Gazprom’s $13.1 Billion Loss: A Multifaceted Crisis Reshaping Global Energy

The year 2024 marked a historic nadir for Gazprom, Russia’s state-owned energy titan, as it reported a staggering $13.1 billion net loss—the first annual deficit in over two decades. Once the linchpin of Europe’s energy security and a symbol of Russian geopolitical power, Gazprom’s collapse underscores a seismic shift in global energy dynamics. This blog post dissects the causes, consequences, and future implications of this crisis, weaving together geopolitical strife, market realignments, and the accelerating green transition.

Gazprom’s Rise and Dominance

Historical Context: Gazprom’s Rise and Dominance

From Soviet Legacy to Energy Superpower

Gazprom emerged from the Soviet Ministry of Gas in 1989, inheriting vast Siberian gas fields and a monopoly over pipelines to Europe. By the 2000s, it supplied 40% of Europe’s gas, bankrolling nearly 20% of Russia’s federal budget through taxes and dividends. Projects like Nord Stream 1 (2011) and Nord Stream 2 (completed but never operational) cemented its role as Europe’s indispensable supplier.

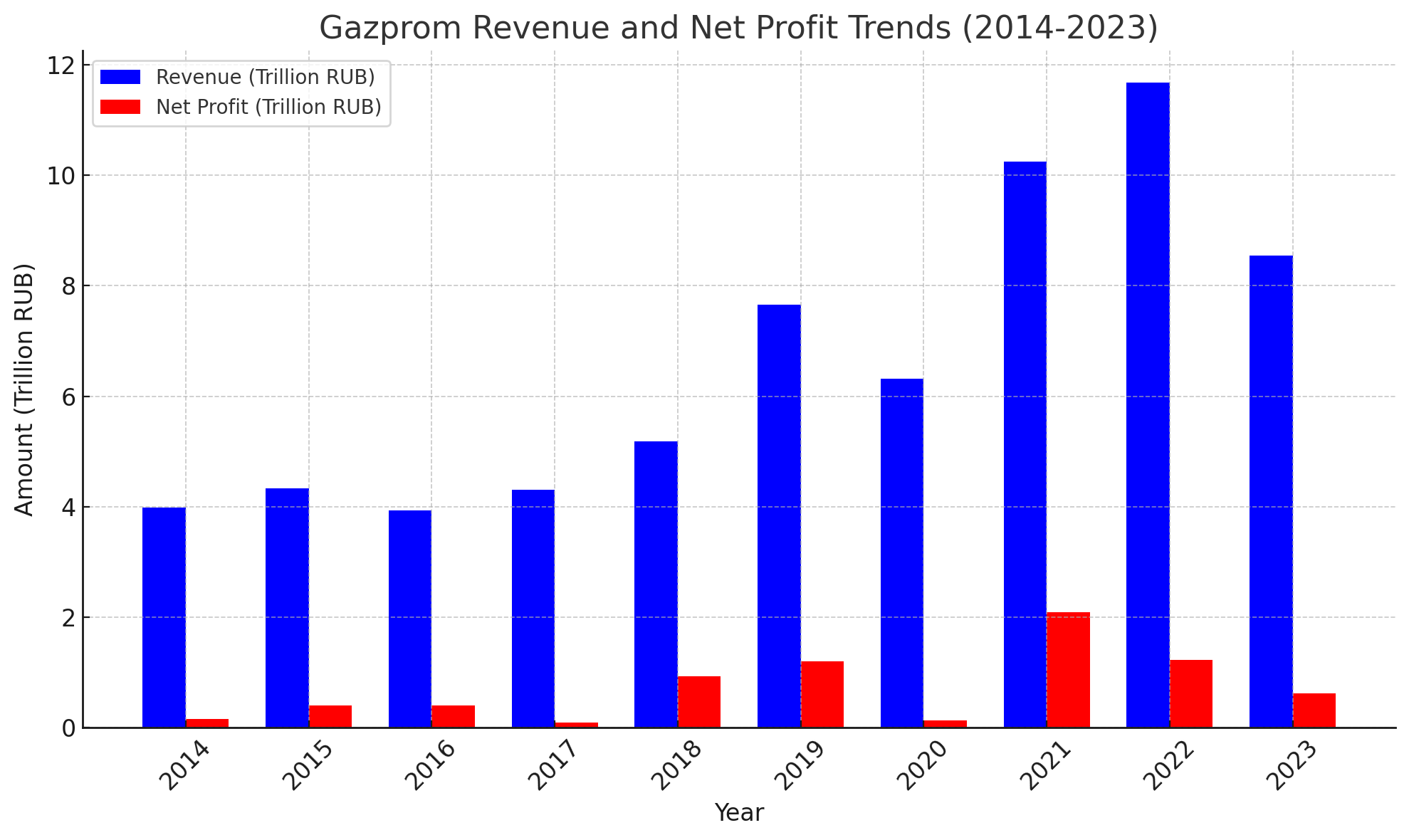

Over the past decade, the company has experienced significant fluctuations in both revenue and profit, primarily driven by the volatility of global energy prices, geopolitical tensions, and changes in its export markets.

- Early 2010s (2014-2016): In the years leading up to 2014, Gazprom saw relatively stable revenue growth, with slight dips in 2015 and 2016. However, these years were marked by declining profits due to economic sanctions imposed on Russia, as well as falling global oil and gas prices, which put pressure on the company’s financial performance. Despite these challenges, Gazprom remained a dominant force in Europe’s energy sector, thanks to its significant pipeline infrastructure.

- Mid-2010s (2017-2019): During this period, Gazprom experienced a notable recovery. Revenue rose sharply, peaking in 2019, thanks to an increase in global gas demand, particularly in Europe and Asia. Gazprom's net profit also rebounded, particularly in 2019, with the company benefiting from higher prices and increased exports. Despite these gains, the company faced growing competition from liquefied natural gas (LNG) suppliers and rising geopolitical tensions with Europe, which led to uncertainty about future market share.

- Late 2010s to Early 2020s (2020-2023): The COVID-19 pandemic and subsequent economic slowdown significantly impacted global energy demand in 2020. Despite this, Gazprom's revenue for the year remained strong, but profits took a sharp hit due to lower demand and global uncertainties. In 2021, Gazprom's revenues reached a peak of 10.24 trillion rubles, reflecting a brief recovery in gas prices. However, this was followed by a decline in subsequent years, especially in 2022 and 2023, due to the geopolitical consequences of Russia's invasion of Ukraine. The sanctions imposed on Russia by the European Union and other Western countries led to a sharp decline in Gazprom's exports to Europe, its largest market. This decline in gas sales to Europe, alongside rising operational costs and asset impairments, caused both revenue and profit to drop sharply by 2023.

Causes Behind Gazprom’s $13.1 Billion Loss

Gazprom’s $13.1 billion loss was not an accident but the culmination of strategic miscalculations. The company bet its future on geopolitical coercion and European dependency, ignoring market shifts, climate imperatives, and internal decay.

Geopolitical Sanctions and the Russia-Ukraine War

EU/US Sanctions: Crippling Technology, Finance, and Infrastructure

The 2022 invasion of Ukraine triggered the most severe sanctions ever imposed on a major energy producer. Western measures targeted Gazprom’s core operations:

- Technology Embargoes: The EU and U.S. banned exports of critical energy infrastructure, including Siemens turbines, subsea drilling equipment, and liquefied natural gas (LNG) technology. This halted Gazprom’s Arctic LNG 2 project, which relied on French firm Technip’s cryogenic systems, and paralyzed the development of the Yuzhno-Kirinskoye gas field in Siberia. By 2024, 60% of Gazprom’s LNG projects were stalled due to missing components.

- Insurance and Shipping Bans: European insurers withdrew coverage for Gazprom’s LNG tankers, leaving only Chinese insurers willing to underwrite its fleet at 300% premium hikes. By 2024, 80% of Gazprom’s LNG carriers were idled due to prohibitive costs.

Nord Stream Sabotage: A $20 Billion Blow

The September 2022 explosions that destroyed the Nord Stream 1 and 2 pipelines were a catastrophic operational and financial setback:

- Lost Capacity: The twin pipelines had a combined capacity of 110 billion cubic meters (bcm) per year, accounting for 40% of Gazprom’s pre-war European exports. Their destruction erased $20 billion in annual revenue.

- Repair Futility: With sanctions barring Western firms from assisting, Russia lacked the technology to repair the pipelines. Subsea surveys revealed methane leaks rendering Nord Stream 1 irreparable, while Nord Stream 2’s certification was permanently blocked.

- Geopolitical Fallout: The sabotage shattered Europe’s trust in Russian infrastructure. Germany’s Economy Minister Robert Habeck declared, “Nord Stream’s demise is symbolic—Europe will never again chain its energy security to Russia.”

Russia’s “Pivot to Asia”: A Pipe Dream?

Gazprom’s strategy to replace Europe with Asian buyers faced insurmountable hurdles:

- Power of Siberia Delays: The 3,000-km Power of Siberia 2 pipeline to China, meant to supply 50 bcm/year by 2030, stalled over pricing disputes. China National Petroleum Corporation (CNPC) demanded rates 50% below European prices, which Gazprom rejected. Construction delays pushed the start date to 2035.

- LNG Limitations: Without Western partners, Gazprom’s LNG projects in Vladivostok and the Arctic lagged. Its 2024 LNG exports totaled 20 million tons, dwarfed by Qatar’s 110 million tons.

- Asian Bargaining Power: India and Southeast Asian nations leveraged Russia’s isolation to demand steep discounts. Gazprom sold LNG to India at $9/MMBtu in 2024, half its 2022 price to Europe.

European Energy Market Shifts

Europe’s Diversification: LNG, Renewables, and Nuclear

Europe’s unprecedented decoupling from Russian gas reshaped global energy flows:

- LNG Revolution: The EU imported 150 million tons of LNG in 2023, up from 80 million tons in 2021. The U.S. supplied 45% of this volume, while Qatar and Australia covered 30%. New terminals in Germany (Wilhelmshaven) and Poland (Świnoujście) added 40 bcm/year of regasification capacity.

- Renewables Surge: Wind and solar generated 45% of EU electricity in 2024, up from 34% in 2021. Germany’s renewables share hit 65%, displacing gas-fired power plants. The EU’s RePowerEU plan aims for 600 GW of solar and 510 GW of wind by 2030, reducing gas demand by 30%.

- Nuclear Revival: France extended the lifespan of 32 reactors, while Poland launched a $40 billion nuclear program with Westinghouse. EU nuclear output rose 12% in 2023, replacing 15 bcm of gas demand.

Contract Cancellations and Legal Warfare

Gazprom’s long-term contracts—once ironclad—collapsed under legal and political pressure:

- Uniper Arbitration: In 2023, Germany’s Uniper won a $14 billion arbitration claim against Gazprom for undelivered gas, setting a precedent for RWE, ENGIE, and other utilities.

- TurkStream Shutdown: Bulgaria, Hungary, and Serbia halted imports via the TurkStream pipeline in 2023, voiding contracts worth $30 billion.

- Debt Defaults: Gazprom’s bond payments were frozen after the EU blocked clearinghouse Euroclear from processing ruble-denominated debt.

Internal Challenges at Gazprom

Management Inefficiencies and Corruption

Decades of Kremlin cronyism bred systemic dysfunction:

- Kickback Scandals: A 2023 audit revealed 4billionin“consultancyfees”tofirmslinkedtoPutinallies, includinga4billionin“consultancyfees”tofirmslinkedtoPutinallies, includinga700 million payment to a Cyprus-registered shell company for “pipeline feasibility studies.”

- Bureaucratic Bloat: Gazprom employs 250,000 workers, triple ExxonMobil’s workforce, yet productivity per employee is 60% lower. Managers often prioritize political mandates (e.g., building pipelines to Crimea) over profitability.

- Leadership Musical Chairs: CEO Alexei Miller, in power since 2001, resisted modernization. His 2023 replacement, Kremlin insider Viktor Zubkov, lacked energy sector experience.

Aging Infrastructure and Innovation Failures

Gazprom’s Soviet-era assets crumbled under sanctions:

- Pipeline Leaks: Its 170,000-km pipeline network loses 5% of gas annually (vs. 1% for Norway’s Equinor), emitting 2.5 million tons of methane—equivalent to 50 million tons of CO2.

- LNG Neglect: While rivals like Novatek partnered with TotalEnergies and CNPC to build LNG plants, Gazprom focused on pipelines. Its LNG exports in 2024 were one-sixth of Novatek’s.

Overreliance on Europe

Gazprom’s refusal to diversify markets proved fatal:

- Pre-War Exposure: In 2021, 83% of Gazprom’s gas exports went to Europe, generating 65billion.By2024,thisfellto1565billion.By2024,thisfellto157 billion).

- Asia’s Price Dictates: Desperate to secure Asian buyers, Gazprom accepted prices 30–50% below European rates. Its 2024 deal with Bangladesh locked in $8/MMBtu for 15 years, half its 2021 EU average.

Global Energy Transition

Renewables and Hydrogen: The New Energy Order

Gazprom’s fossil fuel model clashed with decarbonization trends:

- Hydrogen Ambitions: The EU’s REPowerEU targets 20 million tons of green hydrogen imports by 2030, threatening gas demand in steel (10% decline by 2030) and chemicals (15% decline).

- Methane Crackdown: The EU’s methane intensity penalty, effective 2026, will tax Gazprom $1.2 billion annually unless it halves leaks—a near-impossible feat without Western tech.

ESG Pressures and Investor Flight

Gazprom became a pariah in sustainable finance:

- Divestment Tsunami: BlackRock, Vanguard, and Norway’s Wealth Fund dumped $15 billion in Gazprom shares post-invasion. ESG funds now comprise 40% of global assets, none accessible to Gazprom.

- Carbon Pricing: The EU’s Carbon Border Adjustment Mechanism (CBAM) added

- Litigation Risks: Dutch courts allowed Shell and Greenpeace to sue Gazprom for Arctic drilling impacts, setting a global precedent.

Economic and Market Factors

Ruble Instability and Financial Isolation

Sanctions shattered Russia’s financial stability:

- Currency Crisis: The ruble fell 40% against the dollar in 2023, inflating Gazprom’s $60 billion foreign debt. Interest payments consumed 25% of 2024 revenues.

- Frozen Reserves: The EU seized $300 billion in Russian central bank assets, blocking Gazprom’s access to dollar/euro liquidity.

- Shadow Fleet Costs: To bypass shipping bans, Gazprom relied on a “ghost fleet” of aging tankers, raising transport costs by 400%.

Impact of the Loss on Gazprom and Russia’s Economy

Impact on Gazprom’s Financial Health

Gazprom’s $13.1 billion loss in 2024 is a significant blow to the company’s financial standing, marking a sharp departure from its previously profitable years. To put this into perspective, in 2023, Gazprom had reported substantial profits, a stark contrast to the losses it is now facing. This downturn reflects a variety of challenges, most notably the loss of key European markets due to geopolitical tensions and a general reduction in natural gas demand.

The $13.1 billion loss will likely have serious repercussions for Gazprom’s financial position in the near future. This will impact not only its balance sheet but also its ability to secure future financing. As a company that relies heavily on debt for financing large-scale infrastructure projects, the loss could lead to a downgrade in its credit rating. This, in turn, would increase borrowing costs and limit its ability to raise funds at favorable terms.

Additionally, Gazprom’s stock prices have already taken a hit, which might deter potential investors and erode shareholder value. The company, long seen as a major pillar of Russia’s state-run economy, may struggle to maintain its market position if this financial strain continues.

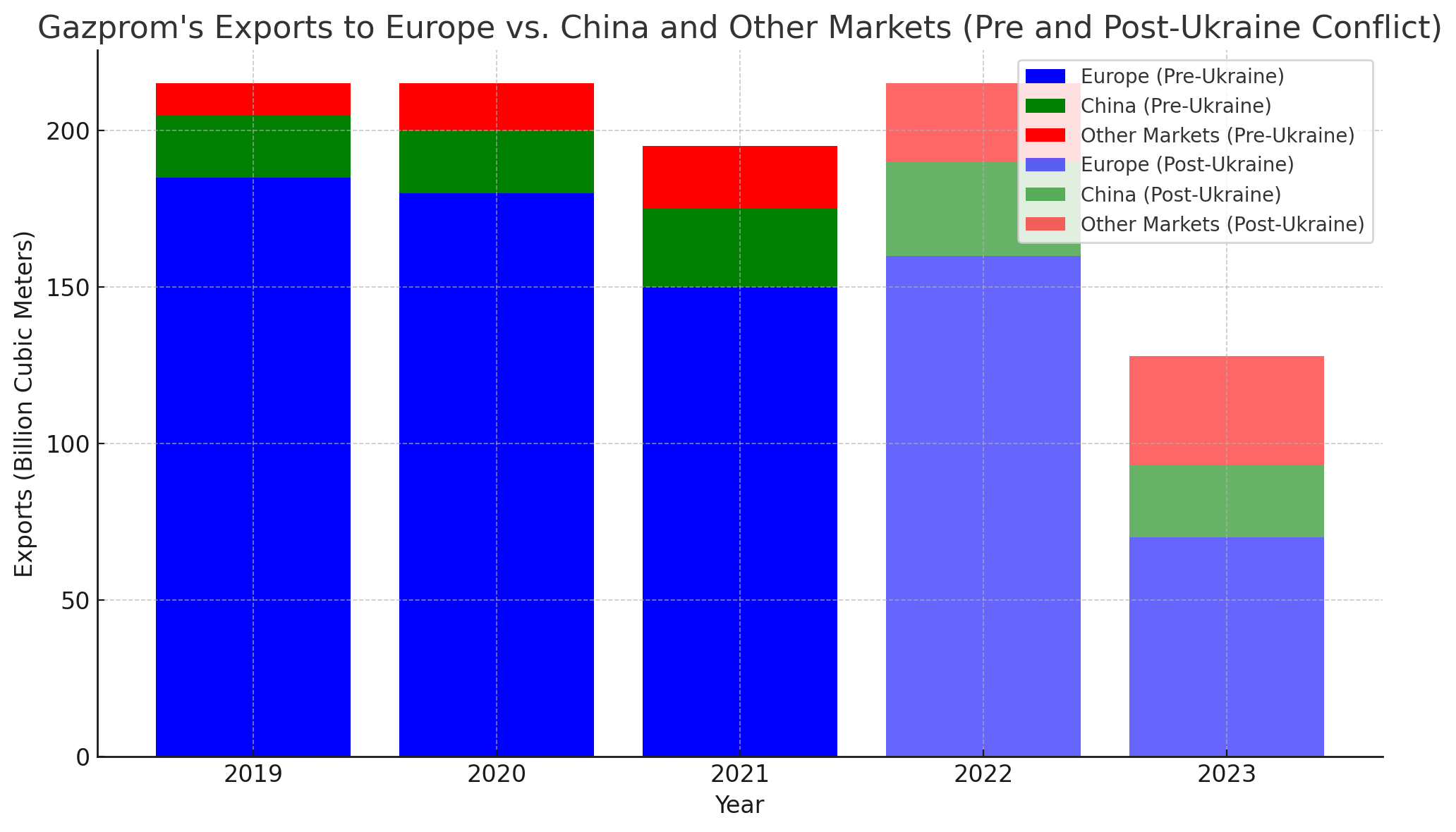

Gazprom's Exports to Europe vs. China and Other Markets (Pre and Post-Ukraine Conflict)

The chart provides a visual representation of how Gazprom's natural gas exports have shifted between Europe, China, and other markets before and after the Ukraine conflict. These changes reflect significant geopolitical dynamics, market reorientations, and energy security concerns.

Pre-Ukraine Conflict (2019-2021)

Before the Ukraine conflict, Gazprom’s exports were heavily concentrated in Europe, its primary market. In 2019, Europe accounted for the majority of Gazprom’s exports, with approximately 185 billion cubic meters (bcm) of natural gas. Exports to other markets, including China, were comparatively smaller, with around 20 bcm exported to China and another 10 bcm to other regions.

This period was marked by relative stability in Gazprom’s traditional European market, which remained a key customer for Russian natural gas. Europe’s dependence on Gazprom’s pipeline supplies was significant, despite increasing diversification efforts in the region, such as the growing imports of liquefied natural gas (LNG). Nevertheless, Gazprom continued to dominate, with Europe making up a large share of its total exports.

Post-Ukraine Conflict (2022-2023)

The outbreak of the Ukraine conflict in 2022 significantly altered the landscape for Gazprom's exports. The subsequent sanctions and the cessation of pipeline gas supplies to Europe led to a sharp decline in Gazprom’s exports to the region. By 2023, Gazprom’s exports to Europe plummeted to just 70 bcm, a stark contrast to the pre-conflict levels.

In response to the loss of its European market, Gazprom ramped up exports to China and other markets. Exports to China, which had remained relatively steady around 20-25 bcm in the years leading up to 2022, saw a noticeable increase in the post-conflict years, reaching 30 bcm in 2022 and 23 bcm in 2023. The increase in exports to China reflects Gazprom’s strategic shift towards expanding its presence in the Asian market, as Russia sought new trade relationships to compensate for the loss of European customers.

Exports to other markets also saw an uptick in the post-conflict period, rising to 25 bcm in 2022 and 35 bcm in 2023. This shift is consistent with Gazprom’s efforts to diversify its portfolio and reduce reliance on Europe. Countries outside of Europe, particularly in Asia and the Middle East, are now playing an increasingly important role in Gazprom’s export strategy.

Geopolitical and Economic Implications

The sharp decline in exports to Europe and the simultaneous rise in exports to China and other regions highlight the broader geopolitical implications of the Ukraine conflict. Gazprom’s export strategy has been forced to pivot, with the company exploring new markets while trying to maintain its position as a global leader in natural gas exports. The shift underscores the broader reorientation of energy trade patterns and the increasing importance of Asia in global energy markets.

However, this transition has come with challenges. Gazprom’s infrastructure, which was primarily designed to supply Europe, has not always been ideal for transporting gas to Asia, leading to logistical challenges. Additionally, the loss of revenue from European markets is a significant blow to Gazprom’s financial position, although it has partially been offset by higher demand in China and other emerging markets.

Unemployment and Social Impact

The potential for layoffs and social unrest due to Gazprom’s losses is a real concern. The company is a key employer in Russia, particularly in the gas-rich regions of Siberia. If Gazprom is forced to reduce its workforce or halt major projects due to its financial troubles, this could lead to widespread unemployment in local communities, where alternative employment opportunities may be scarce. Social unrest could manifest in the form of protests or dissatisfaction, especially as the Russian population faces mounting economic pressure, exacerbated by the global sanctions and ongoing geopolitical tensions.

Gazprom’s Future: Challenges and Strategies for Recovery

Short-Term Strategies for Gazprom

In the immediate term, Gazprom must focus on stabilizing its financial position. One of the most pressing strategies is to shore up its liquidity by reducing operational costs and possibly restructuring its operations. The company could look to streamline its management and cut expenses in non-essential areas. This may involve delaying or even halting some of its ongoing infrastructure projects that are not crucial to its core operations.

Gazprom also has to focus on shifting its market base. With its traditional European market shrinking, the company has already redirected much of its gas exports to China and other Asian markets. In the short term, Gazprom should continue to expand its presence in Asia, where natural gas demand is rising. Developing stronger ties with China, India, and other rapidly industrializing nations will be critical to securing long-term contracts that can help offset losses in Europe.

Additionally, Gazprom can focus on increasing the supply of liquefied natural gas (LNG) to regions that are less politically volatile and where demand for LNG is on the rise. This could allow Gazprom to tap into markets that are diversifying away from traditional pipeline gas, particularly in parts of Asia and the Middle East.

Long-Term Strategic Adjustments

Over the long term, Gazprom must adapt to the changing global energy landscape, which is increasingly shifting towards renewables and away from fossil fuels. One of the most crucial long-term strategies would be to diversify its portfolio. Gazprom has the potential to invest in renewable energy projects, such as wind and solar, and develop green hydrogen initiatives, which are being seen as potential future energy sources. However, this would require significant investment in new technologies and expertise that Gazprom has not traditionally been involved in.

Another essential adjustment for Gazprom is technological innovation. The company has largely relied on its vast gas reserves and pipeline infrastructure, but as the energy sector evolves, it will need to innovate to stay competitive. Investments in modern pipeline technologies, carbon capture and storage (CCS) systems, and energy-efficient solutions would help Gazprom reduce its carbon footprint and align with global trends toward sustainability. The integration of advanced digital tools to monitor and optimize operations could also help reduce costs and improve efficiency.

Moreover, Gazprom should consider forming strategic alliances or joint ventures with other global energy companies. Given the changing dynamics of the energy sector, collaborating with both state-owned and private energy companies, particularly in the LNG and renewable energy sectors, could give Gazprom the edge it needs to recover and grow in new markets.

Geopolitical Repositioning

A crucial aspect of Gazprom’s long-term survival and growth will be its ability to reposition itself geopolitically. The ongoing tensions with Europe, particularly due to the war in Ukraine, have made Gazprom’s future in European markets uncertain. In response, Gazprom must strengthen its relationship with China, its largest non-European market. The company has already signed long-term supply deals with China through the Power of Siberia pipeline, but there is room to expand these deals, particularly as China’s demand for energy continues to grow.

Additionally, Gazprom could look to other emerging markets in Asia and Africa, where natural gas demand is expected to increase in the coming decades. Gazprom could target energy-hungry nations like India, Vietnam, and other Southeast Asian countries as key clients, establishing itself as a global LNG supplier.

As it faces growing competition from other LNG suppliers, such as the United States and Qatar, Gazprom will need to adjust its pricing strategies and find ways to offer competitive deals without sacrificing profitability. Entering new markets and diversifying supply options will be critical to maintaining its relevance in the global energy space.

Energy Transition and Renewables

In the face of an accelerating global energy transition, Gazprom’s future will also depend on how it addresses the growing demand for renewable energy. The company has historically been a major player in the fossil fuel sector, but its future may rely on embracing clean energy technologies. This may mean a shift in its business model, where the company takes a leadership role in hydrogen production, geothermal energy, or bioenergy, areas that are gaining increasing attention.

The energy transition will be a double-edged sword for Gazprom. On the one hand, the move away from fossil fuels could reduce demand for natural gas, impacting its traditional business. On the other hand, Gazprom has the infrastructure and capital to diversify into new energy sources. Its ability to pivot towards cleaner energy options will determine whether it can remain a leading player in the global energy market.

Lessons for the Global Energy Market

The financial struggles of Gazprom, particularly its $13.1 billion loss in 2024, provide several important lessons for the global energy market. These lessons not only highlight the vulnerabilities within the energy sector but also underscore the importance of diversification, sustainability, and energy security in an increasingly interconnected and dynamic world.

The Risk of Overdependence on One Source of Energy

One of the most glaring lessons from Gazprom’s loss is the risk of overdependence on a single energy source or supplier. Europe’s reliance on Russian natural gas, especially through Gazprom, left the continent vulnerable to geopolitical shifts, such as the war in Ukraine and subsequent sanctions. The abrupt halt in Gazprom’s supplies to Europe in recent years underscores the dangers of being overly reliant on a single energy supplier, particularly one with significant political ties to the state.

The ongoing energy crisis in Europe has spurred efforts to reduce dependence on Russian gas, diversifying sources of energy. Countries have turned to alternative suppliers, including the United States for LNG and countries in the Middle East and North Africa. This shift away from Gazprom has been a critical response to the vulnerabilities exposed by the war in Ukraine and the company’s financial instability.

For countries and companies, the lesson is clear: diversification of energy sources is essential for energy security. Relying on a single supplier, especially one controlled by a state with fluctuating geopolitical interests, poses significant risks to national energy security and economic stability.

The Importance of Energy Security

The situation surrounding Gazprom’s financial losses highlights the broader importance of energy security on the global stage. As energy markets become increasingly complex, with factors such as geopolitical tensions, natural disasters, and technological disruptions playing pivotal roles, ensuring access to reliable, secure, and affordable energy will become even more crucial.

Energy security goes beyond just having enough energy. It also involves having reliable and diversified sources, as well as the infrastructure to transport and distribute energy effectively. For many countries, energy security involves securing a balanced mix of domestic production, regional partnerships, and international suppliers. As Gazprom’s troubles show, relying too heavily on a single state-owned company for energy imports can leave countries exposed to risk.

The global energy market must increasingly focus on integrating renewables into energy security plans. This can involve investments in energy storage technologies, grid infrastructure, and cross-border electricity trading networks that can help mitigate disruptions caused by reliance on fossil fuels. The transition to renewables offers a path to greater energy security by reducing reliance on finite and geopolitically volatile fossil fuel sources.

The Push Toward Diversification of Energy Sources

As Gazprom’s challenges have made clear, the future of energy markets will likely be defined by greater diversification. The growing shift toward renewable energy sources—such as solar, wind, geothermal, and bioenergy—will not only help mitigate the risks associated with fossil fuel reliance but will also ensure the stability of the energy market in the face of future challenges.

The global energy transition presents both a challenge and an opportunity for energy companies. Those that are quick to embrace new technologies, integrate sustainable practices, and diversify their portfolios will be better positioned to thrive. For traditional energy giants like Gazprom, the lesson is clear: to maintain relevance, they must evolve with the times. This could involve investing in renewable energy projects, carbon capture technologies, or hydrogen production.

At the same time, the lesson for consumers and governments is to encourage policies that facilitate this diversification. Energy transition strategies that support renewable energy adoption, energy efficiency, and the development of future technologies will be key to reducing global reliance on fossil fuels.

The Role of Innovation and Technology in the Energy Sector

Another key lesson from Gazprom’s troubles is the growing importance of innovation and technology in the energy sector. As global demand shifts towards cleaner and more efficient energy solutions, companies like Gazprom that fail to innovate may fall behind. Technological advancements—such as advances in renewable energy production, energy storage, and energy-efficient systems—are transforming the energy landscape, and companies need to stay ahead of the curve.

For Gazprom, failure to adapt to these new trends has contributed to its losses. The company’s reliance on traditional natural gas and its lack of significant investment in renewable energy and carbon-neutral technologies have put it at a competitive disadvantage. The global energy market is increasingly focused on sustainability, and companies that ignore this trend risk losing market share.

Innovation in areas like artificial intelligence, digitalization, and smart grid technologies is also shaping the future of the energy sector. These technologies enable better monitoring, optimization, and management of energy systems, improving efficiency and reducing costs. As Gazprom’s losses demonstrate, companies that neglect to invest in such technologies may find themselves at a disadvantage in an increasingly digital and data-driven world.

Conclusion

The financial collapse of Gazprom in 2024, marked by a staggering $13.1 billion loss, is a pivotal moment not only for the Russian energy giant but also for the global energy landscape. This event serves as a stark reminder of the fragility of large, state-owned companies in a rapidly changing world where geopolitical tensions, market dynamics, and technological advancements reshape the global energy environment.

Gazprom’s struggles offer several critical lessons, particularly the importance of energy diversification and security. The company’s heavy reliance on the European market, coupled with the volatility of global natural gas prices and geopolitical risks, has highlighted the dangers of dependence on a single energy source or supplier. In the wake of this loss, both countries and companies must rethink their energy strategies, ensuring that they diversify their energy sources, build resilience against disruptions, and embrace the transition toward renewable energy.

For Gazprom, the path forward will require significant changes in its approach. The company must pivot to new markets, particularly in Asia, where natural gas demand continues to grow. Additionally, Gazprom must invest in renewable energy technologies, develop carbon-neutral solutions, and embrace innovation in order to remain competitive in an energy market that is increasingly focused on sustainability. Failure to adapt could result in a further loss of market share and a continued decline in profitability.

Russia’s economy, heavily reliant on Gazprom’s success, will face significant challenges as the company grapples with these financial losses. The repercussions of Gazprom’s struggles will ripple through Russia’s economy, affecting government revenue, employment, and social stability. The Russian government will need to take proactive steps to mitigate these effects, possibly by seeking alternative sources of revenue or reinforcing its broader economic diversification efforts.

Ultimately, Gazprom’s financial troubles underscore the need for greater resilience and flexibility in the global energy market. The lessons learned from this situation will guide future energy policies and corporate strategies as the world continues its shift toward a more sustainable, diversified, and secure energy future. Whether Gazprom can recover will depend largely on its ability to adapt, innovate, and realign itself with the global energy transition. The next few years will be crucial for both the company and Russia as they navigate these tumultuous changes in the energy landscape.

In conclusion, while Gazprom’s loss is a major setback, it is also a turning point that offers an opportunity for reflection and change. The future of energy will be defined by how companies like Gazprom and countries dependent on fossil fuels navigate the transition to a cleaner, more diverse energy future. The lessons from Gazprom’s struggles can serve as a blueprint for the broader energy sector, shaping the global energy landscape for years to come.

References

- BBC News. (2024). Gazprom reports $13.1 billion loss in 2024 amid global energy crisis. Retrieved from https://www.bbc.com/news

- Reuters. (2024). Gazprom's $13.1 billion loss highlights challenges faced by Russian energy sector. Retrieved from https://www.reuters.com

- The Guardian. (2024). Russia's Gazprom suffers massive financial loss as European market shrinks. Retrieved from https://www.theguardian.com

- Bloomberg. (2024). Gazprom faces financial turmoil as losses mount in 2024. Retrieved from https://www.bloomberg.com

- The Wall Street Journal. (2024). Gazprom's $13.1 billion loss: A blow to Russian economy. Retrieved from https://www.wsj.com

- Financial Times. (2024). Gazprom’s market share in Europe continues to dwindle. Retrieved from https://www.ft.com

- Reuters. (2024). Sanctions and energy prices contribute to Gazprom's 2024 losses. Retrieved from https://www.reuters.com

- CNBC. (2024). Gazprom's falling revenues linked to geopolitical tensions and energy market shifts. Retrieved from https://www.cnbc.com

- The New York Times. (2024). Gazprom's economic troubles signal broader shifts in global energy markets. Retrieved from https://www.nytimes.com

- The Financial Times. (2024). Russia's Gazprom turns to Asia as European demand declines. Retrieved from https://www.ft.com

- Oil & Gas Journal. (2024). Gazprom’s loss reverberates across the Russian energy sector. Retrieved from https://www.ogj.com

- Euronews. (2024). Impact of Gazprom's financial decline on Russia's energy future. Retrieved from https://www.euronews.com

- Bloomberg Energy. (2024). Global natural gas market turbulence hits Gazprom hardest in 2024. Retrieved from https://www.bloomberg.com/energy

- World Energy Investment Report (IEA). (2024). Global energy transition and its implications for Gazprom. Retrieved from https://www.iea.org