China’s EUV Lithography Breakthroughs: Challenging ASML’s Monopoly and Reshaping the Semiconductor Industry

In the world of semiconductor manufacturing, technological advancements play a crucial role in shaping the future of electronics, computing, and communication. One such breakthrough that has revolutionized the industry is Extreme Ultraviolet (EUV) lithography. EUV lithography, the cutting-edge technology used for producing the most advanced semiconductor chips, enables manufacturers to print smaller, more complex circuit patterns on silicon wafers. As the demand for faster, more powerful, and energy-efficient electronics increases, EUV lithography has become indispensable in the production of chips that power modern devices, including smartphones, computers, and artificial intelligence systems.

At the heart of EUV lithography stands ASML, a Dutch company that has maintained a near-monopoly on the development and production of EUV machines. ASML's EUV technology has been the gold standard for several years, and the company is widely regarded as the only firm capable of producing machines that can print the extremely fine features required for cutting-edge semiconductor manufacturing. In recent years, ASML has expanded its dominance in the market, solidifying its position as a key player in the semiconductor industry. The company's EUV machines have enabled manufacturers like TSMC, Samsung, and Intel to produce chips at the forefront of technological innovation.

However, China’s growing ambitions in semiconductor technology and its quest for self-reliance in the sector have created a new challenge for ASML's monopoly. With increasing geopolitical tensions and a strategic push for technological independence, China has focused on advancing its own EUV lithography capabilities. As the world's largest consumer of semiconductors and a significant player in global manufacturing, China’s entry into the EUV market could fundamentally alter the landscape of the semiconductor industry. By developing domestic EUV lithography technology, China seeks to break free from the constraints imposed by foreign suppliers like ASML, reduce its reliance on external sources, and boost its own semiconductor manufacturing capabilities.

This blog post explores China’s ambitious efforts to develop domestic EUV lithography technology, delving into the historical context, technological breakthroughs, potential impact on the global semiconductor market, and the challenges that lie ahead. We will examine how this development could disrupt ASML’s long-standing monopoly and reshape the future of semiconductor manufacturing on a global scale. Additionally, we will look at the implications for the broader technology industry and the geopolitical tensions that accompany such advancements.

Through an exploration of China’s progress in EUV technology, we aim to understand how the nation's quest for self-sufficiency in semiconductor manufacturing could pose a serious challenge to ASML’s position and change the trajectory of the global semiconductor market in the coming years.

China’s Investment in Lithography Technology

Over the past two decades, China has made significant strides in developing its semiconductor industry, aiming to reduce dependence on foreign technology and build a self-sufficient ecosystem. As part of its broader strategy to enhance technological capabilities, the Chinese government has increasingly focused on the critical area of semiconductor manufacturing equipment. Among the most essential components in this domain is lithography technology, particularly EUV lithography, which has become the cornerstone for fabricating the most advanced semiconductor chips.

China’s ambitious push for innovation in this area stems from both economic and strategic imperatives. The country’s massive semiconductor market, which is the largest in the world, has driven the demand for more advanced chips used in everything from mobile phones and consumer electronics to military applications and artificial intelligence. However, the country has long faced challenges in sourcing the most cutting-edge equipment necessary to compete at the global level, with ASML being the sole provider of EUV lithography systems.

To overcome this challenge, China has invested heavily in research, development, and industrial partnerships aimed at producing domestic EUV lithography machines. The government has poured substantial resources into the project through initiatives like the "Made in China 2025" plan, which outlines the country’s goal to achieve technological self-reliance across several critical sectors, including semiconductors. The plan prioritizes the development of semiconductor manufacturing equipment, including photolithography, as one of the key areas of focus. As part of this, the Chinese government has funded numerous research programs, collaborations with domestic academic institutions, and incentives for private companies to contribute to the nation’s semiconductor ambitions.

One of the key players in China’s push for EUV lithography is the National Innovation Center for Semiconductor Equipment (NICS), a state-backed organization dedicated to developing the tools and technologies needed to build advanced semiconductor manufacturing systems. NICS has played a central role in fostering collaboration between Chinese universities, research institutions, and private companies to develop EUV lithography technology that can rival ASML’s. Their goal is not only to create EUV systems capable of producing chips at advanced nodes but also to establish a complete semiconductor supply chain within China.

In addition to government-backed research and development, China’s private sector has also been active in pursuing the goal of self-sufficiency in semiconductor manufacturing. Companies such as SMIC (Semiconductor Manufacturing International Corporation), China’s largest semiconductor foundry, have been working in close partnership with both domestic and foreign researchers to advance photolithography technology. While SMIC has not yet reached the level of sophistication seen in ASML’s EUV systems, the company has made significant progress in developing deep ultraviolet (DUV) and extreme ultraviolet photolithography tools. These tools are essential for smaller node production and have enabled SMIC to produce chips at advanced nodes, although they are not yet capable of fully competing with ASML’s EUV machines.

In parallel, other Chinese tech giants like Huawei and ZTE have been investing in semiconductor technology, albeit facing significant hurdles in sourcing EUV machines due to export restrictions and sanctions. Nonetheless, these companies are working on alternative solutions to secure the necessary equipment and materials to meet their growing demands for advanced chips. Huawei, in particular, has sought to mitigate its reliance on foreign technology by developing in-house alternatives to high-end chip manufacturing and exploring partnerships with countries that have advanced semiconductor capabilities.

Another key aspect of China’s investment strategy is the emphasis on talent development and recruitment. The country has made considerable efforts to attract top semiconductor researchers and engineers, both domestically and from abroad, to accelerate the development of its lithography technology. This talent pool is crucial for advancing China's domestic capabilities in EUV technology and ensuring the long-term success of the country’s semiconductor ambitions.

Despite these efforts, China’s journey to achieving domestic EUV lithography capabilities has been met with numerous challenges. The extreme complexity of EUV systems, which require unprecedented precision in the design and manufacturing of components, has made it difficult for China to match the expertise and technological sophistication of ASML. Key obstacles include the development of high-powered lasers, specialized optics, and advanced materials, all of which are necessary for EUV machines to operate effectively. Moreover, the supply chain for EUV components remains highly specialized and tightly controlled, with few suppliers capable of providing the necessary materials and equipment for the production of EUV machines.

To mitigate these challenges, China has not only focused on homegrown solutions but also sought to build international partnerships with countries that have complementary technologies. For instance, China has expressed interest in collaborating with Russia on semiconductor development and has been negotiating with other nations to access key components that are currently monopolized by ASML and other Western suppliers.

The investment in domestic EUV lithography technology is part of a larger strategy for China to build a world-class semiconductor manufacturing industry, capable of producing cutting-edge chips without relying on foreign sources. While the path to achieving this goal is fraught with challenges, China’s growing investment in research, infrastructure, and talent development is steadily laying the groundwork for future success. As the country continues to invest in innovation and pursue self-sufficiency in semiconductor manufacturing, the race to develop competitive EUV lithography systems could potentially reshape the global semiconductor landscape, challenging ASML’s long-standing dominance.

In conclusion, China’s significant investment in EUV lithography technology marks a pivotal moment in the global semiconductor industry. By investing heavily in research, talent, and industrial collaboration, China aims to reduce its dependence on foreign suppliers and establish a domestic capability in semiconductor manufacturing. While ASML currently holds a dominant position in the market, China’s growing efforts in developing its own EUV systems could disrupt this monopoly and alter the competitive dynamics of the semiconductor market in the years to come.

Technological Breakthroughs – EUV Developments

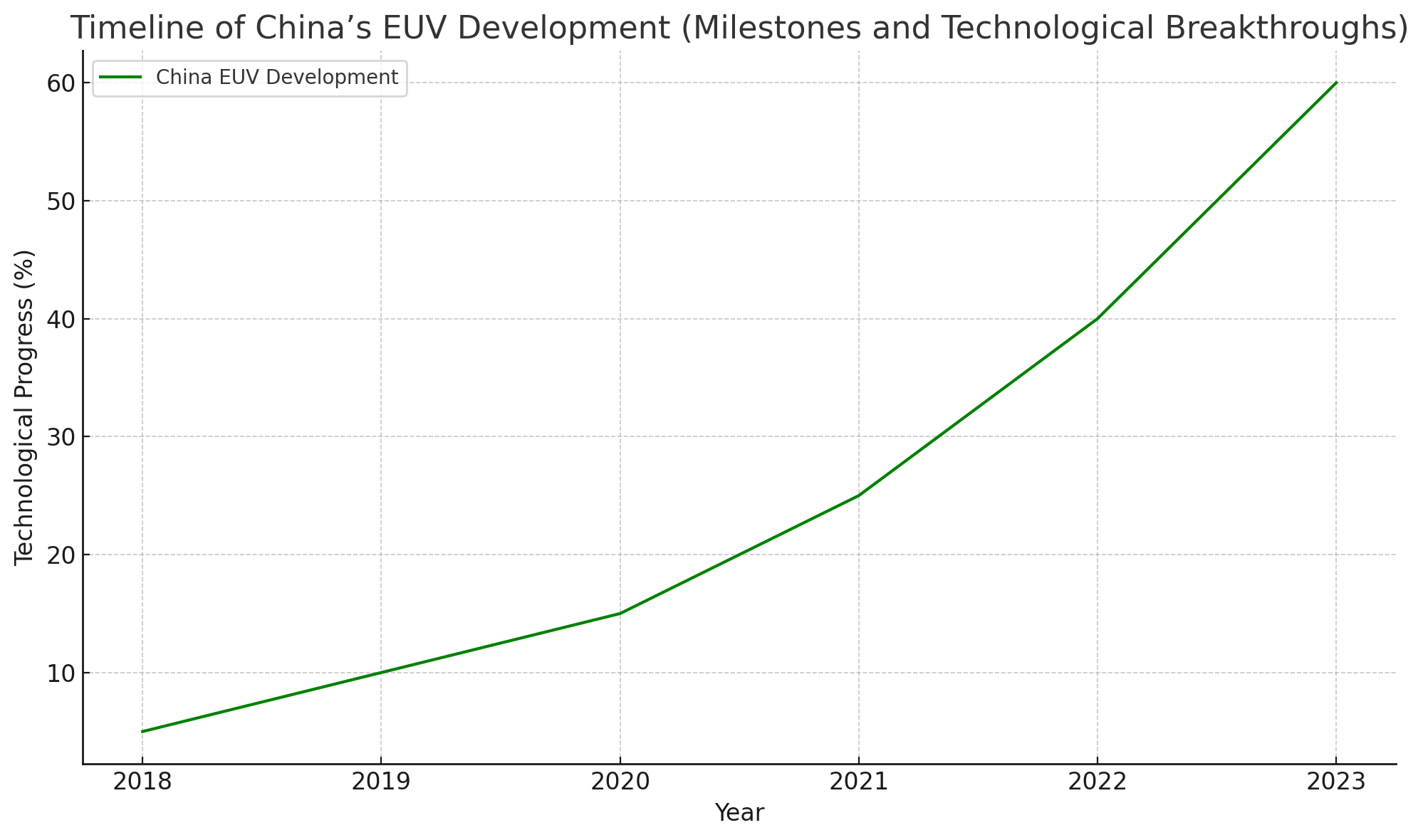

China’s push to develop domestic EUV lithography technology represents one of the most ambitious and complex technological endeavors in the global semiconductor industry. The development of EUV systems requires cutting-edge advancements in several highly specialized fields, including optics, laser technology, materials science, and precision engineering. For China to achieve self-sufficiency in EUV lithography and challenge the long-standing dominance of ASML, it must not only make breakthroughs in these areas but also integrate them into a fully functional and competitive system. Despite the immense challenges, several key technological advancements have been made in China’s pursuit of EUV lithography, positioning the country to take significant strides toward producing advanced semiconductor chips.

Advancements in EUV Source Technology

One of the most critical components of an EUV lithography system is the light source. ASML’s EUV systems use a complex and highly sophisticated laser-produced plasma (LPP) source to generate the extreme ultraviolet light required for lithography. This light has a wavelength of 13.5 nanometers, which is significantly shorter than the deep ultraviolet light used in traditional lithography systems, enabling the production of smaller and more intricate semiconductor features. Developing such a source requires the generation of incredibly high-powered, stable, and continuous light at 13.5 nm, which has proven to be a formidable challenge.

China has made significant progress in developing its own EUV light source. Research institutions and semiconductor companies in China have focused on advancing laser-driven plasma technology, a fundamental component of the EUV source. The primary challenge in this area has been to achieve the necessary energy levels to produce a stable and powerful EUV beam. Chinese researchers have developed innovative approaches to optimize laser pulses and improve the efficiency of plasma generation. Through these advancements, China has been able to demonstrate EUV sources capable of producing the necessary output for semiconductor manufacturing, though they have not yet reached the power levels or stability of ASML’s EUV sources.

China’s progress in this area has been facilitated by the country’s investments in high-powered laser technology, particularly in the development of high-energy excimer lasers, which are essential for driving the plasma used in EUV light generation. Additionally, Chinese companies have been working on developing alternative light sources, such as extreme ultraviolet free-electron lasers (EUV-FEL), which could eventually offer more stable and powerful light for EUV lithography systems. Although these sources are still in the experimental phase, they represent a promising area of research that could play a key role in the future of China’s EUV development.

Development of EUV Optics

The optics used in EUV lithography systems are another critical technological challenge that China has been working to address. EUV lithography requires highly specialized mirrors and lenses that can focus and direct extreme ultraviolet light with unparalleled precision. Due to the short wavelength of EUV light, traditional optical materials and coatings are not suitable. This has led to the development of reflective optics that are made from materials such as multilayered coatings of molybdenum and silicon. These mirrors must be manufactured to an extreme degree of precision, as any imperfections can significantly affect the resolution of the final pattern on the wafer.

China has made notable advancements in the development of EUV optics. The country’s optics manufacturers have worked to develop the required multilayer coatings, as well as the precision manufacturing techniques necessary to produce mirrors capable of handling EUV wavelengths. Collaborations with domestic research institutions have helped China refine these manufacturing processes and achieve higher levels of optical precision. While Chinese optics are still behind ASML in terms of quality and reliability, the progress made in recent years suggests that China is closing the technological gap.

In particular, China has developed a range of multilayer coatings with improved reflectivity, which has been one of the major challenges in EUV optics development. Additionally, China’s advancements in the production of high-precision reflective mirrors are critical to achieving the necessary resolution for advanced semiconductor nodes. While these optics are still in the early stages of deployment, they represent a key milestone in the development of China’s EUV lithography capabilities.

Advancements in Wafer Stage and Precision Alignment

Another essential component of an EUV lithography machine is the wafer stage, which is responsible for moving the semiconductor wafer with extreme precision during the exposure process. The wafer stage must be capable of positioning the wafer within nanometer-level tolerances to ensure that the light from the EUV source is accurately projected onto the wafer. Achieving this level of precision requires highly advanced motion control systems, sophisticated metrology, and feedback mechanisms.

China has made significant progress in developing advanced motion control systems for its EUV machines. Researchers have focused on improving the precision and stability of wafer stage movements, utilizing cutting-edge technologies such as air bearings, magnetic levitation, and ultra-precise laser interferometry. These systems ensure that the wafer is positioned with nanometer accuracy, enabling the creation of intricate chip designs. China has also made advancements in real-time alignment and metrology systems, which allow for continuous monitoring and adjustment during the lithography process.

In addition to the development of wafer stage technology, Chinese researchers have focused on enhancing the overall alignment of the entire lithography system. Alignment is crucial in EUV lithography, as even minor misalignments can result in defects on the final chip. China has made strides in developing advanced alignment systems that ensure precise synchronization between the light source, optics, and wafer stage, further bringing the country closer to achieving competitive EUV systems.

Materials Innovation for EUV Lithography

The materials used in EUV lithography are also a critical area of development for China. EUV lithography requires highly specialized materials for the photomasks, resists, and substrates used in the production process. Photomasks, which contain the chip design patterns, must be able to withstand the intense energy of the EUV light without degrading, while resists must be capable of responding to the EUV exposure to form the intricate patterns required for semiconductor fabrication.

China has made substantial progress in the development of EUV-specific materials. Researchers have focused on developing new types of resists that are more sensitive to EUV light, as traditional resists used in deep ultraviolet lithography are not suitable for EUV. Additionally, China has invested in the development of high-quality photomasks and substrates that can withstand the intense conditions in the EUV process. While these materials are still in the early stages of commercialization, their development represents a critical step in ensuring that China can produce competitive EUV systems capable of fabricating advanced chips.

The Road Ahead

While China’s technological breakthroughs in EUV lithography are promising, significant hurdles remain. The country has made important strides in developing key components such as light sources, optics, wafer stages, and materials, but it is still in the early stages of producing fully functional EUV systems. To truly compete with ASML, China will need to continue making progress in these areas while also overcoming the challenges of scaling up production, ensuring reliability, and achieving the extreme precision required for semiconductor manufacturing at the smallest nodes.

Nevertheless, China’s advancements in EUV lithography technology are indicative of the country’s growing capabilities in semiconductor manufacturing and its determination to challenge the dominance of ASML. As the country continues to invest in research and development, it is likely that we will see further breakthroughs in the coming years, bringing China closer to achieving self-sufficiency in semiconductor manufacturing and reshaping the global market for EUV technology.

Impact on the Global Semiconductor Market

The development of domestic EUV lithography technology by China has far-reaching implications for the global semiconductor market. ASML has long been the undisputed leader in the field of EUV lithography, with its machines providing the means to produce the most advanced semiconductor chips for industries ranging from consumer electronics to artificial intelligence. However, China’s entry into this high-tech domain is poised to disrupt the dynamics of the semiconductor supply chain, particularly in terms of competition, supply chain resilience, and geopolitical influence.

As China continues to develop its own EUV lithography capabilities, the global semiconductor market is likely to experience shifts in several key areas. These shifts include changes in market competition, supply chain structure, pricing dynamics, and geopolitical tensions, all of which will have significant ramifications for both industry players and governments. In this section, we will explore the potential consequences of China’s EUV technology advancements on the global semiconductor market.

Disruption of ASML’s Market Dominance

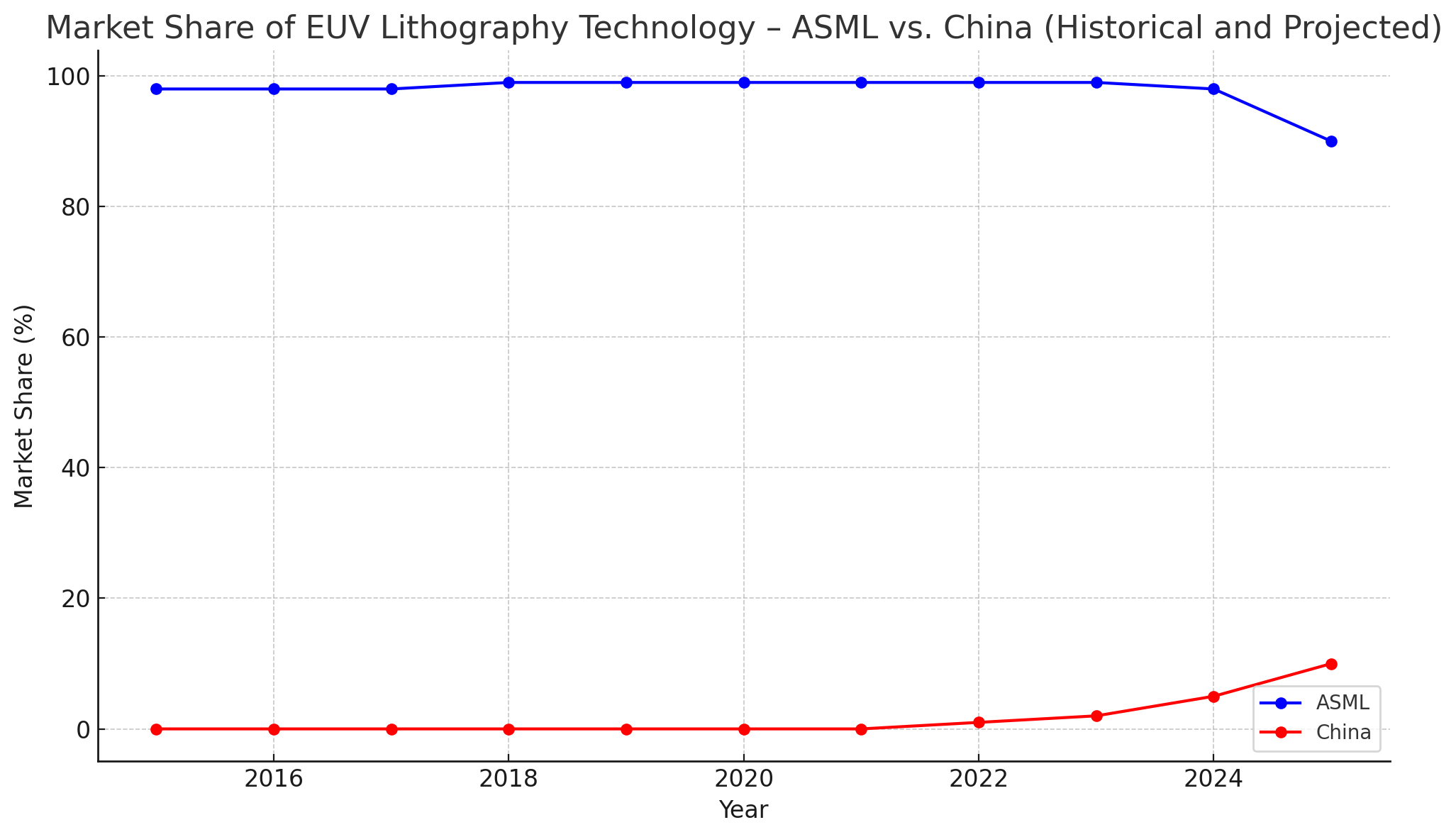

ASML has held a near-monopoly in the field of EUV lithography for nearly two decades. Its machines are essential for manufacturing chips at the smallest nodes—currently 5 nanometers and below—used in everything from high-performance computing and telecommunications to consumer electronics and automotive systems. With no direct competitors in the EUV market, ASML has maintained control over the pricing and availability of this critical technology.

However, China’s progress in developing its own EUV lithography technology introduces a formidable challenge to ASML’s dominance. While China’s machines may not yet match ASML’s in terms of performance and reliability, the mere fact that China is developing competitive alternatives could lead to increased competition. This competition could force ASML to adjust its pricing strategies, offer more favorable terms to customers, or accelerate its own technological advancements to maintain its lead.

In the long term, as China fine-tunes its EUV systems and gains more experience with large-scale manufacturing, the competition between Chinese-made and ASML-produced EUV machines could shift from a monopoly to a more balanced market with multiple players. This diversification in the EUV lithography market could foster a more competitive environment, benefiting semiconductor manufacturers by providing them with alternative sources of high-end lithography equipment.

Shifting Geopolitical Dynamics and Supply Chain Resilience

China’s development of EUV lithography technology has significant geopolitical implications. The ongoing trade tensions between China and the United States, as well as other Western countries, have already made the semiconductor industry a focal point of global competition. ASML, a Dutch company, is caught in the crossfire of this geopolitical rivalry, as the U.S. has imposed strict export restrictions on the sale of semiconductor manufacturing equipment to China, particularly high-end tools like those used in EUV lithography.

If China successfully develops its own EUV technology, it would reduce its reliance on Western suppliers and mitigate the impact of export restrictions. This would enhance the resilience of China’s semiconductor supply chain, allowing the country to produce advanced chips domestically without being subject to geopolitical pressure from foreign governments. In turn, this could lead to a realignment of global supply chains, with China becoming less dependent on the West for critical semiconductor manufacturing tools.

For countries and companies outside of China, the emergence of China’s EUV lithography technology could prompt a reevaluation of supply chain strategies. Manufacturers in the West and other regions may look to diversify their sources of lithography equipment to avoid over-reliance on a single supplier, particularly if tensions between China and the West continue to escalate. In this context, Chinese-made EUV machines could offer a viable alternative to ASML’s products, especially in markets where geopolitical considerations are increasingly important.

Price Pressure and Cost Reduction for Semiconductor Manufacturers

One of the most immediate impacts of China’s EUV developments will be on pricing. ASML has faced little competition in the EUV market, which has allowed it to set high prices for its machines. These high costs are passed on to semiconductor manufacturers, who must invest significant capital in acquiring and maintaining EUV lithography systems. The price of a single ASML EUV machine can exceed $150 million, creating a barrier for many companies, particularly smaller foundries and chipmakers.

The introduction of domestic EUV technology from China could disrupt this pricing structure. As China’s capabilities in EUV lithography improve, the cost of Chinese-made EUV machines may be lower than ASML’s, offering a more affordable option for semiconductor manufacturers. This price competition could force ASML to reduce its prices or offer more flexible financing options to maintain its market share. Such cost reductions would benefit semiconductor manufacturers by lowering their capital expenditures, which could, in turn, lead to lower prices for end consumers and greater investment in advanced semiconductor technology.

In addition to price competition, China’s entry into the market could drive innovation and efficiency improvements within the EUV lithography sector. Increased competition between ASML and Chinese manufacturers could push both companies to invest more heavily in research and development, leading to faster advancements in EUV technology and further cost reductions over time. This could ultimately result in more cost-effective and efficient EUV machines, benefiting the entire semiconductor manufacturing ecosystem.

Potential Impact on Global Semiconductor Supply

The global semiconductor industry is already grappling with supply shortages, exacerbated by the COVID-19 pandemic and subsequent disruptions in the supply chain. The rise of China’s domestic EUV lithography technology could help alleviate some of these challenges by providing an additional source of equipment for semiconductor manufacturers. As China scales up its production of EUV machines, it could help meet the growing demand for advanced chips in key markets such as telecommunications, automotive, and high-performance computing.

Furthermore, if China’s EUV technology becomes commercially viable at scale, it could attract more investment in China’s semiconductor manufacturing sector, leading to the establishment of more chip production facilities. This expansion would diversify the global semiconductor supply base, reducing the dependence on a few countries and companies for advanced semiconductor production. By increasing the supply of EUV lithography machines, China could play a pivotal role in meeting global demand for advanced chips and mitigating the risks of supply chain disruptions.

Long-Term Implications for Innovation and Global Competitiveness

Looking ahead, China’s advancements in EUV lithography technology could have broader implications for global innovation in semiconductor manufacturing. The growing competition between China and ASML would encourage both parties to continue pushing the boundaries of what is technologically possible in EUV lithography, accelerating progress in areas such as resolution, throughput, and energy efficiency. This competitive dynamic could lead to the development of even more advanced lithography techniques, such as high-NA (numerical aperture) EUV, which promises to push semiconductor fabrication to even smaller nodes.

Additionally, the emergence of China as a competitive player in the EUV market could stimulate further innovation across the entire semiconductor supply chain. Companies involved in materials science, wafer production, and chip design may be encouraged to develop new technologies that can take full advantage of the capabilities of advanced EUV machines. As China’s semiconductor sector continues to grow, its technological advancements could drive global progress and further reshape the semiconductor landscape.

A Shifting Landscape

China’s development of domestic EUV lithography technology is poised to have a transformative impact on the global semiconductor market. The potential disruption of ASML’s monopoly, the reshaping of supply chains, and the reduction in equipment costs could change the dynamics of semiconductor manufacturing on a global scale. As China continues to refine its EUV capabilities and integrate them into its semiconductor ecosystem, the market will likely witness increased competition, enhanced supply chain resilience, and greater innovation. While ASML’s market dominance remains intact for the moment, the rise of China’s EUV technology marks a new era in semiconductor manufacturing, one in which multiple players are vying for dominance and the landscape of global competition continues to evolve.

Future Outlook and Challenges

The rapid pace of development in China’s domestic EUV lithography technology presents both significant opportunities and formidable challenges for the country’s semiconductor ambitions. As China continues to invest in advancing its capabilities in EUV lithography, the future outlook for its semiconductor industry appears promising, with the potential to reshape global competition and supply chains. However, despite the progress made so far, the path ahead remains fraught with challenges, ranging from technological hurdles to geopolitical tensions and market acceptance.

This section will explore the future prospects of China’s EUV lithography development, examining the opportunities it presents as well as the key challenges that must be overcome for China to become a major player in the global EUV lithography market. By understanding these dynamics, we can better assess how China’s efforts will impact the future of semiconductor manufacturing and its role in the broader technology landscape.

The Road to Commercial Viability: Scaling Up Production

While China has made significant strides in developing its own EUV lithography technology, the commercial viability of Chinese-made EUV machines remains a critical factor in determining the future success of its semiconductor sector. ASML has invested years of research and development into perfecting its EUV machines, which are highly sophisticated and require extreme precision to function effectively. As China moves forward with its own EUV lithography systems, it must address several key issues before these machines can compete on an equal footing with ASML’s offerings.

One of the major challenges China faces is scaling up its EUV production to meet the demands of semiconductor manufacturers. The development of EUV machines is a complex process that involves the integration of numerous components, each of which must be manufactured to exacting standards. This requires an advanced supply chain, a highly skilled workforce, and a long-term investment in infrastructure. Scaling up production will require not only improvements in technology but also the establishment of a robust ecosystem that can support the volume production of EUV lithography machines.

China must also address the issue of reliability. EUV lithography systems are used in highly demanding environments, where even the slightest defect can compromise the quality of semiconductor chips. For Chinese-made EUV machines to be widely adopted by semiconductor foundries, they must demonstrate the same level of performance, precision, and reliability as ASML’s machines. This will require continued refinement of the core technology, rigorous testing, and validation in real-world manufacturing settings.

Technological Advancements: Meeting Global Standards

Another major challenge for China is ensuring that its EUV lithography technology meets the exacting standards required for advanced semiconductor manufacturing. ASML’s EUV machines are currently the most advanced in the world, enabling semiconductor manufacturers to produce chips at the smallest nodes (5nm and below). These chips are crucial for industries such as artificial intelligence, telecommunications, and high-performance computing. To remain competitive, China’s EUV systems must be capable of producing chips at these advanced nodes with the same level of precision, throughput, and yield as ASML’s machines.

China’s EUV technology is still in the early stages of development, and while the country has made significant progress, there is a considerable gap between Chinese-made systems and those of ASML. In particular, the light source technology and optics used in Chinese EUV machines are not yet at the same level of sophistication and efficiency as those employed by ASML. Additionally, while China has made progress in improving wafer stage technology and alignment systems, it still faces challenges in ensuring the precision required for the most advanced manufacturing processes.

To overcome these challenges, China will need to continue investing heavily in research and development, focusing on critical areas such as EUV light source power, optics, and materials innovation. Collaborations with international research institutions and partnerships with semiconductor manufacturers may also play a key role in accelerating technological advancements. If China can overcome these technological hurdles, it could develop EUV systems that are competitive with ASML’s offerings, thus reducing its dependence on foreign suppliers.

Geopolitical and Trade Considerations

Beyond the technological challenges, China’s efforts to develop domestic EUV lithography technology are also influenced by geopolitical factors. The ongoing trade tensions between China and the United States, as well as between China and other Western countries, have made it increasingly difficult for China to access the critical components and technologies required for semiconductor manufacturing. Export controls and sanctions have been a significant obstacle for China, as many of the key materials and components used in EUV machines are sourced from Western countries. These restrictions have hindered China’s ability to acquire the advanced technologies necessary for developing its own EUV systems.

For instance, key suppliers of high-end components such as photomasks, resist materials, and certain optical coatings are predominantly based in the United States, Japan, and the European Union. These suppliers have long been critical to the success of EUV lithography, and the inability to access these materials has placed China at a significant disadvantage. While China has made progress in developing alternative sources for some of these components, the complexity and specialized nature of EUV manufacturing make it difficult to substitute Western suppliers completely.

Furthermore, geopolitical tensions surrounding China’s semiconductor ambitions could lead to further restrictions and trade barriers, which may complicate China’s path to developing fully functional EUV lithography systems. As the geopolitical landscape evolves, China will need to navigate these challenges while continuing to develop its technological capabilities in EUV lithography. This may involve seeking alternative international partnerships or accelerating domestic production of critical components.

The Role of International Collaboration and Market Adoption

While China’s ambitions to develop domestic EUV lithography technology are primarily driven by a desire for self-sufficiency, international collaboration will be an essential factor in the country’s success. Semiconductor manufacturing is a highly complex and collaborative process, with players across the globe contributing to the development of key technologies and components. For China to compete effectively in the EUV market, it will need to forge partnerships with international research institutions, technology providers, and semiconductor manufacturers.

Collaboration in the areas of materials science, optics, and light source technology will be crucial to ensuring that China’s EUV machines can meet the high standards required for mass semiconductor production. Additionally, partnerships with semiconductor foundries and chipmakers will be essential to ensuring that China’s EUV lithography systems are adopted by the industry. As the global semiconductor market evolves, Chinese-made EUV machines will need to prove themselves in real-world manufacturing settings, demonstrating their ability to meet the needs of semiconductor manufacturers in terms of cost, performance, and reliability.

Furthermore, the success of China’s EUV lithography technology will depend on its ability to meet the market’s growing demand for smaller and more powerful semiconductor chips. As the need for advanced chips continues to rise, China must ensure that its EUV systems can deliver the high-resolution capabilities required to produce these chips efficiently and cost-effectively.

Long-Term Prospects: A Competitive and Diversified Market

Looking ahead, the future of China’s EUV lithography development is promising, but its success will depend on overcoming a series of challenges. If China can address the technological, geopolitical, and market adoption hurdles outlined above, it has the potential to become a serious competitor to ASML in the global EUV market. The diversification of suppliers in this critical sector would benefit the semiconductor industry, providing manufacturers with greater flexibility, resilience, and access to cutting-edge technology.

In the long run, China’s advancements in EUV lithography could lead to a more competitive and balanced semiconductor manufacturing ecosystem, where multiple players contribute to the production of the most advanced semiconductor chips. This would not only reduce reliance on a single supplier but also drive innovation and cost reductions in the industry.

As the semiconductor landscape evolves, the race to develop next-generation EUV technology will continue to accelerate. China’s growing capabilities in this area represent a pivotal moment in the evolution of semiconductor manufacturing, with the potential to reshape the industry for years to come. While the challenges are significant, the opportunities for China to become a key player in EUV lithography are equally vast, and the country’s continued investment in this field could mark the beginning of a new era in semiconductor manufacturing.

References

- https://www.semanticscholar.org/paper/EUV-Lithography-A-Review-of-Technologies-and-Challenges/4eb8c8e4b83a004c4379f5f6d31eb7b9c1f89cda

- https://www.forbes.com/sites/forbestechcouncil/2021/04/29/the-future-of-lithography-technology-what-you-need-to-know/

- https://www.sciencedirect.com/science/article/pii/S2351978919302899

- https://www.reuters.com/article/us-china-semiconductors-idUSKCN1VV0M2

- https://www.sme.org/technologies/articles/2021/january/how-euv-lithography-is-shaping-the-future-of-semiconductor-manufacturing/

- https://www.thedailystar.net/opinion/news/china-breaks-asmls-monopoly-1963443

- https://www.eetimes.com/china-seeks-self-reliance-in-semiconductors-and-euv-lithography/

- https://www.theverge.com/2021/3/17/22336791/china-advances-in-chip-manufacturing-euv-technology-competition-asml

- https://www.bbc.com/news/technology-53216050

- https://www.digitaltrends.com/news/china-aims-to-break-asmls-monopoly-in-chip-manufacturing/