Enterprise Gen AI Spending Soars: Trends, Use Cases, and Strategic Shifts in 2025

The enterprise technology landscape is undergoing a transformative shift, propelled by the rapid evolution and adoption of generative artificial intelligence (Gen AI). As of 2025, Gen AI is no longer a futuristic concept or limited to experimental pilot projects. It has become a core component of enterprise IT strategy, embedded across operations, product development, customer engagement, and decision-making. What was once viewed as a tool for innovation has now matured into a driver of operational efficiency, competitive differentiation, and revenue growth.

Gen AI refers to systems that can generate text, code, images, audio, and other data outputs that resemble human-like creativity and logic. These models, typically trained on vast corpora of unstructured data, use advanced neural architectures such as transformers to produce coherent, contextually relevant content. From conversational AI assistants to auto-generating software code, the enterprise use cases of Gen AI are vast and expanding by the day.

In recent years, early enterprise adoption of Gen AI was primarily experimental. In 2023, most organizations were exploring proofs-of-concept (PoCs) and limited deployments to test viability, compliance, and performance. However, the landscape has changed dramatically. By 2024, successful early adopters began scaling their Gen AI deployments and demonstrating measurable business outcomes. This momentum has carried into 2025, with enterprises across sectors significantly increasing their investment in Gen AI technologies and infrastructure.

Several macroeconomic and technological factors are fueling this trend. First, the accessibility of foundational models through APIs from vendors like OpenAI, Google DeepMind, Anthropic, and Cohere has drastically reduced the barrier to entry. Second, advancements in cloud-based GPU infrastructure and orchestration frameworks have enabled scalable deployments. Third, the growing availability of enterprise-specific fine-tuning tools has empowered organizations to customize models for domain-specific tasks without having to build from scratch.

Moreover, the pressure to remain competitive in a digital-first world has intensified. As digital-native companies leverage Gen AI to accelerate time-to-market and reduce operational costs, traditional enterprises are compelled to respond in kind. Industry leaders now view Gen AI not only as a tool for innovation but also as a necessity for staying relevant in an increasingly automated economy.

The scale of enterprise investment reflects this strategic shift. According to industry analysts, enterprise spending on Gen AI is expected to surpass $50 billion globally in 2025, representing a year-over-year growth rate of over 70%. This surge in spending is being distributed across various functions, from IT infrastructure and application development to customer service automation and AI-driven decision support. The scope is broad, but the intent is clear: enterprises are betting big on Gen AI to drive the next wave of digital transformation.

Notably, Gen AI is also reshaping the role of the IT department itself. No longer confined to system maintenance and infrastructure provisioning, IT leaders are now at the forefront of strategic decision-making. CIOs and CTOs are expected to evaluate not only the technical feasibility but also the ethical implications, regulatory compliance, and long-term scalability of Gen AI systems. The convergence of technology, governance, and business strategy has never been more critical.

While the promise of Gen AI is immense, the path to enterprise-scale adoption is complex and nuanced. Challenges such as data privacy, model transparency, integration with legacy systems, and workforce transformation remain significant. As organizations allocate substantial portions of their IT budgets to Gen AI initiatives, they must also invest in robust governance frameworks, risk mitigation strategies, and continuous learning for their teams.

This blog post aims to provide a comprehensive analysis of Gen AI spending in enterprise IT for 2025. We will explore market forecasts, budgetary breakdowns, key use cases, strategic vendor relationships, and the challenges organizations face as they scale their investments. Supported by data visualizations and practical insights, this article will offer enterprise decision-makers a roadmap for navigating the Gen AI opportunity in 2025 and beyond.

2025 Market Forecast and Spending Trends

As generative AI solidifies its position at the core of enterprise technology, the financial commitment from organizations worldwide has reached unprecedented levels. The year 2025 marks a pivotal inflection point: generative AI is no longer a peripheral investment but a mainstream budgetary priority across a wide spectrum of industries. This strategic shift is reflected in the projected global spending figures, which signal a substantial acceleration in enterprise adoption and integration.

Global Spending Projections

According to recent market research from leading IT and AI advisory firms, enterprise spending on generative AI is expected to exceed $50 billion globally in 2025. This figure represents a 70% year-over-year increase from 2024, when enterprise expenditures reached an estimated $29.5 billion. The growth trajectory from 2023 to 2025 illustrates a compounded annual growth rate (CAGR) of approximately 75%, indicating not only rapid adoption but also expanding deployment footprints across departments and geographies.

This exponential rise is largely attributed to the transition from experimentation to implementation. In 2023, a majority of enterprise AI budgets were allocated toward research, pilot testing, and proof-of-concept initiatives. However, by 2025, enterprises are aggressively moving into full production mode, allocating funds toward platform integration, infrastructure scaling, model fine-tuning, and workforce transformation. The resulting surge in spending signals both confidence in the technology and recognition of its operational value.

Industry-Specific Spending Trends

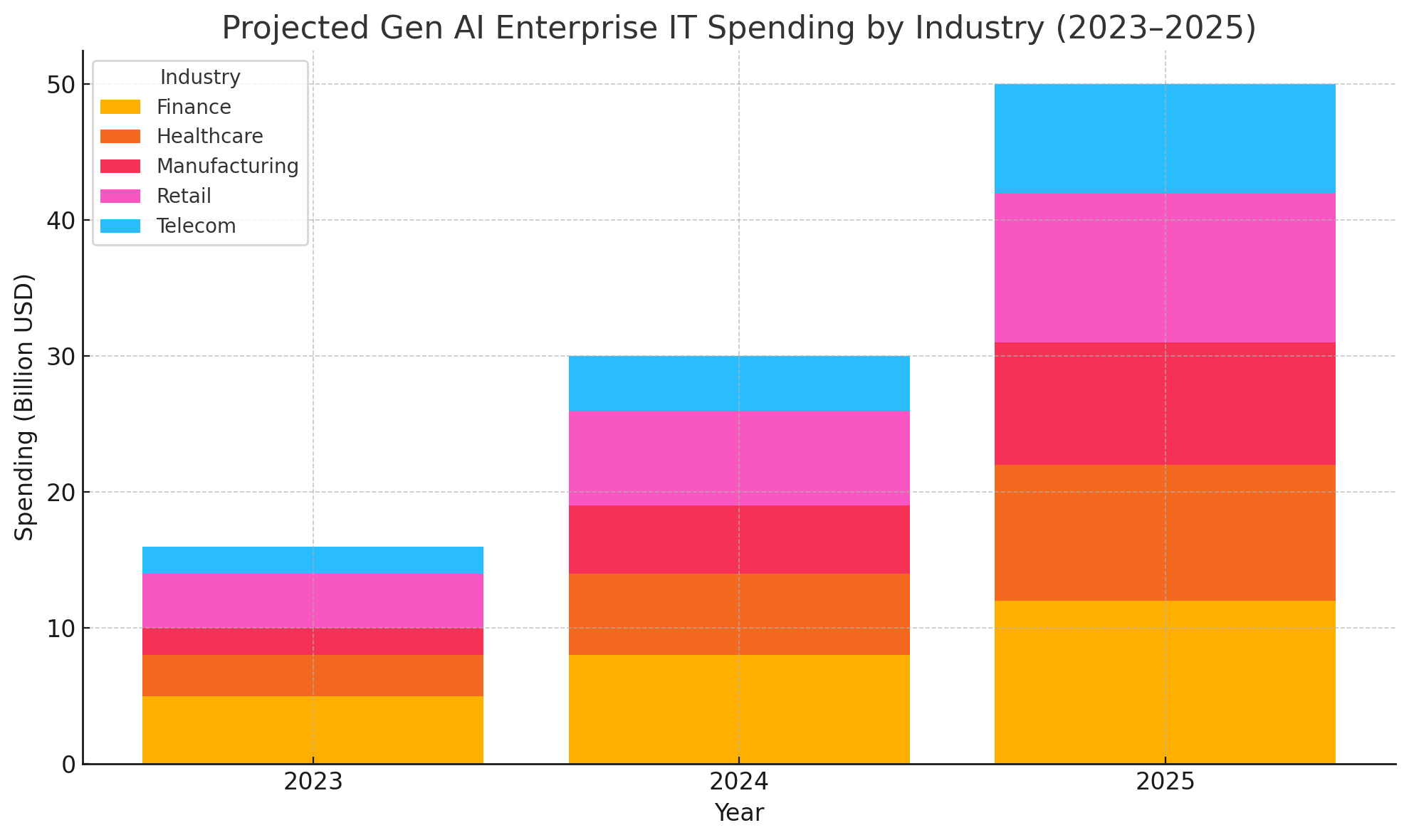

The distribution of spending across industries is uneven, with certain sectors emerging as frontrunners due to the immediate applicability of generative AI solutions. The chart below illustrates the estimated enterprise IT spending on Gen AI from 2023 to 2025 across five primary sectors:

Finance leads all sectors, with projected Gen AI investments rising from $5 billion in 2023 to $12 billion in 2025. The financial services industry, with its heavy reliance on data-driven decision-making and regulatory reporting, has found generative AI particularly effective in automating document generation, compliance workflows, and customer interaction. Chatbots, fraud detection systems, and real-time financial modeling have become prominent applications.

Healthcare is the second-largest spender, with investments growing from $3 billion in 2023 to $10 billion in 2025. The industry has adopted generative AI to support clinical documentation, summarize patient records, assist in diagnostics, and streamline administrative workflows. The promise of AI-augmented decision-making in clinical settings has significantly increased stakeholder confidence and investment.

Retail is not far behind, scaling its investments from $4 billion in 2023 to $11 billion in 2025. Gen AI is being used extensively to enhance customer experiences through personalized marketing content, automated product descriptions, and AI-driven recommendation engines. Large-scale adoption in e-commerce platforms has pushed the boundaries of how retailers engage customers digitally.

Manufacturing and telecommunications, while slightly behind in absolute spending, have demonstrated the highest relative growth. Manufacturing's investments are projected to climb from $2 billion in 2023 to $9 billion in 2025, driven by generative AI applications in predictive maintenance, supply chain optimization, and digital twin simulations. Similarly, telecom companies are investing heavily in automated customer support, network optimization, and AI-based predictive analytics, with spending projected to rise from $2 billion to $8 billion over the same period.

Regional Investment Patterns

From a geographical perspective, North America continues to dominate Gen AI enterprise spending, accounting for nearly 45% of the global market in 2025. The United States, in particular, is home to many of the world’s leading Gen AI vendors and benefits from a mature cloud ecosystem, a dynamic startup scene, and a strong culture of digital innovation.

Europe follows as the second-largest region, contributing roughly 25% of global enterprise spending. However, regulatory considerations, particularly around AI ethics and data protection, have introduced additional due diligence layers that slow down implementation cycles. Still, enterprises in Germany, France, and the UK are investing heavily, especially in regulated sectors such as finance and pharmaceuticals.

Asia-Pacific (APAC) has emerged as the fastest-growing region, with China, Japan, and South Korea making significant inroads. Driven by national AI strategies and large-scale public-private collaborations, APAC is expected to account for approximately 20% of global enterprise Gen AI spending in 2025, up from just 12% in 2023.

Spending Trajectory and Budget Evolution

One of the defining characteristics of Gen AI in 2025 is how spending has evolved from tactical to strategic. In 2023, budgets were primarily managed by innovation or R&D teams experimenting with generative models. By 2025, Gen AI investments are directly governed by CIOs and CFOs, with annual planning cycles incorporating Gen AI line items across infrastructure, software licensing, and talent development.

Enterprises are also becoming more sophisticated in how they structure their Gen AI expenditures. Subscription-based access to large language models (LLMs), such as those offered by OpenAI’s GPT or Anthropic’s Claude, is being complemented by increased spending on model customization, private hosting, and security. Additionally, a growing portion of budgets is now being reserved for prompt engineering, retrieval-augmented generation (RAG) systems, and AI observability tools, all of which ensure operational transparency and performance.

Looking ahead, analysts forecast continued momentum. If current adoption patterns persist, enterprise Gen AI spending could reach $85–$90 billion globally by 2027, with broader penetration across mid-sized businesses and emerging markets. The trend toward AI-native enterprise architecture—where AI models are integrated as foundational components in software stacks—is expected to solidify in the latter half of the decade.

Key Enterprise Use Cases Driving Investment

The unprecedented surge in generative AI (Gen AI) spending in 2025 is not a consequence of theoretical enthusiasm alone; it is deeply rooted in tangible, high-impact enterprise applications that are already transforming core business operations. As organizations shift from experimental pilots to production-grade deployments, they are increasingly directing their investments toward well-defined use cases with measurable returns. These use cases span across industry verticals and functional areas, underscoring the versatility and utility of Gen AI in driving business value.

This section outlines the most prominent enterprise applications of Gen AI, examining how each is contributing to operational efficiency, revenue generation, and strategic differentiation.

Customer Service and AI-Powered Agents

Among the most widely adopted and heavily funded use cases is the deployment of AI-powered virtual agents for customer service. These systems, often powered by large language models (LLMs), provide human-like responses to customer inquiries, troubleshoot common problems, and escalate complex issues to human operators when necessary.

Enterprises across sectors—particularly in banking, telecommunications, and e-commerce—have reported significant improvements in customer satisfaction scores, reduced call center costs, and shorter resolution times. In 2025, the sophistication of these agents has reached new heights, with many capable of maintaining context across long conversations, integrating with customer relationship management (CRM) systems, and operating in multiple languages with a high degree of fluency.

This use case continues to attract strong investment due to its ability to scale support operations globally without corresponding increases in headcount. Moreover, the introduction of emotion-aware Gen AI agents—capable of detecting customer sentiment and responding empathetically—is pushing the frontier of digital customer engagement.

Software Development and DevOps Acceleration

The integration of Gen AI into software development lifecycles is revolutionizing how enterprise applications are built, maintained, and optimized. Developers are now leveraging AI coding assistants that can generate boilerplate code, suggest bug fixes, and even perform automated testing. Platforms such as GitHub Copilot, Amazon CodeWhisperer, and internal proprietary tools have become essential to modern DevOps pipelines.

In 2025, enterprises are not merely supplementing development tasks with AI—they are rearchitecting workflows to optimize for AI-human collaboration. For instance, teams are using Gen AI to rapidly prototype new applications based on natural language specifications. Code generation capabilities are further enhanced by fine-tuned models trained on internal code repositories, ensuring outputs align with company-specific standards and architectural patterns.

From an investment perspective, Gen AI in software development offers compelling returns: accelerated time-to-market, improved code quality, and reduced reliance on scarce senior developer talent. As such, CIOs are prioritizing this use case in their IT modernization initiatives.

Document Processing and Workflow Automation

One of the most immediate and scalable applications of Gen AI lies in the automation of document-intensive workflows. Enterprises, especially those in legal, healthcare, insurance, and government sectors, manage vast volumes of unstructured data—contracts, claims, reports, patient records—that must be analyzed, summarized, and processed.

Gen AI models are now capable of parsing long documents, extracting key insights, generating summaries, and even drafting responses or follow-up documentation. These capabilities have been deployed to automate underwriting processes in insurance, generate compliance reports in banking, and create clinical notes in healthcare.

In 2025, enterprises are increasingly pairing Gen AI models with retrieval-augmented generation (RAG) systems that connect to internal databases and content repositories. This allows the models to ground their outputs in up-to-date, domain-specific information—greatly enhancing accuracy and reliability. As regulatory scrutiny over AI-generated content grows, such capabilities are vital to maintaining auditability and transparency.

Marketing Personalization and Content Generation

Marketing departments are at the forefront of creative automation, with Gen AI unlocking new levels of personalization, efficiency, and experimentation. Enterprises are using generative models to produce copy for email campaigns, website content, product descriptions, social media posts, and ad creatives—often in multiple languages and tailored to diverse customer segments.

Beyond content generation, Gen AI is enabling real-time personalization at scale. By combining customer behavioral data with LLM capabilities, marketers can dynamically generate messages that resonate with individual preferences, behaviors, and purchase history. This hyper-personalization is proven to boost engagement rates and conversion metrics, making it a high-priority use case.

Furthermore, marketing teams are adopting Gen AI tools for competitive intelligence, trend forecasting, and brand monitoring. The ability to analyze vast amounts of public data and synthesize strategic insights gives enterprises a decisive edge in crowded markets.

Data Analysis and Decision Intelligence

As enterprise data volumes continue to explode, the challenge has shifted from collecting data to deriving actionable insights. Gen AI addresses this gap by providing natural language interfaces for querying data, generating reports, and offering recommendations—often in real time.

In 2025, business analysts and executives increasingly rely on Gen AI dashboards that allow them to ask questions such as “What were the key drivers of revenue decline in Q1?” or “Which customer segments are showing early churn signals?”—and receive accurate, context-aware answers backed by internal datasets.

These decision intelligence tools are being integrated into business intelligence (BI) platforms, customer analytics solutions, and enterprise resource planning (ERP) systems. The value proposition is clear: democratizing access to analytics, accelerating decision-making cycles, and enabling data-driven cultures at scale.

Research and Development Innovation

Enterprises with significant R&D functions—particularly in pharmaceuticals, automotive, aerospace, and materials science—are leveraging Gen AI to augment innovation. Use cases include hypothesis generation, literature summarization, automated experimentation design, and predictive modeling.

For instance, pharmaceutical companies are using generative models to propose novel drug compounds, simulate molecular interactions, and draft regulatory documentation. Automotive firms are using AI to explore design permutations and generate early-stage CAD drawings. In materials science, researchers use Gen AI to model new composites with specific properties.

These use cases demand large-scale compute resources and highly specialized models, but the potential return on investment—accelerated innovation, reduced development costs, and faster time to patent—justifies the substantial capital outlays being made in 2025.

The diversity and depth of Gen AI use cases in enterprise IT underscore why investment is accelerating so rapidly. These applications not only improve efficiency but also open new pathways for value creation. As enterprises continue to scale their Gen AI initiatives, use case alignment with strategic business goals will be critical. Organizations that succeed in this alignment will be best positioned to harness Gen AI as a transformative force in the years to come.

Budget Allocation: Where Enterprises Are Spending

As generative AI (Gen AI) matures into a mission-critical capability within enterprise IT, budgetary strategies have become more structured and intentional. Organizations are no longer treating Gen AI as a line item in innovation budgets; instead, it is being embedded into long-term capital and operational expenditure frameworks. With global Gen AI enterprise spending projected to exceed $50 billion in 2025, a deeper understanding of how these budgets are allocated provides critical insight into enterprise priorities, challenges, and expectations.

This section analyzes how enterprises are distributing their Gen AI investments across infrastructure, software, services, and human capital. The findings reflect a rapidly evolving ecosystem where technical foundations, operational scaling, and organizational readiness all demand concurrent funding.

Overview of Budgetary Distribution

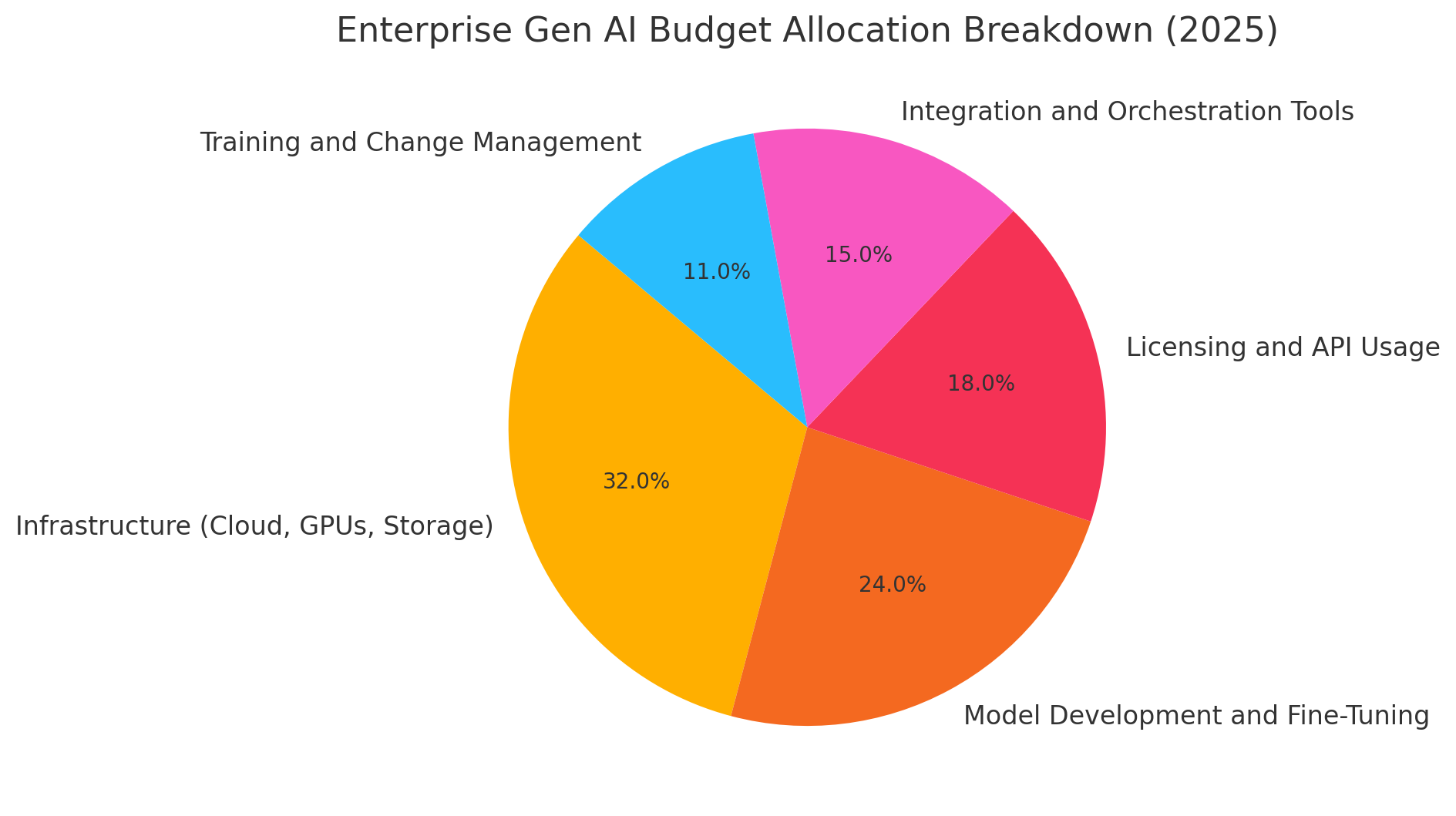

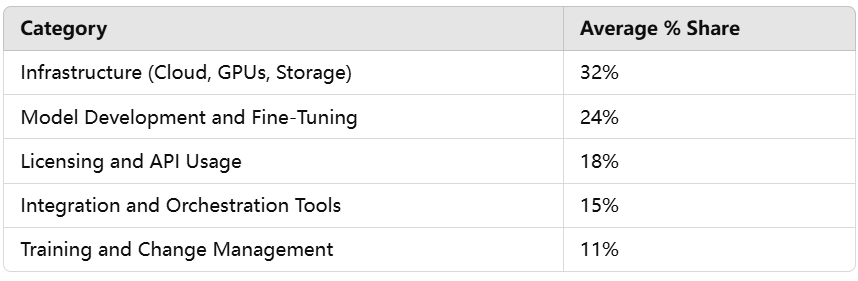

Enterprise Gen AI budgets in 2025 typically span five major categories:

- Infrastructure (Cloud, GPUs, Storage)

- Model Development and Fine-Tuning

- Licensing and API Usage

- Integration and Orchestration Tools

- Training and Change Management

Each category addresses a distinct requirement for deploying Gen AI at scale, and the weight of each varies based on industry, organizational maturity, and strategic goals. The chart and table below present an aggregated view of average enterprise allocations across these categories:

1. Infrastructure (32%)

Infrastructure accounts for the largest share of Gen AI-related expenditures in 2025, representing approximately 32% of the total enterprise budget. This category includes investment in cloud platforms, high-performance GPUs, storage solutions, and networking hardware required to support compute-intensive AI workloads.

Most enterprises rely on public cloud providers—particularly AWS, Azure, and Google Cloud—for their scalability and access to specialized hardware such as NVIDIA’s A100 or H100 chips. As demand for real-time inference and fine-tuning of models increases, many organizations are moving beyond shared cloud environments and adopting dedicated AI clusters or hybrid cloud strategies.

Infrastructure spending also includes AI-specific observability, security, and compliance tooling—critical for enterprises operating in regulated sectors. These investments lay the foundation for stable, scalable, and secure Gen AI operations.

2. Model Development and Fine-Tuning (24%)

The second-largest allocation—24%—is dedicated to model development and fine-tuning. While some enterprises continue to use general-purpose APIs, a growing number are building or adapting models for their own use cases. This includes supervised fine-tuning, reinforcement learning with human feedback (RLHF), and prompt optimization tailored to proprietary datasets.

Organizations in industries such as healthcare, legal, and finance are investing in domain-specific large language models (LLMs) that reflect their internal knowledge base and regulatory requirements. These efforts not only enhance accuracy but also help reduce hallucination risks and improve alignment with enterprise governance policies.

Additionally, model fine-tuning requires investment in MLOps frameworks, synthetic data generation, benchmarking tools, and privacy-preserving mechanisms—all of which contribute to this budget category.

3. Licensing and API Usage (18%)

Enterprises allocate approximately 18% of their Gen AI budgets toward third-party licensing and API consumption. This includes subscription fees for access to commercial models such as OpenAI’s GPT, Anthropic’s Claude, Google’s Gemini, and Cohere’s Command R.

For many organizations, API-based access remains the most efficient path to leveraging advanced LLMs without the overhead of infrastructure and training. These solutions are used in a wide variety of use cases, from chatbots and summarization engines to coding assistants and personalized recommendations.

However, as API usage scales across business units, costs can rise rapidly. Enterprises are implementing strict usage controls and exploring hybrid approaches where lightweight tasks are handled by in-house models while complex tasks are routed through commercial APIs.

4. Integration and Orchestration Tools (15%)

Integration is a critical, often underestimated, component of Gen AI success. Around 15% of enterprise Gen AI budgets are allocated to connecting AI capabilities to existing systems and workflows. This includes integration with customer relationship management (CRM), enterprise resource planning (ERP), content management systems (CMS), and data lakes.

Enterprises are also investing in orchestration platforms that manage model invocation, input/output formatting, fallback strategies, and contextual memory. These platforms are essential for combining Gen AI with traditional rule-based engines, retrieval-augmented generation (RAG) systems, and vector databases.

Open-source tools such as LangChain, Haystack, and LlamaIndex—as well as proprietary enterprise platforms—fall into this category. The focus is on reliability, scalability, and governance across model-based applications.

5. Training and Change Management (11%)

Though often the smallest line item, 11% of Gen AI budgets in 2025 are being allocated toward training, change management, and talent development. Enterprises are recognizing that successful Gen AI adoption requires not just technical readiness, but organizational preparedness as well.

Training programs are being developed for technical staff (engineers, data scientists), business users (marketers, analysts), and executive leadership. Topics range from prompt engineering and prompt security to responsible AI usage and ethical risk management.

Change management efforts include AI literacy campaigns, organizational restructuring, and the creation of new roles such as AI product managers and governance leads. These initiatives help ensure adoption at scale and reduce resistance among stakeholders.

Budget allocation patterns in 2025 reflect a growing sophistication in how enterprises approach Gen AI implementation. While infrastructure remains the dominant cost center, investments in fine-tuning, integration, and workforce enablement signal a transition toward long-term sustainability and scale.

As organizations continue to refine their strategies, a key success factor will be their ability to balance technical innovation with governance, integration, and human-centric design. The next sections will explore the challenges that arise in scaling Gen AI investments, and how IT leaders are rethinking their vendor and platform strategies in response to an evolving ecosystem.

Challenges in Scaling Gen AI Investment

Despite the surge in generative AI (Gen AI) investments in 2025, enterprise-scale adoption remains far from frictionless. As organizations transition from isolated pilots to large-scale deployments, they encounter a host of structural, technical, operational, and strategic barriers. These challenges do not simply hinder progress—they shape how enterprises design, govern, and future-proof their Gen AI initiatives.

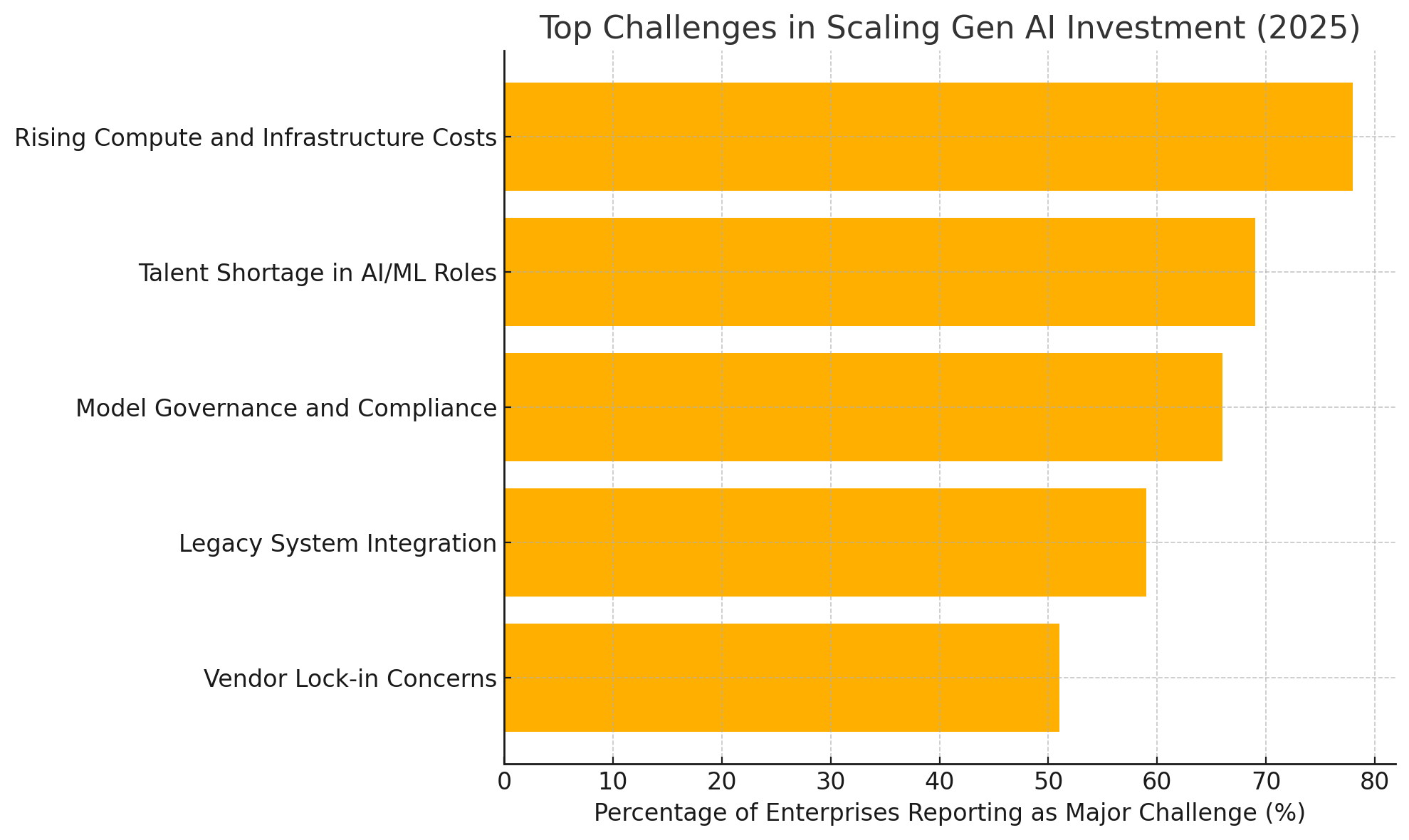

While enthusiasm and capital are abundant, successful scaling requires more than model access and compute resources. It demands deliberate investment in systems integration, talent acquisition, regulatory compliance, and ecosystem strategy. The following analysis explores the five most cited challenges that enterprises are facing in their Gen AI journeys, supported by industry survey data.

Rising Compute and Infrastructure Costs (78%)

The most frequently cited challenge in 2025 is the escalating cost of compute infrastructure. Gen AI workloads—particularly training and fine-tuning large models—require substantial GPU capacity, high-speed storage, and low-latency networking. As demand for high-performance computing has surged, so too have associated costs.

While public cloud providers offer elastic scalability, enterprises with heavy usage often face mounting operational expenditures. Some organizations are exploring hybrid or on-premises deployments to control long-term costs, but this introduces new complexities in infrastructure management and reliability.

Moreover, the shift toward real-time inference at scale—for use cases like customer service agents or embedded AI in applications—further increases compute intensity. Without cost-optimization strategies and resource-efficient model architectures, Gen AI projects risk becoming financially unsustainable over time.

Talent Shortage in AI/ML Roles (69%)

Despite the proliferation of Gen AI tools, enterprise implementation still requires skilled professionals—AI engineers, data scientists, prompt engineers, MLOps specialists, and governance experts. In 2025, the supply of such talent remains critically limited, especially for roles demanding both technical and domain-specific expertise.

Hiring challenges are compounded by the pace of innovation. The Gen AI landscape evolves rapidly, with new techniques, frameworks, and best practices emerging monthly. Enterprises must invest heavily in upskilling, continuous learning programs, and cross-functional collaboration models to remain competitive.

Additionally, many organizations struggle with workforce alignment. While technical roles are in demand, so too are non-technical roles that support adoption—change managers, AI ethicists, product owners, and legal advisors capable of navigating emerging regulations. The talent gap is thus both deep and wide.

Model Governance and Compliance (66%)

As Gen AI systems become more integrated into core business functions, questions of accountability, transparency, and legal compliance take center stage. Enterprises must ensure that their AI systems are fair, explainable, secure, and aligned with regional regulations.

In the European Union, the AI Act mandates risk-based compliance frameworks, including audit trails and transparency disclosures. In the United States, sector-specific regulations (e.g., in healthcare or finance) impose stringent data governance and liability rules. Similar frameworks are being developed across APAC, Canada, and Latin America.

Model governance includes the development of internal policies around data usage, consent management, content filtering, and the documentation of model behavior. Enterprises are investing in tools that support model monitoring, output validation, red teaming, and adversarial testing.

However, governance efforts are often fragmented and reactive. Without a centralized strategy and automation support, organizations find it difficult to maintain oversight at scale—particularly when multiple business units deploy Gen AI independently.

Legacy System Integration (59%)

A major technical hurdle lies in integrating Gen AI models with legacy enterprise systems—many of which were never designed for real-time, dynamic AI interactions. Traditional IT architectures are typically rule-based, deterministic, and siloed; Gen AI introduces probabilistic outputs, multi-modal inputs, and evolving prompt logic.

Integration challenges manifest in several ways. First, connecting Gen AI applications to legacy databases or ERP systems often requires middleware or orchestration layers. Second, older systems may lack the APIs or data formats required for efficient communication with AI models. Third, enterprises must address version control, latency, and consistency across distributed environments.

Organizations that lack modern data infrastructure—such as vector databases, retrieval systems, or low-latency API gateways—face particular difficulties. These barriers slow time-to-value and complicate system testing and validation.

Vendor Lock-in and Ecosystem Complexity (51%)

Finally, as enterprises adopt third-party Gen AI platforms, concerns about vendor lock-in are becoming more pronounced. Many commercial model providers offer proprietary architectures, tokenization methods, prompt formats, and performance enhancements that are not easily transferable.

This raises several issues: first, switching vendors can be costly and time-consuming. Second, data residency and privacy concerns may restrict the use of externally hosted models. Third, the rapid pace of model evolution—where new releases can outperform older ones in weeks—creates dependencies that can distort long-term planning.

To address these concerns, some enterprises are adopting open-source models (e.g., LLaMA, Mistral, or Falcon) or building internal platforms that enable model-agnostic deployment. Others are negotiating flexible licensing agreements and implementing multi-vendor orchestration strategies to mitigate single-provider risk.

Nevertheless, as the ecosystem matures, achieving true interoperability remains a technical and legal challenge. Enterprises must balance innovation velocity with long-term platform resilience.

Scaling Gen AI in the enterprise is as much a matter of infrastructure and governance as it is of innovation and ambition. The challenges explored above reflect a growing realization: successful Gen AI adoption is not simply about deploying a powerful model, but about embedding it within a complex organizational, technical, and regulatory ecosystem.

Addressing these challenges requires cross-functional leadership, strategic investments in both people and platforms, and a deep commitment to responsible AI principles. In the next section, we will explore how enterprises are reconfiguring their IT and vendor strategies to navigate this complexity and position themselves for long-term success in the Gen AI era.

Strategic Shifts in IT and Vendor Ecosystems

As generative AI (Gen AI) cements its role as a cornerstone of digital transformation, enterprises in 2025 are undergoing a profound reconfiguration of their IT strategies and vendor relationships. The scale and complexity of Gen AI initiatives—combined with the speed of innovation and regulatory scrutiny—have compelled CIOs, CTOs, and enterprise architects to rethink long-standing paradigms regarding platform selection, application architecture, data governance, and procurement.

The Rise of Platform-Centric AI Strategy

A defining feature of the 2025 enterprise AI landscape is the shift toward platform-centric strategies. Rather than building one-off Gen AI applications in isolation, leading organizations are consolidating capabilities on unified platforms that facilitate model orchestration, observability, integration, and lifecycle management.

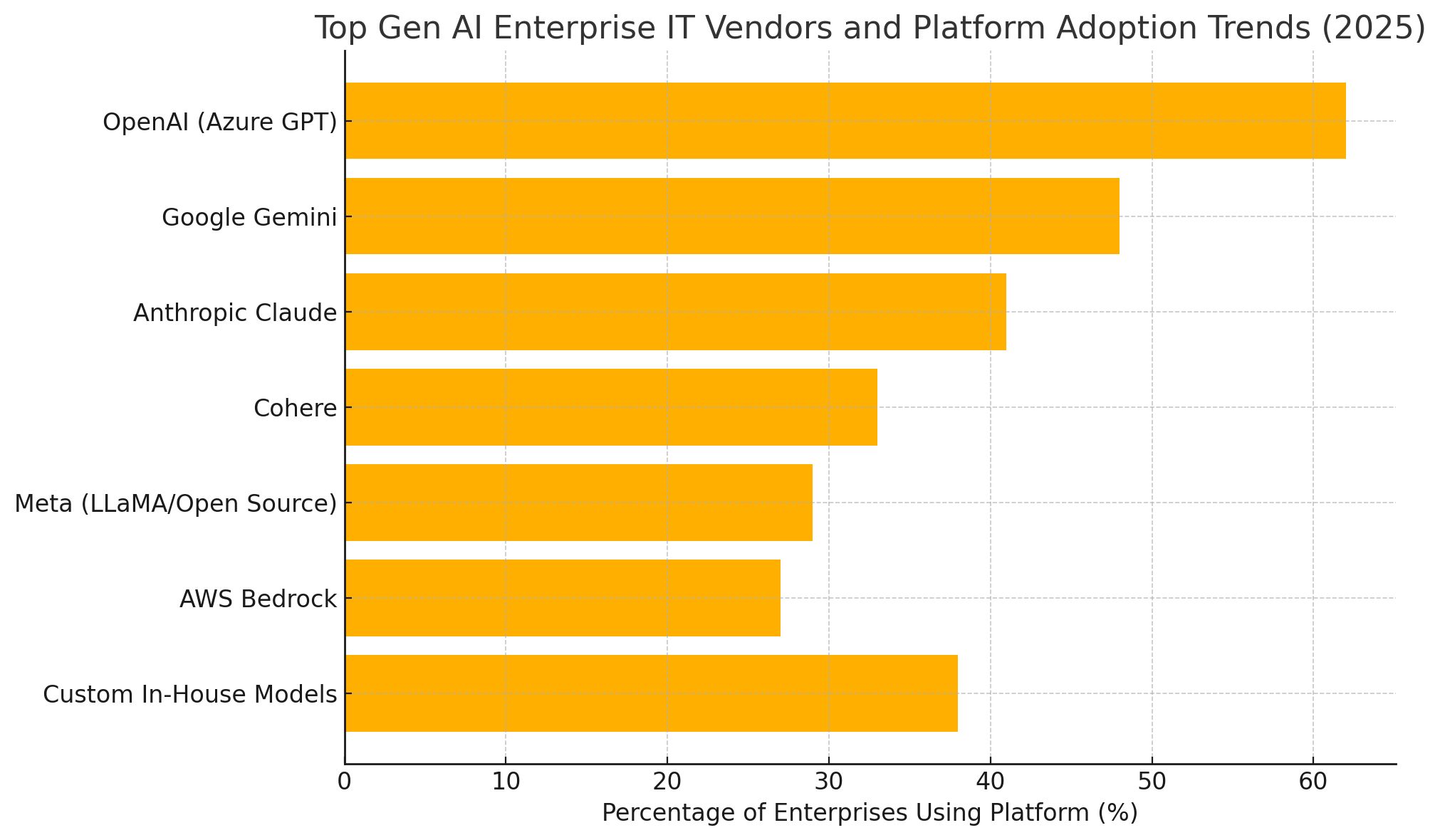

These platforms, often cloud-native and containerized, serve as the backbone for deploying multiple models, whether proprietary, open-source, or third-party hosted. They also incorporate connectors to business applications, security frameworks, and governance tools. Examples include Azure AI Studio (integrating OpenAI’s GPT models), Google Vertex AI (hosting Gemini models), and AWS Bedrock (offering access to multiple foundation models).

By adopting platform strategies, enterprises gain consistency in deployment, monitoring, and compliance—enabling Gen AI to operate as a utility service within their broader IT estate.

Multi-Model and Multi-Vendor Approaches

Given the dynamic nature of the Gen AI ecosystem, many enterprises have adopted multi-model and multi-vendor approaches. These strategies are motivated by several factors:

- Performance Differentiation: Certain models outperform others in specific tasks. For example, OpenAI’s GPT-4 may be preferred for creative content generation, while Cohere or Claude may excel in retrieval-based summarization.

- Cost Optimization: Licensing and inference costs vary significantly across providers. Enterprises are increasingly routing tasks to the most cost-effective model for a given workload.

- Risk Mitigation: Avoiding overreliance on a single provider reduces exposure to price changes, service disruptions, or shifts in terms of use.

- Compliance Requirements: Jurisdictional restrictions and data sovereignty concerns may necessitate using locally hosted models or region-specific vendors.

To support this, enterprises are implementing orchestration layers—middleware platforms capable of dynamically invoking models from different vendors based on criteria such as latency, accuracy, context sensitivity, and prompt complexity. Some organizations are also maintaining internal model registries to facilitate versioning and benchmarking across use cases.

Emergence of AI-Native Enterprise Platforms

A notable development in 2025 is the proliferation of AI-native enterprise platforms—software solutions that embed Gen AI capabilities as core components rather than optional features. This trend is visible across enterprise resource planning (ERP), customer relationship management (CRM), content management systems (CMS), and data analytics platforms.

Vendors such as Salesforce, SAP, ServiceNow, and Adobe have launched AI-first product suites that integrate LLMs into workflows for document generation, ticket classification, trend forecasting, and knowledge base summarization. In parallel, startups are emerging with AI-native alternatives to legacy enterprise systems, designed around prompt-based interfaces and autonomous agents.

This evolution forces IT leaders to evaluate traditional vendors through a new lens—assessing not just functionality and pricing, but also model architecture, customization flexibility, and governance transparency.

Vendor Consolidation vs. Open Source Diversification

While hyperscalers and proprietary model vendors continue to dominate enterprise adoption, a growing share of organizations are exploring open-source models as a hedge against vendor consolidation. Frameworks like Meta’s LLaMA, Mistral, and Falcon are gaining traction due to their customizability, cost control, and ecosystem support.

Enterprises pursuing this route typically build internal ML platforms using container orchestration (e.g., Kubernetes), model serving tools (e.g., Ray Serve, Triton), and vector databases (e.g., Pinecone, Weaviate). This allows them to tailor model behavior, integrate domain-specific knowledge bases, and retain control over data pipelines.

However, the open-source path is not without trade-offs. It requires significant in-house expertise, robust DevOps processes, and a mature approach to model lifecycle management. As such, it is often pursued by organizations with strong AI/ML capabilities or strategic mandates for data sovereignty.

Strategic Partnerships and Co-Development Initiatives

Another trend shaping the 2025 vendor landscape is the rise of strategic partnerships and co-development initiatives. Enterprises are no longer passive consumers of Gen AI technology; many are entering joint development agreements with model vendors, contributing training data, and co-owning application intellectual property.

For example, banks are partnering with AI startups to develop domain-specific LLMs for compliance automation. Pharmaceutical firms are collaborating with foundation model providers to accelerate drug discovery. Retailers are working with API providers to build proprietary customer interaction models trained on behavioral data.

These partnerships align incentives and offer competitive differentiation, but they also require careful negotiation of data sharing terms, model ownership, and regulatory risk.

IT Operating Model Transformation

The introduction of Gen AI has profound implications for enterprise IT operating models. IT departments are evolving from service providers to strategic enablers of business transformation. New roles and functions are emerging:

- AI Platform Owners – responsible for managing Gen AI infrastructure, APIs, and model orchestration.

- AI Governance Officers – overseeing compliance, bias mitigation, and ethical usage.

- Prompt Engineering Teams – optimizing prompts, contexts, and chaining strategies for consistency and quality.

These roles demand cross-functional collaboration across data, security, legal, HR, and business units. The traditional IT silos are giving way to integrated teams with shared ownership of Gen AI outcomes.

The strategic shifts in enterprise IT and vendor ecosystems in 2025 reflect a broader recognition: generative AI is not merely a technology to be adopted, but a capability to be operationalized and governed. The complexity of vendor selection, platform integration, and ecosystem alignment necessitates a new level of architectural rigor and strategic foresight.

Enterprises that embrace multi-model agility, invest in platform abstraction, and align with transparent, flexible vendors will be best positioned to sustain their Gen AI momentum in the years ahead. As we turn to the final section, we will examine the road ahead—highlighting trends that will shape enterprise Gen AI strategy through 2026 and beyond.

The Road Ahead for Gen AI in Enterprise IT

The year 2025 stands as a critical juncture in the evolution of generative artificial intelligence (Gen AI) within enterprise information technology. No longer an emerging technology or experimental tool, Gen AI has become a foundational component of enterprise strategy, embedded across operational workflows, digital products, customer engagement, and decision-making systems.

Over the course of this report, we have examined the extraordinary surge in Gen AI investment, dissected the budgetary allocations across infrastructure and use cases, explored the expanding vendor ecosystem, and identified the critical barriers organizations must navigate to scale effectively. These findings paint a picture of a technology space that is not only growing in economic magnitude but maturing in architectural sophistication and strategic value.

From Hype to Institutionalization

One of the most significant transitions observed in 2025 is the movement from hype-driven adoption to institutionalization. Enterprises are no longer exploring Gen AI for novelty or brand equity; they are integrating it as a core competency to drive productivity, innovation, and resilience.

IT departments are redesigning architectures to accommodate AI-native patterns. Business leaders are reallocating budgets from traditional IT modernization toward AI transformation. Legal and compliance teams are drafting policies to govern model usage, transparency, and accountability. The result is a more disciplined, structured, and value-driven approach to Gen AI—an essential shift as technology cycles shorten and stakeholder expectations rise.

Emerging Trends Shaping the Future

Looking beyond 2025, several macro and micro trends are expected to shape the next chapter in enterprise Gen AI deployment:

1. Transition Toward Autonomous Enterprises

Enterprises will increasingly pursue autonomous capabilities—systems that not only generate content or code but also make real-time decisions, take autonomous actions, and continuously learn from feedback loops. These capabilities will span customer service agents, procurement bots, IT incident responders, and digital R&D assistants.

The emergence of agent-based architectures, driven by frameworks like AutoGPT, Open Agents, and LangGraph, will facilitate this evolution. Enterprises must prepare for this shift by investing in safety layers, goal alignment strategies, and human-in-the-loop governance models.

2. Convergence of Gen AI and Enterprise Data Lakes

While current deployments often rely on pre-trained models and external APIs, the next wave of value will come from tight integration between Gen AI systems and enterprise data lakes. Retrieval-augmented generation (RAG), fine-tuning with proprietary data, and embedded domain-specific knowledge graphs will become standard practice.

This trend will also blur the lines between business intelligence, analytics, and Gen AI—giving rise to intelligent dashboards, voice-based analytics interfaces, and AI-driven insights that are explainable and grounded in real-time enterprise data.

3. Regulatory and Ethical Governance at Scale

With regulatory frameworks maturing across global jurisdictions, enterprises will need to operationalize responsible AI principles. Compliance will no longer be a reactive function but a proactive design constraint embedded into every layer of Gen AI architecture—from model selection to user interface.

This includes implementing audit trails, bias detection, model provenance tracking, and transparency reporting. Enterprises must also prepare for stakeholder expectations around explainability, consent management, and ethical oversight—particularly in sectors such as healthcare, finance, and public services.

4. Workforce Evolution and AI-Augmented Roles

As Gen AI tools continue to augment human tasks, enterprises will face both challenges and opportunities in workforce transformation. Roles will shift from execution to orchestration—from manually writing content, code, or analysis to guiding, validating, and refining Gen AI outputs.

To remain competitive, organizations must invest in large-scale upskilling and reskilling programs. This includes training employees in prompt engineering, ethical AI usage, domain-specific model interpretation, and collaborative workflows with AI copilots. Successful enterprises will not displace human talent—they will enhance it.

5. Economic Redistribution of IT Spend

Finally, Gen AI is poised to significantly reshape the allocation of IT budgets over the next three to five years. As traditional software licensing and infrastructure costs decline due to automation and consolidation, spending will shift toward:

- Model lifecycle management and orchestration.

- AI-native SaaS tools.

- Cloud-native vector and semantic search infrastructure.

- Enterprise-grade content moderation and generative security tools.

IT leaders must therefore prepare for new financial planning paradigms—where operational AI performance metrics replace traditional KPIs, and investment is increasingly measured against AI-driven business outcomes.

Strategic Imperatives for CIOs and CTOs

To capitalize on the promise of Gen AI while navigating its complexity, enterprise technology leaders should prioritize the following strategic imperatives:

- Architect for Flexibility: Adopt modular, model-agnostic frameworks that support multi-vendor deployments and evolving AI capabilities.

- Invest in Trust: Establish robust governance frameworks to ensure responsible AI usage, transparency, and stakeholder confidence.

- Align with Business Value: Tie Gen AI initiatives directly to business KPIs, customer experience metrics, and innovation goals.

- Upskill Continuously: Treat AI literacy as a core enterprise competency and build cross-functional teams that blend technical, ethical, and domain expertise.

- Plan for Sustainability: Balance innovation with cost containment, environmental impact, and long-term maintainability.

Final Thoughts

As 2025 draws to a close, the trajectory of generative AI within enterprise IT is unmistakably upward. What was once a novel technological breakthrough has evolved into a general-purpose capability—redefining how enterprises compete, operate, and innovate. Yet the journey is far from complete.

The decisions made today—regarding platforms, partners, governance, and talent—will shape not only the success of Gen AI projects but the broader strategic direction of enterprises over the next decade. Those who navigate this moment with foresight, agility, and ethical rigor will define the next generation of digitally intelligent enterprises.

References

- The State of AI in the Enterprise

https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2023 - Emerging Tech: Generative AI Adoption in Enterprises

https://www.gartner.com/en/articles/emerging-tech-generative-ai-adoption-in-enterprises - The Path to Gen AI at Scale

https://www2.deloitte.com/us/en/insights/focus/cognitive-technologies/generative-ai-enterprise-adoption.html - Generative AI for Business

https://www.accenture.com/us-en/insights/artificial-intelligence/generative-ai - Generative AI Spending Guide

https://www.idc.com/getdoc.jsp?containerId=US51337723 - Pricing and Model Capabilities

https://openai.com/pricing - Claude API Overview

https://www.anthropic.com/product - Gemini and Gen AI Solutions

https://cloud.google.com/generative-ai - Enterprise LLM Use Cases

https://cohere.com/use-cases - OpenAI Integration and Enterprise AI Services

https://azure.microsoft.com/en-us/products/cognitive-services/openai-service