How China’s EngineAI Startups Are Revolutionizing the Global AI Robotics Industry

In the rapidly accelerating domain of artificial intelligence and robotics, China has emerged as a formidable force, aggressively positioning itself at the forefront of the next industrial wave—the AI robot boom. As nations and corporations worldwide invest heavily in the fusion of machine learning, robotics, and embedded intelligence, a new breed of Chinese startups has surfaced to redefine the landscape. These emerging companies, often referred to as EngineAI startups, represent a critical nexus of generative AI, edge computing, and robotics hardware innovation. Their ambitious goals reflect China’s broader geopolitical and economic strategy: to not only catch up to but surpass global competitors in next-generation automation technologies.

The term “EngineAI” has increasingly become shorthand for startups that fuse three key technological capabilities: advanced large AI models, hardware-optimized edge inference, and autonomous robotics integration. These companies are not merely building intelligent machines—they are crafting multi-modal, sensor-rich, and context-aware systems capable of interacting with and navigating complex environments. They draw from recent breakthroughs in transformer-based models, simultaneous localization and mapping (SLAM), low-latency computing, and human–robot interaction frameworks. Enabled by government backing, capital investment, and an expansive domestic market, these startups are becoming pivotal players in the global race to bring general-purpose AI robots from lab prototypes to commercial deployment.

China’s support for AI development is not a recent phenomenon. Since 2017, when the State Council released its “New Generation Artificial Intelligence Development Plan,” the country has strategically prioritized AI as a key driver of national competitiveness. This directive has translated into billions of dollars of state funding, public–private partnerships, and the establishment of dozens of national AI innovation zones. The robotics segment has received special emphasis, particularly in response to labor shortages in manufacturing and an aging population that demands advanced care solutions. The government’s “Made in China 2025” initiative and recent policy shifts around semiconductors and automation have only sharpened the national focus on next-gen robotics as both an economic imperative and a matter of technological sovereignty.

Simultaneously, Chinese universities, research institutions, and private companies have been producing increasingly sophisticated AI models, with homegrown platforms like MiniCPM and InternLM challenging Western incumbents. Unlike their Western counterparts, many Chinese EngineAI startups operate within a vertically integrated ecosystem, where software, hardware, and firmware co-evolve under one umbrella. This integration offers speed and agility, allowing faster iteration cycles and customized deployment in vertical markets ranging from logistics and eldercare to education and consumer companionship. For instance, a startup designing a bipedal humanoid robot is likely also developing its proprietary motor control firmware and fine-tuning an LLM that governs speech, perception, and locomotion—ensuring system-level cohesion rarely matched in siloed Western models.

China’s AI robotics sector is not only robust but diverse. From industrial robotics deployed in smart factories to expressive humanoids offering concierge services in shopping malls, the spectrum of applications is broad and ever-expanding. Particularly noteworthy is the rise of affordable, small-scale robots with general-purpose capabilities—targeted not just at enterprises but also at affluent consumers. This marks a departure from traditional robotics markets, which have historically focused on high-capital, low-volume applications such as automotive assembly lines. EngineAI startups are reshaping this equation by leveraging low-cost components, in-house AI chips, and scalable software to deliver value at a mass-market level.

Yet this emergence is not without challenges. Intellectual property disputes, export restrictions on key technologies, and talent retention pressures loom large. China’s reliance on imported high-performance chips—especially GPUs and ARM-based processors—remains a strategic vulnerability, despite recent advances in domestic chipmaking. Additionally, ethical questions surrounding surveillance, autonomy, and labor displacement are surfacing as EngineAI robots become more intelligent and ubiquitous. These issues necessitate not only technological advancement but also nuanced policy frameworks and international engagement.

Nonetheless, the broader trajectory remains clear: China’s EngineAI startups are on the cusp of transforming the country into a global hub for autonomous robotic intelligence. With an ecosystem that blends scale, speed, and state support, these companies are driving toward a future where AI robots are as common in households and hospitals as smartphones are today. The implications for global supply chains, labor markets, and even military applications are profound.

This blog aims to provide a comprehensive examination of this unfolding phenomenon. We will explore the structure of the EngineAI ecosystem, profile the most prominent players, unpack the technological breakthroughs powering this movement, compare China’s positioning to other global leaders, and assess the broader socio-economic implications of this technological arms race. As the world prepares for an era of AI-augmented machines, China’s EngineAI startups are determined to lead—not follow.

Inside the EngineAI Ecosystem: The Startups Fueling the Boom

At the heart of China’s AI robot boom lies a dynamic and rapidly expanding ecosystem of startups collectively dubbed “EngineAI” firms. These startups are characterized by their seamless integration of generative AI models, edge computing capabilities, and robotics hardware into unified, intelligent systems. What sets the EngineAI ecosystem apart is not merely technological novelty, but the strategic coherence and operational maturity these firms display in an environment shaped by both market forces and national industrial policy. As China's government pushes aggressively to localize advanced technology production and dominate next-generation industries, these startups have become the vanguard of a transformative shift in global robotics.

The defining trait of EngineAI startups is their vertical integration across the AI-robotics stack. Unlike traditional robotics companies that rely on external vendors for machine learning, or AI software companies that remain agnostic to hardware, EngineAI firms co-design software and hardware from the ground up. This gives them a significant competitive advantage in terms of performance, latency, and modular adaptability. For example, instead of retrofitting existing robots with third-party language models, EngineAI firms train their own models to function optimally on custom-designed edge chips embedded within their robots. This synergy enhances real-time decision-making, sensory responsiveness, and multimodal interaction—essential features for general-purpose AI robots.

Among the standout players in this burgeoning ecosystem is Fourier Intelligence, a Shanghai-based robotics company originally known for its rehabilitation robots. In recent years, Fourier has made a dramatic pivot into the humanoid robotics arena, unveiling GR-1, a bipedal humanoid equipped with a proprietary motion control system and natural language interface. Backed by major investors including IDG Capital and CITIC Securities, Fourier’s approach combines mechatronics with transformer-based AI for real-time task planning and interaction. With partnerships across Southeast Asia, Europe, and the Middle East, Fourier exemplifies how EngineAI startups are transitioning from domestic champions to global contenders.

Another key player is Agibot, a Shenzhen-based firm focused on intelligent logistics and warehouse automation. Agibot’s robot platforms leverage self-developed visual perception modules, multi-agent coordination algorithms, and adaptive routing powered by generative AI. Unlike traditional warehouse robots limited to repetitive paths, Agibot’s machines operate in dynamic environments, learning and adapting without exhaustive reprogramming. The company recently raised a Series C round valued at over $300 million, indicating strong investor confidence in its ability to disrupt traditional supply chain automation.

Meanwhile, Horizon Robotics, while primarily known as a fabless AI chip designer, has become integral to the EngineAI landscape due to its high-performance AI processors tailored for robotics and autonomous systems. Horizon’s Journey series chips are widely deployed in mobile robots and embedded AI applications, boasting low-power consumption and ultra-low-latency inference. Beyond chips, Horizon has developed a proprietary software stack for distributed AI computation, making it an enabling force behind many EngineAI initiatives. Its recent merger with a Tier 1 automotive supplier signals its ambitions beyond China, aiming to export not just hardware but a full-stack AI development platform for intelligent machines.

Unitree Robotics, based in Hangzhou, offers another fascinating case study. Originally developing quadruped robots for research and entertainment, Unitree has moved rapidly toward enterprise and consumer markets with its AlienGo and Go1 series. These robots combine visual SLAM, depth sensing, and GPT-based voice interaction to execute a broad range of tasks—from inspection and delivery to companionship and security. What makes Unitree’s strategy unique is its direct-to-consumer approach, offering agile robots at a fraction of the cost of Western equivalents like Boston Dynamics’ Spot. Through open-source SDKs and mobile app integration, Unitree is also cultivating a vibrant developer ecosystem, positioning itself as both a hardware and platform company.

Geographically, the EngineAI startup ecosystem is clustered in three primary innovation zones: Beijing, Shanghai, and Shenzhen. Beijing’s Zhongguancun Science Park serves as a hub for algorithmic research and startup incubation, often in close collaboration with Tsinghua University and the Chinese Academy of Sciences. Shanghai offers strong industrial manufacturing capabilities and financial backing, with many robotics labs co-located with venture capital offices. Shenzhen, known as China’s hardware capital, continues to attract a dense network of robotics entrepreneurs, component suppliers, and embedded systems engineers. The synergy between these regions fosters a robust supply chain that includes everything from servo motors and lithium battery packs to silicon wafers and printed circuit boards—all domestically produced, reducing dependence on foreign imports.

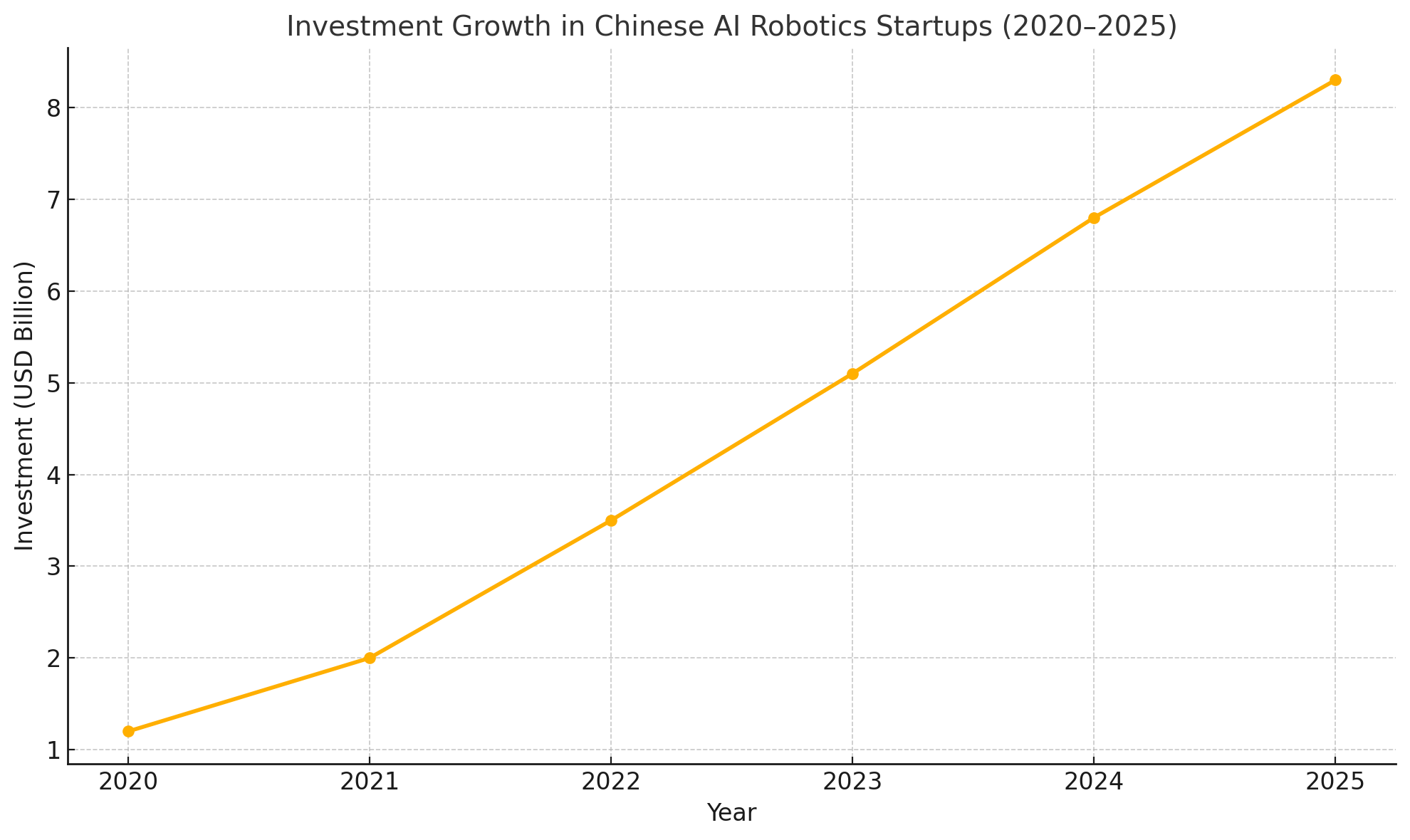

A critical enabler of this ecosystem is the abundant and diversified funding landscape. Chinese EngineAI startups benefit from a blended capital pipeline consisting of government subsidies, state-guided industrial investment funds, and an increasingly active venture capital community. For instance, the National Integrated Circuit Industry Investment Fund has directed billions of RMB toward AI chip startups that form the backbone of robotic intelligence. Simultaneously, municipal governments offer land grants, tax incentives, and pilot project funding to support early-stage development and deployment. Private equity has not been shy either, with firms like Hillhouse Capital, Sequoia China, and GGV investing heavily in robotics ventures that align with national strategic goals.

EngineAI’s appeal also extends beyond domestic investors. International firms, eager to participate in China’s fast-growing robotics market, have begun forming joint ventures, R&D partnerships, and supply agreements. For example, Fourier Intelligence recently entered a collaboration with UK-based Cambridge Bio-Augmentation Lab to integrate neuro-symbolic reasoning into its humanoid robots. Meanwhile, Unitree Robotics has shipped its products to over 50 countries and announced partnerships with researchers in the United States, France, and Japan. These developments underscore how Chinese EngineAI startups are not just export-focused but also committed to co-developing global solutions across healthcare, manufacturing, and education sectors.

This chart illustrates the exponential rise in capital investment from $1.2 billion in 2020 to a projected $8.3 billion in 2025, highlighting the robust confidence in China's EngineAI ecosystem.

The growing sophistication of these startups is reflected in their organizational design as well. Many EngineAI firms adopt agile team structures, fusing hardware engineers, AI scientists, user experience designers, and product managers into tightly integrated development pods. This allows for rapid prototyping and real-world testing—often conducted in live environments such as hospitals, shopping centers, and distribution hubs. The feedback loop from deployment to iteration is notably short, enabling startups to release new firmware updates and AI model improvements on a biweekly or even weekly basis. The culture of rapid iteration and deep integration is helping these firms outpace slower-moving incumbents in both China and abroad.

Yet challenges remain. Talent competition is intense, particularly for AI model training and robotics firmware development. While China produces a large number of engineering graduates annually, retaining top-tier talent in the face of global poaching from U.S. and European tech firms is an ongoing battle. Moreover, regulatory scrutiny over surveillance capabilities, public safety, and data usage is beginning to mount, prompting calls for more robust compliance frameworks. Despite these headwinds, the growth trajectory remains overwhelmingly positive, and EngineAI startups are becoming increasingly central to China’s strategy to dominate the intelligent automation value chain.

In summary, the EngineAI ecosystem is a multifaceted, well-funded, and strategically aligned network of startups reshaping the robotics frontier. With a convergence of policy support, capital investment, and technical depth, these firms are primed not just to participate in the AI robotics revolution—but to lead it.

Technological Edge

AI Models, Hardware Synergies, and R&D Innovation

One of the defining strengths of China’s EngineAI startups lies in their deep technological integration, combining state-of-the-art AI models with custom-built robotics hardware and domain-specific research pipelines. This section explores the unique technological architecture that enables these firms to push the boundaries of autonomy, agility, and human-robot collaboration. While their Western counterparts often follow a modular or third-party approach to robotics and AI integration, Chinese firms are rapidly moving toward vertically unified platforms where proprietary AI models, chipsets, firmware, and actuators are developed and optimized within a single ecosystem.

A fundamental pillar of this technological edge is the development and deployment of large language models (LLMs) tailored for robotic applications. EngineAI firms are increasingly training or fine-tuning LLMs such as MiniCPM, InternLM, and Yi to enable real-time comprehension, reasoning, and dialogue management in physical environments. These models are not generic chatbots; rather, they are embedded within robots that must interpret sensor data, maintain context across physical interactions, and respond in natural language while executing tasks such as navigation, retrieval, or manipulation. Multimodal training, which combines visual, tactile, auditory, and language inputs, has become a crucial innovation, enabling these models to act more like agents and less like static processors of input-output commands.

This integration is particularly evident in the speech–action feedback loop, where a robot receives verbal input, interprets it using a generative AI model, executes a physical response, and then communicates status or asks for clarification. Such loops demand extremely low latency and high reliability—challenges that many Western systems, which separate the AI and robotics layers, struggle to address effectively. Chinese startups, by contrast, are embedding optimized inference engines and light-weight model variants directly onto edge chips, allowing local processing without dependence on cloud connectivity. This approach not only ensures data privacy and responsiveness but also makes the systems viable in infrastructure-limited environments, such as rural areas or mobile scenarios.

Edge computing is central to this success. Instead of relying on centralized servers, EngineAI firms are building robots that operate independently using on-device AI acceleration. Companies like Horizon Robotics have developed chipsets such as the Journey series, which support up to 128 TOPS (trillions of operations per second) of AI inference on a low-power platform. These chips are specifically optimized for multimodal workloads—vision, language, motion control—and form the computational backbone for many mobile and humanoid robots emerging from the Chinese ecosystem. By minimizing power draw while maximizing inference capacity, these chips allow real-time decision-making for robots navigating crowded warehouses, retail stores, or urban streets.

In tandem, hardware innovation has kept pace. Startups like Fourier Intelligence and Unitree Robotics have made breakthroughs in actuator design, joint torque sensors, and power management systems. Unlike traditional industrial robots that rely on rigid servo systems, EngineAI startups are increasingly using soft robotics principles and compliant actuators, which allow for safer interaction with humans. This is critical for use cases in healthcare, eldercare, and consumer applications, where precision and safety must coexist. Fourier’s GR-1 humanoid, for example, uses a proprietary balance control algorithm informed by proprioceptive sensors embedded in its limbs, enabling it to recover from perturbations and adapt to uneven terrain—a feature previously limited to top-tier research labs.

Sensor fusion represents another frontier of innovation. Many EngineAI systems integrate RGB cameras, depth sensors, inertial measurement units (IMUs), LiDAR, and tactile feedback systems to build a composite understanding of the robot’s surroundings. These multimodal inputs are preprocessed on-device and passed through custom AI pipelines that perform semantic segmentation, object recognition, spatial mapping, and environmental modeling. The result is a robot that not only sees and hears but understands and anticipates. For instance, a service robot deployed in a hospital can identify a patient’s face, recognize medical equipment, avoid obstacles, and initiate appropriate conversations—all processed in real time.

From an algorithmic standpoint, reinforcement learning, imitation learning, and hierarchical planning have all been adopted to enhance robotic autonomy. Companies are using synthetic environments and digital twins to pre-train models before deployment, significantly reducing real-world testing costs and time. Moreover, RLHF (Reinforcement Learning with Human Feedback) techniques are being increasingly applied to fine-tune AI agents for alignment with user expectations in customer service and healthcare applications. By involving human supervisors in the training loop, these models learn not only how to perform tasks, but how to do so with empathy, cultural awareness, and ethical sensitivity—attributes critical in high-trust environments.

In addition to proprietary models, EngineAI firms are also investing in custom operating systems and control architectures. Unlike ROS (Robot Operating System), which remains popular in Western labs and startups, Chinese companies are experimenting with lightweight, real-time alternatives that are deeply integrated with their hardware. These systems offer deterministic latency and tighter coupling with sensor arrays, enabling smoother task transitions and better synchronization across limbs and modalities. Some firms are even developing AI-native operating systems, where all system components—from memory management to motor control—are mediated by machine learning algorithms, allowing the robot to adapt at the systems level, not just at the application layer.

Furthermore, interoperability and modularity are being enhanced through open SDKs and developer platforms. Companies like Unitree provide full access to APIs for their robots, encouraging third-party developers to build custom applications. This openness fosters a vibrant ecosystem of plugins, apps, and tools that extend the utility of EngineAI platforms far beyond their initial design. Developers can, for instance, write a plugin for a robot to perform yoga instruction, conduct security patrols, or teach language lessons—all without modifying the underlying firmware.

Significantly, these technological advancements are backed by robust R&D infrastructure and government-backed testbeds. Major cities such as Shanghai and Shenzhen host robotics innovation labs funded jointly by universities, municipalities, and private firms. These labs focus on AI safety, generalization, energy efficiency, and task-transfer learning—areas where EngineAI startups hope to outperform both legacy incumbents and Silicon Valley disruptors. Research produced in these labs often transitions directly into commercial applications, shortening the traditional lag between academic innovation and market adoption.

The synergy between AI models and hardware is also reflected in collaborative research partnerships with universities and international labs. For instance, Horizon Robotics has collaborated with Tsinghua University to co-develop energy-efficient neural network architectures, while Fourier Intelligence has partnered with Singapore-based research institutes to advance neuro-symbolic reasoning in humanoids. These collaborations ensure that EngineAI firms remain at the cutting edge of global innovation while localizing breakthroughs for the Chinese market.

Despite their rapid progress, EngineAI startups face a few persistent technological challenges. Energy efficiency remains a concern, particularly for mobile and humanoid robots that must operate untethered for extended periods. Efforts are underway to develop more compact battery technologies and dynamic power management systems, but limitations remain. In addition, real-world generalization—where a robot trained in one environment can seamlessly operate in another—continues to be a difficult benchmark to meet. Bridging the sim-to-real gap is a high priority, and many startups are investing in hybrid learning strategies and curriculum-based reinforcement training to address this issue.

In summary, EngineAI startups in China have established a decisive technological advantage through tightly coupled AI–hardware systems, domain-specific model development, and adaptive operating architectures. Their approach diverges significantly from the piecemeal strategies of many global competitors, enabling higher performance, greater reliability, and faster deployment. As these firms continue to innovate across sensing, computing, and cognition, they are not just building robots—they are laying the foundation for an intelligent, embodied AI future.

The Global Battlefield: China vs the World in the AI Robot Race

As the pace of innovation in AI robotics accelerates, China finds itself in an increasingly strategic contest with other global powers to define, dominate, and deploy the future of intelligent machines. The emergence of EngineAI startups has positioned China as not only a domestic leader but a formidable global contender in the next wave of automation. However, the international AI robotics landscape is highly competitive, with Western pioneers such as Tesla, Boston Dynamics, and Sanctuary AI also racing to push the boundaries of humanoid and general-purpose robotics. This section explores how China’s EngineAI firms stack up globally, what strategies the country is deploying to expand its influence, and how this escalating technological rivalry may reshape geopolitics, trade, and labor markets.

The global AI robotics race is shaped by multiple vectors: hardware sophistication, software intelligence, production scalability, regulatory compliance, and international partnerships. On each of these fronts, China has made remarkable strides, though it continues to face significant headwinds. In terms of hardware and manufacturing, Chinese companies benefit from mature supply chains and vast economies of scale. Startups like Unitree Robotics are producing quadruped robots for under $3,000—less than one-fifth the cost of equivalent models from U.S.-based firms. This cost advantage is not only a function of labor and component prices but also of design-for-manufacture philosophies and vertical integration across fabrication, assembly, and distribution.

In the software domain, China has emerged as a serious challenger to Western incumbents. While U.S. firms such as OpenAI, Google DeepMind, and Nvidia lead in frontier model development, Chinese organizations are rapidly closing the gap with robust open-source and commercial alternatives like MiniCPM, InternLM, and Yi. These models are increasingly being embedded directly into robotics workflows, where their performance is being validated in real-world conditions—from hospitals and classrooms to smart cities and factories. Importantly, Chinese firms often design their AI systems with specific robotic use cases in mind, unlike Western developers who typically build general-purpose models and adapt them for downstream tasks.

However, where China gains a tactical advantage is in global deployment and export strategy. Under the umbrella of the Belt and Road Initiative (BRI), China has begun exporting intelligent robots to countries in Southeast Asia, Africa, and Latin America—often bundled with infrastructure projects, government procurement programs, or education packages. These deployments not only serve economic goals but also cultivate technological dependence and alignment with Chinese platforms. For example, service robots developed by EngineAI firms are now present in smart city pilots in Nairobi, logistics hubs in Jakarta, and retail settings in Abu Dhabi. These exports often come with localized language models, training programs, and cloud dashboards hosted on Chinese servers, creating long-term ecosystem lock-in.

This aggressive export strategy contrasts with the more cautious and fragmented global expansion observed in Western firms. Companies like Boston Dynamics have focused primarily on military and industrial clients, while Tesla’s Optimus project remains largely confined to demonstration phases. Sanctuary AI, a Canadian startup, has shown promise with its cognitive architectures but faces scale and capital limitations. Meanwhile, regulatory burdens in Europe and the United States around safety, privacy, and labor displacement continue to delay broader rollout of autonomous robots. China, by contrast, benefits from centralized coordination between the state and private sector, enabling faster approvals, streamlined integration into public infrastructure, and policy-based incentives for adoption.

Nonetheless, the battlefield is not without friction. Export controls imposed by the United States on advanced semiconductors have created substantial constraints for China’s AI robotics sector, particularly in the training and fine-tuning of frontier models. While China has developed competitive edge chips for inference—thanks to firms like Horizon Robotics and Cambricon—it still relies on imported GPUs for large-scale training, particularly in domains that require multimodal fusion or high-resolution perception. This dependency could hamper China’s ability to keep pace with real-time advances in foundational models and robotic cognition, unless domestic innovation accelerates significantly or alternative supply routes are developed.

Intellectual property (IP) and standards are another front in this competition. Western firms have historically led the development of global robotics standards through institutions such as ISO and IEEE. By contrast, Chinese companies are now pushing for regional and national standards that reflect their architectural paradigms and priorities. The Chinese government has proposed its own guidelines for humanoid robots, service robots, and AI safety, with the intention of exporting these frameworks alongside its products. This divergence may lead to a bifurcation of global standards, complicating interoperability and compliance for multinational deployments.

Furthermore, ethical considerations and regulatory scrutiny are playing an increasingly important role in shaping international perception. Concerns about surveillance, data ownership, autonomous decision-making, and workforce disruption are prompting public debates and legislative action in various jurisdictions. While Chinese EngineAI firms often operate within domestic regulatory frameworks that are more permissive, they must navigate a complex mosaic of foreign laws when exporting their technologies. Any incident involving AI misuse, such as biased decision-making or physical harm, could significantly undermine international trust and market access.

To mitigate these risks, China has begun engaging in techno-diplomacy. This includes cross-border research collaborations, robotics summits, and participation in AI ethics panels hosted by the UN and other international bodies. These efforts are designed not only to improve transparency but to position Chinese firms as responsible and capable stewards of advanced technologies. By aligning with international governance norms while promoting its own technological narratives, China aims to secure a seat at the table in shaping global AI policy.

The rivalry also extends to talent acquisition and academic collaboration. While U.S. universities still dominate AI and robotics research, Chinese institutions such as Tsinghua University, Zhejiang University, and ShanghaiTech are producing increasingly influential publications and patents. Government incentives have encouraged foreign-trained Chinese researchers to return home, while strategic alliances with international labs have brought in global expertise. The result is a growing parity in research productivity and a narrowing innovation gap.

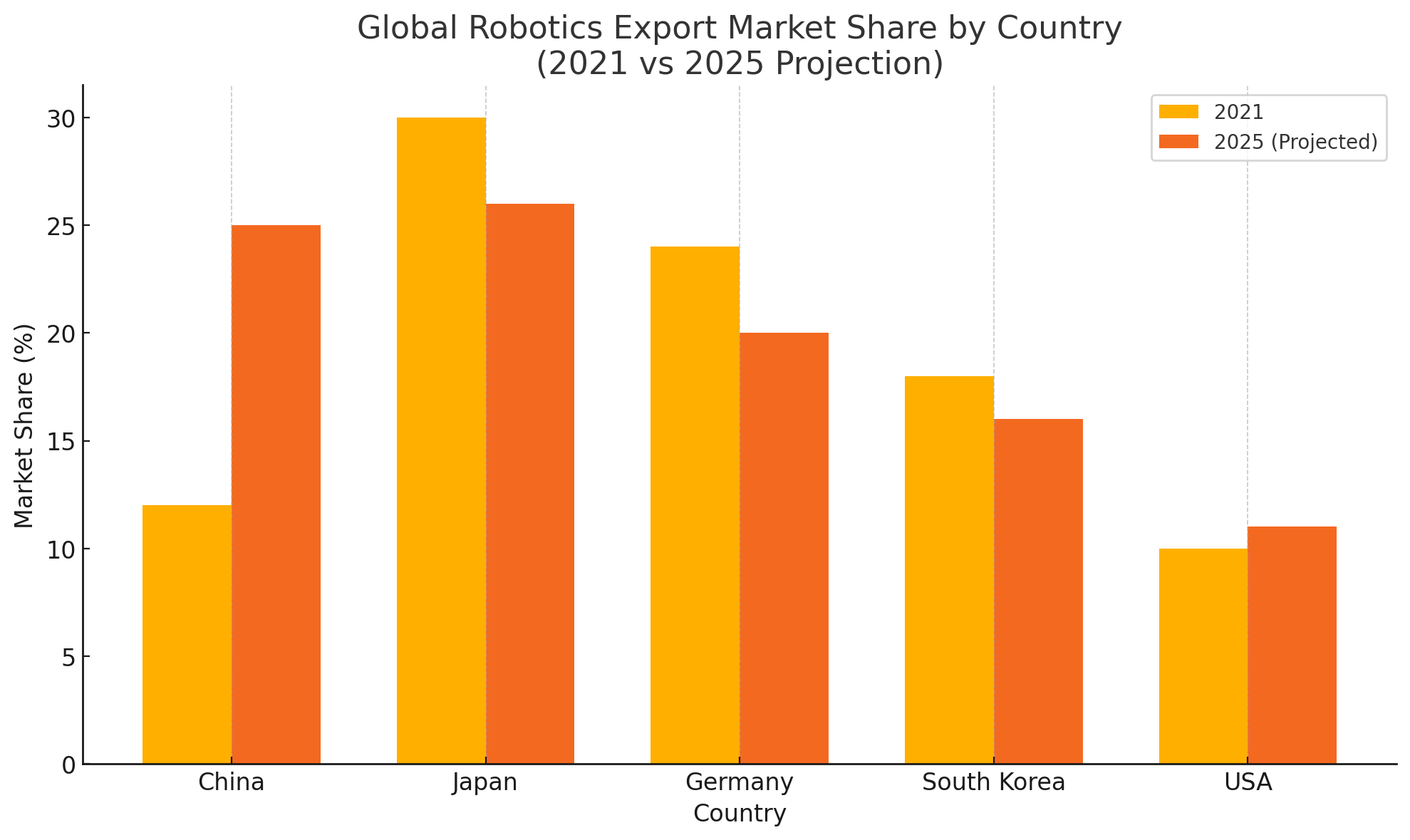

A key metric in evaluating this global contest is market share in robotics exports, where China is steadily gaining ground. In 2021, Japan, Germany, and South Korea were the top exporters of industrial robots. However, by 2025, China is projected to surpass at least two of these countries, driven by its dominance in mid-range service robots, consumer-grade quadrupeds, and logistics automation. EngineAI startups, with their vertically integrated platforms and aggressive pricing strategies, are leading this export surge and transforming China from a manufacturing base into an innovation hub.

In conclusion, the global battlefield for AI robotics is no longer a two-horse race dominated by Silicon Valley and Japanese hardware firms. China’s EngineAI startups have redefined the rules by fusing cost-effective manufacturing, advanced AI integration, and state-aligned expansion strategies. While challenges persist in semiconductors, standards, and global trust, the momentum is clearly in China’s favor. As robots become ubiquitous in public, private, and industrial spaces, the EngineAI revolution is fast becoming one of the most consequential shifts in global technological leadership.

The Stakes of the EngineAI Revolution

The rise of EngineAI startups in China marks a pivotal inflection point in the global technological landscape. These firms are not merely building smarter robots—they are reengineering the entire robotics paradigm by integrating large-scale artificial intelligence, real-time edge computing, and advanced electromechanical systems into cohesive, general-purpose machines. With robust policy support, strong capital inflows, and a growing network of global partnerships, China is fast transforming from a manufacturing hub into a global epicenter for autonomous intelligence. The stakes of this revolution are profound, touching every facet of society—from industrial productivity and national competitiveness to ethical governance and the future of labor.

As this blog has explored, EngineAI firms are driving a new generation of robotics characterized by multi-modal intelligence, autonomy, and adaptability. These companies are building systems that not only navigate space but also understand context, respond to human language, and learn from their surroundings. Their ability to embed custom-trained AI models directly onto energy-efficient chips has allowed for real-time responsiveness in settings as diverse as hospitals, warehouses, shopping malls, and private homes. This level of integration represents a structural leap over previous robotic systems that relied heavily on cloud services, rigid programming, or single-functionality.

The technological foundation of this movement has been reinforced by China's expansive approach to R&D. The nation’s EngineAI startups benefit from a seamless fusion of academic research, enterprise innovation, and state sponsorship. Through national AI initiatives, specialized test zones, and collaboration with elite universities, China is nurturing a holistic pipeline of innovation—from the drawing board to mass deployment. Moreover, the government’s industrial policy ensures that these technologies are rapidly diffused into the broader economy, creating a positive feedback loop of application, refinement, and reinvestment.

Yet, the implications of EngineAI’s rise extend far beyond Chinese borders. As Section IV detailed, China is actively leveraging its EngineAI capacity to shape the future of global robotics exports, standards, and norms. By embedding its technologies into the infrastructure of partner countries, China is laying the groundwork for long-term technological influence. These moves are not purely commercial—they are deeply strategic, enabling Beijing to assert soft power, promote techno-economic alignment, and build resilience in the face of geopolitical constraints.

This expansion is already beginning to shift the global center of gravity in robotics. While the United States, Japan, and Europe maintain leadership in certain domains—such as foundational model development, IP generation, and high-precision industrial robotics—China’s ability to produce affordable, intelligent, and general-purpose robots at scale presents a challenge to the existing order. The success of companies like Unitree and Fourier Intelligence underscores a broader shift: in the near future, the most ubiquitous robots may be those born not in Silicon Valley or Tokyo, but in Hangzhou, Shenzhen, or Shanghai.

At the same time, this transition raises critical questions about regulatory oversight, workforce impact, and societal alignment. As robots gain cognitive and physical capabilities that were once uniquely human, they will increasingly perform roles across healthcare, logistics, education, and domestic life. This creates pressure on labor markets, particularly in middle-skill roles that can be automated with embodied AI. Governments must act proactively to reskill workers, implement inclusive technology strategies, and ensure that productivity gains are equitably distributed.

Additionally, there is a growing need for international governance frameworks that address the ethical and operational complexities of AI robots. Issues such as autonomous decision-making, liability, data privacy, and human–machine interaction protocols are still in their infancy. China, through its centralized policy apparatus and large-scale testing environments, has the opportunity to define some of these standards—but it must do so in dialogue with international stakeholders to ensure compatibility, trust, and legitimacy. Without coordinated governance, the world risks fragmentation, where divergent standards and opaque AI behavior limit the safe adoption of robotic systems across borders.

Moreover, EngineAI’s trajectory underscores the increasingly dual-use nature of advanced robotics. The same AI systems that deliver packages or assist patients can be reconfigured for military logistics, surveillance, or strategic deterrence. As countries race to adopt autonomous systems, the line between civilian and military applications will continue to blur. This dynamic adds another layer of urgency to discussions about transparency, arms control, and responsible innovation. China’s success in EngineAI could either foster global cooperation through shared progress—or fuel mistrust if deployed in opaque or unilateral ways.

Nevertheless, the positive potential of EngineAI robotics should not be understated. These technologies offer unprecedented opportunities to address structural challenges such as aging populations, labor shortages, and disaster response. In regions with limited infrastructure, low-cost intelligent robots can serve as educational aides, medical support systems, and economic multipliers. By democratizing access to automation, EngineAI has the power to extend the benefits of the digital revolution to populations that were previously excluded from its most transformative effects.

Looking ahead, the coming decade will be defined not merely by how fast nations can develop AI-powered robots, but by how well they can integrate them into human-centric ecosystems. China’s EngineAI startups are leading this charge with bold vision and strategic execution. Their progress serves as both a model and a challenge to other nations, highlighting what is possible when innovation is guided by long-term planning, full-stack engineering, and cohesive industrial alignment.

In conclusion, the EngineAI revolution is more than a technological phenomenon—it is a defining force of the 21st century. The choices made today by engineers, investors, regulators, and societies will shape not only how we live and work, but also who leads and who follows in the next chapter of global development. For now, China’s EngineAI startups have seized the initiative. Whether they maintain this lead will depend on how the world responds—through competition, collaboration, or both.

References

- Fourier Intelligence – https://www.fourierintelligence.com

- Unitree Robotics – https://www.unitree.com

- Horizon Robotics – https://www.horizon.ai

- China’s AI Development Plan – https://www.ndrc.gov.cn

- Agibot Company Info – https://www.agibot.cn

- Belt and Road Initiative Overview – https://www.yidaiyilu.gov.cn

- MiniCPM Model on Hugging Face – https://huggingface.co/openbmb/MiniCPM

- InternLM Project – https://github.com/InternLM

- Sanctuary AI – https://www.sanctuary.ai

- Boston Dynamics – https://www.bostondynamics.com