Meituan’s Global Expansion Strategy Drives Record Profit and Revenue Growth

In the rapidly evolving global tech and commerce landscape, few companies have captured investor attention and consumer loyalty with the same intensity as Meituan. Founded in 2010, Meituan initially operated as a group-buying website before pivoting into a sprawling platform that now integrates food delivery, hotel bookings, bike-sharing, grocery services, and a host of on-demand local commerce verticals. As China's largest food delivery and lifestyle services company, Meituan commands significant market share in its home territory. However, in recent quarters, its global aspirations have emerged as a central growth narrative — and the results are beginning to show.

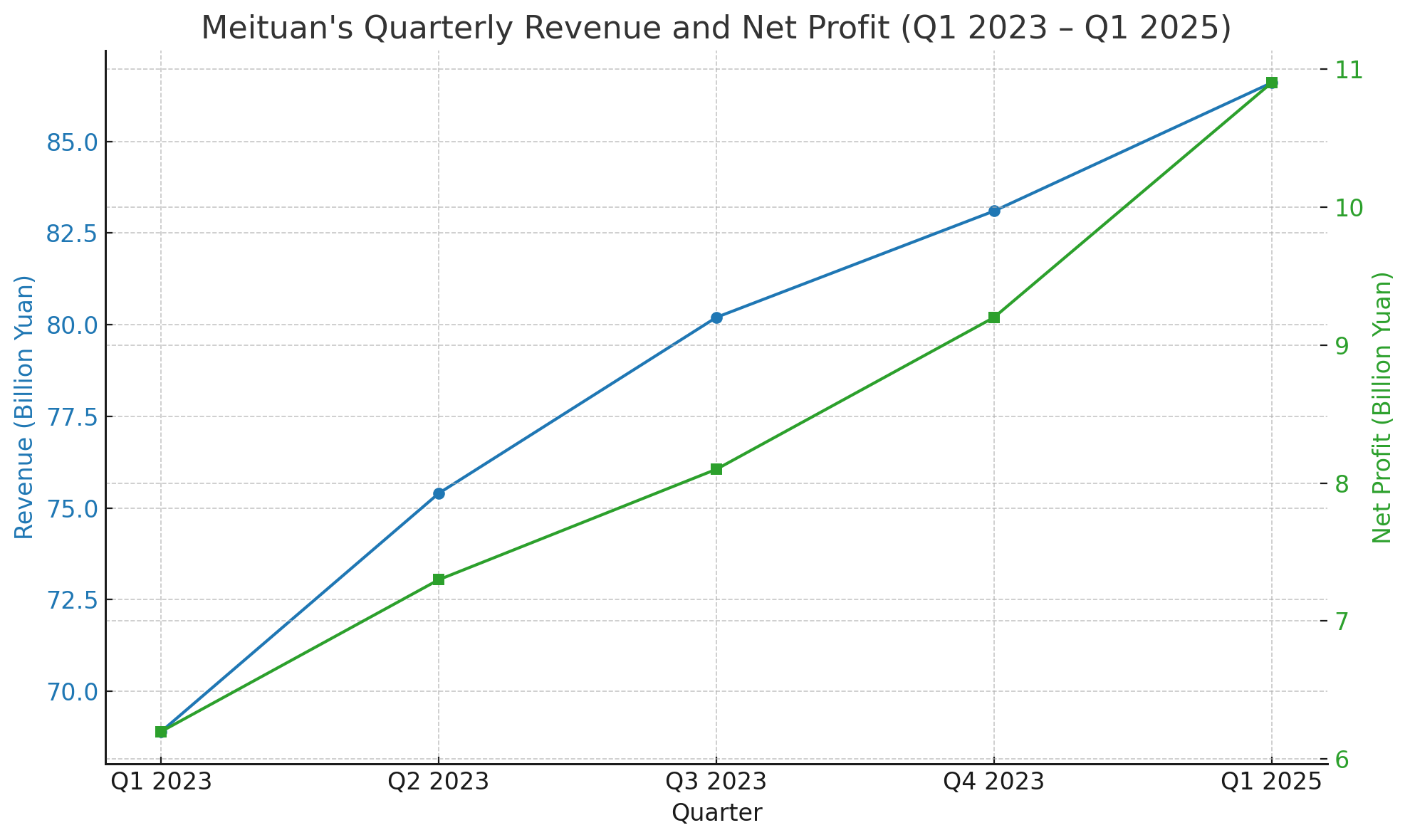

The latest financial disclosures for Q1 2025 underscore this transition, as Meituan’s earnings and revenue figures significantly outpaced analyst expectations. Total revenue reached 86.6 billion yuan (approximately $12.1 billion), marking an 18.1% year-on-year increase, while net profit surged to 10.9 billion yuan ($1.52 billion), a dramatic 46.2% jump from the same quarter the previous year. These impressive figures are not solely the result of domestic dominance; rather, they reflect a deliberate and increasingly effective global expansion strategy.

Meituan's foray into international markets is a response to multiple interwoven trends. Domestically, the platform faces stiffening competition, especially from entrenched rivals like Alibaba’s Ele.me and JD.com. In parallel, the Chinese local commerce sector is approaching saturation, limiting the company’s ability to achieve aggressive growth within its traditional boundaries. Moreover, economic headwinds, regulatory interventions, and demographic shifts have collectively prompted Chinese tech giants to reevaluate their long-term expansion strategies. For Meituan, internationalization presents a viable — and now evidently fruitful — route toward sustained profitability.

The company’s global initiatives began gaining meaningful traction in mid-2023, with the launch of its delivery app “Keeta” in Hong Kong. Within a year, Meituan managed to capture a dominant share of the Hong Kong market, outpacing established competitors like Foodpanda and Deliveroo in order volume. Shortly thereafter, Meituan expanded its operations into Saudi Arabia’s capital, Riyadh, with an initial investment of SR1 billion ($266.6 million). These moves represent more than geographic diversification — they exemplify Meituan’s evolving strategy that combines technological innovation, capital investment, and localized service design to break into new, culturally diverse markets.

Equally notable is the company's shift toward operational excellence through innovation. Meituan has invested heavily in artificial intelligence, autonomous delivery systems, and data-driven logistics to optimize its platform. From real-time coupon distribution engines that increase consumer conversion rates to unmanned aerial vehicle (UAV) deliveries and self-driving delivery robots, the company's commitment to smart infrastructure is central to both its domestic and international success. These technologies not only improve efficiency and lower operational costs but also create differentiated user experiences that give Meituan a competitive edge in foreign markets.

This blog post will examine Meituan’s global growth story in depth, dissecting the factors that have allowed it to exceed financial expectations. Section II will provide a financial breakdown, showcasing how revenue and profit figures are outperforming both historical baselines and market forecasts. Section III will focus on the specifics of Meituan’s international expansion — its market entries, strategies, and localized adaptations. Section IV will explore how innovation in logistics, AI, and automation underpins the company’s expansion success. Finally, Section V will critically assess the challenges that lie ahead, including regulatory hurdles, competition, and long-term sustainability.

Each section is supported by visual data in the form of charts and a table. These visuals will contextualize Meituan’s performance over time and across regions, illustrating the scale and trajectory of its ambitions.

Meituan’s global story is still in its early chapters, but the foundational evidence suggests a company that is not just surviving a plateau in domestic growth — it is thriving through reinvention. By balancing its stronghold in the Chinese local commerce market with selective and high-impact international forays, Meituan is redefining the boundaries of what it means to be a Chinese tech giant in a post-pandemic global economy.

In an environment where geopolitical tensions and protectionist policies often curtail cross-border expansion, Meituan’s success offers a rare counter-narrative — one of calculated globalization, operational discipline, and relentless innovation. For investors, industry watchers, and competitors alike, Meituan’s global push is not just a corporate milestone; it is a case study in how regional champions can evolve into global contenders without losing their technological and cultural moorings.

As we delve deeper into Meituan’s financial performance and strategic trajectory, it becomes clear that the company is not merely responding to market pressure. Instead, it is setting a new standard for international growth, one that combines the dynamism of platform economics with the precision of data-driven logistics and AI-powered customer experiences. The remainder of this post unpacks how and why Meituan’s global expansion is redefining the economics of local commerce — not just in China, but around the world.

Financial Performance – Surpassing Market Expectations

Meituan’s financial performance in the first quarter of 2025 decisively dispelled lingering concerns over the company’s growth ceiling amid a maturing domestic market and mounting competitive pressures. The Chinese on-demand service giant not only exceeded Wall Street and domestic analyst forecasts but also posted some of its strongest quarterly metrics to date — a testament to the effectiveness of its recalibrated business strategy and international diversification. As global market volatility continues to unsettle tech valuations, Meituan’s solid earnings provide a case study in resilient growth, efficient platform operation, and the power of well-executed expansion.

In the latest earnings report, Meituan posted total revenues of 86.6 billion yuan ($12.1 billion), marking an impressive 18.1% increase compared to the same period in 2024. This performance handily beat analyst estimates, which had forecast a more modest 15% increase year-on-year. Even more striking was the company’s net profit, which surged 46.2% to 10.9 billion yuan ($1.52 billion). These results signal a remarkable rebound from previous quarters marred by regulatory overhang and post-pandemic consumer behavior normalization.

A significant portion of this growth stemmed from Meituan’s "Core Local Commerce" segment — encompassing its primary services such as food delivery, Meituan Instashopping, and hotel and travel bookings. This business vertical generated 64.3 billion yuan ($9 billion) in revenue for Q1 2025, up 17.8% from the prior year. This segment alone contributed nearly three-quarters of total revenue, underscoring the continuing strength of Meituan’s foundational offerings. Notably, the sustained surge in high-frequency, small-ticket transactions is a positive indicator of broad consumer stickiness and operational scale advantages.

The company’s food delivery services remain a standout performer. According to internal disclosures and third-party estimates, Meituan controls nearly 70% of the Chinese food delivery market. Its average daily order volume has risen steadily over the past twelve months, with further acceleration in tier-2 and tier-3 cities driven by increased smartphone penetration and the adoption of digital payment systems. The addition of premium services, AI-powered order routing, and subscription-based delivery packages has also lifted average order values and customer lifetime value.

Another key contributor to Meituan's quarterly outperformance was the rapid growth in Instashopping — the company’s on-demand retail initiative encompassing convenience goods, fresh produce, and non-perishable consumer items. The segment benefitted from both improved merchant acquisition and a refined last-mile logistics network, enabling faster delivery times and higher order density per hour. Notably, this growth has been margin-accretive, as Meituan leverages existing courier infrastructure and algorithmic dispatching to contain operating expenses.

From a financial discipline perspective, Meituan demonstrated improved cost structure management, particularly in areas that had previously been significant cash drains. Gross margin for the quarter rose to 33.4%, up from 29.1% a year earlier. Operating margin reached 10.6%, supported by technology-enabled reductions in delivery redundancies, automated customer service functions, and more efficient advertising spend through real-time conversion optimization. In effect, Meituan’s superior data analytics capabilities have begun translating into durable operating leverage.

Meanwhile, its New Initiatives segment — comprising services such as community group buying (Meituan Select), Meituan Grocery, and overseas ventures — also delivered encouraging signals, albeit with slightly slimmer margins. Revenue from New Initiatives grew 19.4% year-on-year to reach 22.3 billion yuan ($3.1 billion). Although this segment is still not uniformly profitable, the growth is particularly notable because it includes early-stage international operations, which have begun to contribute meaningfully to top-line expansion.

Investor sentiment has responded favorably to Meituan’s Q1 2025 results. Shares surged over 7% in the immediate aftermath of the earnings release, reflecting increased confidence in the management team’s ability to execute amid complex macroeconomic conditions. The earnings call, led by CEO Wang Xing and CFO Chen Shaohui, reiterated the company’s long-term commitment to both technological investment and geographic diversification — two pillars that appear to be paying off in tangible financial terms.

In terms of competitor benchmarking, Meituan’s performance continues to place it ahead of key rivals such as Alibaba’s Ele.me and JD Daojia in the food delivery and on-demand retail segments. While these competitors have made inroads via aggressive pricing and subsidies, Meituan’s superior logistics capabilities, richer ecosystem integrations, and more engaged user base have enabled it to maintain higher margins without compromising on growth. Additionally, the recent recovery in China’s domestic travel and tourism sector has fueled demand for Meituan’s hotel booking and experience services, providing a lift that most competitors in the food delivery-only space are unable to replicate.

Foreign analysts have also taken note of Meituan’s sustained profitability in the face of sector headwinds. In research notes published by Morgan Stanley and Nomura, analysts praised the company’s disciplined capital expenditure strategy and expanding addressable market via its entry into international jurisdictions. The company’s balance sheet remains healthy, with a reported cash reserve exceeding 120 billion yuan ($16.8 billion) and a debt-to-equity ratio well below industry norms. These financial fundamentals position Meituan not just as a dominant player in Chinese local commerce but as a scalable model for profitable growth in the platform economy.

However, it is worth acknowledging that the road ahead is not without challenges. Meituan continues to operate under the scrutiny of regulatory authorities in China, particularly concerning antitrust issues and the rights of gig economy workers. The company's strategic response has included more robust compliance frameworks and pilot programs for enhanced courier welfare. Additionally, fluctuating macroeconomic indicators, such as consumer confidence and energy prices, may exert unpredictable influence on input costs and order volumes. Yet, the Q1 2025 financial report suggests that Meituan is well-prepared to weather such volatility with its robust monetization model and operational scale.

In summary, Meituan’s Q1 2025 financial results affirm that the company is executing a strategy that balances near-term profitability with long-term vision. By delivering strong revenue growth, expanding margins, and maintaining competitive leadership in both legacy and emerging verticals, Meituan has not only surpassed market expectations but also repositioned itself as a tech platform with global relevance. The following section will delve deeper into the international strategies fueling this growth — offering insight into how Meituan is translating its domestic dominance into global success.

International Expansion – Strategies and Market Penetration

Meituan’s success in the domestic market has long been attributed to its seamless integration of services, unmatched logistical sophistication, and data-driven personalization. However, the company's trajectory in recent quarters suggests that it is no longer content with dominance within China alone. Meituan’s foray into international markets marks a pivotal evolution in its corporate strategy—one focused on geographic diversification, ecosystem transplantation, and competitive displacement abroad. This section explores the strategies that underpin Meituan’s global expansion and assesses the early indicators of its market penetration success.

The company’s international ambitions first materialized tangibly in May 2023 with the launch of its food delivery platform “Keeta” in Hong Kong. Designed as a lightweight, app-first service optimized for dense urban environments, Keeta was a strategic pilot for global scalability. Within just a few quarters, Keeta overtook incumbents such as Foodpanda and Deliveroo in terms of order volume—a feat facilitated by aggressive customer acquisition strategies, first-order subsidies, and superior delivery logistics. Keeta’s rapid ascent was not accidental. It was powered by Meituan’s proprietary intelligent dispatching algorithms and real-time inventory tracking, which allowed couriers to fulfill orders more efficiently than rivals.

Hong Kong served as an ideal proving ground: it featured high population density, strong consumer purchasing power, and a regulatory environment that was relatively predictable. More importantly, it allowed Meituan to test the translatability of its domestic success factors in a culturally proximate yet distinctly international setting. The lessons gleaned from this pilot shaped its broader international rollout strategy, confirming that Meituan's technology stack and operations model could be reconfigured to suit foreign regulatory, economic, and consumer conditions.

Following its success in Hong Kong, Meituan’s next major expansion occurred in the Middle East, where it entered the Saudi Arabian market in September 2024. The company committed to investing over SR1 billion ($266.6 million) in Riyadh to establish a full-fledged delivery ecosystem. Unlike the Hong Kong operation, this expansion required more extensive ground-up infrastructure development, including the recruitment of local drivers, merchant onboarding, and building supply chain networks from scratch. Despite these challenges, early adoption metrics indicate positive reception, particularly among younger, digitally fluent consumers in urban centers.

Meituan’s entry into Saudi Arabia reflects a broader strategic pivot toward emerging markets with high growth potential and limited incumbent competition. These markets offer a unique value proposition: relatively low customer acquisition costs, rising smartphone and internet penetration, and governments eager to digitize their service economies. By embedding itself early in these ecosystems, Meituan is positioning itself not just as a latecomer challenger, but as a foundational player in shaping the on-demand economy in these regions.

A critical component of Meituan’s international strategy is localization. Unlike some Western platforms that impose a uniform product model across markets, Meituan has adopted a modular, adaptive framework. This means the platform’s core features—such as one-click ordering, instant delivery tracking, and loyalty programs—are retained, but user interface design, pricing structures, delivery packaging, and payment options are localized based on consumer expectations and regulatory constraints. In Riyadh, for instance, Meituan adjusted delivery hours to accommodate cultural norms around prayer times and fasting periods during Ramadan, thereby demonstrating operational sensitivity.

Another key pillar of Meituan’s global expansion is technology-driven scalability. By leveraging its AI infrastructure, Meituan can forecast demand surges, optimize delivery routes, and dynamically adjust driver incentives across geographies. This allows it to maintain service efficiency even in unfamiliar logistics environments. Moreover, its extensive use of automation—ranging from chatbot-based customer service to warehouse robotics—reduces the marginal cost of scaling operations in new markets.

The company also benefits from capital efficiency, supported by strong cash reserves and sustained domestic profitability. Unlike startups that must burn cash to buy market share, Meituan can afford a longer runway for return on investment in global markets. Its expansion budget is backed not by speculative VC capital, but by organically generated revenue streams. This financial stability allows Meituan to withstand prolonged gestation periods and resist the temptation to over-discount or engage in price wars that erode margins.

In addition to launching standalone operations, Meituan is exploring strategic partnerships with local players to accelerate its market entry. In Southeast Asia, it has reportedly held preliminary discussions with regional logistics firms and cloud kitchen operators, aiming to leverage their operational expertise while offering technological infrastructure and platform integration. These alliances are expected to reduce friction in scaling up and navigating unfamiliar legal and supply chain environments.

Importantly, Meituan’s global expansion is not solely about revenue diversification—it is also a hedge against regulatory volatility in China. As the domestic platform economy comes under increased scrutiny from Chinese regulators, including probes into anti-competitive behavior and labor rights, international revenue streams offer insulation from policy shocks. In this context, building a diversified portfolio of geographically dispersed income sources becomes a strategic necessity, not just an opportunity.

Despite these promising developments, challenges persist. In many international markets, Meituan must compete against entrenched incumbents with deep local knowledge, established customer bases, and pre-existing merchant networks. Furthermore, adapting to diverse legal frameworks—ranging from labor classification rules to data privacy laws—requires substantial compliance investment. There are also reputational risks: failure to adapt culturally or ethically could tarnish Meituan’s brand and undermine future growth.

Nevertheless, early signs suggest that Meituan is not merely transplanting its domestic model into foreign soil, but actively re-engineering it for international success. It is taking a disciplined, phased approach—prioritizing markets where it can secure early wins, build operational maturity, and then replicate its model elsewhere. This iterative methodology minimizes risk while maximizing learning, allowing Meituan to refine its international playbook continuously.

The company's international expansion timeline, detailed in Table 1, illustrates this calculated approach. From its initial tests in Hong Kong to its bolder venture in the Middle East, and exploratory movements in Southeast Asia, Meituan has demonstrated a blend of caution and ambition that few of its domestic peers have matched. Its growing international footprint is increasingly being seen not as an ancillary revenue channel, but as a core growth engine that complements and de-risks its domestic dominance.

In conclusion, Meituan’s global expansion is not just a geographic story—it is a strategic reinvention. By combining world-class logistics, scalable AI, localized adaptability, and strong financial discipline, the company is carving a space for itself in the increasingly crowded field of global platform giants. If current trajectories hold, Meituan’s international presence will soon be as defining as its domestic one, reshaping its identity from a Chinese super-app to a global enabler of on-demand commerce.

Innovation and Operational Efficiency

As Meituan extends its operational footprint beyond China, the company's capacity to innovate and operate with precision has become a critical differentiator. In a market category where margins are razor-thin and customer expectations are exceedingly high, operational efficiency is not merely a competitive advantage—it is a prerequisite for sustainable growth. At the core of Meituan’s success, both domestically and in emerging international markets, lies a sophisticated technological and logistical backbone designed to scale rapidly, adapt locally, and optimize relentlessly. This section explores how innovation and operational discipline have enabled Meituan to deliver superior service outcomes, reduce costs, and set new benchmarks in the on-demand economy.

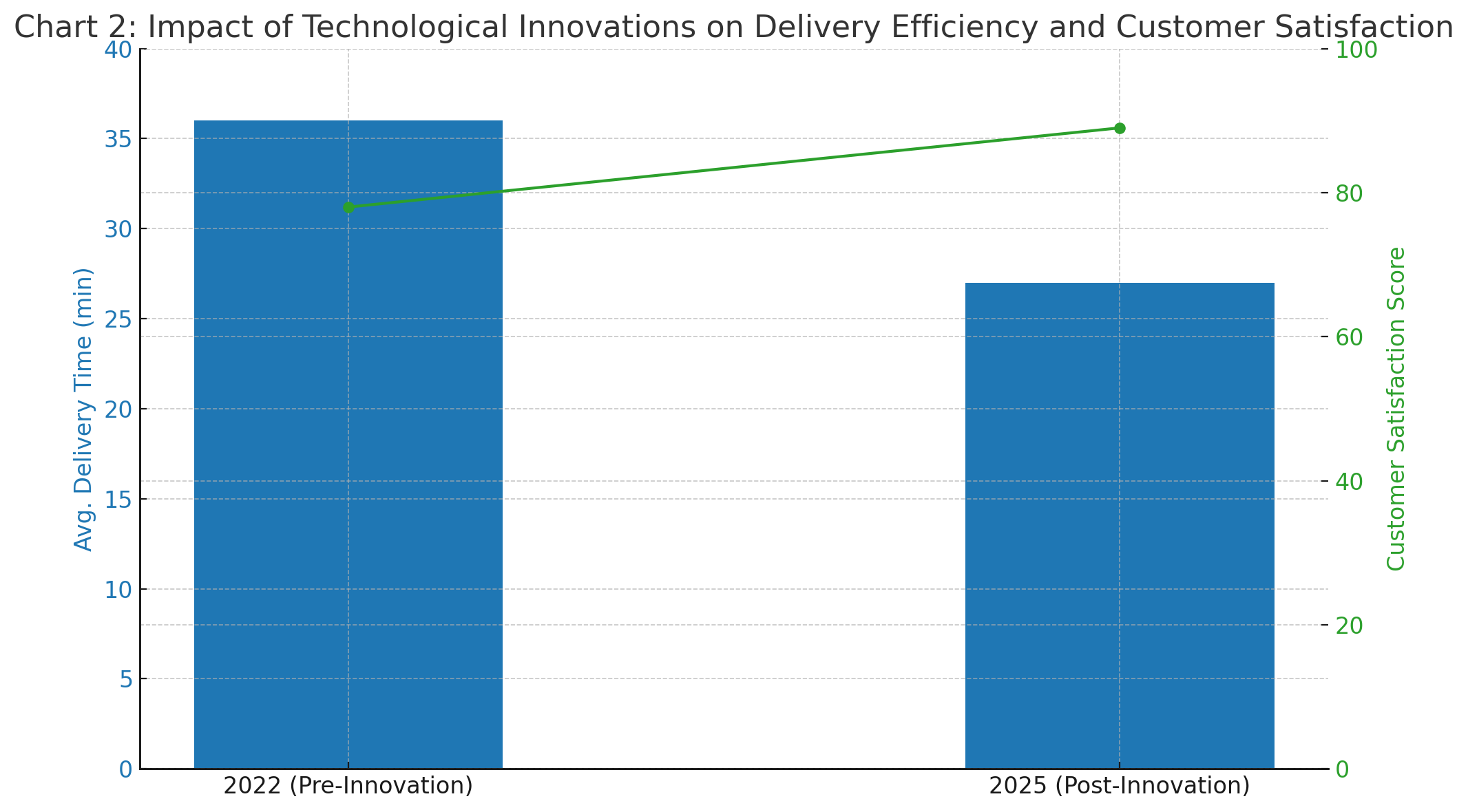

One of the most transformative aspects of Meituan’s operational infrastructure is its deployment of artificial intelligence (AI) across nearly every facet of its ecosystem. From order prediction and dynamic pricing to real-time delivery optimization and customer personalization, AI is deeply embedded in Meituan’s core processes. The company’s intelligent dispatch system—one of the most advanced in the industry—allocates delivery orders based on a range of real-time variables, including rider location, traffic congestion, restaurant prep times, and weather conditions. This system significantly reduces delivery delays, maximizes courier productivity, and enhances customer satisfaction.

In tandem with AI, Meituan’s use of machine learning algorithms for demand forecasting has proven particularly effective. These models analyze historical and behavioral data to predict order volumes at hyper-localized levels—sometimes down to individual neighborhoods or building complexes. Such predictive capability enables Meituan to pre-position delivery personnel and inventory, thereby minimizing idle time and improving throughput. In a service economy increasingly defined by immediacy, this predictive efficiency offers Meituan a distinct operational edge over global and regional competitors.

Another hallmark of Meituan’s innovation playbook is its emphasis on automation. In high-density urban areas, Meituan has introduced autonomous delivery vehicles (ADVs) to navigate short-distance routes. These vehicles, equipped with LiDAR, cameras, and navigation software, are capable of delivering goods to consumers without human intervention. Trials in cities such as Beijing, Shenzhen, and Shanghai have demonstrated both cost efficiency and consumer acceptance, laying the groundwork for potential global deployment in cities with similar urban layouts.

In addition to ground-based robots, Meituan has also made significant progress in unmanned aerial vehicle (UAV) logistics. The company has tested drone deliveries in select suburban regions, particularly in areas with geographical constraints that hinder conventional delivery. These drones have completed tens of thousands of successful deliveries in real-world conditions, reducing delivery times by as much as 50% in hard-to-access areas. While regulatory challenges remain in many countries, Meituan’s growing UAV expertise gives it a first-mover advantage as aviation authorities worldwide begin to liberalize airspace regulations for commercial drones.

Beyond the delivery network, Meituan has also introduced operational innovations in customer acquisition and retention. Notably, the company has deployed real-time coupon allocation engines powered by reinforcement learning. These systems determine the optimal discount type, timing, and delivery method for each individual user based on their behavior, purchase history, and current session data. The result is a significant uplift in conversion rates and average order value, particularly in price-sensitive segments. Such precision marketing is far more cost-effective than traditional blanket promotions and has become a cornerstone of Meituan’s monetization strategy.

Meituan’s innovations also extend to backend efficiency. The company operates a sophisticated merchant management system that provides vendors with AI-generated business insights, including peak-hour trends, popular menu items, customer feedback analytics, and promotional recommendations. This platform enables restaurants and retailers to fine-tune their operations, optimize inventory, and improve service quality—all of which directly benefit Meituan by improving customer retention and reducing order cancellations.

Crucially, these technologies are not only used to optimize performance but also to enhance sustainability and workforce well-being. Meituan has introduced AI-powered scheduling tools that balance courier workloads to prevent burnout and optimize delivery routes to reduce carbon emissions. In cities where electric scooters are permitted, the company subsidizes e-bike rentals for its riders, lowering both fuel costs and environmental impact. These initiatives support broader ESG (Environmental, Social, and Governance) goals and position Meituan as a responsible technology platform in an era of increasing stakeholder scrutiny.

From a financial standpoint, the impact of these innovations is tangible. According to the company’s internal metrics and disclosures, Meituan has achieved a 17% reduction in per-order delivery costs over the past two years, largely due to routing optimization and automation. Additionally, customer satisfaction scores have reached record highs, with average delivery times in tier-1 cities now under 28 minutes. Such improvements directly correlate with higher customer retention and lower churn rates—key drivers of long-term profitability in platform businesses.

Meituan’s approach to R&D investment also reflects its innovation-first mindset. In 2024 alone, the company allocated over 8.5 billion yuan ($1.2 billion) to research and development activities, representing nearly 10% of its total revenue. These investments span a broad spectrum, including robotics, edge computing, natural language processing, and computer vision. The company operates several dedicated innovation centers across China and has begun establishing satellite labs in regions targeted for international expansion. This proactive allocation of resources ensures that Meituan remains at the cutting edge of technological development.

To support and scale its innovation infrastructure, Meituan has also embraced cloud-native architectures and modular system design. Its proprietary cloud platform supports real-time analytics, elastic computing, and microservices architecture, allowing the company to rapidly test, iterate, and deploy new features across geographies. This architectural flexibility is especially critical as the company scales its international operations, where latency, regulatory compliance, and user behavior can vary dramatically.

Despite these advances, Meituan’s innovation journey is not without obstacles. The integration of autonomous systems with urban infrastructure, for example, requires coordination with local governments and transportation departments. Additionally, public acceptance of robots and drones remains variable across cultures and geographies. Moreover, while AI offers significant efficiency gains, it also introduces ethical considerations around data privacy, algorithmic bias, and the displacement of human labor—issues that Meituan must navigate with transparency and accountability.

Nonetheless, Meituan’s track record indicates a company capable of translating technological ambition into operational reality. By embedding innovation into its core functions—from logistics and customer engagement to merchant services and sustainability—Meituan has constructed an adaptive engine of growth. This engine not only propels its domestic leadership but also equips it to compete on the global stage against both incumbent and emerging challengers.

In summary, Meituan’s operational efficiency is the product of deliberate and sustained investment in innovation. Through its AI-powered logistics, autonomous delivery technologies, real-time personalization engines, and cloud-native platforms, the company has developed a future-proof operational model. As Meituan continues to enter new markets, its ability to replicate and localize these innovations will determine the scale and speed of its global ascendancy.

Challenges and Future Outlook

While Meituan’s financial and operational achievements paint a picture of success, the path forward is far from without obstacles. As the company continues to expand its international footprint and push the boundaries of on-demand service innovation, it must navigate a complex landscape of regulatory, competitive, and technological challenges. This final section examines the structural hurdles that Meituan faces and outlines potential scenarios that will shape its future trajectory—both as a global platform and as a technology leader.

Navigating Regulatory Complexities

One of the most persistent challenges facing Meituan lies in the regulatory environments in which it operates. In its home market of China, the company continues to contend with evolving antitrust laws, labor rights reforms, and cybersecurity mandates. Over the past two years, Chinese authorities have introduced a series of sweeping policy changes affecting large tech platforms, including mandates around data localization, gig worker protections, and fair competition. As a dominant player in food delivery and local commerce, Meituan remains under continuous scrutiny by state agencies. These regulations may constrain profitability by increasing compliance costs and limiting certain monetization practices such as exclusivity agreements or dynamic pricing strategies.

Outside China, Meituan faces a different but equally intricate regulatory puzzle. Countries in which it seeks to expand—such as those in the Gulf, Southeast Asia, and potentially Europe—enforce a wide variety of rules governing e-commerce, labor classification, data privacy, and consumer protection. The fragmentation of global regulatory regimes makes it difficult to apply a uniform business model across regions. Moreover, growing skepticism toward Chinese tech firms in certain Western jurisdictions may add further political and reputational risk to Meituan’s global expansion strategy.

Rising Competitive Pressures

Even as Meituan secures strong footholds in new markets, competitive dynamics remain fierce. In many international regions, local incumbents are well-capitalized and culturally attuned, offering formidable resistance to foreign entrants. For example, in Southeast Asia, companies like Grab and Gojek have already established multi-service ecosystems akin to Meituan’s. These rivals benefit from deep local knowledge, loyal user bases, and integration with regionally dominant payment platforms. Likewise, in the Middle East, players like Talabat and Jahez pose competition through government-backed partnerships and logistical agility.

To remain competitive, Meituan must continue to differentiate on technological grounds—offering faster deliveries, smarter routing, and more personalized experiences. However, the cost of customer acquisition in these environments is high, particularly when entering into markets with established duopolies or oligopolies. Without careful strategic planning and localized innovation, Meituan risks burning capital without achieving the necessary scale for profitability.

Talent, Culture, and Organizational Adaptability

Global expansion also places considerable demands on Meituan’s internal organization. Operating in multilingual, multicultural environments requires not only linguistic fluency but also a deep understanding of consumer behavior, social norms, and business etiquette. Building truly localized teams with empowered leadership is essential for capturing the nuance of foreign markets.

Additionally, Meituan must evolve its internal governance structures to support decentralized decision-making while preserving the core efficiency of its platform. This is a delicate balance. Excessive centralization can hinder responsiveness in new regions, while excessive decentralization can dilute brand consistency and operational coherence. Investing in cross-functional teams, global training programs, and region-specific KPIs will be crucial for long-term success.

Ethical and ESG Considerations

As Meituan scales, ethical considerations surrounding its business practices are increasingly coming under scrutiny. The company operates in sectors—such as food delivery and gig work—that have been historically criticized for labor exploitation and environmental impact. Questions about courier pay, working conditions, and long-term career sustainability are particularly pressing. Regulatory responses, including mandatory insurance schemes and minimum wage enforcement for gig workers, may increase operational costs.

On the environmental front, Meituan faces pressure to reduce the carbon footprint of its delivery network, packaging, and data centers. Although the company has initiated green logistics programs—including subsidies for electric scooters and investment in biodegradable packaging—stakeholders now expect detailed disclosures and measurable progress. ESG compliance is no longer a peripheral concern; it is a fundamental pillar of investor and public trust, especially as Meituan courts international capital and partnerships.

Technological Disruption and Cybersecurity

The very technologies that underpin Meituan’s competitive edge—AI, robotics, and real-time analytics—also introduce risks. Algorithmic transparency, data bias, and surveillance concerns could invite backlash from both regulators and the public. The increasing use of AI in areas such as pricing, job assignment, and consumer segmentation may raise fairness and privacy concerns, especially in jurisdictions with stringent digital rights frameworks.

Cybersecurity remains another high-priority risk. As Meituan collects vast quantities of personal and behavioral data from users, merchants, and couriers, it becomes a lucrative target for cyberattacks. A breach in one market could undermine consumer trust globally. Ensuring robust cybersecurity protocols, conducting frequent audits, and complying with cross-border data protection laws will be essential to maintaining digital resilience.

Strategic Outlook: What Lies Ahead

Despite these challenges, Meituan is well-positioned to thrive if it continues to apply the same discipline and foresight that have characterized its rise in China. Analysts forecast a compound annual growth rate (CAGR) of 12–15% for Meituan’s international revenue over the next five years, driven by deeper market penetration, adjacent service expansion, and higher per-order value. By 2030, international markets could account for over 30% of Meituan’s total revenue, transforming it from a China-centric powerhouse into a truly global technology platform.

To reach this future state, Meituan must continue executing on three strategic fronts:

- Selective Market Expansion – Prioritizing regions where regulatory frameworks are clear, digital infrastructure is advanced, and consumer appetite aligns with its service model.

- Operational Flexibility – Adapting its logistics architecture and service portfolio to reflect local conditions while preserving the technological DNA of the Meituan brand.

- Innovation-Led Differentiation – Maintaining R&D momentum in areas such as autonomous delivery, personalized commerce, and AI-powered merchant services.

Moreover, Meituan’s potential to act as a technology exporter should not be underestimated. As more countries look to build smart cities and digitize local economies, Meituan’s logistics expertise, platform algorithms, and infrastructure management capabilities could be licensed or integrated into public-private initiatives. This "B2G" (business-to-government) and "B2B" angle opens additional revenue streams beyond the consumer-facing app, further diversifying its business model.

Final Considerations

In conclusion, Meituan’s future will be defined by how effectively it navigates a dual challenge: sustaining its core advantage at home while building a resilient, adaptive presence abroad. The company's track record—grounded in continuous innovation, data-driven agility, and bold strategic moves—suggests it is up to the task. However, global scale brings global scrutiny. As Meituan expands, it must not only operate efficiently but also lead responsibly, maintaining the trust of users, workers, partners, and regulators across diverse geographies.

Meituan’s journey is emblematic of a broader shift in the global tech ecosystem—where companies born in domestic markets must now think, act, and innovate with a global mindset. Whether it ultimately succeeds will depend not just on code or capital, but on its ability to integrate vision with execution in an increasingly complex and interdependent world.

References

- Meituan Financial Earnings Overview –

https://www.reuters.com/technology/chinese-food-delivery-giant-meituan-beats-quarterly-revenue-expectations-2025-05-26 - Hong Kong Launch of Keeta –

https://www.wsj.com/business/earnings/meituans-profit-triples-as-revenue-grows-despite-competition-cb6b5d1c - Meituan Overview and Services –

https://www.wikipedia.org/wiki/Meituan - AI in Meituan’s Delivery Operations –

https://technode.com/2023/11/01/meituans-ai-powered-delivery-strategy - Meituan Drone Delivery Projects –

https://kr-asia.com/meituan-tests-drone-deliveries-to-beijing-customers - Saudi Arabia Expansion –

https://gulfnews.com/business/meituan-launches-in-riyadh-with-266m-investment - Global Food Delivery Market Trends –

https://www.statista.com/outlook/mmo/food-delivery/worldwide - Autonomous Delivery in China –

https://asia.nikkei.com/Business/Technology/Meituan-rolls-out-robot-deliveries-in-Beijing - Southeast Asia Platform Competition –

https://www.techinasia.com/food-delivery-giants-clash-southeast-asia - ESG Challenges for Gig Platforms –

https://www.brookings.edu/articles/gig-economy-workers-and-tech-platforms-regulatory-perspectives