Estée Lauder and L’Oréal Rethink Strategy as China’s Duty-Free Beauty Market Slumps

Over the past decade, China has emerged as the linchpin of global luxury growth, particularly in the high-margin beauty and cosmetics segment. For multinational titans such as Estée Lauder and L’Oréal, Chinese consumers—known for their appetite for prestige skincare, fragrances, and makeup—have consistently driven revenues and share price momentum. Yet, a surprising shift in recent quarters has disrupted this well-established trajectory. Duty-free sales, a cornerstone of luxury consumption in the region, are faltering. For brands that once bet heavily on China’s duty-free boom, this reversal is more than a temporary setback—it signals the onset of a new, more complex chapter in global beauty commerce.

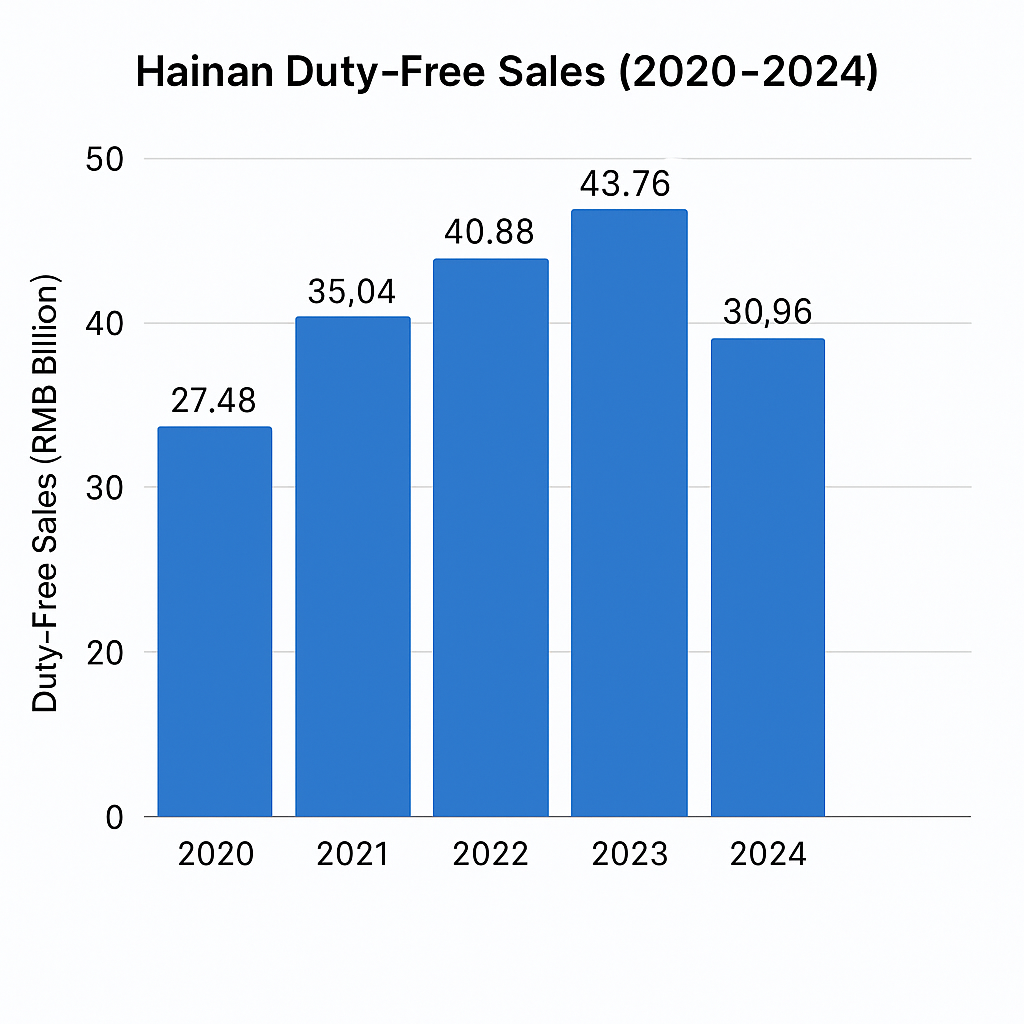

The collapse in duty-free spend, particularly in key markets like Hainan, has rattled investor confidence and forced a recalibration of corporate strategies. Hainan, once touted as China’s answer to international shopping hubs such as Paris or Seoul, had been instrumental in capturing pent-up demand during pandemic-era travel restrictions. The island’s flourishing duty-free market, bolstered by government support and a flood of domestic tourists, created an ideal scenario for luxury brands struggling with declining global foot traffic elsewhere. In 2023 alone, duty-free sales in Hainan reached an impressive RMB 43.76 billion, underscoring the locale’s critical economic importance.

However, this boom has now given way to a notable contraction. According to recent trade and retail data, Hainan’s duty-free revenue plunged by nearly 30% in 2024, driven by a combination of factors including economic uncertainty, shifting consumer preferences, intensified regulation, and a gradual normalization of international travel. These forces have upended expectations, and with them, the fiscal performance of companies that had leaned heavily on this revenue stream.

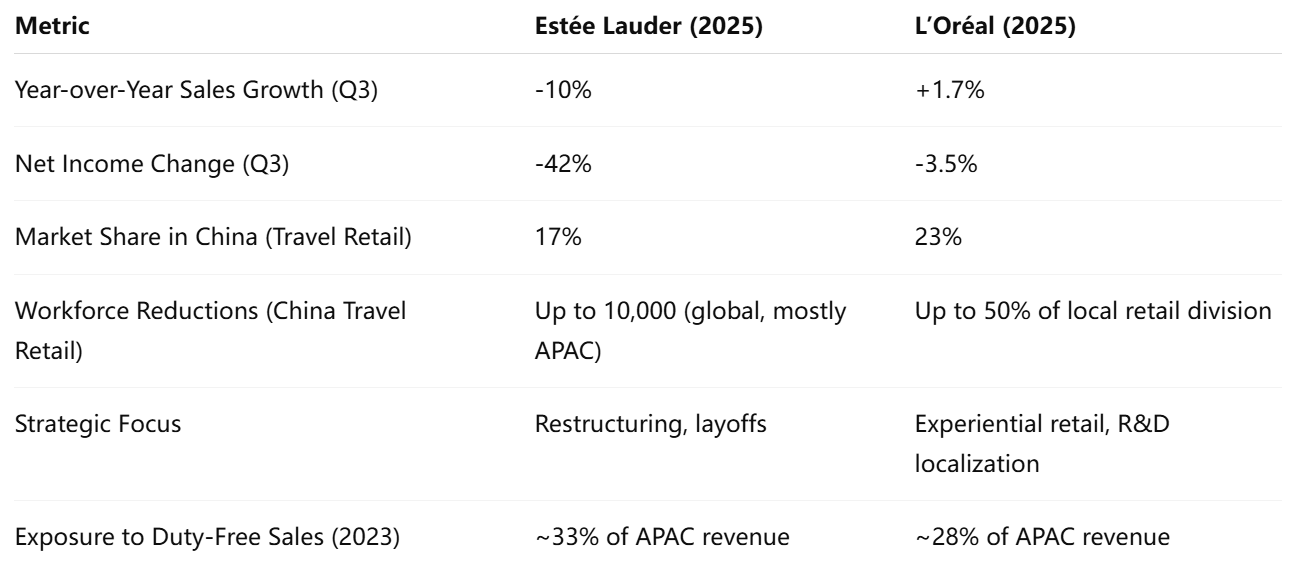

For Estée Lauder and L’Oréal in particular, the downturn in China’s duty-free consumption presents a stark challenge. Estée Lauder reported a staggering 42% decline in profit for the third quarter of 2025, much of which has been attributed to the contraction in Asia-Pacific travel retail. L’Oréal, while more diversified and resilient, is also taking decisive measures, including workforce reductions and operational realignment in its Chinese travel retail division. These companies are not merely responding to a temporary dip in performance; they are contending with a possible structural shift in how Chinese consumers approach luxury beauty consumption.

The significance of China’s consumer base to the global beauty sector cannot be overstated. In pre-pandemic years, China accounted for nearly one-third of global luxury beauty sales. During the travel-restricted years of 2020 to 2022, this share increased even further as Chinese consumers shifted spending to domestic channels. Duty-free hubs like Hainan flourished in this period, capturing both local spending and purchases intended for resale through informal channels such as daigou networks. With the Chinese economy slowing in 2024 and government efforts to curb unauthorized luxury resale intensifying, much of this ecosystem has unraveled. This development has reshaped the landscape in ways that even well-resourced multinational corporations were unprepared to manage.

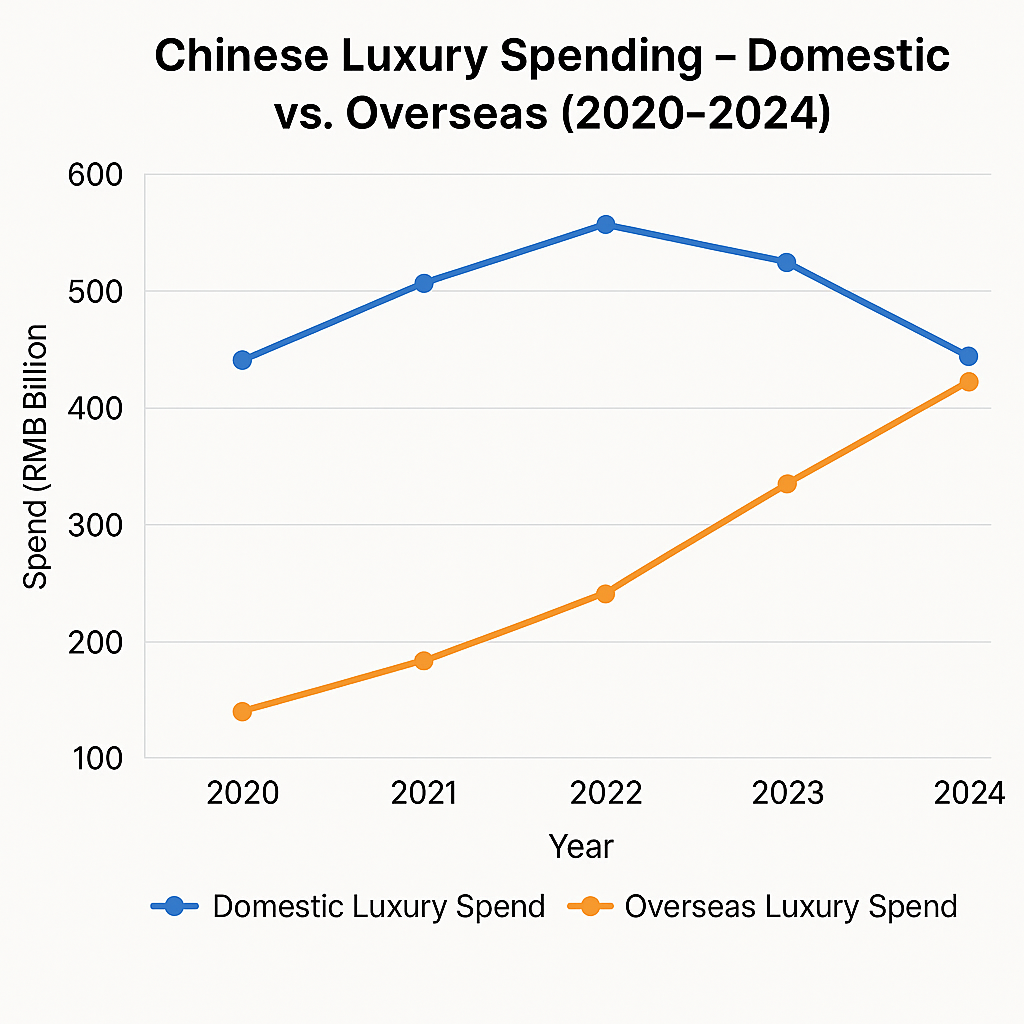

Adding to the complexity is the ongoing transformation of Chinese consumer behavior. Price sensitivity has grown amid economic uncertainty, with shoppers increasingly gravitating towards promotions, loyalty programs, and even homegrown beauty brands that deliver comparable quality at lower cost. Furthermore, the resurgence of outbound international tourism means more Chinese consumers are again making purchases abroad, diminishing the relevance of domestic duty-free retail as the dominant distribution channel. These dynamics present a multi-dimensional challenge for brands, requiring more than just tactical pivots—they demand a rethinking of geographic strategy, product positioning, and digital engagement.

This blog post explores the multifaceted implications of this shifting terrain. In the sections that follow, we will examine the historical rise and current decline of China’s duty-free market, focusing on the underlying macroeconomic and policy drivers. We will then delve into the financial and operational ramifications for Estée Lauder and L’Oréal, presenting comparative data and expert insights. A third section will explore how consumer behavior is evolving and what it means for luxury incumbents and emerging local challengers. Finally, we will assess the strategic responses undertaken by key players and offer projections on what lies ahead in the post-duty-free era of Chinese beauty retail.

In presenting this analysis, our aim is not merely to document recent turbulence but to distill the lessons it offers for stakeholders across the global beauty industry. For investors, executives, marketers, and analysts alike, the fate of Estée Lauder and L’Oréal in China provides a valuable case study in the risks of market overdependence, the limits of promotional strategy, and the urgency of structural adaptability.

As the curtain begins to fall on the duty-free gold rush, the question is no longer whether beauty brands must adapt—but how swiftly and effectively they can do so. The answers will shape not only their immediate recovery prospects but also their long-term viability in one of the world’s most vital luxury markets.

The Rise and Fall of China's Duty-Free Market

The development of China's duty-free market over the past decade is emblematic of the country’s broader economic transformation and its emergence as a global consumer powerhouse. What began as a policy-driven initiative to stimulate domestic consumption has evolved into a complex ecosystem that both mirrors and shapes global luxury trends. Now, as that market undergoes a sharp contraction, understanding its ascent and subsequent descent is critical to grasping the challenges faced by companies like Estée Lauder and L’Oréal.

A Decade of Ascent: The Making of a Retail Phenomenon

China’s foray into duty-free retail was rooted in a strategic imperative: to transform the nation from a manufacturing-led economy into a consumption-driven one. In 2011, the Chinese government launched its pilot duty-free program in Hainan, an island province long known for its tropical allure but little recognized for luxury shopping. Initially modest in scope, the program offered domestic travelers tax-free access to a selection of imported goods within a regulated quota. Over time, it evolved into one of the most ambitious retail experiments in Asia.

The real inflection point came in the aftermath of the COVID-19 pandemic. With international travel all but frozen, millions of affluent Chinese consumers who typically shopped in Paris, Tokyo, or Seoul were redirected to domestic alternatives. Hainan quickly rose to prominence as the crown jewel of this transition. The government seized the moment by expanding duty-free allowances—from RMB 30,000 in 2019 to RMB 100,000 in 2020—and issuing more licenses to retailers, including state-owned players like China Duty Free Group (CDFG).

By 2023, Hainan’s duty-free market reached unprecedented scale, with total annual sales hitting RMB 43.76 billion. This explosion in demand turned the island into a symbolic and economic centerpiece of China’s luxury strategy. For global beauty and fashion houses, the appeal was irresistible: direct access to a concentrated, affluent consumer base with high turnover and reduced overhead compared to international outlets.

Economic and Political Tailwinds

Several macroeconomic and regulatory conditions facilitated this growth. First, the Chinese middle class—estimated at over 400 million individuals—was expanding rapidly, and their disposable income was increasingly funneled into aspirational consumption, especially in categories like beauty, fashion, and health. Second, domestic policy favored inward spending. Campaigns like “dual circulation” explicitly encouraged Chinese consumers to buy at home rather than abroad, and import duty reductions made foreign goods more competitive onshore.

Retailers responded accordingly. Major players such as LVMH, Shiseido, and the Estée Lauder Companies ramped up investment in localized inventory, marketing campaigns, and in-store experiences tailored for the Hainan traveler. At the same time, e-commerce integration with duty-free platforms enabled pre-ordering, personalized services, and influencer-driven promotions, turning Hainan into a seamless, hybrid retail experience.

The Sudden Shift: Cracks Begin to Show

Despite this remarkable expansion, the momentum proved fragile. In 2024, total duty-free sales in Hainan plummeted by 29.3% year-over-year—a figure that shocked both analysts and stakeholders. This downturn cannot be attributed to a single variable; rather, it reflects the convergence of economic, regulatory, and behavioral shifts.

Foremost among these is the broader deceleration of the Chinese economy. Sluggish GDP growth, elevated youth unemployment, and a deflating property market have together eroded consumer confidence. Luxury purchases, once seen as attainable symbols of personal progress, are now viewed with greater caution, especially among middle-income consumers who were previously key contributors to duty-free sales.

Second, the normalization of international travel has diluted the allure of domestic duty-free shopping. With outbound travel increasing—particularly to Hong Kong, Japan, and Southeast Asia—Chinese tourists are once again returning to their pre-pandemic luxury shopping haunts, where selection is broader, prices are competitive, and the cachet of purchasing abroad remains strong.

Another key factor is regulatory tightening, particularly the government's crackdown on “daigou” operations. These informal resellers often purchased luxury goods in duty-free locations to sell at a markup on the mainland, blurring the line between personal consumption and commercial arbitrage. Beijing’s efforts to curb this practice—via tracking quotas, mandating real-name registration, and auditing suspect purchases—have curtailed a significant portion of volume in the travel retail sector.

Systemic Vulnerabilities and Brand Overexposure

The repercussions of this contraction are most acutely felt by beauty and skincare brands that had come to rely on Hainan as a critical sales channel. Estée Lauder, for instance, attributed much of its 42% decline in Q3 2025 profit to softening demand in China’s duty-free segment. Similarly, L’Oréal noted underwhelming growth in its travel retail division, prompting reevaluations of staffing and allocation strategies.

These companies, in retrospect, appear to have over-indexed on what was essentially an artificial bubble. Unlike diversified markets in Europe and North America, where sales are spread across thousands of locations and multiple demographic segments, the Hainan model was geographically concentrated and highly policy-dependent. Such a structure, while efficient in boom times, is exceptionally vulnerable in downturns.

Moreover, the erosion of duty-free’s core value proposition—price advantage—is further compounding the problem. As domestic retail channels increasingly offer aggressive discounts and loyalty rewards, and as exchange rate volatility affects overseas pricing, the relative benefit of shopping duty-free has narrowed. In many cases, the convenience of local shopping or online delivery now outweighs the marginal savings of duty-free purchases.

The figures above encapsulate the boom-bust cycle of Hainan’s duty-free market. After peaking in 2023, the 2024 numbers reflect both the policy headwinds and shifting consumption patterns currently plaguing the sector.

Toward a New Equilibrium

The fall in duty-free sales in Hainan signals not just a cyclical correction but perhaps the beginning of a structural realignment in China’s luxury landscape. Consumers are no longer bound by the same geographic or policy constraints, and brands must recognize that the next phase of growth will depend on more sophisticated engagement—through localized product lines, culturally resonant branding, and omnichannel distribution.

As the duty-free fantasy recedes, companies must contend with a more grounded reality—one that prizes resilience, diversification, and adaptability over sheer volume. The next section will examine how global giants like Estée Lauder and L’Oréal are absorbing this shock and recalibrating their approach in the world’s most complex beauty marketplace.

Impact on Global Beauty Titans: Estée Lauder and L’Oréal

The global beauty industry is inextricably tied to China’s evolving consumer landscape, and no companies exemplify this dynamic more than Estée Lauder and L’Oréal. For decades, these two powerhouses have cultivated strong footholds in the Chinese market, capitalizing on rising affluence, a digitally connected consumer base, and the allure of Western prestige brands. Yet, the recent downturn in China’s duty-free spending, particularly within Hainan’s retail ecosystem, has exposed deep vulnerabilities in their regional strategies. As spending power cools and market dynamics shift, both firms are now contending with the financial, operational, and reputational consequences of overexposure to a single, volatile geography.

Estée Lauder: From Growth Engine to Revenue Drag

Estée Lauder’s reliance on China’s travel retail market has long been both a competitive advantage and a source of risk. In the years leading up to 2023, the company enjoyed consistent double-digit growth in the Asia-Pacific region, with Hainan accounting for a significant share of this expansion. However, the company’s Q3 2025 financial report revealed a dramatic reversal: sales fell by 10% year-over-year, while net income dropped a staggering 42%, largely due to weakening demand in travel retail, especially in China.

This sharp contraction has been exacerbated by a narrowing consumer base and waning confidence in the brand’s long-term outlook. Estée Lauder has historically positioned itself at the premium end of the skincare and fragrance spectrum, appealing to status-conscious Chinese buyers. However, amid growing price sensitivity and increasing competition from both domestic brands and more affordable Western labels, its value proposition appears increasingly fragile.

Moreover, Estée Lauder’s challenges are not solely operational. In March 2025, the company became the subject of a class-action lawsuit filed in the United States, alleging that it misled investors regarding its exposure to China’s gray-market channels, especially in Hainan. The plaintiffs claim that Estée Lauder knowingly overstated sales through unofficial resale networks—commonly referred to as “daigou”—without adequately disclosing the regulatory risks involved. While the case is still under litigation, the reputational damage has compounded investor concerns and further weighed on share performance.

Internally, the company is undertaking a broad-based restructuring effort aimed at mitigating its overdependence on China. CEO Fabrizio Freda announced in early 2025 that Estée Lauder would increase global operational efficiency by cutting up to 7,000 jobs—more than 10% of its global workforce—over the next 18 months. While positioned as a proactive move to reorient resources toward innovation and digital growth, the cuts signal the scale of the pressure facing the firm.

L’Oréal: Strategic Adaptation Amid Volatility

Compared to Estée Lauder, L’Oréal entered this downturn from a position of greater diversification. The French beauty giant has cultivated a broad consumer base in China, spanning mass-market lines such as L’Oréal Paris and Maybelline, as well as premium segments including Lancôme, Kiehl’s, and Yves Saint Laurent Beauty. Despite this advantage, the company has not emerged unscathed from the contraction in duty-free spending.

In late 2024, L’Oréal reported a sequential slowdown in travel retail revenues across Asia-Pacific, with particular weakness concentrated in China. While overall sales for the company remained relatively stable due to strong performance in Western Europe and Latin America, management expressed concern over “structural headwinds” in Chinese travel retail. Among the immediate responses was a significant downsizing of the company’s travel retail operations, including workforce reductions of up to 50% in its China-based sales and support teams.

Unlike Estée Lauder, L’Oréal has responded not by doubling down on austerity but by pivoting to a new growth model. Recognizing the declining efficacy of traditional duty-free discounting, the company has shifted its focus toward “experiential luxury.” This approach emphasizes immersive brand storytelling, personalized skincare consultations, AI-driven beauty tech integration, and exclusive product offerings. In collaboration with domestic partners and travel hubs, L’Oréal has launched redesigned retail environments that blur the lines between commerce, entertainment, and self-care—a model intended to resonate with post-pandemic Chinese consumers who increasingly value experience over acquisition.

This shift is part of L’Oréal’s broader transformation under CEO Nicolas Hieronimus, who has emphasized digital acceleration and sustainable innovation as core strategic pillars. The company has expanded its investments in China-based R&D, including the recent opening of a new research center in Shanghai focused on developing products tailored specifically to Chinese skin types, beauty preferences, and climate conditions.

Still, the path forward is fraught with challenges. L’Oréal faces growing competition from local brands like Perfect Diary and Proya, which offer competitive pricing, culturally resonant branding, and deep integration into domestic e-commerce platforms like Douyin and Xiaohongshu. To maintain its leadership position, L’Oréal must not only reimagine retail but also deepen its relevance in the everyday lives of Chinese consumers.

Comparative Analysis: Financial and Strategic Metrics

To fully understand the impact of China’s duty-free downturn on Estée Lauder and L’Oréal, a comparative review of financial indicators from 2023 to 2025 provides useful perspective.

The table illustrates that while both companies have been affected by the downturn, Estée Lauder has been more directly exposed and consequently more adversely impacted. L’Oréal’s diversified product portfolio, regional balance, and faster strategic pivot have allowed it to maintain relative stability in a turbulent operating environment.

Broader Industry Significance

The difficulties faced by Estée Lauder and L’Oréal highlight broader challenges confronting the global beauty industry. Heavy reliance on a single geography—even one as vast and promising as China—can amplify vulnerability when consumer sentiment shifts or regulatory conditions change. Both firms have also been forced to grapple with the limits of the travel retail model, which, while profitable in times of high traffic, is highly cyclical and sensitive to both policy and macroeconomic disruptions.

Moreover, the challenges underscore the importance of nuanced, locally tailored strategies. The one-size-fits-all model of Western beauty dominance no longer suffices in China’s highly fragmented and culturally unique market. Brands that wish to succeed must engage deeply with local trends, invest in consumer education, and embed themselves into the digital and social commerce ecosystems that increasingly define Chinese retail.

Shifting Consumer Behaviors and Market Dynamics

As the foundation of China’s once-flourishing duty-free market shows signs of stress, a deeper transformation is underway: the rapid evolution of consumer behavior and the reshaping of beauty industry dynamics. These shifts are not transient reactions to economic cycles but rather enduring trends that reflect generational change, technological integration, and a reassessment of luxury itself. The implications for brands such as Estée Lauder and L’Oréal extend far beyond short-term sales volatility, pointing instead to a fundamental reevaluation of strategy, engagement, and relevance in the Chinese market.

Erosion of the Price Advantage: Duty-Free’s Waning Allure

One of the defining features of the duty-free retail model has historically been its compelling price proposition. By exempting purchases from import duties and value-added taxes, the sector promised significant savings—an especially powerful incentive in a market as price-sensitive as China. For years, this competitive edge enabled duty-free zones in Hainan and elsewhere to draw throngs of aspirational consumers seeking access to luxury at more attainable price points.

However, in the post-pandemic period, this price advantage has eroded noticeably. Domestic e-commerce platforms, particularly during national shopping festivals like “Double 11” and “618,” now frequently match or undercut duty-free prices, especially when factoring in brand coupons, live-streaming discounts, and loyalty-based rewards. As a result, many consumers no longer perceive duty-free as the optimal value channel. This shift is especially pronounced among Gen Z and younger millennials, who prioritize immediacy, convenience, and digital incentives over the perceived prestige of shopping in physical stores.

Additionally, currency volatility and global inflationary pressures have further complicated pricing calculations. When international price points fluctuate due to exchange rate differentials, and domestic platforms aggressively localize promotions, the consistency of duty-free pricing falters. The once-straightforward consumer calculus—buy duty-free to save—has become murky, undermining one of the channel’s core appeals.

Rise of Domestic Beauty Brands and National Sentiment

In parallel with the diminishing appeal of imported duty-free products, domestic Chinese beauty brands are enjoying a renaissance. Companies such as Perfect Diary, Florasis (Hua Xizi), Proya, and Winona have rapidly gained market share by offering high-quality formulations, contemporary packaging, and branding strategies that speak directly to local cultural values.

What sets these local challengers apart is not just price competitiveness, but also their intuitive grasp of Chinese aesthetics, digital behaviors, and social narratives. Florasis, for instance, has built a loyal following through intricate designs inspired by Chinese folklore and traditional craftsmanship, transforming cosmetics into objects of cultural pride. Similarly, Perfect Diary’s aggressive use of Key Opinion Leaders (KOLs), short videos, and interactive platforms has allowed it to reach consumers with precision and relatability.

This emergence of “Guochao” (国潮), or national pride in domestic brands, has created a compelling emotional undercurrent that global companies often struggle to replicate. While foreign brands continue to enjoy strong cachet in prestige skincare, their influence is increasingly being challenged in color cosmetics and entry-level skincare—segments that were previously dominated by imported products.

In this new environment, brand origin is no longer a guaranteed advantage. Instead, resonance with local values, responsiveness to digital culture, and agility in product development are becoming decisive factors in consumer choice.

Digital Engagement and Channel Fluidity

China's beauty retail landscape has also undergone a rapid and irreversible digitization. Platforms such as Tmall, JD.com, Douyin (TikTok’s Chinese counterpart), and Xiaohongshu (RED) are now central to product discovery, evaluation, and purchase. This ecosystem allows consumers to move fluidly between inspiration and transaction, often within minutes. As such, traditional marketing funnels have collapsed in favor of nonlinear, experience-based journeys.

In particular, live-streaming e-commerce has emerged as a dominant channel. Beauty influencers host real-time product demonstrations, answer questions, offer time-limited discounts, and convert viewers into buyers with striking efficiency. While both Estée Lauder and L’Oréal have engaged with this format, they are often outpaced by more agile domestic competitors who tailor their messages in hyper-local and spontaneous ways.

Moreover, younger consumers increasingly expect brand interaction to be interactive, real-time, and personalized. Chat-based customer service, AR-powered virtual try-ons, gamified loyalty programs, and co-creation campaigns (e.g., letting fans vote on product designs or scents) are no longer novel—they are baseline expectations. Brands that fail to meet these expectations risk being perceived as outdated or disconnected.

Return of Outbound Tourism and Reallocation of Luxury Spend

With China’s borders reopening in late 2023 and outbound international tourism steadily rising through 2024 and 2025, a major redirection of luxury spending is underway. Affluent Chinese travelers are once again frequenting shopping destinations in Hong Kong, Tokyo, Seoul, and Singapore—markets that offer broader selection, newer product releases, and a more established luxury retail ambiance.

This shift has dealt a dual blow to domestic duty-free zones. Not only are consumers diverting spending to overseas markets, but their expectations are also being recalibrated. Having experienced high-touch service and immersive brand environments abroad, many now find local duty-free stores lacking in both sophistication and novelty. In this context, maintaining brand relevance requires more than operational excellence; it requires reimagining the entire consumer journey across borders.

There is also a broader psychological factor at play. For many Chinese consumers, shopping abroad serves as a form of social currency and symbolic consumption. The act of purchasing a luxury item in Paris or Ginza conveys a cosmopolitan identity and elevated status. Domestic alternatives, even if comparable in price or quality, struggle to evoke the same emotional satisfaction.

The data underscores a pronounced rebalancing in luxury consumption patterns. While domestic spend peaked during border closures, the resumption of outbound travel has reignited international purchases, particularly in categories like beauty and fashion.

Market Fragmentation and the End of the Monolith Consumer

Perhaps the most significant shift is the growing fragmentation of the Chinese beauty consumer base. The days of monolithic “urban elites” dictating nationwide trends are over. Today’s market comprises multiple micro-audiences, each with unique preferences, cultural contexts, and consumption triggers. From eco-conscious Gen Zers in Tier 1 cities to rising middle-class consumers in Tier 3 locales seeking functional skincare, no single message or distribution channel can reach them all effectively.

This complexity demands unprecedented levels of data literacy, audience segmentation, and product localization. It also requires an openness to test-and-learn methodologies, cross-functional collaboration, and brand humility—recognizing that influence must now be earned rather than assumed.

Strategic Responses and Future Outlook

The recent contraction in China’s duty-free market and the broader recalibration of consumer behavior have forced global beauty companies to reevaluate their strategic priorities. For industry giants such as Estée Lauder and L’Oréal, the shift has been especially jarring, as it not only disrupted near-term sales performance but also challenged long-held assumptions about market structure, growth trajectories, and consumer loyalty. In response, these corporations—and the luxury beauty industry at large—are initiating significant structural, operational, and branding transformations to maintain competitiveness and restore investor confidence.

Restructuring and Organizational Realignment

Estée Lauder’s response has been swift and substantial. In early 2025, the company announced an extensive restructuring program aimed at cost rationalization and organizational simplification. This initiative includes the planned layoff of approximately 7,000 employees—over 10% of its global workforce—primarily focused on non-revenue-generating functions and underperforming regions. According to CEO Fabrizio Freda, the move is designed to free up capital for reinvestment into high-growth channels such as direct-to-consumer (DTC) platforms, digital marketing, and product innovation.

Simultaneously, Estée Lauder has begun consolidating some of its regional operations, reducing overlapping administrative functions, and re-aligning marketing strategies to target segmented demographics more effectively. A key element of this realignment is the de-prioritization of China as a singular growth engine. Instead, the company is working to balance its exposure by strengthening its presence in emerging markets like India, Brazil, and Southeast Asia—regions that exhibit favorable demographic trends and rising per capita spending on beauty.

L’Oréal, by contrast, has taken a more targeted and innovation-led approach. While it too is implementing cost-containment measures, the company has chosen to preserve its workforce in key markets, focusing instead on operational optimization and digital transformation. L’Oréal’s China-based travel retail division has undergone a 50% workforce reduction, but these layoffs have been offset by increased investments in R&D, localized content production, and AI-powered consumer engagement tools.

Shift Toward Experiential Luxury and Hybrid Retail

A core theme uniting both companies’ strategic pivots is the transition from transactional retail to experiential luxury. This approach moves beyond product discounting and inventory push to emphasize immersive, emotionally resonant brand interactions.

Estée Lauder has initiated a “beauty destination” concept in its major Chinese retail outlets, blending skincare consultations, aromatherapy experiences, and interactive beauty classes. These in-store features are designed to forge stronger consumer attachment and encourage repeat visits, particularly from experience-seeking millennials and Gen Z consumers. The company has also invested in partnerships with Chinese hospitality and lifestyle brands to integrate beauty experiences into hotels, spas, and wellness resorts.

L’Oréal’s efforts have taken on a more digitized form. It recently launched a suite of AR-based virtual try-on tools, coupled with a proprietary AI skin diagnostic app tailored to Asian skin types. These tools are now embedded within its Tmall and JD.com flagship stores, offering users real-time recommendations, personalized skincare routines, and gamified engagement through reward systems. In doing so, L’Oréal aims not only to boost conversion rates but also to gather granular consumer data for future product development and targeted outreach.

In addition, L’Oréal is expanding its use of "phygital" formats—a hybrid of physical and digital retail. For instance, pop-up installations in Tier 1 and Tier 2 cities offer QR-enabled displays, allowing consumers to engage with the brand both in-person and online, creating a seamless and continuous shopping journey. These strategies illustrate a recognition that the future of beauty retail in China lies not in price leadership but in experience, personalization, and convenience.

Product Localization and Innovation Pipelines

In response to rising competition from domestic brands and shifting consumer preferences, both Estée Lauder and L’Oréal are reconfiguring their product development pipelines to prioritize localization. This strategy involves tailoring formulations, packaging, and messaging to better align with Chinese cultural aesthetics, skincare routines, and environmental factors such as pollution and humidity.

Estée Lauder has increased R&D spending at its Shanghai Innovation Center, focusing on anti-pollution serums, lightweight moisturizers for humid climates, and fragrances inspired by traditional Chinese botanicals. It has also formed strategic partnerships with Chinese universities and dermatology institutes to co-develop skin-health research relevant to East Asian consumers.

L’Oréal, meanwhile, is leveraging its acquisition of Chinese skincare brand Magic Holdings to deepen its local expertise. The acquisition has provided the company with advanced knowledge of herbal ingredients and formulation techniques that resonate with Chinese consumers. Products co-branded or co-created with Magic Holdings have received strong traction on local platforms like Xiaohongshu and Douyin, suggesting that global-local hybridization may be an effective hedge against nationalistic consumer sentiment.

Geographic Diversification and Portfolio Balancing

Beyond China, both companies are actively diversifying their geographic exposure to mitigate future market-specific risks. Estée Lauder is accelerating its push into South Asia and Latin America, markets that are benefiting from favorable demographic shifts and rising urbanization. It has launched several market-specific products in India, including skincare lines targeting hyperpigmentation and sun damage, two of the most common skin concerns in the region.

L’Oréal, already well-entrenched in Europe and North America, is focusing on expanding its footprint in the Middle East and Africa. In 2024, it opened a regional logistics hub in Dubai and signed a multi-year partnership with local e-commerce platforms to increase accessibility and delivery efficiency across the region. These efforts are complemented by brand campaigns that emphasize inclusivity and representation, tapping into a broader global conversation about identity and self-expression in beauty.

Moreover, both companies are streamlining their brand portfolios to focus on high-potential verticals. Estée Lauder is shifting resources toward clinically-backed skincare brands like La Mer and The Ordinary, while scaling back less profitable color cosmetics lines. L’Oréal is doubling down on dermocosmetics and sustainability-forward products, including its CeraVe and Garnier franchises, which have shown resilience in a range of macroeconomic conditions.

Future Outlook: Pragmatism Over Optimism

Looking ahead, analysts remain cautious but not entirely pessimistic about the prospects for global beauty brands in China. While the duty-free boom may have run its course, the long-term fundamentals of the Chinese beauty market—an expanding middle class, increasing emphasis on self-care, and digital fluency—remain intact. What is changing, however, is the path to capturing that potential.

According to Bain & Company’s 2025 luxury report, China’s luxury market is expected to remain flat or grow modestly through 2026, barring a major policy shift or economic stimulus. In this environment, success will depend less on aggressive expansion and more on operational excellence, cultural intelligence, and strategic restraint. Companies that cling to outdated assumptions or pursue short-term gains through discounting and channel saturation risk further erosion of brand equity.

Instead, the new model demands measured investment in brand authenticity, agile innovation cycles, and an infrastructure capable of responding to highly localized shifts in demand. It also requires brands to build trust—not just through product quality, but by demonstrating ethical supply chains, environmental responsibility, and genuine cultural respect.

In sum, the post-duty-free era in China will not reward scale alone. It will reward adaptability, integrity, and the ability to see Chinese consumers not as a monolithic bloc but as diverse, discerning individuals whose tastes are rapidly evolving. For Estée Lauder, L’Oréal, and their peers, embracing this complexity is not merely advisable—it is essential for long-term viability.

Conclusion: Navigating the New Normal

The decline in China’s duty-free spending has laid bare the vulnerabilities inherent in a business model overreliant on geographic concentration, policy-driven growth, and the illusion of perpetually rising consumer demand. For global beauty titans like Estée Lauder and L’Oréal, this contraction marks more than a revenue setback—it represents a critical inflection point that will define their operational paradigms, strategic orientations, and consumer engagement methodologies for years to come.

The rise and fall of China’s duty-free market, particularly centered in Hainan, is a case study in both the power and peril of policy-fueled retail ecosystems. Initially buoyed by generous government incentives, relaxed import regulations, and explosive consumer enthusiasm during pandemic-related travel bans, the market appeared invincible. Brands rushed to establish presence, localize supply chains, and market aggressively, capitalizing on a seemingly insatiable demand for high-end beauty products.

Yet the very characteristics that drove duty-free’s success also sowed the seeds of its fragility. Overconcentration in a single channel made companies acutely susceptible to regulatory shifts, macroeconomic volatility, and evolving shopper psychology. As restrictions eased and outbound tourism resumed, the comparative advantages of domestic duty-free zones diminished. Concurrently, rising nationalist sentiment, the maturation of e-commerce, and the emergence of high-quality domestic competitors upended old assumptions about consumer loyalty and brand prestige.

The financial data speaks volumes. Estée Lauder’s double-digit sales decline and 42% profit drop in 2025 are not isolated anomalies—they are reflective of deep structural exposure. Similarly, L’Oréal’s decision to downsize its travel retail division by 50% reveals that even the most diversified players must reassess their China risk. These responses, though painful in the short term, suggest a necessary recalibration—one driven not by panic, but by pragmatism.

At the core of this transformation lies a redefinition of what it means to succeed in the Chinese luxury beauty market. No longer can brands depend on aggressive promotional tactics, blanket distribution models, or imported cachet alone. Instead, they must embrace a nuanced, multidimensional approach that prioritizes localized innovation, digital-first engagement, and emotionally resonant storytelling. Today’s Chinese consumer is highly informed, brand-savvy, and values alignment with lifestyle and identity as much as functional efficacy or price.

Both Estée Lauder and L’Oréal are showing early signs of this strategic evolution. Estée Lauder’s pivot toward cost rationalization, experiential store formats, and R&D partnerships in Asia demonstrates a willingness to move beyond legacy paradigms. L’Oréal’s embrace of AI beauty tech, virtual retail, and culturally embedded co-branded products reflects an understanding that relevance now trumps reputation. These companies are not simply reacting to market noise—they are initiating long-overdue strategic realignments designed to create sustainable, differentiated value in a rapidly fragmenting market.

Critically, this period also invites reflection on the broader role of multinationals in emerging markets. The old model—where Western brands set the agenda and consumers followed—no longer holds. In China, the dynamic has flipped. Domestic consumers increasingly dictate terms, from ingredient transparency to brand values, forcing foreign players to listen, adapt, and sometimes cede space. This is not a threat to global leadership, but an opportunity to foster genuine partnerships with local ecosystems and evolve in ways that resonate globally.

Moreover, the rise of domestic champions should not be seen purely through a lens of competition. Companies like Florasis, Proya, and Perfect Diary have demonstrated extraordinary insight into consumer behavior, digital channel mastery, and the power of cultural fluency. Multinational firms would do well to view these brands not only as rivals, but as potential collaborators and innovation catalysts. Strategic alliances, ingredient co-sourcing, and joint sustainability initiatives could usher in a new era of hybrid excellence—where global scale meets local soul.

The digital transformation of China’s beauty market further accelerates this need for adaptability. As consumer journeys become increasingly nonlinear—intertwining product discovery, education, purchase, and feedback across platforms like Xiaohongshu, Douyin, and WeChat—the ability to create consistent, personalized, and engaging brand experiences becomes paramount. Static advertising and push-marketing are relics of the past; what is needed now is a dynamic, responsive, and participatory model of brand building.

Looking forward, the outlook for global beauty in China is neither bleak nor guaranteed—it is conditional. Conditional on brands’ willingness to shed outdated assumptions. Conditional on their capacity to read weak signals from the market and respond with agility. Conditional on their ability to re-center strategy around the needs and aspirations of today’s fragmented, complex, and empowered consumer base.

For investors, the lesson is one of tempered optimism. China will remain a critical node in the global luxury map, but no longer on the same terms. The years of unmitigated growth driven by novelty, access, and policy largesse are behind us. What lies ahead is a more competitive, more regulated, and more sophisticated landscape—one that rewards long-termism over opportunism.

For corporate leadership, this moment calls for strategic humility. Acknowledging missteps, rebalancing portfolios, and diversifying growth channels are not signs of weakness but of maturity. Those who act decisively, listen closely, and invest patiently will not only recover lost ground but establish themselves as enduring players in a transformed global beauty order.

And for consumers, this evolution is a welcome development. It promises greater choice, deeper engagement, and a more inclusive definition of beauty that honors local heritage and global innovation alike. It shifts the balance of power in their favor—where loyalty is earned, not assumed, and where brands must compete not only on product but on purpose.

In sum, the contraction of China’s duty-free spending has exposed the risks of strategic complacency and overconcentration. But it has also created a powerful impetus for change—one that, if harnessed wisely, can lead to stronger, more resilient, and more culturally connected global beauty brands. Estée Lauder and L’Oréal have taken the first steps on this path. The journey ahead will require fortitude, creativity, and above all, respect for the evolving complexity of the market they once thought they had mastered.

References

- In Hainan, China’s shopping paradise, duty-free spending fell

https://www.hellenicshippingnews.com/in-hainan-chinas-shopping-paradise-duty-free-spending-fell-in-2024 - Weak Chinese economy sees Hainan duty-free spending plunge

https://insideretail.asia/weak-chinese-economy-sees-hainan-duty-free-spending-plunge - Estée Lauder to lay off up to 7,000 more than it initially planned

https://www.marketwatch.com/story/estee-lauder-to-lay-off-up-to-7-000-more-than-it-initially-planned-1ace15e0 - Estée Lauder faces US legal challenge over China sales practices

https://www.reuters.com/business/retail-consumer/estee-lauder-faces-us-legal-challenge-over-china-sales-practices - L’Oréal to cut travel retail beauty workforce in China amid sales decline

https://www.globalcosmeticsnews.com/loreal-to-cut-travel-retail-beauty-workforce-in-china-amid-sales-decline - China travel retail woes trigger industry reset

https://jingdaily.com/posts/china-travel-retail-woes-trigger-industry-reset-l-oreal-cuts-shiseido-merges - Estee Lauder, L’Oreal suffer as China’s duty-free spending falls

https://us.fashionnetwork.com/news/Estee-lauder-l-oreal-suffer-as-china-s-duty-free-spending-falls,1733142.html - Luxury market in mainland China to stay flat

https://www.bain.com/about/media-center/press-releases/luxury-market-in-mainland-china-to-stay-flat-in-2025 - Chinese luxury spending shifts from domestic to overseas

https://www.bain.com/insights/2024-china-luxury-goods-market - The rise of Guochao and China’s domestic beauty boom

https://jingdaily.com/the-rise-of-guochao-and-chinas-domestic-beauty-boom