How China is Building the Future of Work with Humanoid Robots

Humanoid robots – machines designed with a human-like form and behavior – are fast emerging from science fiction into real-world workplaces. Unlike traditional industrial robots (typically stationary mechanical arms), humanoid robots walk on two legs, use arms and hands to manipulate objects, and are envisioned as versatile co-workers that can navigate environments built for humans. From factories and warehouses to hospitals and offices, these bipedal automatons promise to take on labor-intensive tasks, assist human colleagues, and even address workforce shortages. Around the world, technology leaders are racing to develop useful humanoid “worker” robots, with the potential to transform countless industries.

As this global competition unfolds, China has rapidly seized a leading position. Bolstered by national strategy, a thriving robotics industry, and urgent economic needs, China is investing heavily to make humanoid robots a practical reality in the workplace. In recent years, Chinese companies have unveiled advanced humanoid prototypes and begun pilot programs in factories and public settings. Government officials have declared humanoid robotics a priority for future growth, aiming for China to become the world leader in this field within just a few years. Meanwhile, U.S., European, and Japanese firms are also pushing the envelope – from Tesla’s much-publicized “Optimus” bot to Canada’s AI-powered humanoids and Japan’s legacy of android pioneers. The stakes are high: whichever nation masters humanoid co-workers first could gain a competitive edge in manufacturing, logistics, healthcare, and beyond.

In this comprehensive exploration, we delve into the rise of humanoid robots as co-workers, with a focus on China’s pivotal role. We will introduce what humanoid robots are and how they can be applied in workplaces, profile leading Chinese robotics companies and research institutions driving innovation, examine China’s national AI and robotics strategy, and compare China’s progress with key global competitors in the U.S., Europe, and Japan. Real-world case studies of humanoids already working in Chinese industries will illustrate how far this technology has come. We will also analyze the economic, technological, and policy forces propelling China’s advancement – and the challenges that still loom. Finally, we consider the future outlook: how widespread humanoid co-workers might reshape labor markets and global automation, and the ethical and international implications of China’s humanoid robotics revolution.

Humanoid Robots in the Workplace: A New Era

Humanoid robots are broadly defined as robots that resemble the human body in shape and capabilities. Typically, they have a head (sometimes with sensors mimicking eyes and ears), a torso, two arms, two hands, and two legs with feet. This form factor is not an arbitrary aesthetic choice – it is deliberately designed to operate in environments made for humans. Doorways, staircases, tools, vehicles, and most infrastructure are built to human proportions and abilities. A robot with a human-like shape can theoretically use the same spaces, tools, and equipment that people do, making them highly adaptable “drop-in” replacements or assistants for human workers. In contrast, wheeled robots or fixed robotic arms must have the environment modified for them or are limited in scope. Humanoids aim to perform a wide range of tasks: walking around a factory floor to deliver or sort parts, using their arms to assemble products or carry loads, interacting with human co-workers and customers, and even learning to perform skilled labor or provide care.

Early humanoid robots were often research projects or charismatic demos – for example, Honda’s ASIMO robot, first introduced in the early 2000s, could walk and climb stairs and became a symbol of Japan’s robotics prowess. However, these early humanoids were not yet good co-workers. They had limited battery life, slow and stiff movements, and could only handle very controlled tasks. In short, they were “lousy co-workers,” as one recent Wall Street Journal piece bluntly put it. Even today, building a humanoid robot that is truly useful in a real workplace is an immense technical challenge. It requires expertise in mechanical engineering (for the legs, arms, and actuators that mimic muscles), advanced AI for vision and decision-making, and sophisticated software to coordinate balance and movement. Many tasks that are simple for humans – twisting a knob, gauging the force to pick up an object, walking on uneven ground – are extraordinarily complex for a robot.

Yet, recent advances in artificial intelligence (especially computer vision and machine learning), improved actuators and batteries, and an abundance of computing power are enabling a new generation of humanoid robots with far greater capabilities. The year 2021 was a milestone when Tesla announced its plan for a general-purpose humanoid called Optimus, sparking a surge of interest and investment in humanoid robotics. By early 2025, the Consumer Electronics Show (CES) featured no fewer than 14 different humanoid robot models on stage, demonstrating walking, grasping, and interacting – a stunning showcase of progress in just a few years. Nvidia’s CEO Jensen Huang declared at CES 2025 that “the ChatGPT moment for general robotics is just around the corner,” predicting that advances in AI and hardware will power “a billion humanoid robots in the coming years”. Analysts forecast that what seems like a futuristic novelty today could become an enormous market over the next decade: Bank of America projects global humanoid robot shipments to reach 1 million units by 2030, with a market value of around $20 billion annually by that time. Looking further ahead, some optimistic scenarios envision hundreds of millions or even billions of humanoid robots deployed worldwide by mid-century if technology and adoption follow an exponential trajectory. Elon Musk, known for his bold predictions, even mused that humanoid bots might one day outnumber humans on Earth – though such extreme forecasts are viewed with skepticism by many experts.

Why are humanoid robots poised to become so important? A major driver is the potential productivity boost and labor supply augmentation they offer. In manufacturing and logistics, humanoids could automate physically demanding or repetitive tasks for which companies struggle to find workers. Unlike fixed automation, these robots could be re-trained for new assignments, making factories more flexible. In healthcare, humanoid aides might help lift patients or deliver supplies in hospitals. In service industries, a humanoid could staff a reception desk, guide visitors, or perform cleaning – all tasks that currently require human labor. Critically, humanoid robots bring automation into environments that were not originally designed for robots, which means they can be deployed without rebuilding entire facilities. This versatility positions them as a disruptive innovation, often billed as the next revolution in productivity after the advent of personal computers, the internet, smartphones, and more recently, electric vehicles and AI. China’s Ministry of Industry and Information Technology (MIIT) explicitly calls humanoid robots “a disruptive product following computers, smartphones, and new energy vehicles”, highlighting their expected impact on future industries.

China’s Strategic Focus on Humanoid Robotics

National AI Strategy and Policy Support

China’s rise in humanoid robotics is no accident – it is the result of a deliberate national strategy that prioritizes robotics and artificial intelligence as keystones of economic development. In recent years, Chinese leadership has repeatedly emphasized the importance of “smart manufacturing” and automation, especially as the country faces demographic and economic transitions. President Xi Jinping himself has drawn attention to robotics: in January 2025, Xi convened a meeting with top business leaders – among them the young CEO of Unitree Robotics (a Chinese robot startup) – underscoring the sector’s “rising importance in the $19 trillion economy.” This high-profile meeting sent a strong signal that humanoid robots and AI are strategically vital technologies in China’s rivalry with global competitors.

A key motivation for China’s government is the nation’s shifting demographics and labor market. China’s population is aging rapidly and its workforce is shrinking. Younger generations are less inclined to take up repetitive factory jobs, resulting in labor shortages for manufacturing and service roles. In fact, officials forecasted a shortfall of nearly 30 million manufacturing workers by 2025. By 2045, China’s working-age population is projected to decline to around 645 million, down from a peak of 794 million in 2013. This dramatic demographic shift threatens to slow economic growth and undermine China’s industrial output. To preempt this, the Chinese government is turning to robotics and AI to “fill the gap.” Humanoid robots are seen as a way to address the labor crunch by supplementing the human workforce, ensuring factories and essential services remain productive even as human labor becomes scarcer.

In 2023, China’s Ministry of Industry and IT issued guiding guidelines to accelerate humanoid robot development. The government formally designated humanoid robots as a frontier technology for China’s economy and set ambitious goals for innovation. For example, the Beijing Robot Industry Innovation and Development Action Plan (2023–2025) called for developing 100 key high-tech robots and 100 pilot applications nationwide. Financial support, tax incentives, and research grants have been directed to build a robust ecosystem for robotics innovation. By 2024, the phrase “new productive forces” – referring to advanced technologies like AI and humanoid robotics – was included in China’s central government work report for the first time, listed as a top priority for the year. This indicates that at the highest levels, China views humanoid robots not just as gadgets, but as critical infrastructure for the next stage of economic growth.

Concrete initiatives back up these policy statements. The Joint National & Local Embodied Intelligence Robot Innovation Center was established in Beijing, supported by major tech corporations and research institutions. Ten leading companies – including UBTECH Robotics, Jingcheng Machinery Electric, and Xiaomi Robotics – each took significant stakes in this center. The center serves as a hub to develop open-source platforms for humanoid robots, lowering the barrier for innovation across industry. It has already launched platforms like “Tiangong”, a general-purpose robotics software/hardware stack reportedly capable of high-speed motion (running up to 10 km/h), and “Kaiwu”, an AI-driven “embodied brain” for task planning and skill execution in robots. Importantly, the center embraces open-source principles, gradually releasing software frameworks, structural blueprints, and electrical designs for others in China to use. This collaborative approach aims to standardize and accelerate progress, so that smaller startups and researchers can build on shared advances rather than reinventing the wheel.

Alongside government-funded efforts, massive venture capital and state investment funds are pouring money into humanoid robotics. In 2024, China launched a new state-guided industrial investment fund worth roughly $138 billion, specifically naming “embodied AI” (the intelligence that animates physical robots) as a priority. This fund is encouraging private investors and companies to join the robotics push, offering a familiar recipe of subsidies and favorable policies that China previously used to dominate sectors like electric vehicles, shipbuilding, and solar panels. “They have more companies developing humanoids and more government support than anyone else,” notes Jeff Burnstein, president of the Association for Advancing Automation in the U.S., adding that China “may have an edge” right now due to this concerted backing. By setting a target to be the world leader in humanoid robots by 2027, China’s government has effectively kicked off a high-stakes “space race” of sorts in robotics – and given domestic companies every incentive to sprint ahead.

Economic and Technological Drivers

Several economic and technological factors further explain why China is uniquely positioned to lead in humanoid co-worker robots:

- Manufacturing Ecosystem and Cost Advantages: China’s deep manufacturing supply chains and experience give it a potential cost edge in building complex electromechanical products like robots. From high-precision sensors and motors to batteries and control chips, Chinese firms produce a vast range of components. In fact, Chinese companies hold roughly two-thirds of global robotics patents, and China has been the world’s largest market for industrial robots for over a decade. This means Chinese engineers and factories have accumulated know-how in robotics and can leverage economies of scale. Analysts predict that a humanoid robot built in China could eventually cost less than half the price of one built elsewhere, thanks to domestic component sourcing and manufacturing efficiency. This mirrors the pattern in electric vehicles, where China’s dominance in the supply chain drove down costs significantly over time. One Bank of America analyst remarked, “I think humanoid robots will be another EV industry for China”, suggesting China could end up producing the majority of the world’s humanoid bots just as it did with batteries and EVs. Lower costs will be critical for widespread adoption, since current humanoid prototypes can cost hundreds of thousands of dollars each (for example, UBTECH’s industrial humanoid Walker robot system, including software, runs in the high six figures).

- Rapid Iteration in Real Environments: China’s huge network of factories and commercial spaces offers a testing ground for robots that is hard to match. A robot improves by gaining experience (through data) and by engineers refining it in response to failures. Chinese startups have the opportunity to deploy prototypes directly on factory floors or in malls and gather immense real-world data. “The reason why China is making rapid progress today is because we are combining it with actual applications and iterating and improving rapidly in real scenarios,” explains Cheng Yuhang, a director at Deep Robotics, a Chinese robot firm. He notes that this is “something the U.S. can’t match” easily, because American companies may be more constrained in finding on-site deployment partners early on. In China, a robot can be put to work in a friendly partner factory to sort parts or deliver items, exposing it to unstructured, unpredictable conditions. Engineers then quickly refine the software based on these trials. As one UBTECH manager observed, a problem that might take a month to solve in the lab “may only take days in a real environment” once the robot is out in the field. This fast feedback loop dramatically accelerates development. China’s willingness to embrace new tech in daily life – from AI chatbots to delivery drones – also means the public is relatively receptive to seeing robots in action, easing field testing.

- Integration of AI Advances: China has not only hardware prowess but also significant AI research talent and resources. The surge in artificial intelligence (such as computer vision and natural language processing) provides the “brain” for humanoid robots to make sense of the world. Chinese tech giants and startups alike are investing in AI models that can be embedded in robots. Large Language Models (LLMs), exemplified by GPT-style AI, have given robots a better ability to understand instructions and plan tasks. Wang Xingxing, founder of Unitree Robotics, noted that the emergence of powerful AI models has “sparked new possibilities for making humanoid robots more universally applicable”, effectively bridging robotics with general-purpose AI. For example, UBTECH’s Walker robots integrate a large language model for general task planning, enabling them to interpret high-level instructions and break them into actions. Another Chinese company, iFLYTEK (a leader in voice AI), launched an “AIBOT” platform that combines multimodal perception and cognitive intelligence to help robots listen, speak, and understand in noisy, real-world environments. By merging advanced AI with physical robots, Chinese developers are tackling one of the hardest challenges – giving robots the cognitive skills to be helpful co-workers, not just moving machines.

- Government as Early Adopter and Promoter: The Chinese government not only funds R&D but also helps create a market for robots by encouraging adoption in public services and state-owned enterprises. We see robots greeting customers in state-backed banks, patrolling shopping centers, or even performing on national TV. During the 2024 Lunar New Year gala (China’s most-watched television event), humanoid robots took the stage and performed a synchronized dance alongside human dancers, an eye-catching demonstration broadcast to hundreds of millions of viewers. This kind of promotion helps normalize humanoids in the public eye and signals to …domestic industries that the leadership stands firmly behind this technology, encouraging companies to invest and integrate robots. In Chinese hotels and banks, it’s not uncommon now to see humanoid greeters or customer service robots. Tourist sites have even featured humanoid robots – for instance, some robots have been seen climbing the steps of the Great Wall alongside visitors as part of tech demonstrations. This public visibility and government endorsement help smooth the path for humanoid robots to move from prototypes to real deployment.

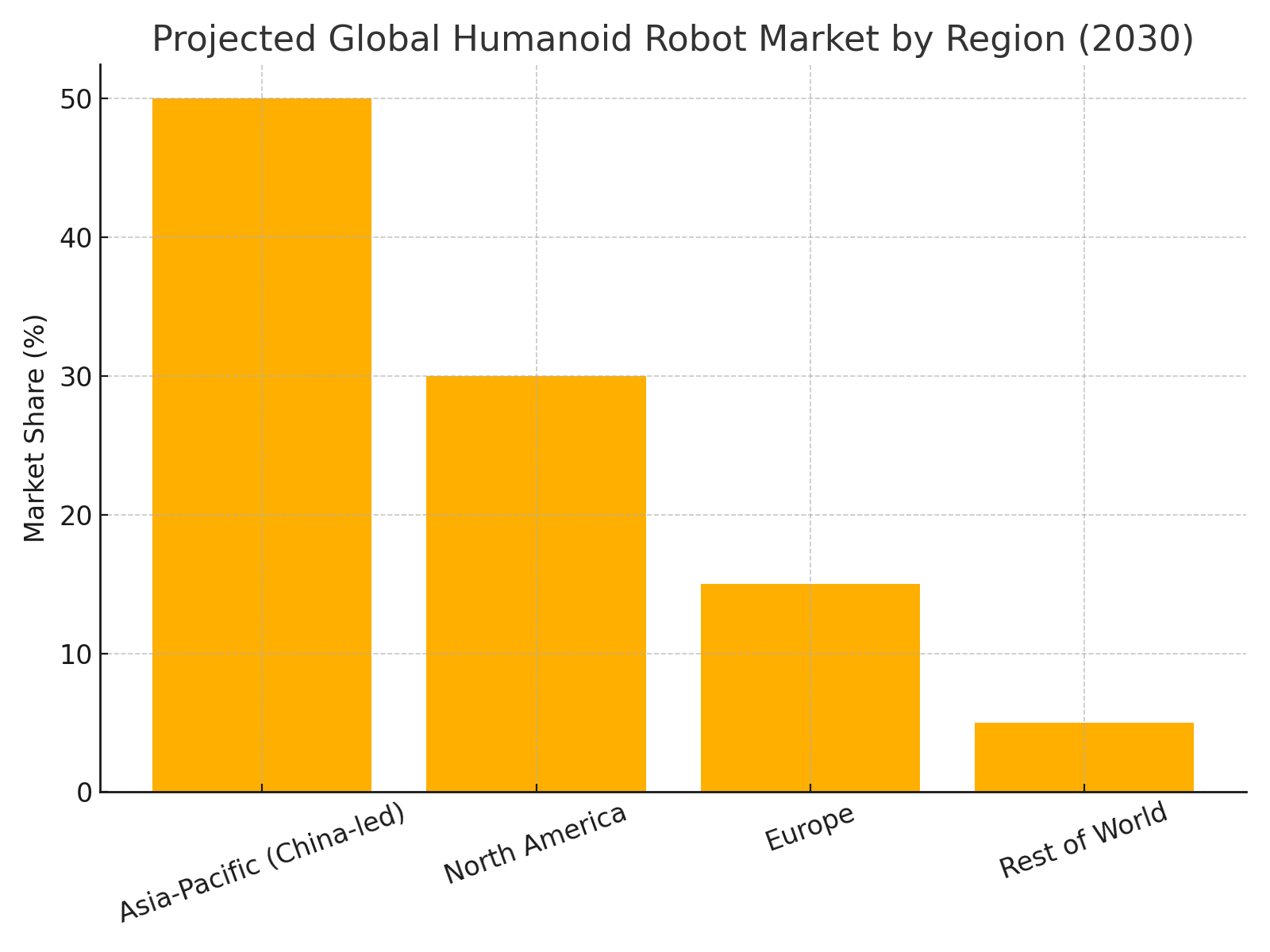

Projected Global Humanoid Robot Market by Region, 2030: Asia-Pacific (led by China) is anticipated to command roughly half of the global humanoid robotics market by 2030, reflecting the region’s aggressive adoption and manufacturing advantages. North America is projected to account for around 30%, with Europe and other regions comprising the remainder. This regional outlook underscores how China’s push in humanoid robots could translate into significant global market leadership in the coming decade.

Leading Chinese Companies and Research Institutions in Humanoid Robotics

hina’s momentum in humanoid robotics is driven by a constellation of companies and institutes, ranging from well-funded tech giants to agile startups. Many of these firms have made headlines by unveiling advanced humanoid prototypes and achieving technical milestones. Below we profile some of the leading Chinese developers and their contributions:

- UBTECH Robotics (Shenzhen): Founded in 2012, UBTECH is a pioneer in humanoid robots and artificial intelligence. It gained fame with its earlier small humanoid toys and educational robots, but has since moved into industrial-grade humanoids. UBTECH’s flagship Walker series robots stand about 1.7 meters tall and are designed to perform tasks in factories and service environments. In December 2023, UBTECH became the first humanoid robot company to go public (listing on the Hong Kong exchange) – a testament to its scale. UBTECH’s Walker robots have entered pilot use in manufacturing: notably, a Walker S model was introduced into electric car maker NIO’s assembly line, marking the world’s first instance of a humanoid working alongside humans in auto production. UBTECH has also formed partnerships with major firms like Foxconn (the world’s largest electronics manufacturer) to deploy humanoids for tasks such as component transport, assembly assistance, and quality inspection on electronics production lines. The company plans to deliver 500–1,000 units of its Walker S robots to clients in 2025 (including to Foxconn and other partners) and ramp up to over 10,000 units by 2027. This aggressive scaling target underscores UBTECH’s ambition to mass-produce humanoid co-workers on a scale not yet seen elsewhere.

- Fourier Intelligence (Shanghai): Established in 2015, Fourier started in the field of rehabilitation robotics – producing exoskeletons and robotic therapy devices used in hospitals. Leveraging that expertise in human motion, Fourier launched its first general-purpose humanoid, the GR-1, in mid-2023. The GR-1 stands 1.65 m tall and features a highly biomimetic body with 40 degrees of freedom, enabling human-like motion control. It can walk at a brisk pace (over 5 km/h), navigate around obstacles, handle slight inclines, and maintain balance against impacts. Fourier emphasizes the strength of GR-1 – it can reportedly carry close to its own weight (around 50 kg payload) which is exceptional for a bipedal robot of its size. Company chairman Gu Jie has said he envisions humanoid robots becoming “the next generation of terminals, much like cars and mobile phones” – in other words, ubiquitous platforms in daily life. While pursuing general-purpose capabilities, Fourier hasn’t forgotten its roots: it is positioning GR-1 for use in medical rehabilitation and elder care (assisting therapists or caregivers), and has already deployed various robotics solutions to over 2,000 rehab institutions worldwide By integrating cognitive AI and force-feedback control, Fourier’s humanoid is expected to safely interact with people who need physical assistance, illustrating a unique use-case beyond factory floors.

- Xiaomi Robotics Lab (Beijing): Better known as a consumer electronics giant, Xiaomi has ventured into humanoid robotics as part of its strategy to expand in AI and smart devices. In August 2022, Xiaomi unveiled CyberOne, a full-sized bipedal humanoid often nicknamed “Metal Bro.” Standing 177 cm tall and weighing 52 kg, CyberOne can walk and gesture and is equipped with Xiaomi’s self-developed actuators and vision systems. Xiaomi developed the robot’s intelligence and mechanical systems in-house, showcasing its broad R&D capabilities beyond smartphones. CyberOne is capable of recognizing human emotions, thanks to AI algorithms that interpret voice tone and facial expressions. In 2023, Xiaomi followed up with a second-generation quadruped robot (CyberDog 2) and announced a dedicated Robotics Lab in partnership with Wuhan University to advance robotics research. While Xiaomi’s humanoid efforts are in relatively early stages (more prototype than product), the company’s entry highlights how major Chinese tech firms are investing in embodied AI. Xiaomi’s experience in mass-producing consumer electronics could eventually translate to making robots at scale, and its ecosystem of AI software (voice assistants, computer vision, etc.) can be repurposed for humanoid interaction. The involvement of a popular brand like Xiaomi also helps draw public and investor attention to humanoid robots as part of future “smart life” scenarios.

- Unitree Robotics (Hangzhou): A rising star founded in 2016 by a young engineer, Unitree first made waves by producing affordable agile quadruped robots (four-legged robots akin to Boston Dynamics’ Spot). Unitree’s vision is to create accessible robotics for wide use, and it has already sold legged robots to customers globally. In January 2024, Unitree debuted its first humanoid robot, the Unitree H1, at a tech event in Las Vegas. The H1 drew attention as it was demonstrated performing autonomous movements in a live setting. Unitree leverages its in-house design of high-performance motors and actuators (it has over 150 patents) to give the H1 smooth motion and balance. As a younger startup, Unitree is notable for its entrepreneurial energy – its founder Wang Xingxing (born in the 1990s) represents a new generation of Chinese roboticists. He noted that contemporary AI breakthroughs like large language models have accelerated progress in humanoids. Unitree has achieved national-level recognition (being labeled a “Little Giant” high-tech enterprise in China), and even gained a spot in North American. Unitree’s humanoid development is one to watch, as the company aims to marry low-cost innovation with advanced capabilities.

- AgiBot (Shenzhen): A newcomer founded in 2023, AgiBot (also stylized as Agibot) has quickly become a domestic “unicorn” in humanoid robotics. Led by Peng Zhihui – a former Huawei engineer famous for his inventive DIY robotics projects – AgiBot raised several funding rounds in its first year, reflecting high investor enthusiasm. In August 2023, the startup revealed its prototype Expedition A1 humanoid, demonstrating tasks like tightening screws, assembling chassis components, and even acting as a home companion or handling hazardous material experiments. Such a range of scenarios suggests AgiBot is exploring both industrial and personal-service applications. Peng’s celebrity status in China’s tech community (he was known as a prodigious “maker” before founding AgiBot) has helped draw attention to the company. AgiBot’s rapid progress – launching a complex humanoid within months of founding – also highlights the benefits of China’s open-source and collaborative ecosystem. Peng likely drew on existing research and readily available component suppliers to accelerate development. AgiBot represents the startups’ sprint in China’s humanoid race: small, fast-moving teams that are pushing the envelope, inspired by the government’s call to innovate. While still early, their contributions add to China’s overall lead.

- Research Consortia and Academic Labs: In addition to companies, China’s top universities and institutes are deeply involved in humanoid robotics R&D. For example, Beijing Institute of Technology and Shanghai Jiao Tong University have robotics labs focusing on bipedal locomotion and dexterous control. Tsinghua University and Wuhan University are partnering with industry (as seen in Xiaomi’s joint lab) to blend theoretical research with practical robot designs. The Embodied Intelligence Robot Innovation Center in Beijing, backed by academia and industry, is acting as a national incubator for core technologies. Through this center, foundational platforms (like the Tiangong and Kaiwu systems mentioned earlier) are developed and shared, benefitting many research groups. Chinese researchers are publishing papers on topics such as whole-body motion control, robot perception, and human-robot interaction – ensuring that the country is not just building robots, but also contributing to advancing the underlying science. This tight integration of academia, startups, and established companies forms a powerful innovation network. It means breakthroughs can rapidly move from a university lab to a startup prototype to a real-world pilot deployment, all within China’s ecosystem.

Together, these players – from UBTECH’s industrial might to AgiBot’s startup agility – create a robust pipeline for humanoid robot development. The larger companies provide resources and pathways to mass production, while startups and labs inject fresh ideas and specialized focuses. Notably, they are not working in isolation: we often see collaboration (for instance, component suppliers like Zhejiang Shuanghuan Driveline providing advanced motors and transmissions to multiple robot makers). This collaborative yet competitive environment is a strength for China. It increases the odds that if one approach falters, another will succeed, keeping the overall progress on track.

Real-World Deployments in Chinese Industries

A key measure of China’s lead in humanoid robots is that these machines are already stepping out of the lab and into real workplaces in China. While most humanoid robots globally are still in prototype or testing phases, China has launched several pilot programs where humanoids operate in actual industrial and commercial settings. These early deployments provide invaluable lessons and showcase the potential of robots as co-workers.

One prominent example is in the automotive industry. In late 2023, electric vehicle manufacturer NIO began testing UBTECH’s Walker S humanoid on the assembly line of its second advanced factory. The robot was “trained” on-site to assist human workers in assembling car components and performing quality inspections. This marked the first time globally that a humanoid robot worked alongside humans to build cars on a mass production line The Walker S moved between workstations, helped tighten bolts, and used computer vision to check fit and finish on the vehicles – tasks that could free up human workers to focus on more complex issues. Following NIO’s lead, other Chinese automakers showed interest. Zeekr (a premium EV brand under Geely) hosted a group of UBTECH engineers testing humanoid robots in its factory, as reported by the Wall Street Journal. Likewise, state-owned carmakers like FAW’s Hongqi brand and Dongfeng Motor have explored humanoid robots for tasks such as parts handling and machine tending, seeking to automate more of their production amid skilled labor shortages. Chinese manufacturers see these robots as a way to maintain high throughput even as the workforce ages or young people prove hard to recruit for factory work.

In the consumer electronics sector, the world’s manufacturing powerhouse Foxconn has partnered with UBTECH to deploy humanoid robots in assembly plants. Foxconn’s giant facilities in Shenzhen and other cities assemble devices like the iPhone, employing hundreds of thousands of human workers. Even a partial automation of these lines could have huge implications. In 2024, UBTECH’s Walker robots completed training at a Foxconn site, demonstrating the ability to perform visual inspections and precision assembly tasks with a high degree of autonomy. Plans are underway to integrate multiple humanoid units in Foxconn factories to work in tandem with humans on assembly lines for smartphones and other electronics. If successful, Foxconn could gradually reduce its reliance on manual labor for intricate assembly, a long-sought goal as labor costs rise in China. It’s telling that Foxconn, which has long used conventional factory robots, is now turning to humanoid forms – it suggests that only now are robots becoming flexible enough to handle the same tasks as human line workers, such as picking up delicate parts, fastening tiny screws, or moving between different work cells. A Chinese news headline even boldly stated “Humanoid robots to assemble iPhones in China,” capturing the imagination of how far this technology has come.

Beyond factories, Chinese companies are trialing humanoid robots in logistics and warehouses. E-commerce and delivery firms face pressure to automate sorting and distribution centers to keep up with online shopping volumes. Trials have been conducted with humanoid (and other legged) robots to pick and place packages, or to ferry goods in warehouses that were originally designed for human workers with carts. While wheeled autonomous robots are common in new, purpose-built logistics centers, humanoid robots offer a way to automate older facilities with staircases, narrow aisles, and shelves meant for humans. A humanoid could climb steps or reach high shelves without warehouse redesign. SF Express, one of China’s largest courier companies, reportedly tested a humanoid robot for handling parcels in a pilot program in 2024 (this was noted by industry insiders, although detailed results weren’t public). Meanwhile, Amazon in the U.S. has begun using bipedal robots (the Digit robot) in its warehouses since 2023 as a pilot, underlining that logistics is a key application globally. Chinese logistics firms are keen not to fall behind. Early experiments in China suggest humanoids can work cooperatively with existing automation – for instance, transferring a package from a conveyor (where a human would normally do the hand-off) and then walking it to a loading bay, bridging the gap between fixed machinery and truck loading which currently still requires people.

In service and hospitality roles, humanoid robots in China are mostly at the demo stage, but are drawing public interest. Some hotels in Beijing and Shanghai have trialed humanoid receptionists that can greet guests, check IDs, and escort visitors to elevators. These robots combine face recognition with speech interaction (often powered by AI companies like iFLYTEK) to handle simple customer service dialogs. In restaurants, a few pilots have used humanoid robots as waitstaff that can carry trays to tables – although simpler wheeled “robot waiter carts” are far more common at present (and arguably more efficient for that specific task). Still, the humanoid form catches attention – patrons at a hotpot restaurant in Shenzhen were surprised and delighted when a humanoid robot in an apron brought them their order, an experiment by the restaurant’s tech-savvy owner. In healthcare, a hospital in Guangzhou tested a humanoid as a medical assistant that could walk between wards delivering medicine and even help lift patients under supervision. This trial, while small-scale, aimed to see if a humanoid assistant could reduce the physical strain on nursing staff.

Perhaps the most charming deployment was cultural: during the 2024 Chinese New Year Gala on CCTV, a troupe of humanoid robots from several companies performed a dance routine on stage. They moved in sync with human dancers, bowing and even taking selfies in a pre-recorded segment. While purely entertainment, that demonstration required the robots to execute complex, human-like motions in unison – a feat of balance and coordination. It served to familiarize the public with humanoid robots and showcase Chinese engineering on a grand stage.

All these examples show that China is not just building humanoid robots in theory – it is actively testing them in practice, in diverse settings. Each pilot provides feedback: engineers learn how the robots cope with noise, variable lighting, unpredictable human behavior, and other real-world conditions that are hard to simulate fully in a lab. They also uncover practical issues (for example, how often the robot needs to recharge, or which parts wear out fastest under continuous use) that can be addressed in next iterations. Moreover, Chinese companies are gathering data to make the robots smarter: vision algorithms improve as the robot sees thousands of real parts and products; AI models learn from the mistakes and successes of these field trials. This experience dividend further widens China’s lead – while elsewhere humanoid robots might still be confined to guarded test sites, in China they are quickly learning on the job.

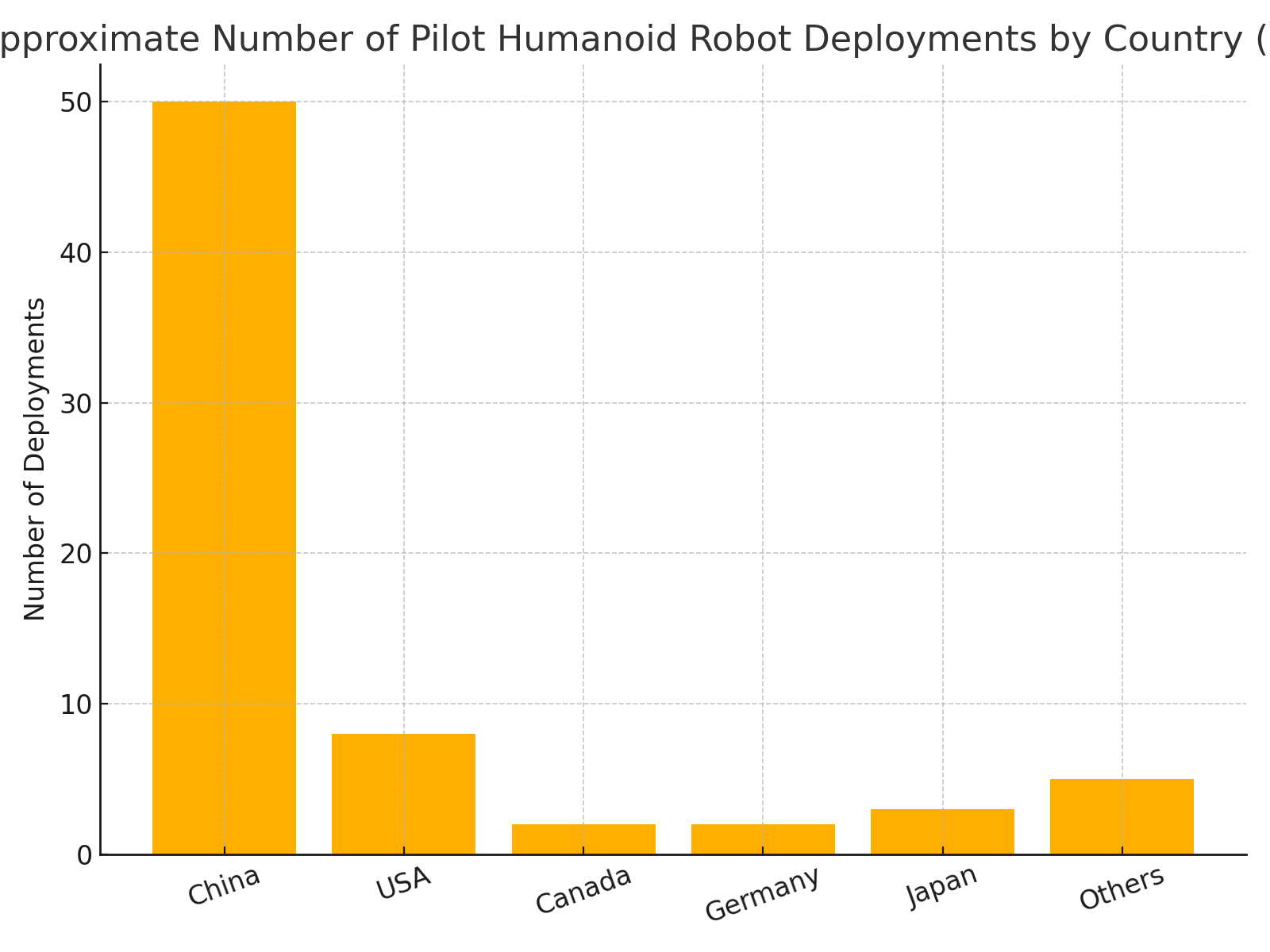

Approximate Number of Humanoid Robot Pilot Deployments by Country (as of 2024): China has taken a commanding lead in trialing humanoid co-workers, with numerous pilots across factories, warehouses, and public venues. By contrast, the United States has only a few known deployments (such as limited tests in warehouses), and countries like Canada or those in Europe have at most one or two active pilots. China’s head start in real-world deployments means its engineers and robots are accumulating practical experience at a faster rate. This accelerates improvement and helps Chinese humanoid designs iterate toward reliability and efficiency, reinforcing the nation’s early edge.

What Drives China’s Leadership – and the Challenges Ahead

China’s head start in humanoid co-workers is driven by a blend of economic necessity, government support, and engineering prowess. However, staying ahead will require surmounting significant challenges. Let’s break down the key factors enabling China’s rise and the hurdles it faces:

Drivers of China’s Advancement:

- Demographics and Labor Economics: As discussed, China’s aging workforce and shrinking pool of young labor make automation a national imperative. Humanoid robots offer a solution to fill labor gaps without completely overhauling existing factories. The government and companies are aligned in seeing robots as crucial to sustaining growth and productivity. This urgency is less acute in some Western countries (which can still rely on immigration or outsourcing for labor), giving China an extra push to innovate or risk economic slowdown.

- Unified National Strategy and Investment: China’s top-down support provides consistent funding and clear goals for industry. The 2025 target to be a global leader focuses efforts, and the large state-guided funds reduce financial barriers for startups. By contrast, in places like the U.S., funding is abundant but more decentralized and subject to market cycles – a hype bust could hurt investment. China’s policy insulation means even if one project fails, the broader program continues steadfastly. The inclusion of humanoid robots in high-level plans (MIIT guidelines, Five-Year Plans, etc.) also coordinates multiple stakeholders – from component suppliers to AI firms – to work in tandem. This holistic approach is paying dividends in speed.

- Manufacturing Ecosystem and Cost: China’s manufacturing capability is a decisive advantage. It can iterate prototypes faster and cheaper. For example, if a Chinese robot company needs a custom gear or sensor, there are domestic factories that can produce it quickly. Companies can co-locate design and production, shortening development cycles. Once ready to scale, Chinese firms can ramp up production and drive down unit costs. Just as China managed to drastically cut costs in solar panels and EV batteries through scale and process improvements, it could do the same for humanoid robots. Lower costs will not only help Chinese adoption but make Chinese robots attractive for export – potentially outpricing competitors.

- Rapid Real-World Iteration: The willingness of Chinese industries to pilot robots early (even if they are imperfect) generates a faster learning curve. Each deployment in a factory or hotel yields data and insights that engineers feed back into design. Chinese culture’s relative comfort with new tech – people are used to mobile robots delivering food or AI apps in daily life – creates an environment where robots can be tested without as much public resistance or liability fear. This “fail-fast, fix-fast” mentality in real settings is a huge accelerator. Meanwhile, foreign competitors might still be refining algorithms in simulation or limited trials, the Chinese robots are already encountering edge cases and improving. Real-world data is the fuel of AI, and China’s deployments ensure it collects that fuel in great quantity.

- Integrated AI Ecosystem: China’s AI sector (from giants like Baidu, Alibaba, Tencent to startups) is providing the brains to match the brawn of its robots. Off-the-shelf solutions for vision, speech, and planning are often available from these AI firms, which robotics companies can customize. Moreover, cross-disciplinary collaboration – e.g., an AI company investing in a robot firm (as iFLYTEK did with UBTECH) – means the latest algorithms get transferred quickly into hardware. China’s leadership in some AI areas (it publishes a large share of AI research papers and has world-class experts) complements its robotics drive. For humanoids, which need a fusion of mechanical engineering and AI, this convergence is crucial. The result is robots that are not just physically capable but increasingly smart and autonomous in their decision-making.

Challenges and Limitations:

- Technical Hurdles: Despite progress, humanoid robots are still nowhere near as capable or adaptable as humans. Chinese humanoids, like all others, struggle with autonomy in unstructured environments. They can handle repetitive tasks in controlled settings, but if something unexpected happens (say a tool is misplaced, or an obstacle appears in their path), they may get confused or require human intervention. Achieving true general-purpose utility – where a robot can be given almost any job and figure it out – remains a distant goal. Specific technical challenges include improving battery life (most humanoids run only 1-2 hours on a charge currently), reducing weight while maintaining strength, and enhancing hand dexterity (today’s robot hands are clumsy compared to human hands for fine manipulation). Chinese engineers are working on better actuators (motors), materials, and AI algorithms, but so are competitors globally. It’s a race against the inherent difficulty of replicating human biomechanics and intelligence.

- Reliability and Safety: For wider adoption, humanoid robots must become extremely reliable and safe. If a robot frequently breaks down, loses balance, or worse, causes accidents, it will hinder trust and deployment. Ensuring a bipedal robot doesn’t fall is a non-trivial challenge – even a 1% chance of a fall is problematic in a busy workplace. Making robots safe requires extensive testing and design redundancies (for example, sensors to detect collisions and software to limit force so that if it bumps a person, it won’t hurt them badly). Chinese companies have less experience with safety certification processes that, say, an automotive company might have. They will need to develop rigorous testing protocols. Additionally, software reliability (avoiding crashes or glitches) is vital, especially as robots integrate complex AI. There’s a long road from impressive demo to a robot that can work 24/7 with minimal errors. Overcoming this will be a common challenge for all, including China.

- High Costs (for now): While China aims to lower costs, currently these humanoid robots are very expensive to develop and produce in low volumes. UBTECH’s Walker, for example, costs on the order of hundreds of thousands of dollars apiece at present This is only viable for pilot trials at wealthy companies. For broader adoption, the cost per robot needs to come down dramatically – ideally to the tens of thousands of dollars or less, which might only happen with mass manufacturing and more standardization of parts. Chinese companies are banking on scaling up (500+ units) to achieve some economies of scale, but there is a catch-22: you can’t scale until there’s a proven market demand, yet demand will be limited until costs come down. China’s strategy of government subsidies and placing robots in state-owned enterprises can help bridge this gap initially. Still, until a clear return on investment is demonstrated, private-sector uptake might be slow. Essentially, Chinese humanoid makers must prove that their robots can do work cheaper, faster, or better than hiring humans, at least in certain tasks, to justify the expense. This is on the near-term to-do list.

- Global Perception and Market Access: As Chinese humanoid robots advance, they may encounter geopolitical headwinds. Already, as noted, some in the U.S. are calling for restrictions on Chinese robots citing security concerns. If Chinese robots are seen as potential tools for espionage (due to their sensors and data collection) or simply as strategic technology, Western countries might limit importing them or partnering on sensitive projects. This could somewhat limit Chinese companies’ ability to tap into global markets, at least in the West. Conversely, Chinese companies might focus on Belt and Road partner countries or developing markets more open to their tech. Additionally, global standards could be an issue – if Chinese robots don’t meet stringent safety or data privacy standards set in the EU or US, they’ll need modifications to enter those markets. Overcoming trust barriers will be as important as technical barriers if Chinese humanoids are to be deployed worldwide.

- Competition from Abroad: China’s lead is real, but other nations are hardly out of the race. American companies, flush with capital, could leapfrog with a breakthrough (for instance, if Tesla solves something fundamental or if AI advances suddenly give U.S. robots a brainpower edge). Likewise, Japan or Europe could surprise with their own initiatives (Japan could re-energize its robotics industry with fresh investments, and Europe’s consortium approach might yield results in niche areas that then expand). The challenge for China is to maintain momentum and not plateau. Often, taking a technology from 80% functionality to 99% functionality is the hardest part – and it’s a part that companies in more mature tech ecosystems have experience with. China will have to prove that it can not only innovate quickly but also polish and perfect technology to make it truly dependable and world-class. If Chinese companies become complacent or hit engineering roadblocks, competitors are ready to catch up. The next decade will likely see a back-and-forth of innovations among global players, and China will need to continuously invest in R&D to hold its edge.

- Ethical and Workforce Concerns at Home: Replacing human workers with robots is socially sensitive. Even in an authoritarian system that can dictate industrial changes, there is recognition in China that massive automation could displace workers and potentially cause unrest or require significant retraining programs. Chinese policymakers will have to balance automation with employment. We may see strategies like “robot-human dual teams” where robots augment rather than fully replace workers, at least initially, to mitigate the shock. Additionally, there are ethical concerns about AI decision-making – for example, if a robot in a public setting malfunctions or causes harm, how to assign liability? China is developing regulations for AI in general, and those will have to extend to physical robots. The government will need to craft rules on what robots can or cannot do (especially if they interact with the public), ensure data collected by robots (like video footage in a workplace) is handled properly, and manage public perception (people need to feel these robots are introduced to help, not simply to take jobs). These are soft challenges but important ones to solve for smooth adoption.

In summary, China’s leadership in humanoid robots is propelled by strong tailwinds – urgent need, top-level support, manufacturing might, and vibrant innovation – but it also faces stiff headwinds – technical complexity, the need for reliability, international skepticism, and competitive pressure. How China navigates these will determine if its current lead translates into long-term dominance.

Future Outlookpact

Humanoid Co-Workers and Their Impact

The coming years are poised to be an exciting and critical period for humanoid robots, as prototypes turn into products and pilot projects scale up. China’s humanoid robots are likely to become an increasingly common sight in factories and workplaces domestically, and perhaps in many other countries if they prove cost-effective. Here we consider the future trajectory and implications of this rise of humanoid co-workers, particularly under China’s influence:

- Reshaping Labor Markets: If humanoid co-workers mature, they could significantly transform labor dynamics. In China, robots could alleviate the manufacturing labor shortage caused by demographic shifts, allowing factories to maintain or even boost output with fewer human workers. This could help sustain China’s role as the “world’s factory” even as its population ages. At the same time, widespread robot adoption will require a shift in the human workforce – demand will grow for skilled technicians, robot maintenance specialists, and AI operators, while low-skill assembly jobs might dwindle. Over the long term, economists project a scenario where robots take over a large portion of routine jobs across industries. A Bank of America analysis went so far as to predict that by around 2050, there could be over 3 billion humanoid robots in use globally, potentially replacing up to half of the jobs in the services sector under a blue-sky scenario. While that figure is speculative, it underscores the scale of disruption possible. For China (and other countries), this means education and job training systems will need to pivot. Training programs in robotics, AI, and advanced manufacturing will be crucial to prepare the next generation for a robot-integrated economy. The government may also need to implement policies to support workers transitioning to new roles – perhaps similar to how it handled earlier economic shifts, but on a larger scale. Conversely, humanoid robots might fill roles in sectors facing worker shortages such as elder care, healthcare, or cleaning services, thereby addressing unmet demand rather than displacing existing workers. The net effect on employment will depend on how fast new jobs are created in the robot economy relative to jobs automated.

- Global Industrial Automation and Economic Shifts: Should China continue to lead in humanoid robot deployment, it could export this automation model globally. Much as China exported affordable consumer goods, it might become a supplier of affordable robotic workers to other nations. Countries in Asia, Africa, and Latin America that have growing economies but labor shortages (or safety issues for certain jobs) might eagerly adopt Chinese humanoids. This could bolster Chinese economic influence – essentially exporting labor in the form of machines. It might also change the calculus of manufacturing location. For instance, if a Chinese-made robot can make manufacturing costs similar everywhere, companies might “reshore” production closer to their markets, using robots instead of cheap overseas labor. That could reduce some manufacturing in China in the long term, but Chinese firms would still profit by selling the robots and the control software. We might see a future where Chinese tech companies operate fleets of humanoid robots worldwide under Robotics-as-a-Service models, charging subscriptions for automated workforces. In such a scenario, global supply chains would be less about goods and more about technology and maintenance services for robots. This could potentially erode traditional low-cost labor advantages of developing countries unless they also acquire robots – a dynamic some economists refer to as “automation altering comparative advantage.”

- Standards and Technology Ecosystems: With China at the forefront, it may have a strong hand in setting technical standards for humanoid robots. These include communication protocols (how robots talk to factory systems or to each other), safety standards (what emergency behaviors are required), and even ethical norms (like whether robots should have identifiable markers as machines, how data from robots’ sensors is stored, etc.). If Chinese robots dominate in numbers, their standards could become de facto global standards, especially in regions where they’re widely used. This is analogous to how Chinese companies influenced global 5G telecom standards by being early and ubiquitous. However, Western countries might push their own standards – for example, ISO might issue rules for robot safety that Chinese makers must comply with to sell abroad. A positive outcome would be international collaboration on standards so that robots from any country can operate safely anywhere, much like aviation standards. Given the stakes, it’s likely that international bodies will start focusing on humanoid robot guidelines, and Chinese experts will want a seat at the table. China has already shown interest in this by open-sourcing parts of its humanoid platforms, possibly to encourage global adoption of its frameworks.

- Ethical and Social Implications: The rise of humanoid co-workers raises profound questions about the relationship between humans and machines. Ethically, societies will need to consider how much autonomy to grant these robots. For instance, is it acceptable for a humanoid to make life-and-death decisions (in healthcare or emergency response)? Probably not without human oversight, at least for now. Should robots have any form of “rights” or should there be clear guidelines that they are tools, not to be treated as humans despite their form? In workplaces, rules about accountability must be set: if a robot makes a mistake, who is responsible – the manufacturer, the operator, the owner? China’s deployment at scale will likely produce case studies that force these questions. Culturally, there’s also the matter of human acceptance. In some cultures, people may resist interacting with robots, preferring human contact. In others (perhaps including China to some extent), novelty and efficiency might trump those concerns. Over time, as humanoids become more common and perhaps more life-like in behavior, humans might anthropomorphize them, which could have psychological impacts – positive (companionship for the lonely, etc.) or negative (people feeling alienated or replaced). Ensuring an ethical balance – using robots to complement human well-being rather than detract from it – will be a universal challenge. China’s experience could pave the way for how to integrate robots harmoniously: its use of robots in elder care trials, for instance, will show whether patients respond well to robotic helpers or not.

- International Competition and Collaboration: The humanoid robot race, particularly between China and the U.S., could either become a point of intense rivalry or an area of potential collaboration (or a bit of both). On one hand, if viewed through a national security lens, we might see export controls, talent wars (countries trying to recruit the best roboticists), and even propaganda battles (each side showcasing their robot achievements to demonstrate technological supremacy). This could mirror the space race of the 20th century, where being first (e.g., to deploy robots at scale) is seen as a matter of prestige and strategic advantage. On the other hand, the world could benefit from cooperation – for instance, sharing safety research, or jointly developing ethical norms so that we don’t have vastly different rules in different countries that hinder innovation. Climate change and global health are areas where humanoid robots could be jointly utilized (robots for environmental cleanup or to support healthcare systems). It’s conceivable that international projects (perhaps through the UN or G20 frameworks) might be proposed to ensure humanoid robots benefit humanity broadly. As the leader, China will have the chance to either open its ecosystem or keep it insular. Historically, China has sometimes followed a tech autarky approach (building its own standards, e.g., its GPS alternative, its internet firewalls) but with robots, given the complexity, it might find value in global cooperation too – especially to allay fears about its robots when exported. The international implications also extend to development divides: if advanced economies all adopt robots, developing nations might struggle with job creation and industrialization (because they can’t compete with robot-powered efficiency). This could deepen global inequality. To offset that, there might be initiatives to make robots affordable everywhere or to support developing countries in using robotics without causing social harm.

- Human Life and Work Transformation: Looking further ahead, if humanoid robots become as common as PCs or smartphones are today, we will witness a transformation in daily life. Factories could operate 24/7 with minimal human staffing – humans might oversee control centers while robots do the physical work. In homes, perhaps a humanoid butler/assistant could be feasible in a couple of decades, helping with cooking, cleaning, or caring for the young and old. This would especially address the needs of aging populations (a big factor in China, Japan, Europe) – many elderly people living alone could have robot helpers ensuring they can live independently longer. In offices, robots might handle errands, deliveries, or simple administrative tasks. Labor-intensive industries like construction might use humanoid robots for dangerous tasks like working at heights or handling heavy materials. Such a future raises productivity and could improve safety (fewer humans in hazardous jobs), but also necessitates rethinking economic structures (how do people earn incomes if many jobs are automated? Perhaps new jobs we can’t imagine yet, or societal changes like universal basic income in some form). It also will influence urban planning (if robots do deliveries, cities might need robot lanes or infrastructure adjustments) and even family structures (could a robot take over some childcare? How would that affect child development and social norms?). These speculative ideas underline that the humanoid robot revolution, led by countries like China, is not just about technology – it stands to alter the human experience of work and daily living.

In the near to medium term (5–10 years), expect China to deploy humanoid robots in increasing numbers across manufacturing plants and maybe logistics hubs, achieving incremental improvements. We may see a few breakthrough moments, such as a Chinese factory running primarily with humanoid robot labor, or a service robot performing a complex public service role. By that time, other nations will likely have narrowed the gap, with US and international robots also coming online in factories and public trials. This competition will spur all players to improve and cut costs, much to the benefit of end users. The late 2020s could be analogous to the early days of personal computers or smartphones – a period of rapid iteration and competitive leaps, after which the technology becomes truly mainstream in the 2030s.

Conclusion

China’s determined drive in humanoid robotics has positioned it at the forefront of what might be the next great technological revolution: robots that work alongside humans as colleagues and helpers. By coupling visionary government policies China’s determined drive in humanoid robotics has positioned it at the forefront of what might be the next great technological revolution: robots that work alongside humans as colleagues and helpers. By coupling visionary government support with the ingenuity of its tech companies and researchers, China has rapidly advanced the state of humanoid robots – making science fiction closer to reality. Today, Chinese humanoid robots are sorting parts in factories, testing their limbs on assembly lines, and greeting customers in malls. These early deployments, though still limited, showcase China’s ability to execute on an ambitious tech vision. In effect, China has signaled that it intends to lead the world in developing humanoid robots as co-workers, leveraging them as a solution to economic challenges and as a springboard for future industries.

However, the race is far from over. Other nations are marshaling their strengths – from Silicon Valley’s AI prowess to Japan’s decades of robotics experience – to compete in this arena. The coming decade will likely see rapid progress and intense competition. We can expect breakthroughs, surprises, and even setbacks as engineers strive to make humanoid robots more capable, affordable, and safe. It’s a marathon as much as a race: mastering humanoid robotics will require sustained effort and global collaboration, even amid rivalry. China’s current lead gives it a strong hand, but maintaining that lead will demand continuous innovation and openness to addressing the social impacts that robots will bring.

In the end, the rise of humanoid co-workers could usher in profound changes for the global economy and daily life – changes reminiscent of the transformative impact of the personal computer or the smartphone in earlier eras. Factories might roar back to life with automated productivity, labor shortages could be eased by mechanical helping hands, and entirely new services and industries may emerge around a workforce of machines. As we stand at this technological inflection point, China’s example illustrates both the opportunities and the challenges ahead. The country has shown what is possible when there is a bold vision backed by resources and resolve. Now, as humanoid robots step out of the research labs and into the real world, humanity as a whole will have to navigate the new partnership between man and machine. In that journey, China will be leading the charge, demonstrating how embracing innovation can redefine work and society – and inviting the world to see humanoid robots not as a threat, but as a new frontier for growth and collaboration.

Ultimately, whether it’s a Chinese-made android helping on a factory floor, or an American one in a warehouse, or a Japanese one caring for an elderly person, the age of humanoid co-workers is dawning. China’s strides have brought that dawn closer. The race now is to ensure these robots fulfill their promise as beneficial co-workers, driving progress in a way that uplifts economies and complements the human workforce. In that respect, the world will be watching closely as China leads the race in developing humanoid robots as co-workers, charting a path into the robo-industrial age.

References

- Company Profile and Product Lines

https://www.ubtrobot.com/en/ - GR-1 Humanoid Robot

https://www.fftai.com/en/products/gr-1 - Tesla Optimus Project

https://www.tesla.com/AI - Atlas Robot Overview

TALOS Humanoid Platform

https://pal-robotics.com/robots/talos/ - Phoenix Humanoid Robot

https://www.sanctuary.ai/ - Agility Robotics – Digit Robot Platform

https://agilityrobotics.com/digit - Ministry of Industry and Information Technology (China)

https://www.miit.gov.cn/ - China Robotics Industry Alliance

http://www.cria.org.cn/ - iFLYTEK – AIBOT and Embodied AI Development

https://www.iflytek.com/en/ - Unitree Robotics – H1 Humanoid and Quadruped Robots

https://www.unitree.com/ - Xiaomi Robotics Lab – CyberOne

https://www.mi.com/global/discover/newsroom/cyberone - Nvidia – Robotics and AI Platforms

https://www.nvidia.com/en-us/robotics/ - China Daily – National Humanoid Robot Strategy Insights

https://www.chinadaily.com.cn/ - The Robot Report – Global Humanoid Developments Tracker

https://www.therobotreport.com/