AI and the Reinvention of Consulting: How McKinsey, Bain, and BCG Are Navigating the Next Frontier

In recent years, artificial intelligence (AI) has emerged not only as a transformative technology but as a fundamental force reshaping industries across the global economy. From finance and healthcare to logistics and manufacturing, AI has begun to alter value chains, operating models, and competitive dynamics. Professional services—traditionally reliant on human expertise and interpersonal dynamics—have not been immune to this disruption. Among these, the elite strategy consulting firms—McKinsey & Company, Bain & Company, and Boston Consulting Group (BCG)—are undergoing one of the most significant periods of change in their histories.

Consulting, long considered the apex of human intellectual capital, faces a paradoxical inflection point. On the one hand, AI represents a powerful augmentation tool, capable of enhancing consultants’ capabilities, optimizing project outcomes, and accelerating insights. On the other hand, it poses an existential threat to the traditional labor-intensive business model that has long sustained the sector. Clients are increasingly demanding data-driven insights, faster turnaround times, and demonstrable ROI—all of which AI is uniquely positioned to deliver. The old paradigm of deploying large teams of MBAs and analysts for multi-month strategy engagements is being called into question.

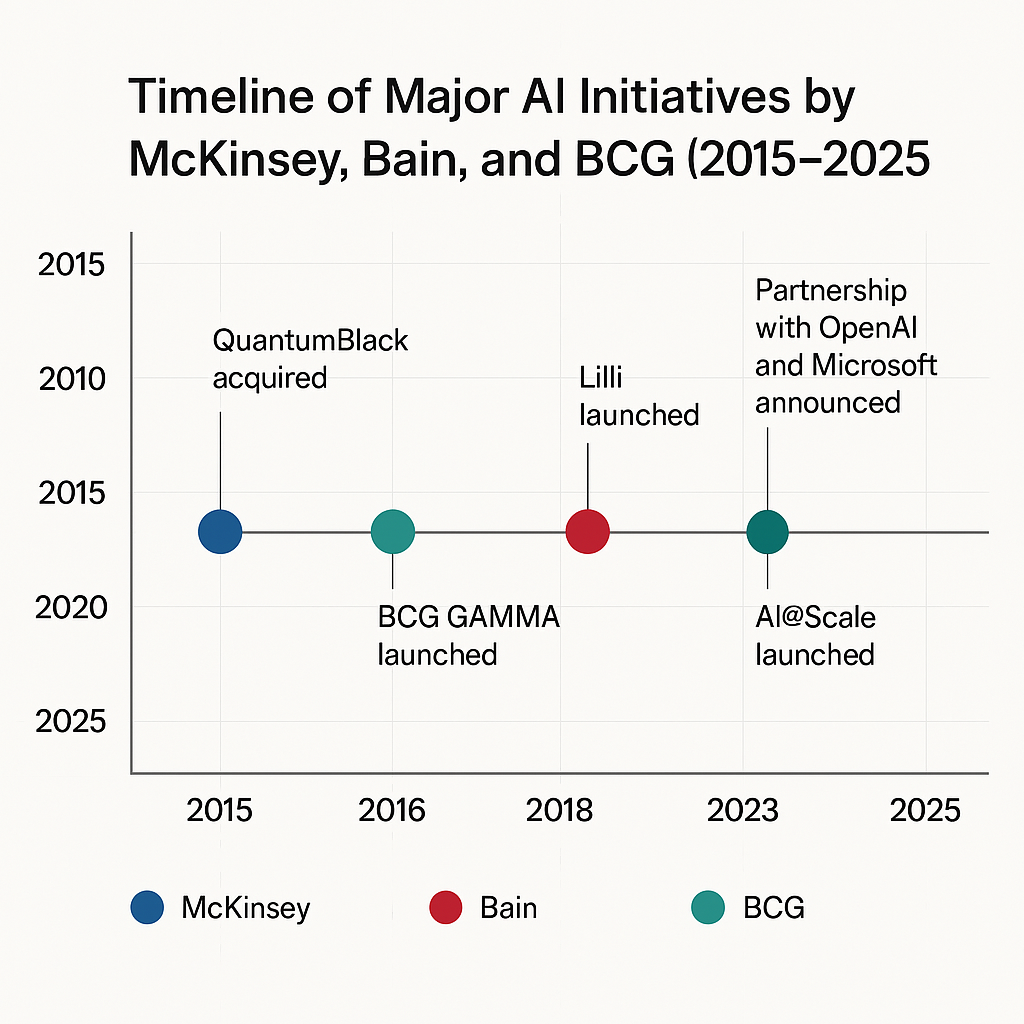

This shift is not speculative. The consulting giants have already begun retooling their operational foundations to embed AI into their service offerings. McKinsey’s acquisition of QuantumBlack in 2015 was an early indication of the firm’s intention to lead in data science consulting. BCG followed suit with the rapid development of BCG GAMMA, its dedicated AI and analytics unit. Bain, taking a strategic partnership route, aligned with OpenAI and Microsoft to rapidly infuse generative AI into client-facing solutions. These moves signify more than digital ambition; they represent a structural pivot in how value will be created, delivered, and monetized in the consulting industry.

The implications are profound. Internally, these firms are re-skilling their workforces, blending data scientists and machine learning engineers with traditional consultants. Externally, they are reinventing engagement models—shifting from high-touch, custom advisory services to platformized, AI-powered diagnostics and solutions. As AI systems evolve in capability—from data processing to generative reasoning—the boundaries between human and machine consulting blur, prompting firms to reassess not just how they work, but why clients hire them in the first place.

Moreover, competition is intensifying. Niche AI consultancies and technology firms are entering the strategy space, leveraging automation to deliver fast, cheap, and scalable insights. The Big Three no longer face just each other but an ecosystem of agile disruptors. In response, they must leverage their deep industry expertise, trusted client relationships, and global footprints to remain competitive while aggressively modernizing their offerings.

This blog post examines how McKinsey, Bain, and BCG are responding to the AI revolution—analyzing their strategic investments, evolving service models, workforce transformation, and shifting competitive dynamics. It will also explore future scenarios in which AI continues to alter the consulting landscape, perhaps irrevocably.

The analysis is structured into six sections. Following this introduction, we will delve into the specific strategic initiatives that McKinsey, Bain, and BCG have undertaken to embed AI into their operations. We will then examine how AI is reshaping the consulting delivery model, pushing firms toward new modes of engagement and client interaction. A closer look at workforce transformation will reveal how these firms are reskilling and restructuring in response to AI. We will then assess the competitive dynamics, especially in the face of emerging AI-native competitors and changing client expectations. Finally, we will explore the future trajectory of consulting in an AI-dominated era, highlighting both opportunities and risks.

As AI becomes a central driver of value creation across all sectors, consulting firms must reconcile their traditional strengths with the demands of a new era—one defined not by intuition alone, but by the seamless integration of machine intelligence into every layer of decision-making. The Big Three are not merely adopting AI; they are being reshaped by it. The outcome of this transformation will determine their relevance and leadership in the decades to come.

Strategic Adoption: How the Big Three Are Integrating AI

As artificial intelligence evolves from experimental technology to enterprise imperative, the consulting industry’s leading firms—McKinsey & Company, Bain & Company, and Boston Consulting Group (BCG)—have embarked on comprehensive strategies to embed AI into their operations and client services. These efforts are not isolated initiatives but rather large-scale transformations that signal a paradigm shift in how strategic advisory firms create and deliver value.

Historically, the Big Three have been early adopters of advanced analytics and digital transformation technologies. However, the proliferation of generative AI, machine learning, and automated decision-making tools has catalyzed a deeper, more integrated approach. The strategic adoption of AI within these firms reflects both defensive positioning and offensive growth. On one hand, they are mitigating the risks of obsolescence by modernizing legacy methodologies; on the other, they are seizing new market opportunities by commercializing AI-powered products and services.

McKinsey & Company: Scaling Intelligence with QuantumBlack and Lilli

McKinsey’s most significant strategic investment in AI to date is its acquisition and subsequent expansion of QuantumBlack, a London-based analytics firm it acquired in 2015. Originally focused on applying data science to Formula 1 racing, QuantumBlack has since been repositioned as McKinsey’s flagship AI and machine learning unit. It now operates globally, serving clients across sectors with solutions that integrate AI into core business processes.

QuantumBlack’s offerings range from AI strategy design and algorithm development to full-scale machine learning deployment. In 2023, McKinsey further solidified its AI ambitions with the launch of Lilli, an internal generative AI tool designed to enhance productivity and knowledge retrieval across the firm. Lilli enables consultants to access and synthesize vast amounts of proprietary data, frameworks, and case studies within seconds, thus significantly reducing research time and improving the quality of recommendations.

Lilli is not simply a productivity tool; it represents a broader internal shift towards AI-assisted consulting. McKinsey has announced plans to integrate Lilli into client engagements, making it a dual-purpose asset—supporting both internal operations and client outcomes. Additionally, McKinsey’s AI adoption strategy emphasizes building in-house talent capabilities through structured upskilling programs and targeted recruitment of AI specialists.

Boston Consulting Group (BCG): Engineering at Scale through GAMMA and AI@BCG

BCG’s approach to AI integration has centered on the development of BCG GAMMA, a specialized business unit launched in 2016. GAMMA comprises data scientists, software engineers, and machine learning experts who collaborate with industry consultants to develop AI-based solutions tailored to client needs. The firm describes GAMMA as the “engineering backbone” of its digital transformation work.

BCG has positioned GAMMA not only as an internal capability but also as a client-facing solution suite that includes predictive analytics, generative AI models, computer vision, and AI-driven simulation. These tools are deployed across industries such as healthcare, financial services, consumer goods, and manufacturing to solve complex challenges ranging from demand forecasting to operational optimization.

In 2023, BCG introduced AI@BCG, a broader firm-wide initiative designed to embed AI across all aspects of consulting delivery. This includes the use of proprietary AI tools to augment human insights, as well as partnerships with leading technology vendors to integrate third-party platforms into client workflows. AI@BCG reflects a recognition that AI adoption must extend beyond niche applications to permeate the firm’s entire operating model.

Importantly, BCG’s strategy emphasizes responsible AI, with strong governance structures to manage model bias, data privacy, and ethical deployment. The firm has published whitepapers on trustworthy AI and collaborates with academic institutions to remain at the forefront of AI ethics in consulting.

Bain & Company: Accelerating with OpenAI and Microsoft

While McKinsey and BCG have focused heavily on building proprietary AI units, Bain has pursued a different route—leveraging strategic partnerships to accelerate its AI integration. In early 2023, Bain announced a landmark alliance with OpenAI and Microsoft. This partnership grants Bain privileged access to cutting-edge generative AI capabilities, including OpenAI’s GPT models and Microsoft Azure’s AI infrastructure.

This collaboration is not merely technological; it is operational. Bain has integrated OpenAI’s generative models into a broad range of client engagements, helping companies automate customer service, enhance personalization, improve content generation, and streamline internal knowledge management. The firm has developed “AI-as-a-Service” offerings that package these solutions into repeatable modules, significantly reducing implementation time.

Internally, Bain is deploying AI to optimize knowledge retrieval, proposal generation, and project scoping. Moreover, the firm has invested in training its consultants on how to use and interpret generative AI outputs, ensuring that the human advisory layer remains critical and value-added. Bain’s strategy underscores the belief that consulting’s future lies in combining the power of foundational AI models with deep industry expertise and contextual judgment.

Bain’s alignment with OpenAI and Microsoft reflects an agile approach to capability development—rather than building from scratch, it partners with best-in-class providers to rapidly bring AI to market. This model enables Bain to remain technologically competitive while focusing on its core strength: strategic advisory.

Comparative View of Strategic Adoption

While all three firms are heavily investing in AI, their strategies reflect different philosophies:

- McKinsey is building robust internal capabilities with proprietary tools and acquisitions, prioritizing AI as a lever for both internal and external transformation.

- BCG is engineering scalable AI solutions through GAMMA and focusing on embedding AI at the core of every consulting engagement, with an emphasis on governance.

- Bain is moving quickly through strategic partnerships, emphasizing speed to market and client-ready generative AI applications.

Despite these differences, a unifying theme emerges: AI is no longer a peripheral experiment. It is central to the strategic direction of the Big Three, dictating how they attract talent, interact with clients, and design future services.

Transformation of Consulting Services and Delivery Models

The integration of artificial intelligence into the consulting practices of McKinsey, Bain, and BCG is not merely a technological enhancement—it is catalyzing a profound transformation in how consulting services are designed, delivered, and monetized. The traditional consulting model, built on labor-intensive, bespoke advisory engagements, is increasingly giving way to scalable, AI-augmented delivery systems. This shift represents a strategic reconfiguration that impacts not only operational efficiency but also the very nature of client-consultant interaction.

Historically, the core value proposition of top-tier consulting firms has rested on three pillars: elite human talent, customized frameworks, and deep industry knowledge. Engagements typically involved the deployment of teams—often composed of analysts, associates, and partners—who would conduct extensive data collection, perform analyses, and synthesize insights into strategic recommendations. While effective, this model is resource-heavy, time-consuming, and often expensive for clients.

With the advent of AI, particularly machine learning and generative models, the reliance on human-centric processes is rapidly declining. AI systems are now capable of performing many of the tasks that previously required weeks of manual work, such as identifying patterns in large data sets, generating scenario-based forecasts, and producing draft reports. This has significantly compressed delivery timelines, enhanced the precision of recommendations, and lowered the marginal cost of service delivery.

From Custom Engagements to Scalable AI Solutions

One of the most notable transformations is the shift from entirely bespoke consulting engagements to modular, AI-powered solution suites. Rather than reinventing the wheel for each client, consulting firms are developing reusable digital assets and AI tools that can be quickly customized and deployed. For instance, McKinsey’s QuantumBlack offers pre-built machine learning models for demand forecasting, customer segmentation, and supply chain optimization. These models can be adapted with client-specific data to deliver rapid insights.

BCG GAMMA has similarly developed AI-based tools for procurement optimization, pricing strategy, and operational efficiency. These tools are increasingly delivered through a “consulting-as-a-platform” model, where clients engage with a combination of software, analytics engines, and human advisory support. Bain’s collaboration with OpenAI has accelerated the development of generative AI tools that can automate content creation, customer interaction simulations, and internal knowledge retrieval—allowing consultants to focus on high-value judgment tasks.

This evolution parallels the broader trend of productization of services. By packaging consulting IP into AI-enabled software solutions, the Big Three are not only increasing delivery efficiency but also creating new revenue streams. These solutions are often licensed on a subscription basis, reflecting a move away from hourly billing toward outcome-based or usage-based pricing models.

Enhanced Client Engagement and Decision Velocity

AI-driven consulting services are also reshaping client engagement models. The traditional cadence of weekly meetings, interim deliverables, and final presentations is being replaced by continuous, real-time collaboration platforms. Clients now expect interactive dashboards, dynamic simulations, and AI-generated insights that update in response to new data. This fosters greater agility in decision-making and promotes a more iterative, co-creative consulting process.

For example, Bain’s AI toolkits allow clients to test multiple strategic scenarios in real-time, adjusting key variables and receiving immediate feedback from predictive models. McKinsey’s Lilli enables rapid access to internal knowledge and industry benchmarks, equipping consultants to answer complex client questions on the spot. These tools reduce information asymmetry between consultants and clients, shifting the relationship from directive advisory to collaborative problem-solving.

Furthermore, AI enables deeper personalization of recommendations. By leveraging client-specific datasets and advanced analytics, consultants can tailor solutions to a level of granularity that was previously impractical. This increases the relevance and credibility of the recommendations, enhancing client satisfaction and trust.

Operational Efficiency and Margin Enhancement

Internally, AI adoption has significantly improved the operational efficiency of consulting firms. Tasks such as data cleaning, slide generation, benchmarking, and document drafting are increasingly automated. This has freed consultants from routine administrative burdens, allowing them to concentrate on higher-order thinking and client interaction.

The impact on project economics is substantial. With AI reducing the number of human hours required per engagement, firms can deliver more value at lower cost, thereby expanding profit margins. This operational leverage also enables firms to scale more rapidly and serve a larger client base without proportionally increasing headcount.

At the same time, the integration of AI into project delivery necessitates new roles and capabilities. Data engineers, AI architects, and product managers are now essential members of consulting teams, working alongside traditional consultants. This multidisciplinary model reflects the increasing convergence of technology, strategy, and implementation within modern consulting.

Challenges in AI-Driven Service Transformation

Despite the advantages, the transformation of consulting services through AI is not without its challenges. One significant issue is client readiness. Not all clients possess the digital maturity or data infrastructure necessary to fully benefit from AI-powered consulting. As a result, firms must often invest time and resources in helping clients build foundational capabilities before AI solutions can be effectively deployed.

There is also the challenge of over-automation. While AI can accelerate and augment decision-making, excessive reliance on algorithms risks diminishing the nuanced, human-centric insights that form the core of strategic advisory. Maintaining the right balance between machine-generated outputs and human judgment is critical to preserving the integrity and distinctiveness of high-end consulting.

Moreover, concerns around data privacy, model transparency, and ethical AI use must be proactively addressed. Clients are increasingly scrutinizing how AI recommendations are generated, demanding explainability and auditability. This places a responsibility on consulting firms to ensure their AI tools meet stringent ethical and regulatory standards.

The consulting services of McKinsey, Bain, and BCG are undergoing a fundamental transformation, driven by the pervasive adoption of artificial intelligence. From modular solution suites and real-time decision platforms to enhanced personalization and internal automation, AI is reshaping the architecture of consulting delivery. This transformation is enabling firms to deliver faster, smarter, and more scalable solutions—while also challenging them to rethink traditional engagement models and value constructs.

Ultimately, the firms that succeed in this transition will be those that harness AI not just as a tool, but as a catalyst for redefining the consulting experience. As clients increasingly demand intelligence at speed and scale, AI-enabled delivery will become not merely a differentiator but a baseline expectation in the consulting industry.

Workforce Restructuring

From MBAs to Data Scientists

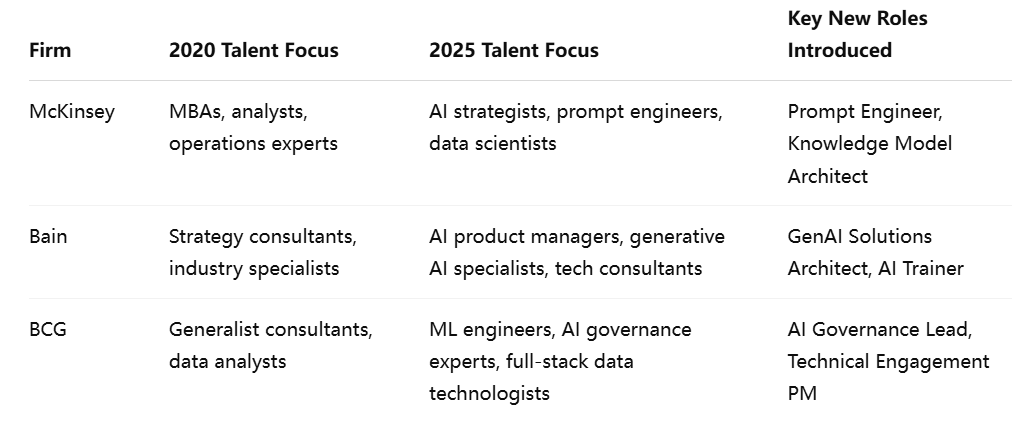

As artificial intelligence redefines the consulting landscape, one of the most profound areas of disruption is the workforce itself. At McKinsey, Bain, and BCG—the consulting industry’s Big Three—the composition, capabilities, and roles of their professionals are undergoing accelerated transformation. The traditional archetype of the consultant—typically a generalist with a prestigious MBA and strong analytical acumen—is being replaced, or at least supplemented, by a more diverse array of skill sets rooted in technology, data science, and human-AI collaboration.

The advent of AI-powered consulting services has created an urgent need for professionals who can develop, interpret, and integrate AI models into strategic advisory work. This demand is reshaping the talent model of these firms and introducing new dynamics in recruitment, team composition, career development, and organizational structure.

The Rise of the Hybrid Consultant

At the heart of this transformation is the emergence of the “hybrid consultant”—a professional equally fluent in business strategy and advanced technologies. McKinsey, Bain, and BCG are investing heavily in training programs designed to upskill traditional consultants in data literacy, machine learning fundamentals, and AI ethics. At the same time, they are expanding their hiring pipelines to recruit technical specialists such as data scientists, machine learning engineers, AI product managers, and prompt engineers.

These professionals do not function on the periphery; they are embedded in core client teams and contribute directly to value creation. For instance, a typical digital transformation engagement at BCG might include a combination of industry experts, strategic advisors, data engineers from GAMMA, and algorithm developers working in concert. This integrated model ensures that AI solutions are not only technically robust but also aligned with business realities.

Moreover, the development of internal AI tools—such as McKinsey’s Lilli or Bain’s generative AI platforms—has created new internal roles focused on prompt engineering, model training, and product design. These roles did not exist five years ago, yet they are now central to the firm’s service delivery model.

Reskilling the Traditional Workforce

Recognizing that not all traditional consultants need to become coders or data scientists, the Big Three have launched large-scale reskilling initiatives to ensure their existing workforce can effectively collaborate with AI systems and technical specialists.

McKinsey has introduced a global training curriculum through QuantumBlack, offering modules in AI strategy, data visualization, and model explainability. Bain runs an “AI Fluency” program across all career levels, designed to instill a foundational understanding of how AI tools operate and where they can be applied within client work. BCG has integrated AI literacy into its core consulting training, ensuring that all consultants, regardless of background, can confidently engage in AI-led engagements.

These efforts are not simply educational—they are strategic. As AI takes on more of the data analysis and presentation burden, consultants are expected to focus more on contextual interpretation, client interaction, and ethical oversight. This redefinition of roles allows firms to preserve their human differentiators—judgment, empathy, and communication—while benefiting from machine-enabled efficiency and scale.

Evolving Career Paths and Incentive Structures

AI’s growing influence is also altering the career trajectories within these firms. Whereas promotion paths once relied heavily on project delivery and client relationship building, new metrics are emerging to account for technical contributions, IP development, and digital asset deployment. For instance, creating a successful AI tool or model that becomes widely used across multiple client engagements may now carry weight equivalent to managing a high-profile strategy project.

In addition, the traditional “consulting ladder”—from associate to partner—is increasingly supplemented by parallel career tracks for technical professionals. These tracks offer competitive compensation, leadership opportunities, and client-facing roles, enabling firms to retain high-caliber technologists without forcing them into traditional consulting molds.

Incentive systems are also adapting. McKinsey and BCG have introduced performance frameworks that reward interdisciplinary collaboration, product innovation, and AI tool adoption in client work. Bain is piloting bonus structures tied to usage metrics of AI platforms and their business impact, signaling a shift from activity-based evaluation to outcome-based recognition.

Organizational Realignment and Cultural Shifts

To support this workforce transformation, organizational structures within the Big Three are being reconfigured. Specialized AI and analytics units—such as McKinsey’s QuantumBlack, BCG GAMMA, and Bain’s Vector team—are becoming central hubs of innovation and delivery. These units are no longer peripheral support functions; they are integral to client service models and revenue generation.

Culturally, these changes are prompting a broader shift toward openness, experimentation, and digital-first thinking. Historically conservative and hierarchical, the firms are evolving toward more agile and collaborative environments, where data-driven decision-making complements strategic intuition. This transition, while necessary, also requires deliberate change management to overcome legacy mindsets and ensure alignment across legacy and new talent pools.

Strategic Implications of Workforce Transformation

The restructuring of the workforce has significant strategic implications. First, it enables consulting firms to scale their impact without proportionally scaling headcount, improving both profitability and responsiveness. Second, it positions the firms to compete not only with each other but also with tech-native consulting entrants and AI platform companies that offer fast, automated insights at lower cost.

However, challenges persist. Integrating technologists into a traditionally business-centric culture requires ongoing efforts to bridge language, expectations, and working styles. There is also the risk of internal stratification, where technical experts may feel marginalized or undervalued relative to traditional consultants.

To mitigate these risks, the Big Three are emphasizing cross-functional team norms, inclusive leadership training, and integrated development programs that foster mutual respect and knowledge exchange between strategic and technical roles.

Ultimately, the future of consulting depends on the successful fusion of human expertise and machine intelligence. The firms that master this blend—at both the individual and institutional level—will define the next era of strategic advisory leadership.

Competitive Landscape and Client Perception Shifts

As artificial intelligence becomes increasingly embedded in consulting practices, the competitive landscape surrounding McKinsey, Bain, and BCG is undergoing significant realignment. While these firms have long operated in an oligopolistic environment defined by reputation, exclusivity, and long-term client relationships, the rise of AI is lowering the barriers to entry and catalyzing new forms of competition. At the same time, evolving client expectations are redefining what constitutes value in the consulting relationship.

This dynamic has placed the Big Three at the nexus of both challenge and opportunity. To maintain their preeminence, they must outpace not only one another but also a rapidly growing cohort of AI-native disruptors and technology consulting hybrids. In parallel, they must adapt their engagement strategies to align with the shifting preferences of increasingly digital-first and outcome-driven clients.

The Rise of AI-Native Consulting Firms

Perhaps the most consequential competitive development is the emergence of AI-native consulting firms—boutiques and startups that are building strategy and operations advisory models from the ground up with AI at the core. Unlike traditional consultancies, these firms are not burdened by legacy delivery models or hierarchical staffing structures. Instead, they rely on lean teams, proprietary algorithms, and cloud-native platforms to deliver faster, often cheaper, insights to clients.

Examples include firms like Palantir Technologies, which now positions itself as a partner in operational AI strategy for enterprise clients; Turing Talent, which blends consulting with AI workforce deployment; and a host of analytics-driven firms focused on niche areas such as customer retention, supply chain optimization, and ESG reporting. These players are increasingly viewed by clients as viable alternatives for data-heavy or tech-centric engagements.

These challengers often pitch themselves as “results-first” partners—delivering measurable outcomes through platformized, repeatable solutions rather than traditional deliverables. While they may lack the institutional gravitas and global networks of the Big Three, they make up for it through speed, transparency, and technical sophistication.

Tech Giants and Platform-Based Competition

In parallel with boutique consultancies, large technology firms such as Microsoft, Google Cloud, Amazon Web Services (AWS), and IBM are encroaching on consulting territory. Through vertical-specific AI solutions, enterprise transformation services, and co-innovation partnerships, these tech giants are reshaping the advisory landscape. Their value proposition lies in providing integrated stacks that combine infrastructure, tools, and services—often with built-in AI accelerators and automation capabilities.

For instance, Microsoft’s partnership with Bain gives the latter access to Azure’s extensive cloud and AI services, while also allowing Microsoft to deepen its consulting footprint. Similarly, Google Cloud’s AI and data services are now frequently bundled with its consulting engagements in sectors like retail, healthcare, and financial services.

These developments are blurring the line between technology vendor and strategic advisor, placing additional pressure on McKinsey, Bain, and BCG to differentiate not just on insight but also on execution capability and technological relevance.

Changing Client Expectations and Decision Criteria

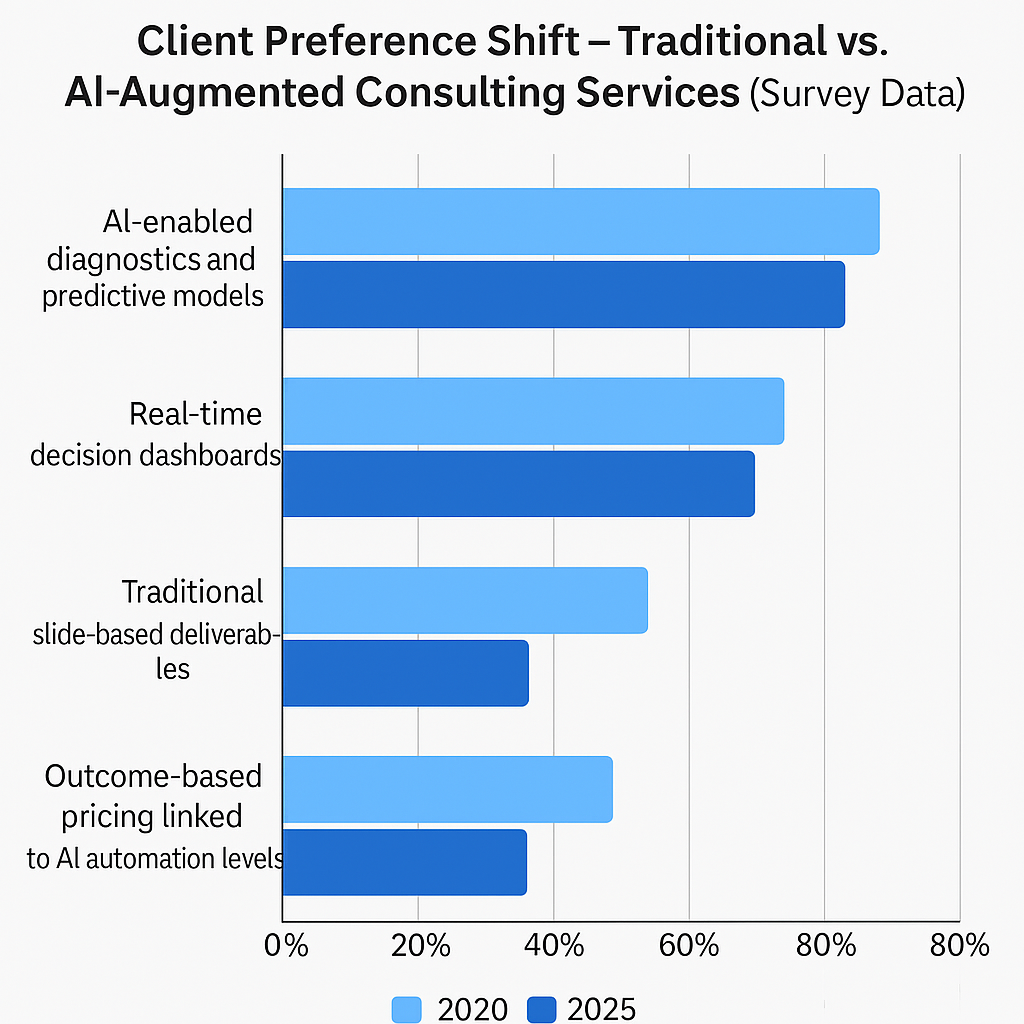

Simultaneously, client expectations are undergoing a marked shift. Traditionally, organizations sought consulting support to provide strategic clarity, industry benchmarking, and qualitative synthesis. While these elements remain important, clients are now prioritizing speed, customization, and evidence-based decision-making—attributes that AI can uniquely deliver.

Modern clients, especially those in technology-forward sectors, demand tools and dashboards that offer real-time insights. They want to run predictive simulations, test hypotheses dynamically, and generate forecasts based on live data rather than static reports. Furthermore, as digital transformation permeates every function, even non-technical stakeholders are becoming more comfortable using AI-enabled tools and platforms to inform strategic decisions.

This evolution is reflected in how clients select consulting partners. According to recent surveys, clients increasingly assess firms based on their AI capabilities, data infrastructure maturity, and ability to operationalize solutions. Reputation and relationship capital remain important, but they are no longer sufficient. Demonstrable technical expertise and AI fluency are now baseline requirements for top-tier engagements.

Key Findings:

- A 35% increase in demand for AI-enabled diagnostics and predictive models

- A 40% rise in client preference for real-time decision dashboards

- A 28% decline in preference for traditional slide-based deliverables

- Growing interest in outcome-based pricing linked to AI automation levels

Response Strategies by the Big Three

To remain competitive in this transformed environment, McKinsey, Bain, and BCG have implemented multi-pronged strategies aimed at reinforcing their relevance and leadership.

First, they are doubling down on proprietary AI assets. Each firm is investing heavily in internal tools that combine generative AI, predictive analytics, and knowledge graph technologies to streamline delivery and enhance client outcomes. These tools not only reduce engagement time but also serve as differentiators in competitive pitches.

Second, they are offering AI-forward engagement models that combine traditional strategy advisory with implementation services and managed AI solutions. For example, McKinsey now supports end-to-end AI transformation projects, from strategy formulation to model deployment and change management. BCG’s GAMMA unit collaborates closely with client IT departments to ensure that AI solutions are not only designed but also embedded and sustained.

Third, the Big Three are leveraging their global scale and domain expertise to maintain an edge over newer entrants. Their deep sectoral knowledge, access to senior decision-makers, and ability to manage complex, multi-market engagements provide enduring competitive advantages that AI-native firms may struggle to replicate.

Finally, they are adopting more flexible pricing structures, including subscription models for digital tools, performance-based fees, and hybrid advisory-service bundles. This approach aligns better with clients’ preference for outcome-linked value and reflects the evolving economics of AI-driven consulting.

The competitive environment for management consulting is in flux, driven by the transformative power of AI and the evolving demands of clients. McKinsey, Bain, and BCG are no longer competing solely with one another but with a constellation of new entrants—ranging from nimble AI startups to multinational tech firms—all vying for a share of the strategic advisory market.

To navigate this landscape, the Big Three must continue to evolve—not only technologically, but also culturally and commercially. By blending their heritage strengths with digital innovation, they can remain trusted advisors in an era where intelligence is not only artificial, but essential.

The Future of AI-Powered Consulting: Scenarios and Strategic Risks

As artificial intelligence becomes increasingly central to the value proposition of management consulting, McKinsey, Bain, and BCG face a future that is both rich in opportunity and fraught with uncertainty. The long-standing assumptions that have underpinned the consulting industry—exclusivity of expertise, client dependency on bespoke problem-solving, and premium billing for human capital—are being fundamentally reevaluated in light of AI’s capacity for automation, scale, and precision.

Looking ahead, the trajectory of AI-powered consulting is likely to unfold along multiple dimensions. These include the further industrialization of consulting services, the emergence of verticalized AI solutions, greater productization of intellectual property, and increasing demand for ethical oversight and governance. However, with these advancements come risks—ranging from technological dependency and value erosion to reputational damage and cultural resistance. In this final section, we explore key future scenarios and the strategic imperatives they present for the Big Three.

Scenario 1: Productization and the Rise of Consulting-as-a-Platform

In the next decade, we are likely to witness an accelerated shift from project-based advisory work toward productized consulting platforms. Firms like McKinsey, Bain, and BCG are already investing in reusable AI tools, but the future may see these tools evolve into standalone platforms that clients subscribe to—blurring the boundary between consulting and enterprise software.

Such platforms could encompass diagnostic engines, industry benchmarking databases, simulation tools, and predictive analytics dashboards—all delivered through cloud-based interfaces. Clients would use these solutions in real time, often with minimal consultant intervention. Human expertise would still be required, but increasingly to customize models, interpret edge cases, or provide strategic context, rather than to generate insights from first principles.

This shift enables consulting firms to move from a labor-dependent business model to a scalable, margin-rich platform business, similar to how SaaS companies operate. However, it also commoditizes certain elements of consulting, pushing firms to continuously innovate in order to justify premium pricing.

Scenario 2: Industry-Specific AI Solutions

Another probable development is the verticalization of AI solutions, whereby consulting firms build industry-specific AI tools tailored to sectoral challenges. For example, McKinsey may offer AI products designed for predictive maintenance in manufacturing, while Bain could develop generative AI tools customized for retail marketing automation. BCG may deepen its efforts in AI models for healthcare diagnostics or energy efficiency simulations.

This move toward industry-specific AI not only increases relevance and impact for clients but also protects consulting firms from generalized competition. By embedding domain expertise into proprietary AI systems, firms create defensible value that is difficult for horizontal software providers or new entrants to replicate.

Moreover, this approach positions consulting firms as long-term digital transformation partners, rather than transactional service providers. It also strengthens recurring revenue streams by embedding AI tools into clients' daily operations, thus deepening engagement and increasing switching costs.

Scenario 3: Ethical AI Leadership and Governance

As AI becomes more pervasive in shaping executive decisions, clients are growing increasingly concerned about ethical, regulatory, and reputational risks. Issues such as algorithmic bias, data privacy, model transparency, and AI governance are no longer peripheral—they are central to enterprise risk management.

Consulting firms have a critical opportunity to establish themselves as leaders in responsible AI deployment. By embedding ethical frameworks, auditing mechanisms, and compliance protocols into their AI solutions, they can offer clients not just technological capability but also reputational assurance. Firms that proactively engage in these issues—publishing guidelines, conducting impact assessments, and advising on AI policy—will gain a competitive advantage.

BCG, for instance, has already taken steps toward responsible AI leadership by issuing white papers and forming internal governance committees. McKinsey and Bain are also investing in AI ethics training for consultants and establishing risk-mitigation protocols. In the future, advisory services related to AI regulation, auditing, and compliance may constitute a significant revenue stream.

Scenario 4: Talent Stratification and the AI-Centric Workforce

As AI continues to automate analytical and operational tasks, the consulting workforce will undergo further stratification. High-value roles will increasingly center around strategic interpretation, ethical oversight, client relationship management, and advanced AI development. At the same time, mid-tier roles that primarily involve data gathering, synthesis, and slide preparation may be partially or fully automated.

This evolution raises important questions about the future of career progression within consulting. The traditional “pyramid model” may give way to a more diamond-shaped structure, with fewer entry-level roles and more specialization at the mid-career level. Additionally, consulting firms may need to create new incentives and career tracks to attract and retain technical talent who are more accustomed to startup or product-based environments.

The strategic challenge lies in maintaining a cohesive culture amid this diversification. Firms will need to ensure that strategic consultants, AI specialists, and ethical auditors can collaborate effectively, understand each other’s contributions, and work toward shared client outcomes.

Scenario 5: Client Disintermediation and the Risk of Over-Automation

Perhaps the most existential risk facing consulting firms is client disintermediation. As AI tools become more sophisticated and user-friendly, there is a real possibility that clients—especially large enterprises with internal data science teams—will bypass traditional consultancies altogether. They may opt instead to license AI platforms directly from vendors, develop in-house capabilities, or rely on AI-driven decision support systems without external advisors.

This risk is exacerbated by the proliferation of low-code and no-code AI tools, which allow non-technical users to build and deploy models without deep expertise. If consulting firms fail to demonstrate value beyond tool provision—such as in strategic framing, organizational change, and ethical governance—they may find themselves increasingly marginalized.

Furthermore, there is a risk of over-automation, where AI is used inappropriately or excessively, resulting in poor decisions, organizational resistance, or reputational damage. Consulting firms must avoid the temptation to promote AI for its own sake and instead ensure that its deployment is always contextually appropriate, human-guided, and strategically aligned.

Strategic Imperatives for the Big Three

In light of these scenarios, McKinsey, Bain, and BCG must focus on a set of strategic imperatives to secure their leadership in the era of AI-powered consulting:

- Invest in proprietary platforms and intellectual property that embed domain expertise into scalable tools.

- Develop vertical AI capabilities that address specific industry pain points and regulatory environments.

- Establish ethical AI governance frameworks that offer clients confidence and mitigate reputational risk.

- Redesign workforce models and career paths to reflect the emerging needs of a hybrid consulting environment.

- Continuously demonstrate human-AI complementarity, ensuring that value is derived not just from automation but from thoughtful integration.

Conclusion

The future of consulting will not be defined by AI alone, but by how effectively consulting firms integrate AI into their ethos, operations, and client relationships. McKinsey, Bain, and BCG stand at a critical juncture: their ability to lead in this transformation will determine whether they remain the arbiters of corporate strategy or become relics of a pre-AI era.

The next decade will reward those firms that can navigate complexity with clarity, innovation with integrity, and machine intelligence with human wisdom. For the Big Three, the AI era is not a threat to their existence—it is a test of their ability to evolve.

References

- QuantumBlack Overview

https://www.mckinsey.com/capabilities/quantumblack - Lilli: AI Assistant Transforming Consulting

https://www.mckinsey.com/about-us/new-at-mckinsey-blog/introducing-lilli - Advanced Analytics and AI Solutions

https://www.bcg.com/capabilities/gamma - OpenAI and Microsoft Strategic Partnership

https://www.bain.com/about/media-center/press-releases/bain-openai-microsoft-partnership - The State of AI in Consulting

https://www.mckinsey.com/business-functions/mckinsey-digital - Responsible AI and Ethics in Practice

https://www.bcg.com/publications/responsible-artificial-intelligence - AI-Powered Customer Experience Strategy

https://www.bain.com/insights/ai-powered-customer-experience - Bain Partnership Case Study

https://openai.com/blog/bain-partnership - Microsoft Industry Solutions for Consulting Firms

https://www.microsoft.com/industry/professional-services - AI Consulting and Implementation Services

https://cloud.google.com/consulting - AI and Hybrid Cloud Services for Strategy

https://www.ibm.com/consulting/artificial-intelligence - Future of Consulting in the Age of AI

https://www.gartner.com/en/articles/the-future-of-consulting-in-the-age-of-ai - AI Tools and Market Disruption in Professional Services

https://www.forrester.com/research/ai-in-professional-services - How AI is Changing Consulting

https://hbr.org/2023/03/how-ai-is-changing-consulting - Responsible AI: Strategy, Governance, and Risk

https://www.pwc.com/gx/en/services/analytics/artificial-intelligence/responsible-ai.html