Discord Prepares for a Potential IPO with Goldman Sachs and JPMorgan

Discord is a social communication platform founded in 2015 by Jason Citron and Stanislav Vishnevskiy, initially created as a voice and text chat app for gamers. Over the past decade, it has grown from a niche tool for video game communities into a mainstream communication service used by a wide range of groups—from students and hobbyists to developers and professional communities. Discord’s growth accelerated notably during the COVID-19 pandemic, as people sought online spaces to gather while physical meetups were restricted. The platform’s versatility (supporting text, voice, and video chat) and community-centric “servers” model have made it a popular hub for everything from study groups and fan clubs to virtual events and company discussions.

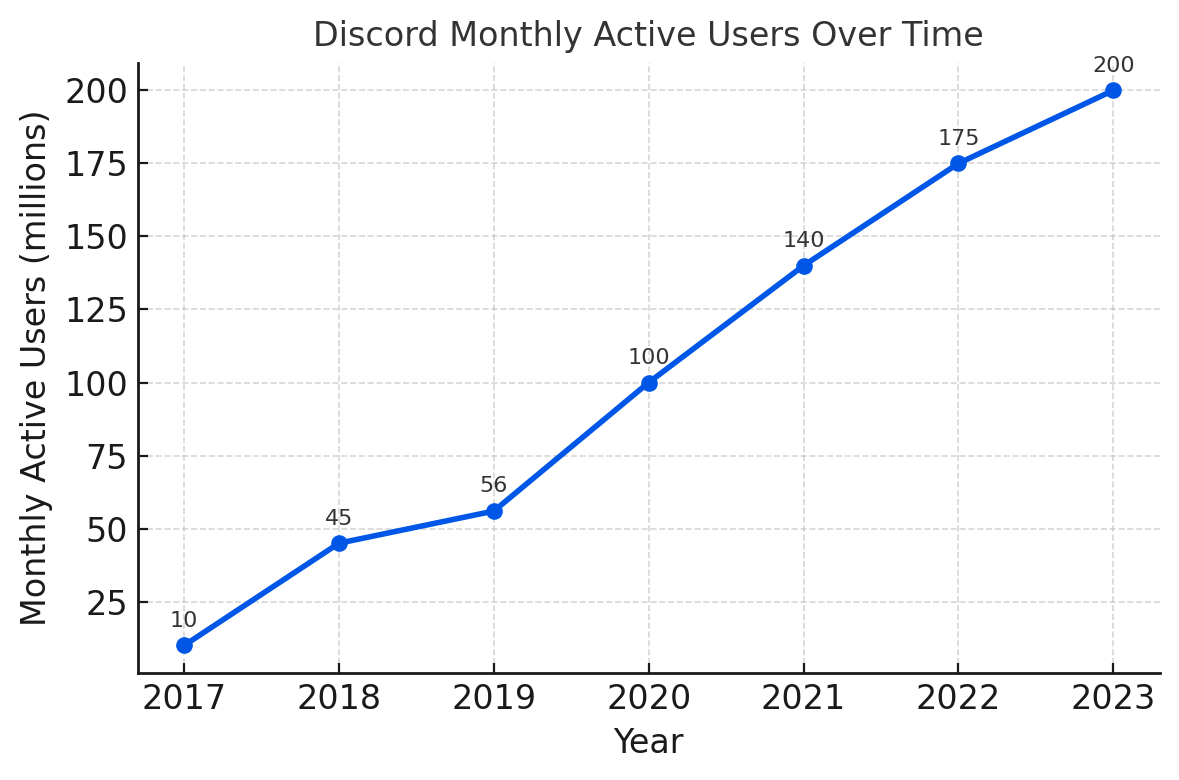

Discord’s user base expansion has been dramatic. In its early years, growth was steady; by 2017 the service had around 10 million monthly active users. The real explosion came in 2020: usage doubled during the pandemic year, driven by lockdowns and an influx of young users, with monthly actives jumping from about 56 million in 2019 to 100 million in 2020. This momentum continued into the following year—by 2021 Discord surpassed 140 million monthly active users, and growth has remained strong since. The company reported approximately 175 million monthly active users in 2022 and about 200 million in 2023. This trajectory underscores how rapidly Discord has become a staple of online communication for many communities.

Discord’s monthly active users have grown exponentially from 2017 through 2023. The platform saw a particularly sharp rise in 2020–2021 during the pandemic, and it continues to add tens of millions of users each year.

Discord’s popularity and strategic position have made it a coveted asset in the tech industry. The company famously turned down a $12 billion acquisition offer from Microsoft in 2021, opting to remain independent. (Around the same time, there were reports of interest from other tech giants like Amazon and Twitter, with rumoured valuations as high as $18 billion.) Instead of selling, Discord continued to raise private funding to fuel its growth. In late 2021, it secured a $500 million funding round led by Dragoneer Investment Group, which valued the company at $15 billion. This was more than double its valuation from the previous year (Discord had been valued around $7–8 billion in 2020 after earlier funding) and signaled investors’ confidence in Discord’s potential. Small subsequent financing deals and secondary share sales have occurred (including a March 2022 secondary round), but essentially that $15 billion valuation has remained a benchmark for Discord’s worth in the private market.

Having established itself as a major player in communications—often mentioned in the same breath as platforms like Slack (for workplace chat) or Reddit (for community forums)—Discord now stands at the precipice of a new phase: entering the public markets. The decision to go public via an Initial Public Offering (IPO) would mark a milestone in Discord’s journey from a gamer-centric startup to a mature company with broad appeal. Before diving into the implications of an IPO, let’s explore what we know about Discord’s IPO plans and why two of Wall Street’s top banks are involved.

Planning the IPO: Goldman Sachs and JPMorgan’s Role

On March 26, 2025, news broke that Discord is preparing for a potential IPO and has enlisted investment banking giants Goldman Sachs and JPMorgan Chase as lead advisors. According to reports (initially from Bloomberg, citing sources close to the matter), Discord is working with these banks to guide its initial public offering strategy, with an eye toward a stock market debut as early as this year. The hiring of Goldman Sachs and JPMorgan suggests that Discord is serious about moving forward with a public listing and is getting its financial ducks in a row. These banks are likely helping Discord with tasks such as refining its equity story for investors, preparing required disclosures, and timing the offering to market conditions.

It’s worth noting that the IPO plans are not set in stone. The company has not publicly filed anything with the Securities and Exchange Commission yet (at least not as of the time of writing), and the timing could still change depending on market conditions. The sources indicated Discord might even bring on additional advisors as planning progresses. This cautious approach isn’t unusual – many tech firms explore IPO options and line up bankers well in advance, sometimes waiting months (or longer) for the optimal market window to open.

Why Goldman Sachs and JPMorgan? Both are leading global investment banks with extensive experience underwriting tech IPOs. Goldman Sachs, in particular, has led numerous high-profile tech offerings and was famously the lead underwriter for Facebook’s IPO in 2012, among others. JPMorgan is likewise a top player in tech finance. Having these two as partners gives Discord access to deep capital markets expertise and investor networks. It’s a strong signal to the market that Discord intends to mount a significant IPO when it goes forward. As one analyst noted, Discord’s reported engagement of such high-profile banks “may signal [that] the IPO window [is] opening” again for large tech unicorns. In other words, after a relatively quiet period for tech IPOs in 2022–2023, Discord’s move could be a harbinger of renewed IPO activity.

Discord’s potential IPO timing in 2025 also aligns with a broader sense of optimism among market watchers. Goldman Sachs CEO David Solomon recently remarked that the pipeline of IPOs is growing and that he expects IPO activity to increase in 2025 after a muted couple of years. Indeed, IPOs had slowed sharply in 2022 and 2023 due to market volatility and economic uncertainty, but late 2023 saw a few successful listings (like Arm and Instacart) which hinted at reopening investor appetite. Discord appears to be positioning itself to take advantage of this improving climate. By working with Goldman and JPMorgan now, Discord can be ready to launch its offering quickly when it deems the moment right.

From an internal perspective, preparing for an IPO entails significant work. Discord will need to ensure its financials and accounting are IPO-ready, bolster its corporate governance (possibly adding independent board members), and articulate a compelling growth story for public investors. Part of the banks’ role will be to help craft the narrative of “Discord’s journey and future prospects” for institutional investors during the roadshow. Given Discord’s strong brand among consumers, there may also be considerable interest from retail investors when it debuts (as was seen with other popular tech IPOs in the past).

In summary, the involvement of Goldman Sachs and JPMorgan indicates that Discord is serious about going public and is taking prudent steps to maximize its chances of a successful IPO. Next, let’s delve into Discord’s financial picture—understanding its revenue, user base, and valuation—to see what might underpin its IPO valuation and investor pitch.

Discord by the Numbers

To evaluate Discord’s IPO prospects, it’s important to understand the company’s fundamentals: how fast it’s growing, how it makes money, and where its finances stand. While Discord is still private (and thus not obligated to publish detailed financials publicly), a fair amount of information has emerged through press reports and data from funding rounds.

User Base: As mentioned, Discord’s user growth has been impressive. The platform had about 140 million monthly active users in 2021, which grew to roughly 200 million MAUs by the end of 2023. For context, this user count puts Discord in the upper echelon of social platforms globally. These are active users; in terms of registered users, Discord has even more – over 560 million registered accounts as of January 2023 (though not all are active monthly). Engagement is high, but perhaps not daily for all users: Discord caters to communities that might convene weekly or for specific events, so monthly active figures are a key metric. The chart above illustrates Discord’s meteoric user growth, particularly the surge in 2020–2021.

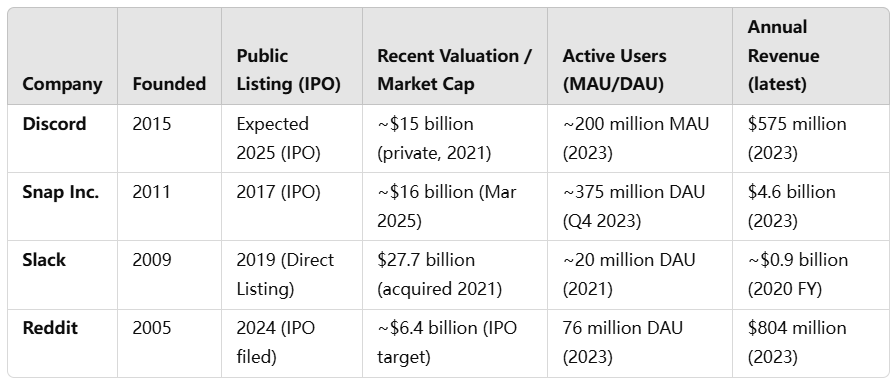

Another way to appreciate Discord’s scale is to compare it to some peers: for instance, Snapchat had about 375 million daily active users in 2023(Snapchat’s DAU count is a bit higher than Discord’s MAU, reflecting different usage patterns and the fact that many Discord users are more intermittent). Reddit, another community-focused platform, reported 76 million daily users in 2023 – Discord’s 200 million monthly users suggests its overall audience might be of a similar order (hundreds of millions) when measured on a monthly basis. Slack, which is focused on workplace communication, had on the order of 12–20 million daily active users in the years before it was acquired (far smaller than Discord’s consumer user base).

Revenue: Discord primarily makes money through a subscription service called Discord Nitro, which offers users premium features (like higher quality streaming, custom emojis, larger file upload limits, and profile customizations) for a monthly or annual fee. Unlike many social platforms, Discord notably does not rely on advertising for its revenue – a distinguishing feature that has endeared it to users who enjoy an ad-free experience. Instead, Discord’s model is closer to that of an optional freemium upgrade or community monetization. In addition to Nitro subscriptions, Discord earns some revenue from server boosts (a feature where community members can pay to unlock perks for a specific server) and marketplace features. In late 2022, for example, Discord expanded an online marketplace that allows creators and communities to sell digital products and server-specific subscriptions, diversifying its income streams.

Despite not showing ads, Discord’s revenue growth has been robust. In 2020, Discord generated about $130 million in revenue, which was nearly triple the $45 million it made in 2019. This rapid growth continued: estimates put 2021 revenue around $300 million and 2022 around $445 million. By 2023, Discord’s annual revenue reached approximately $575 million, marking another year of significant growth (about 29% year-over-year from 2022). For 2024, forecasts suggest revenue could climb further (one estimate projects ~$630 million in 2024). Almost all of this revenue comes from Nitro and other user-paid features, a testament to Discord’s ability to monetize its community without advertising. Discord reportedly has over 6 million paying subscribers to Nitro as of 2023, though that’s a small fraction of total users – indicating plenty of room to grow monetization per user.

On the cost side, Discord has been investing heavily in its platform and growth, and it has not yet achieved overall profitability. Precise profit/loss numbers aren’t public, but we can infer from similar companies that Discord likely runs at an operating loss, given its expansion stage. For example, in 2023 Reddit had $804 million revenue and a net loss of about $90 million; Snap Inc., at $4.6 billion revenue, still lost over $1.3 billion in 2023. Discord’s losses are presumably much smaller in absolute terms than Snap’s, but as a private company it has been able to prioritize growth over profit. One encouraging sign is that Discord’s gross margins (revenue minus cost of providing service) are probably healthy – Reddit’s gross margin is ~86%, and Discord, not running expensive data centers (it uses cloud services) and with digital goods, likely has high margins as well. The main expenses are in R&D and moderation/safety, areas that Discord has been ramping up. Investors will be looking at unit economics – e.g. revenue per user (Discord’s was roughly $2.50 per MAU in 2023) – and the potential to improve margins at scale.

Recent Funding and Valuation: Discord has raised nearly $1 billion in venture funding since its inception. Key milestones in its funding history include early investments from Silicon Valley VCs and a major round in late 2020 when it was valued at $7 billion. The September 2021 Series H round, which brought in $500 million, pegged Discord’s valuation at $14.7–15 billion. That valuation has been widely cited up to the present as Discord’s last known private market value. It’s likely that in any IPO, Discord would seek a valuation higher than this (perhaps significantly higher if market conditions are strong), but the $15 billion figure provides a reference point.

For context, consider some comparable companies around that valuation: Slack was acquired for $27.7 billion in 2021, Snapchat’s market capitalization in early 2025 is around $16 billion, and Reddit’s recent IPO filing targeted about a $6.4 billion valuation (down from its $10B private valuation in 2021). Discord at $15B sits in the middle of these, which seems plausible given its large user base but more modest revenue (compared to ad-driven firms). Whether public investors will value Discord higher (for its growth potential and strategic position) or push for a lower valuation (due to lack of profitability and a choppy market) remains to be seen. Much will depend on market sentiment at the time of the IPO.

To better understand how Discord stacks up, here is a comparison of Discord’s key metrics with a few similar tech companies – some that have recently gone public or are in the IPO pipeline:

This table highlights a few points: Discord’s user base (200M MAU) is larger than Snapchat’s daily users or Reddit’s daily users, but its revenue is much lower than Snap’s because Discord has chosen a non-advertising model. Slack, which had a much smaller user base focused on enterprise, generated similar revenue to Discord (around $900M at its peak pre-acquisition) but was valued higher due to its strategic fit in the enterprise software market. For Discord, convincing public investors of its monetization potential will be key—can it keep converting a growing fraction of its 200M users into paying customers? The good news is that even a modest increase in penetration of Nitro subscriptions could yield big revenue gains given the sheer scale of users. Discord’s annual revenue per user is only a few dollars, whereas more monetized social platforms like Facebook or Reddit (ads-based) or Slack (B2B subscriptions) earn far more per user. This is both a challenge and an opportunity.

Having surveyed Discord’s current position, we can now look outward to the broader tech IPO landscape of recent years. This will provide context on how other companies have fared going public and what lessons Discord might take from those experiences.

The Tech IPO Landscape

Recent Trends and Comparables

The past five years have been a roller coaster for tech IPOs. We’ve seen periods of feverish enthusiasm, followed by droughts when the market window virtually shut. Discord’s potential IPO will inevitably be compared to notable tech listings like Slack’s and Snap’s, as well as judged against the backdrop of how tech stocks have performed post-IPO.

Recent IPO Trends: 2019 and 2020 saw a rush of high-profile tech companies going public. Companies like Uber and Lyft (ride-hailing), Slack (workplace chat), Pinterest (social media), and Zoom (video conferencing) all hit the public markets. 2020, despite the pandemic, was particularly hot for tech IPOs (and direct listings), culminating in huge debuts like Airbnb and DoorDash in late 2020. Valuations skyrocketed for many of these companies amid bullish investor sentiment and low interest rates. This momentum carried into early 2021, which saw the IPO of Coinbase and the wave of SPAC (special-purpose acquisition company) deals for tech firms.

However, by mid-2021 and into 2022, the mood shifted. Inflation and the prospect of rising interest rates cooled the market, and many newly public tech stocks saw steep declines from their peaks. The year 2022 was especially slow for IPOs – with very few major tech companies braving the market due to volatile conditions (and those that did, such as some fintechs and electric vehicle startups, often struggled). In 2023, the IPO market showed tentative signs of life. For example, chip designer Arm’s IPO in September 2023 was a success (the stock popped on debut), and grocery delivery firm Instacart went public the same week (though its stock quickly fell below the IPO price, reflecting more tempered enthusiasm). By early 2024, the pipeline started moving again: Reddit filed for an IPO (albeit at a lower valuation than its last private round), and other big names like Stripe and Databricks were rumored to be eyeing 2024–25 listings.

In this context, Discord’s timing in 2025 could be fortuitous if the market continues to recover. There is a bit of pent-up demand among investors for high-growth tech stories, and Discord is one of the larger unicorns that hasn’t gone public yet. As noted, Goldman Sachs’ CEO predicted a pickup in IPOs in 2025, suggesting that market insiders see the window opening. Still, Discord will be mindful of the mixed outcomes experienced by its peers:

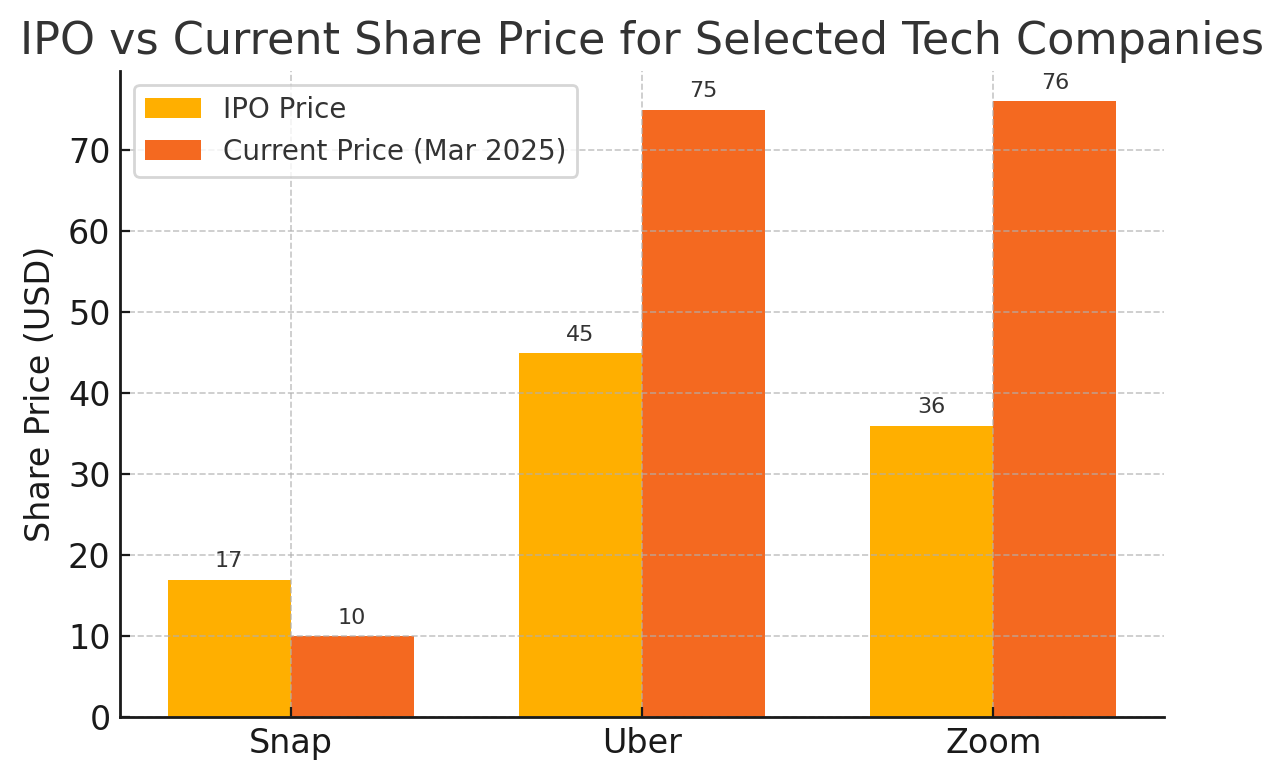

Post-IPO Performance of Peers: Some tech companies have thrived after going public, while others have disappointed. For instance, Zoom Video Communications had an astonishing rise after its 2019 IPO – it priced at $36and, thanks to the remote work boom, saw its stock soar to over $500 in 2020. Although Zoom’s stock has since come back down to earth (around the $70–$80 range in early 2025), it’s still trading above its IPO price and proved that public investors will reward explosive growth and profitability (Zoom was profitable at IPO time). On the other hand, Snap Inc. (Snapchat) had a more turbulent journey: it went public in 2017 at $17 a share, but within a year the stock dipped below its IPO price amid user growth concerns. Snap then surged in 2020–2021 to far above its IPO level (riding a digital advertising boom), only to fall back again after 2022’s ad market slowdown and privacy changes. As of 2025, Snap trades around $10 per share, considerably below its IPO price and reflecting investor skepticism about its path to profitability.

Another instructive case is Slack. Slack chose a direct listing in 2019, debuting around $38 per share (versus a reference price of $26) and initially achieving a valuation over $20 billion. But Slack’s stock was relatively flat in the following year, and ultimately the company accepted Salesforce’s acquisition offer in late 2020. Salesforce paid $27.7 billion for Slack, which equated to roughly $45 per Slack share – a solid premium over Slack’s listing price and a successful outcome for Slack’s investors. This shows that being public can still lead to a lucrative buyout, especially if a strategic suitor sees value that the public market isn’t fully crediting. In Slack’s case, its synergy with Salesforce justified the high price. For Discord, one might wonder if remaining independent post-IPO is the plan, or if an eventual acquisition (at an even higher valuation) by a big player could be possible down the road (Microsoft’s interest in 2021 hints at that possibility).

Let’s also consider Uber and Lyft, since they were high-profile consumer tech IPOs like Discord would be. Uber went public in 2019 at $45/share, saw its stock drop in the early months, then recover. Impressively, by early 2025 Uber’s stock trades in the mid-$70s – about 70% above its IPO price – after the company made strides toward profitability in its ride-sharing and delivery businesses. Lyft, by contrast, struggled: IPO-ing at $72, it never lived up to its initial hype and its shares are now worth a fraction of that (Lyft’s market share and margins eroded under competition). The divergence of Uber and Lyft shows that public market patience can vary; the larger player with better execution earned investor confidence, while the smaller laggard lost favor. In Discord’s case, it is more akin to a category leader in its niche (more like Uber than Lyft, since Discord doesn’t have an equal competitor of its scale in the gaming/chat space). That bodes well, but public markets will still demand that Discord demonstrates a path to profitability eventually.

The chart below illustrates how a few of these companies’ stocks have performed, comparing their IPO prices to current trading prices:

Comparison of IPO price vs early 2025 share price for three notable tech companies. Snap has fallen below its 2017 IPO price of $17, trading around $10 in 2025. Uber has risen from a $45 IPO price to about $75 as investors rewarded its improving financials. Zoom remains above its $36 IPO price at roughly $76, despite coming down from pandemic-era highs. This illustrates the varied fortunes of tech IPOs – some underperform, while others deliver solid gains to IPO investors.

As the chart and cases show, tech IPO performance can be very mixed. High-growth companies can have volatile rides – early pops can be followed by deep troughs if expectations overshoot reality (as happened with many 2020-2021 IPOs). Conversely, some companies that IPO at what seems like a rich valuation manage to grow into it and beyond (Uber, for example, or enterprise firms like Snowflake which, despite stock volatility, still command valuations above their IPO levels on strong execution).

For Discord and its prospective investors, key questions will be: Is Discord’s valuation at IPO justified by its fundamentals and growth prospects? And how will the stock perform once the initial hype settles? The experiences of Snap, Slack, Reddit, and others provide benchmarks. Discord might position itself in between a social media company (like Snap/Reddit with massive users but heavy reliance on engagement) and a SaaS-like subscription business (like Slack/Zoom with more predictable revenue but smaller user bases). If Discord can tell a story of steady subscription growth and potential new revenue lines (without needing advertising), it could attract a mix of growth investors and those who prefer subscription business models.

In any event, going public will give Discord a currency (public stock) and capital that could amplify its advantages – if used wisely. Let’s consider why Discord is looking to go public and what benefits that could bring.

Why Go Public? Potential Benefits for Discord

Choosing to pursue an IPO is a significant decision for Discord. There are several potential benefits and strategic reasons why going public in 2025 could make sense for the company:

- Access to Capital for Growth: An IPO would raise a substantial amount of cash for Discord’s balance sheet (depending on how much of the offering is new shares). This capital can be used to accelerate product development, invest in infrastructure, and expand into new markets. While Discord has nearly $1B from private funding, the IPO could raise hundreds of millions more. Being public also means the company can more easily issue stock in the future to raise additional funds if needed (secondary offerings), providing a war chest for long-term growth.

- Currency for Acquisitions: With publicly traded stock, Discord could use its shares as currency to acquire other companies. This is a common strategy for tech firms post-IPO – having liquid stock makes it easier to buy smaller startups or competitors. Discord might target companies that complement its platform (for example, firms specializing in moderation AI, audio/video tech, or community management tools). In fact, even before IPO Discord made small acquisitions like the AI moderation company Sentropy in 2021. Post-IPO, with a higher profile and more resources, Discord could pursue larger strategic acquisitions to enhance its platform and accelerate growth.

- Employee Liquidity and Talent Attraction: An IPO would allow Discord’s employees and early investors to cash out a portion of their holdings, rewarding them for the company’s success. This liquidity event can boost morale and also helps in retaining and attracting talent. Stock options and RSUs (restricted stock units) from a public company are seen as more tangible by employees since they have a clear market value and vesting schedule. Discord will be competing with other tech firms for top talent, and being public (with an equity compensation program) can be an advantage. Additionally, early investors like venture capital firms typically expect an eventual exit; an IPO provides that while still allowing Discord to remain independent (unlike an outright acquisition).

- Credibility and Brand Visibility: Being a publicly listed company could enhance Discord’s credibility, especially if it plans to expand into enterprise or educational markets. Some organizations prefer doing business with public companies due to their transparency and perceived stability. An IPO is often seen as a company’s “coming of age,” which can raise its profile in the media and among potential partners. Discord’s brand is already strong with consumers, but going public might make, say, potential enterprise partners (schools, developers, or even businesses using Discord for communities) view it as a more established platform. Moreover, the IPO process will subject Discord to regulatory scrutiny and disclosure, potentially increasing public trust through transparency.

- Community and Developer Confidence: Interestingly, going public could also reassure Discord’s vast community of users and third-party developers that the platform is here to stay for the long term. While an IPO means answering to shareholders, it also typically means the company is well-capitalized and less likely to face cash crunches. Users who rely on Discord for their own communities (be it a game clan, a fan forum, or a study group) may take comfort that Discord has the funds and oversight to keep improving the service. Likewise, developers building bots and integrations for Discord can be confident in the platform’s longevity.

- Valuation Realization: For Discord’s founders and early backers, an IPO at a strong valuation is the realization (and validation) of years of work. If the market assigns a valuation significantly above that $15B private mark – for example, hypothetically $20B or more – it confirms the belief that Discord is one of the most valuable social tech companies. This not only is financially rewarding but positions Discord as a powerful entity in the industry (which can have knock-on benefits like more bargaining power in partnerships, etc.).

Of course, while these benefits are appealing, an IPO also comes with new challenges and risks that Discord will have to manage, which we discuss next.

Challenges and Risks on the Road to IPO

Taking a company public isn’t all upside; it exposes the company to market pressures and potential pitfalls. Discord will need to navigate several risks and challenges associated with the IPO process and being a public company:

- Market Volatility and Timing: The stock market’s condition at the time of Discord’s IPO will heavily influence its success. If the market turns sour (due to economic downturn, geopolitical events, etc.), investor appetite for new tech listings could evaporate. Discord experienced explosive growth during a unique period (pandemic), and if it comes to market during a downturn, it might be harder to convince investors of continued high growth. The company may have to delay or price the IPO lower than hoped if conditions aren’t favorable. The timing dance is tricky – there’s always a risk of either going out in a frothy market and being overvalued (then facing a correction), or going out in a cold market and not raising as much as the company’s true worth. Discord’s management and bankers will have to gauge this carefully, possibly adjusting plans if needed.

- Pressure to Improve Monetization: Once public, Discord will face quarterly scrutiny on its financial performance. Investors will expect consistent growth in revenue and a path toward profitability. This could pressure Discord to ramp up monetization faster than it might have as a private company. That introduces a risk: if Discord pushes too hard to sell Nitro subscriptions or other paid features, it might alienate users who are accustomed to a mostly free experience. The community-centric nature of Discord means any moves that seem to prioritize profit over user experience could spark backlash among its user base (which is very vocal). For instance, if Discord ever considered introducing advertising or too aggressively promoting paid tiers, users might react negatively. Balancing growth with user goodwill will be a key challenge.

- Competition and Copycats: While Discord currently doesn’t have a direct competitor of equal scale offering the same blend of features, it isn’t without competition. Big tech companies could try to replicate some of Discord’s functionality. Microsoft, for example, has integrated voice chat into Xbox and could develop more community features (it even took a minor stake in Discord in 2021 through a partnership with PlayStation). Slack and Microsoft Teams serve professional users (Slack’s CEO famously noted that Slack and Teams integration was still pursued despite competition), but they are not consumer-focused like Discord. There’s also Reddit (which leans more asynchronous forums) and Telegram or Guilded (smaller platforms with some feature overlap). Post-IPO, Discord might be seen as “open season” by competitors who think it now has to satisfy shareholders. If a heavyweight like Google or Amazon decided to target online communities, they have immense resources. Discord will have to keep innovating to stay ahead – adding features, improving moderation (to maintain safe environments, which is an ongoing challenge), and perhaps exploring new domains like game distribution or content creation tools. The risk is if a competitor launches a similar product that gains traction, it could slow Discord’s user growth or force costly battles for users.

- Valuation and Investor Expectations: If Discord’s IPO valuation is very high relative to its current revenue (which it likely will be, as tech IPOs often price in future growth), the company will be under pressure to live up to lofty expectations. A valuation of say $15–20B against ~$600M in revenue means a Price/Sales multiple of around 25–30x, which assumes years of fast growth ahead. Any stumble in growth (for example, if revenue growth decelerates significantly or user growth stalls) could lead to a sharp stock price decline. Public tech companies can be punished severely for misses – as seen with Facebook (Meta) in 2022 when growth slowed, or with Snap in various quarters. Discord will need to manage expectations and perhaps guide investors with conservative but achievable targets. Internally, forecasting accurately and hitting those numbers becomes crucial to maintain credibility on Wall Street.

- Profitability and Costs: Currently, Discord likely operates at a loss (spending to grow). Public markets may tolerate losses for a while (they did for Amazon, Snap, Uber, etc.), but there is usually an expectation of a plan toward profitability. Discord will face the challenge of eventually turning a profit, which means either substantially increasing revenue (through more paying users or new revenue lines) and/or managing costs tightly. Expenses such as cloud infrastructure (all those voice/video servers), R&D staff, trust and safety teams, and general overhead will grow as Discord grows. If the economy tightens, Discord might be pressured to implement cost controls or demonstrate operating leverage (i.e. revenue growing faster than costs). For a culture-rich startup, those adjustments (like possibly slowing hiring or trimming projects) can be tough. The risk is if Discord doesn’t show a clear path to break-even, some investors might lose patience.

- Regulatory and Content Moderation Risks: Like any large online platform, Discord must contend with content moderation, privacy regulations, and potentially harmful misuse of its service. It has had to improve tools to combat harassment, hate speech, and other violations on its servers. Being public could heighten scrutiny from regulators or the public regarding how Discord handles these issues. Any scandal (for example, misuse of Discord by extremist groups, or a data breach) could not only damage its reputation but also impact its stock price. Discord will need to invest continuously in trust and safety to mitigate this risk, which is both the right thing to do and important for sustaining user and investor trust. Regulatory compliance (GDPR, upcoming laws on online content, etc.) also becomes more demanding as a company grows internationally.

- Internal Transition: Finally, the cultural shift from private to public company should not be underestimated. Discord’s leadership will have to split focus between running the business and dealing with investors/analysts. Executives will spend time on earnings calls, regulatory filings, and other public-company bureaucracies. Sometimes, this shift can be distracting or even demoralizing for employees if not managed well. Discord will have to instill a culture of discipline (for financial reporting) while trying to maintain the innovative, community-first ethos that made it successful. Companies like Facebook managed to stay innovative post-IPO, while others became more conservative. How Discord’s team navigates this will influence its post-IPO performance.

In summary, going public will introduce new pressures on Discord to perform financially without compromising the user experience that made it beloved. It will face scrutiny each quarter and must fend off competitive and operational risks. The good news is that Discord has some strong tailwinds (user growth, brand loyalty) and is entering the public stage at a time when it’s relatively mature in scale for a private company. If it manages these challenges, the IPO could indeed be the springboard to its next chapter of growth.

Post-IPO Horizons: Opportunities for Growth

Assuming Discord successfully completes its IPO, what lies ahead? With fresh capital and a public listing, Discord will have a host of strategic opportunities to pursue. Here are some areas where Discord could expand or strengthen its position post-IPO:

- Enhanced Features and Services: Discord can invest in expanding its platform beyond its current core. This might include richer video streaming capabilities (perhaps challenging Zoom or Twitch in certain use cases), improved discovery features to find public communities, or built-in content creation tools (imagine Discord facilitating recorded podcasts or video highlights directly within servers). Discord started as text and voice; it could delve deeper into video and multimedia sharing. Already, features like Stage Channels (for larger audio events) were introduced, and Discord could grow this into a bigger offering for live events or seminars. Essentially, Discord can work to increase the time users spend on the platform and the ways they use it, which in turn could justify new premium offerings.

- New Revenue Streams: Beyond Nitro subscriptions, Discord has experimented with other revenue models, like Server Subscriptions, where community owners can charge members for access to exclusive content or roles. Post-IPO, Discord could roll these out more broadly, effectively giving creators and community leaders tools to monetize (with Discord taking a revenue share). This moves Discord a bit in the direction of platforms like Patreon or YouTube Memberships, leveraging its communities. Another area is commerce and digital goods – Discord could facilitate game sales or in-app purchases in partnership with game studios (in the past, Discord briefly ran a game store). With sufficient scale, even advertising could be revisited in a user-friendly way (for example, opt-in sponsored events or game promotions within servers), though Discord has so far shied away from traditional ads to preserve the user experience. Nonetheless, being public might inspire creative new monetization features that align with user interests.

- Global Expansion: Discord is popular in North America and Europe, and also has a presence in markets like Brazil and India, but there is still room to grow internationally. In some regions, other apps dominate (for instance, WeChat or QQ in China, Line in Japan, Telegram/WhatsApp for general messaging). Discord could use some of its new funds to localize and market the platform in new geographies, adapting to cultural needs or even compliance in those areas. Non-English speaking communities on Discord could be a huge growth vector. For example, gaming and anime communities have driven adoption in some countries – Discord can capitalize on any niche where real-time community chat is valued. By being more global, Discord also diversifies its user base and reduces reliance on any single market.

- Enterprise and Education Use Cases: While Discord’s heart is with casual and enthusiast communities, there is potential to make inroads into professional or educational use. During the pandemic, some classrooms and study groups used Discord as a teaching aid or for club activities. Discord could create a version or features tailored to educational institutions (with more moderation controls, integrations with learning management systems, etc.). On the enterprise side, Discord is less likely to directly challenge Slack/Teams in regulated corporate environments, but startups and developer communities already use Discord for collaboration. If Discord can improve security and administrative features, it might convince more professional teams to adopt it for less formal communication (some companies already use Discord for social or cross-company communities). Being public and having more resources can accelerate development of these specialized features, opening new customer segments.

- Partnerships and Integrations: Discord has been very effective at integrating with other services (e.g., linking with Twitch, Xbox, Spotify, and more). Post-IPO, it could strike deeper partnerships. For instance, a partnership with a game streaming service or a cloud gaming platform could position Discord as the default community layer on those services. The 2021 Sony PlayStation partnership (where Sony took a small stake and integrated Discord for console chat) is a model—we could see more such deals with other console makers or entertainment platforms. Additionally, Discord might partner with content companies to host official communities (like how some musicians or creators have official Discord servers). Strategic partnerships can boost user engagement and also bring in potential revenue-sharing deals.

- Acquisitions for Capability: With its stock as currency, Discord could acquire smaller companies that give it new capabilities. For example, it might acquire a company specializing in machine learning to improve content moderation or personalization (ensuring users find servers they’d like). It could look at acquiring popular Discord bot developers or extensions to natively incorporate those features (Discord’s ecosystem of third-party bots adds a lot of functionality, from music to games; bringing the best of those in-house could enhance the platform). Another angle is acquiring community-driven platforms that could complement Discord – for instance, event organization platforms, or forums (to integrate asynchronous discussion better). Each acquisition would aim to make Discord more sticky and comprehensive as a one-stop community platform.

- Maintaining Community Trust: Although not a traditional “growth” initiative, continuing to invest in user safety and community health is crucial for Discord’s long-term growth. Post-IPO, Discord can allocate significant resources to trust & safety engineering, moderation teams, and user support. Successful growth isn’t just about raw numbers; it’s about sustaining an environment where communities flourish. This includes keeping harmful content off the platform and ensuring that public perception of Discord remains positive. Particularly as it becomes more mainstream, Discord will want parents to feel comfortable with their teens using it, and organizers to trust it for events. Strong community trust will indirectly drive growth through word-of-mouth and retention.

In essence, Discord’s post-IPO strategy will likely focus on deepening engagement and broadening its reach. The company has a solid foundation: a large user base and a beloved product. With IPO proceeds and the spotlight of the public market, Discord can double down on what’s working (like community-driven innovation and subscription monetization) and thoughtfully extend into new areas. The goal will be to evolve Discord from a great communications app into a lasting platform that can generate substantial and consistent revenues, while still being the fun, user-friendly space that got it here.

Conclusion

Discord’s journey from a gamer chat app to a tech industry heavyweight has been remarkable. Now, with preparations underway for a potential IPO led by Goldman Sachs and JPMorgan, the company stands on the cusp of another transformation. Going public will bring challenges – from satisfying Wall Street’s hunger for growth to maintaining the ethos of its user community – but it also holds the promise of solidifying Discord’s position and providing resources for its next chapter.

In this comprehensive look at Discord’s IPO plans, we examined the company’s origins and explosive growth, its financial trajectory of hundreds of millions in revenue driven largely by loyal paying users (rather than ads), and the context of a tech IPO market that has seen both spectacular successes and cautionary tales in recent years. We compared Discord’s metrics with peers like Snap, Slack, and Reddit to gauge where it stands. We’ve also outlined why Discord is eyeing the public markets: from raising capital and fueling expansion, to giving its investors liquidity and increasing its strategic flexibility. At the same time, we discussed the risks: market swings, pressure to monetize, competition, and the need to eventually turn profits without alienating users.

If Discord executes well, the IPO could be a springboard for innovation – enabling features and acquisitions that make the platform even more indispensable to its users. Imagine a future where Discord is not only where gamers and friends hang out, but also where classrooms collaborate, creators host interactive events, and global communities engage daily, all under a sustainable business model. That is the opportunity that a successful IPO can help unlock.

For both general readers and financial professionals, Discord’s IPO will be an event to watch. It will test investor appetite for a community-centric, subscription-driven social platform. It will also provide a barometer for the tech industry: a signal that the late-2020s IPO window is truly open if a company of Discord’s prominence can debut strongly. A lot will depend on execution, timing, and market sentiment, but one thing is clear – Discord has come a long way from its 2015 startup days, and its potential debut on the stock market represents a defining moment in its evolution.

As we await further announcements (such as an official IPO filing, likely with detailed financials and an “S-1” prospectus), stakeholders will be parsing every bit of news. Will Discord achieve the valuation it hopes for? Can it continue its growth streak and eventually satisfy public shareholders? Those questions will be answered in due time. What’s certain now is that Discord’s preparations with Goldman Sachs and JPMorgan signal that it is gearing up to make the leap, joining the ranks of publicly traded tech companies and bringing its unique success story to Wall Street. For Discord’s millions of users, the service they love is entering a new era – one that, if navigated well, could ensure that the Discord you log into every day only gets better, backed by the momentum and capital of the public markets.

References

- Discord Prepares for Potential IPO, Hires Goldman Sachs and JPMorgan

https://www.bloomberg.com/news/articles/2025-03-26/discord-prepares-for-ipo-hiring-goldman-sachs-and-jpmorgan - Discord’s Journey to a $15 Billion Valuation

https://techcrunch.com/2021/09/16/discord-valued-at-15-billion-in-new-funding-round/ - Goldman Sachs CEO Expects Surge in IPOs in 2025

https://www.cnbc.com/2025/03/19/goldman-sachs-ceo-sees-strong-ipo-pipeline-in-2025.html - How Discord Evolved from Gamer Chat to Community Platform

https://www.theverge.com/2020/12/23/discord-evolution-pandemic-communities - Discord’s Revenue Model: Nitro, Server Boosts, and the Road Ahead

https://www.businessinsider.com/discord-revenue-model-subscriptions-nitro-server-boosts-2023-11 - What to Know About Discord’s IPO Plans

https://www.wsj.com/tech/discord-ipo-explained-stock-market-listing-2025 - Discord Turns Down Microsoft Acquisition Offer

https://www.reuters.com/business/discord-declines-microsoft-12-billion-offer-2021-04-20/ - Discord Grows Amid User Privacy Concerns in Social Media

https://www.ft.com/content/discord-privacy-growth-social-platforms - Comparing Tech IPOs: From Snap to Reddit

https://www.forbes.com/sites/techcomparison/2025/03/20/snap-vs-reddit-ipo-performance/ - Discord Company Profile & Funding Rounds

https://www.crunchbase.com/organization/discord - Reddit IPO Filing (Form S-1)

https://www.sec.gov/Archives/edgar/data/0001651721/000165172124000001/reddit-s1.htm - Snap Inc. Historical Stock Data & IPO Details

https://www.nasdaq.com/market-activity/stocks/snap - What Is an IPO? Understanding the Process and Key Players

https://www.investopedia.com/terms/i/ipo.asp - Discord’s Financial Growth and User Metrics Overview

https://finance.yahoo.com/news/discord-financials-revenue-user-growth-2025 - Valuation and Funding History of Discord

https://pitchbook.com/profiles/company/110789-29