OpenAI’s $3B Windsurf Acquisition—A Strategic Leap in AI Coding

In a move that underscores the escalating competition and value in the artificial intelligence (AI) development tools space, OpenAI is reportedly in advanced talks to acquire Windsurf—an emerging leader in AI-powered coding assistants—for a staggering $3 billion. This prospective acquisition, if finalized, would mark OpenAI’s most significant strategic purchase to date and a definitive signal of its intentions to deepen its presence in the developer productivity and enterprise AI segments. The transaction would represent not just a consolidation of technological capability, but a transformation of OpenAI’s market positioning from a model-centric AI lab to a broader software infrastructure provider with vertically integrated tools.

Windsurf, formerly known as Codeium, has rapidly gained recognition in the AI and software development ecosystem for its suite of intelligent code generation and optimization tools. Founded in 2021 and backed by prominent investors such as General Catalyst and Kleiner Perkins, the company has emerged as a key player in the post-GitHub Copilot era. Its product suite includes advanced coding features like "Cascade Flow," which automates the analysis of massive codebases, streamlines onboarding for developers, and optimizes team workflows. With its annual recurring revenue (ARR) having quadrupled in just over a year—from $10 million in 2023 to over $40 million in early 2025—Windsurf’s trajectory aligns with broader industry trends toward intelligent, assistive developer tools.

The potential $3 billion acquisition price implies a valuation multiple of roughly 75 times ARR, which while steep, is not unusual for fast-scaling AI companies in high-demand categories. This premium valuation is less a reflection of Windsurf’s current financials and more an acknowledgment of its technological moat, user engagement, and synergy potential with OpenAI’s existing ecosystem. As companies increasingly turn to generative AI to streamline software development, OpenAI’s interest in Windsurf can be seen as both offensive and defensive: a way to extend its influence in the AI toolchain while preempting competition from rivals like Microsoft, Amazon, and Alphabet, all of whom are aggressively expanding their own AI coding solutions.

Strategically, this deal would strengthen OpenAI's offerings in several key ways. First, it would integrate an already successful and growing product directly into the ChatGPT ecosystem—offering a more feature-rich, developer-centric experience. Second, it would provide OpenAI with access to a trove of anonymized usage data that can be harnessed to train and fine-tune coding-specific large language models (LLMs), creating a flywheel of product improvement. Third, it may catalyze a new phase in OpenAI’s enterprise go-to-market strategy, as Windsurf’s client base includes numerous corporations and development teams already deploying the tool in production environments.

OpenAI’s interest in developer tooling is not entirely new. The launch of Codex in 2021 and its integration into GitHub Copilot (via a licensing partnership with Microsoft) was among the earliest attempts to apply LLMs to programming tasks. However, OpenAI has gradually shifted from providing models to external platforms to launching and owning full-stack solutions—evident in the evolution of ChatGPT into a multimodal assistant capable of coding, data analysis, and plugin integrations. The Windsurf acquisition would dramatically accelerate this trend by giving OpenAI ownership over a mature product already optimized for enterprise use.

Windsurf, for its part, offers not only compelling technology but also visionary leadership. CEO Varun Mohan has repeatedly emphasized a paradigm shift in software development—from “just coding” to what he describes as “vibe coding,” a new workflow where developers focus on high-level intent and creativity while offloading much of the syntax and structuring work to AI systems. This philosophical approach aligns closely with OpenAI’s mission to “amplify human potential,” suggesting a strong cultural and strategic fit between the two companies. Moreover, Windsurf’s focus on building scalable, production-ready tools rather than research-grade prototypes further increases its attractiveness to OpenAI, which is increasingly focused on monetizing its research breakthroughs.

The broader implications of this potential deal are significant. It could reshape how AI coding tools are developed, distributed, and integrated into the modern software stack. It might also prompt regulatory scrutiny, particularly in light of OpenAI’s growing dominance across multiple layers of the AI ecosystem—from foundational models to application-level tools. Policymakers and industry watchdogs may raise questions about competition, data privacy, and model transparency, especially if the acquisition leads to further centralization of power in the hands of a few dominant players.

This blog post will explore the strategic rationale behind the proposed acquisition, evaluate Windsurf’s technological and financial trajectory, examine the competitive dynamics in the AI developer tools landscape, and assess the broader impact on software engineers, enterprises, and the future of AI in software development. In doing so, we aim to provide a comprehensive understanding of what OpenAI’s $3 billion bet on Windsurf means—not just for the companies involved, but for the entire technology industry.

In the sections that follow, we will first delve into the rise of Windsurf—from its humble beginnings as Codeium to its current status as a unicorn startup poised for acquisition. We’ll then analyze the motivations driving OpenAI’s interest in this acquisition and how it fits into the company’s longer-term vision. Subsequently, we will assess the deal’s impact on developers and the broader AI ecosystem, supported by data visualizations and a comparative tool table. Finally, we will close with an in-depth look at the financial metrics behind the acquisition, its challenges, and the possible paths forward for OpenAI and Windsurf as they merge their operations and missions.

Windsurf’s Journey: From Codeium to a $3B Valuation

The story of Windsurf, formerly known as Codeium, encapsulates the broader narrative of how generative AI has rapidly reshaped the landscape of software development. Founded in 2021, Codeium began as a modest AI coding assistant built by a small team of engineers and AI researchers who saw an opportunity to streamline the most repetitive and time-consuming aspects of programming. Over the course of four years, the company evolved into Windsurf—a rebranded, venture-backed powerhouse recognized for pioneering some of the most advanced code intelligence systems on the market. Its journey from a niche tool to a potential $3 billion acquisition target by OpenAI is a testament to strategic focus, technical innovation, and exceptional execution.

At its inception, Codeium focused on developer productivity, launching as a lightweight browser extension and API that could auto-complete lines of code using transformer-based models. Unlike earlier attempts at code suggestion tools, Codeium’s architecture was designed to be extensible, privacy-conscious, and IDE-agnostic. Within a year, it had launched integrations with major development environments such as Visual Studio Code, JetBrains, and JupyterLab, quickly gaining traction among individual developers, startups, and enterprise software teams. The emphasis on accessibility and speed differentiated it from competitors who were often burdened by latency, limited language support, or excessive vendor lock-in.

A pivotal moment in Codeium’s growth came in late 2022 when it released a proprietary inference engine optimized for low-latency, on-device LLM execution. This development significantly enhanced the responsiveness and performance of its coding assistant, setting a new industry benchmark for user experience. Around the same time, the company began expanding its scope beyond simple code completion to include debugging suggestions, documentation generation, and even full-function synthesis from natural language prompts. By early 2023, it had introduced collaborative coding features tailored for remote teams—ushering in a new paradigm of "AI pair programming."

As the product matured, so too did investor interest. In 2023, Codeium secured $60 million in Series A funding, led by Kleiner Perkins, with participation from General Catalyst and notable angel investors from the AI research community. The infusion of capital allowed the company to expand its engineering team, invest in fine-tuning its proprietary LLMs for coding tasks, and launch a paid enterprise tier. In August 2024, just over a year later, the company completed a Series B round that brought in $183 million, pushing its post-money valuation to $1.25 billion. It was around this time that Codeium formally rebranded as Windsurf, a name reflecting its broader ambitions to help developers “catch the wave” of the AI revolution and ride it toward dramatically more efficient workflows.

The rebrand was more than cosmetic—it represented a strategic pivot toward enterprise clients and a deeper product focus. Windsurf launched its flagship enterprise platform, centered around a feature it called Cascade Flow. This innovation allowed engineering teams to map out entire codebases, analyze historical code changes, and optimize onboarding processes for new developers. Cascade Flow quickly became popular among CTOs and team leads, especially within large organizations managing legacy systems or sprawling microservice architectures. Unlike typical AI code tools that operated at the individual file level, Cascade Flow could process and reason across entire projects—accelerating understanding, refactoring, and even automated test case generation.

By the end of 2024, Windsurf had achieved an impressive $40 million in annual recurring revenue (ARR), growing 4x from its previous year. Its customer base included Fortune 500 companies, mid-market software vendors, and leading universities integrating the platform into computer science curricula. Notably, the company was included in the Forbes AI 50 for 2025, earning praise for both its technical innovations and its disciplined approach to commercialization—a rarity in a sector often driven more by hype than utility.

Technologically, Windsurf differentiated itself through its hybrid architecture. It combined local execution with cloud-based inference, enabling users to toggle between privacy-sensitive and performance-intensive tasks. The company also invested in a custom compiler-aware LLM architecture that allowed it to understand the syntax, semantics, and dependencies of real-world programming languages more accurately than many of its competitors. While most AI code tools relied heavily on fine-tuned versions of general-purpose LLMs, Windsurf’s approach emphasized specialization—resulting in fewer hallucinations and more actionable code outputs.

Another distinguishing feature of Windsurf was its developer-centric design philosophy. The platform never sought to replace software engineers but to augment their capabilities. CEO Varun Mohan was vocal in his belief that AI should serve as a “creative accelerant,” helping coders shift from rote implementation to higher-level problem solving. In interviews and keynote speeches, he popularized the term “vibe coding,” referring to a new mode of interaction where developers communicate intent while allowing the AI to handle scaffolding, boilerplate, and syntax. This vision resonated strongly with younger developers, who saw Windsurf not as a crutch, but as a springboard for innovation.

As interest in generative AI surged globally in 2024–2025, Windsurf found itself in a uniquely advantageous position. While GitHub Copilot, backed by Microsoft and OpenAI’s Codex, remained the dominant incumbent, it was increasingly seen as a developer tool baked into Microsoft's broader software suite. Windsurf, by contrast, maintained a platform-neutral posture, appealing to developers who preferred independence and cross-platform flexibility. Meanwhile, new competitors like Anysphere's Cursor and Replit's Ghostwriter were rising, but Windsurf had already established a defensible position through both brand recognition and enterprise relationships.

OpenAI’s interest in acquiring Windsurf can thus be understood through multiple lenses. First, Windsurf is a proven revenue-generating product with an enterprise footprint—offering a compelling complement to ChatGPT's current capabilities. Second, the company’s architecture, dataset, and LLM tuning methods offer strategic advantages that can be integrated into OpenAI’s own development pipeline. Third, Windsurf’s brand and developer loyalty may help OpenAI expand beyond its current user base and offer a more developer-native experience, particularly for organizations that have been hesitant to adopt ChatGPT for professional software engineering.

The potential $3 billion valuation, while significant, reflects more than financials—it is a bid on the future of software creation itself. Windsurf’s journey from a lightweight autocomplete plugin to a platform recognized by top-tier VCs, lauded by developers, and courted by OpenAI highlights the increasing convergence between generative AI and traditional software engineering. As AI continues to redefine how code is written, tested, and maintained, the tools that facilitate this transformation will become central to both developer productivity and broader enterprise efficiency.

In conclusion, Windsurf’s meteoric rise is emblematic of a new era where AI is no longer an experimental overlay to existing workflows but a foundational element of software development itself. The company's blend of technical excellence, rapid execution, and user empathy has placed it at the forefront of this transformation. Whether or not the acquisition with OpenAI is finalized, Windsurf’s legacy is already assured: it has helped shift the narrative from AI as a coding assistant to AI as a collaborative partner in creation.

Strategic Rationale Behind the Acquisition

The proposed acquisition of Windsurf by OpenAI for approximately $3 billion represents far more than a simple expansion of capabilities; it is a calculated move to consolidate power, reinforce product strategy, and respond to intensifying competition in the rapidly evolving generative AI ecosystem. As the race to develop and monetize advanced AI tools accelerates, OpenAI’s acquisition of Windsurf serves as both an offensive maneuver to strengthen its developer-centric offerings and a defensive strategy to prevent strategic assets from falling into the hands of rivals. The rationale behind this high-profile transaction can be understood by examining four core dimensions: product synergy, competitive positioning, data strategy, and vertical integration.

Enhancing OpenAI’s Developer-Centric Product Portfolio

First and foremost, Windsurf offers a suite of tools that would immediately and materially enhance OpenAI’s product portfolio, particularly in the domain of AI-assisted software development. ChatGPT, while versatile and widely adopted, is still perceived by many professional developers as a generalist tool. Despite its ability to generate and interpret code across multiple languages and frameworks, ChatGPT has limitations when it comes to real-time IDE integration, codebase-wide context, and team collaboration workflows. These are precisely the domains in which Windsurf excels.

The integration of Windsurf’s flagship features—such as Cascade Flow, real-time code completion, contextual debugging suggestions, and automated test generation—into ChatGPT could transform the latter from a capable assistant into a full-fledged, production-grade coding environment. By acquiring Windsurf, OpenAI would be able to close the feature gap with Microsoft’s GitHub Copilot and establish a standalone suite of enterprise-grade tools that can serve the needs of individual developers, startups, and large software teams alike.

Furthermore, Windsurf’s tools are designed to be extensible and modular, meaning they could be seamlessly embedded into OpenAI’s existing offerings. For example, OpenAI could roll out new developer modes within ChatGPT, leveraging Windsurf’s infrastructure to enable long-context code editing, project-wide refactoring, or version control-aware recommendations. Such integration would enable OpenAI to offer a comprehensive, vertically-integrated developer experience, spanning everything from model-powered code suggestion to version-controlled project management and team collaboration.

Strategic Positioning in a Competitive Landscape

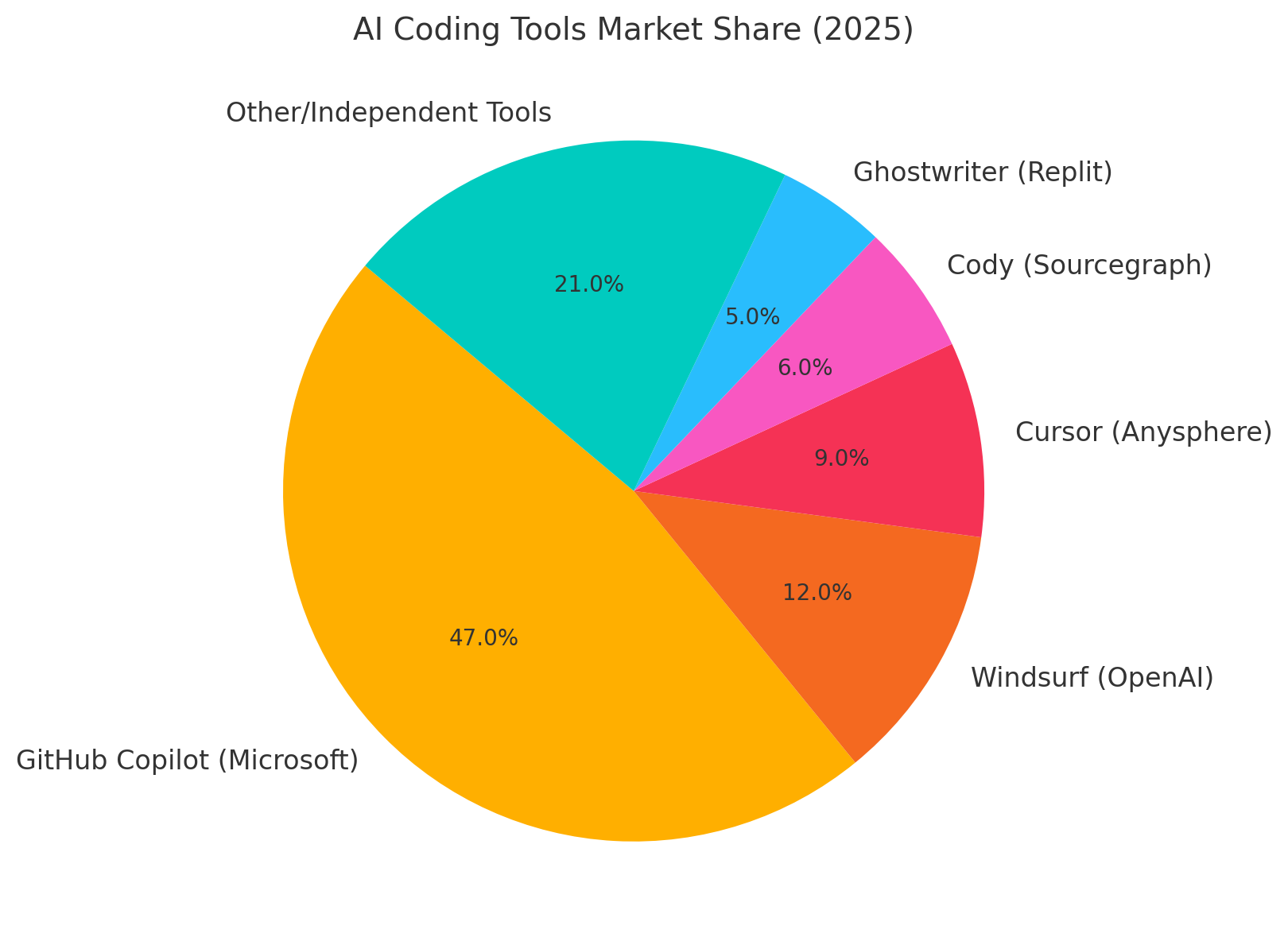

The AI coding space is becoming increasingly competitive, with both incumbents and startups vying for dominance. Microsoft’s GitHub Copilot, powered by OpenAI’s own Codex model, has captured significant market share and enjoys tight integration with Visual Studio and Microsoft Teams. Meanwhile, startups like Anysphere (maker of Cursor), Replit (with Ghostwriter), and Sourcegraph (with Cody) are innovating rapidly, targeting underserved niches such as long-form code editing, real-time pair programming, and codebase-specific fine-tuning.

By acquiring Windsurf, OpenAI gains a competitive lever against these players and reclaims a degree of autonomy in a market it helped to create. Codex, while foundational to GitHub Copilot, has effectively become part of Microsoft’s ecosystem, and OpenAI’s ability to influence that product is limited by licensing constraints. Windsurf, in contrast, provides OpenAI with end-to-end ownership of both the underlying models and the application layer. This enables faster iteration cycles, tighter feedback loops, and more responsive product development—advantages that are critical in a field where innovation outpaces regulation.

Importantly, the acquisition would also allow OpenAI to preempt potential competitive threats. Windsurf is a strategic asset not only for its technology but for its trajectory. With rising revenue, growing developer adoption, and favorable enterprise sentiment, Windsurf could soon become the default alternative to Copilot. If acquired by another tech giant such as Google, Amazon, or Meta, Windsurf could pose a direct threat to OpenAI’s influence in developer tooling. The $3 billion purchase thus functions as a containment strategy: securing a fast-rising competitor before it becomes too difficult—or too costly—to buy.

Leveraging Windsurf’s Data and Model Training Infrastructure

Another key driver behind the acquisition is Windsurf’s data infrastructure and training methodology. Generative AI products are only as effective as the datasets on which they are trained and the reinforcement mechanisms used to improve them. Windsurf has built a sophisticated system for collecting, curating, and utilizing anonymized telemetry data from real-world developer interactions. This includes context-aware prompt completions, user-corrected suggestions, code navigation patterns, and team collaboration workflows. Such data is invaluable for fine-tuning large language models to better understand intent, handle edge cases, and minimize hallucinations.

For OpenAI, which already operates some of the most powerful general-purpose LLMs in existence, Windsurf’s domain-specific data represents an opportunity to specialize further. Just as OpenAI has fine-tuned models like GPT-4 for specific tasks such as legal reasoning (via CaseText) or customer support (via ChatGPT Enterprise), it can now build a specialized coding LLM, optimized using Windsurf’s telemetry and supervised learning feedback. This would not only improve model accuracy but also increase user trust—two factors critical to long-term adoption in professional software development environments.

Additionally, Windsurf’s architecture supports hybrid model execution, offering both cloud-based inference and local model deployment. This is particularly attractive to enterprises concerned about intellectual property security, latency, or compliance with data residency requirements. OpenAI could build on this foundation to offer developers more flexible deployment options, potentially giving it an edge in markets where regulatory scrutiny is high or data sovereignty is a concern.

Advancing Vertical Integration and Ecosystem Expansion

From a business model perspective, the acquisition of Windsurf supports OpenAI’s broader strategy of vertical integration. Rather than simply offering API access to models, OpenAI is increasingly focused on delivering turnkey applications that solve specific problems. This approach maximizes user retention, increases revenue per user, and enables tighter product control. By absorbing Windsurf, OpenAI adds a critical layer to its stack—positioning itself not just as a model provider, but as a full-service platform for AI-assisted software engineering.

This vertical strategy also aligns with OpenAI’s evolving enterprise ambitions. With the launch of ChatGPT Enterprise, OpenAI began targeting businesses with security-hardened environments, extended context windows, and administrative features. Adding Windsurf’s capabilities would allow the company to offer tailored solutions to engineering departments, digital transformation units, and DevOps teams. In essence, OpenAI could evolve into an AI-native alternative to traditional software tool vendors like Atlassian, JetBrains, and even AWS CodeWhisperer.

Moreover, the deal would expand OpenAI’s addressable market. While ChatGPT has found success with knowledge workers, writers, and analysts, its penetration into software engineering teams has been more limited. Windsurf provides a clear entry point into this market and a brand already trusted by a large and growing segment of developers. Combined with OpenAI’s existing user base, distribution channels, and model performance, this creates significant cross-sell and upsell opportunities.

This visualization would underscore Windsurf’s current presence in the coding tools market while highlighting the potential uplift post-acquisition.

In conclusion, the rationale for OpenAI’s acquisition of Windsurf is multidimensional. It represents a logical extension of product capabilities, a competitive counter-move, a data-driven model enhancement strategy, and a step toward full-stack vertical integration. In a market where time-to-market and user engagement define success, acquiring Windsurf enables OpenAI to move swiftly, decisively, and comprehensively into a future where AI is not merely assistive—but essential—to modern software development.

Implications for Developers and the AI Industry

The potential acquisition of Windsurf by OpenAI for $3 billion is more than a consolidation of market share—it represents a seismic shift in how software development is approached, perceived, and practiced. As AI becomes an integral part of the programming workflow, the implications extend far beyond organizational boardrooms and corporate strategies; they reverberate throughout the global developer community and the broader AI ecosystem. From individual coders to enterprise IT departments, from open-source projects to regulatory bodies, this acquisition carries profound consequences for the future of code creation, team collaboration, and innovation in artificial intelligence.

Redefining the Role of the Developer

Perhaps the most direct impact of this acquisition will be felt by developers themselves. Traditionally, software engineering has been grounded in logic, structure, and human-driven problem solving. Developers were expected to write, test, and debug code with minimal abstraction. However, the integration of tools like Windsurf into widely used AI platforms such as ChatGPT is accelerating a transition toward what some in the industry have called “prompt engineering” or even “vibe coding”—a shift where coders specify high-level intent and allow AI to handle the mechanical aspects of implementation.

This paradigm shift carries with it both promise and uncertainty. On the positive side, developers are likely to benefit from unprecedented productivity gains. According to internal case studies released by Windsurf, developers using its tools experienced up to a 40% improvement in coding efficiency, measured by time to deploy, code quality, and bug reduction. Tasks that previously required days of manual coding, such as onboarding to a new codebase or writing unit tests, can now be completed in hours or even minutes. These productivity benefits are particularly valuable in enterprise environments where velocity and scalability are key metrics of success.

However, there are also concerns about deskilling and over-reliance on automated tools. While junior developers may find AI tools to be empowering learning aids, there is a risk that prolonged dependence on automation could erode foundational programming skills. The challenge for developers moving forward will be to maintain fluency in core programming principles while leveraging AI to abstract away the repetitive components. The ability to critically evaluate, correct, and guide AI-generated code will become a key competency in the software engineering profession.

The Rise of the “Builder” and Team Augmentation

Windsurf’s CEO, Varun Mohan, has articulated a vision of the “AI builder” as a new category of software professional—someone who uses AI not merely as a tool, but as a collaborator in creating scalable, intelligent applications. This idea is not just a marketing term; it reflects a tangible evolution in the division of labor within software teams. Rather than specializing exclusively in frontend, backend, or DevOps roles, the AI builder is a cross-functional contributor who coordinates intent, prompts AI agents, and validates outputs across the stack.

In practical terms, this means that software teams may need to be restructured to incorporate roles focused on prompt design, workflow orchestration, and model supervision. Senior developers may find themselves acting more like AI supervisors or product architects, ensuring that the output of automated agents aligns with business requirements, security policies, and performance standards. This development could also foster the emergence of hybrid roles that blend programming with domain-specific knowledge, especially in regulated industries such as finance, healthcare, and government.

Moreover, the integration of Windsurf’s collaborative features—such as shared code intelligence, version-aware suggestions, and project-wide insights—into OpenAI’s ecosystem could transform how teams operate. Engineers will no longer work in silos but in AI-augmented networks where knowledge is centralized, codified, and contextually surfaced. This could reduce redundancy, accelerate onboarding, and improve the consistency of codebases across distributed teams.

Impacts on Open-Source and the Innovation Economy

The implications of this acquisition also extend into the open-source community and the broader innovation economy. Windsurf, like many generative AI tools, has benefited immensely from open-source code repositories, which have served as training data for its models. However, its commercial success—and now its likely integration into a for-profit entity like OpenAI—raises ongoing ethical and economic questions about the monetization of communal knowledge.

Open-source advocates may view the acquisition as part of a troubling trend in which community-driven resources are leveraged to build proprietary, closed-source tools that primarily benefit large corporations. This could exacerbate existing tensions between open innovation and commercial AI development. To address these concerns, it may become necessary for firms like OpenAI to increase transparency around data sourcing, provide opt-out mechanisms for public repositories, or contribute back to open-source ecosystems through funding, tooling, or shared research.

At the same time, the acquisition could serve as a powerful signal to AI startups and VCs that the developer tools market remains highly investable. With valuations surging and exits materializing, innovation in this space is likely to accelerate. Startups focusing on niche tooling—such as API testing, real-time collaboration, or industry-specific coding frameworks—may find themselves targets for acquisition or partnership by major AI labs seeking to expand their application ecosystems. In this regard, the acquisition could trigger a wave of consolidation and specialization across the AI tools sector.

Regulatory and Labor Market Considerations

Given OpenAI’s rapidly growing market footprint, the Windsurf acquisition is likely to attract scrutiny from regulatory bodies in both the United States and abroad. Antitrust agencies may examine whether OpenAI’s vertical expansion—from foundational models to productivity applications—constitutes an unfair concentration of power. As with previous tech acquisitions, regulators will likely assess how the deal affects market competitiveness, developer choice, and consumer welfare.

From a labor market standpoint, the implications are complex. While AI tools like Windsurf can dramatically reduce the time required to ship software, they do not necessarily reduce the overall demand for software engineers. On the contrary, the ability to build more software faster may increase the need for engineers to specify requirements, integrate systems, and maintain AI-generated code. In addition, many businesses are now seeking developers who can work fluidly with AI tools—prompting a new wave of educational initiatives, certification programs, and workforce training to meet evolving skill demands.

That said, some displacement is inevitable. Roles that focus exclusively on repetitive, low-level tasks may be automated away. Organizations will need to rethink workforce planning, prioritize upskilling, and potentially shift hiring strategies to focus on creativity, design, and systems thinking. For governments and educational institutions, the policy response must be proactive, ensuring that curricula, labor protections, and social safety nets evolve in tandem with technological capabilities.

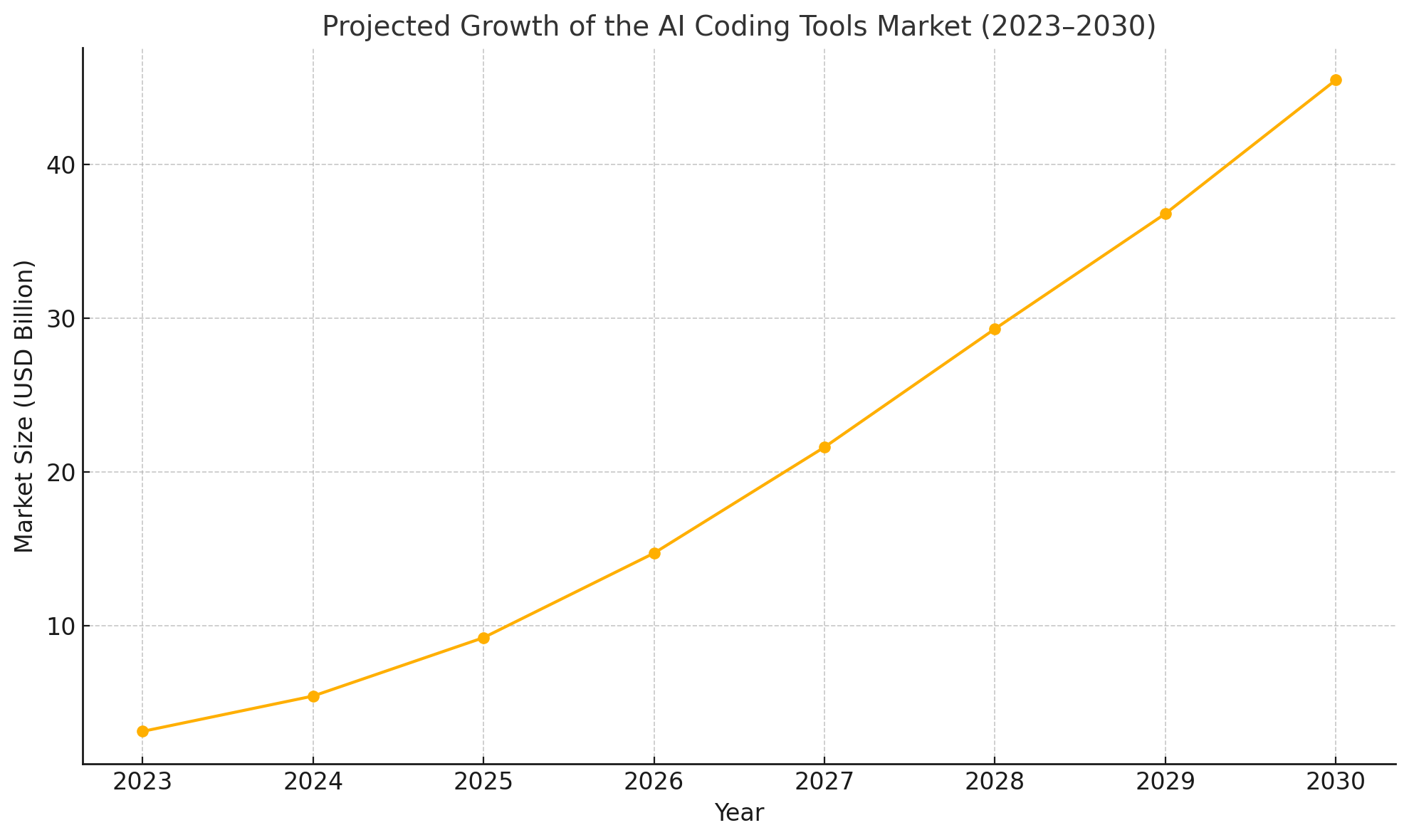

This chart visually demonstrates the explosive growth expected in the AI coding tools market, validating the strategic importance of OpenAI’s Windsurf acquisition.

In conclusion, the implications of OpenAI’s potential acquisition of Windsurf are far-reaching and multifaceted. For developers, it represents a shift toward higher-level programming practices centered around collaboration with AI. For software teams, it offers new paradigms in how code is created, shared, and maintained. For the AI industry, it sets a precedent for consolidation, specialization, and monetization. And for society, it raises essential questions about skills, labor, fairness, and accountability in a world where AI is not just a tool—but a collaborator. As OpenAI and Windsurf move toward integration, the technology community must engage with these changes thoughtfully, ensuring that the benefits of AI-enhanced development are equitably shared and responsibly governed.

Financial Overview and Future Outlook

The proposed acquisition of Windsurf by OpenAI, valued at approximately $3 billion, offers a revealing lens into both the financial calculus of cutting-edge artificial intelligence companies and the broader strategic ambitions of the AI industry. As OpenAI continues its rapid expansion into commercial applications and enterprise solutions, this deal encapsulates a confluence of financial optimism, market timing, and long-term value projection. In this section, we explore the core financial metrics underlying the deal, examine OpenAI’s capital positioning, and provide a forward-looking analysis of integration challenges, competitive dynamics, and potential paths ahead.

Decoding Windsurf’s Valuation

At face value, Windsurf’s $3 billion price tag may appear ambitious, particularly when benchmarked against its most recent revenue figures. As of Q1 2025, Windsurf had reported an annual recurring revenue (ARR) of approximately $40 million—a remarkable feat for a startup founded in 2021, but still modest relative to its valuation. This implies a revenue multiple of 75x, which is well above average in even the most bullish software-as-a-service (SaaS) environments.

However, the elevated multiple can be justified by a combination of high growth rates, strategic synergies, and scarcity value. Windsurf’s ARR has quadrupled in less than 18 months, indicating a compounded monthly growth rate exceeding 10%. Such growth rates suggest a strong product-market fit, especially within an emerging category like AI-assisted software development. Investors and acquirers are typically willing to pay a premium for high-growth companies in strategic markets, particularly when those companies offer a path to exponential scaling and long-term defensibility.

Moreover, the acquisition is not just about revenue—it is about asset consolidation. Windsurf possesses proprietary training datasets, a loyal and growing user base, and a suite of features that complement OpenAI’s existing products. In an environment where differentiation increasingly depends on owning the full technology stack—from foundational models to end-user applications—Windsurf’s capabilities are more than a financial asset; they are a strategic accelerant.

OpenAI’s Capital Structure and Deal Feasibility

OpenAI is well-positioned to finance this acquisition without significant liquidity risk. In early 2025, OpenAI reportedly raised $40 billion in a funding round led by SoftBank, bringing its post-money valuation to an estimated $300 billion. This makes OpenAI one of the most valuable private technology companies globally, rivaling even the largest cloud providers in terms of perceived market influence and technological prowess.

The capital raised is intended to fuel OpenAI’s infrastructure expansion, talent acquisition, and vertical product development. Acquiring Windsurf aligns with all three objectives. First, it supports OpenAI’s infrastructure ambitions by augmenting its software capabilities. Second, it brings on board a high-performing team of engineers and AI researchers. Third, it enhances OpenAI’s product depth in the highly valuable developer tools vertical.

Assuming a cash-equivalent deal structure, the $3 billion acquisition would represent less than 8% of OpenAI’s recently raised funds. Even if structured with equity components or earn-outs, the financial burden on OpenAI would be minimal in the context of its capital base. The strategic return on such an investment—both in terms of product capabilities and market positioning—would likely outweigh any short-term financial dilution.

Competitive Benchmarking and Comparative Metrics

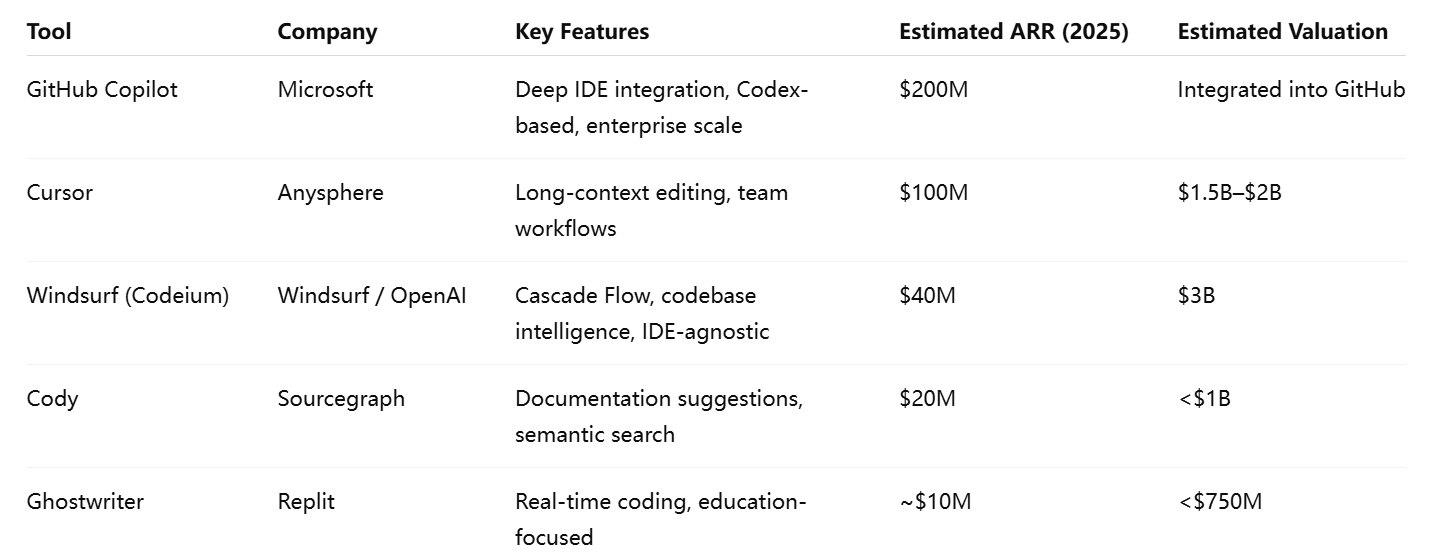

To contextualize Windsurf’s valuation, it is useful to examine how it compares with similar companies in the space. GitHub Copilot, for instance, is estimated to generate over $200 million in ARR for Microsoft, with a significantly higher user base but constrained to Microsoft’s ecosystem. Anysphere’s Cursor has reached approximately $100 million in ARR and is reportedly valued in the $1.5–2 billion range, while Replit’s Ghostwriter and Sourcegraph’s Cody operate at smaller scale but continue to draw significant investor interest.

Below is a comparative analysis:

From this comparison, it is evident that Windsurf’s valuation is aggressive but strategically aligned with OpenAI’s future trajectory. What differentiates Windsurf is not just revenue, but the architecture, extensibility, and platform-agnostic design of its toolset, which OpenAI can leverage across its own rapidly growing product suite.

Integration Challenges and Operational Complexity

Despite the clear strategic rationale, the integration of Windsurf into OpenAI will not be without challenges. Technologically, both companies operate at different abstraction levels. OpenAI focuses primarily on foundational models and multimodal interaction systems, while Windsurf delivers tightly engineered, IDE-integrated tooling. Bridging these layers will require thoughtful product integration, UI alignment, and backend harmonization.

Culturally, there may also be challenges in assimilating a startup mindset into a maturing AI enterprise. Windsurf has thrived as a nimble, product-driven organization with a tight feedback loop between developers and product engineers. Maintaining that agility while operating under the broader umbrella of OpenAI—whose product roadmap is increasingly shaped by global partnerships, safety protocols, and regulatory scrutiny—will require careful alignment and leadership continuity.

Additionally, OpenAI must manage potential friction with existing partners, particularly Microsoft. While OpenAI licenses its Codex model to power GitHub Copilot, the acquisition of Windsurf may strain this partnership by introducing a competing product directly under OpenAI’s control. This could necessitate renegotiation of terms or clearer delineation of product boundaries.

Long-Term Outlook: Dominating the Developer Stack

Looking forward, the acquisition of Windsurf positions OpenAI to expand its footprint beyond conversational AI and into the heart of the modern software development lifecycle. With ChatGPT already being used by millions of developers for Q&A, prototyping, and documentation, the addition of Windsurf enables OpenAI to support persistent, project-aware, and team-oriented development environments.

In the near term, OpenAI is likely to integrate Windsurf’s Cascade Flow into ChatGPT’s developer mode, offering users intelligent project summaries, real-time code recommendations, and collaborative editing features. Over time, the company could launch a new vertical—OpenAI DevOps Cloud—offering a fully AI-managed platform for software development, testing, deployment, and monitoring.

The ultimate goal may be to create a self-improving software development ecosystem in which LLMs not only assist but autonomously maintain, debug, and refactor software systems. With Windsurf as a foundational piece, OpenAI can accelerate this vision and shape the standards by which future software is built, modified, and audited.

In conclusion, the financial and strategic foundations of OpenAI’s proposed $3 billion acquisition of Windsurf are well aligned. The deal represents a bold but calculated investment in a high-growth vertical, a hedge against competitive encroachment, and a springboard for long-term product expansion. By acquiring Windsurf, OpenAI positions itself not merely as a provider of intelligent agents, but as a central infrastructure layer in the software development value chain. As the integration unfolds, stakeholders across the AI and software industries will be watching closely to gauge its success—and its ripple effects on the future of intelligent coding tools.

References

- OpenAI Eyes Acquisition of Windsurf for $3B in AI Coding Push

https://www.theinformation.com/articles/openai-in-talks-to-buy-codeium-for-3-billion - Windsurf (formerly Codeium) Adds Cascade Flow to Supercharge Dev Workflows

https://codeium.com/blog/cascade-flow - Windsurf Named to Forbes AI 50 List of Most Innovative AI Startups

https://www.forbes.com/lists/ai50 - How Windsurf Aims to Redefine Software Development with AI

https://venturebeat.com/ai/windsurf-codeium-ai-coding-tools/ - ChatGPT Enterprise Expands OpenAI's SaaS Strategy

https://openai.com/blog/introducing-chatgpt-enterprise - GitHub Copilot and the Future of AI-Powered Programming

https://github.blog/2023-03-22-the-evolution-of-github-copilot/ - Anysphere Cursor: The Fastest-Growing Alternative to Copilot

https://www.anysphere.dev/blog/cursor-launch - How AI is Transforming Developer Roles and Workflows

https://techcrunch.com/ai-developer-productivity-automation - Replit’s Ghostwriter: Democratizing AI Coding Assistance

https://blog.replit.com/ghostwriter - Sourcegraph’s Cody AI and the Shift to Semantic Code Search

https://sourcegraph.com/blog/cody-ai-announcement