CATL’s $25B IPO Marks Global Milestone in Battery Innovation and Green Tech Expansion

In the dynamic and rapidly evolving global energy landscape, few companies have captured the imagination of investors and industry stakeholders quite like Contemporary Amperex Technology Co. Limited (CATL). As the world’s leading manufacturer of lithium-ion batteries, CATL has not only established itself as a linchpin in the electric vehicle (EV) supply chain but has also become emblematic of China's dominance in clean energy technologies. In a move that underscores its strategic importance and financial muscle, CATL is preparing to launch what is being heralded as the world’s largest initial public offering (IPO) of 2025, guiding its IPO price at the top end of its range amid robust demand and bullish market sentiment.

The announcement has sent ripples through global financial markets. With institutional investors jostling for allocations and retail enthusiasm surging across Asia and beyond, the IPO is poised to raise tens of billions of dollars. This momentous event is not merely a reflection of CATL’s market capitalization or product leadership; it is a powerful signal of confidence in the broader electrification and energy storage revolution sweeping across the globe. The successful pricing at the top end of the guided range suggests not only strong investor appetite but also a renewed optimism in growth-oriented technology and green energy sectors—domains that CATL has helped define and expand over the last decade.

Founded in 2011 and headquartered in Ningde, Fujian Province, CATL has rapidly ascended the global leaderboard of battery manufacturers. Through a combination of cutting-edge research, expansive production capabilities, and a client roster that includes marquee names such as Tesla, BMW, and Hyundai, CATL has positioned itself as a foundational player in the decarbonization of transportation and grid systems. As nations accelerate their timelines for phasing out internal combustion engines and invest heavily in renewable energy infrastructure, the strategic value of battery suppliers like CATL has surged. Investors, aware of this inflection point, are now keen to participate in CATL’s next phase of growth.

This IPO is more than just a capital-raising exercise—it is a defining moment for China’s technology and manufacturing sectors. It demonstrates the country’s maturing equity markets and growing appetite for innovation-driven listings, even amid a cautious global macroeconomic environment. The fact that CATL has been able to attract such significant international interest for its offering also highlights the strategic balancing act it must perform: to maintain its growth momentum and global market share while navigating complex geopolitical tensions, regulatory scrutiny, and intensifying competition from U.S., European, and South Korean rivals.

The decision to guide the IPO price at the top of the band is particularly telling. It signals the company’s confidence in its valuation and long-term prospects, despite market volatility and investor concerns over rising material costs, supply chain constraints, and environmental compliance pressures. It also reflects CATL’s carefully crafted narrative: that it is not just a battery manufacturer but a vertically integrated energy solutions provider with a robust pipeline of innovations, including solid-state batteries, second-life battery applications, and advanced grid storage solutions.

This blog post will explore the significance of CATL’s IPO from multiple dimensions. We will begin with an examination of the company’s pivotal role in the global battery supply chain and its evolving business model. We will then delve into the technical and financial details of the IPO, including valuation metrics, pricing strategy, and comparative analysis with other major listings in recent history. The third section will assess the broader implications of this IPO on global energy markets, the EV sector, and supply chain realignments. We will then analyze the post-IPO landscape, highlighting both the risks and opportunities CATL will face in an increasingly competitive environment. Finally, we will conclude by reflecting on the long-term significance of this historic offering for green technology, capital markets, and the global economy.

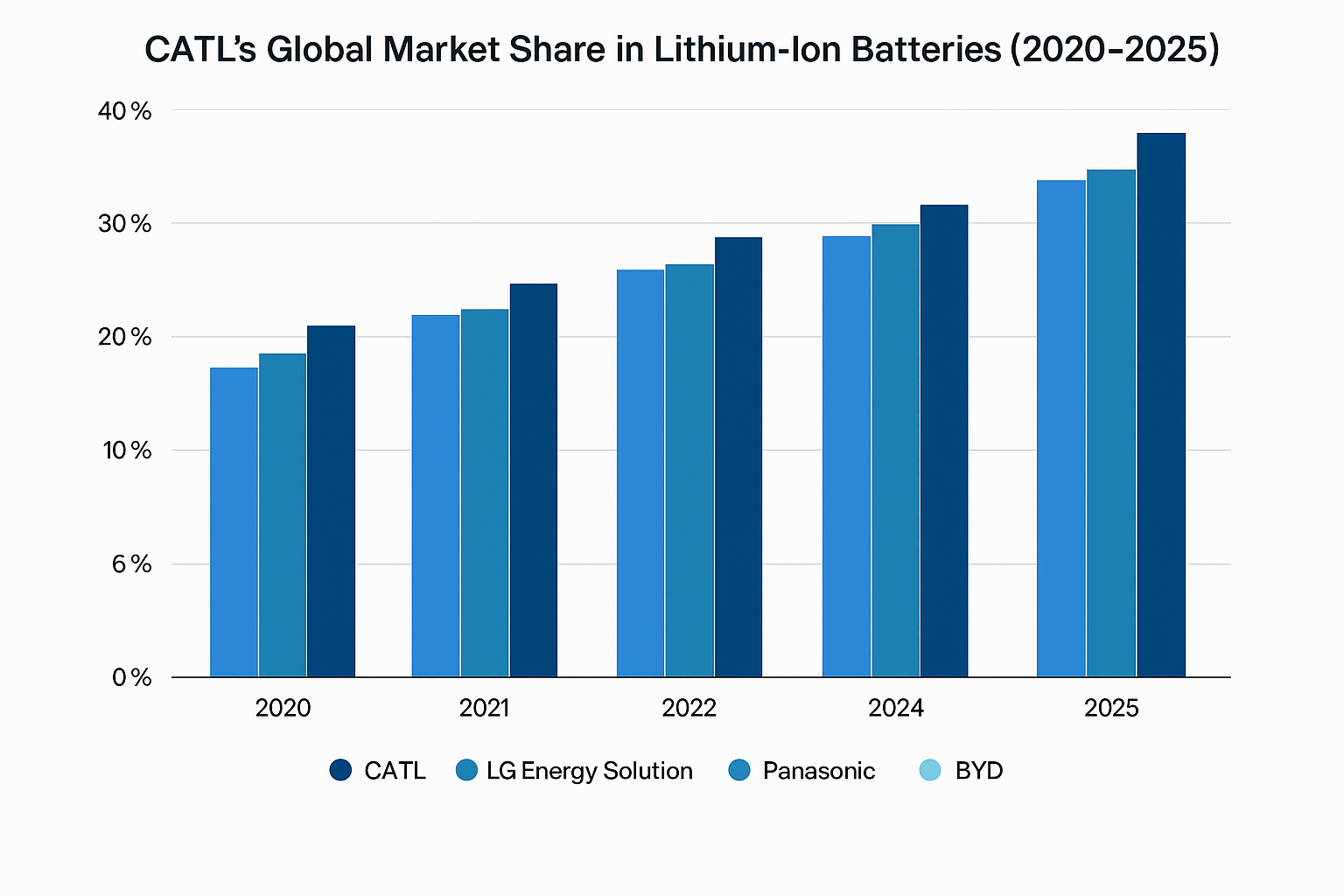

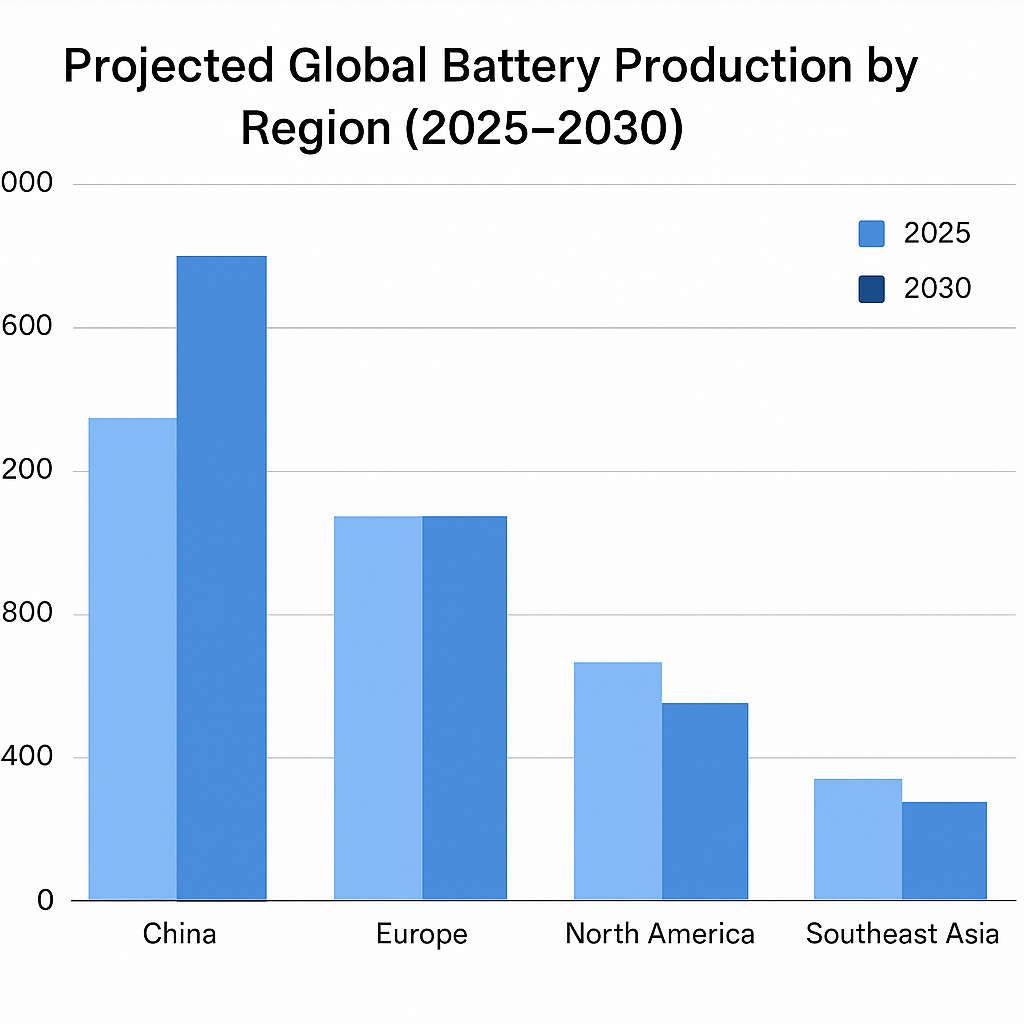

In addition to comprehensive analysis and commentary, this blog will also feature two informative charts and one comparative table. These visuals will offer insights into CATL’s market trajectory, IPO comparisons with other industry leaders, and future projections for global battery demand segmented by region. The goal is to provide readers—whether industry analysts, retail investors, policymakers, or technology enthusiasts—with a holistic view of what this IPO represents, not only for CATL but also for the future of sustainable innovation.

As we navigate this landmark financial event, one thing is abundantly clear: CATL’s IPO is not just a fundraising milestone—it is a defining moment for the future of energy.

CATL’s Strategic Position in the Global Battery Ecosystem

Contemporary Amperex Technology Co. Limited (CATL) has emerged as a pivotal player in the global transition to clean energy, occupying a strategic position within the lithium-ion battery value chain. As governments, automotive manufacturers, and technology firms aggressively pivot toward electrification and sustainability, CATL’s role has become increasingly central—not only as a supplier of battery cells but as a vertically integrated solutions provider spanning materials, manufacturing, recycling, and energy storage systems. The company’s strategic positioning is not incidental; it is the product of a decade-long investment in innovation, scale, partnerships, and geopolitical navigation.

A Global Leader by Design

Founded in 2011 as a spin-off from ATL (Amperex Technology Limited), CATL was early to recognize the scale and scope of the energy transition. At a time when lithium-ion batteries were primarily used in consumer electronics, the company foresaw their transformative potential in electric vehicles (EVs), renewable energy storage, and industrial applications. By 2017, CATL had already surpassed Panasonic and LG Chem in total battery production for EVs, and by 2020, it had captured over 30% of the global EV battery market. As of 2025, it remains the world’s largest lithium-ion battery producer, supplying over 250 GWh annually and servicing clients in more than 20 countries.

CATL’s dominance is underpinned by several key factors: its vast production capacity, vertically integrated supply chain, early investment in technology, and strong alignment with China’s industrial policy. The company’s manufacturing footprint spans multiple provinces in China and includes strategic overseas expansions in Germany, Thailand, and Indonesia. This geographic diversification enables CATL to reduce supply chain friction, localize production in key markets, and maintain resilience in the face of rising protectionism and trade barriers.

Technological Innovation as a Strategic Asset

In an industry defined by rapid innovation and volatile raw material markets, CATL’s commitment to research and development is both a differentiator and a competitive moat. The company invests over 7% of its annual revenue into R&D, funding a team of over 15,000 engineers and scientists focused on areas such as high-energy-density chemistries, fast-charging capabilities, battery management systems, and solid-state battery prototypes.

Notable breakthroughs include CATL’s “Qilin” battery, unveiled in 2022, which offers up to 255 Wh/kg energy density—outperforming many conventional lithium iron phosphate (LFP) cells. The company is also exploring sodium-ion batteries for grid storage and two-wheeled vehicles, as well as modular “battery-as-a-service” platforms that enable EV users to swap or lease batteries instead of purchasing them outright.

Through these innovations, CATL not only meets current market demands but shapes the future trajectory of battery technology. Its patents, licensing agreements, and collaborations with automotive OEMs ensure that it remains embedded in the product development cycle of next-generation electric vehicles and smart energy systems.

Supply Chain Sovereignty and Resource Strategy

Another cornerstone of CATL’s strategic position is its proactive resource strategy. The global battery ecosystem is increasingly constrained by limited supplies of lithium, cobalt, nickel, and manganese—critical inputs for battery production. CATL has responded by building a portfolio of mining rights, offtake agreements, and joint ventures across Latin America, Africa, and Southeast Asia.

Its acquisition of a significant stake in Pilbara Minerals (Australia), investment in lithium mining projects in Argentina, and partnerships in cobalt extraction in the Democratic Republic of Congo exemplify a vertically integrated approach designed to secure long-term access to scarce materials. This control over upstream resources enhances CATL’s cost competitiveness and insulates it from supply disruptions, while allowing it to support sustainable sourcing through traceability programs and ESG compliance.

Moreover, the company has taken significant steps toward a closed-loop battery economy. It operates several recycling facilities in China and has invested in startups focused on second-life battery applications, enabling it to reduce reliance on virgin materials and capture additional value from end-of-life products.

Strategic Partnerships and Global Client Base

CATL’s role in the battery ecosystem is amplified by its client portfolio, which reads like a who’s who of the global automotive industry. The company supplies battery packs and modules to major EV manufacturers, including Tesla, BMW, Mercedes-Benz, Hyundai, Ford, and NIO. These partnerships are not limited to transactional supply agreements; in many cases, CATL co-develops battery solutions, integrates into vehicle platforms, and shares intellectual property.

One illustrative example is its long-standing collaboration with Tesla. CATL’s LFP batteries are widely used in Tesla’s Model 3 and Model Y vehicles sold in Asia and Europe. The partnership has expanded over time to include supply chain integration and localized production in Tesla’s Shanghai Gigafactory. Similarly, CATL’s agreement with BMW includes the establishment of a joint battery manufacturing facility in Erfurt, Germany, aimed at supplying the automaker’s upcoming EV models in Europe.

These relationships confer multiple strategic advantages. First, they ensure consistent demand and production visibility for CATL. Second, they enable the company to embed itself in the early stages of vehicle design and development. Third, they provide a platform for CATL to expand its global footprint, leveraging client factories and distribution networks to scale internationally.

Alignment with National Policy and Global Trends

CATL’s rise has occurred in parallel with China’s strategic push to lead in new energy technologies. Supported by national subsidies, favorable industrial policies, and infrastructure investment, CATL has benefited from a domestic environment highly conducive to rapid growth. The company’s IPO timing aligns with broader efforts by Chinese regulators to strengthen capital markets and elevate national champions with global reach.

On the international stage, CATL’s strategy is also well-aligned with global decarbonization efforts. The 2020s are characterized by the global push toward net-zero emissions, the phasing out of internal combustion engines, and the need for scalable energy storage solutions to support intermittent renewables. As governments from the European Union to India introduce incentives for battery manufacturing and EV adoption, CATL is strategically positioned to benefit from both policy and market tailwinds.

The company is also participating in global climate dialogues and international sustainability platforms. It has pledged to achieve carbon neutrality in its operations by 2040 and is investing in green manufacturing practices, such as low-carbon aluminum, closed-loop water systems, and renewable-powered factories.

Reinforcing the Ecosystem Through Ecosystem Leadership

Beyond its direct operations, CATL exerts a broad influence over the global battery ecosystem through its role as an anchor institution. It invests in upstream and downstream startups, collaborates with academic institutions, and serves as a standard-setter in safety protocols and testing methodologies. Its active participation in international standard bodies and research consortia ensures that it can shape the rules of engagement for emerging battery technologies and regulations.

Moreover, CATL is expanding its reach beyond mobility. It has launched solutions for grid-scale energy storage, industrial power backup, and residential battery systems—diversifying its revenue streams and extending its influence into the broader energy transition.

The IPO Mechanics – Valuation, Price Guidance, and Investor Appetite

The announcement that Contemporary Amperex Technology Co. Limited (CATL) will guide its initial public offering (IPO) price at the upper end of its valuation range represents not only a landmark financial event for 2025 but also a signal of profound investor confidence in the company’s long-term vision. As global capital markets remain selective amid macroeconomic uncertainty, the strong interest CATL has garnered across institutional and retail segments underscores its reputation as a high-quality, future-focused industrial champion.

This section dissects the technical mechanics of CATL’s IPO—covering the valuation metrics, pricing strategy, demand profile, and comparative context within the pantheon of historic listings. It also evaluates investor sentiment, regulatory considerations, and the broader implications for Chinese capital markets and green tech investment.

IPO Structure and Price Guidance

According to regulatory filings and company disclosures, CATL’s IPO—expected to raise upwards of $25 billion—will take place on the Shanghai STAR Market, China’s Nasdaq-style bourse focused on innovation-driven enterprises. The firm is offering approximately 1.8 billion shares, representing about 15% of its post-offering equity, with the final offering price guided toward the upper end of a ¥165 to ¥180 range per share (approximately $22 to $24 USD).

The decision to price aggressively suggests confidence in robust demand and strong underlying fundamentals. The guided valuation at the top end places CATL’s post-money market capitalization in excess of $170 billion, making it one of the largest IPOs in global history—and the largest of 2025 by a considerable margin. This strategic pricing also reflects the company’s desire to project strength and capitalize on positive momentum in the clean energy and electric vehicle (EV) sectors.

Notably, the offering includes both primary and secondary components. A portion of the proceeds will be used for expanding battery production facilities, investing in next-generation battery chemistries, and vertically integrating raw material supply chains. The secondary tranche, consisting of shares sold by existing shareholders including early-stage venture investors, provides liquidity and reflects a carefully balanced approach to capital mobilization.

Valuation Metrics and Financial Fundamentals

CATL’s valuation has attracted significant scrutiny and admiration in equal measure. Analysts have noted that the company is being priced at a forward price-to-earnings (P/E) ratio of roughly 55x, based on projected 2025 earnings. While this figure is considerably higher than traditional industrial companies, it is consistent with other clean tech and innovation leaders in the global equity market—particularly those with high-margin, high-growth trajectories.

From a fundamentals perspective, CATL’s financial performance supports its elevated valuation. In the fiscal year 2024, the company reported:

- Revenues exceeding $70 billion, driven by strong EV battery demand and energy storage projects.

- Net profit of approximately $6.2 billion, up 18% year-on-year.

- Operating margin of 17.4%, highlighting robust cost management and pricing power.

- R&D expenditures of over $5 billion, reflecting its commitment to innovation.

The company’s balance sheet is strong, with a low debt-to-equity ratio and substantial cash reserves, which it aims to further bolster through the IPO. Importantly, analysts project sustained double-digit growth in both revenue and profit for the next five years, as battery demand accelerates in both developed and emerging markets.

Investor Appetite: Institutional and Retail Demand

Investor enthusiasm for CATL’s IPO has reached unprecedented levels. During the book-building process, the offering was more than 25 times oversubscribed, with participation from a diverse range of institutional investors including sovereign wealth funds, pension funds, ESG-aligned asset managers, and major Chinese brokerage houses. Among the high-profile participants are global funds such as Norway’s Government Pension Fund Global, Singapore’s GIC, and BlackRock’s Clean Energy Fund.

One of the key factors driving this strong demand is CATL’s strategic importance in the global decarbonization narrative. As governments and corporations alike pursue aggressive net-zero commitments, access to scalable, high-performance battery technologies has become mission-critical. Investors view CATL not just as a battery company but as a cornerstone enabler of the green transition.

Retail demand has also been notably strong, buoyed by national pride in CATL’s rise as a Chinese tech champion and the broader enthusiasm around EV adoption. On the Shanghai STAR Market, where retail participation is robust, individual investors submitted orders totaling more than $100 billion USD equivalent during the initial subscription window.

Regulatory Support and Government Signaling

The regulatory and political environment surrounding CATL’s IPO has been overwhelmingly supportive. Chinese financial authorities, eager to deepen domestic capital markets and promote local innovation, have fast-tracked the offering through approval processes. This IPO is widely seen as a showcase event for China’s STAR Market and a test case for other unicorns eyeing public listings domestically rather than in New York or Hong Kong.

Additionally, the IPO aligns with China’s broader economic objectives of achieving technological self-sufficiency and reducing reliance on foreign energy sources. By supporting CATL’s expansion, the Chinese government is not only promoting a national champion but also reinforcing industrial policies targeting advanced manufacturing and renewable energy leadership.

Beyond China, the listing has attracted significant attention from international regulators. While geopolitical tensions persist, particularly between the U.S. and China, CATL’s relatively low exposure to Western capital markets allows it to navigate political risk with agility. The choice to list on the STAR Market rather than pursue a dual listing overseas mitigates potential sanctions, trade restrictions, and shareholder activism that might accompany a foreign IPO.

Comparative Analysis: CATL Among the World’s Largest IPOs

To fully appreciate the magnitude of CATL’s IPO, it is instructive to compare it against historical benchmarks. When measured by total proceeds raised, CATL’s offering ranks alongside major global listings, such as:

- Saudi Aramco (2019) – $29.4 billion

- Alibaba (2014) – $25 billion

- SoftBank Corp. (2018) – $21.3 billion

- Visa (2008) – $17.9 billion

- Agricultural Bank of China (2010) – $22.1 billion

Given its green focus and technological edge, CATL is also viewed as a peer to recent tech IPOs such as Arm Holdings (2023) and Rivian (2021), although it exceeds both in terms of profitability and scale. The inclusion of CATL in this elite group underscores its maturity, relevance, and broad market appeal.

Forward Implications for Capital Markets and ESG Investment

CATL’s IPO is expected to have ripple effects across both Chinese and global capital markets. Domestically, it is anticipated to set new benchmarks for pricing, compliance, and investor outreach, potentially encouraging a wave of follow-on listings from other energy technology firms. It also strengthens the STAR Market’s reputation as a premier platform for innovation-driven IPOs.

From an international perspective, CATL’s successful listing reinforces the appeal of ESG-aligned industrial companies in an environment where investors are increasingly focused on sustainability, decarbonization, and long-term value creation. Funds and indexes tracking green energy, electric mobility, and smart infrastructure are likely to include CATL in their holdings, further supporting post-IPO demand and share price appreciation.

In summary, the mechanics of CATL’s IPO reflect a highly deliberate, strategic approach to capital raising in a complex but opportunity-rich environment. The combination of top-end price guidance, strong fundamentals, and overwhelming investor interest positions the company for a powerful market debut. More importantly, it marks a critical juncture in the evolution of public equity markets toward green innovation and long-term sustainability.

Implications for the EV Supply Chain and Global Markets

The successful pricing and imminent listing of Contemporary Amperex Technology Co. Limited (CATL) at the top end of its IPO valuation carries far-reaching implications not only for capital markets but also for the broader electric vehicle (EV) supply chain and the global clean energy economy. As the primary supplier of lithium-ion batteries to some of the world’s leading automakers and renewable energy developers, CATL’s expansion—bolstered by the capital raised through its IPO—will catalyze structural shifts in supply chain dynamics, global industrial strategy, and geopolitical positioning.

This section explores how CATL’s IPO proceeds are expected to reshape manufacturing networks, bolster innovation pipelines, accelerate regional localization, and impact raw material sourcing—all within the context of a decarbonizing world increasingly dependent on battery technology.

Capital-Driven Capacity Expansion and Supply Chain Scaling

At the core of CATL’s post-IPO strategy is a substantial capacity expansion initiative aimed at addressing surging global demand for EVs and energy storage systems (ESS). The capital raised through the IPO—estimated at more than $25 billion—will be deployed across multiple high-impact areas, foremost among them the construction of new gigafactories in key domestic and international markets.

In China, CATL is expected to double production capacity in its Jiangsu and Sichuan facilities while investing in next-generation smart manufacturing lines equipped with AI-driven quality control and energy efficiency modules. Simultaneously, international expansion efforts are gathering pace. Ongoing projects in Germany (Erfurt), Indonesia (Morowali), and Thailand are being accelerated to ensure compliance with regional rules of origin—especially important in Europe due to local content requirements in EV incentives and battery passport regulations.

By significantly expanding its footprint, CATL will increase its ability to supply major automakers at scale, reducing lead times and ensuring more predictable delivery cycles. This will ease the bottlenecks that have plagued global EV supply chains since the COVID-19 pandemic and semiconductor crisis, enabling OEMs to ramp up production of electric models with greater confidence and speed.

Localization and Strategic Autonomy for OEMs

CATL’s aggressive expansion also supports the regionalization trend that is transforming the global battery industry. Auto manufacturers, wary of geopolitical disruptions and trade uncertainties, are prioritizing suppliers who can manufacture close to their assembly plants. CATL’s decision to establish local production hubs serves as a direct response to this demand.

For instance, in Europe, its Erfurt plant is not only supplying BMW and Mercedes-Benz but also serving as a critical node for recycling initiatives and battery component localization. In Southeast Asia, the Morowali and Thai facilities aim to meet the needs of emerging EV assemblers in the region while tapping into abundant nickel reserves critical for high-performance battery chemistries.

This localized approach enhances strategic autonomy for OEMs, enabling them to comply with evolving trade frameworks, reduce transportation emissions, and exercise more granular oversight over quality and sustainability metrics. As such, CATL is not merely expanding capacity but embedding itself into the industrial ecosystems of its major clients—an advantage that competitors may struggle to match.

Technology Deployment and Upstream Influence

Another major implication of CATL’s IPO is its potential to accelerate technology deployment across the EV supply chain. The capital influx enables CATL to scale commercial applications of several next-generation battery technologies, including:

- High-nickel NMC and NMCA chemistries for performance vehicles.

- Sodium-ion batteries for cost-sensitive two-wheeler and storage applications.

- Solid-state batteries, expected to debut in limited capacity by 2026.

- Battery Management Systems (BMS) that leverage AI and machine learning for predictive analytics, thermal control, and lifecycle extension.

The downstream effects of these technologies are considerable. Automakers benefit from extended range, faster charging, and improved safety; grid operators gain more stable storage platforms; and consumers experience better overall performance at competitive prices. Through partnerships and licensing agreements, CATL can also influence design standards, software protocols, and interface compatibility across the battery ecosystem.

Upstream, CATL’s influence is equally pronounced. With its vertically integrated strategy, the company wields significant control over lithium, cobalt, and nickel supply chains. Its pre-IPO investments in mining projects in Africa, South America, and Asia are now poised for expansion. This forward integration reduces dependence on third-party commodity markets and enhances CATL’s leverage in pricing negotiations and materials certification.

Supply Chain Resilience and ESG Leadership

The battery supply chain is fraught with risk—ranging from volatile commodity prices to geopolitical instability and labor rights concerns in mining regions. CATL’s IPO strengthens its ability to build resilience into this complex system through greater vertical integration, diversification of suppliers, and the establishment of long-term offtake agreements.

Furthermore, CATL’s growing financial firepower allows it to invest heavily in environmental, social, and governance (ESG) programs across its global operations. From carbon-neutral gigafactories and closed-loop recycling systems to traceable sourcing and community development partnerships, CATL is aligning itself with the expectations of ESG-focused investors and regulators alike.

Its flagship Ningde facility is being transformed into a “zero-waste” production hub powered by 100% renewables, while European operations are being integrated with circular economy pilot programs. These initiatives position CATL as a sustainability leader in an industry often criticized for its environmental and social externalities.

Geopolitical Implications and Market Realignment

The expansion of CATL’s supply chain has profound geopolitical implications. As the company strengthens its hold over the battery market, national governments—particularly in the United States, Japan, and Europe—are accelerating policy responses aimed at reducing dependency on Chinese suppliers.

In the U.S., the Inflation Reduction Act (IRA) incentivizes domestic battery production and excludes foreign entities of concern (FEOCs) from subsidy eligibility, which complicates CATL’s potential North American entry. Nonetheless, CATL is exploring licensing, joint ventures, and technical service agreements that allow it to maintain a presence in the market without triggering geopolitical backlash.

In response, global competitors such as LG Energy Solution, Panasonic, and SK On are intensifying their own expansion efforts, leading to a highly competitive, fragmented supply landscape. Yet CATL’s scale, vertical integration, and technology lead give it a defensible position, especially in markets where Chinese EVs and supply chains already dominate, such as Southeast Asia, Africa, and parts of Latin America.

In summary, CATL’s IPO is far more than a capital markets milestone—it is a catalyst for transformation across the global EV supply chain. By leveraging the proceeds to scale capacity, localize manufacturing, advance technology deployment, and reinforce sustainability leadership, CATL is reinforcing its strategic role in the global energy transition. For stakeholders across the mobility, energy, and materials sectors, the implications are sweeping and structural, ensuring that the company’s influence will resonate well beyond the confines of its financial performance.

Risks, Opportunities, and Long-Term Outlook Post-IPO

As Contemporary Amperex Technology Co. Limited (CATL) prepares to enter the public market with the largest IPO of 2025, the excitement around its growth trajectory is tempered by a variety of long-term risks and strategic inflection points. While the infusion of capital is expected to accelerate CATL’s leadership in global battery markets, the post-IPO environment introduces a new era of scrutiny, accountability, and market-driven expectations.

This section examines the multi-dimensional risk factors CATL must navigate after listing, evaluates emerging growth opportunities, and outlines the long-term strategic outlook for the company in a competitive, policy-driven, and technologically fluid global energy landscape.

Post-IPO Risks: Navigating Complexity and Competition

1. Margin Pressure from Raw Material Volatility

One of the most pressing risks facing CATL post-IPO is its exposure to raw material price fluctuations. The company’s battery chemistries rely heavily on lithium, cobalt, and nickel—commodities that are subject to volatile price swings driven by geopolitical events, speculative trading, and extraction bottlenecks.

While CATL has made strides in vertically integrating supply chains through upstream investments, complete insulation from market dynamics is neither practical nor immediate. A sharp increase in lithium carbonate prices, for instance, could significantly compress profit margins unless mitigated by contractual hedging or technological substitution such as sodium-ion deployment.

2. Technological Disruption and Innovation Lag

Despite CATL’s reputation as an innovation leader, the pace of technological disruption in energy storage is accelerating. Competitors across the globe, including QuantumScape, Toyota, and Northvolt, are making significant advances in solid-state battery technologies, semi-solid electrolytes, and silicon-dominant anodes.

If CATL fails to commercialize breakthrough products ahead of or alongside peers, its technology edge could erode. Furthermore, startups backed by major OEMs are experimenting with novel battery architectures that could challenge the lithium-ion paradigm altogether. For CATL, sustained investment in fundamental science and agile commercialization will be necessary to preserve its innovation narrative.

3. Geopolitical and Regulatory Constraints

As a Chinese firm operating across sensitive technology sectors, CATL faces increasing geopolitical risk, especially from Western markets seeking to reduce dependence on Chinese suppliers. The United States has enacted multiple legislative frameworks—including the Inflation Reduction Act (IRA) and CHIPS and Science Act—that contain clauses limiting eligibility for tax credits and subsidies if critical components are sourced from "foreign entities of concern."

CATL’s potential partnerships and joint ventures in the West may face heightened regulatory review, or even rejection, due to national security concerns. At the same time, CATL must remain compliant with evolving environmental, safety, and trade regulations in each jurisdiction where it operates. This complex patchwork of regulatory environments adds to the operational burden of internationalization.

4. Investor Expectations and Governance Evolution

Transitioning from a private enterprise to a public company comes with expectations around governance, disclosure, and shareholder value creation. Post-IPO, CATL will be required to adhere to heightened transparency standards, quarterly performance reporting, and a robust investor relations strategy.

Shareholder scrutiny may also intensify around capital allocation decisions, executive compensation, and long-term ESG performance. Maintaining a balance between growth-oriented reinvestment and near-term profitability will be a constant challenge for the leadership team, especially as it strives to meet the expectations of global institutional investors.

Strategic Opportunities: Capitalizing on Global Transformation

Despite the aforementioned risks, CATL’s IPO positions it uniquely to seize a variety of transformative opportunities that could reinforce its global leadership over the next decade.

1. Electrification of Transport Beyond Passenger Vehicles

While much of CATL’s growth to date has been tied to electric passenger vehicles, the electrification wave is rapidly expanding into adjacent transport sectors—commercial trucks, buses, two-wheelers, aviation, and maritime. CATL has already piloted partnerships with logistics firms for electric truck batteries and is reportedly exploring solid-state battery configurations for aviation applications.

The total addressable market (TAM) for transport electrification is projected to exceed $2 trillion by 2035, and CATL’s extensive R&D portfolio places it in a favorable position to diversify beyond its core automotive clientele.

2. Grid-Scale Energy Storage and Utility Partnerships

Another high-growth opportunity lies in grid-scale energy storage systems (ESS), which are critical to enabling high-penetration renewables like wind and solar. CATL’s collaboration with utility companies and its deployment of containerized ESS units in China, Germany, and South Africa mark the beginning of a major strategic shift toward energy infrastructure.

Governments across Europe and Asia are mandating the deployment of long-duration storage systems to stabilize grids and reduce fossil fuel peaker plants. CATL’s ability to deliver high-capacity, long-cycle solutions could position it as a central player in future grid modernization programs.

3. Circular Economy and Battery Recycling

Post-IPO, CATL plans to scale its recycling operations to reduce material costs and meet ESG mandates. The company is investing in closed-loop facilities capable of recovering lithium, nickel, cobalt, and graphite at high purity levels, feeding them back into the production cycle.

With battery waste forecasted to reach 3 million metric tons annually by 2030, this circular economy approach provides both an economic and environmental advantage. CATL’s integrated model allows it to internalize recycling processes, reduce dependence on virgin mining, and lower lifecycle emissions—an increasingly important metric for ESG-conscious clients and regulators.

4. Licensing and Software Monetization

Beyond hardware, CATL is developing proprietary software for Battery Management Systems (BMS), lifecycle diagnostics, and energy usage optimization. These digital layers, when licensed to automotive and energy clients, open up new revenue streams independent of production volume.

By offering “battery-as-a-service” and data-driven optimization tools, CATL can embed itself more deeply into client ecosystems and capture recurring value from post-sale services. This shift toward software-defined energy solutions mirrors the broader industry trend seen in automotive and cloud markets.

Long-Term Outlook: Sustainability, Strategy, and Scalability

Looking ahead to the next decade, CATL’s trajectory will be defined by its ability to scale sustainably while remaining agile in a world of shifting political, environmental, and technological paradigms. The successful IPO provides the capital foundation, but enduring leadership will hinge on strategic clarity and disciplined execution.

Sustainability as a Core Metric

CATL has pledged to achieve carbon neutrality across its operations by 2040. Meeting this goal will require investments in green electricity procurement, low-carbon materials, emissions monitoring systems, and supplier audits. Public shareholders will expect measurable progress on Scope 1, 2, and eventually Scope 3 emissions, as well as transparent ESG reporting.

Sustainability is no longer a secondary objective; it is becoming a primary determinant of capital access, customer loyalty, and regulatory compliance. For CATL, aligning with the principles of sustainable industrial development will be essential to safeguarding its license to operate globally.

Strategic Partnerships and Ecosystem Positioning

As competition intensifies, ecosystem positioning will matter more than ever. CATL’s success will depend on forging deep, long-term alliances—not only with automakers, but also with grid operators, raw material consortia, governments, and technology providers. By acting as a platform company that enables innovation across sectors, CATL can enhance stickiness and diversify its revenue model.

The company must also balance ambition with focus—avoiding overextension while remaining responsive to new frontiers such as hydrogen-battery hybrids, virtual power plants, and mobility-as-a-service platforms.

Scalability Through Automation and AI

As production volumes multiply, CATL will rely increasingly on advanced automation, robotics, and AI to manage complexity and maintain quality. Smart factories equipped with digital twins, predictive maintenance, and real-time analytics will be critical to ensuring that operational excellence scales with demand.

Moreover, AI applications in R&D, supply chain logistics, and customer support will provide performance insights, reduce lead times, and optimize resource allocation. These capabilities will form the technological spine of CATL’s next-generation operating model.

In sum, the post-IPO journey of CATL is marked by both extraordinary promise and formidable challenges. The company stands at the center of a global energy transition, armed with capital, technology, and market influence. However, sustaining its competitive edge will demand vigilance in risk management, relentless innovation, and a deep commitment to sustainability and governance excellence.

Investors, clients, and policymakers alike will be watching CATL closely—not just as a stock or a supplier, but as a barometer for the future of electrification and energy storage in a rapidly changing world.

What CATL’s Record IPO Signals for the Future of Green Tech

The record-setting IPO of Contemporary Amperex Technology Co. Limited (CATL) in 2025 is far more than a financial milestone—it is a defining moment in the global shift toward sustainable industrial innovation. As the largest public offering of the year, CATL’s decision to guide its share price at the top end of the valuation range is emblematic of the growing confidence in clean energy solutions and the centrality of battery technologies to the world’s decarbonization ambitions.

At its core, the IPO underscores the tremendous value that investors now place on companies driving electrification, storage scalability, and industrial transformation. CATL’s rapid ascent from a regional battery supplier to a global technology giant is a reflection of its visionary strategy, technological capability, and deft navigation of an increasingly complex geopolitical landscape. The company’s role in powering electric vehicles, stabilizing renewable energy grids, and developing next-generation chemistries positions it as one of the most consequential players in the future energy economy.

From a market perspective, the IPO validates investor appetite for ESG-aligned growth stories, particularly those grounded in tangible industrial innovation. It also signals the maturation of China's domestic capital markets, with the STAR Market serving as a credible and strategic alternative to Western exchanges. By retaining domestic listing sovereignty while attracting global capital, CATL has exemplified a model that many Chinese tech and industrial firms may emulate in the years to come.

More broadly, CATL’s post-IPO roadmap provides insight into the evolving architecture of the clean tech supply chain. With proceeds earmarked for capacity expansion, technology development, recycling, and internationalization, CATL is actively shaping the contours of the global energy ecosystem. Its efforts to localize production in Europe and Asia, pioneer solid-state and sodium-ion chemistries, and establish recycling-driven circular economies illustrate how major firms can simultaneously pursue scale, innovation, and sustainability.

However, the journey forward is not without its challenges. The competitive landscape is intensifying, with rivals in the United States, Europe, South Korea, and Japan pouring billions into battery R&D and manufacturing. Geopolitical tensions, trade restrictions, and raw material volatility threaten to disrupt global supply chains. And as a public company, CATL must now meet elevated standards for transparency, governance, and investor communication.

Despite these headwinds, the company’s ability to anticipate industry trends, invest ahead of the curve, and align with long-term policy goals gives it a unique strategic advantage. Its proactive moves in upstream resource acquisition, software monetization, and ecosystem partnership formation reveal a firm thinking beyond short-term earnings and toward systemic leadership.

Perhaps most importantly, CATL’s IPO arrives at a pivotal moment for humanity’s energy transition. As the world grapples with the dual crises of climate change and energy insecurity, the importance of scalable, affordable, and sustainable battery technologies cannot be overstated. In this context, CATL is more than a company; it is an enabler of decarbonized growth, electrified mobility, and energy equity.

In conclusion, CATL’s historic public debut marks a new chapter not only for the company but for the global energy industry. It affirms the ascendancy of batteries as the backbone of 21st-century infrastructure, the viability of green tech as an investment category, and the growing sophistication of Chinese industrial champions on the world stage. As stakeholders across industries look toward a cleaner, smarter, and more connected future, CATL’s IPO will be remembered as both a catalyst and a bellwether of transformative change.

References

- CATL official site – https://www.catl.com/en

- Reuters – https://www.reuters.com/business/autos-transportation

- Bloomberg – https://www.bloomberg.com/news/articles

- CNBC – https://www.cnbc.com/world

- Financial Times – https://www.ft.com/companies

- S&P Global – https://www.spglobal.com/marketintelligence

- Electrek – https://electrek.co/guides/catl

- Nikkei Asia – https://asia.nikkei.com/Business/Technology

- TechCrunch – https://techcrunch.com/tag/battery

- World Economic Forum – https://www.weforum.org/agenda/archive/clean-energy