BYD: The Global EV Leader Absent in the U.S.

Electric vehicles (EVs) are reshaping the auto industry worldwide, and a Chinese company named BYD (“Build Your Dreams”) has rapidly risen to the forefront of this revolution. In fact, BYD has become the world’s leading EV manufacturer by volume, surpassing even Tesla in total EV units sold. Yet for all its global success, BYD’s electric cars are conspicuously absent from the United States – the world’s second-largest auto market. This blog post provides a comprehensive overview of BYD’s history and evolution, its current standing in the global EV market, comparisons with other EV leaders, its expansion strategy across continents, and an in-depth look at why BYD isn’t in the U.S. (and whether it might be in the future).

BYD’s Origins and Evolution as an EV Manufacturer

BYD’s journey is a classic underdog story in the automotive world. The company was founded in 1995 by chemist Wang Chuanfu in Shenzhen, China – not as a carmaker, but as a battery manufacturer. BYD initially built rechargeable batteries for devices like cell phones, rapidly growing into one of the world’s largest battery producers. This early mastery of battery technology would later become the cornerstone of its EV success.

In 2003, BYD took a bold step into autos by acquiring a struggling state-owned car company and forming BYD Auto. At first, BYD produced fairly conventional (and inexpensive) gasoline cars, often inspired by or reverse-engineered from Toyota designs. Its first model, the BYD F3 (launched 2005), was a basic sedan that became a top-seller in China’s budget market. But BYD’s true ambition lay in electrification. Leveraging its battery know-how, BYD began developing hybrid and electric drivetrains early on.

- 2008: BYD launched the F3DM, one of the world’s first plug-in hybrid cars, demonstrating its EV intent.

- 2009: It introduced the BYD e6, a pure electric crossover, which later saw use as electric taxis in China.

- 2008 also saw a pivotal investment: Warren Buffett’s Berkshire Hathaway bought a ~10% stake in BYD, a strong vote of confidence in BYD’s technology and vision.

Throughout the 2010s, BYD expanded its lineup with “Dual Mode” (DM) plug-in hybrids like the Qin sedan and Tang SUV, while also producing electric buses and trucks. By the mid-2010s, BYD became a leader in electrified vehicles in China, thanks in part to favorable government policies and its vertical integration (making batteries, electronics, and vehicles in-house). In April 2022, BYD took a decisive step – it ceased production of pure gasoline cars entirely, focusing only on plug-in hybrids and battery EVs. This move made BYD the first major automaker to abandon internal combustion engines and go nearly all-electric.

Today, after ~20 years in the auto business, BYD’s evolution is remarkable: from a small battery company into a global EV powerhouse. The company’s history is marked by continuous innovation in battery tech, aggressive product expansion, and a willingness to challenge automotive conventions – all of which have set the stage for its current dominance.

BYD’s Current Status in the Global EV Market

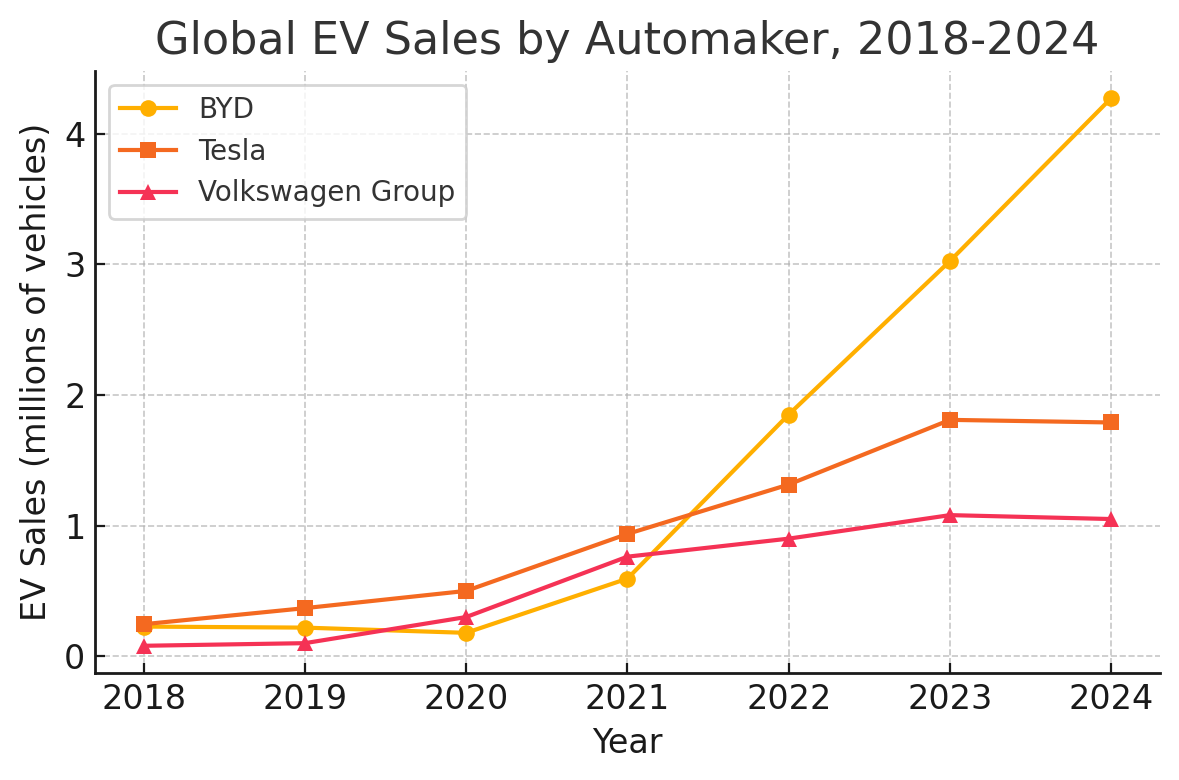

BYD’s growth in recent years has been nothing short of meteoric. In 2023, BYD sold over 3 million new energy vehicles (EVs including battery electrics and plug-in hybrids) worldwide, a 62% jump from the prior year. This made BYD the #1 automaker globally in EV sales for the second year running. By comparison, Tesla – the world’s largest purely electric carmaker – delivered about 1.81 million EVs in 2023. In other words, BYD is outpacing Tesla in total EV volume when plug-in hybrids are included. As the chart below shows, BYD’s sales surge after 2021 has been extraordinary, eclipsing other automakers in sheer EV units sold:

Global EV sales (battery EV + plug-in hybrid) by automaker, 2018–2024. BYD’s volume (yellow line) took off after 2021, exceeding all rivals in 2022–24. Tesla (orange line) remains the largest pure BEV maker, while Volkswagen Group (red line) is a distant third in EV sales.

By the end of 2024, BYD’s momentum further accelerated. The company reported 4.27 million vehicles sold in 2024, a 41% year-over-year surge, giving it an estimated 22% share of the global EV market. This even edged out Tesla in total units sold (Tesla had ~1.79 million in 2024). In its home market of China, BYD is now the best-selling auto brand overall – including gas cars – surpassing Volkswagen in 2023 for the first time in decades. In Chinese EV sales specifically, BYD commanded about one-third of the market in 2023. (For context, China is by far the largest EV market at 8.4 million EVs sold in 2023.)

BYD’s dominance is underpinned by several strengths:

- Extensive Product Lineup: BYD offers a portfolio of over 30 models across its EV and hybrid “Dynasty” series (Han, Tang, Qin, Song, etc. named after Chinese dynasties) and newer “Ocean” series (Dolphin, Seal, etc.). These range from affordable compacts to luxury SUVs. In 2023, BYD had 5 of the world’s top 10 best-selling EV/PHEV models. Notably, the BYD Song Plus (an SUV) and BYD Qin (sedan) were the world’s best-selling plug-in hybrids, while new pure electrics like the BYD Dolphin (hatchback), Yuan Plus/Atto 3 (crossover), and Seagull (mini EV) added significant BEV volume.

- Battery Technology and Vertical Integration: As a battery expert, BYD produces its own EV batteries – and even supplies batteries to other automakers. It pioneered the Blade Battery, a slim lithium-iron-phosphate (LFP) battery with high safety and longevity, which has been a game-changer in lowering cost per kWh and reducing fire risk. BYD’s in-house battery subsidiary is now the world’s #2 EV battery manufacturer (after CATL). Beyond batteries, BYD makes its own motors, electronic controls, and even semiconductors for cars. This vertical integration gives BYD greater control over its supply chain and costs, at a time when many automakers face battery sourcing challenges.

- Technological Innovations: BYD has been innovating on multiple fronts. For instance, the company recently unveiled an ultra-fast 1,000 kW charging system capable of adding ~400 km of range in just 5 minutes (set to debut on upcoming models). It has also introduced advanced driver assistance and smart cockpit features in its cars (voice AI, AR displays, even a built-in fridge in one model). These tech features underscore that BYD’s vehicles are not just cheap, but also cutting-edge in many respects.

- Global Revenue and Profitability: BYD’s rapid growth has translated into financial heft. In 2024, BYD reported over $107 billion in revenue, overtaking Tesla’s ~$98 billion. Its net profits have climbed over 30% year-on-year, fueled by economies of scale in both battery production and vehicle manufacturing. This financial strength enables BYD to invest heavily in R&D and global expansion.

In summary, BYD today stands as an EV juggernaut: the world leader in electrified vehicle sales, with a broad range of products and proprietary battery tech that give it a cost advantage. It’s important to note, however, that BYD’s sales dominance includes a large portion of plug-in hybrids (which have a gasoline engine backup). If we look at pure electric vehicles (BEVs) only, Tesla still led with about 1.8 million BEVs in 2023 vs. BYD’s ~1.6 million. But BYD’s BEV share is rapidly increasing as new models like the Dolphin, Seal, and others ramp up. In fact, in the 4th quarter of 2023, BYD surpassed Tesla in quarterly BEV sales (526,409 vs. 484,507) for the first time. BYD’s trajectory suggests it could soon lead in pure EVs as well, cementing its status as Tesla’s chief global rival.

BYD vs. Other EV Leaders: Tesla, Volkswagen, NIO, and More

How does BYD compare to other prominent EV manufacturers? Let’s examine a few key players:

BYD vs. Tesla: These two are often compared as the titans of the EV revolution – one from China, one from the U.S. Tesla is renowned for its innovation (pioneering long-range EVs, Autopilot, etc.) and has a strong global brand. BYD, while lesser-known in the West, matches or exceeds Tesla in several ways:

- Volume and Variety: BYD sells a wider variety of models (from $10k mini EVs to $150k luxury off-roaders) and in 2023 sold about 1.2 million more vehicles than Tesla (when counting plug-in hybrids). Tesla focuses on a few high-volume models (Model 3, Y, S, X), all pure electric. BYD’s strategy of offering both affordable plug-in hybrids and BEVs has captured a broader swath of consumers, especially in China. However, Tesla’s models typically outsell individual BYD models in markets where both are present – for example, the Tesla Model Y became the world’s top-selling vehicle (of any kind) in 2023 with over 1.2 million solde.

- Technology and Vertical Integration: Both companies are highly vertically integrated. Tesla designs its own batteries (and partners with suppliers like Panasonic and CATL for production) and has advanced software (leading in over-the-air updates and autonomy). BYD, on the other hand, makes its own batteries in-house (and even supplies Tesla with batteries in some markets) and has deep expertise in materials and electronics. BYD’s Blade LFP battery is lauded for safety and cost, while Tesla is pushing ahead with 4680 cell technology and a focus on high energy density. In terms of software/infotainment, BYD uses a more conventional approach (often Android-based systems) tailored to Chinese users, whereas Tesla’s operating system and Autopilot tech are considered more advanced in the West. Each excels in different tech domains: Tesla in software and autonomous-driving development, BYD in battery and manufacturing efficiency.

- Global Presence: Tesla has a truly global footprint – it’s the EV market leader in the U.S. (with ~55–60% share in 2023) and a top seller in Europe. BYD, meanwhile, utterly dominates in China (roughly one-third of China’s NEV sales) but has minimal presence in North America or Europe (so far). We will dive more into BYD’s international expansion later, but as of now Tesla enjoys a brand recognition and charging network advantage in many Western markets. However, BYD’s vehicles often compete very favorably on price. For instance, in China a BYD Seal (a Model 3 rival) or BYD Dolphin (compact EV) can cost 30–40% less than a comparable Tesla, partly due to BYD’s cost-efficient LFP batteries and economies of scale in China’s supply chain.

In short, Tesla is the innovation leader and premium brand in EVs, while BYD is the volume leader with a value-driven approach. It’s telling that BYD’s market cap now ranks it as the world’s 3rd most valuable automaker (after Tesla and Toyota), reflecting investor belief in its growth, even if its brand cachet internationally is not yet on Tesla’s level.

BYD vs. Volkswagen (and other legacy automakers): Volkswagen Group – which includes VW, Audi, Porsche, etc. – is the world’s second-largest carmaker overall. In EVs, VW has made aggressive moves (the “ID” series electric cars, massive investment in battery plants) but is still playing catch-up to BYD and Tesla:

- In 2023, VW Group sold 771,100 battery EVs globally, plus additional plug-in hybrids (for a total of around 1.0–1.1 million electrified vehicles). This is about one-third of BYD’s total EV volume. VW’s EV sales grew +35% in 2023, but not as explosively as BYD’s. Particularly in China, Volkswagen has struggled – its EV sales in China were ~232,000 in 2023, a small fraction of BYD’s 2.78 million there. In fact, in China’s overall auto market (including gas cars), BYD overtook the VW brand in 2023 – a seismic shift, as VW had been China’s top-selling brand for decades.

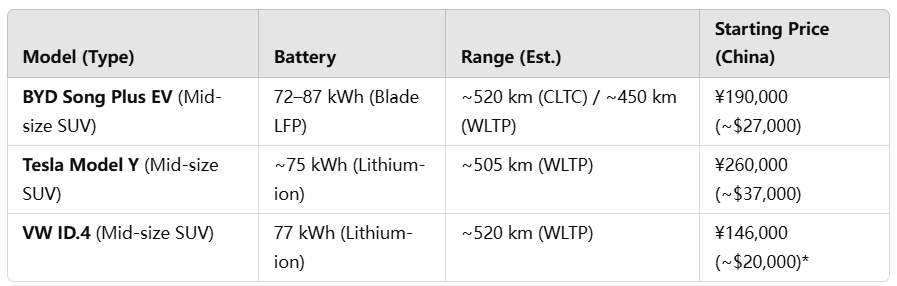

- Volkswagen’s EV models like the ID.4 SUV and ID.3 hatchback have been well-received in Europe, and VW is the top legacy automaker in EV sales. But when comparing product for product, BYD often offers more competitive specs at a lower price. For example, the table below compares a popular electric SUV from each brand:

Table: *Comparison of specifications for three popular electric SUVs (data for China market configurations). *Prices: BYD and Tesla prices are post-subsidy standard pricing in China in 2023; VW ID.4 price reflects significant price cuts in late 2022, bringing it under $20k in China

As shown, BYD’s Song Plus EV offers a battery as large as the VW’s, with comparable range, at a much lower list price than Tesla’s Model Y (and even competing with an aggressively discounted VW). BYD’s cost advantage stems from local manufacturing and cheaper LFP batteries. Volkswagen had to slash ID.4 prices by 13–30% in China to spur sales, highlighting the intense price competition where BYD excels. That said, Volkswagen (and other legacy brands like GM and Ford) bring strengths in design, safety certification, and established dealership networks in Western markets – areas where BYD is a newcomer.

BYD vs. Chinese EV startups (NIO, Xpeng, etc.): In the Chinese market, alongside BYD there are innovative younger companies like NIO, Xpeng, Li Auto, among others. These companies are often touted as “China’s Teslas” and focus on high-tech features: e.g. NIO is known for its battery-swapping stations and premium service, Xpeng for its advanced autonomous driving software. However, their sales volumes are much smaller – typically on the order of 100,000 units a year or less – whereas BYD moves millions. BYD’s advantage over these startups is its scale, manufacturing muscle, and profit from mass-market models that bankroll its R&D. While NIO and Xpeng compete more directly with Tesla in the luxury segment, BYD has effectively cornered the mass-market segment in China, using a strategy similar to Toyota’s in the gasoline era (reliable, affordable models for the masses) but with electrification as the hook.

It’s worth noting that some of these startups are expanding overseas (for example, NIO and Xpeng have shipped cars to Norway and other niches). But again, BYD’s head start in batteries and volume production gives it an edge to expand faster – as we’ll see next.

BYD’s Global Expansion Strategy: Europe, Asia, Latin America and Beyond

While BYD has been a giant at home in China, until recently it had only a modest presence overseas (mostly in electric buses). That is rapidly changing. BYD’s international sales grew 334% in 2023 to about 243,000 units exported, and the company now sells EVs in over 70 countries across six continents. BYD’s global strategy can be summarized as “Everywhere but the U.S.” (for now). Key expansion highlights include:

- Europe: Europe’s EV-friendly regulations and high consumer interest make it a prime target. BYD entered Europe via Norway in 2021 (with the Tang SUV) and has since expanded to the UK, Sweden, Germany, France, the Netherlands, Denmark, and more. It’s launching a full lineup, from the small BYD Dolphin and Seal sedan to the premium Tang SUV and even its luxury brand models (like the Denza D9 MPV and Yangwang U8 off-roader) in Europe. BYD is attacking both ends of the market – offering the affordable “Seagull” mini EV (planned at ~€10k, which even after tariffs could be Europe’s cheapest EV), and introducing upscale vehicles through sub-brands to compete with BMW/Audi.Europe has responded with both enthusiasm and caution. Consumers have shown interest – for instance, BYD’s Atto 3 (a compact crossover) received decent orders in markets like Sweden and Israel. In the UK, BYD’s sales in 2024 were almost entirely EVs. However, European policymakers worry about a flood of cheap Chinese EVs. In late 2024, the EU launched an anti-subsidy investigation into Chinese EV imports and moved to impose an additional 10–17% tariff on them. BYD was prepared for this: it has plans to build EV factories in Europe (e.g. in Hungary and possibly a site in Germany or France) to localize production. It’s also adjusting strategy by offering some plug-in hybrid models in Europe (which weren’t hit by the BEV-specific tariffs) In short, BYD is committed to Europe for the long haul, even if it means building cars there to mitigate tariffs. S&P Global predicts BYD could double its European sales from ~83k in 2024 to ~186k in 2025. If achieved, that would make BYD a significant player in Europe’s EV market, directly pressuring local brands and Tesla.

- Asia-Pacific & Emerging Markets: BYD is aggressively expanding in Asia outside China. Notably:

- Southeast Asia: In countries like Thailand, Malaysia, Vietnam, and Singapore, BYD has launched models (Atto 3, Dolphin, etc.) and is building local assembly. Thailand saw EV sales surge in 2023, with BYD becoming a top seller in a market traditionally dominated by Japanese cars. BYD is constructing a factory in Thailand to serve ASEAN markets.

- Australia and New Zealand: The Atto 3 (Yuan Plus) has been very successful in Australia, even becoming one of the country’s top EVs in 2023 due to its lower price compared to Tesla. Oceania is a smaller market but an early win for BYD’s international push.

- India: BYD has made tentative moves in India (selling some e6 MPVs to fleet customers and unveiling the Atto 3). However, India’s government has restricted Chinese investment of late, making it tricky for BYD to scale up there. (A planned $1 billion BYD India factory was put on hold amid regulatory obstacles.)

- Japan: Interestingly, BYD opened dealerships in Japan in 2023, launching models like the Dolphin and Seal in a market where domestic brands have been slow on EVs. Japanese consumers are wary of Chinese cars, but BYD’s approach is to offer better value EVs than pricey limited-range options from local companies. It remains to be seen if BYD can break through in Japan, but its presence itself is notable.

- Latin America: BYD has been active in Latin America for years, initially via electric buses (for public transit in cities like Bogotá and Santiago). Now it’s selling passenger EVs in countries such as Brazil, Mexico, Colombia, Chile, and others. Brazil is becoming a major foothold – BYD is converting a former Ford plant in Bahia, Brazil into an EV factory, slated to start production in 2025. Brazil could serve as an export hub and is rich in lithium, which BYD is investing in. In Mexico, BYD has begun selling models like the Han and Tang, and it announced a new factory investment there as well. Mexico is especially strategic (more on that in the next section). BYD’s success in Latin America is aided by relatively less competition (Tesla has minimal presence in many of these countries, and local import tariffs on Chinese cars are lower than in the U.S./Europe). BYD has even become the best-selling EV brand in some Latin American markets.

- Middle East & Africa: BYD’s footprint here is still small but growing. It has entered markets like Israel (where the Atto 3 became a top EV), UAE, Jordan, Kenya, South Africa, and a number of smaller countries. Often the first affordable EVs in these developing markets are Chinese (for example, BYD or SAIC’s MG). BYD’s long-range hybrids are also attractive in places with limited charging infrastructure. While volumes are not huge yet, BYD is establishing its brand early across the developing world.

BYD’s global expansion strategy can be described as “multi-pronged and fast-moving.” The company is investing in local production where prudent (e.g. factories in Thailand, Brazil, possibly Europe) and partnering with local distributors to enter new markets quickly. It leverages its cost advantage to undercut competitors – often pricing EVs on par with or below gasoline cars in the same segment, which is very compelling for consumers.

However, it’s not all smooth sailing. BYD faces challenges abroad: building brand recognition and trust (convincing buyers that a Chinese EV can be as good as a Toyota or VW), navigating trade barriers (tariffs, local content rules), and providing after-sales service far from its home base. There’s also intensifying competition – other Chinese automakers like SAIC (MG brand), Geely (via Volvo/Polestar), and Great Wall are also expanding globally with EVs. Even so, BYD enjoys a unique position as arguably the most vertically integrated and scale-driven EV exporter from China. If it continues its trajectory, BYD could become a top EV brand in many regions – perhaps except one notable gap: the United States.

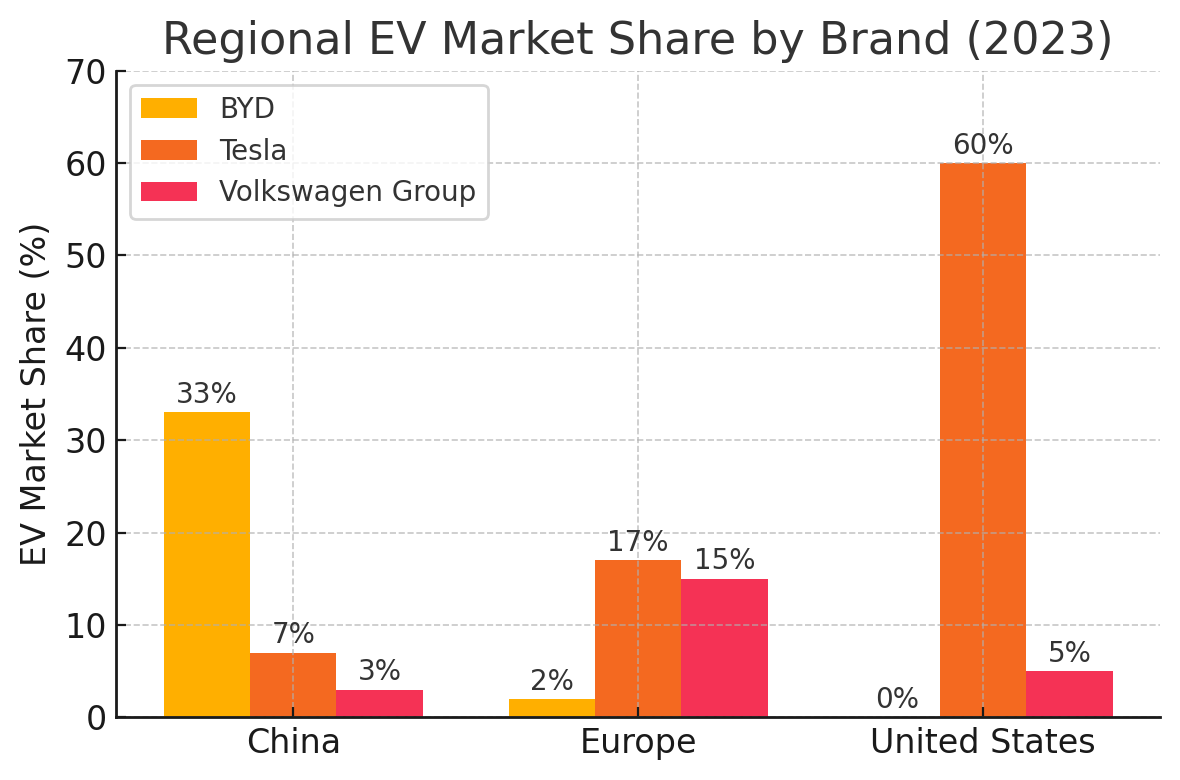

The chart below illustrates BYD’s uneven regional presence compared to a couple of competitors (Tesla and VW):

Regional EV market share of BYD vs. Tesla vs. Volkswagen (2023). In China, BYD (orange) held roughly a third of EV sales, far above Tesla or VW. In Europe, BYD’s share was minimal (~2%), while Tesla and Volkswagen each captured a mid-teens percentage. In the U.S., Tesla dominated with about 55–60% of EV sales, Volkswagen had a small single-digit share, and BYD’s share was effectively 0% (no consumer EV sales).

As shown, BYD has conquered China’s EV market and made strong inroads in many regions – but it has zero presence in the U.S. This stark absence raises the obvious question: why isn’t BYD selling its cars in America?

Why BYD Is Absent in the U.S. Market

Despite BYD’s global ambitions, the company has intentionally steered clear of U.S. passenger car sales to date. This might seem surprising – the U.S. is a huge car market with rising EV adoption. But multiple factors – regulatory, political, and strategic – have created a hostile or “too complicated” environment, in BYD’s view. Let’s break down the key reasons:

1. The Tariff Wall – High Import Taxes on Chinese Cars: One of the most immediate barriers is cost. The U.S. imposes a 27.5% tariff on imported Chinese-made vehicles. This steep tax would erase BYD’s price advantage. BYD’s strategy relies on delivering value for money, but a quarter increase in cost would make its cars far less competitive. For instance, BYD’s Seagull or “Sealion 05” SUV might sell for around $16,000 in global markets, but with U.S. tariffs that could exceed $20,000. Tesla, by contrast, avoids this tariff by manufacturing in the U.S. (Texas, California) for domestic sales. European and Japanese automakers also mostly build in North America for the U.S. market to sidestep import taxes. BYD currently produces vehicles only in China (and just starting in places like Thailand/Brazil). Shipping Chinese-built BYD cars to the U.S. with a ~28% tax renders them economically unviable – “it nearly obliterates BYD’s cost advantage,” as one analysis noted.

These tariffs aren’t going away anytime soon. They’re partly a legacy of the U.S.-China trade war and partly a reflection of bipartisan concern about China’s trade practices. U.S. officials have openly worried about China “flooding” the market with subsidized EVs. BYD, as a leading beneficiary of China’s EV subsidies, is exactly the kind of company under scrutiny. Thus, from a purely financial standpoint, entering the U.S. means BYD would likely have to build a factory in North America to avoid tariffs – a huge investment not easily justified while it has easier growth opportunities elsewhere.

2. U.S. Policy Favoring Domestic & Allied Production: Beyond tariffs, the U.S. has new laws that heavily incentivize local EV manufacturing. The Inflation Reduction Act (IRA) of 2022 offers EV tax credits up to $7,500, but only for vehicles assembled in North America with a high percentage of battery materials from the U.S. or free-trade partners. This effectively excludes Chinese-made EVs from any consumer tax credits. A BYD car imported from China would get $0 subsidy, while a Ford or Tesla made in the U.S. gets the full $7,500 – a big disadvantage. The policy is “very protective” (to quote BYD’s own exec) of domestic production. BYD could build a factory in say, Mexico (a NAFTA country) to qualify, but even then the battery minerals might disqualify it (China is not a free-trade source). BYD’s Americas president Stella Li noted the U.S. market is “confusing” and “very protective” with its politics and rules. BYD likely doesn’t want to tangle with these complex requirements right now.

3. Geopolitical Tensions and National Security Concerns: U.S.-China relations are at a low point, and this extends to technology and trade. Chinese tech firms (like Huawei, DJI, TikTok) have faced bans or scrutiny in the U.S. Autos are becoming like “computers on wheels,” loaded with software and sensors, raising security fears that Chinese EVs could be used for data collection or espionage. BYD’s vehicles, for example, come with connected infotainment and driver assistance cameras – similar to Tesla’s. But in the U.S., there’s political wariness about Chinese-connected devices in critical infrastructure or even consumer electronics. Some lawmakers have floated concerns about data privacy if Chinese cars send data back to China. While there’s no evidence BYD cars pose such a threat, the perception is a barrier. The U.S. government already banned federal funds from being used to buy Chinese transit buses or rail cars (a law in 2019 targeted companies like BYD for buses and CRRC for trains). This doesn’t directly ban consumer car sales, but it shows the climate of suspicion. In such an environment, BYD may fear that even if it tried to enter, it could face negative publicity or even legislative hurdles. As an example of the tech security climate: Microsoft recently advised its employees in China to stop using Huawei and BYD devices due to security worries. If corporate America is cautious, regulators will be too.

4. Brand Perception and Market Dynamics: Even setting aside policy, the U.S. market is extremely competitive and brand-conscious. Breaking into the U.S. would mean competing head-on with Tesla (which had ~55% of U.S. EV sales in 2023), as well as rising offerings from Ford (F-150 Lightning, Mustang Mach-E), GM (Bolt, upcoming models), and international brands (Hyundai, VW, etc.). BYD is virtually unknown to American consumers; convincing them to buy a Chinese-made car, a category with no success history in the U.S., would be a marketing uphill battle. No Chinese auto brand has ever established itself in the U.S. passenger car market to date (previous attempts by brands like Geely and Great Wall were aborted, and even well-known Chinese-owned brands like Volvo sell under their European name). Americans have also had concerns about Chinese vehicle quality in the past. BYD did have a small pilot program around 2011–2015 importing its e6 electric cars for fleet trials (e.g. as taxis in New York and as airport shuttles), but those were limited and highlighted challenges (charging and service for a small fleet far from China). Stella Li (BYD America’s CEO) has frankly said that entering the U.S. consumer market isn’t a priority, calling it “too complicated” due to confusing regulations and slower EV adoption among consumers. Indeed, as of 2023, EVs were ~8% of new car sales in the U.S., versus 21% in Europe and 34% in China. BYD may simply calculate that its effort is better spent in markets that welcome EVs and welcome Chinese trade, rather than one where a “not invented here” attitude might limit customer acceptance.

5. BYD’s Strategic Focus – Picking Battles: BYD’s leadership has repeatedly stated that they will enter the U.S. on their own terms and timing, if at all. “We’re not planning to come to the US,” Stella Li said in early 2024, emphasizing that the company doesn’t lack ambition but knows when a market isn’t worth the fight. Right now, BYD is capacity-constrained trying to meet booming demand in Asia and Europe. Every EV it makes is sold easily in markets with less friction. BYD is also focusing on commercial vehicles in the U.S. instead – it has an electric bus and truck assembly plant in California (opened in 2013) which allowed it to tap public transit contracts (though, as noted, federal funding for Chinese buses has since been curtailed). By building buses locally, BYD showed it can navigate Buy America rules for that sector. But for cars, BYD likely doesn’t see a profitable path under current conditions. The company might also be avoiding U.S. entry until after certain political moments (for instance, one BYD exec hinted that maybe after U.S. elections or when trade tensions ease, things could “get back to normal”). In essence, BYD is avoiding the U.S. not just because of external barriers, but as a deliberate strategic choice to focus on friendlier markets first.

To sum up, BYD is absent in the U.S. due to a perfect storm of protective tariffs, policy barriers, geopolitical tensions, and brand/market challenges. Even though U.S. consumers are starting to embrace EVs in larger numbers, the deck is stacked against a company like BYD entering at this time. As the CEO of BYD America candidly put it, “Everything is complicated [in the U.S.]. Politics complicate [it]”– implying it’s just not worth it right now.

Will BYD Enter the U.S. in the Future?

Given BYD’s global ambitions, it’s natural to ask if and when circumstances might change regarding the U.S. market. While nothing is certain, we can consider a few perspectives and scenarios:

- Indirect Entry via North America: BYD is making moves in Mexico and Canada, which could serve as stepping stones. In 2023, BYD announced a factory in Mexico (to open in 2024) and started selling cars there, like the Tang EV and Han EV. Mexico, being part of USMCA (NAFTA), could one day export BYD cars to the U.S. tariff-free if BYD decided to do so (and if they meet content rules). For now, BYD says the Mexico plant is “mainly for the Mexican market”, but industry observers see it as strategic positioning – a future backdoor if opportunities improve. Likewise, BYD has shown interest in Canada (which has more open trade with China than the U.S. and strong EV mandates coming). If BYD cars roam Canadian streets and get good reviews, that could soften American attitudes and possibly lead to small-scale trials in border states.

- Local Manufacturing in the U.S.: In a more optimistic trade scenario, BYD could partner with a U.S. entity to assemble cars stateside. This is what some other foreign automakers did in decades past to overcome tariffs (e.g., Japanese and Korean automakers building U.S. plants). BYD could license a model to be built under another brand, or do a joint venture. However, given current politics, any Chinese joint venture might face approval issues. Another angle: selling components or technology in the U.S. – BYD could supply its Blade batteries to U.S. automakers (it already supplies to Toyota and others abroad). That way BYD is indirectly in the market even if its brand isn’t on the car.

- Waiting for Political Climate Change: It’s conceivable that in a future where U.S.-China relations improve (or if there’s a trade deal reducing auto tariffs), BYD might reassess. If U.S. consumers also become more price-sensitive about EVs (demanding cheaper EV options as opposed to $50k Teslas), there could be pressure to allow companies like BYD to help meet EV adoption goals. Already, U.S. EV adoption lags – only ~9% of new cars in 2023 (including plug-in hybrids) – and cost is a big factor. BYD’s affordable models could accelerate EV uptake, which is aligned with climate goals. Some voices in the industry argue that completely locking out Chinese EVs may slow EV adoption. So if priorities shift, BYD could be welcomed as part of the solution (with proper safeguards). It might take a few years, but not impossible.

- BYD’s Own Caution: On the flip side, BYD might remain hesitant even if some barriers fall. The company is partly shielding itself from potential legal/IP risks – the U.S. is a very litigious market for patent and safety issues. A Chinese automaker entering could face lawsuits (frivolous or real) that it has little experience with. There’s also the risk of sudden regulatory crackdowns. BYD may prefer to consolidate its leadership in the Eastern hemisphere and Europe first. After all, even without the U.S., BYD can access over 85% of the global auto market. BYD’s billionaire founder Wang Chuanfu is known to be pragmatic – he won’t push into a market unless he’s confident of success.

- American Reactions: If BYD did try to enter in a big way (say, built a U.S. plant and launched consumer sales), expect significant reactions. U.S. automakers and possibly labor unions would lobby against it (similar to how Japanese automakers faced hostility in the 1980s until they localized jobs). National security hawks might demand stringent data protections. BYD would have to possibly localize software (ensure no data goes to China servers) and be very transparent. All that is doable, but is there enough incentive? Perhaps only if the U.S. becomes one of the few markets BYD hasn’t conquered by late this decade, and BYD’s growth needs a new outlet.

Perspectives vary on whether BYD will eventually sell cars in the U.S. Some analysts think it’s inevitable by the late 2020s, given BYD’s scale – they’ll want a piece of the American EV market, even if through local production. Others think BYD might skip U.S. consumers entirely and focus on less politically charged markets, while maybe selling commercial EVs (trucks, buses) quietly where possible. An interesting clue came in 2023 when BYD launched a new premium brand “Fang Cheng Bao” (translated as Formula or “Parallel”), and an ultra-lux off-road EV Yangwang U8; these high-end vehicles could be aimed at eventually challenging luxury brands globally – possibly even in the U.S. if sold under a less overtly Chinese brand name. BYD could adopt a branding strategy (like how Polestar is Chinese-owned but markets itself as Swedish) to ease entry.

For now, BYD’s official line is “no plans for U.S. entry”, but with a hopeful eye that maybe things change after 2024 elections or down the road. BYD likely figures that when/if the U.S. market becomes more open – or if its hand is forced by saturating other markets – it will be in an even stronger position to enter, with more advanced tech and a proven global track record. And if that day comes, it could upend the U.S. auto industry by introducing a fierce new competitor.

Conclusion

BYD’s story – from a battery startup to the world’s leading EV maker – is a testament to how quickly the automotive landscape is changing. In just two decades, BYD built an EV empire that now challenges established giants like Tesla and Volkswagen on the world stage. It achieved this through visionary focus on batteries, aggressive innovation, and mastery of cost-efficient manufacturing. BYD’s vehicles are shaping the EV transition in many countries, offering consumers more choices and pressuring rivals to up their game or cut prices (as seen with VW’s price cuts in China).

And yet, BYD’s absence in the United States is a glaring gap in its global footprint – one driven not by lack of capability, but by complex external factors. The U.S. market today is walled off by trade barriers and geopolitical mistrust that make it impractical for BYD to compete. For American consumers, this means some of the world’s most affordable and innovative EVs – like BYD’s Dolphin or Seal – aren’t available to them, potentially slowing EV adoption or keeping prices higher than they might be with full global competition.

Will that change? Possibly. As the EV revolution continues, market forces and climate imperatives could push the U.S. to reconsider its stance, especially if domestic manufacturers struggle to meet demand for low-cost EVs. BYD, on the other hand, will continue growing elsewhere and biding its time. In a few years, if you see a BYD car on American roads, it might mean the trade winds have shifted and the global auto industry has entered a new phase of openness. Or it could arrive stealthily via a local factory in Mexico or a partnership under a different name.

For now, BYD remains the global EV champion that Americans can’t buy. But even from afar, its influence is felt – in the way it’s forcing the entire industry to accelerate electrification. BYD’s success underscores that the future of cars is undeniably electric, and increasingly, that future is being shaped in China. Whether American roads will “Build Your Dreams” anytime soon is uncertain, but globally, BYD is already driving the dream of electrified transportation forward at full throttle.

References

- BYD Global Website – Company Overview

https://www.byd.com/en/AboutBYD.html - Tesla Q4 Vehicle Production & Deliveries Report

https://www.tesla.com/blog/tesla-vehicle-production-deliveries - EV Volumes – Global EV Sales Statistics

https://www.ev-volumes.com - Volkswagen Group – e-Mobility Facts & Figures

https://www.volkswagenag.com/en/news/stories/2023/02/e-mobility.html - Product Launches and Export Updates

https://www.bydglobal.com/en/news.html - BYD vs. Tesla Global Sales Comparison

https://insideevs.com/news/708835/byd-tesla-q4-2023-sales-comparison - Why BYD Is Beating Tesla in China

https://www.reuters.com/business/autos-transportation/byd-beats-tesla-china-ev-sales-2023 - China’s BYD and the U.S. EV Market

https://www.wsj.com/articles/byd-evs-us-market - BYD’s Global Expansion Strategy

https://www.bloomberg.com/news/articles/byd-ev-global-strategy - BYD’s Entry into the European EV Market

https://www.autocar.co.uk/car-news/new-cars/byd-electric-cars-uk-europe - BYD’s Mexico Plant and North America Plans

https://electrek.co/2023/12/12/byd-electric-car-factory-mexico - EV Price War in China

https://www.autonews.com/china/chinas-ev-price-war-escalates - Chinese EV Brands in Europe

https://www.spglobal.com/mobility/en/research-analysis/chinese-oems-to-double-ev-sales-in-europe.html - BYD Dolphin, Seagull, and Seal Explained

https://carnewschina.com/tag/byd - Chinese EVs Face U.S. National Security Scrutiny

https://techcrunch.com/2024/02/12/us-china-ev-national-security-concerns