ByteDance Closes in on Meta as TikTok Drives Global Revenue Surge

In the rapidly shifting landscape of global technology and digital media, few rivalries are as emblematic of the 21st-century internet economy as that between ByteDance and Meta Platforms. The two giants—each a dominant force in the realm of social media and content consumption—are increasingly viewed as benchmarks for innovation, monetization, and user engagement. In 2025, the race between these two titans has intensified, with ByteDance setting its sights on equaling, and potentially surpassing, Meta’s annual revenue. This strategic ambition marks a critical juncture in the global digital economy, and it carries significant implications for the future of online content platforms.

ByteDance, the Chinese parent company of TikTok, has made unprecedented strides in global markets despite geopolitical headwinds. Initially renowned for its domestic success with Douyin, ByteDance’s true inflection point came with the explosive international adoption of TikTok, its short-form video app that has captivated billions. The platform’s meteoric rise has redefined online entertainment, disrupted traditional advertising models, and placed ByteDance in direct competition with Meta, which owns Facebook, Instagram, and WhatsApp—three of the most widely used social applications in the world.

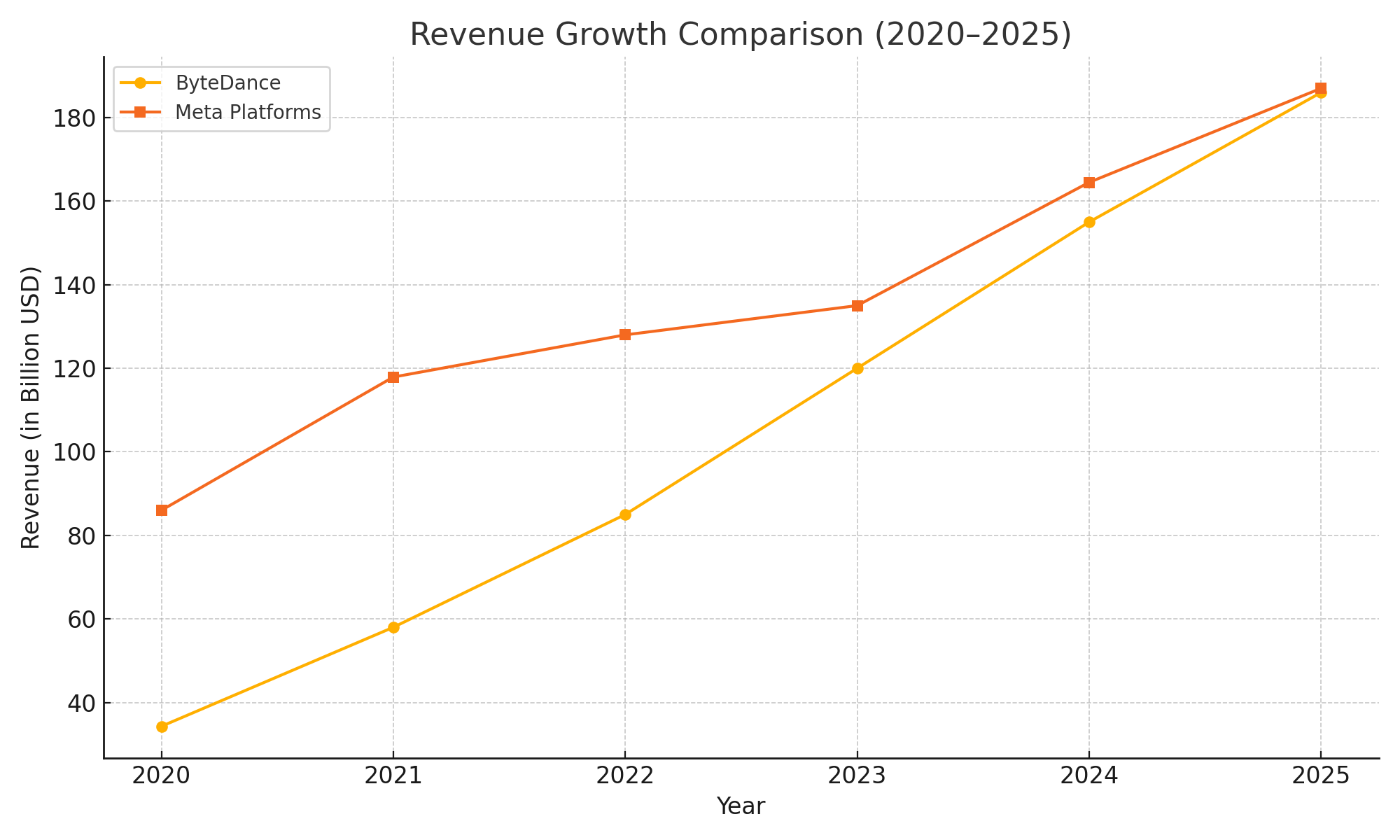

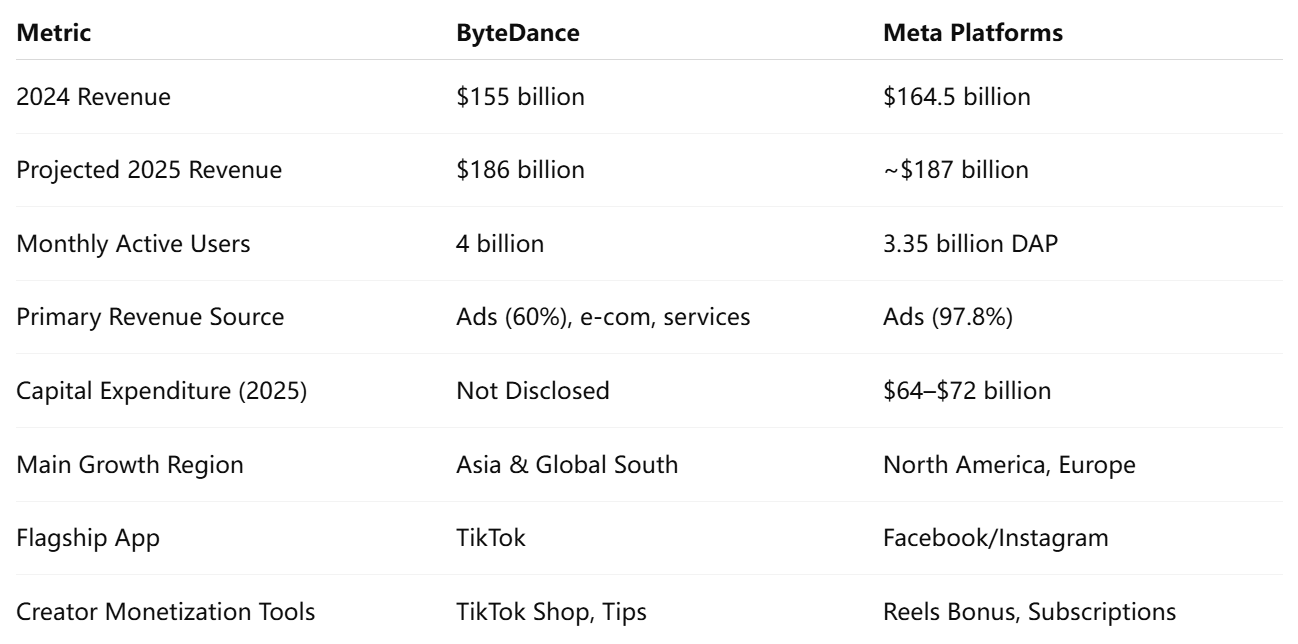

As of 2024, ByteDance reported revenue of approximately $155 billion, representing a 29% increase year-over-year, according to internal projections reported by several credible sources. Meanwhile, Meta Platforms posted revenues of $164.5 billion in the same year, achieving a 22% growth rate. ByteDance is projecting an even more aggressive climb in 2025, with expectations of reaching $186 billion in revenue, thereby closing the gap with Meta, whose revenue is also expected to rise marginally above $185 billion. This narrowing differential signals a potential reordering of power in the global digital economy—an outcome few would have predicted even five years ago.

The foundation of this challenge lies squarely in TikTok’s continued global ascent. The app has transitioned from a viral entertainment platform into a highly sophisticated revenue-generating machine, fueled by an ecosystem of advertisers, influencers, creators, and consumers. In addition to its core ad business, ByteDance is aggressively expanding its e-commerce operations through TikTok Shop, and it has begun to layer financial services and AI-enhanced content tools into its app suite. These expansions are not only enhancing user engagement but also unlocking new streams of revenue that are increasingly rivaling those of Meta’s more established platforms.

However, ByteDance’s rapid growth is not without significant challenges. In the United States—one of its most lucrative markets—ByteDance faces mounting political scrutiny. Ongoing debates about data privacy, national security, and the Chinese government’s potential influence over the app’s operations have prompted regulatory action, including legislation that could force ByteDance to divest its American TikTok business. At the same time, TikTok’s e-commerce efforts are contending with trade policy volatility, such as the evolving status of import tariffs that threaten to disrupt logistics and user confidence. These hurdles could substantially impact ByteDance’s sales trajectory if not adequately managed.

On the other side of the spectrum, Meta Platforms remains a formidable competitor with deeply entrenched infrastructure and a multi-decade presence in global markets. Meta continues to rely heavily on advertising revenue—accounting for over 97% of its income as of 2023—but is strategically investing in artificial intelligence, mixed reality, and foundational models that it believes will define the next generation of computing. With initiatives like Meta AI, the Quest VR headset line, and the construction of custom AI chips, Meta is laying the groundwork for long-term innovation that could insulate it from disruptions in its core social media business.

Meta also continues to demonstrate immense user retention, with over 3.35 billion family daily active people (DAP) across its suite of applications by the end of 2024. The strength of its network effects and global brand equity have helped the company weather algorithmic and product redesigns, regulatory headwinds in Europe and the U.S., and increased competition from ByteDance. Nevertheless, TikTok's rapid traction among Gen Z and younger millennials has prompted Meta to aggressively mimic some of TikTok’s features—such as short-form Reels—highlighting the competitive pressure that ByteDance now exerts on the legacy social media giant.

This blog post explores the forces propelling ByteDance’s remarkable growth, assesses TikTok’s evolving monetization strategy, examines Meta’s counterstrategies and core strengths, and compares the two companies’ business models across key dimensions. With global tech supremacy at stake, this rivalry is more than just a financial contest—it reflects the broader tensions between Eastern and Western paradigms of platform governance, innovation, and market expansion.

To provide a structured analysis, this article will be divided into five main sections. First, we will explore the financial trajectories of ByteDance and Meta, using data-driven projections to map out where the companies stand in terms of revenue and growth momentum. Second, we will assess TikTok’s central role in ByteDance’s global ambitions, detailing its user base, monetization tools, and geographic expansion. Third, we will turn our attention to Meta’s strategic initiatives, particularly in AI, virtual reality, and advertising infrastructure. Fourth, we will conduct a comparative analysis of the two firms, including key business metrics, revenue models, and global reach. Finally, we will forecast the future outlook for both companies and the broader implications for the digital economy.

The ByteDance–Meta competition encapsulates a defining theme of the 2020s: the convergence of entertainment, commerce, and AI into unified, global-scale digital platforms. As TikTok continues to gain steam and ByteDance approaches revenue parity with Meta, the outcome of this race will likely influence how billions of users consume, interact, and transact online. Let us now examine the financial foundations of this rivalry and the mechanisms through which ByteDance seeks to challenge Meta’s global dominance.

Financial Trajectories and Revenue Projections

The accelerating financial performance of ByteDance and Meta Platforms exemplifies the escalating contest for dominance in the global digital economy. As ByteDance aggressively targets revenue parity with Meta in 2025, it is imperative to examine their respective financial trajectories in detail. This section will analyze historical revenue trends, forecast future projections, and assess the underlying drivers of growth for each entity. By mapping the evolving revenue structures of both companies, we gain valuable insights into the strategic positioning and financial durability each brings to this intensifying corporate rivalry.

ByteDance’s Exponential Revenue Growth

ByteDance has exhibited one of the most dramatic revenue growth arcs in the global technology sector over the past five years. Fueled largely by the global proliferation of TikTok, ByteDance’s total revenue rose sharply from an estimated $34.3 billion in 2020 to approximately $155 billion in 2024, marking a compound annual growth rate (CAGR) of roughly 45%. According to internal financial disclosures and third-party estimates, ByteDance expects its revenue to rise to $186 billion in 2025—representing an approximate 20% increase year-over-year.

This projection places ByteDance on a converging path with Meta Platforms, whose own financial performance has been more mature, yet steady. The revenue surge is attributable to a diversified monetization approach across its flagship apps: TikTok, Douyin, Toutiao, and CapCut. While the majority of ByteDance’s historical growth has been driven by Chinese markets, international revenues—particularly from TikTok—are increasingly influential. In 2024 alone, TikTok’s global sales surged by 63% to $39 billion, with advertising and e-commerce functioning as primary contributors.

Furthermore, ByteDance’s reinvestment strategy appears to focus on scaling its infrastructure and expanding its reach in verticals such as gaming, enterprise SaaS, and AI-based services. These initiatives are expected to generate new monetization channels that may buffer the firm against geopolitical risks or platform-specific saturation. ByteDance’s ambition to rival Meta’s revenue stature is therefore grounded not only in organic growth but also in deliberate platform and market expansion.

Meta Platforms’ Resilient Financial Performance

Meta Platforms, despite experiencing periods of market scrutiny and regulatory confrontation, has sustained a robust financial profile over the past five years. The company reported $86 billion in revenue in 2020 and concluded 2024 with $164.5 billion—a nearly twofold increase. This translates to a CAGR of approximately 17%, reflective of Meta’s operational maturity and its scale in global advertising markets.

Meta’s 2025 revenue is projected to slightly exceed $187 billion, indicating a growth rate of approximately 13.7% year-over-year. Although this projection would preserve Meta’s position as the larger of the two companies in absolute revenue terms, the narrowing margin is noteworthy. In 2020, Meta earned over 150% more revenue than ByteDance. By 2025, that gap is expected to narrow to less than 1%, indicating ByteDance’s exceptional velocity in monetization and global market penetration.

A significant share of Meta’s revenue—over 97.8% in 2023—comes from advertising across Facebook, Instagram, and Messenger. Meta has optimized its ad infrastructure to maximize performance for marketers through precision targeting and AI-driven optimization. In addition to ad-based revenue, Meta is investing heavily in AI compute infrastructure and metaverse technologies. The firm anticipates capital expenditures of $64–$72 billion in 2025, signaling a long-term bet on next-generation revenue streams beyond its traditional advertising core.

Revenue Composition and Growth Drivers

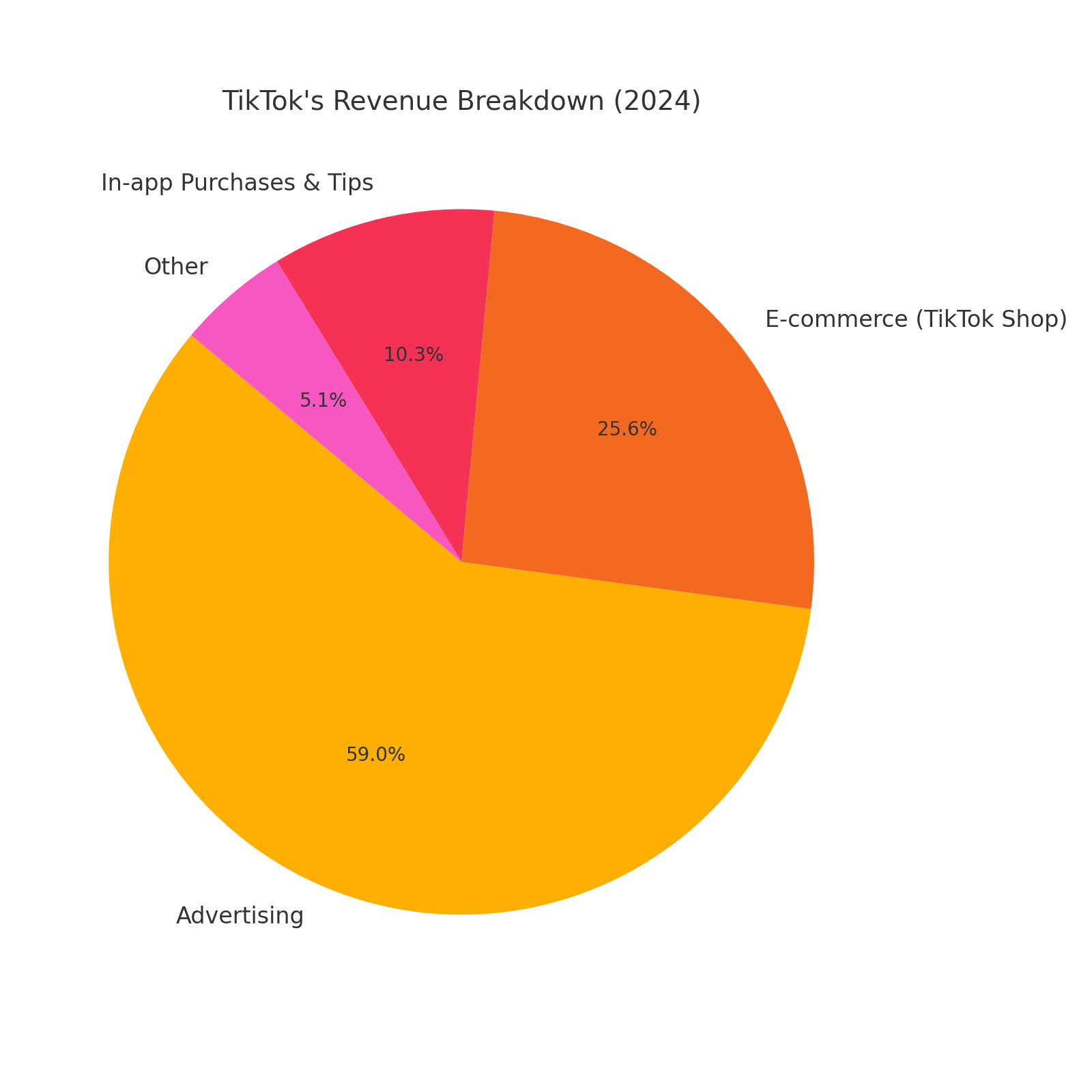

The contrasting revenue compositions of ByteDance and Meta underscore their divergent business models and monetization philosophies. ByteDance has pursued a multipronged monetization strategy that includes advertising (especially through TikTok and Douyin), e-commerce via TikTok Shop and Douyin Store, in-app tipping and virtual goods, and monetized tools like CapCut Pro. This diversified revenue stack, while still maturing, provides ByteDance with resilience against overdependence on any one income source.

Meta, in contrast, remains deeply entrenched in the digital advertising business, deriving the bulk of its revenue from ad impressions and conversions across its platforms. However, it is increasingly seeking to diversify through investments in Reality Labs (VR/AR hardware and software), Meta AI (its generative AI division), and first-party silicon development for AI workloads. These investments are not expected to become dominant revenue contributors in the near term, but they are central to Meta’s long-term growth thesis.

In particular, Meta's ability to maintain advertiser trust and user engagement amid rising competition from TikTok is a critical determinant of its revenue trajectory. Initiatives such as Meta Advantage+ for AI-optimized campaign automation and strategic acquisitions in the immersive tech space are intended to reinforce platform stickiness and reduce churn. Nevertheless, Meta’s core dependency on advertising remains a vulnerability in a rapidly diversifying digital economy.

ByteDance’s International Push and Scaling Strategy

One of the defining attributes of ByteDance’s recent financial performance is the sharp rise in its international revenues. As TikTok cements its position in markets like the U.S., Southeast Asia, Latin America, and Europe, ByteDance’s dependence on China is gradually diminishing. International operations, once a fraction of ByteDance’s revenue portfolio, now account for a substantial share. The firm’s overseas advertising ecosystem has attracted major global brands eager to tap into younger audiences who prefer TikTok to traditional platforms like Facebook or YouTube.

Moreover, ByteDance’s entry into e-commerce through TikTok Shop—particularly in the U.S. and U.K.—represents a parallel to Meta’s failed commerce ventures. In 2024, TikTok Shop contributed significantly to ByteDance’s non-advertising revenue and is expected to scale further in 2025 with improved logistics, merchant onboarding, and product discovery features powered by AI.

However, the sustainability of this growth remains subject to political and regulatory variables. The potential forced divestment of TikTok’s U.S. operations due to national security concerns could significantly impact ByteDance’s revenue prospects. Conversely, successful navigation of these headwinds could allow ByteDance to not only meet but possibly surpass its 2025 revenue target.

Meta’s AI and Infrastructure Investment Strategy

Meta’s aggressive capital expenditure plan for 2025 reflects its strategic shift toward long-term platform transformation. Much of the planned $64–$72 billion in investment is earmarked for data centers, AI model training, and hardware R&D. The goal is to develop a foundational ecosystem that can support its metaverse aspirations and enable AI-native experiences across its social platforms.

While these investments have yet to yield substantial returns, they position Meta to capture new value in an AI-centric internet economy. The integration of Meta AI into Facebook, Instagram, and WhatsApp—along with developer tools—may open future monetization pathways that extend beyond advertising. Additionally, custom chips like “Artemis” for inference workloads and next-gen VR hardware signal Meta’s intent to move up the infrastructure stack and reduce reliance on external vendors.

Still, the short-term financial performance will be dictated by advertising effectiveness and user growth. Meta’s success in countering TikTok’s encroachment with products like Reels, and in retaining younger demographics, will be pivotal to maintaining its leadership in global digital revenues.

Projection Summary and Competitive Positioning

In aggregate, ByteDance and Meta are forecasted to reach near-parity in annual revenue by the end of 2025, with ByteDance expected to hit $186 billion and Meta approximately $187 billion. The compression of this revenue gap signals a structural shift in platform economics and market dynamics. ByteDance’s trajectory is underpinned by rapid global adoption, agile monetization, and platform innovation. Meta’s edge lies in its scale, infrastructural depth, and data network effects, all of which continue to deliver consistent financial performance.

What remains uncertain is whether ByteDance can sustain its velocity amid geopolitical tensions, and whether Meta can successfully pivot into new domains before its advertising advantage begins to erode. The 2025 fiscal year will thus serve as a litmus test for both companies—one driven by exponential scale-up, the other by strategic reinvention.

TikTok’s Role in ByteDance’s Expansion

TikTok has evolved from a viral short-form video app into a cornerstone of ByteDance’s global revenue engine and a formidable challenger to incumbent social platforms. Its transformative role within ByteDance’s broader business strategy cannot be overstated. As the app continues to redefine how billions of users interact with content, it simultaneously fuels ByteDance’s ascent toward revenue parity with Meta. In this section, we examine the pivotal components of TikTok’s contribution to ByteDance’s expansion—spanning user growth, monetization models, international influence, and operational challenges.

TikTok’s Expanding Global User Base

One of TikTok’s most significant assets is its vast and rapidly growing user base. As of 2024, ByteDance reported over 4 billion monthly active users across all of its platforms, with TikTok accounting for a substantial share of that figure. The app has witnessed especially explosive growth among Gen Z and millennial audiences, who increasingly favor its immersive, algorithmically curated content feed over more traditional social media experiences.

In the United States alone, TikTok reached over 170 million monthly active users by late 2024. Its appeal is broad, transcending demographic lines and geographies, with strong footholds in Southeast Asia, Europe, Latin America, and parts of Africa. This global reach enables ByteDance to tap into a wide range of advertising markets, cultural trends, and consumer behaviors. More importantly, the app’s user-centric design—emphasizing entertainment, discovery, and personalization—has led to exceptionally high engagement metrics, including session durations that routinely exceed those on Instagram or Facebook.

The combination of user scale and engagement has made TikTok one of the most influential digital ecosystems worldwide. It has not only become a hub for user-generated content and influencer culture but also a key channel for brand marketing, product discovery, and direct-to-consumer commerce. These characteristics underpin the platform’s revenue-generating capabilities and set the stage for its expanded role in ByteDance’s financial ambitions.

Revenue Contribution and Monetization Strategies

TikTok’s financial importance to ByteDance has grown substantially in recent years. In 2024, the platform generated approximately $39 billion in international sales—a 63% increase year-over-year—according to estimates by Bloomberg and other industry sources. This figure includes revenue from advertising, in-app purchases, and e-commerce transactions facilitated through TikTok Shop.

Advertising remains TikTok’s largest revenue driver. With its AI-driven “For You” feed, the platform offers advertisers highly targeted ad placements with measurable conversion rates. Brands can leverage a range of promotional tools, from sponsored posts and branded hashtag challenges to in-feed video ads and influencer partnerships. The platform’s emphasis on creativity and authenticity has resonated with consumers, enabling higher brand recall and engagement compared to traditional static ads.

Additionally, TikTok has successfully launched and scaled its e-commerce initiative—TikTok Shop. This feature enables users to discover and purchase products directly within the app, blurring the lines between content consumption and shopping. With integrated payment systems, affiliate marketing programs, and tools for merchant onboarding, TikTok Shop has positioned the app as both a content platform and a commercial marketplace. ByteDance’s vision for TikTok includes expanding its role in social commerce, particularly in markets like the U.S., U.K., Indonesia, and Malaysia.

The monetization playbook also includes virtual tipping, live streaming monetization, and premium editing tools like CapCut Pro. These initiatives not only diversify revenue sources but also cultivate a more robust creator economy, which in turn drives content production and user retention. Through these strategies, TikTok is no longer simply a growth asset—it is a profit center for ByteDance and a direct conduit for recurring revenue.

Geopolitical Expansion and Strategic Localisation

A significant portion of TikTok’s success stems from ByteDance’s nuanced approach to global expansion. Rather than employing a one-size-fits-all strategy, ByteDance has localized content, partnered with regional influencers, and tailored its moderation policies to comply with local norms. This localization has enabled TikTok to thrive in culturally diverse regions, outpacing Western platforms that have struggled with regulatory alignment and content relevance.

For instance, in Southeast Asia, TikTok has tailored its content algorithm to support local languages and festivals, while in the Middle East, it has adopted region-specific content moderation frameworks. In Latin America, the company has launched educational programs for digital literacy and small business promotion. This adaptive strategy has built goodwill with users and regulators alike, helping ByteDance mitigate backlash that often accompanies foreign tech platforms.

However, localization does not shield TikTok entirely from geopolitical pressures. The platform remains under intense scrutiny in markets such as the United States, where lawmakers have introduced legislation that could force ByteDance to divest TikTok’s U.S. operations over national security concerns. While ByteDance has attempted to assuage these fears through initiatives like “Project Texas”—which aims to silo U.S. user data within American jurisdiction—concerns about data governance and foreign influence persist.

Challenges Facing TikTok’s Growth Trajectory

Despite its success, TikTok faces a range of challenges that could affect its revenue potential and strategic expansion. Chief among these is regulatory risk. The growing chorus of data privacy advocates and policymakers who question TikTok’s governance structure may culminate in forced divestitures, platform bans, or burdensome compliance requirements. Such outcomes could significantly disrupt ByteDance’s revenue trajectory in key markets like the U.S., which currently accounts for a sizable portion of TikTok’s international income.

Additionally, TikTok’s e-commerce ambitions are encountering headwinds. For example, recent uncertainty surrounding U.S. import tariffs has dampened the enthusiasm of merchants and slowed the onboarding of new sellers. According to Business Insider, some TikTok employees have reported slumping performance in U.S.-based e-commerce operations due to fluctuating tariff policies and logistical challenges. These issues underline the vulnerability of ByteDance’s commercial strategy to macroeconomic and political factors.

Competition is another persistent concern. Meta, YouTube, and Snapchat have all introduced short-form video features to replicate TikTok’s success. Instagram Reels and YouTube Shorts are particularly aggressive in this space, and while TikTok retains a first-mover advantage, the market is fragmenting. Maintaining user loyalty and innovating beyond short-form video will be critical to sustaining TikTok’s growth.

Synergy with the Broader ByteDance Ecosystem

TikTok’s influence extends beyond its own platform, creating synergies across ByteDance’s broader ecosystem. The data generated by TikTok feeds into ByteDance’s advanced recommendation algorithms, which also power apps like Douyin and Toutiao. This shared infrastructure allows for rapid innovation, efficient A/B testing, and personalized experiences across platforms.

Moreover, TikTok is integrated with ByteDance’s proprietary tools like CapCut, its AI-powered video editing app, and Lemon8, its image-sharing platform. These integrations reinforce user engagement and expand monetization opportunities. For example, CapCut’s professional suite offers monetized features for creators, while TikTok Shop leverages the influencer economy built within the app to drive commerce on partner platforms.

By leveraging TikTok as a strategic nexus, ByteDance is building a cohesive digital ecosystem that extends from content creation and curation to transaction and conversion. This comprehensive integration is helping ByteDance solidify its market position while exploring new verticals like AI tools, music production, and education content.

TikTok as a Financial Engine

In summary, TikTok is not merely a growth vector for ByteDance—it is a financial engine that is reshaping how the company monetizes digital attention and engages global audiences. Its innovative ad formats, commerce integrations, and cultural relevance have propelled ByteDance to the forefront of the digital economy. Yet, this ascent is tempered by regulatory scrutiny and intensifying competition, which could impact TikTok’s long-term value contribution.

As ByteDance closes the revenue gap with Meta, TikTok stands at the heart of this transformation. Whether ByteDance achieves or exceeds revenue parity in 2025 will depend significantly on TikTok’s continued innovation, its ability to navigate regulatory hurdles, and its success in broadening revenue streams beyond video advertising.

Meta’s Strategic Initiatives and Market Position

As ByteDance ascends rapidly through the global technology ranks, Meta Platforms Inc. remains a resilient, adaptive, and formidable competitor. While ByteDance has captured the imagination of younger audiences with TikTok’s fast-paced video content and e-commerce integrations, Meta continues to dominate in terms of advertising infrastructure, user scale, and capital deployment. In this section, we explore the strategic initiatives underpinning Meta’s sustained market relevance—from artificial intelligence investments and product innovation to its evolving business model and expansive global presence.

Foundations of Meta’s Market Dominance

Meta’s position as a cornerstone of the digital economy is built on its expansive suite of products: Facebook, Instagram, WhatsApp, and Messenger. Each of these platforms boasts an enormous user base, contributing to Meta’s unrivaled network effect. As of December 2024, the company reported 3.35 billion family daily active people (DAP), underscoring its role in the everyday digital lives of nearly half the global population.

The strength of Meta’s platform ecosystem enables seamless cross-promotion, multi-channel advertising, and integrated commerce experiences. These synergies have historically fueled its core business: digital advertising. In 2023, over 97.8% of Meta’s revenue came from advertising—a statistic that underscores both its efficiency in monetizing attention and its dependency on a single revenue stream.

Meta’s advanced ad delivery system, which leverages machine learning for precision targeting, optimization, and measurement, remains the gold standard for advertisers. The company offers sophisticated tools for campaign management, analytics, and audience segmentation, making it indispensable for brands seeking performance-driven outcomes. Despite emerging challenges from TikTok, Meta’s advertising backbone continues to perform reliably, sustaining the company’s revenue base while supporting investments in emerging technologies.

Artificial Intelligence as a Strategic Priority

One of Meta’s most significant recent strategic pivots is its aggressive investment in artificial intelligence. In 2025, the company plans to spend between $64 billion and $72 billion in capital expenditures, much of which will be allocated to AI infrastructure. This includes the expansion of data centers, acquisition of GPU clusters, development of proprietary silicon, and training of large-scale foundation models.

The core objective of this investment is to infuse Meta’s entire product suite with AI-enhanced functionality. Already, Meta has integrated generative AI into platforms like Facebook and Instagram, enabling features such as AI-generated captions, image editing, chatbots for customer service, and content recommendation refinement. Furthermore, Meta AI, the company’s flagship AI division, is developing large language models (LLMs) and multimodal systems designed to power internal products and external developer tools.

These AI advancements are also aimed at improving ad performance. By leveraging AI, Meta can further automate ad targeting, improve user sentiment analysis, and offer predictive insights to advertisers. These capabilities not only drive better campaign results but also help maintain Meta’s competitive advantage amid evolving consumer behavior and privacy constraints, such as the deprecation of third-party cookies.

Meta’s emphasis on AI is both reactive and proactive. It reflects a response to rising competition from ByteDance and other platforms, but it also anticipates a future where AI-native interfaces become a key differentiator in user experience and commercial value creation.

The Reality Labs Vision: Building the Next Platform

Beyond AI, Meta’s other major frontier initiative lies in its long-term bet on the metaverse—a persistent, spatial computing environment that blends virtual and augmented reality (VR/AR). Through its Reality Labs division, Meta is building the infrastructure, hardware, and software needed to bring this vision to life.

While early metaverse efforts, such as Horizon Worlds and the Quest VR headset series, have yielded mixed reviews and moderate adoption, Meta has maintained its commitment. The company views the metaverse not as a short-term product line but as a generational shift in computing akin to the transition from desktop to mobile. In this view, control over the next hardware platform—whether it be AR glasses, VR environments, or neural interfaces—offers the potential for deeper user engagement and new monetization paradigms.

Reality Labs has incurred substantial financial losses, posting over $16 billion in operating losses in 2023 alone. However, these investments are aligned with Meta’s broader ambition to be the first mover in defining how humans will interact with information, commerce, and one another in virtual spaces. As the ecosystem matures, new forms of monetization—virtual goods, immersive advertising, digital events—may emerge, diversifying Meta’s revenue streams in the long run.

Instagram and Reels: Responding to TikTok

To counter TikTok’s surge, Meta has aggressively expanded its short-form video offering, Instagram Reels. Introduced as a direct competitor to TikTok, Reels has become one of Meta’s fastest-growing content formats. The company has prioritized Reels within Instagram’s and Facebook’s UI, providing creator monetization tools, cross-posting features, and AI-powered editing capabilities.

In 2024, Reels saw a substantial increase in user engagement and ad revenue contribution. Meta has reported that time spent watching Reels increased by over 20% year-over-year, largely due to algorithmic improvements and platform incentives. Moreover, Reels is increasingly being integrated into commerce flows, allowing brands to showcase products via short videos and link them directly to Instagram Shops.

While Reels has narrowed the engagement gap with TikTok, it has not fully matched TikTok’s cultural relevance or creator loyalty. Nonetheless, it serves as a viable defensive strategy that slows user migration while giving advertisers another creative medium within the Meta ecosystem.

Strategic Global Positioning and Risk Mitigation

Meta continues to maintain a strong international presence, with major user bases in North America, Europe, South Asia, and Latin America. The company tailors its platforms to meet regional regulatory requirements, language preferences, and market dynamics. This flexibility is a key enabler of its global advertising dominance.

That said, Meta is no stranger to regulatory pressure. The firm faces ongoing legal challenges from antitrust authorities, privacy commissions, and misinformation watchdogs. The European Union’s Digital Markets Act (DMA), for instance, imposes new restrictions on data interoperability and ad targeting, while the U.S. Federal Trade Commission (FTC) continues to scrutinize Meta’s acquisitions and market power.

To mitigate these risks, Meta is investing in transparency tools, data privacy controls, and open-source initiatives. By aligning itself with emerging regulatory frameworks, Meta aims to preserve operational continuity while maintaining user trust.

Monetization Beyond Advertising: Early Experiments

Although Meta’s financial engine remains advertising, the company is experimenting with additional revenue models. These include subscriptions (e.g., Meta Verified), business messaging on WhatsApp, and digital collectibles within Instagram. While these initiatives are currently nascent in revenue contribution, they reflect Meta’s intent to broaden its economic base in anticipation of future disruptions.

Business messaging, in particular, holds promise. With WhatsApp Business APIs enabling customer support, order management, and promotional messaging, Meta is building a transactional layer atop its messaging platforms. This aligns with trends in emerging markets, where messaging is a primary interface for commerce.

Furthermore, the company is developing new revenue models through its AI-as-a-service offerings, enabling third-party developers to use Meta’s foundational models for business applications. If successful, this could create a monetizable layer beyond its walled-garden platforms.

Conclusion: Meta’s Enduring Strategic Depth

In summation, Meta’s strategic initiatives reflect a multidimensional approach to safeguarding its market position and preparing for future platform transitions. While the company’s core strength remains in advertising, its sizable investments in AI, mixed reality, and product diversification demonstrate a forward-looking posture.

Meta’s massive infrastructure spending and continued dominance in user engagement provide a resilient foundation amid intensifying competition from ByteDance. Although TikTok has disrupted user behavior and captured youth demographics, Meta’s entrenched ecosystem, capital discipline, and innovation pipeline equip it to compete at scale.

As the race toward $190 billion in annual revenue intensifies, Meta is executing a dual strategy: fortify its existing advantages while staking early claims in emerging digital domains. Whether this approach can hold off ByteDance’s charge will depend on execution, adaptability, and the ability to turn long-term bets into sustainable cash flows.

Comparative Analysis of ByteDance and Meta

As ByteDance narrows the revenue gap with Meta Platforms, the competitive landscape between the two technology giants has evolved into a broader battle of business models, market strategies, and innovation philosophies. While both companies operate at the forefront of the digital economy, their paths to success have been markedly different. This section provides a comprehensive comparative analysis of ByteDance and Meta across key operational, financial, and strategic dimensions, highlighting how their differences—and emerging similarities—shape the future of global platform economics.

Revenue Models and Monetization Structures

At the heart of the contrast between ByteDance and Meta lies their respective approaches to monetization. Meta derives over 97% of its revenue from advertising. Its monetization is largely concentrated within its ad-driven social media platforms—Facebook, Instagram, and Messenger—where revenue is a direct function of user engagement, impressions, and click-through performance. While Meta is actively diversifying into AI, VR, and business messaging, these segments currently contribute marginally to its overall income.

ByteDance, on the other hand, has adopted a more diversified monetization architecture. In addition to advertising—contributing approximately 60% of its revenue—ByteDance generates income through in-app purchases, live streaming monetization, e-commerce (TikTok Shop and Douyin Store), virtual goods, and subscription services such as CapCut Pro. This broader monetization palette reduces ByteDance’s dependency on any single channel and enhances its resilience against regulatory or market disruptions affecting individual revenue streams.

Moreover, ByteDance’s advertising model is inherently more decentralized, distributed across multiple platforms including TikTok, Douyin, and Toutiao. This enables greater adaptability in targeting different demographics, geographies, and content formats. Meta’s model is centralized but benefits from its deeply integrated ad infrastructure and unified ad manager system, which offers superior campaign control and analytics capabilities for advertisers.

User Base and Global Reach

Both companies boast vast global user bases, but their geographical and demographic distributions differ significantly. Meta’s ecosystem serves over 3.35 billion daily active people, spanning Facebook, Instagram, WhatsApp, and Messenger. Its core strength lies in its dominance across North America, Europe, and parts of South Asia and Latin America. Meta’s platforms are deeply entrenched in daily communication, media consumption, and digital commerce across these regions.

ByteDance, in contrast, has amassed over 4 billion monthly active users globally across TikTok, Douyin, Toutiao, CapCut, and other applications. While ByteDance originated in China and continues to dominate its domestic market, it has rapidly expanded its presence in the U.S., Southeast Asia, the Middle East, and Latin America. TikTok’s penetration among Gen Z and millennial demographics has been especially notable, positioning ByteDance as a cultural force in youth entertainment.

Notably, ByteDance’s success with TikTok is rooted in algorithmic content discovery rather than social networking. Whereas Meta relies heavily on a user’s social graph (friends, followers), TikTok surfaces content based on behavioral signals, content interaction, and AI-driven predictions. This shift toward interest-based discovery has catalyzed a broader industry trend and forced Meta to recalibrate its content delivery systems to compete effectively.

Product Innovation and Strategic Investments

Meta and ByteDance have both demonstrated robust capacities for product innovation, though their investment philosophies diverge. Meta’s innovation strategy is focused on large-scale platform transitions—most prominently, its investment in the metaverse and AI. The company is allocating upwards of $70 billion in 2025 toward AI infrastructure, AR/VR development, and custom silicon fabrication. These long-horizon bets reflect Meta’s ambition to shape the next computing platform beyond mobile.

ByteDance’s innovation approach is more iterative and commercially immediate. Its strength lies in rapidly launching, testing, and scaling consumer products. The success of TikTok was quickly extended into TikTok Shop, CapCut, and Lemon8, creating a cross-app ecosystem that supports content creation, commerce, and monetization. ByteDance is also investing in generative AI and music production tools, though its capital allocation is more conservative and ROI-driven compared to Meta’s high-risk, high-capex strategy.

Furthermore, ByteDance’s organizational structure supports agile innovation. Teams operate in relatively autonomous units with strong data-sharing mechanisms and short feedback loops. This enables the company to react quickly to trends, iterate features based on user behavior, and capitalize on viral phenomena. Meta, while still innovative, must navigate a more mature and risk-averse environment, given its public ownership and regulatory exposure.

Regulatory and Political Risk Profiles

Both ByteDance and Meta face significant regulatory scrutiny, albeit from different geopolitical fronts. Meta’s challenges stem largely from antitrust investigations, privacy legislation, and content moderation issues in the U.S. and Europe. The European Union’s Digital Markets Act (DMA) and the United States’ evolving antitrust frameworks continue to constrain Meta’s strategic flexibility and may result in more fines, divestitures, or limitations on data usage.

ByteDance’s regulatory risks are more existential in nature. Due to its Chinese ownership, ByteDance has become a focal point of national security concerns, particularly in the United States. The possibility of a forced divestiture of TikTok’s U.S. operations or an outright ban remains a persistent overhang. Similar concerns have also emerged in India and select EU markets, where regulatory bodies are questioning data sovereignty, content governance, and political influence.

While Meta’s challenges are procedural and compliance-driven, ByteDance must navigate ideological and jurisdictional opposition that could fragment its business and threaten access to key markets. In this regard, Meta enjoys greater structural stability, even as ByteDance experiences faster growth.

Cultural and Strategic Orientation

A more nuanced dimension of comparison lies in the cultural ethos and strategic priorities of the two firms. Meta’s operational culture reflects its Silicon Valley roots—emphasizing long-term vision, centralized product development, and aggressive investment in moonshot ideas. Its strategic narrative is aspirational, positioning Meta as a pioneer of future internet architectures, from immersive computing to general-purpose AI agents.

ByteDance, shaped by its origins in China’s competitive tech ecosystem, prioritizes speed, efficiency, and scalability. The company is intensely data-driven, favoring immediate revenue realization over speculative bets. ByteDance’s approach to growth is grounded in performance marketing, iterative experimentation, and high-speed internationalization. This tactical pragmatism has enabled it to scale rapidly and profitably, often outpacing Western peers in execution velocity.

Despite these differences, both companies are increasingly converging around shared priorities: creator ecosystems, e-commerce integration, AI-first interfaces, and platform defensibility through infrastructure investment. Their competitive dynamics reflect not just a clash of firms but a convergence of philosophies in a digitally unified, yet geopolitically fragmented world.

This table underscores both convergence and contrast: ByteDance is a faster-growing, more diversified platform; Meta is a more entrenched, infrastructurally robust player.

Two Models, One Market

In conclusion, the ByteDance–Meta rivalry represents two viable models for dominating the global digital ecosystem. ByteDance thrives on agility, innovation at the edge, and consumer-centric monetization. Meta, in contrast, leverages scale, infrastructure, and long-term vision. Both are adapting rapidly to shifts in consumer behavior, regulatory environments, and technological frontiers.

As they approach revenue parity in 2025, the strategic decisions each makes—from product focus and geographic expansion to regulatory navigation and capital allocation—will shape the competitive landscape for years to come. While the immediate battle is financial, the deeper contest lies in defining the future of platform economics and digital interaction.

Future Outlook and Strategic Implications

The race between ByteDance and Meta Platforms for global digital dominance has reached a pivotal moment. With ByteDance expected to approach Meta’s revenue threshold in 2025, the rivalry is evolving from one of market positioning to one of strategic reinvention. Both companies are now operating at the intersection of social interaction, commerce, artificial intelligence, and geopolitical scrutiny. In this section, we assess the potential future trajectories of ByteDance and Meta, and explore the broader implications for the technology industry, regulators, consumers, and the global digital economy.

ByteDance’s Path Forward: Consolidation and Expansion

ByteDance's near-term objective is clear: close the final revenue gap with Meta and establish itself as a co-equal—if not dominant—player in the digital platform space. To achieve this, the company is expected to continue scaling TikTok’s monetization capabilities while deepening engagement in high-growth markets. TikTok Shop, in particular, holds the potential to become a core profit engine, especially as social commerce becomes more embedded in consumer behavior.

ByteDance is also likely to pursue further diversification. Beyond TikTok, it has launched and grown several ancillary products such as CapCut, Lemon8, and its suite of AI productivity tools. These tools not only extend the brand’s ecosystem but also provide entry points into enterprise solutions, creative services, and data-rich applications that can be monetized independently of consumer-facing media.

In addition, ByteDance is accelerating its investment in generative AI. From text-to-video synthesis to virtual influencers, the company aims to position itself as a leader in next-gen content generation. Given its strong foundation in algorithmic design and content delivery, ByteDance is well-placed to develop vertical AI applications that serve both creators and businesses.

However, ByteDance’s future is not without significant headwinds. Chief among them is regulatory uncertainty, particularly in the United States. Proposed legislation that could compel ByteDance to divest TikTok’s U.S. operations would not only affect its valuation and growth but also disrupt revenue continuity. ByteDance’s ability to comply with or strategically navigate such pressures will be critical to its long-term success. A well-executed localization strategy, including secure data storage and operational independence, may help sustain its presence in key markets.

Meta’s Strategy: Infrastructure, Innovation, and Trust

Meta’s roadmap emphasizes long-term infrastructure, particularly in artificial intelligence and immersive computing. Its massive capital expenditure in 2025—estimated between $64 and $72 billion—is designed to reinforce its core platforms while laying the groundwork for future monetization channels. These include business messaging, developer tools, AI-as-a-service, and virtual commerce.

Artificial intelligence is central to Meta’s future-facing strategy. With Meta AI being integrated across Facebook, Instagram, and WhatsApp, the company is transforming how users search, discover, and interact with content. By offering AI-powered tools for creators and advertisers alike, Meta is enhancing platform value while future-proofing against declining engagement with legacy content formats.

Meanwhile, the company’s metaverse ambitions, though not immediately profitable, reflect a deep-seated belief in immersive media as the next paradigm shift. While market enthusiasm for VR/AR remains tepid, Meta is investing in hardware (Quest headsets, AR glasses) and software (Horizon Worlds, immersive workspaces) with a decade-long horizon. These initiatives represent a high-risk, high-reward proposition that could either elevate Meta as a new-age infrastructure provider or strain its profitability if adoption lags.

Crucially, Meta must also address the erosion of user trust—an issue that has surfaced repeatedly due to data privacy concerns, misinformation, and content moderation controversies. Strengthening governance frameworks, enhancing transparency, and collaborating more effectively with regulators may be essential to retaining its license to operate globally.

Geopolitical Dynamics: Platform Sovereignty and Digital Nationalism

A defining element of this competition is its geopolitical dimension. ByteDance, as a Chinese company, and Meta, as an American enterprise, are caught in the crossfire of escalating digital nationalism. Governments worldwide are asserting greater control over data sovereignty, algorithmic transparency, and platform influence. This will have a cascading impact on market access, operational freedom, and monetization strategies.

For ByteDance, managing perceptions around state influence, censorship, and surveillance will remain an uphill task, particularly in Western democracies. Even with transparency initiatives like Project Texas (in the U.S.) or similar data localization projects in Europe, political resistance may not abate. Conversely, Meta must contend with antitrust regulation, digital services taxation, and restrictions on cross-border data flows, particularly in the EU and India.

In this new geopolitical order, platform companies must increasingly act like quasi-diplomatic entities—balancing commercial objectives with political compliance, while managing relationships with dozens of regulatory jurisdictions. ByteDance and Meta may be forced to structurally reorganize their international operations, adopt federated models, or even spin off regional entities to remain viable.

Industry Implications: New Norms for Platform Competition

The rivalry between ByteDance and Meta is not just reshaping the competitive landscape—it is redefining the benchmarks for what it means to be a platform company. A few key industry-wide implications emerge from this rivalry:

- Platform Ecosystems Must Be Multi-Modal:

Companies can no longer depend solely on ad revenue. Commerce, AI services, subscriptions, creator economies, and enterprise offerings must be interwoven to create durable ecosystems. - AI Integration Is No Longer Optional:

Both ByteDance and Meta are embedding AI deeply into their user experiences, from content curation and moderation to monetization and customer service. AI-native interfaces are becoming a competitive necessity. - Creator Empowerment Is the New Currency:

Platforms that provide tools, revenue models, and discovery features for creators will win long-term loyalty. ByteDance’s focus on integrated monetization and Meta’s experiments with bonus programs reflect this new strategic imperative. - Cultural Capital Matters as Much as Infrastructure:

ByteDance has leveraged cultural resonance through TikTok in a way few platforms have matched. Meta, while infrastructurally superior, has struggled with cultural alignment among younger users. Future platform leaders will need to combine cultural agility with technical robustness. - Global Platforms Must Think Locally:

Whether through partnerships, data centers, or localized content policies, successful platforms must tailor their offerings to meet regional norms and regulatory conditions.

Investor and Market Sentiment: What Lies Ahead

Financial markets are closely watching the ByteDance-Meta rivalry. Analysts see ByteDance as a high-growth disruptor with significant upside potential—especially if TikTok evades divestiture threats and succeeds in monetizing its user base more deeply. Meta, meanwhile, is seen as a cash-rich incumbent making bold future bets that may or may not pay off. Investors will weigh these divergent profiles as they calibrate expectations for long-term value creation.

In terms of valuation, ByteDance’s private-market estimates have hovered around $300 billion, while Meta’s public market capitalization has exceeded $1 trillion. Should ByteDance go public or significantly boost its enterprise offerings, this valuation gap could narrow further. Conversely, any regulatory outcome that materially affects TikTok’s access to Western markets would likely impact investor confidence.

A Defining Decade for Digital Platforms

As ByteDance approaches revenue parity with Meta, the digital economy enters a phase of intensified competition, rapid innovation, and heightened regulatory oversight. This rivalry is emblematic of broader forces transforming the internet—from centralized platforms to distributed ecosystems, from static media to AI-driven interactions, and from global uniformity to regional customization.

The strategic decisions that ByteDance and Meta make in the coming years will not only determine their individual fortunes but also influence the architecture of the next-generation internet. Whether through AI innovation, commerce integration, or immersive experiences, the platforms that balance speed, trust, and adaptability will shape the rules of engagement for digital economies worldwide.

For now, the spotlight remains fixed on 2025—a year poised to mark a turning point in the balance of platform power.

References

- TikTok fuels ByteDance’s global growth

https://www.bloomberg.com/news/articles/tiktok-drives-bytedance-growth - ByteDance targets Meta’s revenue as TikTok expands

https://m.economictimes.com/tech/technology/bytedance-aims-to-match-meta-sales-in-2025-as-tiktok-gains-steam - Meta reports ad revenue surge amid platform innovations

https://investor.atmeta.com/investor-news/press-release-details/meta-reports-fourth-quarter-results - Business model comparison: ByteDance vs Meta

https://www.businessinsider.com/bytedance-vs-meta-business-models - TikTok Shop faces hurdles in the U.S.

https://www.businessinsider.com/tiktok-employees-say-us-ecommerce-is-slumping-amid-tariff-uncertainty - Meta's strategic AI investments

https://www.businessinsider.com/meta-stock-earnings-call-report-live-updates - Global digital ad market outlook

https://www.emarketer.com/content/global-digital-advertising-trends - ByteDance's valuation and IPO considerations

https://www.reuters.com/technology/bytedance-valued-300-billion-private-markets - Meta’s metaverse and Reality Labs investments

https://www.barrons.com/articles/meta-stock-trade-war-tariffs-facebook - TikTok’s cultural and algorithmic dominance

https://www.businessofapps.com/data/tik-tok-statistics