Nissan's Strategic Shift: Plant Closures in Japan and Mexico

In a bold and consequential move that has sent ripples through the global automotive industry, Nissan Motor Corporation recently confirmed plans to shut down some of its major manufacturing facilities in both Japan and Mexico. This decision is part of a broader corporate restructuring initiative aimed at streamlining operations, enhancing profitability, and realigning resources toward future-oriented growth sectors such as electric vehicles (EVs) and autonomous driving technologies. While Nissan has weathered various market storms throughout its history, this round of plant closures marks a significant pivot point in its corporate evolution.

The closures, particularly of the iconic Oppama and Shonan plants in Japan—both integral to Nissan’s historic manufacturing prowess—as well as potential shutdowns in Mexico, represent more than just an operational adjustment. They signal a fundamental reorientation in the company’s global manufacturing strategy. Nissan’s leadership has justified these moves as necessary for long-term sustainability, citing declining profitability, shifting market dynamics, and the urgent need to optimize production capacity in an increasingly competitive global environment.

Founded in 1933, Nissan has long been one of Japan's automotive crown jewels. From its early days producing military trucks to its role as a global innovator in hybrid and electric vehicles like the Nissan LEAF, the automaker has consistently positioned itself as a technology-forward manufacturer. However, over the last decade, Nissan has struggled with fluctuating profits, declining global market share, and a string of leadership challenges that have weakened its competitive stance. The COVID-19 pandemic only deepened its woes, accelerating supply chain disruptions and dampening consumer demand, especially in mature markets such as North America and Japan.

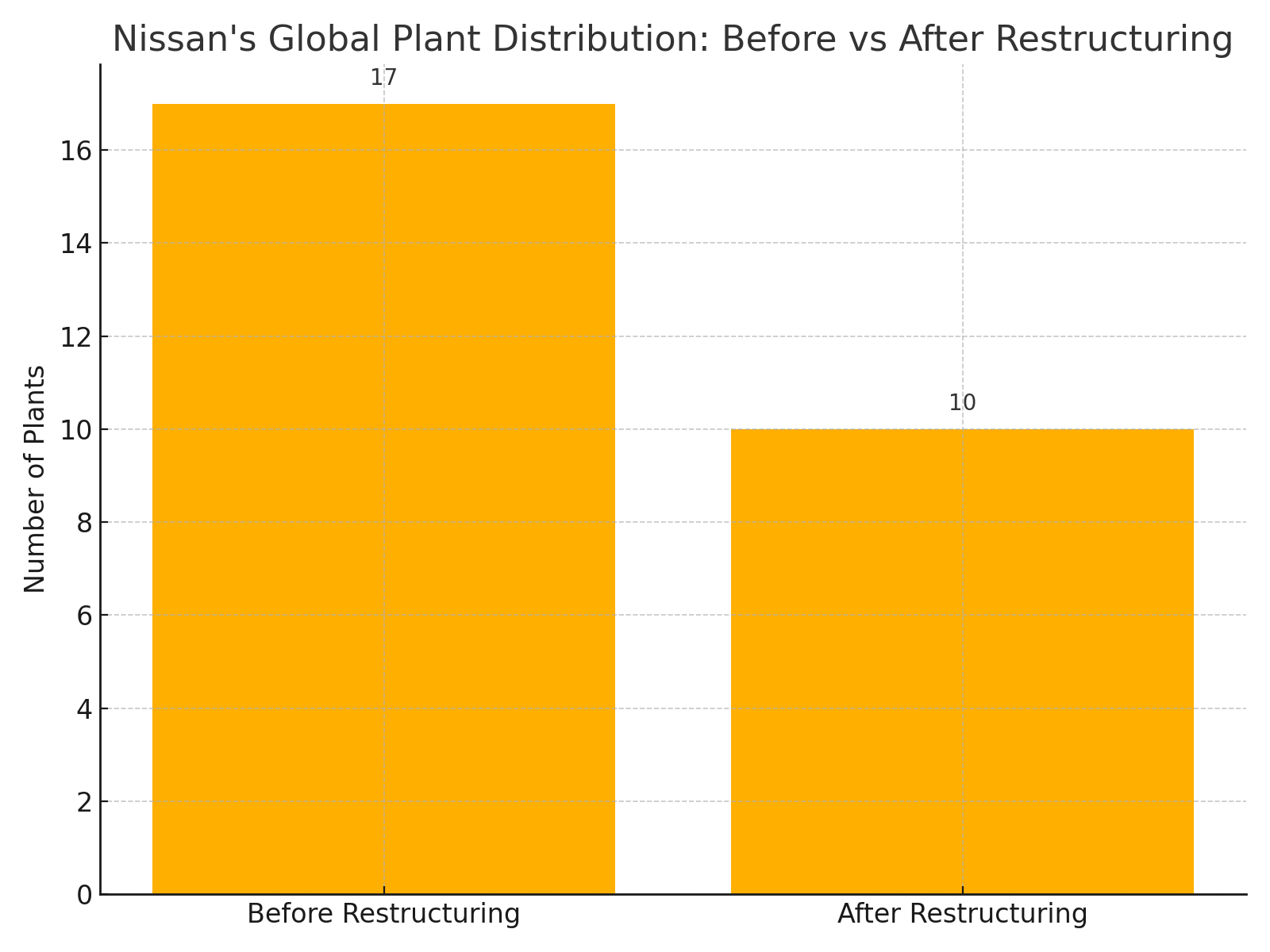

At the core of Nissan's current restructuring initiative—marketed internally as the "Re:Nissan" program—is a plan to reduce the number of its global production sites from 17 to 10 by 2026. The initiative also aims to slash 15% of the company’s global workforce, a reduction that could impact tens of thousands of workers across various international locations. The plant closures are thus both a tactical and symbolic manifestation of Nissan’s commitment to “right-size” its manufacturing footprint in alignment with evolving economic and technological realities.

Japan’s domestic production environment has increasingly posed challenges for Nissan. Rising labor costs, stringent environmental regulations, and a shrinking local market due to demographic shifts have all contributed to diminishing returns from its Japanese manufacturing base. The Oppama and Shonan plants, despite their historical significance, have become financially untenable. Meanwhile, Nissan’s Mexican facilities—previously considered vital to its North American supply chain due to favorable trade policies and lower labor costs—have recently been impacted by shifting trade dynamics, especially in light of U.S. tariffs and the renegotiated United States-Mexico-Canada Agreement (USMCA).

The closures in Mexico also underscore the increasingly protectionist trade environments that multinational manufacturers must now navigate. As the U.S. imposes stricter rules of origin and labor value content requirements under USMCA, automakers like Nissan are being compelled to reassess the cost-benefit analysis of regional production hubs. Furthermore, Mexico’s rising labor unrest and inflationary pressures have added layers of complexity to what was once seen as a low-risk, high-reward manufacturing location.

These closures will have profound implications for a wide array of stakeholders. Thousands of employees are likely to be affected, either through direct job loss or through ripple effects across the supply chain. Local communities that have long depended on these plants for economic vitality will face significant disruptions. Supplier networks will need to be recalibrated, and governments—both local and national—may be pressured to intervene, either through incentives or through direct support to displaced workers.

Yet, amid the turmoil, Nissan views these developments as essential for future growth. The company is reallocating resources toward EV production, solid-state battery research, and AI-based mobility solutions. The transformation is not merely operational but philosophical: Nissan is repositioning itself not just as an automaker but as a mobility innovator. This ambition is in line with broader industry trends that are reshaping what it means to be a car company in the 21st century.

This blog post aims to provide a detailed examination of Nissan’s plant closures in Japan and Mexico, contextualizing the decision within the company’s broader strategic objectives. It will delve into the historical significance of the affected plants, explore the financial and operational drivers behind the closures, assess the impact on stakeholders, and evaluate the long-term implications for Nissan’s position in the global automotive industry.

In the sections that follow, we will first explore the background and context of Nissan’s global manufacturing strategy and recent financial performance. We will then provide an in-depth analysis of the specific closures in Japan and Mexico. Subsequently, we will assess the broader implications for employees, suppliers, and regional economies. Finally, we will discuss Nissan’s strategic realignment toward EVs and future technologies, concluding with a forward-looking perspective on the company’s transformation journey.

Through this comprehensive analysis, we aim to understand not only the mechanics of the plant closures but also the underlying rationale and future trajectory of one of the world’s most recognized automotive brands.

Background and Context

To fully grasp the strategic significance of Nissan’s decision to close manufacturing plants in Japan and Mexico, it is essential to analyze the broader industrial, financial, and operational backdrop underpinning this move. The closures are not isolated or reactionary events but rather deliberate steps within a carefully orchestrated transformation program aimed at long-term sustainability and competitiveness. This section delves into Nissan’s historical manufacturing footprint, recent financial pressures, and the broader global automotive trends that have influenced this consequential strategic pivot.

Nissan’s Global Manufacturing Footprint

Nissan has long been recognized as a pillar of Japan’s automotive sector, and its global presence has steadily expanded over the past five decades. As of early 2024, the company operated 17 production plants across various regions, including Japan, North America, Latin America, Europe, and Asia-Pacific. These plants collectively supported Nissan’s extensive product lineup, ranging from compact sedans and electric vehicles to SUVs and commercial trucks.

Among Nissan’s most historically significant facilities are the Oppama and Shonan plants in Japan. The Oppama plant, located in Yokosuka, Kanagawa Prefecture, began operations in 1961 and became a symbol of Japan’s post-war industrial resurgence. It played a key role in producing several best-selling models such as the Nissan Bluebird and the early generations of the LEAF electric vehicle. The nearby Shonan plant, originally dedicated to powertrain and vehicle parts manufacturing, similarly holds deep symbolic value in Nissan’s industrial heritage.

Outside Japan, Nissan’s manufacturing operations in Mexico have served as a critical export and production hub for North American markets. Plants such as those in Aguascalientes and Cuernavaca have long benefited from Mexico’s trade advantages, including tariff-free access to the United States and Canada under NAFTA and, later, the USMCA. These plants produce high-volume models like the Versa and Sentra, catering to cost-sensitive markets in both the Americas and beyond.

A Strained Financial Landscape

While Nissan’s global expansion helped solidify its reputation in previous decades, the past several years have seen the company struggle with multiple financial headwinds. A combination of internal missteps and external shocks has eroded profitability and shareholder confidence.

In fiscal year 2024, Nissan reported one of its worst financial performances in over a decade. Operating profit declined sharply, reflecting falling vehicle sales in key markets such as the United States, China, and Europe. While the company made modest gains in electrification and next-generation mobility research, these were insufficient to offset losses in its legacy combustion engine business.

The factors behind this decline are multifaceted:

- Market Saturation: Mature markets like the U.S. and Japan are experiencing declining car ownership rates and intensifying competition from both traditional OEMs and emerging EV startups.

- Supply Chain Disruptions: The lingering impact of the COVID-19 pandemic and subsequent semiconductor shortages disrupted production schedules and delivery timelines.

- Leadership Turbulence: Residual effects from the high-profile scandal involving former CEO Carlos Ghosn weakened internal cohesion and strategic consistency.

- Inefficient Cost Structures: Nissan’s expansive manufacturing footprint began to show signs of operational inefficiency, with several underutilized plants operating below break-even levels.

In response to these issues, Nissan unveiled the “Re:Nissan” plan—its most comprehensive restructuring effort in recent history. The initiative targets a 15% reduction in global workforce and aims to rationalize manufacturing by consolidating production into fewer, more efficient locations.

The Re:Nissan Restructuring Initiative

Launched in late 2024, the Re:Nissan plan represents a pivotal recalibration of Nissan’s corporate and operational philosophy. Unlike earlier cost-cutting exercises that focused primarily on temporary margin improvements, this initiative seeks to permanently reposition the company for future relevance in an evolving automotive landscape.

Key goals of the Re:Nissan plan include:

- Shrinking Global Production Footprint: Reducing the number of plants from 17 to 10 by 2026. This will allow Nissan to increase capacity utilization at remaining facilities while eliminating redundancies.

- Enhancing Operational Efficiency: Streamlining manufacturing processes through automation, digitization, and modular production platforms.

- Accelerating EV Adoption: Reallocating investments towards high-demand EV models and battery development, particularly in regions with favorable regulatory environments.

- Strategic Workforce Realignment: Transitioning human capital toward software engineering, battery technology, and AI-based mobility solutions.

The closures in Japan and Mexico are part of the initial phase of this broader plan, selected for a combination of economic, strategic, and logistical reasons. Plants with aging infrastructure, low utilization rates, or limited adaptability to EV production standards are being decommissioned first.

Macroeconomic Pressures and Global Trends

Beyond company-specific dynamics, Nissan’s restructuring must also be understood within the wider context of global automotive industry transformations. The transition to electrification, rising protectionism, and environmental regulation have collectively reshaped the calculus of where and how vehicles should be manufactured.

Electrification and Regulatory Shifts: As governments in the U.S., EU, China, and Japan tighten emissions standards and offer incentives for electric vehicles, automakers are being compelled to invest in cleaner technologies. This shift necessitates new assembly lines, battery facilities, and a digital-first supply chain architecture—changes that legacy plants are often ill-equipped to accommodate without costly retrofitting.

Labor and Input Costs: Japan has one of the highest average labor costs in the world, making it increasingly difficult to operate labor-intensive plants profitably. In Mexico, rising inflation, labor unrest, and new trade rules under USMCA—such as the requirement that a significant portion of a vehicle’s components be made by workers earning at least $16 per hour—have diluted the cost advantages that once made the region so attractive.

Geopolitical Considerations: The post-pandemic era has seen a rise in economic nationalism. Governments are pushing to “reshore” strategic industries and reduce reliance on foreign suppliers. For automakers like Nissan, this translates into mounting pressure to localize production, particularly in markets like the U.S. and China.

Competitive Dynamics: Legacy automakers are under threat from agile EV-first companies such as Tesla, BYD, and Rivian. These newer firms operate leaner production systems and are not burdened by legacy manufacturing infrastructure. Nissan’s move to close older plants is an attempt to shed this baggage and become more competitive in the next-generation mobility arena.

Strategic Imperatives for Change

Faced with such a complex set of internal and external challenges, Nissan’s leadership concluded that the only path forward involves decisive restructuring. Closing plants—while painful from a human and social perspective—has become a necessity for ensuring long-term viability.

Rather than continuing to support facilities that no longer align with its strategic vision, Nissan is opting to concentrate its resources in locations that offer the greatest potential for growth, flexibility, and technological advancement. This includes bolstering its presence in EV-focused markets, investing in new digital production technologies, and collaborating with partners to build next-generation mobility ecosystems.

In conclusion, the closures of Nissan’s plants in Japan and Mexico are not arbitrary or short-term reactions to financial distress. They are strategic actions embedded in a larger transformation framework designed to prepare the company for a rapidly changing industry. By understanding this context, stakeholders can better evaluate both the risks and opportunities that lie ahead in Nissan’s ongoing evolution.

The following chart illustrates the planned reduction in Nissan's global manufacturing facilities under the Re:Nissan initiative:

Details of the Plant Closures

The announcement of Nissan’s intent to close several manufacturing plants across Japan and Mexico represents a pivotal shift in the company’s global operations. These closures are not only logistically significant but symbolically powerful, marking a departure from long-standing industrial traditions in favor of a leaner and more strategically focused manufacturing footprint. This section provides a detailed examination of the specific facilities targeted for closure, the underlying motivations, and the immediate and long-term implications of these decisions.

Japan: Oppama and Shonan Plants

Among the most notable closures announced is the planned shutdown of the Oppama and Shonan plants, both located in Kanagawa Prefecture, Japan. These two facilities have been integral to Nissan’s domestic manufacturing identity and have produced some of the brand’s most iconic vehicles.

The Oppama plant, in operation since 1961, has historically served as a benchmark for Nissan’s innovation in mass production. It was one of the first plants to adopt advanced robotic systems and pioneered early electric vehicle (EV) manufacturing with the Nissan LEAF. At its peak, Oppama produced over 400,000 vehicles annually, supporting not only Japan’s domestic auto market but also exports to North America and Europe.

However, in recent years, the plant has faced declining production volumes. Shifts in consumer demand toward SUVs and crossovers, many of which are not manufactured at Oppama, have reduced the facility’s output. Additionally, the plant’s aging infrastructure and limited adaptability to next-generation EV production standards made it less viable for future investments. Nissan’s internal audits revealed that retrofitting Oppama to support advanced EV lines and battery manufacturing would be cost-prohibitive compared to newer, modular plants.

The Shonan plant, though primarily involved in powertrain manufacturing, is also being targeted for closure. Historically responsible for producing engines, transmissions, and critical drivetrain components, Shonan has seen a steady decline in output as Nissan and other automakers shift away from internal combustion engines (ICEs). With the global move toward electrification, the strategic need for traditional powertrain plants has diminished. As EV platforms consolidate motors and electronics, the demand for standalone ICE component facilities is expected to vanish within the next decade.

The closure of these two plants will affect an estimated 6,000 workers, including both full-time employees and subcontractors. While Nissan has announced early retirement packages and internal reassignments where possible, labor unions have expressed concern over job security and the potential loss of community identity tied to these longstanding industrial sites.

Mexico: Strategic Plant Consolidation

Nissan’s decision to target plants in Mexico for closure or consolidation further underscores the complexity of global automotive logistics in the current geopolitical and economic climate. The automaker has operated in Mexico since the 1960s and currently runs three major facilities: two in Aguascalientes (A1 and A2) and one in Cuernavaca.

Of these, the Cuernavaca plant is most likely to be closed. Established in 1966, it is Nissan’s oldest plant in Latin America and primarily produces entry-level sedans and commercial vehicles. The facility’s output has been in decline due to shifting demand patterns and production redundancy, as newer, more efficient plants in Aguascalientes have taken over high-volume models.

The Cuernavaca facility also suffers from spatial constraints that limit its ability to accommodate advanced robotics, battery assembly lines, or vertical integration of parts supply—capabilities increasingly essential in modern EV manufacturing. Its location, while historically advantageous for access to central Mexican markets, is less strategic in a world where nearshoring and proximity to North American battery supply chains are prioritized.

In contrast, the Aguascalientes A2 plant, which began operations in 2013, will remain operational and may absorb part of the displaced capacity. It is one of Nissan’s most advanced global facilities and is capable of producing both internal combustion and electric vehicles on flexible lines. The facility has also recently been upgraded with intelligent logistics systems and is closely integrated with local and international suppliers.

Another driving factor behind the downsizing in Mexico is the U.S.-Mexico-Canada Agreement (USMCA), which has introduced stricter labor requirements and rules of origin for automotive parts. These provisions have eroded some of the cost advantages traditionally associated with Mexican production. For instance, to qualify for zero tariffs, 75% of a vehicle’s content must be made in North America, and a significant portion must be manufactured by workers earning at least $16 per hour—a wage far above Mexico’s current average.

Moreover, increasing political instability, inflationary pressures, and wage demands in Mexico have reduced its attractiveness as a low-cost production base. As a result, Nissan is now recalibrating its operations in the country to align with both regulatory compliance and strategic supply chain positioning.

Rationale Behind Facility Selection

The facilities selected for closure share several common characteristics that made them vulnerable under the Re:Nissan restructuring plan:

- Aging Infrastructure: Plants like Oppama and Cuernavaca lack the flexibility and modularity required for EV and software-integrated vehicle production.

- Low Capacity Utilization: Declining output due to shifting consumer preferences has rendered these plants inefficient.

- High Retrofitting Costs: Modernizing these plants would require substantial capital investment that outweighs long-term returns.

- Geostrategic Misalignment: Locations that no longer align with future logistics, battery supply chains, or regional consumer markets are being phased out.

It is important to note that Nissan’s closures are not driven purely by financial losses but by strategic realignment. The company is choosing to concentrate production in fewer, more adaptable locations capable of serving high-growth markets and supporting technological transformation.

Operational and Social Impact

The closures will undoubtedly have significant social and economic ramifications. In Japan, the loss of plants in Kanagawa Prefecture is expected to deal a blow to regional employment and tax revenue. Local governments have already expressed concern about the ripple effects on service sectors, housing markets, and small businesses that depend on the spending of Nissan employees.

In Mexico, similar anxieties are surfacing. Cuernavaca’s local economy is heavily reliant on the automotive industry. The closure of Nissan’s plant will impact not just direct employees but also thousands of contractors, parts suppliers, and logistics partners. Regional officials are now exploring public-private partnerships and retraining programs to soften the blow.

Additionally, Nissan must navigate public relations and stakeholder trust. The company has pledged to engage transparently with affected workers, labor unions, and regional authorities. Severance packages, early retirement schemes, and potential relocation options are all on the table. Nevertheless, the magnitude of the workforce reduction—estimated at 8,000 to 10,000 jobs globally in the first phase—means that Nissan’s restructuring will be closely watched by both industry analysts and public policymakers.

In summary, the closures of Nissan’s plants in Japan and Mexico mark a decisive move away from legacy manufacturing practices toward a more digitally integrated, strategically located production model. While the near-term effects will be painful for workers and communities, Nissan’s leadership views these steps as necessary to remain viable in a radically transformed automotive landscape.

Implications for Stakeholders

The closure of Nissan’s plants in Japan and Mexico carries wide-ranging implications for a diverse set of stakeholders. While the company positions these actions as strategic necessities aligned with its long-term transformation goals, the social, economic, and logistical impacts are profound. From thousands of displaced employees and disrupted supply chains to local governments and economies facing financial aftershocks, the ripple effects of these shutdowns extend well beyond Nissan’s corporate boundaries. This section explores the implications of the closures on key stakeholder groups, including employees, suppliers, local economies, and government entities.

Employees and Labor Unions

Arguably the most immediate and visible impact of the plant closures will be on the workforce. Nissan's announcement will result in the loss of an estimated 8,000 to 10,000 jobs globally during the initial phase of its restructuring, with approximately 6,000 jobs directly affected in the targeted Japanese and Mexican plants.

In Japan, where employment in the automotive sector has traditionally been considered secure and often lifelong, the closure of the Oppama and Shonan plants has generated considerable anxiety. Many employees in these facilities have worked at Nissan for decades, with deep community and family ties to the company. While Nissan has offered early retirement packages and internal transfers where possible, the disruption remains significant. Labor unions such as the Confederation of Japan Automobile Workers' Unions have expressed dissatisfaction with the scope and manner of the closures, citing inadequate consultation and the potential erosion of labor protections.

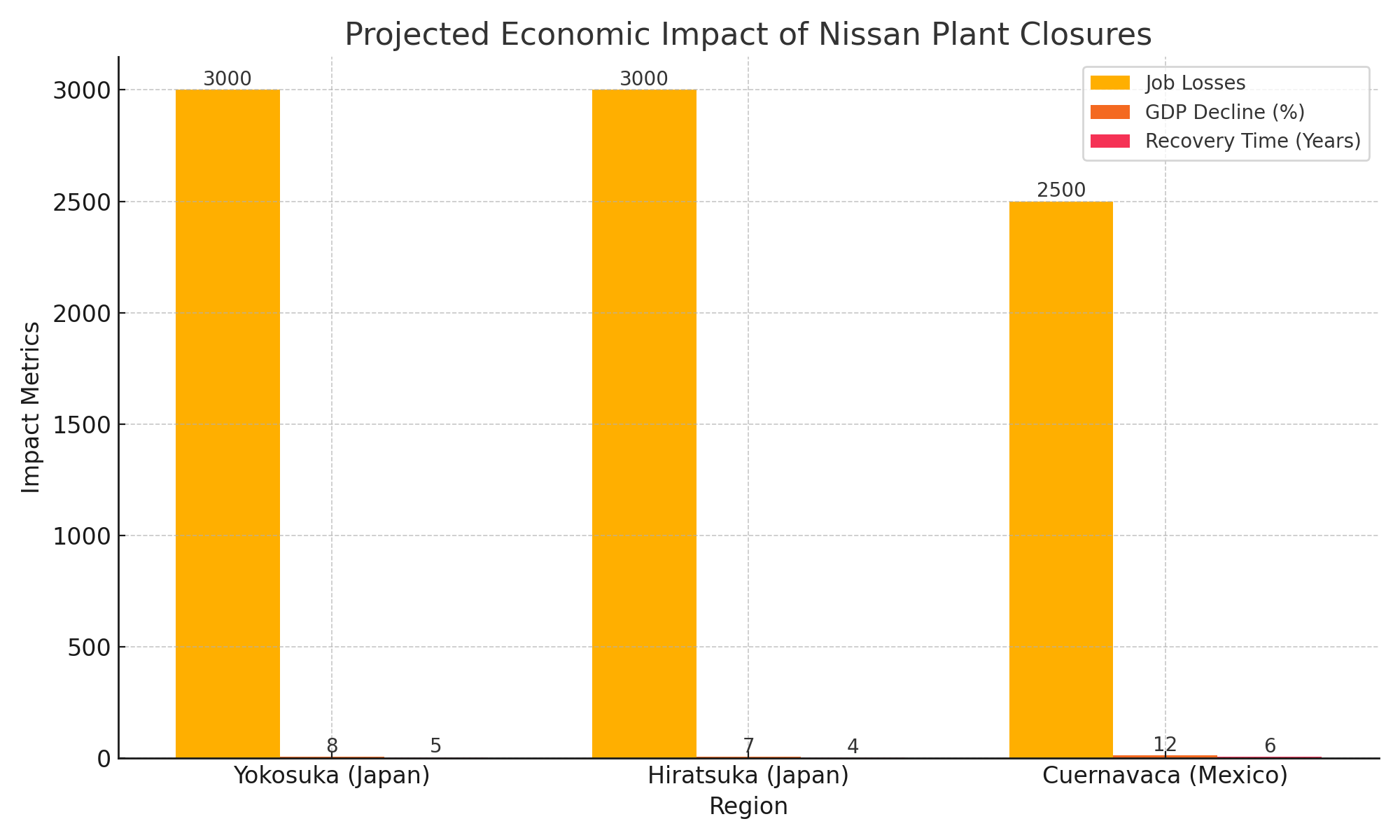

The situation is no less critical in Mexico, particularly in Cuernavaca, where the economy is highly dependent on the automotive industry. The local plant provides direct employment to over 2,500 individuals and indirectly supports several thousand more through ancillary services and suppliers. Many workers earn wages that, while modest by global standards, significantly exceed national averages. The closure thus not only eliminates jobs but also threatens the socioeconomic fabric of the community. Labor unions in Mexico, including the Confederación de Trabajadores de México (CTM), have signaled intentions to negotiate severance terms and advocate for reemployment support from both Nissan and governmental agencies.

The broader psychological toll should not be underestimated either. For workers facing abrupt termination after years or decades of service, the closures bring uncertainty and financial stress, raising concerns about future employability, skill relevance, and long-term economic security.

Supply Chain Partners and Tier-1 Suppliers

Beyond the direct workforce, Nissan’s supply chain ecosystem will experience significant disruption. Automotive manufacturing is characterized by highly integrated supply chains involving hundreds of Tier-1, Tier-2, and Tier-3 suppliers. The shutdown of plants in Japan and Mexico will affect suppliers of stamped metal components, electronics, tires, glass, upholstery, and more.

In Kanagawa Prefecture, dozens of small and mid-sized enterprises (SMEs) that supply the Oppama and Shonan facilities are now at risk of losing long-standing contracts. These suppliers, many of which operate on thin margins and depend on stable production volumes, will need to pivot quickly or face insolvency. Some may attempt to re-align with Nissan’s remaining domestic plants, but spatial and operational constraints could make that transition infeasible.

In Mexico, the closure of the Cuernavaca plant will similarly impact a web of vendors and logistics providers. The Mexican automotive supply chain has historically enjoyed a strong manufacturing cluster effect, where plants and suppliers co-locate to reduce transportation and coordination costs. Disruption to one plant can cause a cascading effect across the region, diminishing overall supply chain efficiency.

In both countries, the closure of these plants threatens to erode supply chain resilience. While Nissan may aim to consolidate and modernize production, the loss of established vendor relationships and the need to build new partnerships elsewhere could lead to short-term bottlenecks and increased costs.

Local and National Economies

The economic implications of the plant closures will be most acutely felt at the regional level, where towns and cities have grown around these industrial facilities for decades. The exit of a major employer like Nissan generates immediate fiscal challenges for local governments due to the loss of tax revenues, reduced consumer spending, and increased demand for public services such as unemployment assistance.

In Japan, the cities of Yokosuka (Oppama plant) and Hiratsuka (Shonan plant) will experience a sudden contraction in economic activity. Retailers, real estate developers, transportation services, and local schools all depend on the steady employment and population base supported by Nissan. Local governments have already begun conducting economic impact assessments and exploring retraining programs in collaboration with regional universities and technical institutions.

In Cuernavaca, a city that has historically benefited from industrial development, the economic blow may be even more severe. The loss of the Nissan plant affects not just direct employment but also the broader infrastructure investments that support manufacturing—such as transportation networks, energy provisioning, and vocational education. Mexican authorities at both the state and federal levels are under pressure to provide relief packages, offer tax incentives to attract new employers, and promote workforce reskilling initiatives.

Moreover, the closures come at a sensitive time globally, as countries seek to enhance economic resilience in the wake of pandemic-induced vulnerabilities. The removal of production capacity in key locations may also impact local automotive clusters, reducing their ability to attract future investment from other industry players.

Government Responses and Public Policy Interventions

The reaction of government entities in both Japan and Mexico will be critical in determining how effectively the negative impacts of the closures are mitigated. So far, the official responses have varied in tone and substance.

In Japan, the Ministry of Economy, Trade and Industry (METI) has expressed concern but acknowledged Nissan’s right to realign operations in the face of global competition. However, METI is actively monitoring the situation and is expected to support affected workers through reemployment programs and subsidies for SMEs affected by the closures. Local officials are also exploring the potential repurposing of Nissan’s industrial real estate for use in advanced technology hubs or green energy projects.

In Mexico, the federal government has taken a more vocal stance. Senior officials have indicated that they are seeking dialogue with Nissan leadership to ensure compliance with national labor laws and to coordinate severance packages. The Mexican Ministry of Labor and Social Welfare has also committed to deploying mobile employment units to Cuernavaca to assist workers in finding alternative opportunities. At the state level, Morelos authorities are developing incentive packages to attract new investments in industries such as logistics, electronics, and renewable energy.

Notably, both countries are considering public-private partnerships to support retraining and certification programs in emerging industries. Given that the global automotive sector is transitioning rapidly toward electrification, digitization, and AI integration, governments see this moment as an opportunity to reskill displaced workers and redirect economic activity toward growth sectors.

Investor and Market Reactions

From a capital markets perspective, the announcement of the plant closures has received a cautiously optimistic response. Analysts view the restructuring as a necessary, albeit painful, step toward restoring Nissan’s profitability and operational efficiency. Several brokerage firms upgraded Nissan’s outlook from “hold” to “buy” in the wake of the announcement, citing the potential for long-term margin improvements and streamlined capital expenditure.

However, investor confidence remains contingent on Nissan’s ability to execute its broader Re:Nissan strategy effectively. Any missteps—such as delays in EV production, supply chain disruptions, or reputational fallout from labor disputes—could quickly erode perceived gains. Shareholders are also watching closely for Nissan’s follow-through on ESG (Environmental, Social, and Governance) commitments, particularly regarding fair labor practices and community engagement in regions affected by the closures.

In summary, the closures of Nissan’s plants in Japan and Mexico reverberate across a wide spectrum of stakeholders. While the company’s intentions may be grounded in operational necessity and future-readiness, the near-term consequences are deeply human and economically complex. Addressing these implications through coordinated action by corporate, governmental, and civil society actors will be essential in ensuring that Nissan’s transformation does not come at the cost of long-term social and economic sustainability.

Strategic Realignment and Future Outlook

As Nissan closes a transformative chapter marked by plant closures and workforce reductions, its corporate focus is now shifting toward a future defined by electrification, digitization, and operational agility. This section examines the company's strategic realignment in the wake of its Re:Nissan initiative, highlighting key areas such as electric vehicle (EV) development, technological innovation, competitive positioning, and long-term business viability. While the immediate impacts of the restructuring have been disruptive, Nissan’s broader vision outlines a pivot toward sustainable mobility and a leaner, more adaptive industrial model.

Embracing Electrification and Next-Gen Mobility

At the heart of Nissan’s strategic realignment is its deepening commitment to electric vehicles (EVs) and the ecosystem that supports them. Having been one of the earliest movers in the global EV market with the launch of the Nissan LEAF in 2010, the company aims to reclaim a leadership position as competition intensifies and consumer demand for low-emission transportation accelerates.

Nissan has announced plans to introduce 19 new EV models globally by 2030, targeting both developed and emerging markets. The closures of outdated facilities are intended to free up capital and operational capacity for the development of EV-focused manufacturing lines. This includes expanding production at plants in Aguascalientes (Mexico), Tochigi (Japan), and Sunderland (UK)—all of which are being retrofitted to support high-efficiency EV assembly and battery integration.

Further, Nissan is making strategic investments in solid-state battery technology, which promises faster charging times, higher energy density, and improved safety compared to current lithium-ion batteries. The company is collaborating with researchers and startups across Japan, Europe, and the United States to scale this technology to commercial viability by the late 2020s.

As part of its electrification roadmap, Nissan has committed to achieving carbon neutrality across its operations by 2050. This includes transitioning its power sources to renewable energy, increasing the recyclability of vehicle components, and optimizing logistics to reduce carbon emissions. The closure of legacy plants that are energy-inefficient or ill-suited for sustainable retrofitting is thus aligned with this broader environmental agenda.

Advancing Technological Integration and Intelligent Manufacturing

Another cornerstone of Nissan’s future strategy is the adoption of intelligent manufacturing systems under its "Nissan Intelligent Factory" initiative. The company envisions a next-generation production model powered by automation, artificial intelligence (AI), digital twins, and real-time analytics. These technologies are designed to reduce human error, optimize production speed, and ensure quality control across vehicle variants.

Facilities like the Tochigi plant, which is currently undergoing a $300 million digital transformation, serve as testbeds for these advanced systems. Robots, autonomous guided vehicles (AGVs), and AI-based inspections are being deployed to create a smart factory environment where minimal human intervention is needed for routine tasks. This transformation not only boosts productivity but also makes plants more adaptable to fluctuations in demand and supply chain constraints.

Nissan is also investing in over-the-air (OTA) software updates and vehicle connectivity features, positioning itself as a player in the evolving software-defined vehicle market. With a growing emphasis on infotainment, predictive maintenance, and autonomous driving, the integration of cloud-based services into Nissan’s product portfolio is expected to be a significant revenue driver in the years ahead.

By divesting from plants that cannot accommodate these innovations, Nissan is seeking to reorient its industrial footprint toward facilities that are scalable, modular, and digitally equipped.

Strengthening Competitive Positioning Globally

In an increasingly fragmented and competitive automotive landscape, Nissan must contend with legacy automakers undergoing similar transformations, as well as agile new entrants such as Tesla, BYD, and Rivian. Each of these companies has leveraged a digital-first, EV-centric model that challenges traditional automotive hierarchies.

To remain competitive, Nissan is adopting a regionalization strategy that consolidates operations around core markets—Japan, North America, China, and Europe—while withdrawing from less strategic geographies. This allows the company to tailor its vehicle offerings, marketing strategies, and production methods to local consumer preferences, regulatory standards, and supply chain realities.

In China, where EV adoption is outpacing most other regions, Nissan has partnered with Dongfeng Motor Corporation to develop region-specific EVs under the Venucia brand. In Europe, the company is doubling down on its alliance with Renault and Mitsubishi, focusing on platform sharing and joint investments in battery factories and autonomous vehicle software.

Meanwhile, in North America, the emphasis is on reshoring EV production and complying with the U.S. Inflation Reduction Act, which ties consumer tax credits to vehicles manufactured domestically. By investing in modernized Mexican plants and considering new EV investments in the U.S., Nissan aims to maintain its relevance in a crucial but evolving market.

Financial Realignment and Capital Allocation

A key goal of the Re:Nissan strategy is to improve capital efficiency by reallocating resources from underperforming or redundant assets to growth-oriented initiatives. The closure of aging plants such as Oppama, Shonan, and Cuernavaca is projected to reduce fixed costs and improve overall capacity utilization across the remaining production footprint.

The company has also announced a shift in its capital allocation model, committing more than ¥2 trillion (~$13.5 billion USD) over the next five years to EV development, digital services, and battery technology. This includes both in-house R&D and strategic partnerships with tech firms and academic institutions. In contrast, investments in traditional ICE vehicles and associated infrastructure are being progressively phased out.

This pivot is expected to improve return on invested capital (ROIC) and help Nissan achieve a more sustainable cost structure. Analysts have projected that the restructuring could yield annual savings of ¥300–400 billion (~$2–3 billion USD) by 2027, assuming successful implementation.

Long-Term Vision and Corporate Philosophy

Beyond tactical moves and financial recalibration, Nissan’s realignment represents a deeper philosophical shift—from being a vehicle manufacturer to becoming a mobility solutions provider. This vision encompasses not just EVs but also mobility-as-a-service (MaaS), shared transportation networks, and urban mobility planning.

CEO Makoto Uchida has emphasized that Nissan’s future lies in innovation, agility, and social responsibility. The company’s transformation strategy includes:

- Reskilling Programs: Preparing the workforce for emerging roles in software engineering, robotics, and battery research.

- Sustainability Targets: Achieving carbon neutrality through innovation, not offsetting.

- Stakeholder Engagement: Building transparent relationships with employees, suppliers, and governments.

Furthermore, Nissan is actively exploring alternative revenue streams, such as vehicle subscription models, digital service bundles, and real-time data monetization, to reduce reliance on traditional car sales.

While the closures in Japan and Mexico represent a difficult transitional phase, they are foundational steps toward building an organization that is not only profitable but also resilient and forward-thinking.

Risks and Opportunities Ahead

Despite the promise of strategic realignment, the path forward is not without risks. Execution failure, supply chain fragility, regulatory hurdles, and reputational damage from workforce downsizing remain persistent concerns. Moreover, as the automotive industry becomes more intertwined with technology and geopolitics, Nissan must navigate an increasingly complex global operating environment.

Yet, the opportunities are equally significant. With a cleaner balance sheet, a sharper product focus, and an enhanced technological roadmap, Nissan is better positioned to meet future demand and reclaim its position as a global innovator. The transition from a decentralized, sprawling manufacturing giant to a focused, tech-savvy mobility firm is not only timely but essential.

In summary, Nissan’s strategic realignment following its plant closures in Japan and Mexico is both a response to immediate challenges and a blueprint for long-term success. By embracing electrification, intelligent manufacturing, and digital innovation, the company aims to redefine its role in a rapidly evolving industry. The real test, however, will be in the execution—translating plans into performance while maintaining stakeholder trust and social responsibility. The next decade will ultimately determine whether Nissan’s gamble pays off as a model for 21st-century industrial reinvention.

References

- Nissan Global Newsroom – Plant Operations Update

https://global.nissannews.com/en/releases/nissan-announces-operational-restructuring - Reuters – Nissan to Shut Plants in Japan, Mexico in Cost-Cutting Move

https://www.reuters.com/business/autos-transportation/nissan-close-plants-japan-mexico - Bloomberg – Nissan’s EV Pivot Reshapes Global Production Strategy

https://www.bloomberg.com/news/articles/nissan-ev-shift-and-plant-closures - Nikkei Asia – Nissan Reforms Manufacturing Footprint

https://asia.nikkei.com/Business/Automobiles/Nissan-to-close-plants-restructure - Automotive News – Nissan Slashes Global Production Network

https://www.autonews.com/manufacturing/nissan-plant-closures-ev-strategy - CNBC – Nissan Cuts Jobs, Shifts Focus to EV and Digital Factories

https://www.cnbc.com/nissan-restructuring-job-cuts-ev - Electrek – Nissan to Expand EV Lineup After Plant Closures

https://electrek.co/nissan-ev-expansion-and-restructuring - Japan Times – Nissan’s Domestic Retrenchment and Its Local Fallout

https://www.japantimes.co.jp/news/nissan-japan-plant-shutdown - Mexico News Daily – Nissan’s Exit from Cuernavaca Sparks Economic Concerns

https://mexiconewsdaily.com/news/nissan-closes-cuernavaca-plant - The Verge – Nissan's Future Lies in Intelligent EV Manufacturing

https://www.theverge.com/nissan-intelligent-factory-ev-strategy