China’s Gold Rush: Why Imports Are Soaring Despite Record Prices

In a remarkable display of economic paradox, China’s gold imports surged to an 11-month high in April 2025 despite gold prices reaching unprecedented levels on global markets. Traditionally, high prices are expected to dampen demand, particularly for a commodity as economically sensitive as gold. Yet, the world’s second-largest economy has defied conventional economic expectations. As global investors and analysts attempt to decipher the underlying causes, the sharp rise in China’s gold imports has sparked a broader conversation about economic strategy, reserve diversification, and shifting financial priorities in a climate of global uncertainty.

Gold has long held a complex and culturally significant position in China’s economic fabric. Not merely a luxury commodity or industrial input, gold in China represents a confluence of tradition, wealth preservation, and strategic asset allocation. The nation’s appetite for gold is historically resilient, often responding not just to market prices but to macroeconomic signals, geopolitical pressures, and domestic policy cues. As inflationary risks persist worldwide and the U.S. dollar experiences renewed volatility, many Chinese investors and institutions appear to be pivoting decisively toward the historical safe haven that gold provides.

April 2025 saw China import a total of 175 metric tons of gold, the highest monthly figure recorded since May 2024, and a 27% year-over-year increase. Simultaneously, global gold prices hit an all-time high of $2,420 per ounce, driven by a combination of robust central bank purchases, geopolitical instability in the Middle East, and persistent inflation in developed economies. This seemingly contradictory trend—soaring imports amid record prices—demands a deeper analysis of China’s economic motivations and the structural dynamics of the international gold market.

This blog post explores the drivers behind China’s surging gold imports, contextualizes them within the broader landscape of global gold trends, and evaluates the implications for international markets. Drawing on import data, central bank reserve patterns, and cultural consumption cycles, we will uncover why China continues to amass gold despite elevated prices and what this might signal for the global economy moving forward. Through comprehensive analysis and supporting visuals, this piece seeks to provide clarity on one of the most intriguing market developments of 2025.

Global Gold Market Overview

The global gold market in 2025 has been characterized by exceptional volatility and historic price surges, marking a pivotal chapter in the commodity’s financial narrative. Gold, long esteemed as a safe-haven asset during times of economic turbulence, has once again asserted its primacy as a global store of value. Its performance over the past 18 months reflects a broader confluence of macroeconomic disruptions, policy shifts, geopolitical strife, and structural realignments in investment behavior. This section offers a comprehensive examination of the gold market’s global dynamics, setting the stage for understanding China’s aggressive import behavior despite historically high price levels.

The Historic Price Climb

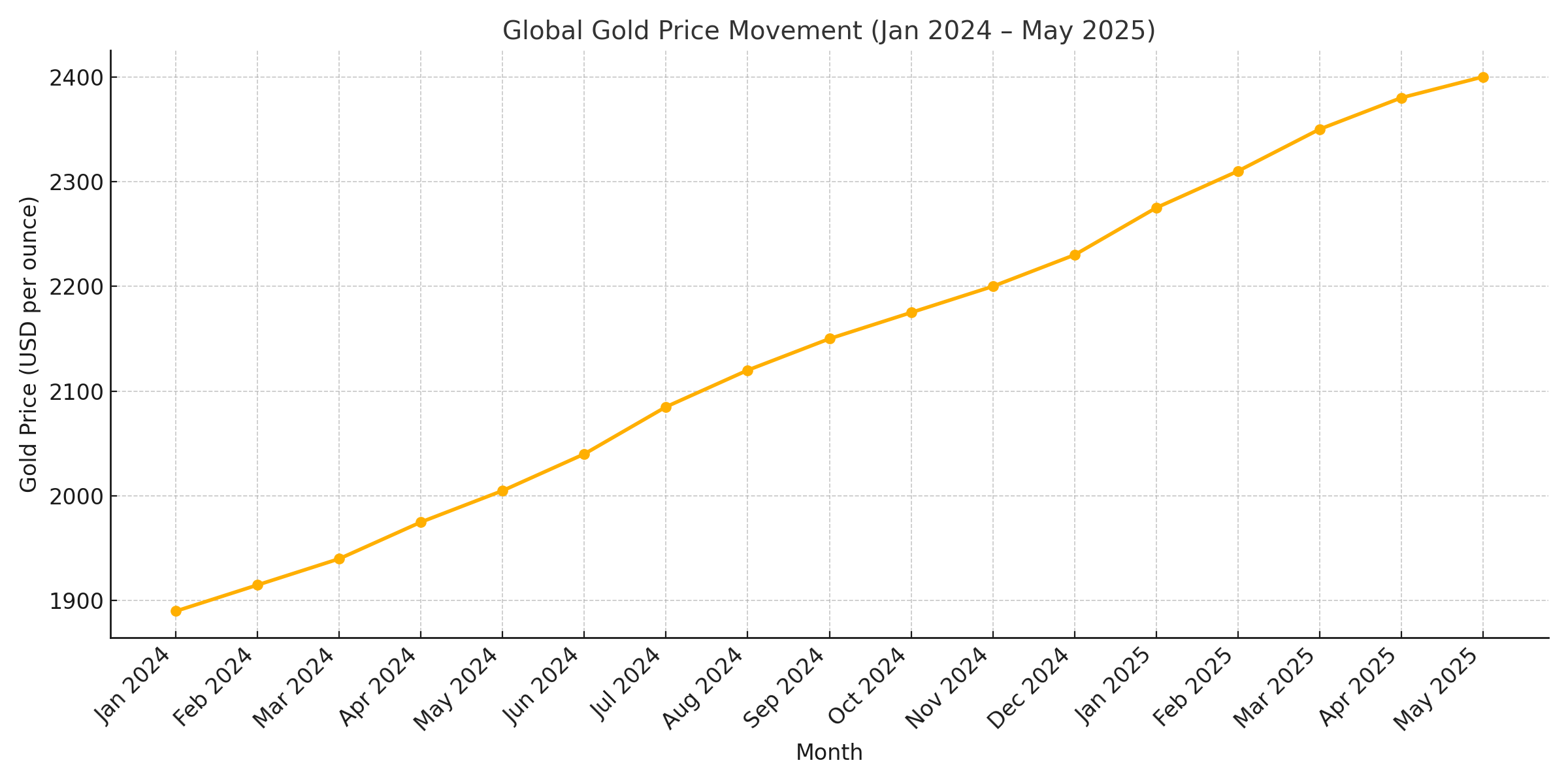

Between January 2024 and May 2025, gold prices have surged by over 35%, breaking successive records and reaching an all-time high of $2,420 per ounce in April 2025. This rally is attributable to a combination of inflationary pressures, declining confidence in fiat currencies, and renewed demand from both institutional investors and central banks. Notably, the average gold price in 2023 hovered around $1,800–$1,950 per ounce, indicating a significant upward acceleration over a relatively short span.

The rally intensified particularly in the first quarter of 2025 following escalations in geopolitical tensions across Eastern Europe and the Middle East. Concerns over an expanding conflict in the Gulf region led to a dramatic flight to safety, with gold emerging as the preferred risk-averse asset. Simultaneously, softening signals from the U.S. Federal Reserve regarding interest rate policy and continued quantitative easing strategies fueled investor anticipation of further dollar weakness—a key catalyst for gold price appreciation.

Monetary Policy and Inflationary Fears

A dominant macroeconomic factor influencing gold prices has been the persistence of inflation across developed economies. Despite efforts by central banks, including the Federal Reserve and the European Central Bank, to rein in inflation through tightening measures, price pressures have remained elevated due to supply chain bottlenecks, energy market instability, and wage inflation.

In the United States, year-on-year inflation hovered around 4.8% through early 2025—well above the Fed’s 2% target. This has eroded the purchasing power of traditional savings and driven retail and institutional investors alike to seek hedges against monetary depreciation. Gold, with its intrinsic value and historical resilience against inflation, has seen inflows not only from private funds but also from government entities reevaluating their reserve strategies.

Emerging markets, particularly in Asia and Latin America, have also contributed to gold’s bull run. Countries with high current account deficits and vulnerable currencies increased gold holdings to mitigate exposure to dollar volatility. This trend has further tightened supply and introduced a sustained upward trajectory in price.

Investment Behavior and Market Sentiment

The investment community has responded to these macroeconomic cues with a renewed fervor for precious metals. Gold-backed exchange-traded funds (ETFs) reported record inflows in early 2025, especially in Asia and Europe. According to data from the World Gold Council, global gold ETF holdings rose by over 18% year-to-date, reversing the outflows seen in 2022 and early 2023.

Additionally, there has been a notable resurgence in physical gold demand, particularly among retail investors and wealth management firms. Sales of gold bars and coins spiked across major markets such as Germany, India, and the United States. In India, for instance, jewelers reported a 25% rise in gold bullion purchases in the first quarter of 2025 despite higher prices, citing wedding season demand and a cultural preference for gold as a symbol of wealth preservation.

Market sentiment remains bullish. A growing consensus among financial analysts suggests that gold prices will continue to rise in the medium term, with some forecasting levels above $2,600 per ounce by the end of 2025 if macroeconomic and geopolitical conditions persist.

Central Bank Activity and Reserve Diversification

Perhaps one of the most structurally important shifts in the gold market has been the behavior of central banks. Over the last decade, central banks have steadily transitioned from net sellers to net buyers of gold. This trend has accelerated in the wake of heightened geopolitical risk and the weaponization of reserve currencies.

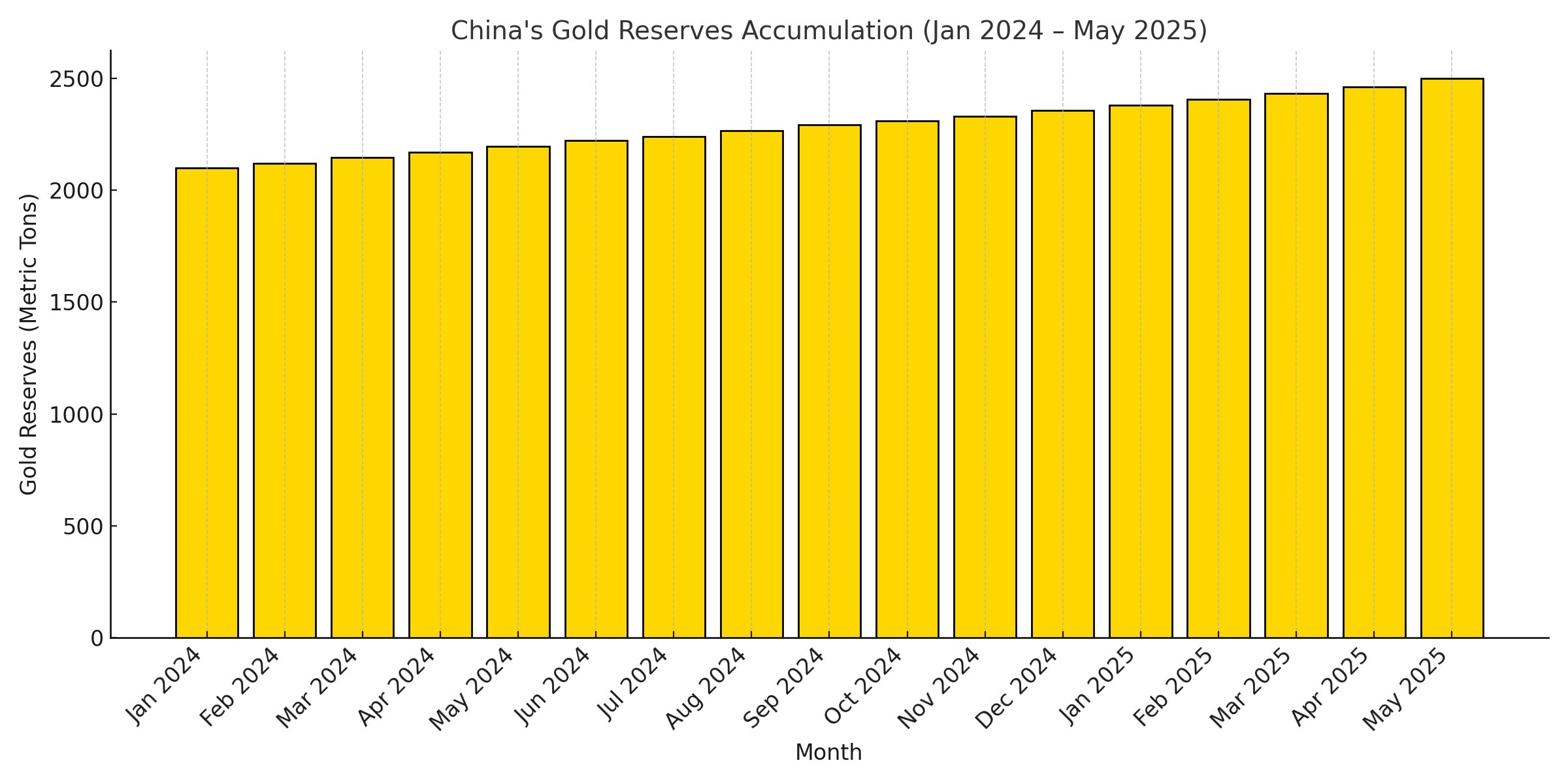

In 2024, central bank gold purchases reached 1,037 metric tons globally, and preliminary data suggests an even higher total for 2025. Major buyers included China, India, Turkey, and Russia—all countries seeking to reduce dependence on the U.S. dollar and diversify their foreign reserves. The People's Bank of China (PBoC) alone reportedly added over 200 tons of gold to its reserves in the past year, underscoring gold’s strategic value in an evolving multipolar financial order.

The rationale behind this behavior is grounded in both economic pragmatism and strategic foresight. In an environment where foreign assets can be frozen, sanctions swiftly imposed, and currency pegs disrupted, gold offers a politically neutral, universally accepted asset that can be mobilized across borders without counterparty risk.

The impact of these multifaceted drivers is evident in the price trajectory of gold over the past 17 months, as illustrated in the chart below.

Supply Constraints and Mining Output

On the supply side, global gold mining production has remained relatively flat, exacerbating the imbalance between supply and demand. While some new projects have been commissioned in Africa and Latin America, declining ore grades, regulatory hurdles, and environmental restrictions have slowed output growth.

According to the U.S. Geological Survey, total global gold mine production was approximately 3,400 metric tons in 2024, only marginally higher than the previous year. The slow pace of new discoveries and the growing cost of extraction have raised concerns about long-term supply sustainability.

This stagnation in mining output, combined with surging demand, has contributed to tight market conditions and supported the structural bullishness that underpins current gold prices. Refining bottlenecks and logistical disruptions—particularly in major transit hubs like Switzerland and the UAE—have further strained supply chains, delaying deliveries and pushing premiums on physical gold.

Gold’s Role Amid Geopolitical Uncertainty

Gold’s enduring value lies in its capacity to function effectively during times of global upheaval. Whether in the form of wars, trade disputes, or systemic banking risks, gold continues to serve as a geopolitical hedge. The escalation of conflict between NATO-aligned and non-aligned powers has placed increased scrutiny on sovereign assets and heightened the demand for gold as a tool of financial sovereignty.

Moreover, the rise of sanctions-driven diplomacy has added another layer of urgency for many countries to reevaluate reserve portfolios. In this context, gold is not merely a commodity—it is a statement of monetary independence. It is within this intricate geopolitical matrix that China’s recent surge in gold imports must be interpreted.

In summary, the global gold market has entered a new phase marked by historically high prices, strong central bank demand, growing investor interest, and constrained supply conditions. The confluence of inflation, geopolitical risk, and strategic realignments has led to a global reassessment of gold’s utility—not just as a financial instrument, but as a sovereign shield and store of value. Against this backdrop, China’s behavior—importing record volumes of gold in defiance of price logic—warrants close scrutiny. As we will explore in the following sections, China’s internal motivations and strategic calculus play a critical role in shaping the evolving landscape of global gold demand.

China's Gold Import Dynamics

China’s role in the global gold market has grown increasingly pivotal, not only as a top consumer and importer but also as a major influencer of pricing dynamics and long-term demand trends. In 2025, this role has been cast into sharp relief with the nation’s gold imports reaching an 11-month high, defying conventional economic logic that elevated prices typically suppress buying interest. This section delves into the structure, scale, and strategic nuances of China’s gold import activity, providing a detailed view of the mechanisms behind the country’s intensified acquisition behavior.

Surge in Import Volumes

According to customs data and independent tracking from the World Gold Council, China imported approximately 175 metric tons of gold in April 2025 alone, marking the highest monthly total since May 2024. This represents a 27% increase compared to the same month a year earlier, and nearly a 12% rise over March 2025.

What makes this surge particularly notable is the context in which it occurred: gold was trading at record levels throughout the month, averaging $2,400 per ounce. Traditional economic reasoning would expect such prices to deter large-volume purchases. Yet, China's importers—ranging from state-owned banks and private institutions to luxury goods manufacturers—continued their acquisitions, indicating that short-term cost considerations were superseded by strategic or structural imperatives.

Key Sources of Gold Imports

China’s gold imports are sourced primarily from Switzerland, Australia, South Africa, and Canada, with Switzerland serving as a central refining and re-export hub. In 2025, Swiss exports to China have climbed significantly, with April alone accounting for over 40% of China's total import volume.

The logistical and regulatory convenience of sourcing from Switzerland is a result of years of bilateral cooperation and the global standardization of gold bar specifications, particularly the “Good Delivery” bars recognized by the London Bullion Market Association (LBMA). Australia and South Africa also remain key exporters due to proximity and longstanding trade relationships. Increased shipments from Russia have also been observed, albeit quietly, due to sanctions-related sensitivities and the use of third-party transshipment routes such as the UAE.

Trade Routes and Mechanisms

Gold is imported into China predominantly through designated ports such as Shanghai and Beijing under the supervision of the People's Bank of China (PBoC) and the State Administration of Foreign Exchange (SAFE). Only a handful of commercial banks—typically large state-owned entities like ICBC, Bank of China, and China Construction Bank—are licensed to import gold directly. This regulated import regime ensures that gold inflows are consistent with national monetary policy and reserve management goals.

The Shanghai Gold Exchange (SGE), which plays a vital role in domestic distribution, also facilitates the settlement and clearing of imported gold. Once the gold enters the system, it is either allocated to industrial users (e.g., electronics, jewelry) or sold to institutional and retail investors. The SGE’s physical delivery model further underscores the real nature of gold demand in China, as opposed to speculative paper trading.

Demand Composition: Consumption vs. Investment

Understanding the end use of China’s imported gold reveals deeper economic insights. Demand is broadly split between two main categories: jewelry and industrial consumption, and investment and reserve accumulation.

Jewelry demand has rebounded significantly in 2025, especially during traditional gift-giving festivals like Lunar New Year and Qingming. The middle class’s rising disposable income and persistent inflationary fears have led to increased purchases of gold ornaments, which double as wearable assets and savings instruments.

On the investment side, Chinese households and institutions are increasingly treating gold as a core asset class. With real estate markets under regulatory tightening and domestic equity markets showing lackluster returns, gold is being perceived as a stable store of wealth. This sentiment has driven demand for bullion bars, coins, and even gold savings accounts offered by banks.

Furthermore, the People's Bank of China has been discreetly increasing its gold reserves in line with a broader strategy to diversify away from U.S. dollar-denominated assets. This demand—largely opaque and state-managed—exerts substantial influence on overall import figures.

Yuan Depreciation and Hedging Behavior

One of the structural drivers behind the spike in gold imports is the depreciation of the Chinese yuan against the U.S. dollar. In Q1 2025, the yuan weakened by approximately 4.5% amid widening interest rate differentials with the U.S., concerns about domestic economic recovery, and capital outflows.

In this environment, gold serves as an effective hedge for Chinese investors and institutions seeking to preserve purchasing power. Because gold is globally priced in dollars, a weaker yuan makes imports more expensive but also increases the value of gold holdings in local currency terms—further enhancing its appeal as a hedge against currency risk.

Role of State Policy and Market Liberalization

Although China's gold market remains heavily regulated, the government has progressively liberalized import and trading mechanisms over the past decade. Reforms have included broader access to the Shanghai Free Trade Zone, expansion of domestic futures markets, and the gradual internationalization of the renminbi in precious metals settlements.

Nonetheless, the state retains significant influence through quotas, licensing, and reserve policy. In times of economic uncertainty, the government has shown a tendency to encourage gold accumulation—both as a financial stability measure and as a symbolic assertion of economic sovereignty.

The 2025 surge in imports may also reflect behind-the-scenes policy adjustments encouraging financial institutions to hold larger gold buffers, particularly as the country prepares to insulate itself against further external shocks and potential sanctions.

Summary and Strategic Implications

China’s gold import dynamics are shaped by a constellation of factors—ranging from global market conditions and currency pressures to domestic economic shifts and state-directed strategies. The April 2025 spike in imports is not a simple anomaly but a manifestation of a broader, structurally embedded orientation toward gold accumulation.

By maintaining strong inflows of gold despite elevated prices, China is signaling that gold’s value, in strategic and monetary terms, outweighs short-term cost considerations. This behavior underscores China’s view of gold not merely as a commodity but as a multi-dimensional asset critical to wealth preservation, financial independence, and geopolitical resilience.

Factors Driving China’s Increased Gold Imports

China’s surge in gold imports amid historically high prices is not merely a function of market behavior but a reflection of deeper structural, economic, and geopolitical imperatives. While elevated prices typically dissuade importers in price-sensitive markets, China’s purchasing behavior in 2025 has proven to be counter-cyclical. This anomaly reveals a multi-layered framework of motivations underpinning the nation's gold acquisition strategy. In this section, we explore the key factors propelling China’s aggressive gold importation: domestic economic uncertainty, reserve diversification policies, cultural preferences, yuan depreciation, and the strategic signaling embedded in its central bank actions.

Domestic Economic Uncertainty and Wealth Preservation

China’s domestic economy has shown signs of fragility in 2025, prompting both institutional and retail investors to seek safety in tangible assets. While GDP growth remains positive, it has moderated to an annualized rate of 4.3%, falling short of the government's 5% target. Persistent property market distress, mounting local government debt, and uneven recovery in consumption have weighed on investor confidence.

The property sector, once a cornerstone of Chinese household wealth, has entered a period of prolonged contraction. Real estate developers continue to face liquidity challenges, and consumer confidence in housing as an investment vehicle has deteriorated. This vacuum in real asset investment has redirected household and institutional capital toward gold, seen as both a hedge against systemic risk and a non-defaultable store of value.

Additionally, China’s private sector—especially high-net-worth individuals—has been gradually diversifying assets away from real estate and into globally recognized safe-haven holdings. Gold, unlike foreign equities or offshore real estate, offers a low-barrier, state-sanctioned asset class that provides long-term capital preservation without the regulatory friction of foreign exchange controls.

People's Bank of China (PBoC) Reserve Diversification

Central to China’s gold accumulation is the strategy of reserve diversification being implemented by the People’s Bank of China (PBoC). In an era marked by rising global tensions, especially with the United States, China is seeking to reduce its exposure to U.S. dollar-denominated assets. The 2022–2024 period witnessed several instances where dollar-based financial systems were leveraged for sanctions, asset freezes, and trade restrictions—events that have accelerated a reassessment of reserve composition among non-Western economies.

In 2025, the PBoC continued its trend of increasing gold reserves, reportedly acquiring over 200 metric tons year-to-date. This brings its total official reserves to more than 2,500 metric tons, making China one of the largest sovereign holders of gold globally. However, analysts suggest that actual reserves may be even higher due to opaque purchasing practices through state-affiliated entities or offshore accounts.

Gold serves a unique role in China’s reserve strategy: it is unencumbered by foreign jurisdiction, immune to counterparty risk, and universally recognized as a neutral asset. While the dollar still comprises the bulk of China’s foreign exchange holdings, the marginal utility of gold is growing—particularly as the country seeks to internationalize the renminbi and challenge the hegemony of the dollar in global settlements.

The scale and consistency of the PBoC’s acquisitions over the past 17 months are illustrated in the chart below.

Currency Depreciation and Capital Protection

The renminbi (RMB) has depreciated considerably against the U.S. dollar in early 2025, driven by interest rate differentials, persistent capital outflows, and relative economic underperformance. From January to April 2025, the RMB weakened by approximately 4.5%, reaching levels not seen since the height of pandemic-related volatility in 2020.

For both institutional and retail investors, currency depreciation poses a dual threat: the erosion of domestic purchasing power and the devaluation of foreign-denominated liabilities. Gold, priced globally in dollars, presents an effective hedge. By converting RMB into gold, investors not only protect against local currency weakening but also align with an asset whose value tends to rise during periods of dollar appreciation and financial turbulence.

Additionally, gold’s portability and global liquidity offer Chinese investors a means of storing wealth in a politically insulated asset. This is particularly appealing amid discussions about the potential tightening of capital controls, especially as Beijing attempts to mitigate capital flight.

Geopolitical Tensions and Sanctions Risk

Another underappreciated but increasingly important factor behind China’s gold accumulation is the growing risk of geopolitical decoupling and sanctions. The fragmentation of global trade and financial alliances has introduced a new layer of risk into traditional reserve management. The U.S.-China rivalry—fueled by disputes over trade, technology, Taiwan, and maritime access—has led to fears that Chinese assets held in foreign jurisdictions could become targets of economic warfare.

In this context, gold is viewed as the ultimate neutral asset. It is not reliant on any particular nation’s economy, it is not issued by any government, and it cannot be unilaterally frozen. For policymakers in Beijing, increasing gold reserves is a rational response to the weaponization of the dollar and SWIFT-based financial systems.

In addition, geopolitical risk drives global demand for safe-haven assets, which, paradoxically, increases the value of gold holdings. This feedback loop reinforces China’s position: by buying gold during geopolitical instability, it not only protects its wealth but also benefits from upward price momentum caused by similar behavior globally.

Cultural and Seasonal Demand Factors

China’s cultural affinity for gold cannot be understated in assessing demand. Gold holds symbolic significance in Chinese traditions, often associated with prosperity, wealth, and status. During key festivals such as Lunar New Year, Mid-Autumn Festival, and National Day, demand for gold jewelry and commemorative coins surges. In 2025, this cultural demand has been amplified by a renewed focus on traditional savings instruments in an uncertain macroeconomic environment.

The wedding season in particular acts as a major catalyst. Between March and June—widely considered an auspicious time for marriages—demand for gold ornaments increases sharply. In the absence of high-yield alternatives and under inflationary pressure, households have prioritized purchasing physical gold as part of dowries and ceremonial gifts.

Furthermore, social media and e-commerce platforms have democratized access to gold investment, allowing younger generations to purchase fractional gold units and participate in digital gold schemes offered by banks and fintech firms. This has expanded the demand base beyond older, wealthier demographics.

Strategic Signaling and Soft Power

China’s gold accumulation is not merely a reactive measure—it also serves as a strategic signal to global markets. Through steady purchases and elevated import volumes, China demonstrates its intent to assert greater autonomy in monetary and trade policy. While not openly antagonistic, this behavior communicates a subtle challenge to the Western-dominated financial order.

Moreover, as China positions the renminbi as a potential alternative reserve currency—particularly among Belt and Road Initiative (BRI) participants and emerging markets—it must back that currency with credibility. While fiat credibility rests on policy stability, it also benefits from a country’s hard asset backing. Gold reserves bolster trust in the Chinese financial system and can support bilateral trade agreements settled in yuan.

This soft-power dimension—using gold as a tool of monetary diplomacy—further justifies sustained imports, even during times of high prices.

The sharp increase in China’s gold imports in 2025 is underpinned by a convergence of economic, strategic, and cultural factors. The weakening yuan, rising domestic uncertainty, shifts in global reserve strategies, and a desire to assert monetary sovereignty all contribute to a systematic and deliberate accumulation of gold. These actions underscore a long-term vision that transcends price fluctuations, reflecting a structural realignment in how China perceives and manages risk.

Whether viewed through the lens of economic resilience, geopolitical caution, or cultural continuity, China’s gold-buying behavior is far from anomalous. Rather, it is emblematic of a broader transformation in global asset allocation—one in which gold, despite its ancient lineage, has regained contemporary strategic relevance.

Implications for Global Markets

China’s aggressive gold import strategy in 2025—unfolding against the backdrop of record-high prices—carries far-reaching consequences for global markets. As the world’s largest gold consumer and a major player in international finance, China’s demand patterns influence not only commodity prices but also monetary policies, investment strategies, trade relationships, and geopolitical alignments. This section explores the implications of China’s elevated gold imports from multiple perspectives: global pricing dynamics, central bank behavior, gold-producing nations, currency markets, and the evolving geopolitical order.

Impact on Global Gold Prices and Market Sentiment

The most immediate and direct consequence of China’s gold buying spree is its effect on global pricing. The spike in imports during April 2025—when China purchased over 175 metric tons—has reinforced upward pressure on already elevated gold prices. At $2,420 per ounce, gold is trading well above its historical averages, and sustained demand from a major economy like China constrains any likelihood of near-term correction.

This demand creates a floor under global prices, bolstering bullish sentiment among investors. As long as China continues to absorb significant volumes—especially in the face of price resistance—speculative flows into gold-backed exchange-traded funds (ETFs) and futures are likely to persist. Consequently, price volatility may increase as other market participants try to anticipate Chinese behavior and position accordingly.

Furthermore, sustained high prices may lead to substitution effects in industrial sectors and discourage gold consumption in more price-sensitive economies, such as India or Turkey. However, China’s capacity to absorb this cost indicates a strategic, rather than purely commercial, rationale—transforming gold from a cyclical commodity into a geopolitical asset.

Central Bank Imitation and Reserve Strategy Realignment

China’s approach to reserve diversification through gold is being closely watched—and, in some cases, replicated—by other central banks. In recent years, the trend of net gold accumulation among monetary authorities has accelerated, especially among emerging markets that view gold as a buffer against dollar dependency and financial coercion.

China’s continued purchases add legitimacy to this approach. For countries such as India, Russia, Turkey, Brazil, and even some Gulf states, gold is becoming a cornerstone of reserve portfolios. These central banks are increasingly favoring physical assets over foreign securities as they seek to insulate their financial systems from external shocks and reduce exposure to Western monetary instruments.

In effect, China’s actions are reinforcing a global monetary shift. By signaling its confidence in gold’s long-term role as a reserve asset, China is nudging the international system toward a more multipolar reserve framework—one where gold, alongside traditional currencies, plays a foundational role in financial sovereignty and trade security.

Benefits for Gold-Producing Economies

From a trade and development standpoint, China’s heightened gold imports offer a boon to gold-exporting countries. Major producers such as Switzerland (a refining hub), Australia, South Africa, Russia, and Canada stand to gain from sustained Chinese demand, especially if they are able to maintain or expand bilateral trade agreements.

In 2025, several of these nations reported increased export revenues attributed directly to the gold trade with China. For example, Australia’s exports to China included over 60 metric tons of refined gold in Q1 2025 alone, generating billions in revenue amid favorable prices. Similarly, South Africa has seen a revival in its gold mining sector, with investment flowing back into exploration and extraction due to renewed demand certainty.

However, over-reliance on Chinese demand may also pose risks. Should China abruptly reduce imports due to policy shifts or price stabilization, these economies could experience sudden trade shocks. Therefore, while current trade flows are favorable, diversification remains critical for long-term resilience.

Currency Market Impacts and Dollar Alternatives

China’s gold strategy has ripple effects on global currency markets, particularly concerning the status of the U.S. dollar. By steadily reducing the share of dollar-denominated assets in its reserves and accumulating gold, China is signaling its desire to challenge the dollar’s dominance as the world’s default reserve currency.

This has strategic implications. If other nations follow suit—either by choice or as a defensive posture—demand for the dollar in central bank reserves may wane over time. While such a shift will not occur overnight, China’s behavior accelerates a broader dialogue on de-dollarization, especially among the BRICS nations and other emerging economies.

Moreover, gold accumulation can act as a precursor to broader monetary innovation. China may, for instance, leverage its gold reserves to back regional trade agreements settled in yuan or even to support a gold-linked digital currency through its central bank digital currency (CBDC) program. This would provide an alternative settlement mechanism to SWIFT and dollar-based trade, especially in politically sensitive transactions.

Geopolitical Signaling and Strategic Hedging

At a more conceptual level, China’s gold buying sends a powerful message about its geopolitical positioning. Gold, by its very nature, is a neutral asset—free from jurisdictional constraints and immune to sanctions. By amassing large quantities, China is not only protecting its economy from external shocks but also reducing the leverage that other countries, particularly the United States, may have over its financial infrastructure.

In the context of rising U.S.-China tensions, sanctions risk, and global political fragmentation, gold becomes a hedge not only against inflation or currency depreciation but also against international confrontation. China’s imports, therefore, represent a form of strategic insurance—an economic maneuver with diplomatic undertones.

This behavior is being interpreted globally as a move toward monetary independence. It could embolden other nations to assert similar autonomy in their financial dealings, thereby accelerating the global shift toward decentralized and asset-backed systems.

Implications for Retail Investors and Asset Allocation

China’s behavior also impacts global retail investors and portfolio managers. The consistent upward trajectory of gold, bolstered by Chinese demand, compels asset allocators to revisit traditional portfolio weightings. Gold’s resurgence may prompt a reallocation from equities and bonds into commodities, especially in portfolios designed for inflation protection and geopolitical uncertainty.

Furthermore, investment platforms—particularly those offering fractional gold exposure or digital gold products—have reported increased user interest globally. This democratization of gold access is feeding into the demand cycle, thereby reinforcing the trend China has helped to catalyze.

Investors are also beginning to incorporate macro themes such as dedollarization, reserve diversification, and geopolitical hedging into their long-term strategies. As a result, gold is reemerging as not just a tactical tool for crisis management, but a structural pillar of diversified portfolios.

In sum, China's surge in gold imports during a period of record-high prices is not an isolated phenomenon, but rather a systemic reconfiguration with global ramifications. By prioritizing gold over dollar assets, China is reshaping the calculus of monetary policy, central banking, international trade, and investor behavior.

The implications are multifaceted:

- For gold prices, China is a stabilizing and driving force.

- For other central banks, it provides a model for diversification.

- For gold producers, it creates near-term export opportunities.

- For currency markets, it raises questions about the future of the dollar.

- For geopolitics, it signals a realignment of financial power.

This trend suggests that gold’s importance in global finance is far from antiquated—it is evolving in response to new economic, strategic, and political realities. As China continues to amass gold, it is not only insulating itself from systemic risk but also, perhaps inadvertently, laying the foundation for a new monetary world order.

Conclusion

China’s decision to significantly ramp up its gold imports to an 11-month high in April 2025—despite the metal reaching record global prices—underscores a shift in both domestic economic strategy and international financial positioning. While most economies might reduce discretionary imports in the face of elevated commodity costs, China’s continued accumulation of gold signals long-term structural intentions that transcend routine market cycles.

The preceding analysis illustrates that China’s behavior is not anomalous but deliberate, informed by a range of converging factors. Domestically, investors are contending with a weakened property sector, a depreciating renminbi, and a sluggish equity market—conditions that make gold an increasingly attractive asset class for both institutional and retail capital. Meanwhile, the People's Bank of China’s reserve diversification strategy reflects a broader ambition to reduce dependence on the U.S. dollar and increase financial autonomy. This ambition is fortified by a rising desire to insulate the Chinese economy from potential sanctions and geopolitical disruptions, particularly as U.S.-China tensions remain elevated.

Globally, the implications of this trend are far-reaching. China’s import surge is contributing to a bullish gold market, encouraging other central banks to increase their reserves and signaling a potential shift toward a more multipolar financial system where gold reclaims a central role in reserve management. Exporting countries are benefiting from the surge in demand, while global investors are recalibrating their portfolios to include higher allocations to gold and other physical assets.

In this context, gold has emerged not merely as a reactive hedge, but as a proactive instrument of economic strategy. Its value lies not only in market returns but in its function as a symbol of monetary independence, geopolitical resilience, and wealth preservation.

As we move forward, it is clear that China’s gold-buying behavior will continue to exert considerable influence on global markets. Stakeholders—from policymakers and investors to commodity traders and economists—must pay close attention to this strategic pivot. Gold is no longer just a relic of the past; it is rapidly becoming a cornerstone of the future financial landscape, shaped increasingly by China’s evolving vision of global economic sovereignty.

References

- World Gold Council – Gold Demand Trends

https://www.gold.org/goldhub/data/gold-demand-trends - Trading Economics – China Gold Reserves

https://tradingeconomics.com/china/gold-reserves - Reuters – China’s Gold Buying Spree

https://www.reuters.com/markets/commodities/china-gold-imports-rise - Bloomberg – Gold Price Forecast

https://www.bloomberg.com/markets/gold - IMF – Composition of Official Foreign Exchange Reserves (COFER)

https://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4 - Kitco News – Central Bank Gold Demand

https://www.kitco.com/news/ - Financial Times – Yuan Depreciation and Policy Response

https://www.ft.com/content/renminbi-currency-policy - South China Morning Post – Chinese Demand for Physical Gold

https://www.scmp.com/business/china-economy - CNBC – Why Gold Prices Are Surging

https://www.cnbc.com/gold-prices-rising-explainer - Al Jazeera – The Global Push for Reserve Diversification

https://www.aljazeera.com/economy/global-reserve-diversification