Lenovo’s Shares Sink After PC, AI Hardware Rivals Squeeze Profit: A Deep Dive into Market Dynamics and Strategic Responses

In the rapidly evolving technology sector, few companies have dominated the personal computing landscape as thoroughly as Lenovo. Headquartered in Beijing and Morrisville, North Carolina, the tech giant has long maintained its status as the world’s largest PC maker by unit shipments. However, recent financial reports suggest that Lenovo’s dominant position is under increasing pressure, driven by intensifying competition from rivals in both the PC and AI hardware markets. This financial strain has culminated in a sharp decline in its share price, with investors reacting swiftly to a significant drop in quarterly profits and warning signs in its growth trajectory.

On May 23, 2025, Lenovo’s stock fell over 10% following the release of its Q4 and full-year earnings. Most notably, the company reported a 64% plunge in quarterly profits, surprising many analysts and investors. While part of the decline was attributed to a non-cash decrease in the value of warrants linked to its Fujitsu deal, a broader concern emerged from flatlining PC sales, rising component costs, and a growing list of aggressive competitors in both consumer and enterprise markets.

This downturn comes at a time when the global technology landscape is undergoing profound transformation. Artificial Intelligence (AI), cloud computing, edge devices, and specialized processors are reshaping how enterprises and consumers interact with technology. Lenovo, traditionally anchored in the PC market, is in the midst of a multi-year pivot toward becoming a broader "intelligent transformation" provider. However, its efforts are now being tested by an influx of nimble startups and entrenched rivals such as Dell, HP, Apple, and AI hardware leaders like Nvidia and Huawei.

As Lenovo attempts to navigate this transitional phase, its financials reveal some deep-rooted vulnerabilities. Revenue from its Intelligent Devices Group (IDG), which includes its PC and smartphone business, remained largely stagnant. Meanwhile, its Infrastructure Solutions Group (ISG)—responsible for AI servers and data center hardware—showed signs of growth but failed to offset the broader slowdown. Adding to the complexity are geopolitical tensions, supply chain disruptions, and the ongoing recalibration of global demand post-pandemic.

This blog post aims to provide an in-depth analysis of Lenovo’s current financial condition, competitive pressures, strategic initiatives, and market outlook. We will dissect Lenovo’s earnings report, compare its position to that of its closest competitors, and evaluate the broader implications for the global PC and AI hardware industries. To enrich this analysis, two visual charts will highlight revenue trends and stock performance, while a comparative table will assess key financial and strategic metrics across Lenovo and its peers.

Understanding Lenovo’s challenges is not merely an exercise in corporate finance; it serves as a broader case study in how legacy technology firms adapt—or fail to adapt—to transformative eras in computing. As AI, automation, and edge intelligence become more pervasive, the stakes for Lenovo and similar firms continue to grow. Whether Lenovo can recover from this earnings shock and realign itself with the industry’s high-growth vectors remains a pivotal question—one with implications for investors, customers, and the global tech supply chain.

In the following sections, we will explore Lenovo’s financial performance in granular detail, assess the competitive landscape in which it operates, evaluate its strategic roadmap, and conclude with a forecast of potential outcomes based on current data and market signals.

Financial Performance: A Closer Look

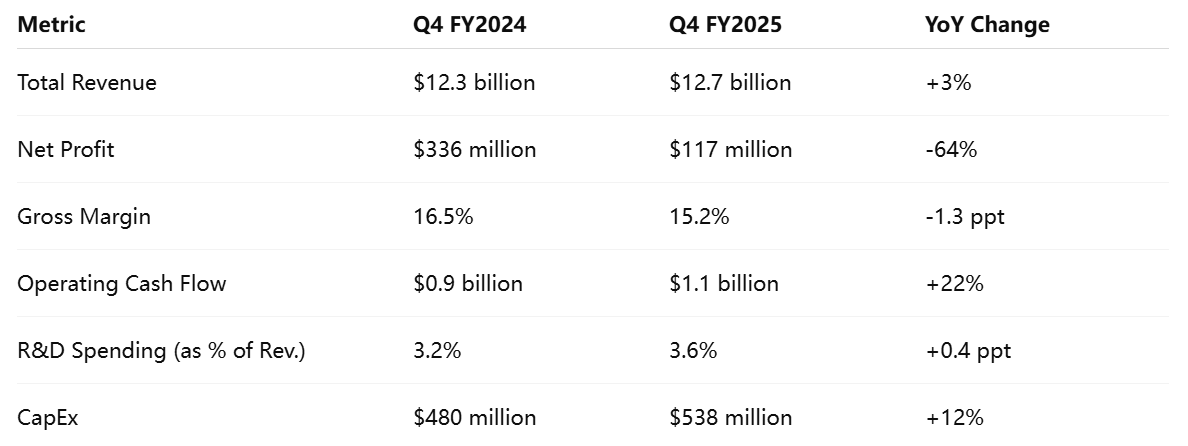

Lenovo’s recent earnings report has cast a spotlight on the financial vulnerabilities that accompany its transformation journey. For the fiscal fourth quarter ending March 2025, the company reported a staggering 64% year-over-year decline in net profit, amounting to $117 million, sharply down from $336 million in the same quarter the previous year. This significant downturn underscores broader systemic issues within Lenovo’s operational and strategic framework, driven by softening demand in its core PC segment and rising challenges in newer business verticals.

Revenue Overview and Segmental Performance

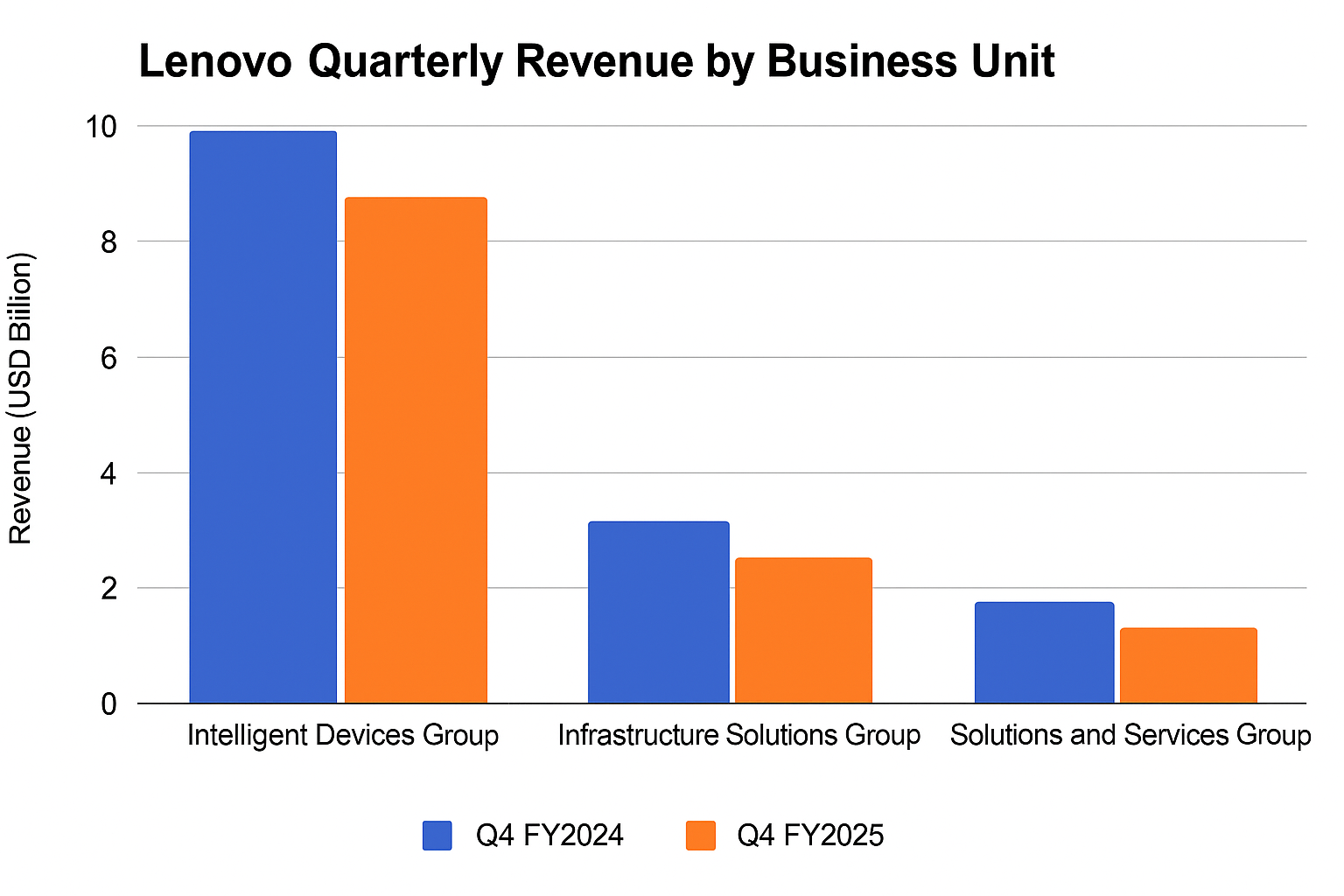

Lenovo’s total revenue for the quarter stood at $12.7 billion, representing a modest 3% year-over-year increase. While the revenue figure itself may appear stable, it masks underlying weakness in Lenovo’s traditional growth engine—the Intelligent Devices Group (IDG), which includes personal computers and smartphones. This division contributed nearly 70% of total revenue, but its growth was virtually flat. While Lenovo maintains the largest share of the global PC market, the broader industry is undergoing a structural shift post-COVID. Elevated inventory levels, longer PC refresh cycles, and budget constraints in enterprise IT spending have dampened demand.

In contrast, Lenovo’s Infrastructure Solutions Group (ISG), which comprises its data center, AI server, and storage hardware businesses, experienced a revenue uptick of 16% year-over-year. However, ISG remains a smaller contributor, accounting for only 11% of Lenovo’s total revenue. The third key segment, the Solutions and Services Group (SSG), encompassing software, IT services, and digital transformation solutions, posted moderate growth at 8%, revealing Lenovo’s intention to build a recurring revenue base. Despite this, the overall growth rate is insufficient to offset the margin pressure seen in the IDG business.

Profitability Erosion and Margin Pressures

A major contributor to the profit collapse was a $249 million non-cash accounting charge related to a drop in the value of warrants it issued during its acquisition of a stake in Fujitsu’s PC business. Although this is a technical write-down, it impacted investor sentiment negatively due to its magnitude and timing.

Gross margin declined from 16.5% to 15.2%, driven by intensified price competition in the PC sector and inflationary cost pressures on components. While Lenovo has traditionally excelled in operational efficiency and supply chain management, the rapid pace of change in component pricing—particularly for AI GPUs, memory chips, and advanced cooling technologies—has posed new cost management challenges.

Moreover, Lenovo has been increasingly bundling its PCs with additional service offerings, which has helped support average selling prices (ASPs) but has not translated into sufficient volume growth. The narrowing gross margin signals a need for Lenovo to either transition to higher-margin offerings more rapidly or undertake further cost rationalization.

Stock Market Reaction and Investor Concerns

Following the release of the earnings report, Lenovo’s shares fell more than 10% in a single trading session on the Hong Kong Stock Exchange, reflecting the market’s disappointment. This was Lenovo’s steepest single-day decline in over a year, driven largely by concerns about its ability to maintain profitability amid intensifying competitive headwinds from Dell Technologies, HP Inc., Apple, and fast-emerging Chinese AI hardware firms such as Inspur and Huawei.

Investor sentiment was further dampened by the absence of a clear signal from Lenovo’s management on whether it would accelerate its AI hardware investments or prioritize profit stabilization. The lack of guidance on upcoming product launches and strategic capital allocation also contributed to the stock selloff.

Cash Flow, R&D, and Capital Expenditure Trends

Despite earnings weakness, Lenovo reported a positive cash flow from operations of $1.1 billion for the quarter, a sign of resilient working capital management. However, capital expenditures rose 12% year-over-year, with increased investments in data center expansion and AI compute infrastructure, particularly in partnership with Nvidia and AMD.

Lenovo’s R&D spending reached 3.6% of total revenue, reflecting its efforts to shift toward high-performance computing (HPC), edge computing, and AI integration across devices. Notably, the company expanded its AI Innovation Centers in Europe and Asia during the quarter, but returns from these investments are expected to materialize only in the medium to long term.

Forward-Looking Statements and Market Guidance

In its earnings call, Lenovo reiterated its strategic focus on three core growth drivers: hybrid AI computing, edge-to-cloud services, and industry-specific digital transformation solutions. However, it refrained from offering concrete forward guidance for the upcoming quarter, citing macroeconomic uncertainty, exchange rate volatility, and fluctuating enterprise budgets.

Management highlighted a cautious outlook for PC demand recovery, projecting a mild rebound in the second half of 2025 but acknowledging that generative AI use cases have yet to drive meaningful hardware refresh cycles among mainstream consumers and small businesses. Additionally, Lenovo plans to re-evaluate its regional pricing strategies, especially in price-sensitive markets like India, Southeast Asia, and Latin America.

In summary, Lenovo’s latest financial results highlight a company at a strategic inflection point. While there are green shoots in its services and infrastructure units, the company continues to be burdened by a reliance on its legacy PC business, which is under siege from multiple angles. Profitability has deteriorated sharply, and despite healthy operational cash flow, the absence of near-term catalysts and intensified rivalry in AI hardware leaves Lenovo facing an uphill battle.

Competitive Pressures – The Squeeze from Rivals

As Lenovo grapples with waning profitability and investor skepticism, a critical dimension of its current predicament lies in the intensifying competitive pressures exerted by both long-standing and emerging players in the PC and AI hardware arenas. While Lenovo continues to lead in global PC shipments, its strategic footing is increasingly being tested by rivals that have adapted more swiftly to the market's changing dynamics. From traditional competitors like Dell Technologies and HP to specialized AI hardware leaders such as Nvidia, Huawei, and Apple, Lenovo is facing a multi-front battle for relevance, margin protection, and long-term growth.

Traditional PC Competitors: Margin Wars and Innovation Pace

Lenovo’s PC business—historically its crown jewel—is under relentless pressure from other global OEMs. Dell and HP, Lenovo’s two closest competitors in the PC space, have implemented aggressive pricing strategies in both enterprise and consumer segments. During the latest fiscal quarter, Dell reported stronger-than-expected growth in its commercial PC segment, aided by bundling strategies and a shift toward premium enterprise solutions. HP, on the other hand, continues to strengthen its foothold in education and government procurement markets, leveraging its hybrid work and learning products.

One major concern for Lenovo is the increasingly commoditized nature of low-to-mid-tier PCs, where price elasticity is high and brand loyalty is limited. Both Dell and HP have streamlined their logistics networks and adopted more responsive supply chains, enabling them to weather demand shocks more effectively. Lenovo’s longer-than-average inventory cycles, especially in emerging markets, have begun to undercut its historical advantage in cost efficiency.

Moreover, Apple’s expanding influence in the PC ecosystem has added a new layer of complexity. Mac shipments rebounded strongly in early 2025, driven by the growing adoption of M3-series chips and superior battery performance for mobile users. Apple's tight hardware-software integration, ecosystem lock-in, and premium brand positioning have enabled it to avoid the margin squeeze impacting Windows OEMs. For Lenovo, this resurgence means losing affluent, high-margin customers who are increasingly prioritizing performance and ecosystem consistency over price.

The Rise of AI-Centric Hardware Players

The surge in demand for AI-driven computing has ushered in a new era of hardware competition—one in which Lenovo finds itself outpaced by more specialized and agile firms. Companies like Nvidia, AMD, Huawei, and even startups like Cerebras and Groq are capitalizing on the generative AI revolution by producing highly optimized chips and servers tailored for AI workloads.

Nvidia, in particular, has become the bellwether of AI infrastructure. Its latest Blackwell GPU architecture, released in 2025, is being rapidly adopted across hyperscale data centers and AI model training centers. Lenovo’s ISG division partners with Nvidia for its AI server offerings, but this partnership comes with limitations. While Lenovo provides the server chassis and integration, Nvidia captures most of the margin through its proprietary chips and software stack (CUDA, TensorRT). This model leaves Lenovo in a vulnerable position—playing a volume game without the benefit of proprietary control or software monetization.

Huawei, despite export controls and geopolitical hurdles, has managed to expand its AI and cloud server business within China and select Southeast Asian markets. Through its Ascend AI chips and Kunpeng server line, Huawei is effectively competing with Lenovo’s domestic market share. With significant state backing, Huawei is capable of undercutting prices while maintaining a high rate of R&D reinvestment—an advantage that Lenovo, as a publicly traded multinational, cannot easily replicate.

Services and Cloud Ecosystem Integration

A further dimension of competitive squeeze emerges from the services and cloud integration space. Hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have begun offering integrated AI workstations and cloud-native development environments, reducing the need for on-premises hardware. This shift directly threatens Lenovo’s enterprise ISG business, which still depends heavily on physical hardware sales to traditional IT departments.

Dell has countered this trend by launching Project Helix—an initiative to tightly integrate its hardware portfolio with AI-centric software and services, co-developed with Nvidia. Similarly, HP’s recent acquisition of a cloud-native AI startup has bolstered its capability to offer AI-as-a-service solutions. Lenovo’s Software and Services Group (SSG), while steadily growing, remains relatively underdeveloped in comparison. Without a strong recurring revenue engine, Lenovo is more susceptible to macro-driven capex cycles.

Pricing Volatility and Supply Chain Rivalry

One of Lenovo’s most critical historical advantages has been its vertically integrated supply chain and manufacturing base in China. However, this very dependency is turning into a liability amid geopolitical uncertainty and rising tariffs in key markets like the U.S. and Europe. Dell and HP have both diversified their assembly operations to Vietnam, Mexico, and India, enabling more agility in response to trade disruptions. In contrast, Lenovo’s heavier reliance on Chinese factories exposes it to greater risk in case of further export restrictions or sanctions.

Additionally, competition for components—especially AI GPUs and high-speed memory—is driving up prices and creating fulfillment bottlenecks. Firms with direct chip design capabilities or long-term exclusive contracts with foundries are better positioned to maintain cost control. Lenovo, which sources from a broad array of third-party suppliers, is finding it increasingly difficult to shield its cost base from this volatility.

Brand Perception and Global Positioning

Another area of competitive concern lies in brand perception. While Lenovo holds strong brand equity in Asia and parts of Europe, it continues to lag behind competitors like Apple and Dell in the U.S. premium market. Lenovo’s identity as a “volume player” in the PC sector contrasts with the image of innovation and high performance that many of its rivals cultivate. This perception gap is becoming increasingly consequential as enterprise and consumer buyers prioritize innovation and integrated experiences in their purchasing decisions.

Moreover, Lenovo’s marketing and channel strategies have not kept pace with the digital-first initiatives deployed by competitors. Dell’s direct-to-consumer model, HP’s immersive education platforms, and Apple’s curated retail experiences are all tailored to the evolving expectations of digital buyers. Lenovo’s relatively traditional channel reliance may constrain its ability to engage with newer buyer personas and deliver differentiated experiences at scale.

In conclusion, Lenovo’s competitive environment is marked by a growing asymmetry—where rivals either dominate in innovation, pricing power, ecosystem integration, or regional focus. The challenge for Lenovo is not just about defending its turf in PCs or servers, but about fundamentally repositioning itself in a rapidly transforming technology value chain. Without bold strategic recalibration, Lenovo risks further erosion of market share and margin compression, especially as hardware continues to commoditize and value shifts toward AI, services, and software-defined infrastructure.

Strategic Repositioning – Lenovo’s Roadmap Amid Uncertainty

As Lenovo faces mounting external and internal pressures, the company’s leadership has articulated a strategy aimed at transforming the enterprise from a PC-centric manufacturer into a diversified, solutions-driven technology player. This repositioning effort is guided by a vision Lenovo refers to as “Smarter Technology for All”—a doctrine that emphasizes innovation in intelligent infrastructure, AI-enabled services, and end-to-end digital transformation. Yet, while the framework is clear in theory, execution remains challenging amid a backdrop of thinning margins, volatile macroeconomic conditions, and hypercompetitive dynamics in AI and cloud computing.

Strengthening the Intelligent Devices Group (IDG)

Lenovo’s primary cash-generating business unit, the Intelligent Devices Group, is undergoing a gradual shift in focus. Traditionally responsible for the bulk of Lenovo’s revenue through PC and smartphone sales, IDG is now pivoting to emphasize premium and commercial devices, where margins are higher and product lifecycles are longer. In recent quarters, Lenovo has launched a refreshed line of Yoga, Legion, and ThinkPad devices equipped with AI acceleration features and improved thermal engineering to meet the needs of hybrid workers and creators.

One cornerstone of this repositioning is Lenovo’s development of “AI PCs”—personal computers embedded with neural processing units (NPUs) designed to locally handle tasks such as speech recognition, language translation, and image generation without needing cloud access. These devices are being positioned as essential tools for knowledge workers in industries ranging from finance to healthcare. However, the commercial traction for AI PCs remains limited thus far, and broader adoption will likely depend on ecosystem support from OS vendors like Microsoft and software partners.

Lenovo is also investing in sustainability-focused design principles—using recycled materials, improving energy efficiency, and enabling repairability—to strengthen its appeal among environmentally conscious enterprises and consumers.

Expanding the Infrastructure Solutions Group (ISG)

The Infrastructure Solutions Group has been positioned as Lenovo’s growth engine for the future, with a focus on servers, storage, AI infrastructure, and edge computing. ISG has posted consistent year-over-year growth, bolstered by high-performance computing (HPC) projects and strategic partnerships with chipmakers such as Nvidia, AMD, and Intel.

To compete more effectively in the AI server market, Lenovo is doubling down on co-engineered solutions. Through its “TruScale” brand, the company offers AI infrastructure as a service—providing customers with on-demand scalability and predictable operational costs. Lenovo’s AI-ready servers, certified under Nvidia’s MGX and HGX reference architectures, are now being deployed across industries such as genomics, manufacturing automation, and autonomous vehicles.

Moreover, Lenovo has expanded its AI Innovation Centers globally—creating hubs in Stuttgart, Singapore, and Raleigh—designed to co-develop enterprise-grade AI use cases with clients. These efforts are intended to position Lenovo as more than a hardware vendor, and instead as a strategic partner in customers’ digital transformation journeys.

Nonetheless, ISG still faces profitability constraints due to the capital-intensive nature of the server business and its dependency on third-party chip providers for differentiation. Lenovo has yet to produce its own AI chips or proprietary accelerators, limiting its ability to capture vertical margins like Nvidia or Huawei.

Building Momentum in Solutions and Services Group (SSG)

Lenovo’s most forward-looking bet lies in the growth of its Solutions and Services Group, which includes managed services, cloud migration consulting, and enterprise software integration. As of Q4 FY2025, SSG represents the company’s smallest revenue segment but enjoys the highest margins—reflecting its ability to generate recurring income streams and deepen client relationships.

SSG’s strategic pillars include:

- Lenovo TruScale Services: Subscription-based offerings for everything from device management to data center provisioning.

- Lenovo Care and Premium Support: Upselling support contracts to extend lifecycle services for devices.

- Vertical Solutions: AI-powered use cases in retail (smart shelves), education (learning analytics), and healthcare (clinical imaging optimization).

The long-term ambition is to transition from a CapEx-heavy sales model to an OpEx-centric, platform-based business. While the services strategy is promising, Lenovo will need to scale faster and recruit talent from top-tier cloud and consulting firms to compete with established managed service providers and systems integrators.

Geographic Diversification and Supply Chain Evolution

A key component of Lenovo’s roadmap is geographic diversification—not only in terms of customer base but also in manufacturing footprint. While the company has historically benefited from economies of scale in China, rising geopolitical risk has prompted Lenovo to expand production in Mexico, India, and Eastern Europe. These investments aim to mitigate exposure to tariffs, export controls, and regional instability.

In parallel, Lenovo is investing in smart factories powered by AI and robotics. Its plant in Shenzhen now features automated inspection systems and predictive maintenance, improving yield and operational efficiency. Additionally, Lenovo is adopting more agile inventory models and leveraging AI to forecast demand shifts across global markets more accurately.

These efforts are part of a broader push to reposition Lenovo as a tech-industrial hybrid—capable of both high-volume manufacturing and digital innovation. However, these supply chain shifts require significant capital and may compress margins in the near term.

Investment in Research & Development and Ecosystem Partnerships

Lenovo has signaled its long-term commitment to innovation through increased R&D investments—reaching 3.6% of revenue in FY2025. The company is exploring custom silicon development, intelligent edge software stacks, and human-AI interaction interfaces. Collaborative partnerships with academic institutions and cloud hyperscalers aim to embed Lenovo more deeply into the AI research ecosystem.

Recent initiatives include:

- Collaborations with Microsoft Azure for cloud-integrated AI PCs.

- Joint ventures with Nvidia to deploy AI factories across Asia.

- Open-source contributions to Kubernetes-native device management frameworks.

By embedding itself into emerging AI ecosystems, Lenovo hopes to evolve from a transactional hardware supplier into a participant in broader platform economies.

In summary, Lenovo’s strategic roadmap is multifaceted and ambitious. The company is working to transform itself across every dimension—product, service, operations, and market footprint. The pivot from legacy PC sales to intelligent transformation is conceptually strong, but its success will depend on swift execution, faster monetization of AI investments, and the ability to differentiate against deep-pocketed and agile competitors. As Lenovo steps into the next phase of its evolution, it must prove that it can generate sustainable growth and resilience amid the technology sector’s most volatile and disruptive period in decades.

Market Outlook – Risks, Opportunities, and Lenovo’s Future

As Lenovo stands at a strategic crossroads, its future trajectory hinges not only on internal restructuring and innovation but also on navigating an increasingly volatile and complex market environment. The broader technology industry is undergoing a tectonic shift toward artificial intelligence, automation, and cloud-first paradigms—dynamics that simultaneously present transformative opportunities and existential threats for legacy hardware players like Lenovo. This section evaluates the macro and sector-specific outlook, identifies key risks and opportunities, and presents plausible future scenarios that may define Lenovo’s path over the coming years.

The Post-PC World: Declining Relevance or Reinvention?

The global PC market has matured significantly, with shipments peaking during the COVID-19 pandemic and subsequently entering a period of normalization. IDC estimates that PC shipments will remain largely flat through 2026, with annual growth averaging under 2% globally. For Lenovo, which still derives over two-thirds of its revenue from PCs and smart devices, this presents a structural ceiling unless it accelerates diversification.

In the face of stagnation, Lenovo’s vision of an “AI PC” emerges as a key differentiator. These machines, designed to handle generative AI workloads locally, are intended to drive a new refresh cycle in enterprise and creative sectors. However, the success of this category will depend heavily on broader ecosystem adoption—such as software providers building NPU-aware applications—and consumer education. Without industry-wide support, AI PCs risk being perceived as niche or redundant in a cloud-dominated workflow environment.

Therefore, Lenovo’s challenge in the post-PC era is not simply to maintain relevance but to lead reinvention. By aligning itself with emerging workflows that demand greater compute at the edge and tighter integration with AI capabilities, Lenovo has a chance to reframe its market narrative—from a commoditized device maker to a high-value solution provider.

AI and Edge Computing: A Frontier for Growth

Artificial Intelligence, especially in its generative and inferencing formats, is set to define the next decade of enterprise IT and consumer technology. For Lenovo, this presents a dual opportunity: to serve as the hardware backbone for data center and cloud infrastructure, and to provide edge devices that enable decentralized AI processing across industries.

Lenovo’s AI-ready server portfolio and its partnership with Nvidia position it to capture demand from enterprise customers building private AI models. In sectors like healthcare, finance, and manufacturing, on-premises AI infrastructure offers advantages in latency, data security, and customization. Meanwhile, Lenovo’s edge computing solutions—bundled with vision processing, IoT, and real-time analytics—are already being piloted in smart city and retail deployments.

To fully capitalize on these trends, Lenovo must continue investing in reference architectures, developer toolkits, and integration frameworks that simplify deployment. The company’s global AI Innovation Centers are a promising start, but more aggressive go-to-market strategies and ecosystem partnerships will be necessary to secure first-mover advantages in key verticals.

Services-Led Transformation: Building Recurring Revenue

The global shift toward software-as-a-service (SaaS) and platform models is reshaping enterprise IT consumption. Customers increasingly prefer predictable operating expenses and outcome-based services over capital-intensive, product-centric procurement. This shift plays directly into the objectives of Lenovo’s Solutions and Services Group (SSG).

If scaled correctly, SSG can become Lenovo’s engine for stable growth, higher margins, and customer stickiness. The “TruScale” platform—a portfolio of device-as-a-service, infrastructure-as-a-service, and managed service offerings—aligns well with this new IT ethos. Furthermore, verticalized services tailored for education, healthcare, and logistics add depth to Lenovo’s value proposition.

However, Lenovo’s transition to a service-led business model requires deep operational change. From sales compensation to customer success frameworks and long-term support infrastructure, the company must rebuild its commercial DNA. Competing against seasoned cloud providers and systems integrators, Lenovo must move quickly to acquire, partner, or build service capabilities that differentiate on speed, reliability, and vertical expertise.

External Risks: Macroeconomics, Geopolitics, and Supply Chains

Lenovo’s global footprint exposes it to a variety of exogenous risks that could derail or delay its transformation efforts. Chief among them are macroeconomic headwinds, including inflation, interest rate volatility, and global capital expenditure tightening. With enterprise IT budgets under constant scrutiny, even promising product lines may experience elongated sales cycles.

Geopolitical tensions, particularly between the U.S. and China, present another layer of unpredictability. Lenovo’s dual headquarters and China-based manufacturing hub place it in a delicate position amidst increasing scrutiny over data security, origin tracing, and market access. Export restrictions on advanced chips, potential tariffs, and limitations on cloud services partnerships could constrain Lenovo’s freedom to operate—especially in strategic segments like AI and HPC.

Furthermore, global supply chains remain fragile. While Lenovo’s smart manufacturing and supplier diversification strategies are in progress, disruptions in key semiconductor supply, shipping bottlenecks, or regulatory changes could still significantly impact delivery timelines and cost structures.

Strategic Opportunities: M&A, Verticalization, and Ecosystem Expansion

To accelerate its transformation, Lenovo must look beyond organic growth and consider strategic acquisitions, joint ventures, and ecosystem alliances. Acquiring niche AI startups, cloud-native service providers, or software vendors could fast-track Lenovo’s entry into high-margin verticals. Similarly, co-developing reference architectures with cloud providers or ERP vendors could expand Lenovo’s addressable market.

The company also has a unique opportunity to deepen its presence in underpenetrated markets across Southeast Asia, Latin America, and parts of Africa—regions where digital infrastructure investments are expected to rise rapidly. By offering localized solutions tailored to public sector, education, and small business segments, Lenovo can generate new growth layers with first-mover advantage.

Finally, Lenovo’s global innovation ecosystem—with partnerships in academia, research, and venture capital—should be further leveraged to position the company as a thought leader in AI and digital transformation. This reputational capital will be crucial in attracting top talent, engaging institutional investors, and shaping industry standards.

Strategic Patience and Bold Execution

In closing, Lenovo’s future is a tale of both challenge and promise. The company's recent financial turbulence and share price decline underscore the urgency of transformation. But beneath the surface, Lenovo holds significant assets—global scale, operational excellence, brand recognition, and a foothold in next-generation technologies.

The path forward will require a careful balance of strategic patience and bold execution. Lenovo must not only defend its core businesses but also accelerate its pivot into AI, edge computing, and services. External uncertainties will persist, but companies that remain agile, customer-focused, and innovation-driven tend to emerge stronger from disruption.

For investors, employees, partners, and customers alike, the coming years will reveal whether Lenovo can transition from a legacy hardware champion to a foundational player in the AI-first economy.

References

- Lenovo Investor Relations – Earnings Reports

https://investor.lenovo.com/en/ - IDC – Global PC Shipments Overview

https://www.idc.com/getdoc.jsp?containerId=prUS51113523 - CNBC – Lenovo Shares Fall After Earnings Miss

https://www.cnbc.com/2024/05/23/lenovo-shares-drop-on-profit-decline.html - Reuters – Lenovo Hit by Sluggish PC Demand

https://www.reuters.com/technology/lenovo-profit-drops-pc-weakness-2024-05-23/ - TechCrunch – AI Hardware Race Heats Up

https://techcrunch.com/ai-hardware-startups-gaining-ground/ - Nvidia – Blackwell Architecture Details

https://www.nvidia.com/en-us/data-center/blackwell-gpu-architecture/ - HP Official Newsroom – Q2 Financial Highlights

https://press.hp.com/us/en/press-releases.html - Dell Technologies – Project Helix Overview

https://www.dell.com/en-us/dt/solutions/project-helix/index.htm - Bloomberg – Global Tech Stocks React to Earnings Season

https://www.bloomberg.com/markets - Gartner – AI Infrastructure Forecast and Vendor Analysis

https://www.gartner.com/en/newsroom