those that are agile, resourceful, and willing to reinvent their operations in alignment with new geopolitical and economic realities.

As the rules of global commerce continue to evolve, success will increasingly depend on the ability to navigate regulatory complexity, maintain consumer trust, and build resilient, ethically grounded supply chains. For Shein, Temu, and their peers, the era of tariff-free hyper-growth may be over, but a new phase of responsible, adaptive, and locally attuned expansion is just beginning.

References

- U.S. Plans to End De Minimis for Chinese Retailers

https://www.reuters.com/world/us/us-set-end-tariff-exemption-chinese-e-commerce-giants-2025-04-10 - Shein Warns of Higher Prices Amid Tariff Changes

https://www.cnbc.com/2025/04/11/shein-says-us-tariffs-will-raise-prices-for-americans.html - Temu's Response to U.S. Tariff Increase

https://www.bloomberg.com/news/articles/temu-responds-to-us-tariff-crackdown-on-chinese-imports - Biden Administration Targets Chinese E-Commerce with New Tariffs

https://www.wsj.com/articles/biden-targets-chinese-retailers-shein-temu-with-trade-policy-shift - Explainer: What is the De Minimis Rule and Why It Matters

https://www.nytimes.com/guide/us-trade-de-minimis-explained - How Shein Became a $100 Billion Fashion Juggernaut

https://www.forbes.com/sites/shein-fashion-growth-strategy - Temu’s Business Model and U.S. Expansion Plans

https://www.businessinsider.com/temu-explained-chinese-app-us-market-strategy - National Retail Federation Praises Tariff Reforms

https://nrf.com/media-center/press-releases/nrf-supports-action-level-playing-field-retailers - US Chamber of Commerce on Trade Equity and Tariffs

https://uschamber.com/issue-brief/us-tariffs-and-fair-trade-practices - Amazon and Walmart Poised to Benefit from Tariff Changes

https://www.marketwatch.com/story/amazon-walmart-could-gain-as-tariffs-hit-temu-shein