HyImpulse’s First Commercial Rocket Launch: A New Milestone for Europe’s Space Ambitions

Europe’s space industry has reached a historic milestone with the first commercial rocket launch by HyImpulse, a German startup. In early 2024, HyImpulse successfully launched its SR75 rocket on a suborbital flight – the first such launch by a German company in decades. This achievement is more than just a one-off triumph; it signals Europe’s growing determination to foster a homegrown launch sector. For years, Europe lagged behind the U.S. and even new spacefaring nations in developing privately-built orbital rockets. Now, with HyImpulse’s launch and several other startups on the cusp of debut flights, Europe is “finally getting serious about commercial rockets,” in the words of Harvard-Smithsonian astronomer Jonathan McDowell.

In this blog post, we’ll dive into the story behind HyImpulse and its groundbreaking launch. We’ll explore the company’s background and unique hybrid-propulsion technology, give details of that first flight and its outcome, and place it in the broader context of Europe’s space industry. We’ll also include visuals—a timeline of HyImpulse’s journey and charts comparing Europe’s leading space startups – to illustrate how this launch fits into a larger narrative. Finally, we’ll consider the environmental and market impacts of HyImpulse’s approach and include commentary from experts on why this launch matters.

Whether you’re a space enthusiast or a general reader, this post will provide a clear and engaging overview of why HyImpulse’s first commercial launch is such a significant event for Europe. It’s a story of innovation, perseverance, and the dawn of a new era where European startups aim to compete in the global launch market. Let’s begin by looking at who HyImpulse is and how they got here.

Background on HyImpulse

HyImpulse Technologies is a German private space launch company founded in 2018. The company emerged as a spin-off from research at the German Aerospace Center's (DLR) propulsion institute in Lampoldshausen, led by a group of four graduate students from the University of Stuttgart. Among its co-founders are Dr. Mario Kobald and Dr. Christian Schmierer, who now serve as co-CEOs. From the outset, HyImpulse’s mission has been to develop a cost-effective small satellite launch vehicle using hybrid-propellant rocket engines—a technology that promises to combine the best of solid and liquid fuel rockets.

Despite being a young startup, HyImpulse benefited from both public grants and private investment in its early years. It received over €5 million in research grants from EU and German government programs, supporting its R&D efforts. The company’s primary investor is Rudolf Schwarz (via Schwarz Holding GmbH), the chairman of German technology firm IABG, who provided at least another €5 million in seed funding. This relatively lean funding (around €10 million in the first few years) meant HyImpulse had to be efficient and innovative. Dr. Kobald noted that building a new launch vehicle with a small team and budget was “quite a feat," accomplished in part through partnerships with DLR and academic institutions, and a laser-focus on a niche propulsion approach.

HyImpulse operates out of Neuenstadt am Kocher in southwestern Germany (near Heilbronn), with additional offices or test sites in Ottobrunn (near Munich) and even a presence in Glasgow, UK (likely to support launch operations). From its founding, the startup set ambitious goals. It initially demonstrated its technology on a smaller scale: in 2016, the founders’ student team set a world record for hybrid rocket altitude, and by 2020 HyImpulse launched a sounding rocket to an altitude of 32 km. These early successes gave credibility to HyImpulse’s hybrid propulsion concept.

Today, HyImpulse has grown to around 55–65 employees, maintaining a tight-knit team with deep expertise in propulsion. The company’s long-term vision is to provide affordable, reliable access to space for small satellites. By 2030, HyImpulse aims to be conducting 30–50 launches per year, delivering payloads up to 500–600 kg to orbit, with a target launch price of about €15,000 per kilogram. This cadence would make it a significant player in the small launch market. “Our order book is already substantial"—over "€100 million in launch contracts—and growing monthly, Dr. Schmierer noted after the first launch, indicating strong demand in Europe for new launch services.

In summary, HyImpulse’s background is one of a research-driven startup turned serious launch contender. In just a few years, the company evolved from a university project into a venture that signaled Germany’s prowess as a spacefaring nation with its first launch. Next, we’ll examine what makes HyImpulse’s rockets unique: their hybrid engine technology.

Hybrid Propulsion Technology

One of the most distinctive aspects of HyImpulse is its use of hybrid-propellant rocket engines. Traditional rockets typically use either solid fuel or liquid fuel engines. HyImpulse chose a hybrid approach, which uses a solid fuel in the rocket’s combustion chamber and a liquid oxidizer that is fed into that chamber during flight. In HyImpulse’s case, the fuel is a form of paraffin wax (essentially “candle wax”) and the oxidizer is liquid oxygen (LOX). This combination is unusual in modern rocketry, but it offers several advantages that HyImpulse is keen to exploit.

How Hybrid Engines Work: In a hybrid rocket, the solid fuel (paraffin) is cast into a cylinder (grain) with a hollow core. Before launch, this fuel is inert and stable – you can literally hold it in your hand like a big candle and it won’t combust. During flight, liquid oxygen is injected into the combustion chamber where it reacts with the surface of the solid fuel grain, causing the fuel to vaporize and burn. The throttling of thrust can be achieved by regulating the flow of the oxidizer (unlike a solid rocket, which burns at full throttle once ignited). HyImpulse’s engine, called HyPLOX-75, generates about 75 kN of thrust and is used in clusters for their larger rocket stages. The “75” in the name indicates the nominal kilonewtons of thrust.

Safety and Simplicity: One big benefit of this hybrid system is safety. Paraffin fuel is not explosive on its own – it needs the oxidizer flow to sustain combustion. This means the risk of accidental detonation is greatly reduced compared to a fully-fueled liquid rocket, where fuel and oxidizer are both present under pressure. HyImpulse emphasizes that paraffin is “inherently safe” and does “not have the risk to explode”, making handling and operations easier. Essentially, the rocket can be stored and transported with solid fuel loaded, and only when ready to launch is the liquid oxygen tanked and the system comes alive. This safety factor also extends to any abort scenario – cut off the LOX supply and the hybrid motor will shut down, as the solid fuel alone can’t burn.

Another advantage is simplified design and lower cost. HyImpulse’s hybrids do not require complex turbo-pumps to feed propellants at high pressure (as many liquid engines do), since the oxidizer can be fed by simpler pressurization systems and the fuel is cast in place. The company claims this cuts engine and vehicle manufacturing costs by about 40% compared to traditional liquid propulsion. With fewer moving parts (no turbopump machinery) and a pre-fabricated fuel grain, the engine can be made more cheaply and reliably. Dr. Schmierer noted that this “entirely new propulsion technology” was set up for launch with a relatively small budget, highlighting the cost-efficiency achieved.

Performance Considerations: Historically, hybrid rockets were thought to offer moderate performance – easier to handle than liquids, but not as high-thrust as solids or liquids. HyImpulse, however, has been optimizing the use of paraffin fuel to maximize performance. Paraffin has a higher regression rate (it burns faster and more completely) than older hybrid fuels like HTPB rubber. In fact, HyImpulse’s engineers achieved a record with a hybrid rocket in 2016, showcasing that hybrids can pack a punch. The successful static fire campaigns (they completed at least nine hot-fire tests) led to the HyPLOX-75 motor being fully qualified for flight by late 2023. Each SR75 rocket uses one HyPLOX-75 engine, and the orbital rocket SL1 will use clusters of them (8 on the first stage, 4 on second stage).

Benefits over Solid and Liquid Rockets: Compared to a solid rocket, HyImpulse’s hybrid can be throttled or even shut down by controlling the LOX flow, giving more control during flight. It also doesn’t produce highly toxic exhaust (many solid motors release hydrochloric acid gas due to perchlorates; burning candle wax and oxygen yields mostly CO₂ and water vapor, which are less harmful, though CO₂ is a greenhouse gas). And unlike solid motors that are one-and-done, a hybrid engine theoretically could be restarted if you have ignition capability and oxidizer supply (though in practice HyImpulse’s current design is meant for one burn per stage). Compared to a liquid-fueled rocket, the hybrid avoids cryogenic fuel handling (only LOX, which is common to both) and complicated plumbing for two fluids. It’s a sort of middle-ground: simpler like a solid, controllable like a liquid – though not quite reaching the extreme performance of the best liquids.

HyImpulse’s choice of hybrids also differentiates it from other players. It’s the only major European startup using this approach; others use liquid methane or kerosene. This could be a selling point if HyImpulse proves it can deliver comparable performance at lower cost. Indeed, the company projects that its system can reduce satellite launch costs by up to 50% for customers, thanks to the combination of cheaper production and operating savings. Lower launch cost opens the door for many small satellite projects (including university and environmental missions) that otherwise might not afford dedicated launches.

In summary, HyImpulse’s hybrid propulsion is both its key innovation and the enabler of its business case. By using paraffin and LOX, they aim to make rockets that are safer, cheaper, and still powerful enough to send satellites to orbit. The successful operation of their hybrid engine in flight was a crucial proof-of-concept – which brings us to the story of their first commercial launch.

Details of the First Commercial Launch

HyImpulse’s first commercial rocket launch took place on May 3, 2024 (local time) – a date that marked the debut of its SR75 suborbital launcher. The mission was cheekily named “Light This Candle”, a nod to the famous phrase used by astronaut Alan Shepard and an apt reference to the rocket’s candle-wax fuel. Here are the key details of this landmark launch:

- Launch Vehicle: The rocket was SR75, a single-stage suborbital rocket. It stands about 12 meters tall and has a mass of roughly 2.5 tonnes. The “75” indicates the use of the HyPLOX-75 hybrid engine. SR75 is designed to carry payloads up to 250 kg on suborbital trajectories, reaching about 250 km altitude at maximum. Essentially, it’s a sounding rocket capable of reaching the edge of space to provide a few minutes of microgravity or high-altitude research. Importantly, SR75 also serves as a technology demonstrator for HyImpulse’s orbital rocket, using the same engine and systems intended for the larger vehicle.

- Launch Site: Unusually, this European rocket made its maiden flight from Australia. The launch took place at the Koonibba Test Range in South Australiag. HyImpulse had originally planned to launch from a European site (the SaxaVord Spaceport in Scotland’s Shetland Islands) and even obtained a UK license to do so. However, delays in spaceport licensing and the desire to move forward led the team to partner with Southern Launch in Australia, which operates the remote Koonibba range. Koonibba offered clear skies, regulatory clearance for suborbital shots up to 100 km, and a sparsely populated area to safely recover the rocket.

- Flight Profile: The SR75 lifted off in the early morning hours (just after 5:00 GMT, according to reports). The hybrid engine ignited and operated as planned, boosting the rocket into the sky. Because this was a test flight, no customer payload was aboard; instead, the rocket likely carried instrumentation to collect data on engine performance, flight dynamics, and recovery systems. The ascent was successful and the vehicle reached a peak altitude of around 50 kilometers. This was a bit lower than the rocket’s theoretical capability, which was by design – by keeping the apogee under 50 km, HyImpulse avoided certain stricter launch licensing requirements in the UK (the original plan) and kept the flight within a well-controlled envelope.

- Outcome and Recovery: After engine burnout, SR75 followed a ballistic arc and began descending. The vehicle was equipped with a parachute recovery system. It parachuted back to the ground and was recovered intact for analysis. The entire flight lasted only minutes (perhaps on the order of 5–10 minutes from launch to landing). By all accounts, the mission objectives were met: “the hybrid rocket propulsion system… operated as planned,” the company stated, and the team retrieved the rocket to examine it and download onboard data. HyImpulse declared the test launch a full success, validating their engine and design in real flight conditions.

- Significance: This launch was a milestone for Germany and Europe. It was the first rocket developed privately in Germany to fly to such an altitude, “the first in decades by a German company,” noted German aerospace experts. (The last time German-built rockets flew commercially was back in the 1970s with OTRAG experiments, or earlier with V2-derived research rockets – so this truly marked a revival of German launch capability in the private sector.) It also came on the heels of Spain’s PLD Space launching a smaller suborbital rocket in 2023, signaling that multiple European startups are now successfully test-flying their vehicles. For HyImpulse specifically, the launch proved that their hybrid engine could transition from test stand to flight. The mission “provided valuable data for further development” and “validated our technical concept,” as Dr. Schmierer said. It also gave confidence to investors and customers that HyImpulse is on track to deliver orbital launches in the near future.

- Technical Learnings: By recovering the rocket, HyImpulse could inspect how the engine, structures, and avionics held up. Such feedback is immensely useful. It’s worth noting that reaching 50 km, while not space (the Kármán line is 100 km), covers the most stressful phases of flight – the launch and high-altitude environment. The engine’s shutdown was intentional once the test objectives were met. The successful demonstration means HyImpulse can press ahead to the next steps: scaling up to the orbital rocket. In fact, the same hybrid motor design will power the first stage of the orbital vehicle (SL1), so this flight was a direct risk-reduction for that program.

- Launch Team and Logistics: The launch in Australia highlights the globalization of the small launch industry. HyImpulse’s team had to transport the rocket and support equipment halfway around the world. They coordinated with Southern Launch and local authorities for range safety. The fact that a startup could accomplish this speaks to their agility. It also underscores how Europe currently lacks an operational inland suborbital test range, something that could change as sites like SaxaVord and Andøya (Norway) come online. Indeed, HyImpulse plans to conduct future test launches closer to home – potentially from SaxaVord in 2024 for more suborbital flights, as they ramp up to orbital attempts.

In summary, HyImpulse’s first commercial launch was a carefully executed suborbital test that met all objectives. On April 30, 2024, at Koonibba, the 12-meter SR75 rocket roared off the pad, powered by paraffin and LOX, and safely returned to Earth. It was a picture-perfect inaugural flight. With this success, HyImpulse immediately turned its focus to the next big step: getting its SL1 orbital rocket ready for launch, aimed for late 2025. Before we discuss the future, let’s zoom out and see how HyImpulse fits into the broader European space industry and how it compares to its rivals.

The European Space Industry

HyImpulse’s rise is happening against a dynamic backdrop: Europe’s push to develop a vibrant commercial space launch sector. Traditionally, Europe’s launch capabilities have been centered on large, government-funded rockets like the Ariane series (for heavy payloads) and the Vega (for smaller payloads), operated via Arianespace and launched from Kourou in French Guiana. While successful, those programs are expensive and slow-moving, and they don’t address the booming demand for launching small satellites on dedicated rockets. In the last few years, recognizing the “explosion in the demand for satellite launches”, Europe has started encouraging startups to fill this niche. HyImpulse is one of several European companies in this new wave, which also includes Isar Aerospace, Rocket Factory Augsburg (RFA), PLD Space, Orbex, Skyrora, and others. Let’s put HyImpulse in context with some of these players and Europe’s broader ambitions:

A New Race for Small Launchers in Europe: The number of small satellites (from cubesats to mini-satellites weighing a few hundred kilograms) has skyrocketed. Over 2,500 satellites were launched globally in 2022 alone, and forecasts for the 2030s predict an average of 10,000 per year. Many of these are in large constellations (for communications, Earth observation, etc.) and often weigh just tens to a few hundreds of kilos. Launching them affordably and flexibly is a challenge. Rideshare on bigger rockets (like SpaceX’s Falcon 9) is one option, but it doesn’t always send satellites to the exact orbit needed, and it depends on others’ schedules. Enter the dedicated small launchers: Europe sees a market opportunity here to serve local customers (commercial and institutional) and to ensure sovereign access to space for small payloads. As one expert put it, “It’s long past time for Europe to have a proper commercial launch industry.”

Starting around 2018–2019, multiple European startups were founded or kicked into high gear, each promising a small orbital rocket (typically lifting a few hundred kilograms to Low Earth Orbit). Among them:

- PLD Space (Spain) – developing the Miura family of rockets.

- Isar Aerospace (Germany) – developing the Spectrum rocket.

- Rocket Factory Augsburg (RFA) (Germany) – developing the RFA One rocket.

- Orbex (UK/Denmark) – developing the Orbex Prime rocket.

- Skyrora (UK) – developing the Skyrora XL rocket.

- ELA (Latitude) (France) – developing Zephyr rocket, etc.

- HyImpulse (Germany) – developing SL1 rocket (and SR75 suborbital).

What’s notable is that Germany has emerged as a hotbed, with HyImpulse, Isar, and RFA all headquartered in Germany and all vying to be the first to orbit. Spain, the UK, and other countries also have entrants.

Support from ESA and Governments: Initially, these startups were mostly privately funded (through venture capital, etc.), but Europe soon recognized they needed support to compete globally. The European Space Agency launched its Boost! program in 2019 to co-fund launch vehicle development. In late 2024, ESA awarded a further €44 million in Boost! contracts split among HyImpulse, Isar, RFA, and Orbex, to help with testing and upcoming flights. National governments pitched in too: Germany’s government created a microlauncher competition (RFA won €11M from DLR in 2021) and in 2023 earmarked €95 million to be shared by the top three German launcher startups. Spain’s government provided tens of millions of euros in loans to PLD Space. The result is that these companies now have a significant war chest (Isar Aerospace, for instance, has raised over €400 million in total funding to date, making it the best-capitalized, while others have on the order of €50–€100M). Europe’s public and private sectors are aligning to ensure these rockets make it off the ground.

Key Competitors: Let’s briefly compare the major startups alongside HyImpulse (we’ll go into more detailed comparison in the charts and table that follow):

- PLD Space – Based in Spain, PLD made history in October 2023 by launching Miura 1, a suborbital rocket, to 46 km altitude. This was the first flight of a privately developed European rocket from European soil (launched from Huelva, Spain). Miura 1 is a smaller predecessor to Miura 5, their orbital vehicle. Miura 5 is a two-stage liquid-fueled rocket (kerosene/LOX engines) about 35 meters tall, aiming to carry ~540 kg to a 500 km sun-synchronous orbit (or up to 1,000 kg to lower inclination orbits). PLD Space has significant backing through government loans (≈€82.7M in 2023/24) and private investment, and is targeting a 2025 debut for Miura 5. They plan to launch from Europe’s Guiana Space Centre in Kourou and possibly other sites (they even signed an agreement to launch from Oman).

- Isar Aerospace – Based near Munich, Germany, Isar is often considered the frontrunner in terms of funding. Its Spectrum rocket is a two-stage liquid-fueled vehicle about 28 m tall, using a unique propane/LOX propellant combination and 9 + 1 engines. Spectrum is designed to loft up to 1,000 kg to LEO (or around 700 kg to SSO). Isar has raised over $330M (≈€310M) by 2023, including large VC rounds, making it extremely well-funded. They aimed for a first orbital attempt from Andøya, Norway in late 2023, but as of early 2025 that launch is still pending. Spectrum’s first flight is expected in 2024 (possibly slipping into 2025). An MIT Tech Review article called the attempt “a big milestone” and emphasized its importance even if the first flight might fail. Isar’s success could make it Europe’s first private orbital launcher.

- Rocket Factory Augsburg (RFA) – Based in Augsburg, Germany, RFA is developing RFA One, a three-stage rocket using LOX/RP-1 (kerosene) fuel in an efficient staged-combustion engine (“Helix”). RFA One is about 30 m talland aims to carry up to 1,300 kg to a polar orbit, making it slightly larger capacity than Spectrum or SL1. RFA had planned a first launch in late 2023 as well, but during a stage test in August 2024, a fire broke out and destroyed their first stage, delaying the launch. They’ll need to build a new first stage, pushing the orbital attempt to (likely) 2024 or 2025. RFA has substantial backing from OHB (a large aerospace company) and others – by end of 2024, with new government funds, RFA’s total funding was on par with HyImpulse’s at around €50–€80M plus recent injections. They plan to launch from SaxaVord in Scotland and possibly other sites. RFA’s marketing emphasizes low-cost launches and even in-space transport via an orbital tug.

- Orbex – Based in the UK (Scotland) and Denmark, Orbex is building Orbex Prime, a two-stage orbital rocket that stands about 19 m tall and is designed for ~150 kg to LEO. Orbex uses bio-propane fuel in lightweight carbon-fiber tanks. It’s a bit smaller class than the others, but notable as the UK’s entry. Orbex received ~€5.6M ESA fundingand tens of millions in VC. First launch could be in 2025 from Scotland.

- Others: There are other contenders like Skyrora (whose Skyrora XL aims for ~315 kg to orbit, first launch TBD) and Maia Space in France, etc. However, the leading pack in Europe’s launcher race consists of the four companies above (Isar, RFA, HyImpulse, PLD) – and notably, all four have now achieved major test milestones except Isar and RFA are still awaiting their maiden flights.

Europe’s Space Ambitions: The push for these small launchers is part of a broader strategy for Europe to maintain independent access to space across all classes of payloads. With geopolitical uncertainties and competition, Europe doesn’t want to rely solely on foreign launchers. The war in Ukraine cut off access to Russian Soyuz rockets that Europe used for medium missions, and delays in Ariane 6 have created launch gaps. Small launch startups offer a way to bolster Europe’s space sovereignty. As Prof. Malcolm Macdonald of Strathclyde University noted, these efforts could give Europe multiple ways to reach space “without having to rely on US rockets”, which is important in an uncertain geopolitical future.

At the same time, Europe is tailoring regulations and facilities to accommodate these launches. New spaceports are under development:

- Andøya Spaceport in Norway for polar/sun-synchronous launches (where Isar aims to launch).

- SaxaVord Spaceport in Scotland, UK, also for polar orbits (HyImpulse, Orbex, and others have eyed this).

- Nuuk, Greenland or Azores, Portugal have been mentioned as potential sites.

- Spain is converting a site for PLD in the Canary Islands or using Kourou’s new small launch pad. The idea is to eventually perform orbital launches from European soil. To date, no vertical orbital rocket has ever been launched from Western Europe, so the first one (possibly Isar’s Spectrum or RFA One or Orbex Prime) will be truly historic.

In summary, HyImpulse is part of a competitive cohort of European launch startups. Each has different technology (hybrid vs liquid, etc.), different home bases, but all share the goal of reaching orbit with smaller payloads. The European space ecosystem – from ESA to national agencies – is actively supporting this with funding and infrastructure, signaling that Europe is serious about nurturing its own SpaceX-like successes. It’s a new chapter for Europe’s space industry, and HyImpulse’s first launch is one page in that story – a story that includes friendly rivalry with its peers.

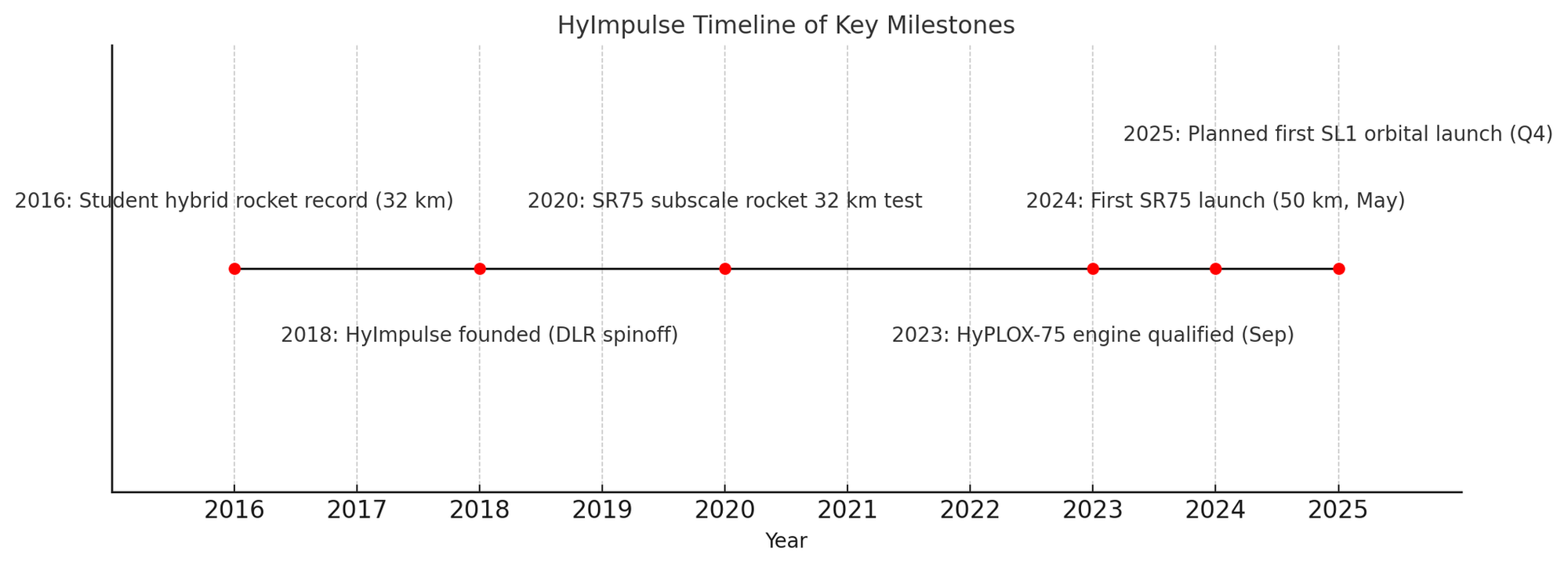

HyImpulse’s Launch History & Milestones

Timeline of HyImpulse’s key milestones from founding to the first launch. The company rapidly progressed from a university spin-off in 2018 to a suborbital launch in 2024. Notably, a student hybrid rocket record in 2016 and a 32 km test flight in 2020 laid the groundwork for later success.

The timeline above highlights major milestones in HyImpulse’s development:

- 2016 – Student Hybrid Rocket Record: Before HyImpulse was formally founded, its future team members were already making waves in rocketry. In 2016, a group of University of Stuttgart students (who would become HyImpulse’s founders) built and launched a hybrid rocket that set a world altitude record for that class. This achievement (an apogee well into the tens of kilometers) proved the performance potential of hybrid propulsion. It was an early indicator that the combination of a solid fuel and liquid oxidizer could deliver serious thrust and efficiency.

- 2018 – HyImpulse Founded: HyImpulse Technologies GmbH was officially founded in 2018as a DLR spin-off, incorporating the student team’s know-how into a startup venture. With initial funding from grants and investor Rudolf Schwarz, the company set up its base in Neuenstadt am Kocher, Germany. This year marks the transition from academic project to commercial enterprise – the point at which the vision of an orbital hybrid rocket started to become reality.

- 2020 – SR75 Subscale Rocket Flight: In May 2020, HyImpulse conducted a successful launch of a small sounding rocket (research rocket), which reached an altitude of 32 km. This rocket was a precursor to the SR75, likely a smaller scale or earlier version of it. The flight demonstrated the hybrid motor in a real launch scenario for the first time. Reaching 32 km, while suborbital, was a significant milestone showing that the propulsion system worked in flight and could be guided and recovered. Achieving this by 2020 indicated strong progress just two years post-founding.

- 2023 – HyPLOX-75 Engine Qualified: Through 2019–2023, HyImpulse focused on developing its full-scale engine and rocket stages. They built and test-fired the HyPLOX-75 engine multiple times. By September 2023, they completed the 9th hot fire test campaign, successfully qualifying the 75 kN hybrid motor for flight. This meant the engine met all design thrust and duration requirements and was deemed flight-ready. Additionally, 2023 saw regulatory groundwork: in July, the UK’s space regulator (CAA) granted a license for HyImpulse to launch SR75 from SaxaVord (Scotland), showing institutional support. Although they pivoted to Australia for the actual launch, having that license was another milestone.

- 2024 – First SR75 Launch (“Light This Candle”): On May 3, 2024, HyImpulse launched the SR75 on its maiden flight from Koonibba, Australia, reaching ~50 km altitude and recovering the rocket. This is the capstone achievement to date – effectively demonstrating their launch vehicle in action. It’s marked as the first commercial launch because it’s the first full-scale launch service the company executed (even if no paying customer payload was aboard, it opens the door to commercial operations). The success in 2024 put HyImpulse on the map globally and provided the data to move forward towards orbital launches.

- 2025 (Planned) – First SL1 Orbital Launch: Looking ahead, HyImpulse aims to launch SL1, its three-stage orbital rocket, by end of 2025. This will be a much more complex endeavor than the suborbital SR75. SL1 is planned to be 32 m tall and capable of reaching orbit with payloads up to 600 kg. The timeline shows this as a future milestone in Q4 2025. Achieving it will depend on building and testing the larger rocket stages (including a new third stage and guidance systems) through 2024 and 2025. If HyImpulse hits this target, it could become one of the first European startups to reach orbit, potentially around the same time as Isar or RFA.

This timeline demonstrates HyImpulse’s steady and relatively rapid progress from concept to launch. In just 6–7 years, they went from founding to a successful flight – a pace comparable to, or even faster than, many other launch startups worldwide. It also underscores the systematic approach: small steps (record-setting experiments, suborbital tests) building confidence toward the big goal of orbit.

European Launch Startups

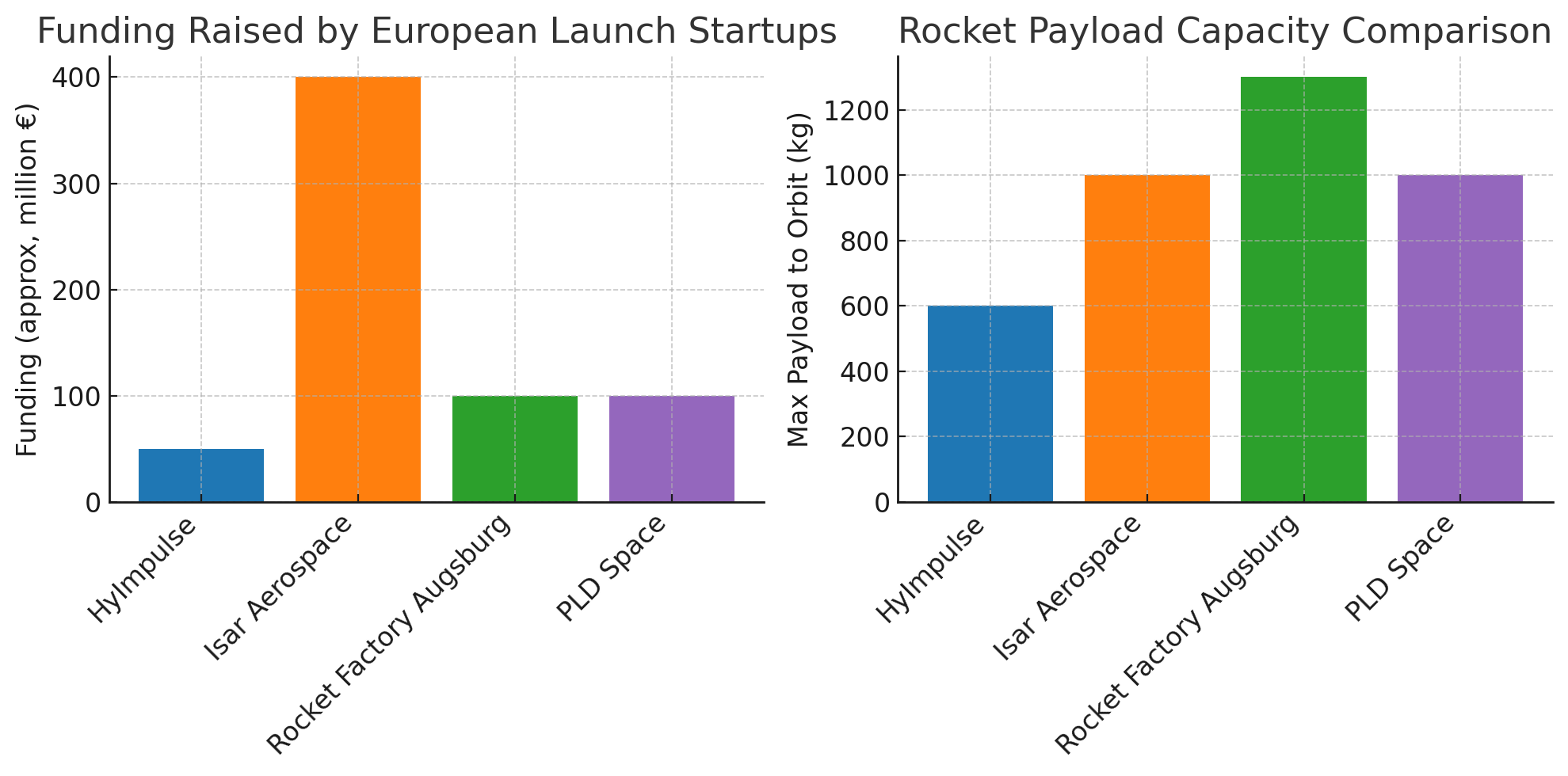

The charts below provide a visual comparison of funding raised and rocket payload capacity for four leading European launch startups:

Comparison of leading European small launch startups: (Left) Approximate total funding raised (in million €) as of 2024, showing that Isar Aerospace has amassed far more capital than others. (Right) Maximum payload capacity to Low Earth Orbit of each company’s main rocket, illustrating Rocket Factory Augsburg’s larger rocket and HyImpulse’s smaller payload target. HyImpulse uses hybrid propulsion (solid/liquid) whereas the others use liquid fuel engines.

As the charts show, there is significant variation among these startups:

- Funding Raised: Isar Aerospace towers above the rest in funding, with around €400 million or more in total financing– thanks to big VC rounds and government support. This hefty bankroll (the orange bar on the left chart) makes Isar the most well-capitalized new-space launcher company in Europe. In contrast, HyImpulse (blue bar) has raised on the order of €50 million (including private investment and grants), a fraction of Isar’s sum. Rocket Factory Augsburg (green bar) and PLD Space (purple bar) each have on the order of €80–€100 million in funding. PLD Space, for instance, received about €82.7M in government-backed loans in 2023 on top of earlier investments, putting its total near €100M. RFA has a similar magnitude if we sum its industry funding and recent awards (RFA got €11.8M from ESA plus ~€31M from the German gov in 2024). The funding chart highlights that HyImpulse is achieving a lot with comparatively little funding – their efficient hybrid approach and smaller team haven’t required huge capital (so far), which might translate to a lean cost structure. However, it also means HyImpulse doesn’t have as much cushion to absorb setbacks as, say, Isar does.

- Rocket Size (Payload Capacity): On the right, the payload capacity chart compares the main orbital rockets each company is developing. HyImpulse’s SL1 is aiming for about 500–600 kg to LEO(blue bar ~600 kg). Isar’s Spectrum and PLD’s Miura 5 are both targeting roughly 700–1000 kg to LEO (we show ~1000 kg as a rough max). RFA’s RFA One is larger, with a capacity up to 1,300 kg to a polar orbit (green bar). This makes RFA One the most capable of the bunch in terms of lifting mass. In essence, HyImpulse is building a “mini-launcher” (smallest class), PLD and Isar are in the small launcher (medium-small) class, and RFA is edging toward a medium launcher. These design choices impact their markets: HyImpulse might focus on dedicated launches for single small satellites or a few cubesats, whereas RFA One could loft a cluster of smallsats or a medium satellite.

- Technology Type: While not explicitly shown in the charts, it’s worth noting the propulsion technology differences: HyImpulse uses hybrid engines (unique among these), whereas Isar uses liquid propane/LOX, RFA uses liquid kerosene/LOX, and PLD uses liquid kerosene/LOX as well (moving toward methane in future upgrades perhaps). All are pursuing innovative tech – for example, Isar’s choice of propane is uncommon and aimed at performance, Orbex uses bio-propane for eco-friendliness, etc. But HyImpulse’s hybrid stands out as a bet on simplicity and cost.

- Home Base and Launch Sites: Out of the four compared, three are German (HyImpulse, Isar, RFA) and one is Spanish (PLD Space). This geographic concentration in Germany isn’t a coincidence – Germany’s government actively stimulated the sector, and the country has strong engineering talent. PLD, as a Spanish venture, enjoys Spain’s support and a head start in actual launching (with Miura 1). In terms of launch sites: HyImpulse and RFA have plans for SaxaVord (UK), Isar is aligned with Andøya (Norway), and PLD with Kourou (French Guiana) and possibly Spanish territory for testing. All these startups are essentially pan-European endeavors, using whichever launch site suits their orbital needs and timelines.

- Progress Timeline: By early 2025, each company’s progress varies. PLD and HyImpulse have completed suborbital test flights (PLD’s in 2023, HyImpulse’s in 2024). Isar and RFA have yet to launch but have tested engines and stages. HyImpulse is now working on orbital hardware; PLD is building Miura 5 for a 2025 launch; Isar and RFA are likely to attempt orbital launches in 2024. It’s a bit of a race to orbit among them. As shown earlier, HyImpulse targets late 2025 for orbit, which might be after Isar or RFA, but HyImpulse could carve a niche with its cost model.

Environmental and Market Impacts

One aspect that often comes up with new launch systems is their environmental footprint and sustainability. HyImpulse’s hybrid propulsion has some environmental advantages, although rocket launches in general do have impacts. Additionally, the rise of small launchers has implications for the market – potentially enabling new businesses and scientific projects, while also facing competition and questions about overcapacity. Let’s explore these facets:

Environmental Considerations of HyImpulse’s Hybrid Fuel: By using paraffin-based fuel and liquid oxygen, HyImpulse rockets avoid some of the nasty chemicals associated with other rockets. Traditional solid rocket boosters (like those used on the Space Shuttle or some ICBMs) use ammonium perchlorate composite propellant, which releases ozone-depleting and acid-forming gases (like HCl). HyImpulse’s paraffin/LOX hybrid emits mainly carbon dioxide and water – CO₂ is a greenhouse gas, but the volume from a small rocket is tiny in the global scale, and there are no chlorine compounds. Also, paraffin can potentially be derived from bio-based sources (like agricultural waxes or even waste plastics converted to wax), giving a pathway to partially renewable fuel. The company hasn’t explicitly stated if their wax is bio-derived, but the possibility exists to improve carbon neutrality.

Another eco-benefit is that hybrid stages can be recovered more easily due to their inherent safety. HyImpulse showed with SR75 that they could parachute the stage back. A recovered stage means no debris left in the ocean or range – less pollution and the option to refurbish or dispose of components properly. While HyImpulse hasn’t announced plans to reuse the SR75 or SL1 stages, even single-use recovery allows safe clean-up. The inert fuel grain (essentially a big candle) in the rocket has low toxicity if it ends up in the ocean or ground.

That said, any rocket launch does release CO₂ and some soot (hybrids can produce black carbon soot if combustion is incomplete). HyImpulse’s impact per launch is relatively small given the rocket’s size (compare ~2.5 tons of mass vs. a 500-ton Falcon 9). If HyImpulse meets its goal of 30-50 launches per year by 2030, the environmental impact would still be modest – likely on the order of a few jetliners’ worth of CO₂ annually. Moreover, the hybrid has no risk of fuel spills or toxic propellant leaks during handling, unlike kerosene or hydrazine fuels, which is a safety plus for the environment on the ground.

Enabling Eco-Friendly Projects: Interestingly, HyImpulse’s leadership mentioned that their cost-effective launch capability will enable more environmental and climate monitoring projects in space. This is an indirect but important environmental benefit: cheaper access to space means more satellites can be launched for Earth observation, climate science, and green tech (like monitoring deforestation, ice caps, or enabling precision agriculture via IoT satellites). For example, a small startup or university with a climate-monitoring cubesat might afford a dedicated HyImpulse launch, whereas before they had to wait for a hitchhike opportunity. So HyImpulse can contribute to environmental solutions by boosting such missions.

Market Impact – Opening the Small Sat Market in Europe: On the market side, HyImpulse and its peers are responding to the substantial demand for small satellite launches in Europe. Right now, many European small satellites have to be launched on foreign rockets (often on SpaceX Falcon 9 rideshares, or sent to India’s PSLV, or Russian Soyuz historically). A domestic launch provider like HyImpulse offers European satellite makers more flexibility and autonomy. This is attractive for commercial companies (who might want to launch on shorter notice or to custom orbits) and for governments (for reasons of security and sovereignty). HyImpulse has indicated that European customers have already filled a robust order book exceeding €100M – likely a mix of commercial constellation operators and institutional missions.

Having multiple small launchers in Europe could also spur competitive pricing and innovation. If HyImpulse indeed achieves 40% lower production costs and passes on 50% savings to customers, it might offer launches at a price point that undercuts foreign options, at least for certain niche payloads. This could make launching a satellite as a European startup or research lab more attainable, potentially spurring innovation in downstream space applications (like satellite-based services).

On the other hand, there’s the question of market saturation: can all these new rockets find enough payloads to launch? Some analysts caution that there are more small launch vehicles in development globally than there are payloads to fill them, especially as bigger rockets (like SpaceX’s Falcon 9 and upcoming Starship, or India’s SSLV) also target the smallsat market with rideshares at extremely low cost per kg. Europe’s launch startups will need to differentiate – perhaps by offering dedicated launches on flexible timelines, or catering to specific orbit needs (like specialty orbits, inclination, or confidentiality for certain government payloads). HyImpulse could find a niche in launches that need extra safety or handling care (e.g. sensitive experimental payloads) given the hybrid’s safety, or in lower-cost launches for cubesat batches.

One niche HyImpulse might exploit is suborbital launches as a service – since they have the SR75. There’s a market for microgravity research, atmospheric science, and component testing that suborbital rockets serve (Blue Origin’s New Shepard in the US, for example). HyImpulse’s SR75 can reach 250 km altitude, potentially crossing the Kármán line (~100 km) and giving several minutes of microgravity. They could launch student experiments or tech demos on SR75 flights. This diversifies revenue while SL1 is still in development. It’s also eco-friendlier to use a smaller rocket for suborbital missions than a large one.

Competitive Dynamics: HyImpulse’s hybrid approach could yield a cost advantage if production scales up. Their CEO mentioned aiming for €15k per kg to orbit by 2030. For a 500 kg payload, that’s about €7.5 million per launch. If they achieve that, it’s competitive – not as low as SpaceX rideshare (which can be <$5k/kg if a cubesat hitches a ride), but for a dedicated launch where the satellite operator controls everything, €7.5M is reasonable. Moreover, HyImpulse might operate in a lower mass class where SpaceX doesn’t bother – launching a single 100kg satellite to a custom orbit isn’t something a Falcon 9 would do (Falcon 9 would have to launch many together). Thus, HyImpulse and similar small launchers fill the gap between very small air-launch or rideshare options and the giant rockets.

Environmentally, one could argue that a rideshare (multiple satellites on one big rocket) is more efficient than many small rockets – akin to carpooling versus many individual cars. However, the operational flexibility can outweigh that if, say, a small satellite’s mission is time-sensitive or requires a unique orbit. Also, as technology improves, these small launchers could become more fuel-efficient or even use green propellants (Orbex’s biofuel, for instance). Hybrid rockets might one day use bio-derived wax and even have reusable components, further improving their sustainability profile.

In conclusion, HyImpulse’s impact on the market is to increase access and options for launching small satellites in Europe, which can accelerate innovation and independence. Environmentally, its hybrid system is a step in a positive direction – safer handling, fewer toxic emissions, and possibly lower manufacturing footprint. As the small launch market matures, we may see some consolidation (not all startups will survive a shakeout), but those that do – potentially including HyImpulse – could form a new backbone of the European space infrastructure, launching satellites that serve everything from climate monitoring to communications. HyImpulse’s emphasis on cost reduction and efficiency positions it well in that regard.

Conclusion

HyImpulse’s first commercial rocket launch is a significant leap forward for the company and a beacon for Europe’s expanding role in commercial space. In delivering a 12-meter rocket to the fringes of space and back safely, HyImpulse proved that its novel hybrid engine technology works in practice – a crucial validation for its business model and for hybrid rockets in general. The launch also marked the return of German-built rockets to flight, underlining a new era where startups, not just state agencies, drive aerospace innovation in Europe.

We’ve looked at HyImpulse’s journey from an academic project to a funded startup carving out a niche with candle-wax powered rockets. We’ve seen how their approach aims to cut costs and improve safety, potentially offering satellite operators affordable dedicated launches. The details of the “Light This Candle” mission showed a textbook test flight, setting the stage for more ambitious orbital attempts.

Placing HyImpulse in the larger European context, it’s clear that this success is part of a broader momentum. Europe’s launcher startups – in Germany, Spain, the UK, and beyond – are pushing the boundaries, some with generous funding, others with clever engineering or unique technologies. They are collectively moving Europe toward a future where the continent can launch anything from tiny cubesats to constellations of small satellites without depending on foreign rockets. As Jonathan McDowell noted, it’s about time this happens. The competition, of course, will be stiff – both amongst these startups and against global players. Not every company may survive the competitive and technical hurdles of reaching orbit reliably. But each test like HyImpulse’s builds know-how and confidence.

What’s next for HyImpulse? The company is now full throttle on developing SL1, its orbital launcher, aiming for a debut by end of 2025. In the coming months, we can expect to hear about stage tests, perhaps more suborbital flights (maybe an SR75 from European soil), and integration of multi-stage systems. They have to go from one engine firing to coordinating a stack of stages, which is a big jump. However, success breeds support: the data and credibility from the first launch will help in raising further funds, securing customers (some of that €100M in orders will start converting to actual launch contracts), and attracting talent. HyImpulse will also be working closely with launch sites like SaxaVord and Andøya to secure spots in their manifest.

By the time SL1 flies, the landscape might already include the first orbital launches of Isar or RFA, or perhaps PLD’s Miura 5. HyImpulse could be joining an elite club of European orbital launch providers, or even beating some to the punch – only time will tell. Even if they are not first to orbit, their differentiated product (a smaller, presumably cheaper launcher) may find a sweet spot in the market.

From a broader perspective, HyImpulse’s story illustrates how rapidly the space industry is changing. What was once the domain of superpower nations has become accessible to small, agile companies. A few dozen people in a German town designed and fired a rocket with a fuel you could buy in a candle shop – and it worked. It’s a reminder that innovation can come from unexpected directions, and that the democratization of space access is well underway.

In conclusion, HyImpulse’s first launch is cause for celebration but not resting on laurels. It demonstrated Europe’s capability, validated a new technology, and energized the smallsat launch market. Going forward, we can anticipate more launches (orbital and suborbital), more competition driving down costs, and more satellites reaching space to do useful work – from climate monitoring to communications – thanks to these new launch options. HyImpulse will be one to watch as it attempts the formidable challenge of reaching orbit. If the past milestones are any guide, they stand a good chance of lighting many more candles on the way to the stars.

References

- Wikipedia. “HyImpulse.” https://en.wikipedia.org/wiki/HyImpulse

- SatNews. “HyImpulse Successfully Launches Its SR75 Hybrid Rocket.” https://news.satnews.com

- MoonToMars.space. “HyImpulse In-Depth Guide.” https://www.moontomars.space/hyimpulse

- Germany Trade & Invest. “Germany's HyImpulse Launches First Commercial Rocket.” https://www.gtai.de

- HyImpulse Technologies. “Press Release: Light This Candle Mission Successful.” https://www.hyimpulse.de/news

- European Spaceflight. “Top 2024 European Launch Companies.” https://europeanspaceflight.com

- Parsonson, A. “ESA + German Government Fund HyImpulse, RFA, Isar, Orbex.” European Spaceflight. https://europeanspaceflight.com

- SpaceNews. “ESA Awards Boost! Funding to Four Launch Startups.” https://spacenews.com

- NASASpaceFlight. “PLD Space Preparing Miura 5 for First Launch.” https://nasaspaceflight.com

- SpaceNews. “PLD Space Receives Government Loans to Advance Miura 5.” https://spacenews.com

- Wikipedia. “Small-Lift Launch Vehicles – Isar Spectrum.” https://en.wikipedia.org/wiki/Small-lift_launch_vehicle

- Wikipedia. “Rocket Factory Augsburg – RFA One.” https://en.wikipedia.org/wiki/Rocket_Factory_Augsburg

- MIT Technology Review. “Europe’s Private Rocket Startups Are Racing to Orbit.” https://www.technologyreview.com

- Space.com. “PLD Space Launches Miura 1 on Historic Suborbital Flight.” https://space.com