Samsung Acquires Masimo’s Audio Brands in $350M Deal to Dominate Premium Sound Market

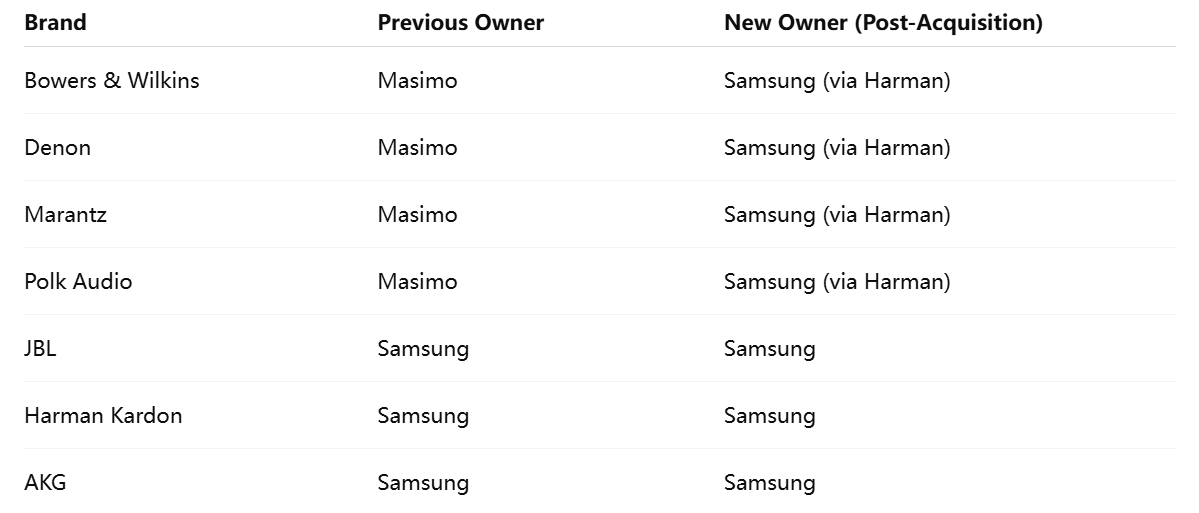

In a bold and calculated move that underscores its growing ambitions in the premium audio market, Samsung Electronics—through its wholly owned subsidiary Harman International—announced on May 6, 2025, its acquisition of Masimo Corporation’s consumer audio division for a staggering $350 million. This landmark transaction, one of the most consequential in the consumer audio space in recent years, transfers a suite of prestigious brands—Denon, Marantz, Bowers & Wilkins, and Polk Audio—into Samsung’s expanding portfolio. This acquisition is not only indicative of Samsung’s continued investment in high-quality consumer electronics but also reflects a broader strategic repositioning within the fiercely competitive global audio market.

This acquisition serves as a definitive pivot away from the short-lived consumer audio ambitions of Masimo, a company historically renowned for its medical technology and patient monitoring systems. Just three years earlier, in 2022, Masimo had entered the consumer electronics sector through its acquisition of Sound United, which owned many of the same audio brands it is now offloading. However, under mounting investor pressure and shifting strategic priorities, Masimo has chosen to divest its audio assets and refocus on its healthcare core—a decision welcomed by markets and analysts alike.

For Samsung, the acquisition is a natural extension of its long-term vision. Since its $8 billion purchase of Harman in 2016, Samsung has steadily built a reputation for integrating advanced audio systems into its TVs, smartphones, and increasingly, connected automotive technologies. With the integration of Denon’s audiophile legacy, Marantz’s high-fidelity amplifiers, Bowers & Wilkins’ luxury speaker systems, and Polk Audio’s accessible home theater products, Samsung now controls one of the most comprehensive and prestigious audio portfolios in the world. These brands are expected to strengthen Samsung’s position across key audio categories, including home entertainment, automotive sound systems, and personal audio devices.

The global consumer audio landscape is experiencing accelerated transformation. As consumer preferences evolve toward wireless, smart, and immersive audio experiences, companies are compelled to deliver integrated, ecosystem-driven solutions. The proliferation of AI-powered audio enhancements, spatial sound technologies, and smart home integration has led to a surge in demand for high-performance, premium audio products. In this context, Samsung’s latest acquisition can be seen as a direct response to emerging consumer expectations and a move to stay ahead of rivals such as Apple, Sony, and Bose.

From a financial standpoint, the $350 million price tag is viewed as a bargain by many analysts, particularly when compared to the approximately $1 billion Masimo paid for Sound United in 2022. Market reactions have largely favored Samsung’s strategic positioning, with shares of Harman International and affiliated supply partners experiencing modest upticks following the announcement. For Masimo, the sale provides liquidity and strategic clarity, allowing the company to reallocate resources toward its core healthcare innovations, such as pulse oximetry, hospital automation, and wearable medical diagnostics.

This blog post aims to explore the multifaceted dimensions of this acquisition. It will begin with a review of Masimo’s original foray into consumer audio and the internal and external forces that drove its eventual exit. Then, the discussion will transition into Samsung’s calculated expansion strategy, including its long-term vision for audio and the implications of this acquisition on its product ecosystem. Following that, we will examine the integration prospects and potential synergies between Samsung’s existing technologies and its newly acquired brands. Finally, we will offer a forward-looking analysis of what this deal means for consumers, the competitive landscape, and the future of premium audio.

As industry lines continue to blur between consumer electronics, AI integration, and connected living, Samsung’s acquisition of Masimo’s audio business marks more than just a transaction. It represents a signal of intent—a declaration that Samsung is not merely participating in the future of audio technology but intends to lead it. With legacy audio brands under its command and the technological prowess to elevate them into a new era, Samsung is poised to redefine the soundscape of tomorrow.

Masimo’s Foray into Consumer Audio

To fully appreciate the strategic realignment that culminated in Samsung's $350 million acquisition of Masimo's audio division, it is essential to first understand the context of Masimo's entry into the consumer audio market—a move that was as ambitious as it was controversial. Masimo Corporation, a company historically entrenched in the medical technology sector, made a surprising and disruptive pivot in 2022 when it acquired Sound United LLC, a privately held firm that owned a collection of prestigious audio brands. These included Denon, Marantz, Bowers & Wilkins, Polk Audio, HEOS, and Boston Acoustics—each with a storied history in high-fidelity audio and consumer electronics.

At the time, the acquisition was valued at approximately $1.025 billion and was financed through a combination of cash on hand and debt. Masimo’s justification for the deal centered around a vision to integrate health-monitoring capabilities into consumer lifestyle products, particularly premium audio devices. The company articulated a future in which health and wellness could be passively monitored through everyday consumer interactions—headphones that could measure oxygen saturation, speakers that could respond to biometric feedback, and home entertainment systems that doubled as medical monitoring stations. This vision was aligned with Masimo’s broader goal of democratizing healthcare through consumer adoption and was part of a trend many technology firms were exploring: the convergence of wellness, wearables, and smart living.

However, while innovative on paper, the execution proved challenging. The acquisition was met with considerable skepticism from investors and analysts, who viewed the pivot as a risky deviation from Masimo’s core competency. Within weeks of the announcement, Masimo’s stock dropped sharply, wiping out over $5 billion in market capitalization. Investors raised concerns about the lack of operational synergy between medical technology and consumer audio, arguing that the company was venturing too far afield without a proven integration roadmap. These anxieties were compounded by broader economic uncertainties and tightening monetary policy, which placed added pressure on highly-leveraged acquisitions and capital expenditures.

Internally, the fallout from the acquisition contributed to rising tensions within Masimo’s leadership structure. In 2023, activist investors, led by Politan Capital Management, mounted a campaign to refocus the company on its core healthcare business. Politan secured two board seats and pushed for significant corporate governance reforms, including a reevaluation of Masimo’s consumer strategy. The boardroom reshuffling culminated in the departure of key executives responsible for the Sound United acquisition and the appointment of new leadership committed to restoring investor confidence through divestiture and strategic discipline.

By early 2024, it had become increasingly apparent that Masimo’s consumer audio ambitions would not be realized as initially envisioned. Despite efforts to align product development between the two divisions, technical challenges, regulatory hurdles, and a lack of commercial uptake hampered progress. Additionally, Masimo faced mounting competition from entrenched players in both healthcare wearables and consumer electronics, making it difficult to achieve the scale necessary to justify ongoing investment in the audio division.

In public statements, the new leadership team acknowledged the misalignment and committed to an orderly sale of the audio assets. The goal was to find a buyer with both the financial resources and the technological infrastructure to fully leverage the potential of the acquired brands. Enter Samsung—a global conglomerate with deep expertise in audio engineering, an extensive supply chain, and a successful track record of integrating acquisitions into a coherent product strategy. Negotiations with Samsung’s Harman division reportedly began in late 2024, and by May 2025, the deal was finalized.

From a financial perspective, the sale at $350 million represented a significant loss when compared to the original purchase price. However, analysts viewed the transaction as a strategic reset that would allow Masimo to restore operational focus and allocate capital more effectively. The company announced that proceeds from the sale would be used to fund its research and development pipeline in non-invasive patient monitoring, expand its hospital automation solutions, and explore new markets for its proprietary health algorithms.

It is worth noting that Masimo’s brief foray into the audio market was not entirely without merit. The Sound United brands continued to launch new products during their tenure under Masimo’s ownership, including the Bowers & Wilkins Px8 wireless headphones and Denon's flagship AV receivers. These products maintained high consumer satisfaction and critical acclaim, indicating that the audio engineering teams retained their core capabilities. However, without the broader consumer ecosystem or strategic clarity to support them, the brands were ultimately underleveraged—trapped in an organizational structure that could not fully support their growth trajectory.

In hindsight, Masimo’s attempt to straddle two distinct industries—medical technology and consumer electronics—was a high-stakes experiment in corporate diversification. While the concept of integrating health and audio was forward-looking, the structural and operational realities proved insurmountable. Nevertheless, the experience provided valuable lessons about the importance of strategic focus, the limits of convergence, and the role of shareholder alignment in long-term corporate planning.

The divestiture marks the end of an unusual chapter in Masimo’s history, and perhaps more importantly, the beginning of a new era for the audio brands it once owned. Under Samsung’s stewardship, these brands now have the opportunity to realize their full potential in a cohesive, innovation-driven environment. Meanwhile, Masimo returns to its roots, more focused than ever on pioneering medical technologies that save lives and improve clinical outcomes.

Samsung’s Expansion Strategy in the Audio Market

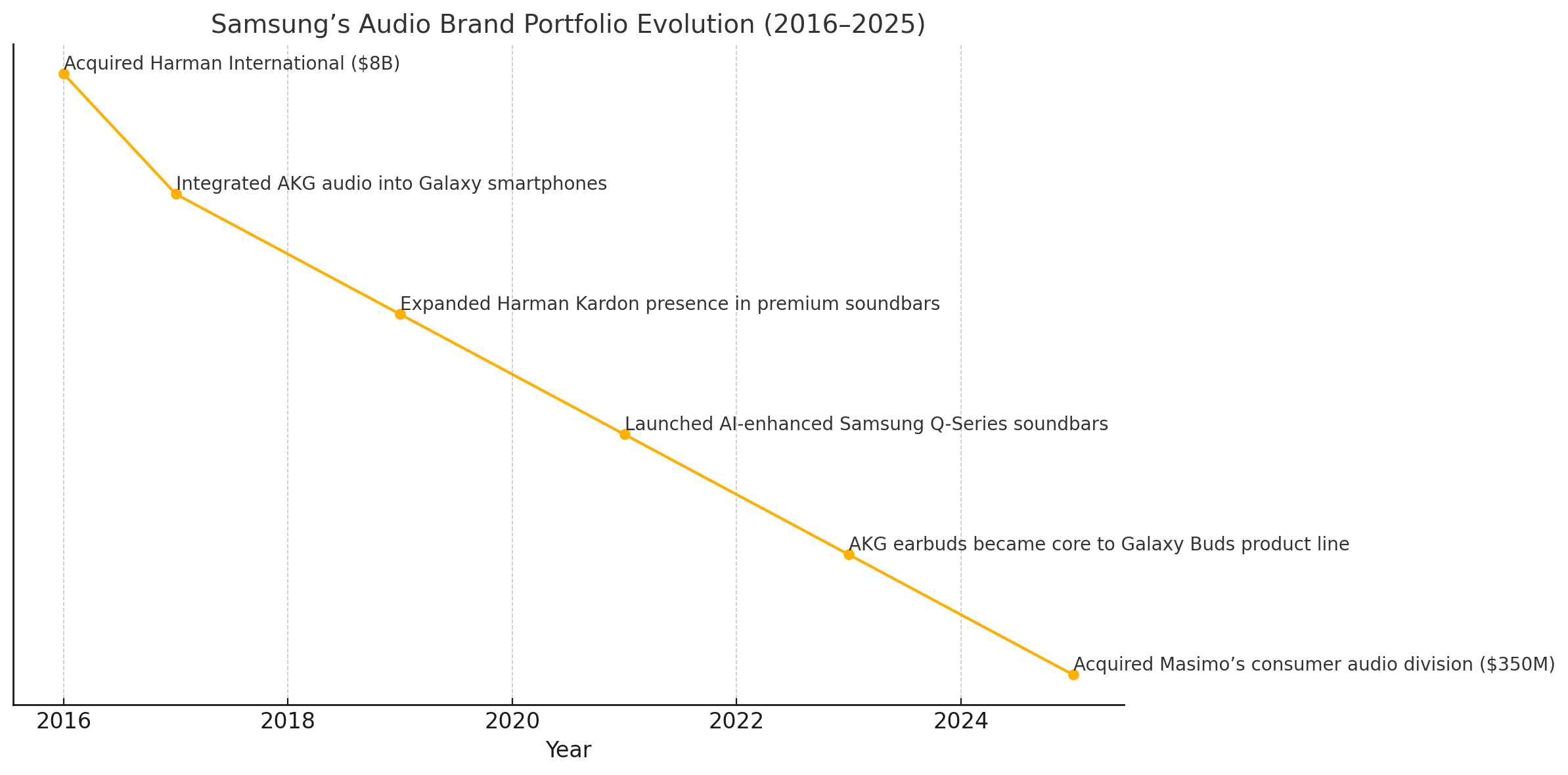

Samsung Electronics has long demonstrated an aptitude for executing strategic acquisitions and product innovations that align with evolving global consumer trends. In the realm of audio technology, the company’s trajectory has been both deliberate and expansive, marked by a sustained commitment to integrating high-quality sound across its hardware ecosystem. The 2025 acquisition of Masimo’s consumer audio division is not an isolated maneuver but rather a continuation of a carefully cultivated strategy that began nearly a decade earlier. To fully grasp the implications of this recent move, one must analyze Samsung’s historical milestones, current positioning, and forward-looking ambitions in the audio market.

The foundational pillar of Samsung’s audio expansion was laid in 2016, when the South Korean conglomerate acquired Harman International Industries for $8 billion. This deal was a watershed moment in the convergence of consumer electronics, automotive systems, and connected technologies. Harman, which owned brands like JBL, Harman Kardon, and AKG, was renowned for its excellence in audio engineering and its dominance in the automotive audio sector. The acquisition significantly enhanced Samsung’s capabilities in both premium sound systems and in-car infotainment platforms, two areas where it had previously lacked competitive scale.

Following the Harman acquisition, Samsung embarked on a broad effort to synergize audio capabilities across its product ecosystem. Its televisions began incorporating tuned speakers from Harman Kardon and Dolby Atmos-certified soundbars, while its Galaxy smartphones and tablets offered AKG-tuned audio components. Samsung also advanced its wearable lineup—such as the Galaxy Buds series—with sophisticated acoustic designs and noise cancellation technologies. Through these developments, the company positioned itself as a full-spectrum audio provider, capable of delivering rich, immersive experiences across devices, form factors, and use cases.

However, as the global audio landscape evolved, so too did Samsung’s strategic imperatives. The premium home audio segment, once dominated by legacy players like Bose, Sonos, and Bang & Olufsen, saw a resurgence in consumer demand for luxury, high-fidelity products. Simultaneously, growth in the smart home and spatial audio categories prompted renewed competition from technology giants such as Apple, Amazon, and Google. Recognizing these shifts, Samsung began exploring opportunities to expand its footprint beyond mass-market soundbars and earbuds and into the more nuanced territory of audiophile-grade and lifestyle-oriented audio equipment.

It is within this strategic context that the acquisition of Masimo’s audio brands becomes a logical progression. The addition of Denon, Marantz, Bowers & Wilkins, and Polk Audio to Samsung’s already formidable audio lineup creates a vertically integrated audio powerhouse. These brands are not only associated with superior sound quality but also boast deep customer loyalty, extensive retail distribution networks, and decades-long engineering heritage. Their inclusion enhances Samsung’s access to high-end market segments while also opening opportunities for brand diversification across geographies and demographics.

Furthermore, the acquisition is poised to strengthen Samsung’s competitive positioning in two rapidly growing domains: immersive home entertainment and automotive audio. In the home entertainment arena, Denon and Marantz bring world-class AV receivers and amplifiers to the table—products that can be seamlessly integrated with Samsung’s premium televisions and projectors. Bowers & Wilkins, known for its flagship 800 Series Diamond speakers and partnerships with luxury automakers, adds prestige and design excellence that will appeal to discerning consumers. Meanwhile, Polk Audio’s accessible yet high-quality offerings provide an entry point into mid-range markets, enabling Samsung to compete at multiple price tiers.

The automotive audio segment presents another significant area of strategic interest. With Harman already supplying audio and infotainment systems to global automakers, the addition of Bowers & Wilkins, which has existing relationships with brands such as BMW and Volvo, can enhance Samsung’s automotive business unit. The potential for multi-brand integration, customized tuning, and AI-enhanced audio experiences within vehicles is substantial—particularly as the global shift toward electric and autonomous vehicles intensifies demand for differentiated in-cabin experiences.

On the technological front, Samsung’s robust R&D capabilities further amplify the strategic value of this acquisition. With over 1,600 patents in audio-related technologies and ongoing research in AI-driven sound optimization, the company is well-positioned to infuse innovation into its newly acquired brands. Initiatives could include the development of smart receivers with real-time acoustic adaptation, integration of health sensors in headphones (revisiting Masimo’s original vision), and spatial audio solutions optimized through machine learning. The convergence of AI, IoT, and audio is no longer speculative; it is becoming an operational reality—one that Samsung is uniquely equipped to harness.

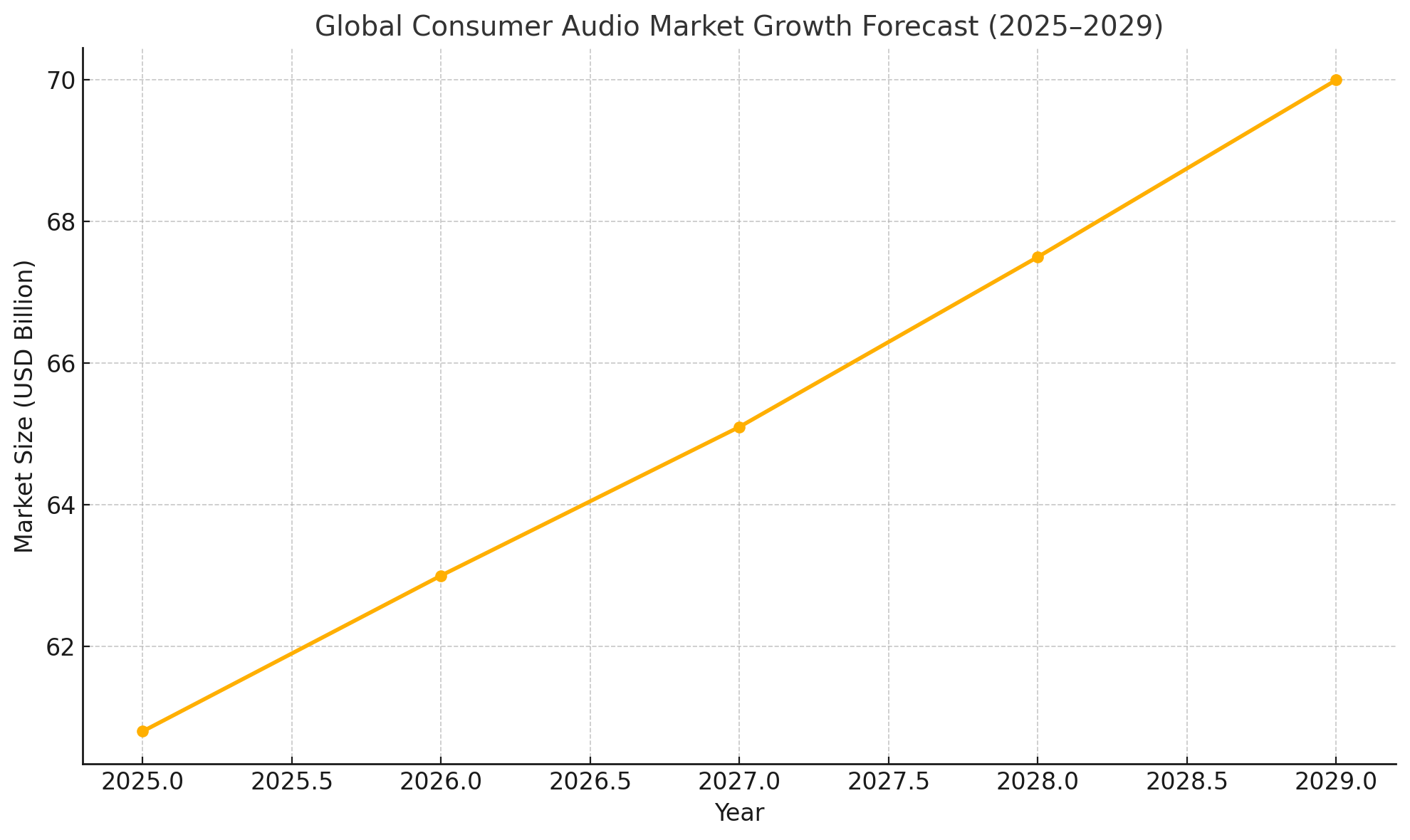

Financially, the acquisition is also aligned with Samsung’s long-term investment strategy. Despite macroeconomic headwinds and sectoral volatility, the consumer audio market remains a robust segment with favorable growth prospects. According to industry analysts, the global consumer audio market is projected to grow from $60.8 billion in 2025 to approximately $70 billion by 2029. This upward trend is fueled by rising consumer expectations, technological convergence, and an increase in remote work and home entertainment setups—factors that continue to drive demand for high-quality, personalized audio experiences.

This data underscores the commercial logic underpinning Samsung’s decision to deepen its investments in audio. By securing well-established brands at a fraction of their original acquisition cost, Samsung not only expands its technological arsenal but also gains valuable market share in a sector poised for sustainable growth.

In summary, Samsung’s expansion strategy in the audio market is neither reactive nor opportunistic. It is a continuation of a clearly articulated vision that prioritizes technological leadership, brand elevation, and user-centric innovation. With the integration of Masimo’s audio assets, Samsung reinforces its commitment to becoming a dominant force in premium sound, smart audio ecosystems, and next-generation infotainment systems. This move not only consolidates its industry influence but also ensures that Samsung remains at the forefront of audio innovation in the years to come.

Competitive Landscape and Industry Response

As Samsung fortifies its presence in the premium audio market through the acquisition of Masimo’s consumer audio division, the move sends ripples across the competitive landscape, prompting both direct and indirect responses from established players and emergent challengers. The significance of this transaction lies not just in the consolidation of high-end brands under one corporate umbrella, but also in how it reshapes strategic considerations for competitors, audio innovation trajectories, and consumer expectations. In this section, we examine the competitive reactions, strategic recalibrations, and broader implications that the acquisition sets into motion within the audio electronics industry.

At the forefront of those most directly impacted by Samsung’s acquisition are companies like Sony, Bose, Sonos, Apple, and LG—all of whom have considerable stakes in the global audio market. These firms must now contend with a Samsung that is no longer reliant solely on in-house brands like AKG and JBL, but one that commands a rich tapestry of legacy audio marques with cult followings and proven engineering credibility. The combination of Samsung’s vast manufacturing, marketing, and R&D resources with the elite audio engineering DNA of Denon, Marantz, and Bowers & Wilkins creates a formidable force that challenges the current competitive equilibrium.

Sony, for instance, has long been a stalwart in both consumer and professional audio. Its portfolio includes everything from studio monitors and high-end headphones to integrated home theater systems. With Samsung’s entry into premium hi-fi and audiophile-grade markets, Sony may face pressure to accelerate innovation in its top-tier offerings and consider expanding its own premium portfolio through targeted acquisitions or licensing partnerships. Furthermore, Sony's unique position in both audio and visual entertainment—bolstered by its film and music divisions—may push the company toward more integrated content-device strategies to maintain differentiation.

Apple, while not traditionally classified as an audio-first company, has increasingly staked a claim in the consumer audio space through its AirPods ecosystem, HomePod smart speakers, and spatial audio innovations tied to Apple Music and Apple TV+. The user experience across Apple’s audio products has benefited from tight software-hardware integration, which remains a core competitive advantage. However, Apple’s offerings are primarily designed for mobile and smart home scenarios rather than the expansive spectrum that Samsung now covers—from high-end stereo systems and AV receivers to automotive and lifestyle audio. In response, Apple may look to deepen collaborations with third-party audio companies or even explore its own acquisitions to bolster its hardware capabilities beyond personal audio devices.

Sonos presents a particularly interesting case. Renowned for its pioneering work in multi-room wireless audio, the company has built a loyal customer base and robust brand equity. Nevertheless, Sonos operates without the safety net of a diversified electronics ecosystem, unlike Samsung. As Samsung incorporates Bowers & Wilkins and Polk Audio into its smart home product stack—potentially linking them with SmartThings for integrated control—Sonos could find itself challenged on both performance and interoperability. Analysts speculate that Sonos may need to revisit licensing deals, form OEM partnerships, or pursue niche market verticals to safeguard its market position.

Meanwhile, Bose, which has long occupied a dual role as a consumer audio giant and a military/government audio contractor, may be compelled to shift its innovation agenda. Bose's QuietComfort series, smart speakers, and automotive audio partnerships have enjoyed sustained market relevance. However, the arrival of Samsung as a direct rival in both consumer and automotive segments may require Bose to invest more aggressively in proprietary software platforms, user personalization technologies, and hybrid speaker systems to retain its edge.

LG Electronics, another major South Korean conglomerate, finds itself in close geographic and market proximity to Samsung. While LG has achieved success in television audio integration and soundbar innovation, its footprint in the audiophile space is comparatively limited. Samsung’s fortified audio portfolio may encourage LG to explore collaborations or to invest in refining its audio technologies—possibly aligning more tightly with its OLED TV dominance to offer richer audiovisual experiences.

Beyond these traditional players, smaller yet highly specialized companies in the audio space may also need to reassess their strategies. Boutique firms such as Focal, Naim, and Cambridge Audio, which cater to the audiophile and luxury segments, may experience increased competitive pressure in brand perception and retail distribution. These companies may respond by emphasizing craftsmanship, exclusivity, and analog purity as points of differentiation against Samsung’s scale-driven digital innovation model.

The industry-wide ramifications are also expected to extend into retail and distribution ecosystems. Samsung’s acquisition positions it to command greater shelf space in electronics stores, influence product placement across online platforms, and potentially set new benchmarks for pricing and feature expectations. Retailers that once relied on distinct pricing tiers between Samsung and brands like Denon or Polk may now need to adapt their merchandising strategies to accommodate an integrated portfolio that includes multiple pricing and performance layers.

A significant competitive advantage that Samsung holds post-acquisition is its ecosystem leverage. Samsung’s ecosystem spans smartphones, smart TVs, tablets, home appliances, smartwatches, and smart home hubs. Integrating high-end audio brands into this ecosystem creates cross-device value propositions that competitors with narrower product ranges will struggle to match. For instance, consumers might enjoy seamless handoffs between a Denon sound system and a Galaxy phone, or adaptive sound calibration across a Marantz receiver and a Samsung Neo QLED TV. This capability enhances consumer stickiness and raises the bar for ecosystem fluidity in the market.

Furthermore, Samsung’s extensive AI and semiconductor expertise may allow it to accelerate audio processing performance at both hardware and software levels. Competitors not vertically integrated in chip design may find it increasingly difficult to compete on latency, fidelity, and energy efficiency—especially as edge AI applications become more central to adaptive sound technologies.

From a branding perspective, there is also a perceptual shift underway. Traditionally, Samsung was seen as a strong contender in mainstream electronics, while boutique audio brands were associated with heritage, craftsmanship, and exclusivity. The acquisition narrows this divide. If Samsung can preserve the integrity of these audio brands while enhancing their functionality and accessibility, it will change the market's perception of what a "premium" audio brand can be in the modern, tech-integrated home.

Finally, it is important to consider how this acquisition may influence future industry consolidation. Other technology giants—such as Amazon and Google—have so far confined their audio strategies to smart speakers and entry-level headphones. If Samsung’s integrated premium audio approach proves commercially successful, it may incentivize these firms to pursue similar deals to catch up. Amazon, for example, could seek high-fidelity audio partnerships to strengthen Alexa’s position in high-end environments, while Google may leverage its AI leadership to enter the adaptive sound space more competitively.

In conclusion, Samsung’s acquisition of Masimo’s audio division represents not only a strengthening of internal capabilities but also a tectonic shift in the competitive dynamics of the global audio industry. It blurs traditional industry boundaries, compels strategic reassessment across competitors, and redefines how premium audio is positioned, sold, and experienced. In doing so, it pushes the industry toward a future where brand legacy, ecosystem integration, and intelligent sound systems are no longer separate advantages—but intertwined necessities.

Integration and Synergies

What This Means for Samsung and Consumers

The integration of Masimo’s consumer audio division into Samsung’s broader electronics ecosystem represents more than a transactional acquisition; it symbolizes the convergence of legacy craftsmanship with advanced technology. With decades of audio engineering excellence embedded in brands like Denon, Marantz, Bowers & Wilkins, and Polk Audio, Samsung now holds a diversified portfolio that enables it to deliver end-to-end audio solutions across a multitude of consumer touchpoints. This section explores the multidimensional integration pathways and the strategic synergies that Samsung is likely to pursue, while also highlighting what consumers can expect as these revered brands become part of the Samsung innovation engine.

At a brand portfolio level, the acquisition allows Samsung to target an unprecedented range of audio segments. Each of the acquired brands serves a distinct consumer demographic and product tier. Denon and Marantz have long dominated the high-performance home theater and AV receiver market, commanding respect among audiophiles and professional installers. Bowers & Wilkins, a brand synonymous with luxury and acoustic precision, caters to high-net-worth individuals and design-conscious consumers. Polk Audio, by contrast, appeals to mainstream audiences seeking affordable but reliable home audio solutions. With these distinct market positions, Samsung gains the flexibility to curate product offerings for different regions, income levels, and use cases—all without diluting individual brand identities.

This brand diversity also opens strategic opportunities for Samsung to scale vertical integration across its device categories. For instance, Samsung can leverage Denon’s signal processing capabilities in future generations of its smart TVs and soundbars, or integrate Marantz’s amplifier innovations into all-in-one home entertainment systems. The potential for such integration extends into mobile and wearable devices as well. AKG, already a Samsung subsidiary, may now be joined by Bowers & Wilkins in shaping the future of high-fidelity wireless earbuds or over-ear headphones. These cross-pollination efforts can produce differentiated experiences not easily replicated by competitors reliant on third-party partnerships.

Another critical area of synergy lies in Samsung’s robust supply chain and distribution infrastructure. While Masimo’s audio brands maintained strong reputations, their global reach was limited compared to Samsung’s massive retail and logistics footprint. Through integration, Samsung can accelerate the global rollout of these premium audio products, particularly in emerging markets where demand for high-quality electronics is growing but brand accessibility has historically been constrained. Samsung’s global channel presence—spanning proprietary stores, online marketplaces, and strategic retail alliances—offers a platform to introduce Denon and Bowers & Wilkins to previously untapped consumer bases.

Moreover, the acquisition provides fertile ground for innovation in the automotive audio sector. Harman is already a dominant supplier of in-car infotainment and audio systems to leading automakers, including Audi, BMW, and Mercedes-Benz. With the addition of Bowers & Wilkins and Denon—both of which have established partnerships in the automotive space—Samsung has the opportunity to develop multi-brand, multi-tiered offerings that cater to varying consumer preferences across vehicle models. These could range from Bowers & Wilkins sound systems for luxury sedans to Polk Audio components for mass-market electric vehicles. Combined with advancements in autonomous driving, where audio becomes central to passenger experience, this synergy could create powerful differentiation for automakers and compelling value for consumers.

From a product development perspective, Samsung’s world-class R&D infrastructure stands to supercharge the innovation potential of its new acquisitions. By incorporating AI and machine learning technologies, Samsung could pioneer adaptive audio systems that calibrate sound profiles in real time based on ambient noise, user behavior, and content type. Imagine a Marantz-powered home theater that optimizes acoustic output during a film scene transition, or Bowers & Wilkins headphones that automatically adjust equalization during a workout or commute. Such intelligent audio ecosystems are no longer speculative—they are becoming technologically feasible, especially under Samsung’s research leadership.

Consumers stand to benefit significantly from this new configuration of capabilities. First and foremost, the expanded brand portfolio means greater choice across a wider range of price points. Whether a consumer is seeking a flagship 9.2-channel AV receiver from Denon or an entry-level smart speaker from Polk, Samsung can now cater to the full breadth of audio preferences. Additionally, with consolidated engineering teams and shared technological resources, consumers can expect shorter development cycles, quicker product releases, and higher innovation throughput.

Another key benefit lies in ecosystem compatibility. One of the enduring pain points in the consumer audio space is the lack of seamless integration between hardware components made by different manufacturers. With unified control over multiple premium brands, Samsung can standardize protocols, interfaces, and connectivity options across its product lines. This means easier setup, better app support, and more consistent performance—advantages that significantly improve the end-user experience. Furthermore, this alignment can reduce friction in smart home setups, where Samsung’s SmartThings platform may now natively support more sophisticated audio configurations using acquired technologies.

Sustainability is another domain where integration could yield meaningful dividends. Samsung has made substantial commitments to reduce its environmental impact through greener manufacturing processes, energy-efficient designs, and recyclable packaging. Applying these standards to its newly acquired brands could result in more sustainable audio products—an increasingly important factor for environmentally conscious consumers.

From an organizational standpoint, Samsung is likely to preserve the identity and operational autonomy of the newly acquired brands, at least in the short term. This is consistent with how it has managed other acquisitions, including Harman and AKG, where product development continued under brand-specific engineering teams with centralized support from Samsung’s corporate R&D and design studios. Such a hybrid model enables the preservation of brand heritage while also capitalizing on operational efficiencies and collaborative innovation.

In conclusion, the integration of Masimo’s consumer audio assets into Samsung’s technology ecosystem represents a compelling alignment of legacy expertise and future-ready innovation. By harnessing synergies across brand portfolios, R&D, supply chains, and distribution channels, Samsung is poised to redefine consumer expectations for what audio products can deliver. For consumers, this means more choice, better performance, enhanced compatibility, and a more immersive auditory experience—regardless of device, context, or environment.

Future Outlook: Implications for the Audio Industry

The completion of Samsung’s $350 million acquisition of Masimo’s consumer audio business marks a critical juncture not only for the involved parties but for the broader trajectory of the global audio industry. This transaction, which consolidates multiple high-profile brands under a single multinational technology firm, is emblematic of a broader trend: the convergence of consumer electronics, smart technology, and lifestyle-driven innovation. As the industry adapts to changing consumer behaviors and technological advancements, Samsung’s strategic move is likely to reverberate across competitive landscapes, product development cycles, and market dynamics for years to come.

One of the most immediate implications of this acquisition is a renewed wave of consolidation within the audio sector. Historically fragmented, the industry has seen increasing M&A activity in recent years as companies seek to bolster their capabilities, streamline supply chains, and expand consumer reach. Samsung’s successful absorption of globally recognized brands like Denon, Marantz, and Bowers & Wilkins raises the competitive stakes for other players in the market. Firms like Sony, Bose, Sonos, and even Apple may now feel pressure to enhance their own audio portfolios—either through acquisitions or strategic partnerships—to maintain brand competitiveness and product differentiation.

The deal also underscores the rising value of vertical integration in the consumer electronics ecosystem. Samsung’s ability to control the entire product stack—from silicon chips and displays to software and sound—gives it a unique advantage in delivering cohesive and optimized user experiences. This model stands in contrast to companies that rely on third-party suppliers or licensing agreements for key components. As consumer expectations increasingly revolve around seamless interoperability, advanced personalization, and high-fidelity performance, vertical integration is becoming not merely a strategic asset but a competitive necessity.

Moreover, the transaction reflects a decisive shift in the audio industry’s strategic orientation toward smart, connected, and adaptive technologies. As artificial intelligence, machine learning, and edge computing become standard across consumer electronics, audio products must evolve beyond traditional roles. They are now expected to function as intelligent assistants, health monitors, environmental sensors, and immersive entertainment conduits. Samsung’s acquisition aligns directly with this trend, positioning the company to lead in the development of next-generation audio platforms that integrate seamlessly into the broader smart home and smart mobility ecosystems.

For consumers, the future promises more personalized, immersive, and context-aware audio experiences. Innovations driven by Samsung’s expanded portfolio may include AI-optimized surround sound that adapts dynamically to content type, user mood, or room acoustics. Additionally, products could feature biometric feedback capabilities, such as headphones that adjust noise cancellation levels based on stress indicators or heart rate variability. With Samsung’s proven capacity to scale innovation rapidly, these features could become commercially viable at both premium and mid-range price points, thus democratizing access to previously niche technologies.

Industry-wide, Samsung’s move may catalyze a new era of cross-sector collaboration. Automakers, for example, may seek deeper partnerships with audio specialists to differentiate their in-cabin user experiences. With increasing emphasis on electrification and autonomous driving, vehicle interiors are becoming mobile living spaces—where premium sound systems play a crucial role. Samsung, with its dual leadership in both in-car infotainment and consumer audio, is now uniquely positioned to deliver integrated solutions that span entertainment, communication, and even wellness monitoring inside the vehicle.

At the macroeconomic level, the deal reflects an emerging pattern of strategic recalibration among large corporations in response to shifting investor priorities and market dynamics. Masimo’s decision to divest its consumer audio assets and return to its core medical technology operations is indicative of a broader trend toward focus, clarity, and operational discipline. For institutional investors and capital markets, this trend signals a renewed emphasis on sustainable growth, resource alignment, and shareholder value creation. Conversely, for Samsung, the move represents a doubling down on diversification and innovation—a bet that the convergence of audio, AI, and smart ecosystems will drive the next wave of consumer demand.

This timeline illustrates how Samsung has methodically built a vertically integrated audio empire, progressively expanding from mobile devices and televisions into luxury audio and automotive sound systems. The incorporation of Masimo’s assets represents both a culmination of prior investments and a launchpad for future innovation.

Looking ahead, challenges remain. The audio industry, like all consumer technology segments, must navigate the complexities of supply chain volatility, component shortages, and geopolitical uncertainties. Moreover, as data privacy regulations tighten globally, companies will need to ensure that AI-enabled audio products comply with evolving legal and ethical standards—especially when these products collect and process biometric or behavioral data.

Nonetheless, the overall trajectory appears favorable. The global appetite for premium audio remains strong, fueled by hybrid work lifestyles, increased streaming consumption, and growing interest in smart home systems. Samsung’s expanded footprint in this space places it in a commanding position to influence product standards, shape user expectations, and chart new paths of innovation.

In conclusion, the acquisition of Masimo’s consumer audio division marks a defining moment in the evolution of the global audio industry. It amplifies Samsung’s ambitions, accelerates the convergence of technology and lifestyle, and sets the stage for a future in which sound is not just heard—but intelligently understood, contextually adapted, and deeply integrated into the fabric of everyday life. For the industry, it signals a new competitive paradigm; for consumers, it promises a richer, smarter, and more connected auditory experience.

References

- Samsung Newsroom – Samsung's official press release on the Harman acquisition

https://news.samsung.com/global/samsung-electronics-to-acquire-harman - Reuters – Samsung Harman to acquire Masimo's consumer audio business

https://www.reuters.com/business/samsung-electronics-says-unit-harman-acquires-masimos-audio-business-350-mln-2025-05-06 - The Verge – Samsung expands its audio empire with Denon, Marantz, and Bowers & Wilkins

https://www.theverge.com/2025/5/6/masimo-sound-united-samsung-harman-acquisition - Bloomberg – Masimo to sell consumer division to focus on healthcare core

https://www.bloomberg.com/news/articles/masimo-sells-audio-unit-to-samsung - WSJ – Investor pushback forces Masimo to retreat from consumer audio ambitions

https://www.wsj.com/business/deals/masimo-to-sell-audio-business-to-harman - CNBC – Samsung’s growing footprint in automotive and premium audio

https://www.cnbc.com/2025/05/07/samsung-harman-masimo-acquisition-impact - TechCrunch – What Samsung’s Masimo buyout means for smart home ecosystems

https://techcrunch.com/2025/05/07/samsung-audio-expansion-masimo - Forbes – Samsung’s latest move puts pressure on Sonos and Bose

https://www.forbes.com/sites/forbestechcouncil/samsung-audio-masimo-deal - Financial Times – Strategic realignment: Masimo’s consumer exit

https://www.ft.com/content/masimo-restructure-samsung-deal - Digital Trends – Audio industry shakeup: Samsung to own Bowers & Wilkins

https://www.digitaltrends.com/home-theater/samsung-harman-bowers-wilkins-denon-acquisition