MicroStrategy Doubles Down: Inside the $1.5 Billion Bitcoin Bet Reshaping Corporate Finance

In a remarkable show of conviction, MicroStrategy has once again drawn the spotlight by announcing an additional $1.5 billion investment in Bitcoin, reaffirming its role as the most prominent corporate backer of the world’s largest cryptocurrency. At a time when global financial markets are roiled by volatility, inflationary pressures, and geopolitical uncertainties, the move has stirred significant debate across financial, technological, and regulatory circles.

Founded in 1989 and known primarily for its business intelligence software, MicroStrategy began its foray into Bitcoin in August 2020 under the leadership of co-founder and then-CEO Michael Saylor. What began as an unorthodox treasury diversification strategy quickly evolved into a full-scale corporate transformation. With each subsequent purchase, MicroStrategy has distanced itself from traditional enterprise software competitors, becoming instead a proxy for Bitcoin investment in the eyes of many investors.

The latest $1.5 billion acquisition brings MicroStrategy’s total Bitcoin holdings to well over 200,000 BTC, solidifying its position as the largest public company holder of the digital asset. The timing of this aggressive acquisition is particularly striking. Bitcoin’s price has experienced sharp swings in 2025, ranging from under $40,000 to highs above $70,000. While the cryptocurrency has shown renewed momentum following the approval of spot Bitcoin ETFs and increasing institutional participation, the asset class remains as volatile and controversial as ever.

This strategic decision reflects a level of confidence in Bitcoin’s long-term trajectory that few other corporate entities have dared to emulate. MicroStrategy’s repeated and large-scale purchases—often financed through convertible debt or share offerings—have raised questions about the prudence of tying so much corporate capital to a speculative and highly volatile asset. At the same time, proponents argue that the company is charting a visionary path, positioning itself for outsized returns in the next decade.

Michael Saylor, now serving as Executive Chairman and Chief Bitcoin Advocate at MicroStrategy, has repeatedly articulated his belief in Bitcoin as “digital gold” and a superior store of value in the digital age. In a recent statement, Saylor remarked:

“Our strategy remains unchanged. We view Bitcoin as the most reliable and desirable asset for long-term value preservation, and we are confident that our latest investment further strengthens our position.”

From a broader perspective, MicroStrategy’s move comes amid heightened scrutiny of crypto markets. While the industry has rebounded from the lows of the 2022–2023 bear cycle, it continues to grapple with regulatory ambiguity in the United States, increasing pressure from global central banks, and lingering concerns about systemic risk following high-profile collapses such as FTX. Nevertheless, the resilience of Bitcoin—bolstered by the legitimizing effect of institutional interest—appears to have renewed confidence among long-term holders and corporate adopters alike.

Critics argue that MicroStrategy’s aggressive Bitcoin accumulation distorts its identity and exposes shareholders to undue risk. Analysts from several major investment banks have raised concerns about the company’s balance sheet concentration, citing the downside exposure in scenarios where Bitcoin’s price were to fall precipitously. However, MicroStrategy’s leadership maintains that its software business continues to operate effectively and that the Bitcoin strategy enhances, rather than detracts from, shareholder value.

Moreover, the move reignites an important discussion about the evolving role of corporate treasuries in a post-fiat, digitally native financial ecosystem. Traditionally conservative in nature, treasury departments have long favored low-risk, liquid instruments such as government bonds or commercial paper. MicroStrategy’s defiance of this orthodoxy signals a willingness—perhaps even a necessity—to rethink capital allocation in an era of low real yields, technological transformation, and monetary uncertainty.

As we examine the rationale, risks, and ramifications of this $1.5 billion Bitcoin bet, one thing is clear: MicroStrategy is not simply reacting to market cycles. It is betting on a paradigm shift—one in which Bitcoin plays a central role in preserving wealth, redefining corporate strategy, and reshaping financial orthodoxy. Whether this proves to be a masterstroke of corporate foresight or a cautionary tale of speculative overreach remains to be seen.

In the following sections, we will explore the strategic underpinnings of this decision, examine how it aligns with MicroStrategy’s evolving corporate identity, assess the associated risks, and analyze what it means for the broader corporate landscape.

Strategic Rationale Behind the $1.5B Bitcoin Acquisition

MicroStrategy’s decision to deepen its commitment to Bitcoin with a $1.5 billion acquisition is far from impulsive. Rather, it reflects a continuation of a carefully articulated capital strategy centered around long-term conviction in Bitcoin as a superior store of value. In this section, we explore the philosophical underpinnings, capital mechanisms, and competitive motivations behind the company's latest investment. Through this analysis, MicroStrategy’s rationale emerges as a blend of ideological conviction and tactical financial engineering, aimed at securing a unique position within both the software and digital asset ecosystems.

MicroStrategy’s Long-Term Bitcoin Thesis

The core of MicroStrategy’s Bitcoin strategy is predicated on the belief that Bitcoin represents the most reliable, decentralized, and finite monetary asset available in the digital era. The company has openly criticized the deteriorating purchasing power of fiat currencies due to quantitative easing, monetary debasement, and structural inflation. In contrast, Bitcoin—with its fixed supply cap of 21 million coins—offers a transparent and algorithmically enforced monetary policy that is immune to human intervention.

From the outset, MicroStrategy framed its Bitcoin strategy not as speculative investment, but as a treasury management innovation. In 2020, with inflation fears looming and yields on traditional safe-haven assets reaching historical lows, the company pivoted toward Bitcoin in an attempt to preserve shareholder value over the long term. As Michael Saylor declared at the time, “Cash is trash,” encapsulating the company’s fundamental belief that fiat-denominated reserves erode real value over time.

In contrast, Bitcoin was positioned as “digital gold,” offering scarcity, divisibility, and portability, with the added benefit of 24/7 global liquidity. While critics pointed to volatility as a weakness, MicroStrategy interpreted it as a feature of a nascent asset class with exponential upside potential.

This philosophical conviction has since matured into a core pillar of MicroStrategy’s identity. Each purchase is framed as a dollar-cost-averaging strategy into a generational asset, akin to acquiring digital land in cyberspace. The $1.5 billion acquisition reaffirms this belief and signals confidence that Bitcoin will serve as a superior long-term treasury reserve asset relative to traditional alternatives.

Internal Capital Strategy and Financial Engineering

MicroStrategy’s Bitcoin purchases have been facilitated not merely through existing cash flow, but through a series of sophisticated capital market operations, primarily involving the issuance of convertible debt and equity. The latest $1.5 billion investment continues this approach, funded partially through the issuance of senior convertible notes and the sale of common stock under its at-the-market (ATM) equity offering program.

The strategy is bold. By leveraging debt with favorable terms—often at interest rates far below historical averages—the company acquires a deflationary asset (Bitcoin) using what it views as inflationary currency. This form of financial arbitrage reflects a broader thesis: that the long-term appreciation of Bitcoin will exceed the cost of capital, thereby generating significant equity value over time.

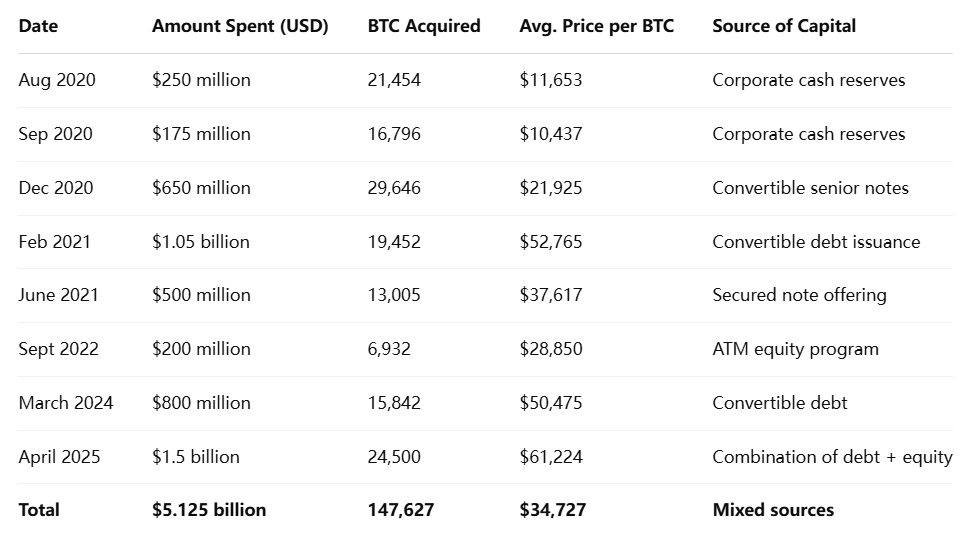

The following table illustrates MicroStrategy’s cumulative Bitcoin acquisition strategy as of 2025, including the latest purchase:

Through these transactions, MicroStrategy has built a sizable Bitcoin treasury at an average purchase price of approximately $34,727 per BTC. While the company has experienced periods of mark-to-market volatility, particularly during bear market phases, the current market value of its holdings stands substantially above the aggregate cost basis, resulting in paper gains exceeding $4 billion.

This leveraged strategy is not without risks. Should Bitcoin's price decline dramatically, the company could face margin pressures, debt servicing issues, and potential equity dilution. Nevertheless, MicroStrategy views such volatility as temporary, and asserts that its long-term time horizon mitigates these concerns.

Competitive Positioning and Identity Transformation

MicroStrategy’s Bitcoin strategy has significantly differentiated the firm from its traditional enterprise software peers. Once a mid-sized analytics provider competing with the likes of Tableau and Qlik, the company is now viewed through a dual lens: both as a software vendor and as a Bitcoin investment vehicle.

This duality has both benefits and drawbacks. On the one hand, it has elevated the company’s visibility, attracting a new cohort of investors, including retail and institutional market participants who are primarily interested in Bitcoin exposure. On the other hand, this transformation has complicated the company’s equity story, with some traditional investors exiting positions due to perceived mission drift.

The decision to double down with a $1.5 billion purchase reinforces MicroStrategy’s commitment to its new identity. Michael Saylor has openly acknowledged this strategic repositioning, stating in a recent interview:

“We’re not just a software company anymore—we’re a Bitcoin development company. Our mission is to acquire and hold Bitcoin as an asset that appreciates over time, while continuing to deliver value to our software customers.”

This pivot has also provided a first-mover advantage in a new category: crypto-aligned public companies. While other firms, including Tesla and Block (formerly Square), have experimented with Bitcoin on their balance sheets, none have done so with MicroStrategy’s consistency or scale. As a result, the company occupies a unique position in the public markets—a synthetic Bitcoin ETF with a revenue-generating business model as a foundation.

Furthermore, the Bitcoin strategy has reinforced brand loyalty among the crypto community, many of whom view MicroStrategy and Saylor as stewards of the Bitcoin ethos. This loyalty has translated into both social media influence and shareholder resilience during market downturns, factors that traditional marketing campaigns could not have achieved with similar impact.

Strategic Timing and Market Signaling

The timing of the $1.5 billion acquisition is especially noteworthy. In early 2025, Bitcoin is experiencing renewed bullish momentum, catalyzed by the long-awaited approval of spot ETFs, continued macroeconomic instability, and a global re-evaluation of fiat currency credibility. Amidst this backdrop, MicroStrategy’s bold move serves as a strategic signal to the market—a declaration of long-term conviction and a challenge to the prevailing hesitancy among institutional actors.

Far from a reactive purchase, this acquisition was likely in planning for months, indicating a calculated move to capitalize on current momentum while reinforcing the company's narrative as the definitive corporate Bitcoin leader. It may also be intended to pre-emptively position MicroStrategy ahead of other public firms that could soon announce crypto-related treasury strategies, thus preserving its first-mover advantage.

MicroStrategy’s $1.5 billion Bitcoin acquisition is not an isolated act of financial speculation. Rather, it is the latest expression of a coherent strategic doctrine rooted in macroeconomic analysis, capital market acumen, and ideological conviction. Through disciplined dollar-cost averaging, creative financial engineering, and bold brand repositioning, the company has constructed a playbook that few have dared to emulate.

While critics will continue to scrutinize the volatility and financial risk associated with such a strategy, MicroStrategy’s unwavering commitment and carefully timed acquisitions suggest a long game in motion—one aimed not merely at weathering the present volatility, but at shaping the future of corporate capital allocation in the digital age.

Risks and Market Reactions

While MicroStrategy’s $1.5 billion Bitcoin acquisition may be strategically consistent with its prior actions, it undeniably raises complex questions regarding financial risk, investor sentiment, and regulatory implications. This section explores the key vulnerabilities associated with such an aggressive cryptocurrency-centric treasury strategy, evaluates market responses from investors and analysts, and discusses the broader economic and policy landscape within which these developments unfold.

Short-Term Volatility and Capital Risk Exposure

Foremost among the concerns surrounding MicroStrategy’s Bitcoin accumulation is the inherent volatility of the asset itself. Bitcoin has long been characterized by its dramatic price fluctuations. While such volatility is often cited as a sign of a nascent and evolving market, it introduces substantial uncertainty into the financial statements and valuation models of companies with significant crypto holdings.

For MicroStrategy, short-term declines in Bitcoin’s market value directly affect reported earnings due to prevailing accounting standards. Under current U.S. GAAP, companies must impair the value of digital assets if their market price drops below the acquisition cost—even if the price later recovers. As a result, unrealized losses are recognized, while unrealized gains are not, leading to distorted earnings and potential investor misinterpretation of performance.

Moreover, the use of debt-financed instruments to acquire Bitcoin adds a layer of leverage risk. Should Bitcoin’s price fall significantly, the company may face challenges in servicing its debt obligations or maintaining favorable credit ratings. Although MicroStrategy has stated that its core software business generates sufficient cash flow to support operations independently of Bitcoin, the convergence of asset depreciation and debt service requirements could strain the company’s financial flexibility.

A related concern is liquidity. Bitcoin, while highly liquid in most market conditions, may become more difficult to convert into fiat currency during episodes of systemic stress or market panic. Although MicroStrategy has never indicated intentions to sell its Bitcoin holdings in the short term, the theoretical liquidity risk nonetheless factors into broader risk assessments by analysts and institutional investors.

Investor Sentiment and Share Price Dynamics

Investor response to MicroStrategy’s evolving Bitcoin strategy has been bifurcated. On one side, a vocal segment of Bitcoin proponents and retail investors have celebrated the company’s actions as visionary, rewarding its stock with substantial premiums during bullish cycles. On the other, traditional investors have expressed reservations about the high correlation between MicroStrategy’s equity value and Bitcoin’s market price, arguing that the company’s fundamentals are increasingly overshadowed by crypto-market dynamics.

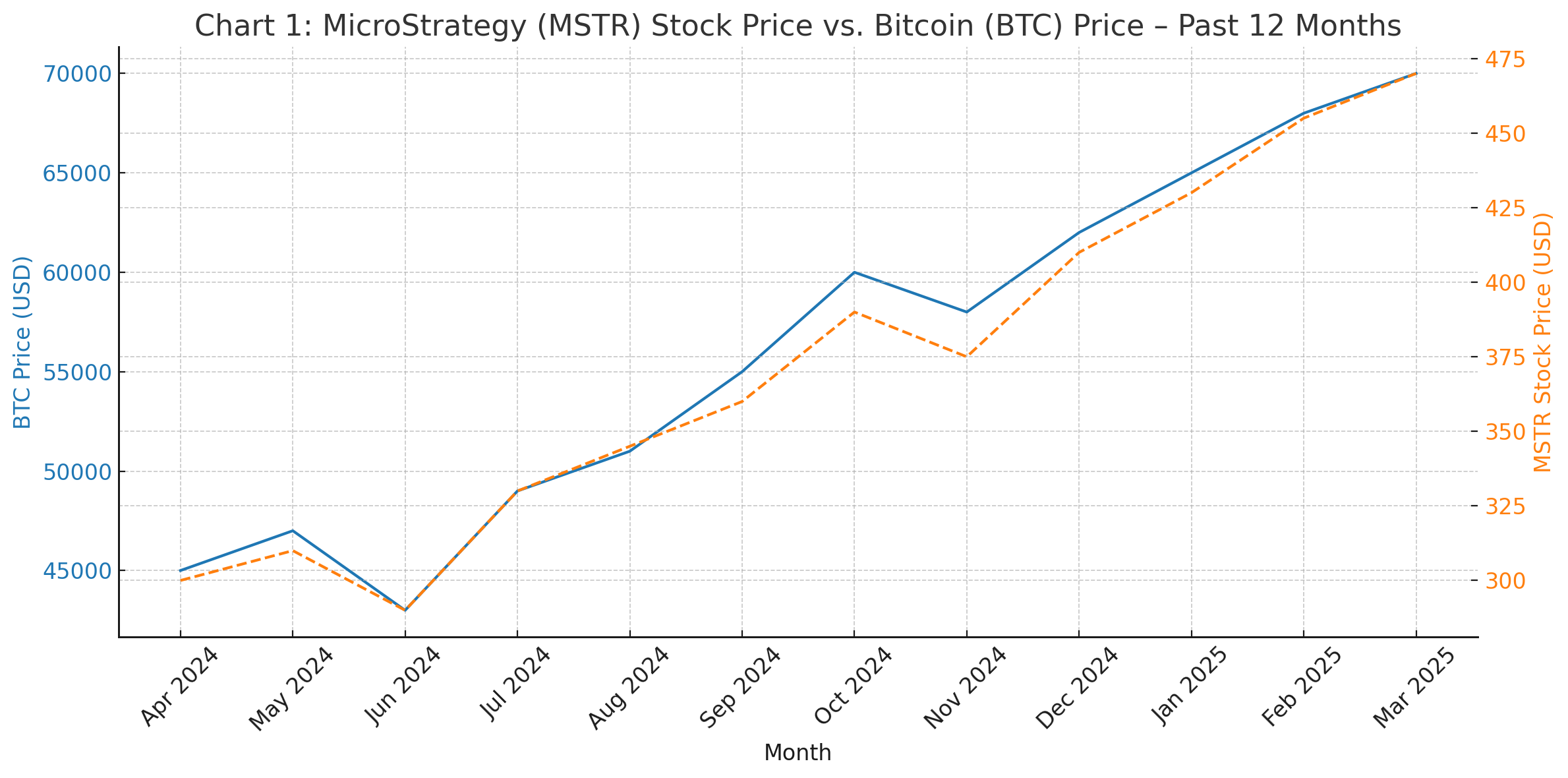

This duality is clearly observable in historical share price movements. MicroStrategy’s stock (ticker: MSTR) has shown pronounced co-movement with Bitcoin, often outperforming during bull markets but also suffering sharper drawdowns during downturns.

To visualize this correlation, the following chart illustrates the performance of MicroStrategy’s stock price relative to Bitcoin’s price over the past 12 months:

This strong correlation raises important considerations for institutional portfolio managers. While Bitcoin ETFs now provide more direct exposure to the asset, MicroStrategy offers an alternative vehicle—one that combines Bitcoin holdings with a functioning software business. However, the increasing identity of the company as a “Bitcoin proxy” may result in valuation premiums or penalties that diverge from the company’s actual operational performance.

Furthermore, analysts have noted that retail-driven speculative flows have at times inflated MSTR’s stock price well beyond its intrinsic value based on discounted cash flow models for its software segment. This introduces volatility not only from Bitcoin’s price movements, but also from changes in retail investor sentiment—amplifying both upside potential and downside risk.

Institutional sentiment has likewise been mixed. While some firms have increased exposure to MicroStrategy due to its Bitcoin leverage, others have scaled back or issued cautious guidance. Several analysts have placed MSTR under “sector perform” or “neutral” ratings, citing macro uncertainty and Bitcoin-driven earnings opacity as primary reasons.

Regulatory Environment and Legal Risk

A significant and growing consideration for any enterprise engaging with digital assets is the evolving regulatory landscape. In the United States, the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Internal Revenue Service (IRS) have all asserted jurisdictional interests in various facets of the cryptocurrency ecosystem. The legal classification of Bitcoin—whether as a commodity, property, or potential security—remains a source of ongoing debate.

To date, Bitcoin has been largely spared from the regulatory scrutiny facing other digital assets, with the SEC affirming that Bitcoin does not meet the criteria for a security. However, this status does not shield companies like MicroStrategy from broader crypto regulations, including those related to accounting, taxation, disclosures, and custodial practices.

Of particular concern are potential changes in tax treatment and fair value accounting standards. If regulators adopt a more conservative stance toward corporate crypto holdings—requiring, for instance, real-time fair value accounting or enhanced liquidity coverage ratios—companies with significant Bitcoin exposure could face increased compliance costs and valuation volatility.

Additionally, should the IRS or international tax bodies implement rules mandating mark-to-market taxation of crypto holdings, MicroStrategy could face substantial tax obligations during periods of asset appreciation—even absent any realized gains. Such scenarios would necessitate active treasury management and possibly unanticipated liquidity outflows.

The broader policy environment also introduces reputational risk. As governments continue to assess the systemic risk posed by cryptocurrencies—particularly in light of past exchange collapses and decentralized finance exploits—public companies associated with crypto may attract heightened scrutiny, both from regulators and from mainstream media.

Broader Economic Implications and Strategic Signaling

MicroStrategy’s bold crypto strategy has also raised questions about broader implications for corporate governance, treasury management, and economic signaling. Traditionally, public company treasuries have been managed conservatively, with capital deployed in short-term government bonds, money market instruments, or bank deposits. Bitcoin represents a radical departure from this norm—a speculative asset with no yield, no central issuer, and limited mainstream acceptance as a medium of exchange.

By championing Bitcoin as a treasury reserve asset, MicroStrategy challenges the traditional risk-return calculus. Its strategy implies that long-duration, high-volatility assets may be superior in preserving real value over time compared to low-yield fiat instruments. This thesis aligns with macroeconomic fears of sustained inflation, currency debasement, and excessive monetary stimulus—all of which have gained salience in recent years.

The impact of such signaling cannot be overstated. MicroStrategy’s continued investment in Bitcoin—despite volatility and criticism—serves as a signal to both institutional investors and peer corporations. It challenges risk-averse norms and invites reexamination of capital allocation strategies in an increasingly digital and inflation-sensitive economy.

However, this role as a strategic outlier also isolates the company. While others have cautiously explored crypto integration—such as Tesla’s brief foray into Bitcoin holdings or Block’s mission-driven embrace of crypto payments—few have matched MicroStrategy’s scale or consistency. As a result, the company bears the burden of both innovation and scrutiny, navigating uncharted terrain with few contemporaries for validation or benchmarking.

MicroStrategy’s deepening engagement with Bitcoin introduces multifaceted risks—ranging from asset volatility and financial leverage to regulatory exposure and investor perception. Yet the company’s unflinching resolve appears to have galvanized a distinct investor base, one that views short-term turbulence as the cost of long-term transformation.

By adopting Bitcoin not only as a speculative asset, but as a foundational element of its financial strategy, MicroStrategy has reshaped the boundaries of corporate treasury governance. It walks a tightrope between visionary leadership and potential overreach, betting on a future in which Bitcoin is not merely accepted—but essential.

What This Means for Corporate Treasury Strategy

MicroStrategy’s decision to allocate an additional $1.5 billion into Bitcoin is not merely an isolated act of corporate risk-taking. Rather, it signals a broader ideological and operational shift in how treasury functions may evolve in the digital age. Traditionally tasked with capital preservation, liquidity management, and low-risk investments, the corporate treasury function is being challenged by novel macroeconomic conditions and emerging financial technologies. This section examines how MicroStrategy’s strategy could reshape corporate treasury practices, the role of Bitcoin on balance sheets, and the potential trajectory of crypto adoption across industries.

Evolving Role of Digital Assets in Corporate Balance Sheets

Historically, corporate treasuries have been conservative in capital deployment, emphasizing capital preservation through instruments such as U.S. Treasury bonds, commercial paper, and bank deposits. These vehicles provide liquidity, stability, and predictable returns, aligning with fiduciary responsibilities to protect shareholder capital. However, in a low-yield environment marked by persistent inflation, many of these traditional assets have failed to generate positive real returns. As a result, an increasing number of corporate finance leaders have begun to question the efficacy of existing capital preservation frameworks.

In this context, Bitcoin and other digital assets have emerged as alternative stores of value. While the majority of enterprises remain hesitant to hold cryptocurrencies due to volatility, accounting treatment challenges, and regulatory ambiguity, a small but growing group of companies has begun to experiment with Bitcoin as a treasury reserve asset. MicroStrategy has become the most prominent example, but other notable corporations—including Tesla, Block (formerly Square), Coinbase, and Marathon Digital Holdings—have also integrated Bitcoin into their balance sheets.

The rationale for such a move is multi-faceted. Proponents argue that Bitcoin’s algorithmically limited supply, global liquidity, and decentralized governance structure make it a compelling hedge against fiat currency debasement and monetary inflation. Moreover, with increasing institutional infrastructure surrounding crypto custody, insurance, and compliance, the perceived barriers to entry have diminished over time.

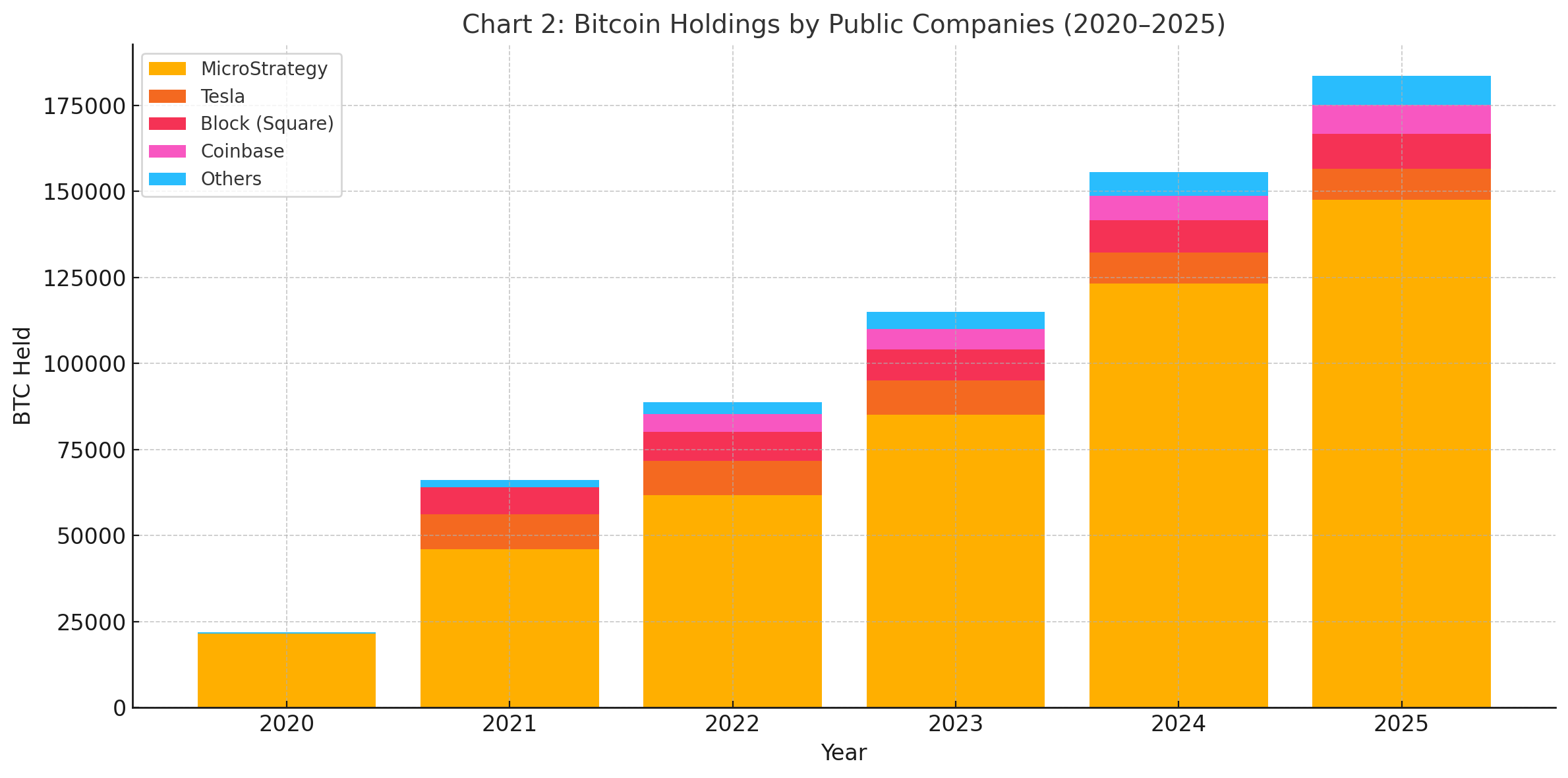

To contextualize the growing trend, the following chart illustrates the Bitcoin holdings of public companies between 2020 and 2025:

The chart reveals that while MicroStrategy accounts for the lion’s share of Bitcoin held by public companies, broader participation has been steadily increasing. These developments suggest a potential inflection point in treasury strategy, as digital assets begin to earn consideration within a diversified portfolio framework.

Nonetheless, this adoption is still in its infancy. As of early 2025, fewer than 40 publicly traded companies report material cryptocurrency holdings. This indicates that while interest is growing, the model remains an outlier rather than a mainstream approach.

Is This a New Standard or an Outlier?

Despite the rising interest in digital assets, MicroStrategy’s strategy remains highly idiosyncratic. The company has not only allocated a significant percentage of its capital into Bitcoin, but it has also issued debt and equity to fund such purchases—essentially transforming itself into a quasi-crypto holding company with a software business attached. Few other firms have demonstrated the same level of commitment or risk appetite.

From a governance perspective, most corporate boards remain cautious about introducing volatility to their balance sheets. Bitcoin’s price swings, combined with stringent accounting standards, can lead to significant income statement fluctuations that complicate quarterly reporting and investor relations. Furthermore, the lack of yield from holding Bitcoin—unlike fixed-income securities—can deter treasurers who prioritize predictable income streams over capital appreciation.

Moreover, internal controls, audit requirements, and custodial risk further inhibit broader adoption. Treasury departments are typically aligned with conservative financial risk frameworks, and deviating from these norms requires exceptional conviction, strong executive leadership, and a robust governance structure to ensure accountability.

In this sense, MicroStrategy’s approach is more of an experimental archetype than a replicable standard. While it has drawn attention and admiration from segments of the crypto community, most corporate finance professionals regard it as a high-risk, high-reward strategy rather than a new orthodoxy.

Nonetheless, this does not mean the strategy is without influence. As Bitcoin matures as an asset class—particularly with the institutional legitimacy provided by spot ETFs, regulated custodians, and standardized reporting frameworks—some elements of MicroStrategy’s approach may inspire incremental shifts in corporate behavior. Treasury departments may begin by allocating a small percentage of their reserves into Bitcoin or other digital assets, treating them as long-term strategic holdings alongside traditional instruments.

Analyst Projections and Strategic Scenarios

To understand the broader implications of MicroStrategy’s strategy, it is helpful to consider hypothetical scenarios involving future Bitcoin valuations and their potential impact on the company's financial position and market perception.

Consider the following two strategic projections:

- Scenario A: Bitcoin reaches $100,000 by Q4 2025

In this optimistic scenario, MicroStrategy’s Bitcoin holdings—now totaling over 200,000 BTC—would be valued at $20 billion, a significant increase from the current market value. The company’s balance sheet would reflect substantial unrealized gains, boosting equity value and further reinforcing its position as a Bitcoin-centric enterprise. MSTR stock would likely outperform both software sector peers and Bitcoin ETFs due to its embedded leverage. Investor sentiment would likely trend positive, and the company could explore additional capital raises on favorable terms. - Scenario B: Bitcoin falls to $15,000 by Q4 2025

In this adverse scenario, the value of MicroStrategy’s holdings would decline sharply, erasing billions in market capitalization. The company’s debt ratios would become concerning, and impairment losses would materially impact reported earnings. MSTR stock could underperform, and the company might face pressure from shareholders to reconsider its Bitcoin-centric identity. Debt covenants and credit ratings could be tested, especially if software revenue fails to offset Bitcoin-related volatility.

These scenarios underscore the asymmetric nature of MicroStrategy’s bet. While upside potential is significant, the downside risks are equally pronounced. For other corporations observing MicroStrategy’s trajectory, such binary outcomes may serve as both inspiration and caution.

Analyst perspectives vary widely on how to interpret this dynamic. Some regard MicroStrategy as a leveraged Bitcoin ETF with limited downside protection, while others view it as an innovative financial architecture designed to capitalize on macro tailwinds in digital finance. Both interpretations acknowledge the company’s role as a trailblazer, but disagree on whether the model is sustainable.

Implications for Treasury Governance and Financial Innovation

Perhaps the most enduring impact of MicroStrategy’s Bitcoin strategy lies in its challenge to established corporate finance doctrines. It raises profound questions about the nature of money, the purpose of capital reserves, and the acceptable boundaries of financial risk in an era of rapid technological and monetary transformation.

In doing so, it opens a pathway for treasury departments to explore more dynamic models of capital allocation—models that consider both inflationary erosion and digital asset appreciation. While the vast majority of firms will remain cautious, the precedent has been set for a class of more experimental, digitally aligned corporate actors who may follow a similar path.

Moreover, MicroStrategy’s strategy invites innovation in risk management tools, including crypto-hedging instruments, insurance products, and volatility-mitigation mechanisms. As these markets mature, the friction currently associated with crypto treasury exposure may decrease, enabling broader adoption.

From a regulatory perspective, MicroStrategy’s actions may also accelerate the push for standardized crypto accounting rules and clearer tax frameworks, particularly as more publicly traded entities enter the digital asset arena. In this way, the company is not only participating in a financial transition—it is actively shaping the infrastructure that will govern it.

MicroStrategy’s Bitcoin investment strategy is a bold departure from conventional treasury practices, but it may foreshadow a broader evolution in corporate capital management. While it remains an outlier in terms of scale and conviction, the company has introduced a compelling alternative to traditional fiat-denominated reserve strategies, especially in an economic environment characterized by low yields and monetary uncertainty.

Whether this represents the future of corporate treasury or a one-off experiment will depend on macroeconomic trends, regulatory developments, and the ongoing maturation of digital asset markets. What is certain, however, is that MicroStrategy has fundamentally altered the discourse around corporate finance—and in doing so, has challenged an entire generation of CFOs, treasurers, and board members to reevaluate the principles of capital preservation and value creation in the 21st century.

Visionary Move or Reckless Gamble?

MicroStrategy’s $1.5 billion Bitcoin acquisition amid a volatile macroeconomic landscape is a bold reaffirmation of the company’s long-standing conviction in the transformative potential of digital assets. By committing such a substantial portion of its corporate treasury to Bitcoin—and doing so repeatedly over a multi-year period—the company has not merely adopted a unique investment strategy; it has redefined its corporate identity and its standing in both the technology and financial sectors.

The central question that continues to divide analysts, investors, and economists is whether this aggressive Bitcoin-centric model represents strategic genius or speculative overreach. On one hand, the logic of capital preservation in the face of fiat currency debasement, coupled with the potential for long-term capital appreciation, offers a compelling thesis. On the other, the risks associated with volatility, regulatory uncertainty, and concentrated exposure cannot be understated.

To its supporters, MicroStrategy embodies the archetype of a forward-thinking enterprise. By seizing the first-mover advantage, the company has positioned itself as the most prominent corporate advocate for Bitcoin, effectively operating as a hybrid between a technology firm and a digital asset investment vehicle. Its leadership, particularly Executive Chairman Michael Saylor, has emerged as a leading voice in the global Bitcoin discourse—arguably elevating the cryptocurrency’s legitimacy through institutional engagement, media influence, and capital market innovation.

Proponents view the Bitcoin strategy as a necessary evolution in corporate finance. In a world where real returns on traditional cash reserves are often negative, MicroStrategy’s pivot is seen not as reckless, but as prescient. Its disciplined approach—employing structured financing mechanisms, strategic timing, and long-term holding policies—demonstrates a sophisticated grasp of both macroeconomics and treasury optimization.

Yet, for its critics, the strategy represents an imprudent gamble that exposes shareholders to excessive risk. The high correlation between MicroStrategy’s equity performance and Bitcoin’s price undermines the diversification benefits that investors typically seek in publicly traded equities. Moreover, the use of leverage to amplify Bitcoin exposure is viewed by many as amplifying potential downside scenarios, especially in the face of sharp market corrections or liquidity constraints.

From a governance perspective, questions have been raised about the balance between visionary leadership and fiduciary responsibility. As a public company, MicroStrategy is accountable to shareholders who may have diverse risk tolerances and investment goals. By anchoring the company’s financial strategy to a single, highly volatile asset, some argue that it has marginalized traditional investors and introduced unnecessary systemic exposure.

The debate is further complicated by the broader regulatory landscape. With the Securities and Exchange Commission (SEC) and other global regulators intensifying scrutiny on digital assets, the risk of unforeseen policy interventions remains a persistent variable. While Bitcoin has largely avoided classification as a security, the corporate mechanisms surrounding its custody, valuation, and disclosure continue to evolve—posing ongoing compliance challenges for firms like MicroStrategy.

Moreover, as Bitcoin adoption grows, the competitive landscape may shift. If other major corporations begin to mirror MicroStrategy’s strategy, the firm’s first-mover advantage could diminish. Conversely, if broader corporate adoption remains limited, MicroStrategy may find itself increasingly isolated, reliant on the long-term performance of an asset that remains contentious in traditional finance.

Ultimately, the implications of MicroStrategy’s actions extend beyond its balance sheet. The company has redefined what it means to manage corporate capital in the digital era. Whether other firms follow suit or remain cautiously on the sidelines, the precedent has been set: Bitcoin is no longer an abstract asset confined to retail speculation and crypto-native ecosystems. It is now a subject of serious consideration in boardrooms, treasury departments, and financial institutions worldwide.

As we look ahead, the success or failure of MicroStrategy’s Bitcoin strategy will depend not solely on the price trajectory of the asset, but on a constellation of factors including regulatory clarity, macroeconomic stability, technological integration, and investor sentiment. What is clear, however, is that the company has committed to this path with extraordinary conviction—and in doing so, has forced a global conversation about the future of money, corporate finance, and digital sovereignty.

In the final analysis, whether MicroStrategy’s strategy is remembered as a visionary leap or a cautionary tale will be determined by history. But irrespective of the outcome, its audacity has earned it a permanent place in the annals of financial innovation. In an era defined by disruption and reinvention, MicroStrategy has chosen to lead, not follow—staking its future on a technology it believes will reshape the very foundations of global value exchange.

References

- MicroStrategy – Bitcoin Acquisition Strategy

https://www.microstrategy.com/en/bitcoin - CoinDesk – MicroStrategy Buys Additional $1.5 Billion in Bitcoin

https://www.coindesk.com/business/2025/04/04/microstrategy-buys-15-billion-bitcoin - CNBC – Michael Saylor on Why MicroStrategy Keeps Buying Bitcoin

https://www.cnbc.com/video/2025/03/30/michael-saylor-on-bitcoin-and-corporate-strategy.html - The Block – Public Companies With Bitcoin on Their Balance Sheet

https://www.theblock.co/data/crypto-markets/bitcoin-treasuries - Bitcoin Treasuries – List of Public Companies Holding BTC

https://bitcointreasuries.net - Bloomberg – MicroStrategy Becomes Proxy for Bitcoin Exposurehttps://www.bloomberg.com/news/articles/microstrategy-bitcoin-investment-stock-performance

- SEC – Cryptocurrency Regulation Overviewhttps://www.sec.gov/spotlight/cybersecurity-enforcement-crypto

- PwC – Crypto in the Treasury: A Guide for CFOshttps://www.pwc.com/gx/en/issues/crypto/blockchain-in-treasury.html

- Fidelity Digital Assets – Institutional Adoption of Bitcoinhttps://www.fidelitydigitalassets.com/articles/institutional-investment-trends

- KPMG – Accounting for Digital Assetshttps://advisory.kpmg.us/articles/2022/accounting-digital-assets.html