Dell’s AI Server Surge: How Unprecedented Demand is Powering Profit Growth

In the evolving landscape of enterprise computing, few phenomena have reshaped corporate priorities as swiftly and significantly as the artificial intelligence (AI) revolution. Among the most notable beneficiaries of this transformation stands Dell Technologies Inc., a company historically known for its prowess in personal computing and data storage solutions. In its latest financial disclosure, Dell surprised analysts and investors alike by raising its annual profit forecast, attributing the upward revision largely to a booming demand for AI-optimized servers. This development not only spotlights Dell’s timely pivot toward high-performance computing but also marks a strategic evolution in its core infrastructure offerings.

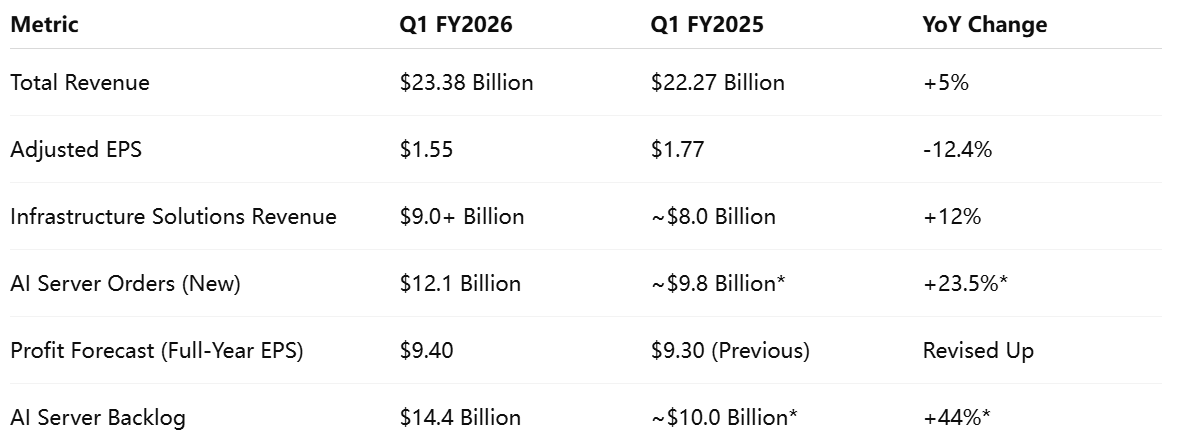

Dell’s fiscal first-quarter results for 2026 underscored this narrative in unequivocal terms. The company reported a total revenue of $23.38 billion—outpacing Wall Street’s expectations—on the back of a 12% surge in its Infrastructure Solutions Group (ISG), which houses its server and networking divisions. Most notably, AI servers have become the company’s growth catalyst, registering a staggering $12.1 billion in new orders during the quarter alone. This figure surpasses the total number of AI server shipments completed in the entirety of the previous fiscal year, hinting at the structural shift occurring in enterprise IT spending patterns.

The sharp increase in demand is more than a numerical outlier—it reflects a tectonic movement in how companies, institutions, and startups are prioritizing next-generation compute capabilities. Dell has found itself uniquely positioned to capitalize on this shift, thanks in part to its strategic partnerships with GPU manufacturers like Nvidia and its ongoing investments in modular server design, liquid cooling solutions, and AI-optimized networking infrastructure. These technological pillars are no longer fringe innovations; they have emerged as essentials for enterprises looking to deploy large language models (LLMs), computer vision algorithms, and other compute-intensive AI workloads.

The driving forces behind Dell’s AI momentum are multifaceted. The global AI arms race—spurred by advancements from OpenAI, Google DeepMind, and Meta’s LLaMA—has generated unprecedented hardware demand. Tech firms such as Elon Musk’s xAI and cloud-native hyperscalers like CoreWeave have turned to hardware providers like Dell to fulfill their insatiable appetite for accelerated computing. Dell, which traditionally thrived in the enterprise server and storage space, has been quick to respond, adjusting its supply chain and production priorities to meet the needs of this burgeoning customer segment.

Moreover, Dell’s AI strategy cannot be fully appreciated without examining its broader enterprise repositioning. No longer simply a hardware vendor, the company is increasingly packaging its AI servers with managed services, security frameworks, and integrated software solutions—aimed at reducing deployment complexity and time-to-value for clients. This vertical integration has provided Dell with both competitive differentiation and margin preservation, even as industry-wide challenges such as GPU shortages and cost inflation persist.

Financially, the company’s bullish stance is reinforced by hard data. Dell’s revised annual profit forecast now sits at $9.40 per share, up from the previously estimated $9.30, illustrating management’s confidence in sustained momentum. Revenue projections for the upcoming quarter range between $28.5 billion and $29.5 billion—well above consensus estimates of $25.05 billion. The earnings narrative is therefore not just about a single quarter of outperformance, but a broader reconfiguration of the company’s revenue base toward higher-value AI-centric solutions.

Against this backdrop, this blog post will explore Dell’s AI server surge through multiple analytical lenses. First, we will examine the company's current financial performance and future outlook, including a breakdown of key metrics. Next, we will delve into the nature of Dell’s AI server strategy, highlighting customer partnerships and market dynamics. This will be followed by a comparative analysis of Dell’s strategic positioning within the competitive landscape of AI infrastructure providers. Finally, we will evaluate the risks, challenges, and future pathways that lie ahead as Dell navigates this transformative chapter.

As we unpack the interplay between technology and financial performance, it becomes clear that Dell’s resurgence is no mere coincidence. Rather, it is the product of calculated innovation, agile strategy, and a profound understanding of where the enterprise computing world is headed. AI is not just reshaping Dell’s revenue model—it is redefining what success looks like in the era of intelligent infrastructure.

Financial Performance and Outlook

Dell Technologies' latest earnings report delivers a compelling case for how the company is effectively navigating the accelerating convergence of enterprise IT infrastructure and AI-driven demand. With a significant year-over-year increase in revenue, a strong uptick in infrastructure orders, and a notable revision in its annual profit guidance, Dell’s financial performance in the first quarter of fiscal 2026 reveals not only resilience but also renewed growth propelled by strategic realignment. This section unpacks Dell’s financial statements, forecasts, and segmental growth, underscoring the deepening impact of its AI-focused initiatives.

Quarterly Financial Highlights

For Q1 of fiscal 2026, Dell reported total revenue of $23.38 billion, reflecting a 5% increase compared to the same period a year earlier. While this growth was generally in line with market expectations, it was particularly notable given the broader macroeconomic challenges affecting global tech spending. Of equal significance was the fact that Dell's results outperformed analyst projections, sending a strong signal to investors about the health of its underlying business.

Despite the revenue beat, adjusted earnings per share (EPS) came in at $1.55, falling short of the consensus estimate of $1.69. This divergence highlights a dynamic that is becoming increasingly common in capital-intensive segments of the tech industry—while top-line growth is strong, it is often accompanied by margin pressures due to high input costs, especially those associated with AI server components and specialized GPUs.

Nevertheless, Dell’s management remains confident in the company’s fiscal trajectory. In a particularly bullish move, the company raised its full-year adjusted EPS forecast to $9.40, up from its prior guidance of $9.30. This upward revision, albeit modest, reflects robust confidence in the AI server pipeline and sustained demand from enterprise customers. CFO Yvonne McGill emphasized that the company expects this momentum to carry forward into subsequent quarters, with even stronger earnings contributions anticipated in the latter half of the fiscal year.

Segmental Performance Analysis

Dell’s Infrastructure Solutions Group (ISG), which comprises its high-margin server, storage, and networking businesses, emerged as the star performer this quarter. ISG revenue rose 12% year-over-year, amounting to more than $9 billion, driven almost entirely by AI server deployments. Demand for traditional server configurations has plateaued, but the shift to high-performance, GPU-accelerated systems has revitalized the entire segment.

The Client Solutions Group (CSG)—responsible for consumer and commercial PCs—posted flat revenue, signaling a maturing product line in an increasingly commoditized space. While CSG continues to be an important part of Dell’s revenue mix, it is clear that the company’s future growth lies in infrastructure, not consumer electronics. This evolving mix also provides Dell with a more resilient profit structure, as enterprise contracts are typically longer-term and carry higher margins than retail sales.

Another point of strength came from Dell’s recurring revenue streams, including as-a-service offerings and software-defined infrastructure solutions. Although still a smaller portion of total revenue, these segments are growing at double-digit rates, reflecting Dell's broader push toward business models that provide stability, scalability, and long-term customer lock-in.

This table clearly demonstrates Dell’s growing reliance on infrastructure-related revenue and its increasingly dominant position in the AI server value chain. It also underscores the company’s improving financial outlook despite near-term cost burdens.

Q2 and Full-Year Guidance

Looking ahead, Dell expects Q2 revenue to fall between $28.5 billion and $29.5 billion, a figure that far exceeds the average analyst estimate of $25.05 billion. Similarly, the company projects adjusted EPS of $2.25, comfortably outpacing the Street's forecast of $2.09. These optimistic projections signal that Dell’s AI strategy is not a temporary phenomenon but a sustained growth engine.

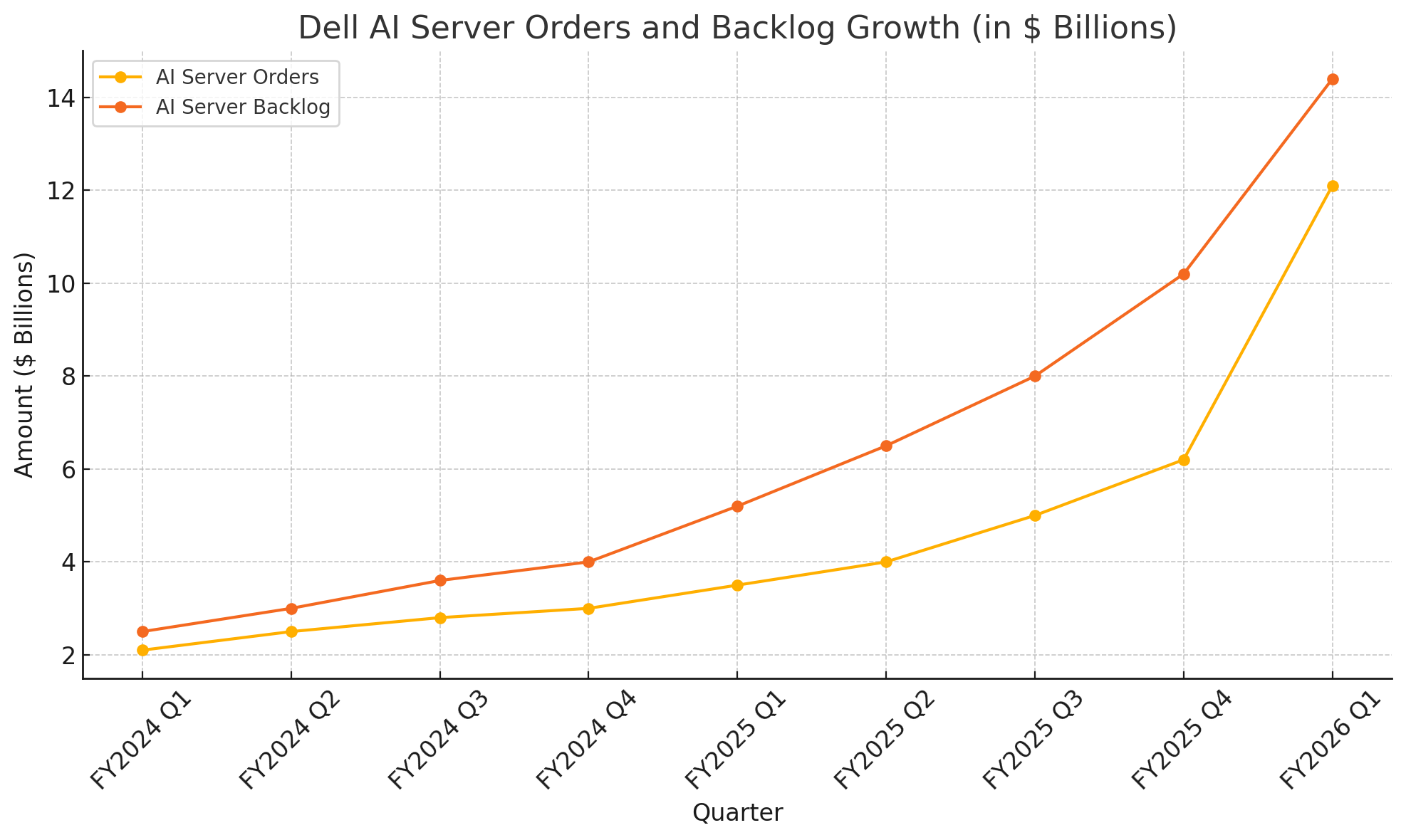

One of the most significant forward-looking indicators is the AI server backlog, which now stands at $14.4 billion. This figure is particularly telling, as it not only exceeds past order levels but also provides revenue visibility well into future quarters. The scale of the backlog indicates that customers are booking server capacity far in advance—a trend generally associated with secular shifts in enterprise computing needs rather than cyclical demand.

Dell’s full-year forecast for AI-related server sales remains at $15 billion, which represents a 50% increase over fiscal 2025 levels. While some analysts had hoped for a more aggressive revision, company executives have suggested they prefer to maintain conservative guidance amidst potential supply chain uncertainties and component availability issues.

Investor Confidence and Market Reaction

Despite a slight miss on EPS, Dell's shares rose following the earnings report, reflecting a broader market endorsement of the company’s AI-first trajectory. Investors appear willing to look past short-term margin pressures in favor of long-term growth potential. The stock price movement also aligns with broader investor behavior, where firms aligned with the AI megatrend are increasingly rewarded with valuation premiums.

Moreover, analysts from several major investment banks reiterated or raised their target prices for Dell, citing the company's unique positioning in the AI infrastructure supply chain. While some concerns linger around cost controls and competition, the consensus view is that Dell is entering a phase of accelerated value creation.

Financial Foundation for AI Leadership

In sum, Dell’s financial outlook for fiscal 2026 reflects a company in the midst of transformative growth, guided by a clear vision and fortified by strong enterprise demand. The company's performance in the first quarter—marked by increased revenue, strong infrastructure growth, and a growing AI backlog—demonstrates not only effective execution but also strategic foresight.

Though earnings per share came under pressure due to rising costs, Dell’s longer-term metrics remain robust. The revenue mix is shifting toward high-margin enterprise solutions, and the company’s AI-first focus is beginning to show tangible results. With positive investor sentiment and encouraging forward guidance, Dell is poised to remain at the forefront of the AI hardware boom.

The AI Server Boom

The intensifying demand for artificial intelligence (AI) compute infrastructure has emerged as a defining force in the enterprise technology landscape. At the heart of this seismic transformation is the dramatic surge in AI server orders, which has fundamentally reoriented strategic priorities for technology companies worldwide. Dell Technologies, a long-standing leader in enterprise hardware, has positioned itself at the vanguard of this revolution. The company’s recent performance underscores how AI server demand has not only revitalized its infrastructure business but also reshaped its long-term value proposition. This section delves into the factors driving Dell’s AI server boom, its key partners and clientele, and the broader technological dynamics underpinning this exponential growth.

Unprecedented Demand: A $12.1 Billion Inflection Point

Dell’s AI infrastructure business has seen a remarkable acceleration, with $12.1 billion in new AI server orders recorded in the first quarter of fiscal 2026 alone. To contextualize this figure, it exceeds the total number of AI server shipments the company fulfilled during the entirety of fiscal 2025. This milestone is not merely a reflection of strong quarterly sales—it signifies a structural shift in the compute needs of modern enterprises, research institutions, and AI-focused startups.

The surge in demand is being driven by multiple market forces converging simultaneously. First and foremost, the proliferation of large language models (LLMs), generative AI systems, and high-volume inferencing workloads requires a new class of hardware—one that is built around GPU-intensive, memory-dense, and thermally optimized configurations. Dell’s PowerEdge server line, equipped with advanced components such as Nvidia’s H100 and emerging Blackwell architecture GPUs, has proven to be ideally suited for these compute-intensive environments.

In parallel, many organizations are transitioning away from traditional, CPU-dominant data centers toward AI-specialized, hybrid, and edge-native infrastructure stacks. This evolution plays directly into Dell’s strengths, particularly in customizable server configurations and robust supply chain orchestration. The company has leveraged its experience in large-scale deployments to provide AI server solutions that are not only high-performing but also scalable and production-ready.

Strategic Partnerships and Tier-One Clientele

One of the most crucial contributors to Dell’s AI server success is its strategic alignment with key industry players. Chief among these is Nvidia, the undisputed leader in AI acceleration hardware. Dell has maintained a strong relationship with Nvidia, enabling the integration of state-of-the-art GPUs into its server offerings. This partnership ensures that Dell can deliver cutting-edge capabilities in areas such as parallel processing, neural network training, and large-scale model inferencing.

Dell’s collaborative ecosystem extends to other technology providers as well, including Intel, AMD, and emerging AI chip startups. However, the Nvidia partnership stands out due to the role its hardware plays in enabling enterprise-scale generative AI. By embedding Nvidia’s CUDA-enabled GPUs and networking fabrics into its server architecture, Dell has positioned itself as a preferred vendor for AI-focused deployments across industries.

In terms of clientele, Dell is working with some of the most high-profile and ambitious players in the AI arena. Among these is Elon Musk’s xAI, a company focused on developing advanced artificial general intelligence (AGI) technologies. Dell is reportedly supplying a substantial number of AI servers to support xAI’s research infrastructure. Similarly, CoreWeave, a cloud infrastructure firm known for its rapid GPU-based service scaling, has turned to Dell for high-performance server hardware.

These customer wins are more than symbolic. They validate Dell’s technical credibility in AI infrastructure and highlight the company's growing relevance in a segment once dominated by cloud hyperscalers and boutique server manufacturers. Furthermore, Dell’s ability to secure long-term contracts with top-tier customers supports its backlog of AI server orders, which currently stands at $14.4 billion—a clear indication of sustained, forward-looking demand.

Technological Differentiation and Infrastructure Readiness

While partnerships and clientele form one pillar of Dell’s AI success, technological innovation provides the other. The company has invested significantly in next-generation server designs that support multi-GPU configurations, high-speed interconnects, and liquid cooling technologies—all essential for AI workloads that demand massive compute density and sustained throughput.

Dell’s PowerEdge XE9680, for instance, supports up to eight high-end GPUs in a single chassis, making it one of the most powerful AI server platforms available in the commercial market. The platform is designed for high-performance AI training tasks, such as transformer model development, as well as AI inferencing in real-time use cases. Its adoption has been particularly strong in research labs, defense contracts, and advanced cloud-native AI environments.

In addition to raw compute power, Dell has also focused on AI deployment orchestration tools and software-defined infrastructure. The company’s Omnia framework simplifies the management of AI clusters, enabling clients to deploy, monitor, and scale AI workloads with minimal latency and maximum resource utilization. This holistic approach to infrastructure—where hardware is tightly integrated with automation software—gives Dell a competitive edge in large-scale, enterprise-grade AI deployments.

Another key strength lies in Dell’s ability to deliver turnkey AI solutions. By combining compute, storage, and networking components with security and compliance modules, Dell is offering end-to-end systems that reduce complexity and accelerate time-to-value for customers. This is especially critical in regulated industries such as healthcare, financial services, and government, where compliance, performance, and security must coexist.

Market Trends Accelerating the Boom

Several macro trends are converging to amplify the demand for AI servers:

- The proliferation of GenAI applications in sectors such as education, enterprise search, customer service, and scientific computing.

- The shift from experimentation to production, as more enterprises move LLMs and AI agents from pilot phases into full deployment.

- Geopolitical and national security concerns, which are leading governments to invest in sovereign AI infrastructure and reduce dependency on public clouds.

- Hybrid and edge computing, which require localized AI inferencing capabilities closer to the data source.

Dell has skillfully aligned its server portfolio to cater to each of these trends. With configurations optimized for both centralized data centers and distributed edge locations, the company is providing flexible infrastructure for a broad range of AI use cases.

Challenges and Supply Constraints

Despite this impressive momentum, Dell’s AI server business is not without challenges. Chief among them is the supply chain bottleneck associated with high-end GPUs, particularly Nvidia’s Blackwell chips. These components are not only expensive but also subject to limited production capacity. While Dell has maintained priority access through its Nvidia partnership, fulfillment speed and component pricing remain key concerns that could affect margin realization.

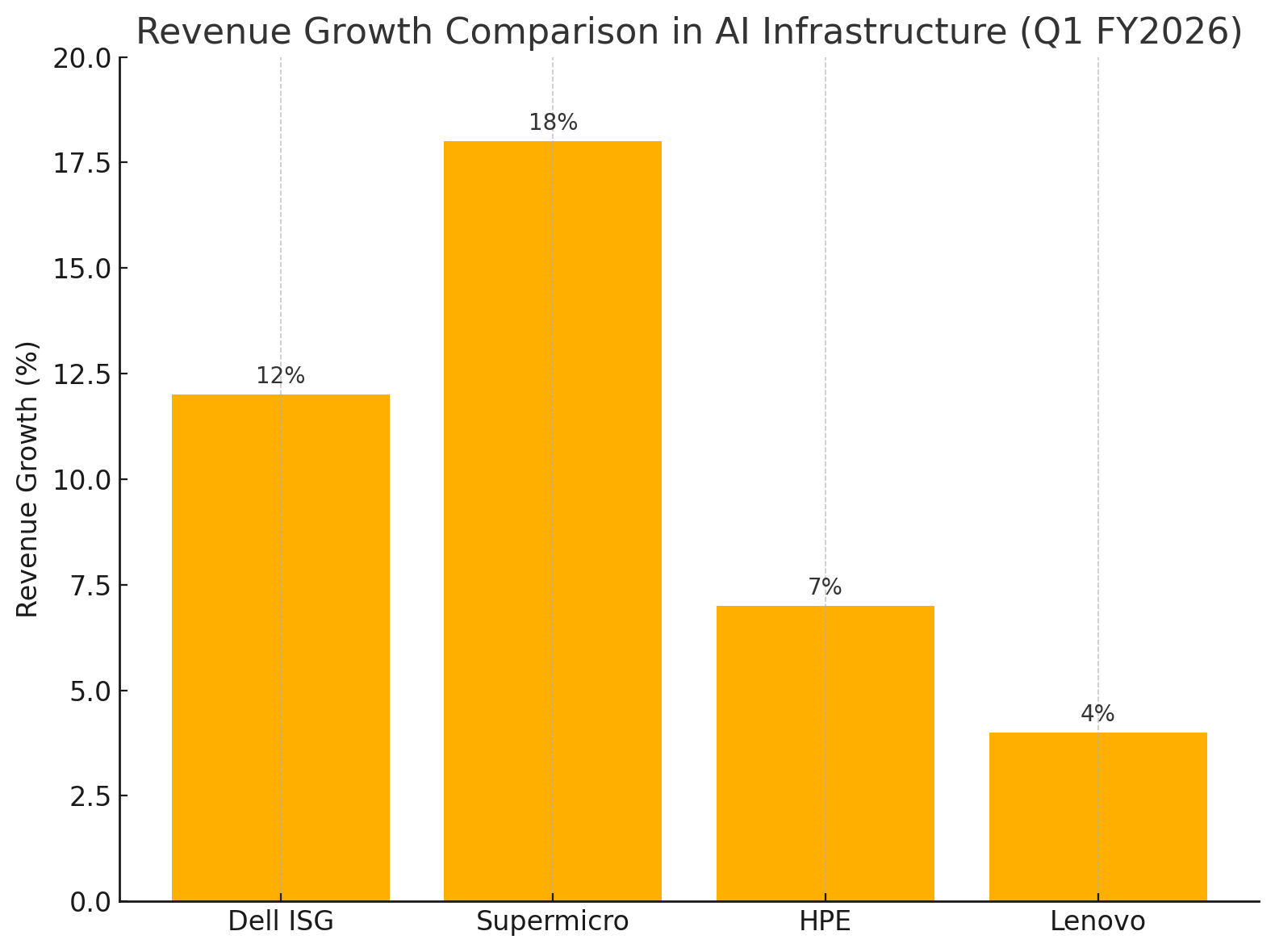

Additionally, as more competitors—ranging from Supermicro to HPE—enter the AI server space with their own high-performance configurations, Dell will need to continue differentiating through service quality, reliability, and software integration. Competitive pricing pressures could also challenge profitability in future quarters, even amid robust top-line growth.

A New Core for Dell’s Business

The AI server boom has transformed Dell Technologies from a traditional hardware vendor into a strategic enabler of next-generation compute infrastructure. With soaring demand, high-profile partnerships, and strong technological differentiation, Dell is not only capitalizing on a fleeting market opportunity—it is redefining its long-term growth architecture.

The coming quarters will be critical as Dell looks to convert backlog into revenue, expand production capacity, and maintain its technological lead. But if current trends are any indication, the company is well on its way to establishing itself as a cornerstone in the global AI infrastructure supply chain.

Strategic Positioning in the AI Infrastructure Market

As the global race to build AI infrastructure accelerates, the competitive dynamics within the enterprise technology sector are being dramatically reshaped. Companies that were once regarded primarily as server vendors or systems integrators are now vying for dominance in a market defined by AI-ready hardware, low-latency networking, and end-to-end infrastructure orchestration. Dell Technologies has emerged as a formidable contender in this high-stakes environment, leveraging its scale, partnerships, and technical innovation to establish a strategic foothold. This section explores Dell’s positioning relative to its peers, the differentiators driving its success, and the strategic challenges it must navigate to maintain its leadership in AI infrastructure.

A Market in Transition: From General Compute to AI-Optimized Systems

The infrastructure landscape is experiencing a profound transformation. Whereas traditional enterprise demand centered on general-purpose compute, today’s organizations require highly specialized systems optimized for artificial intelligence workloads. These include large language model (LLM) training, real-time inferencing, neural search, and federated learning across distributed data environments. As a result, AI infrastructure is not just an adjacency to existing IT infrastructure—it is rapidly becoming the core around which modern data centers are architected.

In this redefined market, Dell is competing against a mix of traditional rivals and emerging disruptors. Key competitors include:

- Hewlett Packard Enterprise (HPE): With a diversified portfolio and strong focus on AI-at-the-edge, HPE remains a key competitor. Its GreenLake platform combines infrastructure-as-a-service with AI workloads but trails Dell in hyperscaler-scale GPU server deployments.

- Super Micro Computer: Once a niche player, Supermicro has capitalized on demand for high-density AI servers and direct Nvidia GPU integration. Its agility and low-latency delivery model offer price-performance advantages but lack Dell’s enterprise-grade global support network.

- Lenovo: While globally diversified, Lenovo’s AI infrastructure presence is more fragmented and regionally dependent. Its server platforms are gaining traction in Asia, but the brand still faces recognition challenges in enterprise AI outside China.

- AWS, Microsoft Azure, and Google Cloud: These cloud hyperscalers present an indirect but formidable form of competition, as they offer scalable AI infrastructure via public cloud platforms. However, many enterprises seek on-premises or hybrid options for security, compliance, and performance reasons—areas where Dell excels.

Dell’s strategy to differentiate itself within this competitive arena involves a multi-faceted approach: vertical integration, robust partner ecosystems, and customer-centric AI solutions.

Vertical Integration and Customization: Dell’s Competitive Edge

One of Dell’s most important strategic decisions has been to retain a vertically integrated model for its infrastructure business. Unlike some competitors who rely heavily on third-party original design manufacturers (ODMs), Dell designs, tests, and validates its AI servers in-house. This approach enables tighter quality control, greater component flexibility, and superior integration with enterprise-grade software.

Dell’s PowerEdge server portfolio, tailored for AI workloads, exemplifies this strategy. By offering configurations that support multi-GPU environments, NVLink interconnects, and liquid cooling, Dell ensures its platforms are ready for the most demanding applications. The PowerEdge XE9680, for instance, supports up to eight Nvidia H100 GPUs and is engineered specifically for LLM training and high-volume inferencing tasks.

In addition, Dell's infrastructure software stack—including Dell iDRAC for remote management, Omnia for workload orchestration, and Apex for as-a-service deployment—enhances the manageability and operational efficiency of its AI systems. These tools are critical for customers seeking to deploy and scale AI applications without deep in-house expertise.

This holistic integration of hardware and software positions Dell as more than a server vendor—it is an AI infrastructure enabler. The value proposition goes beyond performance metrics; it includes deployment speed, cost predictability, and service continuity across multi-cloud and hybrid environments.

Global Reach and Enterprise-Grade Support

Another critical element of Dell’s strategic advantage is its global supply chain and service infrastructure. Unlike niche or regional players, Dell operates one of the most robust logistics and support ecosystems in the tech industry. This enables consistent delivery timelines, component availability, and field support in virtually every major geography.

For enterprises operating across multiple regulatory jurisdictions, Dell’s global presence is invaluable. Clients in financial services, government, and healthcare sectors often require infrastructure solutions that comply with data sovereignty, ISO standards, and local data residency laws. Dell’s ability to meet these needs with consistent SLAs and localized compliance support gives it a significant advantage.

In addition to its global reach, Dell benefits from deep channel partnerships. The company works closely with leading system integrators, value-added resellers (VARs), and cloud MSPs (managed service providers) to deliver AI solutions that are tailored to vertical-specific use cases—ranging from genomics and climate modeling to fraud detection and customer service automation.

Innovation in Cooling and Power Efficiency

AI infrastructure is resource-intensive—not only in terms of compute but also power and thermal management. Dell has responded to this challenge by investing in liquid cooling, chassis-level airflow optimization, and dynamic power throttling technologies. These features allow Dell’s servers to run high-density GPU configurations without performance degradation or unsustainable energy use.

Compared to some competitors who rely on off-the-shelf cooling enclosures or externally integrated systems, Dell’s engineered thermal management provides superior reliability, particularly in data center environments with constrained space or power availability. This is becoming a crucial factor in winning large-scale AI infrastructure contracts.

As enterprises increasingly scrutinize the sustainability footprint of their AI initiatives, Dell’s emphasis on energy-efficient designs and green data center certifications positions it well to capture market share from environmentally-conscious organizations.

Risks and Strategic Challenges

Despite its strong positioning, Dell faces strategic risks that could challenge its continued dominance in the AI infrastructure market.

- Component Availability: The ongoing global shortage of high-end GPUs, especially Nvidia’s Blackwell chips, could impact Dell’s ability to fulfill large-scale orders on time. While Dell benefits from preferential supply arrangements, it remains exposed to upstream supply shocks.

- Margin Compression: As more players enter the AI server space, competitive pricing pressures are likely to increase. Dell’s premium enterprise positioning could be challenged by lower-cost offerings from rivals like Supermicro or ODM-based white-box solutions.

- Cloud Substitution: While Dell benefits from enterprises choosing on-premises or hybrid deployments, the growing maturity of cloud-based AI infrastructure from AWS, Azure, and Google Cloud could reduce the size of Dell’s target addressable market, especially among startups and SMEs.

- Innovation Race: The rapid evolution of AI architectures, including chip-level innovation and software-defined acceleration, means Dell must continuously update its offerings or risk technological obsolescence. Maintaining integration leadership with Nvidia, AMD, and Intel will be essential.

Leadership with Resilience and Agility

Dell Technologies’ strategic positioning in the AI infrastructure market is a testament to its ability to evolve with unprecedented speed. While the company has long been a cornerstone of enterprise IT, its latest initiatives in AI server innovation, global deployment readiness, and vertical integration have elevated it to a new level of relevance in the AI era.

As competitors scramble to match its capabilities, Dell is already capitalizing on its early mover advantage in AI infrastructure deployment. By focusing on integrated solutions, energy efficiency, global scalability, and enterprise-class service, Dell is not just meeting the demands of the AI economy—it is helping define them.

Challenges and Future Outlook

Dell Technologies stands at a pivotal crossroads in its strategic evolution—firmly embedded in the wave of AI-driven infrastructure transformation, yet simultaneously navigating a set of emerging challenges that will define its trajectory in the years ahead. While the company has successfully reoriented its portfolio and operations to align with the surging demand for AI servers, long-term sustainability depends on its ability to manage supply chain volatility, sustain innovation, and adapt to changing regulatory and economic landscapes. This final section examines the core challenges Dell faces and offers a forward-looking view of its prospects in the AI infrastructure domain.

Navigating Supply Chain and Component Pressures

One of the most immediate concerns for Dell—and indeed, for much of the high-performance computing (HPC) industry—is the constrained availability of advanced AI accelerators. With demand for Nvidia’s top-tier GPUs like the H100 and the recently announced Blackwell architecture far outstripping supply, the timing and quantity of shipments are uncertain.

Although Dell has secured favorable allocations through long-standing partnerships with Nvidia, it remains exposed to systemic bottlenecks across semiconductor fabrication, memory modules, and power delivery systems. Given the increasing complexity of AI server configurations—which often involve multi-GPU interconnects, specialized networking fabrics, and advanced cooling—it is not just GPUs that present a challenge. Delays in any component can result in downstream impacts on client delivery timelines and revenue recognition.

The backlog figure of $14.4 billion in AI server orders is a double-edged sword in this context. While it indicates robust demand, it also represents an operational burden. Converting backlog into realized revenue requires a dependable and agile supply chain—something Dell must continue optimizing through logistics innovation, multisource supplier agreements, and diversified fabrication partners.

Balancing Growth and Margin Compression

Another critical tension lies between Dell’s top-line expansion and its bottom-line health. While AI server demand has driven substantial revenue gains, margins remain under pressure due to the high costs associated with component procurement, manufacturing complexity, and competition-driven pricing dynamics.

Competitors such as Supermicro and HPE, with their own aggressive AI offerings, are racing to capture enterprise mindshare—sometimes by offering lower prices, faster delivery, or niche customization options. In response, Dell must strike a careful balance between competitive pricing and value-added service differentiation. Its enterprise focus and bundled support packages help mitigate margin erosion, but the risks persist.

To maintain profitability, Dell will need to continue enhancing operational efficiency, increasing automation across its supply chain, and expanding its software and services layer—especially offerings with recurring revenue such as Dell Apex and managed AI services. These higher-margin business lines will play an increasingly vital role in offsetting hardware-related cost pressures.

The Cloud Question: Partner or Rival?

The rise of cloud hyperscalers as providers of AI infrastructure introduces a complex strategic dynamic for Dell. Companies like AWS, Microsoft Azure, and Google Cloud offer clients instant access to powerful AI computing environments without the need to invest in physical hardware. For many small and medium-sized businesses, this flexibility and scalability are difficult to ignore.

However, Dell has found competitive differentiation by addressing enterprise and government clients with specialized compliance requirements, data sovereignty needs, and predictable total cost of ownership (TCO) expectations. Dell’s on-premise and hybrid infrastructure solutions offer an alternative for organizations wary of cloud lock-in or bound by regulatory mandates.

In the long run, Dell’s ability to integrate and orchestrate hybrid deployments—where some workloads run on-prem and others on the cloud—will be key to maintaining its relevance. Its partnerships with public cloud providers, and support for containerization and edge compute, will help Dell ride both waves: cloud expansion and localized AI adoption.

Sustaining Innovation in a Rapidly Evolving Market

The pace of AI innovation continues to accelerate, and infrastructure providers must evolve in tandem. Dell’s current hardware stack is well-positioned for existing large language models and transformer-based workloads, but the horizon is rapidly shifting toward more distributed, multimodal, and agent-based AI architectures.

This next generation of models will require not only scalable compute but also seamless data movement, heterogeneous chip support (including NPUs and FPGAs), and more efficient training frameworks. Dell will need to continue investing in research and development to ensure its platforms support emerging AI paradigms.

Moreover, edge AI presents another frontier. As demand grows for AI inferencing closer to the data source—in retail, manufacturing, autonomous vehicles, and industrial IoT—Dell’s ability to adapt its infrastructure to meet the requirements of edge environments will determine its ability to lead in decentralized AI.

Geopolitical, Regulatory, and ESG Considerations

No strategic outlook would be complete without acknowledging the geopolitical and regulatory risks that surround the AI ecosystem. Export controls on GPUs, semiconductor restrictions, data localization policies, and government-led AI regulations are rapidly evolving and can influence Dell’s operations across its global footprint.

Dell’s global supply chain and multinational customer base position it both as a beneficiary and a potential target of such regulations. Continued investment in compliance infrastructure, security auditing, and region-specific product adaptations will be necessary to mitigate these risks.

In parallel, environmental, social, and governance (ESG) considerations are becoming central to enterprise technology procurement. Power efficiency, e-waste management, and carbon footprint reduction are emerging as key decision factors for IT buyers. Dell’s sustainability efforts—through green server designs, renewable material usage, and circular economy initiatives—will need to be expanded and clearly communicated to remain competitive in procurement cycles shaped by ESG metrics.

A Strategic Inflection Point

Dell Technologies is entering a new era—one defined not by incremental innovation, but by paradigm-shifting technological demands. The company’s ascent in the AI server market is built on strong fundamentals: enterprise trust, technological prowess, global scale, and strategic alliances. However, the path forward requires continuous adaptation.

Managing hardware supply chains, protecting profitability, competing with hyperscalers, sustaining platform innovation, and meeting global regulatory and ESG expectations are no small tasks. Yet Dell is better equipped than most to address them, armed with decades of experience in delivering mission-critical infrastructure at scale.

The AI server boom has undoubtedly reinvigorated Dell’s narrative and financial trajectory. Whether the company can translate this momentum into durable leadership will depend on its ability to not only execute, but anticipate. In the AI-first future, those who build the backbone will define the frontier—and Dell is staking its claim to be among them.

References

- Dell raises full-year profit forecast on strong AI server demand

https://www.reuters.com/business/dell-raises-full-year-profit-forecast-strong-ai-server-demand-shares-rise - Dell earnings beat expectations driven by AI demand

https://www.investopedia.com/dell-earnings-q1-fy2026-11743321 - Dell’s AI server orders and backlog set records

https://www.cnbc.com/2024/05/29/dell-technologies-ai-server-demand - Elon Musk’s xAI among Dell’s top AI clients

https://www.bloomberg.com/news/articles/2024-05-29/dell-ai-server-orders-include-xai - Dell’s AI-ready PowerEdge XE9680 explained

https://www.dell.com/en-us/blog/introducing-dell-poweredge-xe9680-ai-server - Nvidia H100 GPUs power Dell’s AI surge

https://www.tomshardware.com/news/dell-nvidia-ai-servers - Supermicro and Dell compete in AI server growth

https://www.marketwatch.com/story/supermicro-vs-dell-ai-server-revenue-comparison - Dell Apex expands enterprise AI offerings

https://www.zdnet.com/article/dell-launches-apex-for-generative-ai-infrastructure - Dell’s partnership ecosystem in AI infrastructure

https://www.crn.com/news/dell-strengthens-ai-partner-portfolio - Dell’s global service and compliance advantage

https://www.techradar.com/news/dell-enterprise-ai-compliance