OpenAI Secures $40 Billion in Funding at $300 Billion Valuation: What It Means for the Future of AI

In a landmark event that marks a pivotal juncture in the trajectory of artificial intelligence (AI), OpenAI has reportedly raised an astounding $40 billion in new funding, propelling its post-money valuation to a staggering $300 billion. This development not only underscores the surging investor confidence in generative AI technologies but also places OpenAI among the most highly valued private technology companies in the world, rivaling stalwarts such as SpaceX and Stripe. The magnitude of this fundraising round signals more than a mere capital infusion; it reflects a strategic recalibration of the AI industry’s future, with OpenAI firmly positioned at the epicenter of technological, economic, and societal transformation.

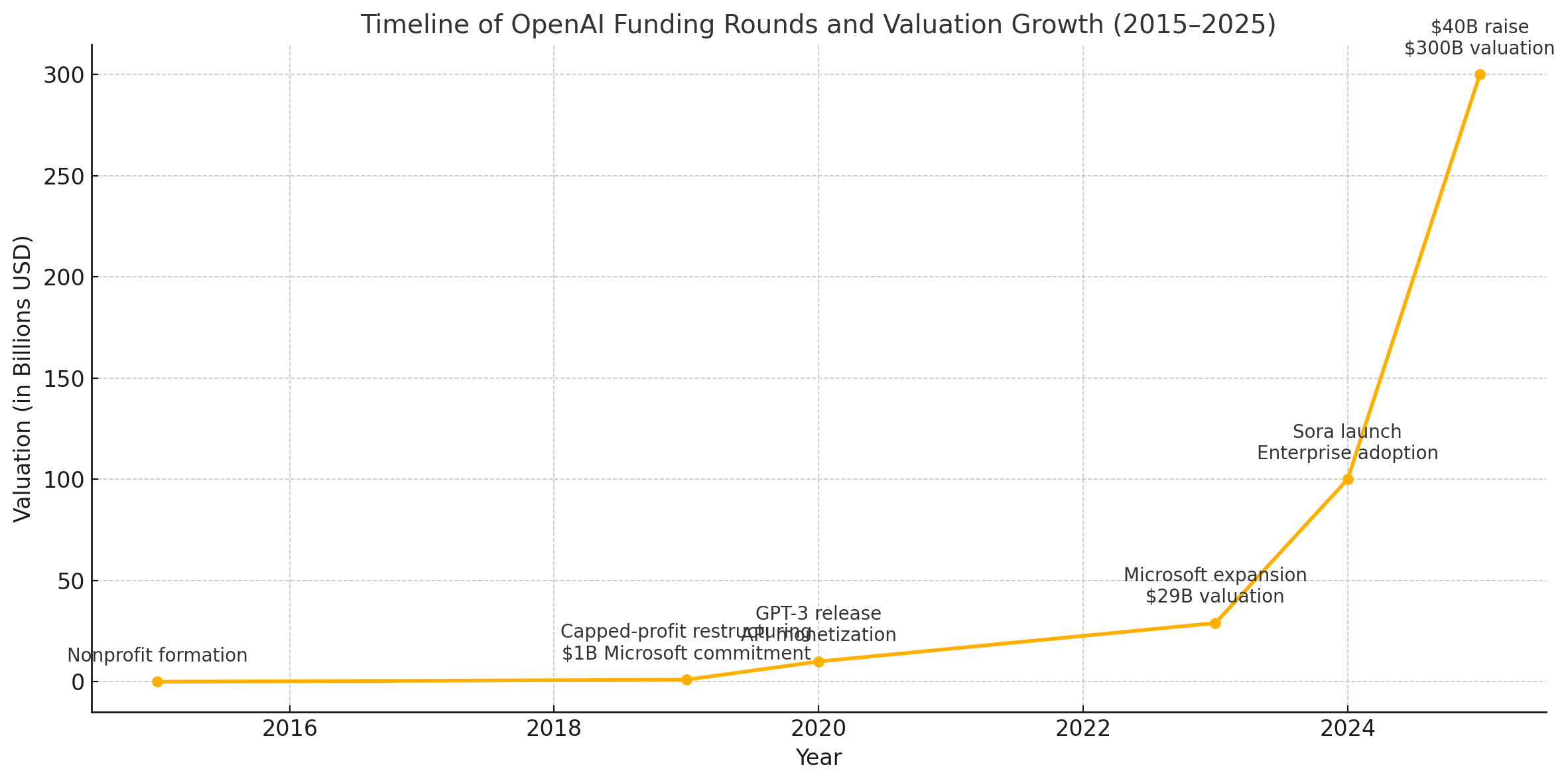

Founded in 2015 as a nonprofit research organization with the mission to ensure that artificial general intelligence (AGI) benefits all of humanity, OpenAI has undergone a remarkable metamorphosis. The introduction of its capped-profit model in 2019 allowed the company to scale its ambitions while balancing commercial imperatives with its original ethical commitments. The organization has since become a cornerstone of the AI revolution, thanks in large part to groundbreaking models such as GPT-3, GPT-4, DALL·E, Codex, and most recently, Sora—a multimodal generative model capable of creating photorealistic video from text. These innovations have not only redefined human-computer interaction but also catalyzed a wave of AI adoption across industries.

The $40 billion capital raise represents both a culmination of OpenAI’s achievements to date and a springboard for its long-term vision. In an era characterized by rapid advances in compute infrastructure, algorithmic breakthroughs, and data scale, access to vast capital is no longer a luxury but a necessity. For OpenAI, this funding will likely serve as the foundation for an aggressive investment strategy in research and development, global expansion, talent acquisition, and the enhancement of its already formidable supercomputing capabilities. Moreover, it opens the door for potential mergers and acquisitions that could consolidate OpenAI’s dominance in the foundational model space.

This announcement comes at a time of intensifying global competition in AI, where private investment, national policy, and research excellence are becoming deeply intertwined. Major technology players—including Google DeepMind, Meta, Anthropic, xAI, Amazon, and Apple—are racing to define the next phase of intelligent systems, from personal assistants and autonomous agents to advanced reasoning models. OpenAI’s unprecedented raise shifts the balance of power, compelling its competitors to reevaluate their strategic positions and potentially triggering a new wave of investment and innovation.

Equally important is the signaling effect this funding round has on the broader venture capital and institutional investment landscape. As late-stage tech funding shows signs of resurgence after a cautious 2022–2023 period, OpenAI’s valuation serves as a bellwether for the next generation of AI-native startups. It challenges prevailing assumptions about market saturation and indicates that investors remain bullish on long-term AI monetization, particularly in enterprise software, infrastructure, creative tools, and digital labor.

Nevertheless, this monumental capital event also invites critical reflection. Questions surrounding model alignment, data privacy, regulatory oversight, and the centralization of AI capabilities are more pertinent than ever. OpenAI’s rise—while undoubtedly a technological triumph—also prompts a reevaluation of how power is distributed in the AI ecosystem and what mechanisms are needed to ensure responsible development.

In this blog post, we will explore the multifaceted implications of OpenAI’s $40 billion raise and $300 billion valuation. Through a detailed examination of its funding architecture, strategic objectives, market dynamics, and ethical considerations, we aim to unpack how this momentous development will shape the future of artificial intelligence. Along the way, we will leverage visual data in the form of charts and tables to contextualize OpenAI’s position within the broader technology and investment landscape.

As we proceed, it is important to recognize that this is not merely a financial story—it is a reflection of how artificial intelligence is becoming deeply embedded in the fabric of modern life. Whether viewed through the lens of opportunity, risk, or transformation, OpenAI’s capital milestone offers a compelling vantage point from which to consider the next frontier of human-machine symbiosis.

The Fundraising Breakdown: Where the $40 Billion Comes From

The $40 billion capital raise by OpenAI stands as one of the largest private funding rounds in the history of technology. To fully appreciate the magnitude and strategic implications of this development, it is essential to examine the composition of the funding round, the identities and motivations of participating investors, and the intended allocation of capital. Understanding these financial underpinnings offers insight not only into OpenAI’s internal roadmap but also into how capital markets are evolving to support high-stakes frontier technology.

Composition of the Funding Round

Preliminary reporting suggests that OpenAI’s funding round was structured as a combination of equity issuance and convertible securities, allowing both flexibility for investors and scalability for the organization. While the final terms have not been publicly disclosed in full detail, the round likely included a blend of direct primary investments into OpenAI LP, as well as secondary market purchases of equity from existing stakeholders. This hybrid structure is increasingly common in late-stage mega-deals, particularly when investor demand outpaces the company’s immediate capital requirements.

The round was reportedly oversubscribed, reflecting strong investor appetite despite broader macroeconomic uncertainties. Sources familiar with the matter indicate that OpenAI opted to cap the total raise at $40 billion to avoid excessive dilution and preserve governance flexibility. This conservative approach to capital management suggests a high degree of financial discipline, even in the face of enormous institutional enthusiasm.

Key Investors: A Blend of Old and New

Microsoft, OpenAI’s largest strategic partner and investor, is widely assumed to have participated in this round, further deepening its already substantial stake in the company. Microsoft’s 2023 investment of up to $13 billion helped formalize its role as both infrastructure provider—via Azure—and distribution partner for OpenAI’s models across Microsoft 365, GitHub Copilot, and Azure OpenAI Service.

In addition to Microsoft, sovereign wealth funds, large-cap venture firms, and late-stage growth equity investors reportedly contributed to the round. Names such as Abu Dhabi’s Mubadala Investment Company, Singapore’s GIC, and Saudi Arabia’s Public Investment Fund (PIF) have been floated as likely participants, underscoring the geopolitical dimensions of AI investment. Their involvement points to a growing trend of state-backed capital flowing into AI as a matter of both economic foresight and national security.

Among the venture capital elite, firms like Sequoia Capital, Andreessen Horowitz, and Thrive Capital are rumored to have increased their exposure. These investors have long advocated for AI as the defining technology of the 21st century and view OpenAI as the most mature instantiation of that thesis. Their continued support further legitimizes OpenAI’s vision while ensuring alignment with Silicon Valley’s most influential capital allocators.

Strategic Intent: Why Raise $40 Billion?

For most companies, a single billion-dollar raise is considered transformational. For OpenAI, however, a $40 billion round represents a strategic imperative. The development and deployment of frontier AI models demand not only immense computational power but also world-class talent, expansive datasets, and secure operating environments. These requirements translate into capital-intensive commitments across multiple verticals.

One of the primary use cases for the funding is the expansion of supercomputing infrastructure. The training of large language models (LLMs) and multimodal systems like Sora necessitates tens of thousands of high-end GPUs and custom silicon—often manufactured by NVIDIA, AMD, or, increasingly, through proprietary chip development. Capital will also be directed toward new data center construction and global energy sourcing, both of which are essential for ensuring scalability and uptime.

A second major use case is investment in research and talent acquisition. OpenAI remains in fierce competition with rival labs, such as DeepMind, Anthropic, Meta AI, and xAI, for a relatively small pool of top-tier machine learning researchers. Compensation packages for elite AI talent now routinely exceed seven figures, and attracting such individuals requires not just monetary incentives but also an inspiring mission and unparalleled compute access.

Beyond R&D and infrastructure, OpenAI is likely to allocate funding toward ecosystem development. This includes enhancements to its API offerings, enterprise partnerships, developer platforms, and real-time inference capabilities. By creating a more accessible and scalable product suite, OpenAI can broaden adoption across industries ranging from healthcare and finance to education and media.

Finally, OpenAI may pursue targeted acquisitions to augment its core capabilities. Whether by acquiring startups specializing in data annotation, model compression, AI agents, or synthetic media detection, M&A represents a high-leverage mechanism for consolidating its leadership position. The capital raised gives OpenAI the strategic flexibility to act quickly and decisively in a highly competitive landscape.

A Financial Watershed in the AI Industry

This fundraising event does not exist in isolation; it reflects a broader recalibration of how capital markets are responding to the AI opportunity. In the past, late-stage tech investing was often characterized by caution and incrementalism. However, the scale and velocity of OpenAI’s raise signify a renewed confidence in deep tech, particularly in companies that have both technological moats and demonstrable market traction.

It is also worth noting the implicit expectations embedded within a $300 billion valuation. Investors are not simply betting on continued innovation—they are anticipating massive revenue growth, high-margin products, and potentially transformative applications across both consumer and enterprise domains. OpenAI’s current monetization channels—including ChatGPT subscriptions, API usage, and embedded enterprise solutions—are seen as only the tip of the iceberg. The next phase of monetization may include digital labor services, intelligent assistants, autonomous decision systems, and vertically integrated AI platforms.

The following chart provides a visual overview of OpenAI’s major funding rounds and corresponding valuation increases over the last decade, highlighting its rapid ascent from a nonprofit research lab to one of the most valuable AI companies in the world.

What a $300 Billion Valuation Means

The declaration of OpenAI’s post-money valuation at $300 billion marks a watershed moment not only for the company itself but also for the artificial intelligence industry and the broader technology ecosystem. Such a valuation does more than merely reflect investor enthusiasm; it encapsulates assumptions about future revenues, profitability, market dominance, and systemic impact. To understand what this valuation truly signifies, it is necessary to unpack its implications across financial, strategic, and competitive dimensions.

Valuation as a Signal of Future Potential

In the realm of venture and growth equity, valuation is not merely a retrospective measure of performance—it is a forward-looking statement. A $300 billion valuation implies that investors believe OpenAI has the potential to generate future cash flows, intellectual property, or strategic leverage that rivals the likes of Amazon, Google, and Apple. These are companies with global platforms, diversified revenue streams, and systemic influence. For OpenAI to be placed in this echelon by private markets is a signal that AI is no longer a vertical within tech—it is becoming the operating system of the digital economy.

This valuation suggests that OpenAI is expected to transition from a primarily R&D-driven entity to a dominant commercial player. While the company has already begun monetizing its capabilities through ChatGPT subscriptions, API access, enterprise licensing, and integrations with Microsoft products, the $300 billion figure suggests that these revenue streams are anticipated to scale exponentially. Moreover, it implies a belief in OpenAI’s ability to pioneer entirely new product categories—autonomous agents, AI-native operating systems, and digital labor platforms—that could reshape business operations globally.

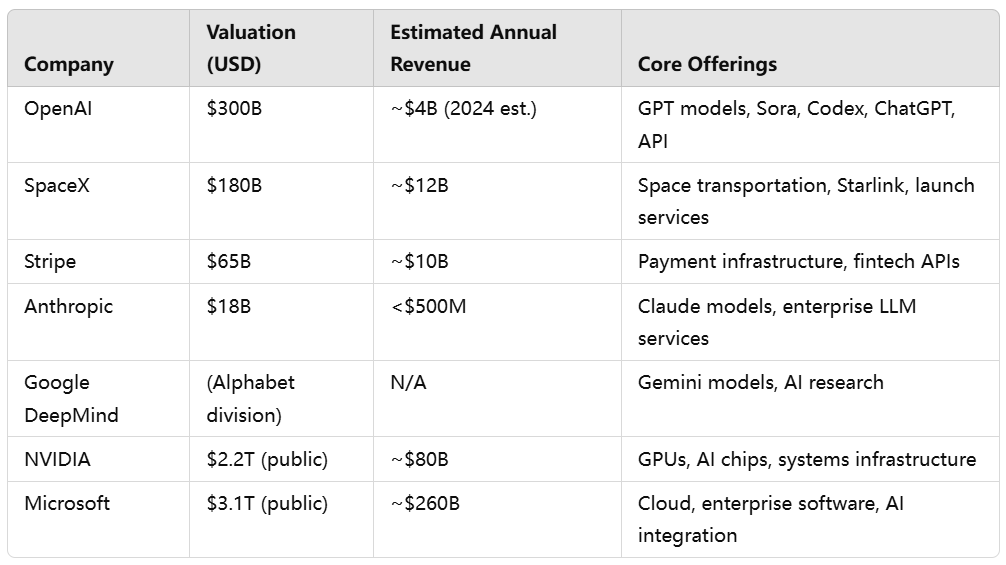

Benchmarking OpenAI Against Other Technology Giants

To appreciate the gravity of a $300 billion valuation, it is useful to contextualize OpenAI within the hierarchy of the most valuable private and public technology companies. The following table outlines how OpenAI compares to other high-profile entities as of 2025, based on the latest available market data.

As the table illustrates, OpenAI’s valuation outpaces many private firms by a wide margin and approaches the scale typically reserved for public megacaps. This discrepancy between valuation and current revenue underscores that OpenAI is being priced based on its anticipated future dominance, not its current earnings.

Investor Psychology: Betting on the Foundations of AI

From the perspective of institutional investors, OpenAI’s valuation is an expression of conviction that the company is building foundational infrastructure for the next era of computing. Much like how Amazon Web Services (AWS) became the de facto backbone of cloud infrastructure in the 2010s, OpenAI’s foundational models are being positioned as general-purpose engines for knowledge work, creativity, and automation. Investors are wagering that OpenAI will occupy a central role in the economic digitization of virtually every industry.

This psychology is reinforced by the idea of winner-take-most dynamics in AI. Because foundational model development requires enormous compute resources, elite research talent, and access to proprietary data at scale, only a few firms are likely to survive at the frontier. OpenAI’s $300 billion valuation is thus a bet on both scarcity and defensibility—two qualities that investors prize in the age of capital-intensive deep tech.

The Role of Product Differentiation and Brand Power

Valuation is also a function of market perception and brand equity. In the public imagination, OpenAI has become synonymous with cutting-edge artificial intelligence. ChatGPT, in particular, has achieved a level of name recognition rivaling Google Search or Apple’s Siri—despite being a relatively recent entrant into the consumer interface space.

This consumer-facing success translates into pricing power, developer mindshare, and enterprise interest. Unlike many AI labs that remain research-first and commercially distant, OpenAI has successfully blended elite technical capabilities with mainstream product experiences. Its models are not only high-performing—they are also accessible and integrated into widely used tools, such as Microsoft Word, Excel, and GitHub Copilot.

Furthermore, OpenAI has cultivated a perception of technical leadership, which is difficult to quantify but immensely valuable in attracting talent, investors, and partners. The valuation reflects a belief that OpenAI is the "Apple of AI"—a firm that can command loyalty, charge premiums, and set the direction of the entire ecosystem.

Risks and Skepticism Embedded in the Valuation

It is important, however, to acknowledge the risks inherent in a valuation of this magnitude. Many analysts have raised concerns that OpenAI’s valuation may be speculative, driven more by hype cycles and competitive FOMO (fear of missing out) than by fundamental economics. With estimated revenues still in the low single-digit billions, the price-to-sales ratio exceeds 75—levels that are often viewed with caution in traditional financial analysis.

Moreover, the pace of technological disruption in AI is relentless. While OpenAI currently enjoys a lead in model performance and platform reach, challengers such as Anthropic, xAI, Google DeepMind, and open-source collectives are rapidly closing the gap. It remains to be seen whether OpenAI can maintain its edge as the industry evolves toward decentralized, specialized, or multi-agent architectures.

There are also regulatory uncertainties. As OpenAI becomes more powerful and influential, it is likely to face heightened scrutiny from policymakers concerned about competition, misinformation, labor displacement, and digital rights. These factors introduce volatility into the long-term risk-adjusted return calculus that underpins such a lofty valuation.

A Reflection of Belief and Power

Ultimately, a $300 billion valuation is more than a financial headline—it is a referendum on the centrality of AI to the global economy and on OpenAI’s perceived role as a steward of that transformation. It encapsulates a deep belief in the company’s mission, technology, and leadership. At the same time, it introduces new responsibilities, expectations, and challenges that must be navigated carefully.

As we move deeper into the AI-native era, the true measure of OpenAI’s value will not lie in financial metrics alone, but in its ability to responsibly scale intelligence, empower innovation, and shape a future in which artificial intelligence augments—rather than undermines—human agency.

Strategic Levers: What OpenAI Might Do With $40 Billion

The successful raise of $40 billion affords OpenAI an extraordinary degree of strategic flexibility, operational resilience, and innovation capacity. At a time when the barriers to entry in frontier artificial intelligence are becoming steeper, this capital injection positions OpenAI not merely to compete—but to define—the next era of intelligent systems. The scale of the raise suggests a deliberate, multifaceted strategy encompassing infrastructure development, research acceleration, talent acquisition, ecosystem expansion, and potential mergers and acquisitions. This section explores the key strategic levers OpenAI is likely to activate in deploying its newly acquired capital.

Infrastructure: Scaling the Backbone of Intelligence

One of the most immediate and capital-intensive imperatives for OpenAI is the expansion of its compute infrastructure. Training and serving large-scale models such as GPT-4, Codex, and Sora requires unprecedented levels of computational power. As model architectures grow in size and complexity, traditional data center infrastructure becomes inadequate. OpenAI must therefore invest heavily in specialized supercomputing facilities tailored for AI workloads.

A significant portion of the $40 billion is expected to be allocated to acquiring advanced GPUs—particularly from NVIDIA, whose H100 and successor chips are considered industry standards for large-scale AI training. Simultaneously, OpenAI may also explore the development of custom AI chips in collaboration with semiconductor partners or through proprietary engineering efforts. This approach would mirror strategies employed by Google (TPUs) and Amazon (Inferentia and Trainium), aiming to reduce long-term dependency on external vendors while optimizing performance for proprietary models.

Moreover, infrastructure investments are likely to extend into energy sourcing and sustainability. Given the immense power requirements of AI training, OpenAI will need to secure long-term contracts for renewable energy and possibly invest directly in next-generation energy sources, such as nuclear or geothermal, to ensure both scalability and environmental responsibility.

Research and Model Innovation

OpenAI’s core value proposition remains grounded in its capacity to build and refine state-of-the-art AI models. With ample funding, the organization is now uniquely positioned to pursue long-term, high-risk research trajectories that smaller firms cannot afford to explore.

Beyond incremental improvements to current transformer-based architectures, OpenAI is expected to intensify research into new model paradigms—such as sparse expert models, reinforcement learning from human feedback (RLHF), and multimodal reasoning systems that can integrate text, vision, audio, and eventually robotics. The release of Sora, a text-to-video generative model, hints at an ambitious roadmap for embodied intelligence and synthetic media.

Importantly, OpenAI’s alignment research team will likely receive enhanced funding to address the increasingly critical questions of model safety, interpretability, and control. As the capabilities of frontier models approach or exceed human-level performance in specific domains, the need for rigorous alignment protocols becomes not just a scientific necessity but also a regulatory and ethical mandate.

Talent and Organizational Growth

At the heart of OpenAI’s success is its world-class talent. The field of artificial intelligence is highly specialized, with only a limited number of individuals globally possessing the deep technical expertise required to operate at the frontier. The $40 billion capital reserve enables OpenAI to aggressively attract, retain, and empower the best minds in the field.

This may involve offering competitive compensation packages, funding independent research tracks, and creating new institutional structures to support interdisciplinary collaboration. OpenAI is also likely to expand internationally, establishing satellite research offices in regions with strong academic and technical ecosystems such as the United Kingdom, Canada, Germany, and Singapore.

Organizationally, OpenAI may pursue internal restructuring to accommodate its rapid growth. This could include spinning out product-specific divisions (e.g., for ChatGPT, Codex, or Sora), formalizing internal incubation programs, and scaling its operational, legal, and policy teams to navigate an increasingly complex global environment.

Ecosystem Development and Platform Strategy

Another critical area of strategic investment is the expansion of OpenAI’s ecosystem. While the company’s API platform has gained traction among developers and enterprises, there remains considerable room for growth in tooling, documentation, support, and integration layers. OpenAI is likely to enhance its platform offering to enable deeper vertical integration, lower onboarding friction, and promote long-term customer retention.

New investments may also support the development of a full-stack application ecosystem that includes software development kits (SDKs), low-code environments, plugin marketplaces, and third-party developer tools. By fostering a thriving community of builders and startups around its models, OpenAI can entrench its position as the default operating layer for AI-powered applications.

Furthermore, OpenAI is expected to launch more enterprise-specific features, including compliance controls, private model deployment options, and sector-specific fine-tuning capabilities. These enhancements would make its offerings more attractive to industries with stringent regulatory requirements, such as healthcare, finance, and government.

Strategic Acquisitions and Defensive Plays

With a sizable balance sheet, OpenAI is well-positioned to pursue targeted mergers and acquisitions (M&A) to bolster its technology stack and defend against competitive threats. Strategic acquisitions could focus on startups working on model compression, real-time inference, AI safety, agent frameworks, or synthetic media detection.

Acquisitions may also serve to secure scarce engineering talent and proprietary datasets—both of which are essential for maintaining a competitive edge. In a landscape where top talent often prefers working at nimble startups, acquisitions offer a viable path to centralize expertise while accelerating product development.

Defensively, OpenAI might also engage in acquisitions designed to preclude competitors from gaining critical capabilities. For example, acquiring a key data provider or compute infrastructure partner could effectively limit the strategic options of rival labs or platform providers.

Laying the Foundation for AGI

Finally, and perhaps most significantly, OpenAI’s capital strategy must be viewed in light of its overarching mission to develop artificial general intelligence (AGI) that benefits all of humanity. This long-term goal requires sustained investment in domains far beyond commercial deployment—such as ethics, governance, coordination with global institutions, and education.

The $40 billion war chest provides OpenAI with the financial latitude to pursue this mission without being beholden to short-term market pressures. It allows the company to explore audacious, high-impact initiatives—such as public AI infrastructure, international safety standards, or open science frameworks—that may not be immediately profitable but are essential for the safe and equitable proliferation of advanced AI.

Competitive Landscape: OpenAI vs. The World

OpenAI’s ascendancy to a $300 billion valuation, backed by a $40 billion capital infusion, firmly establishes it as the dominant force in the modern artificial intelligence (AI) ecosystem. Yet, the competitive landscape in which it operates is neither static nor uncontested. The race to develop frontier AI capabilities is intensifying, driven by a mixture of scientific ambition, geopolitical calculus, and commercial opportunity. In this section, we examine OpenAI’s principal competitors across both private and public sectors, analyze their respective strengths and differentiators, and assess how the broader ecosystem is likely to evolve in response to OpenAI’s newfound scale and resources.

The Principal Competitors

While OpenAI is currently positioned as the most commercially visible AI research organization, it is far from alone in the race to define the future of artificial general intelligence and high-performance machine learning systems. Its most notable competitors include:

- Anthropic: Founded by former OpenAI employees, Anthropic is known for its emphasis on safety-first AI development. Its Claude model series has demonstrated strong performance on language reasoning tasks, and the company has attracted billions in funding from investors such as Amazon and Google. Anthropic’s approach, which focuses on constitutional AI and structured alignment methodologies, has positioned it as a credible challenger, especially in enterprise and safety-conscious domains.

- Google DeepMind: As a division of Alphabet, DeepMind combines extensive computational resources with access to global-scale datasets and scientific expertise. It pioneered breakthroughs like AlphaGo and AlphaFold and now focuses heavily on its Gemini series of large multimodal models. DeepMind’s integration with Google’s product ecosystem (Search, Android, Chrome, and Cloud) gives it immense distribution leverage, even though it operates with less brand visibility in consumer AI than OpenAI.

- xAI: Spearheaded by Elon Musk, xAI was formed with the stated goal of understanding the “true nature of the universe.” While still in its early stages, the company has drawn significant attention due to Musk’s influence and the potential for integration with Tesla’s robotics and autonomy platforms. Its model “Grok,” integrated into X (formerly Twitter), signals an intention to fuse conversational AI with social media and real-time user interaction.

- Meta (formerly Facebook): Through its FAIR and GenAI research divisions, Meta has invested heavily in open-source foundational models such as LLaMA. Its decision to release models under relatively permissive licenses has catalyzed the open-source AI movement, positioning Meta as both a research leader and an ideological counterweight to OpenAI’s more proprietary model. Meta’s infrastructure and user base across platforms like Instagram, Facebook, and WhatsApp provide powerful testbeds for deploying and refining AI agents.

- Amazon: Although Amazon has yet to produce a flagship model of its own, it plays a critical role in the ecosystem through AWS, which powers thousands of AI startups and enterprises. Its investment in Anthropic, development of Bedrock (a multi-model platform), and integration of AI into Alexa and AWS products suggest a strategy centered on platform orchestration rather than pure model supremacy.

- Chinese AI Labs: Companies such as Baidu, Alibaba, SenseTime, and Huawei have rapidly accelerated their foundational model development in response to U.S. export restrictions. Although generally constrained by access to cutting-edge semiconductors, these firms benefit from strong state support, massive domestic user bases, and government-mandated integration of AI in strategic industries.

Strategic Positioning and Differentiation

What distinguishes OpenAI from this field is a convergence of several key factors: its first-mover advantage in public-facing large language models, a highly strategic alliance with Microsoft, a robust commercialization strategy, and an aggressive investment in alignment and safety research.

Whereas DeepMind excels in scientific rigor, Anthropic in safety prioritization, and Meta in open-source democratization, OpenAI balances these elements while delivering tangible, widely used products. ChatGPT, with over 180 million users globally, has achieved consumer penetration at a rate comparable to landmark digital products such as Gmail or TikTok. Moreover, its partnership with Microsoft grants it distribution across Office, Windows, Azure, and enterprise verticals—effectively embedding OpenAI's models within the digital workflows of millions of businesses.

Nonetheless, each competitor brings distinct competitive advantages. Google’s vertical integration with search and mobile devices provides it with data pipelines that remain largely outside OpenAI’s reach. Meta’s open-source strategy, while lacking monetization to date, fosters innovation at the edge of the developer community. Anthropic’s focus on interpretability and model safety may resonate with regulators and institutions seeking more predictable AI behavior.

Talent Wars and the Cost of Human Capital

One of the most acute areas of competition is talent acquisition. The scarcity of elite AI researchers—particularly those capable of working at the cutting edge of transformer architectures, multi-agent systems, and alignment protocols—has created a talent market characterized by hyper-competitive salaries, equity grants, and intellectual freedom.

OpenAI’s funding round provides it with substantial leverage in this contest. It can afford to fund long-term research projects, offer compute-rich environments, and provide compensation packages rivaling those of hedge funds and high-frequency trading firms. However, the cultural and ideological orientation of researchers also plays a role. Some may prefer Meta’s open ethos, DeepMind’s scientific focus, or Anthropic’s ethical mission—demonstrating that financial resources, while critical, are not the sole determinants of organizational attractiveness.

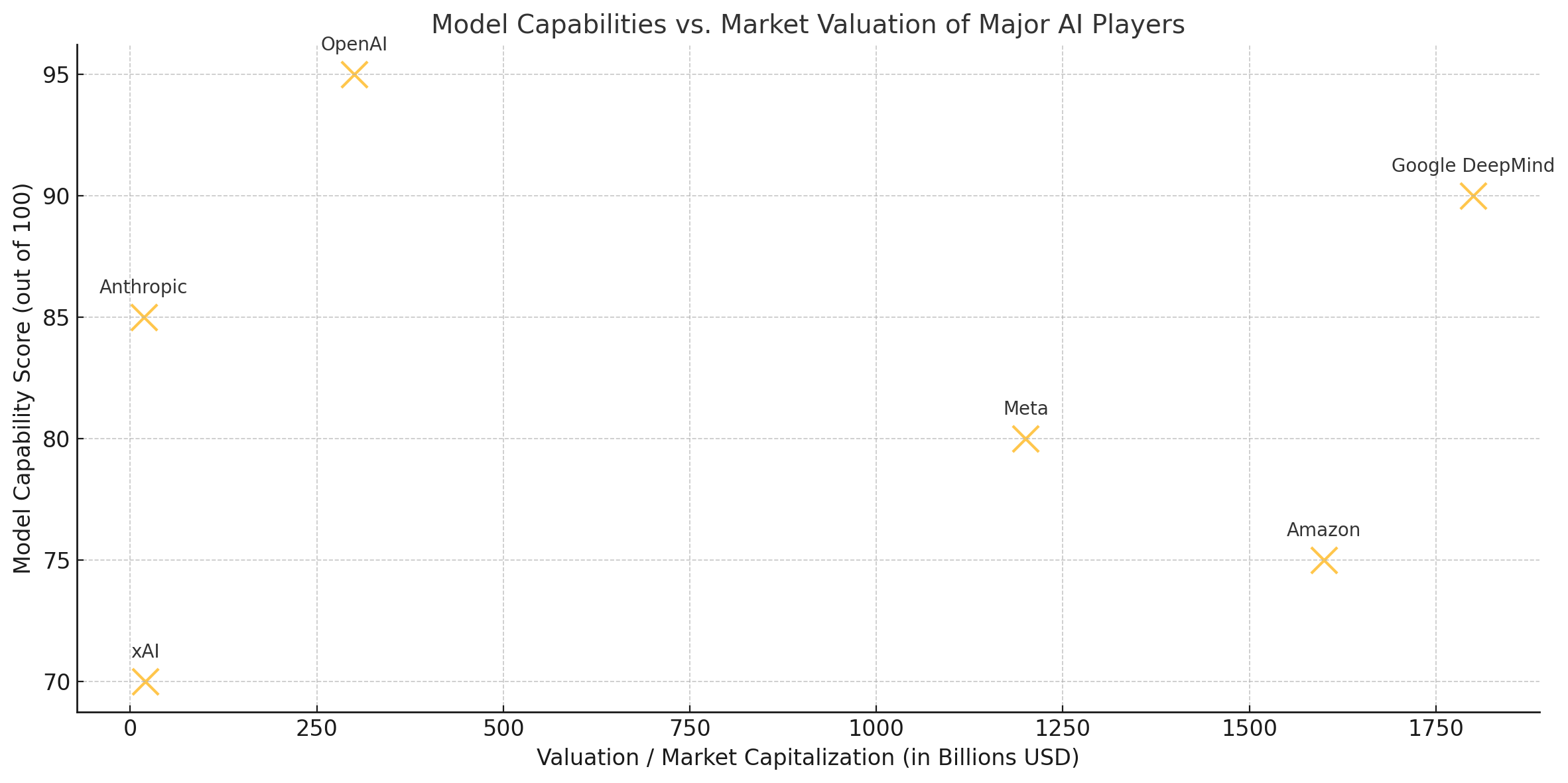

To illustrate the positioning of major AI entities, the following chart compares their estimated model capabilities (as rated by industry benchmarks such as MMLU, BIG-bench, and HumanEval) against their respective market capitalization or valuation.

This visual juxtaposition reveals that while OpenAI leads in valuation and consumer deployment, it faces stiff competition in technical performance and institutional trust. The market remains fluid, and leadership in one dimension does not guarantee long-term supremacy.

Implications for the Ecosystem

The competitive dynamics surrounding OpenAI have broader consequences for the AI ecosystem. The sheer scale of investment flowing into foundational model development is consolidating power into the hands of a few well-capitalized actors, raising questions about diversity of thought, safety incentives, and resilience to failure. At the same time, the presence of multiple competing ideologies—open vs. closed, profit vs. mission, centralized vs. decentralized—ensures that innovation remains multidirectional.

Regulators and civil society groups are increasingly attuned to these dynamics. The competitive environment may accelerate the development of AI governance standards, interoperability protocols, and antitrust scrutiny. It also influences how academic institutions, open-source communities, and smaller startups interact with the AI giants, either as collaborators, challengers, or watchdogs.

Regulatory, Ethical, and Public Impact Considerations

As OpenAI cements its place among the most powerful technology organizations in the world—both in market valuation and in influence—the societal, regulatory, and ethical implications of its work become increasingly critical. The company’s meteoric rise, marked by its $40 billion capital raise and $300 billion valuation, comes with a responsibility that transcends financial success. Artificial intelligence, particularly of the scale and sophistication that OpenAI develops, is not merely a commercial product—it is a transformative force with the potential to reshape economies, labor markets, national security paradigms, and the very fabric of human interaction. This section explores the emerging landscape of governance, ethical accountability, and public impact that must accompany OpenAI’s continued expansion.

The Regulatory Landscape: A Moving Target

Governments around the world are still grappling with how best to regulate the development and deployment of advanced AI systems. Unlike previous technological innovations, AI—especially general-purpose models—poses multidimensional risks that cut across domains: from disinformation and algorithmic bias to data privacy, cybersecurity, and autonomous decision-making.

In the United States, federal agencies and Congress have intensified scrutiny of AI platforms, particularly those with national security and labor market implications. The Biden administration’s Executive Order on Safe, Secure, and Trustworthy AI laid the groundwork for a whole-of-government approach to AI oversight, including mandatory safety evaluations, reporting requirements for frontier model developers, and the promotion of privacy-preserving techniques.

In Europe, the AI Act, expected to become law in 2025, will impose a risk-tiered regulatory framework that categorizes AI systems based on their potential for societal harm. As a developer of high-impact general-purpose AI, OpenAI is likely to fall under the "high-risk" category, subjecting it to transparency obligations, explainability requirements, and post-deployment monitoring. The European Union's emphasis on human rights and ethical standards could significantly influence how OpenAI designs and deploys its models on the continent.

Elsewhere, jurisdictions such as the United Kingdom, China, Canada, and Singapore are crafting their own AI governance regimes, often balancing innovation incentives with public safety imperatives. For OpenAI, global compliance is becoming an increasingly complex endeavor, requiring the development of robust internal governance structures, multidisciplinary policy teams, and adaptive legal frameworks.

Ethical Challenges: Alignment, Safety, and Access

Ethical concerns surrounding frontier AI extend far beyond regulation. At the core lies the issue of alignment—ensuring that powerful models behave in ways that are consistent with human values, societal norms, and democratic principles. OpenAI has been at the forefront of alignment research, including the development of reinforcement learning from human feedback (RLHF) and constitutional alignment frameworks. However, as models become more capable, the challenge of ensuring their safe, predictable behavior becomes exponentially more difficult.

There is also the question of who defines the ethical parameters of AI behavior. While OpenAI has articulated its mission as ensuring that AGI benefits all of humanity, the interpretation of "benefit" is inherently subjective. Differences in cultural values, political ideologies, and economic priorities can lead to conflicting notions of acceptable AI behavior. This complexity is amplified when AI systems interact with users across borders, languages, and social contexts.

Additionally, there is growing concern over access and equity. While OpenAI has democratized access to generative AI through platforms like ChatGPT, it has also faced criticism for prioritizing enterprise clients, implementing usage fees, and enforcing restrictive licensing terms. This raises questions about the inclusivity of AI innovation and whether the benefits of advanced models are being equitably distributed across geographies, income brackets, and institutional settings.

Public Trust and Misinformation

Public perception of AI is shaped not only by direct experience but also by broader societal narratives. In recent years, the proliferation of AI-generated misinformation, deepfakes, and automated propaganda has fueled anxiety about the integrity of public discourse. As a major producer of generative models, OpenAI is increasingly viewed as a gatekeeper of information authenticity.

The company has taken steps to address this issue by implementing content filtering, watermarking, and moderation systems. However, such measures remain imperfect, and critics argue that the pace of innovation continues to outstrip the pace of safeguards. Moreover, decisions about content moderation and ethical use often fall into a gray zone, where the trade-offs between free expression, platform liability, and social cohesion are difficult to adjudicate.

Building and maintaining public trust will require OpenAI to adopt a posture of proactive transparency. This may involve independent audits, open publication of safety research, and third-party partnerships to monitor the social impact of its models. It also demands engagement with educators, journalists, and civil society organizations to foster digital literacy and contextual understanding of AI technologies.

Geopolitical Ramifications

OpenAI's ascent carries significant geopolitical implications. The organization is not merely a U.S.-based company—it is a key actor in the global race for technological supremacy. Governments increasingly view AI capabilities as strategic assets, comparable to nuclear power or satellite infrastructure. As such, OpenAI’s relationships with international institutions, policymakers, and defense actors will come under increasing scrutiny.

There are concerns that the centralization of AI expertise within a handful of Western companies could exacerbate global power imbalances. Countries without domestic access to high-performance models may find themselves dependent on foreign platforms, creating new forms of digital sovereignty risk. In response, some nations are accelerating efforts to develop sovereign AI capabilities, often with state-backed funding and industrial policy.

OpenAI must navigate this landscape with diplomatic sensitivity. It must remain open to multilateral cooperation while respecting national security concerns. Its leadership in safety and alignment gives it a unique opportunity to shape global norms—but only if it engages in good faith with a diverse array of stakeholders, including those outside the traditional centers of power.

The Moral Weight of Scale

Perhaps the most profound implication of OpenAI’s trajectory is the moral burden that accompanies unprecedented capability. A $300 billion valuation may confer financial might, but it also carries ethical accountability. The decisions made by OpenAI—about what to build, who to serve, and how to govern—will have far-reaching consequences for billions of people.

This moral weight is especially pronounced given the emergent nature of AI behavior. As models acquire more autonomous, context-sensitive, and agentic qualities, their deployment becomes not just a matter of utility but of philosophical significance. Questions about personhood, agency, and the boundaries between artificial and human cognition are no longer confined to academic circles—they are becoming pressing policy and societal issues.

OpenAI’s stated mission gives it a framework for action, but fidelity to that mission will be tested as commercial pressures, competitive dynamics, and political forces converge. Navigating this terrain will require not only technical excellence, but also ethical courage, institutional humility, and a sustained commitment to the public good.

The Future of OpenAI and the AI Ecosystem

OpenAI’s recent $40 billion funding round and its valuation at $300 billion are not isolated financial events. They mark the culmination of nearly a decade of technological advancement, organizational transformation, and strategic positioning. More importantly, they serve as a beacon for the broader artificial intelligence ecosystem, signaling a new phase in the maturation of the field—one in which capital, compute, capability, and responsibility converge at an unprecedented scale.

In contemplating the future of OpenAI and its place within the global technological landscape, three central themes emerge: the acceleration of AI as foundational infrastructure, the strategic tensions inherent in concentrated power, and the growing urgency of aligning advanced systems with democratic and ethical principles.

From Research Lab to Infrastructural Pillar

OpenAI’s trajectory from a nonprofit research lab to a commercial powerhouse is emblematic of the evolution of AI itself. No longer confined to experimental use cases or academic benchmarks, artificial intelligence is rapidly becoming infrastructural. Like electricity in the 20th century or the internet in the early 21st, AI is transitioning into a general-purpose technology that will underpin future economies, institutions, and human experiences.

In this context, OpenAI is not merely an application vendor or a research entity—it is becoming a platform upon which other platforms are built. Its models power enterprise workflows, augment creative industries, automate software development, assist in medical research, and influence educational paradigms. The organization's close integration with Microsoft’s ecosystem, and its own expanding suite of developer tools and APIs, reinforce its status as a foundational layer of digital infrastructure.

This infrastructural role brings enormous potential for value creation. It also entails heightened expectations for performance, reliability, transparency, and resilience. Just as the internet required protocols, governance institutions, and redundancy systems, the AI ecosystem will require new layers of trust architecture—areas where OpenAI will be expected to lead, not simply participate.

Strategic Responsibility in a Multipolar Landscape

As OpenAI solidifies its dominance, the dynamics of the AI competitive landscape are entering a multipolar phase. While OpenAI enjoys a commanding lead in valuation and consumer visibility, other actors—such as Google DeepMind, Meta, Anthropic, xAI, and emerging global labs—continue to make substantive advances in model capability, scale, and openness. These firms differ in philosophy, governance structure, monetization strategy, and alignment approaches.

This pluralism is not a weakness of the AI ecosystem—it is its strength. Just as biodiversity promotes resilience in natural systems, a diverse array of AI development approaches guards against monoculture risk, centralization of failure, and ideological homogeneity. OpenAI must navigate this landscape with a delicate balance: assertive in its ambitions, but respectful of a competitive environment that depends on open inquiry, interoperability, and shared safety standards.

The company’s scale also necessitates a deeper engagement with geopolitical realities. As AI becomes a strategic technology on par with semiconductors, quantum computing, and aerospace, OpenAI must function within a framework that acknowledges the interests of nation-states, international institutions, and public-sector stakeholders. It will be called upon to participate in treaty conversations, shape export control regimes, and advise on international norms. This is not merely a technical task—it is a political one, and it will require diplomatic sophistication, institutional transparency, and a commitment to global inclusivity.

Aligning Power with Public Interest

At the heart of the future lies a moral and philosophical question: How can humanity ensure that the most powerful technology it has ever created is aligned with collective well-being? For OpenAI, this is not a peripheral issue—it is a defining one.

The organization’s mission to ensure that artificial general intelligence benefits all of humanity will be increasingly tested as the pressures of market competition, investor expectations, and real-world deployment intensify. Tensions may arise between shareholder return and public good, between speed and safety, between innovation and regulation. OpenAI’s choices in navigating these tensions will serve as a model—positive or negative—for the entire field.

There are encouraging signs. OpenAI continues to invest in alignment research, ethical protocols, and global dialogue. Its policy efforts have contributed to greater awareness of frontier model risks. It has championed principles of long-term safety even while pursuing commercial scale. However, the road ahead is fraught with complexity, and success will require not only internal safeguards but also external accountability—from regulators, academia, civil society, and the broader public.

Furthermore, the organization will need to reckon with inclusion: Who has access to its tools? Who participates in its governance? Whose voices shape its definition of “benefit”? These are not technical questions; they are questions of justice, equity, and legitimacy. The answers will determine whether the age of AI is characterized by empowerment or exclusion, by plurality or monopolization.

A Moment of Transformation

The $300 billion valuation is more than a reflection of market optimism—it is a reflection of belief. Belief that intelligence can be synthesized. Belief that digital agents can augment and amplify human capability. Belief that we stand at the precipice of a new era, one in which cognition itself becomes computable.

But belief, on its own, is not enough. It must be matched by action—careful, deliberate, and principled. OpenAI has the tools, the talent, and the capital to shape the future. Whether it does so wisely will depend on the values it chooses to uphold and the coalitions it chooses to build.

As the dust settles on this historic funding round, one thing is clear: OpenAI is no longer just a company. It is a societal actor of global consequence. Its next decisions will help define the trajectory not only of AI, but of the digital age itself.

References

- OpenAI – Official Website

https://openai.com/ - Microsoft and OpenAI Strategic Partnership

https://blogs.microsoft.com/blog/2023/01/23/microsoft-and-openai-extend-partnership/ - Anthropic – Safety Research and Claude Model Info

https://www.anthropic.com/ - Google DeepMind – Frontier AI Research

https://deepmind.google/ - Meta’s LLaMA and Open-Source AI Initiatives

https://ai.meta.com/ - xAI – Elon Musk’s AI Venture

https://x.ai/ - The White House – AI Executive Order Overview

https://www.whitehouse.gov/briefing-room/statements-releases/2023/10/30/executive-order-on-the-safe-secure-and-trustworthy-development-and-use-of-artificial-intelligence/ - European Commission – Artificial Intelligence Act

https://digital-strategy.ec.europa.eu/en/policies/european-approach-artificial-intelligence - OpenAI API Documentation

https://platform.openai.com/docs - NVIDIA AI Hardware and Ecosystem

https://www.nvidia.com/en-us/data-center/products/